Académique Documents

Professionnel Documents

Culture Documents

(Economy 4 Newbie) Money Market, Repo Rate & Call Money Print

Transféré par

Jitendra RaghuwanshiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

(Economy 4 Newbie) Money Market, Repo Rate & Call Money Print

Transféré par

Jitendra RaghuwanshiDroits d'auteur :

Formats disponibles

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

[Economy 4 Newbie] Money market, Repo Rate & Call Money

Mrunal update October-18-2012: This is Old and outdated article. dont pay much attention, Ill refine and rewrite it later.

What is money market

In simple terms, if I borrow money from you for less than 1 year = the place where we do this deal is Money market For long term loans = Capital market. See this diagram

Technical definition

market refers to the market for short-term funds, i.e., up to one-year maturity. money market is the place where lending and borrowing is done through instruments having an original maturity of up to one year.

Use of money market

money market provides a mechanism to balance the demand for and supply of short-term funds. the opportunity for players to invest their short-term surplus funds and to borrow short-term funds in case of deficit. Its interlinked with Foreign Exchange market (read my article on currency devaluation for more on this)

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/ 1/6

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

Call/ Notice/Term Money Market

It is the market for borrowing and lending for short-term periods (usually upto 14 days, but at times more than that) The deals mostly by commercial banks. It is a telephonic market, i.e., deals are struck over telephone and reported to RBI. (thats why its call market) Commercial banks often face temporary shortages of funds (e.g., to meet CRR and SLR requirements, or sudden outgo of funds) or temporary surpluses. When a bank is in shortage of funds, it telephones & borrows from another bank which is in surplus.

3 types of deals in Call Market

Call Money

If borrowing (or lending) is made for one day (overnight), it is known as Call Money. This segment is also called overnight money market.

Notice Money

If the maturity of borrowing (or lending) is more than 1 day but up to 14 days, then it is known as Notice Money.

Term Money

Term Money refers to money borrowed (or lent) for more than 14 days but less than one year. In Indian money market, most of the transactions are of call money and notice money.

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/ 2/6

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

Players in Call Market

commercial banks and primary dealers can both borrow and lend, LIC, UTI, GIC, IDBI, NABARD, ICICI & Mutual Fund managers can lend money in this market (but theyre not allowed to borrow from this market) RBI, as regulator, routinely participates in the market to inject liquidity (lend) or to mop up liquidity (borrow).

Repos/Reverse Repos

repo (also known as ready forward contract) transaction, Example Suppose I write on a piece of paper anyone who gives me 100 Rs. Ill give him 120 Rs. After 1 year this piece of paper is security. Now I give that paper to you and collect 100 Rs. And tell you that Ill buy (repurchase) that paper after 6 months and give you 110 Rs. This is called repo-contract And this period (6 months) is repo period. Now remember the mirror in the mirror my left hand will show as my right hand. Same is for Reverse Repo Rate

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/ 3/6

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

When you buy a security and sign contract that youll sell it after 6 months = this is reverse repo contract. one party borrows funds for a specific period (known as repo period) against the collateral of specific securities at pre-determined rate (known as repo rate) for buyer its reverse repo rate (RRR) and for seller its repo rate.(RR) And whether the transection is RRR or RR is classified by who initiated the deal? If the buyer initiated the deal then its RRR If the seller initiated the deal then its RR To prevent the topic getting confusing and complicated. Lets take an example First the easy exampleIm the RBI manager. When I give you security (paper) & take money from you this is Repo. When I buy the security (paper) from you and give you money- this is reverse Repo. Now the more correct example Im the RBI manager. When I give you security (paper) & take money from you & promise you that Ill buy the same paper back from you after few months this is Repo. When I buy the security (paper) from you and give you money & you promise me that youll buy back that paper from me after few months- this is reverse Repo.

The players in Repo / Reverse Repo Rate

RBI, Scheduled banks & Primary dealers can borrow and lend Non-Bank participants (Finacial institutions) + companies listed in stock market can only lend , they cant borrow.

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/ 4/6

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

Lets rewind the liquidity tape

1. Liquidity = How much money in the market? = if money is plenty= easy to get loans @ 2. 3. 4. 5.

cheaper interest rate = this is called cheap / easy money. When there is less liquidity =hard to get loans and the interest rate will be higher = this is Dear money. Where there is too much money= inflation When there is too less money= bad to business as you cant get loans easily to run your works. So RBIs work is to fine tune the liquidity (money supply.) = tuning the dear money / easy money policy based on the situation.

See this diagram

RBI & Repo

absorption of short-term liquidity, RBI carries out overnight (one day) repo auction at a fixed rate. Currently, fixed-rate repo and reverse repo auctions are conducted by the RBI on a daily basis (excluding Saturdays, Sundays and other public holidays) for 1 day (overnight) tenor. This means, RBI is ready to sell as much securities as is demanded by the participants at the fixed rate. This rate is fixed in the sense that it does not change on a daily basis depending upon the supply-demand condition of short-term liquidity Changes in the fixed repo rate are usually made in the Annual Monetary and Credit Policy or in the Mid-Term Review of the Monetary and Credit Policy.

RBI & Reverse Repo

In order to inject liquidity into the system, RBI conducts fixed rate auctions of reverse repo at a rate higher than the repo rate.

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/ 5/6

7/2/13

Mrunal [Economy 4 Newbie] Money market, Repo Rate & Call Money Print

The reverse repo rate is linked to the repo rate in the sense that it is set at specific percentage point above the repo rate.

Definition difference from international market.

Keep in mind, the terms repo and reverse repo have been defined above, is just opposite to the international practice. That is, what is repo in Indian terminology is reverse repo in international parlance, and what is reverse repo in India is internationally known as repo. In a fast globalising environment, this may create confusion. Consequently, RBI has changed the definitions of repo and reverse repo to bring them in line with international practice with effect from 27th October 2004. However, in this article, we have throughout followed the older (Indian) definition. Money market topic doesnt stop here, there are other remaining items like Commercial papers, Treasury bills, Certificate of Deposits etc which will be dealt in some other article.

URL to article: http://mrunal.org/2010/02/economy-4-newbie-money-market-reporate.html Posted By On 01/02/2010 @ 14:48 In the category Economy

mrunal.org/2010/02/economy-4-newbie-money-market-repo-rate.html/print/

6/6

Vous aimerez peut-être aussi

- Geothermal Energy 4110007007Document9 pagesGeothermal Energy 4110007007Jitendra RaghuwanshiPas encore d'évaluation

- MTopic 2 - The L-M ScheduleDocument9 pagesMTopic 2 - The L-M ScheduleJitendra RaghuwanshiPas encore d'évaluation

- Public Finance: Anushri Singhania 4110007007Document4 pagesPublic Finance: Anushri Singhania 4110007007Jitendra RaghuwanshiPas encore d'évaluation

- ExportingDocument10 pagesExportingJitendra RaghuwanshiPas encore d'évaluation

- ArticleDocument17 pagesArticleJitendra RaghuwanshiPas encore d'évaluation

- C MKT ScenarioDocument3 pagesC MKT ScenarioJitendra RaghuwanshiPas encore d'évaluation

- Trade Finance Guide2007ch1Document2 pagesTrade Finance Guide2007ch1Rohit SatavPas encore d'évaluation

- International OrganizationDocument4 pagesInternational OrganizationJitendra RaghuwanshiPas encore d'évaluation

- CAMELS ApproachDocument19 pagesCAMELS ApproachJitendra RaghuwanshiPas encore d'évaluation

- Eurocurrency MarketsDocument4 pagesEurocurrency Marketssmh9662Pas encore d'évaluation

- Just in Time: Anushri Dipti ShikhaDocument10 pagesJust in Time: Anushri Dipti ShikhaJitendra RaghuwanshiPas encore d'évaluation

- Rural Credit: A Source of Sustainable Livelihood of Rural IndiaDocument16 pagesRural Credit: A Source of Sustainable Livelihood of Rural IndiaJitendra RaghuwanshiPas encore d'évaluation

- The Shakespeare of Indian LiteratureDocument44 pagesThe Shakespeare of Indian LiteratureJitendra RaghuwanshiPas encore d'évaluation

- NTPC's Vision to Become a Global Leader in Power GenerationDocument8 pagesNTPC's Vision to Become a Global Leader in Power GenerationJitendra RaghuwanshiPas encore d'évaluation

- Making Real Options Really WorkDocument10 pagesMaking Real Options Really WorkJitendra RaghuwanshiPas encore d'évaluation

- Appendix Linear ProgrammingDocument44 pagesAppendix Linear Programminghksanthosh100% (2)

- Corporate StrategiesDocument5 pagesCorporate StrategiesJitendra RaghuwanshiPas encore d'évaluation

- The Shakespeare of Indian LiteratureDocument44 pagesThe Shakespeare of Indian LiteratureJitendra RaghuwanshiPas encore d'évaluation

- 100 Most Expected Computer Questions For Upcoming IBPS PO and IBPS Clerk ExamDocument23 pages100 Most Expected Computer Questions For Upcoming IBPS PO and IBPS Clerk ExamJitendra RaghuwanshiPas encore d'évaluation

- Mrunal (Diplomacy) Shanghai Cooperation Organisation (SCO) and India PrintDocument3 pagesMrunal (Diplomacy) Shanghai Cooperation Organisation (SCO) and India PrintJitendra RaghuwanshiPas encore d'évaluation

- Cheque Truncation SystemDocument1 pageCheque Truncation SystemJitendra RaghuwanshiPas encore d'évaluation

- Mrunal Kyoto Protocol, Carbon Trading, Copenhagen Accord - Meaning, Explained PrintDocument9 pagesMrunal Kyoto Protocol, Carbon Trading, Copenhagen Accord - Meaning, Explained PrintJitendra RaghuwanshiPas encore d'évaluation

- Banking ConceptsDocument2 pagesBanking ConceptsJitendra RaghuwanshiPas encore d'évaluation

- A Spectacular Business RollerDocument4 pagesA Spectacular Business RollerJitendra RaghuwanshiPas encore d'évaluation

- 16Document1 page16Jitendra RaghuwanshiPas encore d'évaluation

- Harshad Mehta ScamDocument12 pagesHarshad Mehta ScamJitendra RaghuwanshiPas encore d'évaluation

- Books and AuthorsDocument2 pagesBooks and AuthorsJitendra RaghuwanshiPas encore d'évaluation

- SelfHelpGroup GuideLineDocument13 pagesSelfHelpGroup GuideLineJitendra RaghuwanshiPas encore d'évaluation

- Derivative Market - India''Document71 pagesDerivative Market - India''love_3080183% (6)

- What Is The Difference Between Money Market and Capital Marke1Document2 pagesWhat Is The Difference Between Money Market and Capital Marke1Jitendra RaghuwanshiPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Work Without Your Laptop.: Samsung Dex ProductivityDocument2 pagesWork Without Your Laptop.: Samsung Dex ProductivityBtakeshi1Pas encore d'évaluation

- PenaltiesDocument143 pagesPenaltiesRexenne MariePas encore d'évaluation

- BISU COMELEC Requests Permission for Upcoming SSG ElectionDocument2 pagesBISU COMELEC Requests Permission for Upcoming SSG ElectionDanes GuhitingPas encore d'évaluation

- The Workmen's Compensation ActDocument23 pagesThe Workmen's Compensation ActMonika ShindeyPas encore d'évaluation

- Guide Internal Control Over Financial Reporting 2019-05Document24 pagesGuide Internal Control Over Financial Reporting 2019-05hanafi prasentiantoPas encore d'évaluation

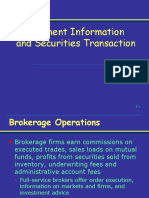

- 3-Investment Information and Securities TransactionDocument59 pages3-Investment Information and Securities TransactionAqil RidzwanPas encore d'évaluation

- I. True or FalseDocument5 pagesI. True or FalseDianne S. GarciaPas encore d'évaluation

- CHAPTER 4 - Basic Numbering System of Police ReportsDocument4 pagesCHAPTER 4 - Basic Numbering System of Police ReportsAilyne CabuquinPas encore d'évaluation

- New Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsDocument8 pagesNew Key Figures For BPMon & Analytics - New Controlling & SAP TM Content & Changes Key Figures - SAP BlogsSrinivas MsrPas encore d'évaluation

- United Coconut Planters Bank vs. Planters Products, Inc.Document4 pagesUnited Coconut Planters Bank vs. Planters Products, Inc.Arah Salas PalacPas encore d'évaluation

- 18th SCM New Points 1 JohxDocument55 pages18th SCM New Points 1 JohxAnujit Shweta KulshresthaPas encore d'évaluation

- Apple Strategic Audit AnalysisDocument14 pagesApple Strategic Audit AnalysisShaff Mubashir BhattiPas encore d'évaluation

- LatestEffective Specs HIIDocument390 pagesLatestEffective Specs HIIGeorge0% (1)

- Modules For Online Learning Management System: Computer Communication Development InstituteDocument26 pagesModules For Online Learning Management System: Computer Communication Development InstituteAngeline AsejoPas encore d'évaluation

- DepEd Mandaluyong City outlines COVID-19 work arrangementsDocument18 pagesDepEd Mandaluyong City outlines COVID-19 work arrangementsRenante SorianoPas encore d'évaluation

- Resume SureshDocument2 pagesResume SureshSiva BandiPas encore d'évaluation

- Brochure - Ratan K Singh Essay Writing Competition On International Arbitration - 2.0 PDFDocument8 pagesBrochure - Ratan K Singh Essay Writing Competition On International Arbitration - 2.0 PDFArihant RoyPas encore d'évaluation

- DENR confiscation caseDocument347 pagesDENR confiscation caseRyan BalladaresPas encore d'évaluation

- UPCAT Application Form GuideDocument2 pagesUPCAT Application Form GuideJM TSR0% (1)

- PowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesDocument5 pagesPowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesAndrii AverianovPas encore d'évaluation

- John D. Ozbilgen ComplaintDocument7 pagesJohn D. Ozbilgen ComplaintAsbury Park PressPas encore d'évaluation

- Spanish Colonial System in the PhilippinesDocument3 pagesSpanish Colonial System in the PhilippinesCathy RafolsPas encore d'évaluation

- 1.18 Research Ethics GlossaryDocument8 pages1.18 Research Ethics GlossaryF-z ImanePas encore d'évaluation

- Patrice Jean - Communism Unmasked PDFDocument280 pagesPatrice Jean - Communism Unmasked PDFPablo100% (1)

- CW: Union Victory at Gettysburg & VicksburgDocument9 pagesCW: Union Victory at Gettysburg & VicksburgPi LoverPas encore d'évaluation

- ACCT5001 2022 S2 - Module 3 - Lecture Slides StudentDocument33 pagesACCT5001 2022 S2 - Module 3 - Lecture Slides Studentwuzhen102110Pas encore d'évaluation

- Emery Landlord Dispute 2015Document2 pagesEmery Landlord Dispute 2015Alex GeliPas encore d'évaluation

- Commerce PROJECT For CLASS 11Document21 pagesCommerce PROJECT For CLASS 11jasdeep85% (67)

- PPSC Announces Candidates Cleared for Statistical Officer InterviewDocument3 pagesPPSC Announces Candidates Cleared for Statistical Officer InterviewYasir SultanPas encore d'évaluation

- CFPB Your Money Your Goals Choosing Paid ToolDocument6 pagesCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrPas encore d'évaluation