Académique Documents

Professionnel Documents

Culture Documents

Strayer Write Up

Transféré par

giorgiogarrido6Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Strayer Write Up

Transféré par

giorgiogarrido6Droits d'auteur :

Formats disponibles

Strayer Education (STRA US)

BUY TARGET PRICE 74 USD

When buying something has become comfortable again, its price will no longer be so low that its a great bargain. Thus a hugely profitable investment that doesnt begin with discomfort is usually an oxymoron. It is our job as contrarians to catch falling knives, hopefully with care and skill. Howard Marks

August 20, 2013

Henrik Stang Heffermehl Portfolio Manager

Strayer Education (STRA US)

BUY TARGET PRICE 74 USD

ELEVATOR PITCH Weve seen this before: an industry temporarily perceived as broken with investors fleeing the stocks en masse because of fear of regulatory changes. Remember Macondo? In 2010, there were days where there was literally no bid side in high quality driller names like Seadrill (SDRL), which subsequently rose well over 100%. I believe the same sort of buying opportunity is present in quality for-profit education stocks today. The regulatory bear case for non-profits was accurate, but has played out to a large extent. More recently the bear case seems to have shifted to a perception of increasing competition. I think the impact from non-profits and MOOCS will probably not be as substantial as many fear. Consensus opinion seems to be that competitive pressures and regulation has led to irreversible enrollment declines in the for-profit industry, but the evidence suggests a (natural) cyclical downturn after a boom period and elevated long term unemployment is to blame. That is a much less dire situation, since long term demand for higher education in the US looks healthy. Underestimated and deeply out of favor company with short interest currently > 30% of float. Expectations really are incredibly low: A reverse DCF with a 10% discount rate, 0% forecast period growth over the next ten years and 0% terminal growth for another 10 years yields 46 USD. Comparing that with todays price of 43 USD, we can safely say that Mr Market is not optimistic when it comes to Strayers future. STRA is dirt cheap based on normalized earnings power and cash flow metrics. My estimated fair value of STRA is 72% higher than todays price of 43 at 74 USD. I base this on the average of a DCF valuation, an EPV (Earnings Power Value aka no growth valuation) and the likely value of STRA in a buyout scenario. Strayer has best-in-class management and its new graduation fund program will improve its value proposition while at the same time strengthening its competitive position. Increased regulation and oversight will benefit the more serious players like Strayer longer term by creating increased barriers to entry, and put the diploma mills out of business. I think Strayer is the best for-profit play going forward because it has both cost advantages from scale, several recruitment channels that do not depend on aggressive marketing, a high percentage of degree students which bring more recurring revenue streams and a reputation for quality (as far as for-profits go) a potent combination.

Strayer Education (STRA US) | 8/20/2013

INVESTMENT THESIS I believe there is tremendous long term value in STRA. A fair value estimate based on several valuation methods suggests an upside of at least 72% to 74 USD from the current price of 43 USD. Strayer has historically generated tons of cash and delivered solid numbers. Yet judging from current valuations; the market perceives STRA to be extraordinarily risky. I believe this is wrong. So why does this opportunity exist?

REGULATORY PRESSURES CREATE UNCERTAINTY One reason for the market misperception of STRA is that a several players in the industry are in fact just as bad as the for-profit naysayers claim if not worse and some companies have clearly bent and even broken the rules. This means regulatory scrutiny is increasing. The industry is subject to numerous regulations, and it takes some time to familiarize oneself with the relevant material. It may be that many investors simply put the for-profits in the too hard pile because earnings visibility is clouded by threats of regulation, and some of regulations are fairly arcane (sifting through senate reports and the like is not exactly a treat). What differentiates Strayer from its peers in the industry is that it is not really at risk with regard to new regulation, and that responsible practices have been the rule all along. This is a result of management focusing on delivering higher quality programs to higher quality students even as the industry went through a period of rapid growth. The company is already in compliance with suggested changes in regulation (90/10 rule, Cohort Default Rates and Gainful Employment). As such, I think regulatory risk is actually quite low for STRA.

DECLINING ENROLLMENTS AND CHANGING INDUSTRY DYNAMICS AMPLIFY NEGATIVE PERCEPTIONS Rapidly declining enrollments for several quarters and industry competition heating up with non-profit unis (and MOOCS) entering on-line to a larger degree has added to investor insecurity. The operational leverage embedded in the non-profit business model results in marked earnings declines in the short term when enrollment falls. I think the total effect of this is that investors on average become overly cautious and flee the sector. Although several negative forces are now adversely impacting the industry, and they are probably not all entirely temporary, I think the lasting impact of many of the often quoted negative factors is overestimated. For example, one worry is that threats of new regulation and media beating up on the industry may cause students to avoid the for-profits. But I think regulatory surprises will be few from here on out, and most prospective students havent paid much attention to the horror stories the media love to tell about students who are debt ridden and unemployed. A Parthenon group study showed only 10% of prospective students had even heard any negative press about for-profit schools, see Exhibit 2 below:

Strayer Education (STRA US) | 8/20/2013

Exhibit 2 from the Parthenon Group survey:

Another worry for investors is that increased online competition from non-profits and MOOCS is causing enrollment declines and margin pressure at non-profit companies. However, MOOCs as of today do not offer degrees, which is the primary goal of Strayers students. Im having trouble understanding how MOOCS can replace for-profit universities if they dont award degrees. My guess is that MOOCs will be a supplement people can use to get some college credit, but that universities will not offer entire degrees through MOOCs. I dont see how they could without destroying their brands. While it is a fact that for-profits have lost some market share to non-profit/public schools in the online space over the last couple of years, public and not-for profit schools have always been larger players in the online space. Some market share loss doesnt mean the for-profit business model is dead, because the overall market will grow over time. Its just not growing right now, which makes people nervous. In Eduventures market share estimates through 2014, F-P market share in online falls from 42% to 38% but the online enrollment CAGR is at the same time estimated to be around 11% at for-profit universities. Thus, this threat is somewhat overestimated in my view, and I suspect competitive pressures are getting credit for what cyclical headwinds and high unemployment is responsible for to a much larger degree.

Strayer Education (STRA US) | 8/20/2013

I think a temporary demand decline for higher education in general is to blame. What has caused this demand decline? In my opinion, it is not increased competition or regulatory scrutiny and bad press. Rather it is primarily long term unemployment and cyclical headwinds the industry brought on itself. I believe long term unemployment in the target demographic is a negative, reducing demand for postsecondary degrees. This goes against conventional wisdom which says that people go back to school in a downturn - recent data suggests this is not the case when the downturn lasts for a very long time. For the 2013 spring cohort, overall enrollment in all types of post-secondary institutions declined for the first time in more than a decade. This backs up the anecdotal evidence given by among others Robert Silberman of Strayer, who has been saying this a while. Looking at the numbers in fig.1, it becomes clear that the students not enrolling in for-profit schools are generally not enrolling anywhere else, either.

Enrollment is down for all sectors (degree granting institutions. Source: NSCRC):

SPRING 2013 SPRING 2012 SPRING 2011 Enrollment % change from prior year Enrollment % change from prior year Enrollment % change from prior year 19,105,651 -2.3 % 19,550,391 0.3 % 19,610,826 0.2 % 7,312,261 -1.1 % 7,397,012 -0.1 % 7,404,225 2.0 % 3,620,640 0.5 % 3,601,383 3.8 % 3,469,781 1.8 % 1,347,238 -8.7 % 1,476,010 -9.3 % 1,626,756 9.0 % 6,351,609 -3.6 % 6,591,687 -1.1 % 6,665,788 -3.8 %

Total enrollment, all sectors Four year public Four year private non-profit Four year for-profit Two year public

Enrollment change (% y-o-y) higher education

10.0 % 8.0 % 6.0 % 4.0 % 2.0 % Strayer Education (STRA US) | 8/20/2013 0.0 % -2.0 % -4.0 % -6.0 % -8.0 % -10.0 % Total enrollment, all sectors Four year public Four year Four year forprivate nonprofit profit Two year public SPRING 2013 SPRING 2012

SPRING 2011

Note that the rate of decline is lower in the latest data than it was one year ago (green circle).

Reduced unemployment in the US is thus likely to be a positive for the industry going forward. It should be mentioned also that the dramatic enrollment declines we are seeing across the industry to a degree is exacerbated by FPUs taking drastic action to avoid being in breach with rules and regulations and improve cohort default rates and graduation numbers etc by strictly limiting enrollment of risky students. This shows up immediately in the enrollment numbers.

Cyclical headwinds: In addition, the past penetration of the target demographic has been extensive (I am not referring to the kind of penetration someone who paid five figures for bartending school has been subjected to, but rather the fact that companies were so effective in reaching their target demographic during the for-profit boom years) and effectively depleted the number of potential future students to a degree because of that aggressive marketing. From 20006 to 2010, student starts in forprofit universities almost doubled. The Parthenon Group estimates that about 800 000 new students enter the addressable private sector school market every year. In 2010, private sector schools enrolled 1.8 million students. The industry is now facing the natural but largely temporary - consequences of this depletion. Together with the exclusion of ATB (Ability to Benefit) students from the target market, the total addressable market has shrunk by 20% in five years (chart source: PG). This leads to decreased enrollment and increased competitive pressures in the short term. But with 800 000 new students entering the market each year, the addressable market will grow again. I think the worst rates of decline have been seen and that enrollment declines are starting to moderate already.

Strayer Education (STRA US) | 8/20/2013

WHY THE FOR PROFIT INDUSTRY HAS A FUTURE

1. The for-profit industry serves a valuable purpose in the US higher education system. It will continue to play a part after the regulatory Jihad (a phrase coined by Lisa Rapuano I think) and media pummeling ends. I believe the quality players will survive and even thrive over the longer term despite profitability and growth rates probably never returning to peak levels. Lower education levels are highly correlated with higher unemployment rates and lower income. Only about 35% of Americans have a degree beyond high school. Unemployment among high school only or less demographic is miles above those who do have a post-secondary degree, and the earnings gap between these demographic groups is increasing rapidly. This is a major problem. University availability for the less qualified is limited and likely to stay that way as funding for subsidized institutions will continue to be limited given the fiscal state of affairs in the US.

2. Secular trends trump cyclical trends. Longer term, the American workforce is trending toward higher education levels. Traditional industry jobs that require little formal education are largely a thing of the past. This ensures renewed industry growth in time. The demand for college degrees long term will thus not be met by public institutions, nor will non-profit private institutions be able to cover demand at the lower end of the education market without diluting their brands. As a consequence, I believe long term demand will be there (BMO estimates the overall for-profit post-secondary market will grow at a 4.1% CAGR for the rest of the decade), and I think a cyclical downturn is disguising the more positive long term enrollment picture.

Strayer Education (STRA US) | 8/20/2013

INVERT, ALWAYS INVERT: INCREASED REGULATION IS ACTUALLY A LONG TERM POSITIVE It is central to my thesis that the increased regulation and oversight strengthens the competitive advantages of the larger, more serious players like STRA longer term. This is both because more regulation effectively raises barriers to entry in the industry and strengthens quality for-profit brands over time as a more disciplined enrollment practice will improve student outcomes a great deal, reducing the negative perception of for-profits as time goes by.

BUT IS IT TIME TO BUY NOW? Yes. STRA simply looks like a good investment even if the boom years will never return and the industry is facing a new normal. STRA will see much lower margins and lower enrollment growth than whats been the case historically in the short term, but the stock is very cheap. STRA is trading at: 6.1 x 10 year average free cash flow 4.3 x EV/TTM EBITDA a 45% discount to its earnings power value (EPV) < 7.5 x TTM depressed EPS

Thats too cheap for a high quality business!

I believe management is responding correctly to the challenges that a more competitive climate presents. As a result of recent initiatives that will be detailed elsewhere in this write-up, STRA will offer bachelor degrees at an extremely competitive price among comparable for-profit universities (even cheaper than many public options). This will obviously create some margin pressure, but it will also help STRA capture market share from other players through this downturn.

Strayer Education (STRA US) | 8/20/2013

The impact of these initiatives are likely to increase over the next few quarters, further suggesting that now, rather than later, is the right time to buy.

MARKET EXPECTATIONS ARE VERY LOW - THE CURRENT PRICE REFLECTS UNWARANTED PESSIMISM

Based on my understanding of the long term dynamics of the industry, I think it is a mistake to be long term pessimistic on for-profit education. Assuming I am correct in this assessment, there is tremendous upside in STRA longer term. In my opinion, enrollment declines will start to improve over the next few quarters - I think the earliest sign of improvement are visible (lower decline rates). Meanwhile, the market is pricing in that STRA revenues will stay 10 to 15 % below 2012 levels more or less forever. This is a classic case of the market extrapolating recent negative events indefinitely. As revenues stabilize and turn, the value in STRA will become apparent to everyone as operational leverage kicks in (this time in the right direction). By that time, its probably too late to start building a position. Using managements sensitivity estimates for EBIT margins and EPS (1% revenue declines creates 0.5% margin contraction and -0,20 USD in EPS), I see the following as the likely impact on EBIT margins, FCF and EPS under different revenue scenarios. Note that while the market price seems to imply a FCF of between 47 and 57 mUSD is likely for 2013, actual FCF was over 45 mUSD in just the first 6 months of 2013. Plugging in a 10% enrollment decline y-o-y using fall semester enrollment numbers from 2012 and flat revenues per student, I get a 2013 EBIT of about 77 mUSD in 2013. This EBIT estimate will be the basis for my DCF valuation later in the write-up.

REVENUE SCENARIO ANALYSIS

2013? Percent dec/inc in revenues from 2012 Revenue mUSD Implied EBIT Margin EBIT mUSD minus taxes @ 39.5% plus normalized D&A minus normalized capex Rough FCF estimate divided by 10% discount rate minus net debt Equity value Per share Up/downside from current price of 45 USD Implied full-year EPS Implied P/E at 45 USD Implied EV/EBITDA @ 45 USD 2012E Numbers Revenue per student 2012 (FT) Number of students Revenue 2012 Implied equity value per share My 2013 Estimate Revenue per student 2013 (est flat yoy) Number of students fall term (- 10% yoy) Revenue Implied equity value per share -20 % 449.6 10.2 % 45.9 -18.1 25 -15 37.7 377.4 -56 321.4 30.5 -32.2 % 1.8 25.6 7.5 -15 % 477.7 12.7 % 60.7 -24.0 25 -15 46.7 467.0 -56 411.0 39.0 -13.3 % 2.8 16.3 6.2 -10 % 505.8 15.2 % 76.9 -30.4 25 -15 56.5 565.1 -56 509.1 48.4 7.4 % 3.8 12.0 5.2 -5 % 533.9 17.7 % 94.5 -37.3 25 -15 67.2 671.7 -56 615.7 58.5 29.9 % 4.8 9.5 4.5 2012 Levels* 0% 562.0 20.2 % 113.5 -44.8 25 -15 78.7 786.8 -56 730.8 69.4 54.2 % 5.8 7.8 3.9 5% 590.1 22.7 % 134.0 -52.9 25 -15 91.0 910.4 -56 854.4 81.1 80.3 % 6.8 6.7 3.4 10 % 618.2 25.2 % 155.8 -61.5 25 -15 104.3 1042.5 -56 986.5 93.7 108.2 % 7.8 5.8 3.0 15 % 646.3 27.7 % 179.0 -70.7 25 -15 118.3 1183.1 -56 1127.1 107.0 137.9 % 8.8 5.1 2.6 20 % 674.4 30.2 % 203.7 -80.4 25 -15 133.2 1332.2 -56 1276.2 121.2 169.3 % 9.8 4.6 2.3

* 2012 capex normalized, it's usually around 15 mUSD (c25 actual)

10,870 51,700 562,000,000 69.4 10,870 46,530 505,800,000 48.0

Strayer Education (STRA US) | 8/20/2013

CONCLUSION: DONT WAIT UNTIL THE DUST SETTLES I think the quality names in the for-profit sector will likely generate strong free cash flow streams in the future and reward the investors who had the fortitude to buy when the industry was in a downturn. The latecomers who waited until the dust had settled will not be able to benefit from the recovery. Finally, a note on possible M&A: I doubt industry players are the most likely buyers, as most struggle and APOL (although cash rich and able to buy STRA twice with cash on the balance sheet) seem to have other priorities. Private equity on the other hand may be (should be!) interested. Strayer is likely to fetch at least 77 USD/share in a buyout scenario based on recent M&A activity in the sector. In the low forties, Strayer is a very compelling target. I recommend buying STRA with a target price of 74 USD.

Strayer Education (STRA US) | 8/20/2013

CONTENTS

1. Elevator pitch 2. Investment thesis 10. Contents 11. Overall qualitative assessment, quality measures and key valuation ratios 12. Quick company and university overview 13. Industry landscape is changing but Strayer will be fine 15. The economic moats of STRA 17. Management team, management shareholdings and insider activity 19. Valuation section a. EPV b. DCF c. Buyout value 21. Possible catalysts and pre-mortem 22. Balance sheet 2007-2012

Strayer Education (STRA US) | 8/20/2013

10

OVERALL QUALITATIVE ASSESSMENT

Strong Moat

Low Risk 5 4 3 2 1 0

High Growth

Good Financials

Under Valued

Well Managed

Quality Measures

Piotroski F-SCORE: Altman Z-SCORE: 6 3.1

Beneish M-SCORE: -3.46

Fundamental Ratios

P/E P/E (cash adjusted) EV/EBITDA EV/Free Cash Flow P/S P/BV P/Tang BV P/CF P/FCF ROE ROA ROIC CROIC Current Ratio Total Debt/Equity Ratio

2011 10.30 9.76 5.70 9.27 1.74 25.82 30.77

2012 10.56 9.84 5.59 13.50 1.24 16.99 20.36

TTM 8.82 7.49 4.27 7.09 0.84 8.79 10.15

Strayer Education (STRA US) | 8/20/2013

7.78 7.05 5.39 8.78 12.14 6.30 250.7% 160.9% 103.9% 45.9% 111.8% 128.5% 1.23 2.78 28.9% 50.1% 41.8% 2.08 3.05 23.0% 44.3% 56.3% 2.84 2.42

11

QUICK COMPANY AND UNIVERSITY OVERVIEW

Strayer University is wholly owned by Strayer Education Inc. The University was founded in 1892 to educate adult students. Today the universitys total enrollment is a little shy of 47 000. The University offers both online and brick-and-mortar versions of their degree offerings (or hybrids) by way of 100 campuses. About 30% of students take 100% of courses online. Strayer is regionally accredited by the Middle States Comission on Higher Education, the same regulatory institution which oversees accreditation for prestigious universities like Princeton and Georgetown. Current accreditation runs through 2017 and it is extremely unlikely that this is not renewed. The Universitys latest periodic review report (2012)was accepted with commendations. Strayer is also well within the much discussed 90/10 limit on federal funding sources of revenue.

STUDENT PROFILE 86% of students are undergraduates. About 2/3rds are female, the student body is predominantly nonwhite (minorities are the majority with African Americans and Hispanic students comprising more than 50%) and the typical student is about 35 years old and currently employed. Most students are enrolled in business, accounting or information technology degrees, but the school also offers other degrees including EMBAs through their Jack Welch Management Institute.

12

Strayer Education (STRA US) | 8/20/2013

THE INDUSTRY LANDSCAPE IS CHANGING BUT STRAYER WILL BE FINE The market is very focused on how Strayer and its peers are subject to regulatory scrutiny and possible sanctions. This will impact enrollment trends and lower margins, especially when combined with the mentioned depletion of the student base in the boom years. However, this is now in the price and more, in my opinion. What is not being factored in by the market is the positive impact this has on the industry over time in creating higher regulatory barriers to entry. Regulations will protect the serious players and will eliminate or marginalize the diploma mills. The stricter student outcome criteria will make sure that upstarts will struggle to achieve efficient scale and compete with the larger, more established players aggressive marketing wont cut it anymore. The slower growing market will favor the incumbents. This is especially true now that offering low cost programs becomes more important as non-profits are entering the online space at a faster pace. I think Strayer will be one of the winners going forward because it has both cost advantages from scale, several recrutiment channels that do not depend on aggressive marketing, a high % degree students which bring more recurring revenue streams and a reputation for quality (as far as forprofits go). This combination of efficient scale, quality and a competitive price point is key.

NOT EXACTLY A PRESTIGIOUS SCHOOL, BUT FAR FROM A DIPLOMA MILL While Strayer is no Ivy League institution, in the for-profit space, Strayer is known as a high-quality provider. Strayer University has an open-access policy, which in practical terms makes it pretty easy to get in, but students have to show specific college-level competencies in math and english and have a high school diploma. Looking at cohort default rates, retention rates, loan defaults and post-graduate employment, it quickly becomes clear that Strayer is not another diploma mill and that it stands out as a quality provider in the for-profit industry. The senate report on Strayer speaks volumes, I think: Like many for-profit education companies, Strayer Education, Inc. has experienced steady growth in student enrollment, Federal funds collected, and profit realized in recent years. However, the companys performance, measured by student withdrawal and default rates, is one of the best of any company examined, and it appears that students are faring well at this degree based for-profit college. () Strayers withdrawal rate is significantly lower than the overall withdrawal rate of 54.4 percent, and is significantly lower when compared to other large publicly traded, for-profit education companies. With just 34 percent of Bachelors degree students withdrawing in the period analyzed, Strayer has the lowest withdrawal rate of any 4-year program examined. () Although Strayers 3-year default rate has gradually increased over the last 4 years, growing from 9.4 percent for students entering repayment in 2005 to 12.8 percent for students entering repayment in 2008, overall, Strayers default rate is far below the 22.3 percent average 3-year default rate for the for-profit education sector and closely tracks the default rate for all schools. Full report: http://www.help.senate.gov/imo/media/for_profit_report/PartII/Strayer.pdf

13

Strayer Education (STRA US) | 8/20/2013

Having now spent a great deal of time researching Strayer, I dont think its a stretch to say that it compares favorably with plenty of public and not-for-profit private schools (though not the the highest quality names obviously) especially if measured by student outcomes. STRA reports that 90% of Strayer alumni are employed at an average salary of 60 000 USD, and student surveys show 91% are satisfied with their experience at Strayer. If this is true (no way for me to verify these claims), it is impressive. When evaluating this company it is important to stay unbiased and remember that this school is not meant to compete with the best schools in the country but rather offers working adults with a less than stellar academic background and busy schedules an alternative way to get an education (the industrys minority-heavy profile and its size also makes political destruction of the industry unlikely). In my opinion, Strayer does this at a competitive price, and their value proposition is getting even better with the new scholarship initiatives. The high degree of student sourcing from both community college alliances, a substantial number of corporate relationships and the relatively low percentage of students coming from purchased leads supports this line of reasoning.

LOOKING AT STRAYERS OFFERING: HOW DOES TUTION COMPARE TO F-P AND N-F-P PEERS? Strayer recently announced an initiative (the SGUF Strayer University Graduation Fund) that improves Strayers value proposition and should help attract new students.(http://www.strayer.edu/gradfund) Basically, this program covers the cost of 1 future course if you complete 3. This makes Strayer extremely competitive in terms of price, it is a great value for new students and will probably improve enrollment and it also has the benefit of improving the retention and graduation rates which strengthens the Strayer quality brand further. Strayer University cost/credit* versus FP peers, non-profit and public unis after new discount:

University Strayer University of Phoenix Kaplan Ashford Capella Grand Canyon Liberty Walden National public average National nonprofit average

*Undergraduate degre, part-time.

Source: University websites.

Obviously, other schools can follow suit and lower their costs as well, which could lead to added margin pressure in the industry. But I believe Strayer is well positioned for a cost battle since it has among the highest EBIT and cash flow numbers per student. Its diversified recruitment profile lowers sales and marketing cost compared to peers (S&M costs as a percentage of revenue is about 12% for Strayer compared to a peer group average of 23.3%). Strayer also spends more on instruction costs than peers. If margins are squeezed further because of continued enrollment declines, competitors will suffer before STRA will in terms of the quality fo their offering. This also makes it more likely that STRA can up their marketing spend to capture market share in this environment if they choose.

14

Strayer Education (STRA US) | 8/20/2013

Cost/credit

296

585

383

413

343

465

304

300

375

495

STRAYERS MOATS

I believe Strayer enjoys certain important sustainable competitive advantages:

1. Cost advantages from economies of scale 2. Intagibles: Brand name in the for-profit industry with a 120 year history and very high student satisfaction scores. When looking at google trends indexed search hits for Strayer University, the trend is quite stable over the last few years. Thats neutral information at best. But when also considering the fact that their marketing spend as a % of revenue is roughly half of the peer group average, that suggests the Strayer brand is stronger, relatively speaking.

Google trend; indexed search results for Strayer University vs peers (APOL not shown)

Strayer Education (STRA US) | 8/20/2013

3. Regulatory advantages: Over time, regulation will provide barriers to entry in the for-profit education industry. Incumbents will benefit from stricter rules on admission practices as regulators focus on student outcomes and cohort default rates. Higher quality providers with stronger brand names will be the winners.

15

4. Network effects: Graduates who successfully land a better job through a STRA degree program strenghtens the brand and encourage new students to enroll. Employers tho find employees through their companys professional relationship with STRA are more likely to to pick future candidates from Strayer. STRA has corporate alliances with companies employing over 3.6 million people (sources: company, Deutsche Bank) including McDonalds, The United States Postal Service, Wachovia, Kroger Co, FedEx, Lowes and Comcast. Finally, STRAs alliances with community colleges (which include letting community colleges use their spaces during the day time) familiarizes CC students with Strayer and encourage them to complete more advanced degrees with Strayer rather than competitors. Since aggressive marketing is now scrutinized and condemned by regulators and politicians the predatory enrollment practices of the past will not return. This leaves companies with others sources of recruitment with an important and sustainable advantage as it lowers their sales and marketing costs substantially. Some of the companies with which Strayer has alliances:

While not strictly speaking a moat, Strayers high quality management is a competitive advantage as well. Management is discussed in more detail on the next page.

16

Strayer Education (STRA US) | 8/20/2013

MANAGEMENT TEAM

Chairman: Robert Silberman Robert Silberman (54) has done an impressive job, and while no longer CEO, is still responsible for capital allocation decisions and strategy. Silberman has been with the company as the CEO from 20012012 and served as chairman since 2003. His track record is very strong. For value investors, his detailed treatment of capital allocation in shareholder letters is refreshing and confidence inspiring. I encourage anyone even remotely interested in STRA to at least read pages 4-9 of the 2012 Annual Report: http://files.shareholder.com/downloads/STRA/2610432438x0x649545/eb557681-4e63-4466bda3-c01b0409ea57/2012.pdf Before joining Strayer, Silberman served as CEO of CalEnergy (a Buffett Company). He has had several senior positions in the US Department of Defense including Assistant Secretary of the Army. Robert Silberman holds a Bachelors degree in history from Dartmouth and a Masters in International Policy from Johns Hopkins University.

CEO Karl McDonnell The current CEO Karl McDonnell (45) has been with the company since 2006 as Chief Operating Officer. He works closely with Silberman on matters regarding company strategy and capital allocation. Before joining STRA, McDonnell worked as COO at InteliStaf Healtcare and Goldman Sachs. Mr McDonell is educated at Virginia Wesleyan and Duke (MBA).

Strayer Education (STRA US) | 8/20/2013

EVP & CFO Mark C Brown Mark Brown has been with the company since 2001. Prior to joining the Strayer team, Brown has held several management positions at PepsiCo and served as CFO of the Kantar Group. Brown is a CPA and holds a bachelors degree in accounting from Duke and an MBA from Harvard.

Management shareholdings are listed on the next page.

17

Management shareholdings

Directors: Robert S. Silberman Dr. Charlotte F. Beason William E. Brock Dr. John T. Casteen III David A. Coulter Robert R. Grusky

(i)

221,536 6,426 6,276 1,525 9,540 10,056 9,454 57,235 3,744 5,426 62,976

0 0 0 0 0 0 0 0 0 0 0

221,536 6,426 6,276 1,525 9,540 10,056 9,454 57,235 3,744 5,426 62,976

2.0 % * * * * * * * * * *

Robert L. Johnson Karl McDonnell Todd A. Milano G. Thomas Waite J. David Wargo

(j)

Named Executive Officers: Dr. Michael A. Plater Mark C. Brown Kelly J. Bozarth All Executive Officers and Directors (16 persons) 20,747 42,337 17,623 513,606 0 0 0 0 20,747 42,337 17,623 513,606 * * * 4.6 %

Recent Insider activity:

Strayer Education (STRA US) | 8/20/2013

18

VALUATION

Based on a median value of three different valuation methods, I arrived at a fair value of 77.5 USD. EPV: DCF Value: Buyout value: Average estimate: 79 USD 66 USD 78 USD 74 USD

EPV Earnings Power Value, aka no-growth valuation: 79 USD Notes on EPV: http://www.scribd.com/doc/15987706/Greenwald-Earnings-Power-Value-EPV-lecture-slides

EPV

Values for Normalized Income

TTM Free Cash Flow Avg Normalized Income Med Normalized Income Avg Adj. Income 5 yrs TTM Adjusted Income $ $ $ $ $ 71.1 127.7 130.5 127.6 83.2

EPV > Net Repro Value = Moat exists EPV = Net Repro Value = No Moat EPV < Net Repro Value = Value Destroyer

$90

$80

$70

Data: EPV

Cost of Capital Normalized Adjusted Income Average Maintenance Capex Interest Bearing Debt 1% of sales Cash & Equiv Cash - Debt Shares $ $ $ $ $ $ 10.0% 108.0 19.5 123.4 5.4 67.5 (61.3) 10.50

$60

$50

$40 $30

$20

Strayer Education (STRA US) | 8/20/2013

$10

$0

Book Value

Net Repro Value

EPV

Calculation: EPV

Cost of Capital Rates 6% 8% $ $ EPV 1,476.4 1,107.3 738.2 632.7 $ $ $ $ Per Share 140.61 105.46 70.31 60.26 $ $ $ $ + Cash - Debt 1,415.2 1,046.0 676.9 571.5 $ $ $ $ Per Share 134.78 99.62

10 %

12 % 14 %

$

$ $

885.8 $

84.37 $

824.6 $

78.53

64.47 54.43

19

DCF Value: 66 USD Im using management guidance on revenue and margins dynamics and the EBIT estimate from my scenario analysis tables above as my starting point (2013 EBIT of 76,9 mUSD, implying flat revenue per student y-o-y, but 10% enrollment declines from last years fall semester number). Im assuming that revenues stay flat in 2014. Im also assuming that EBIT resumes growth by 5% per year from 2014 until 2017, after which I assume 3% terminal growth in perpetuity. This yields a DCF value of about 66 USD.

Ma rket ca p Ta x Ra te Net Debt Sha res

474 39.5% $139.3 10.5

DCF Strayer Education

2012A $113.6 $113.6 (44.9) $68.7 25.0 (25.0) (15.0) $53.7 11.3 %

2013P $76.9 -32.3 % $76.9 (30.4) $46.5 25.8 (12.5) 0.0 $59.8 12.6 %

2014P $76.9 0.0 % $76.9 (30.4) $46.5 26.5 (15.0) 0.0 $58.0 12.2 %

2015P $80.7 5.0 % $80.7 (31.9) $48.8 27.3 (15.8) 0.0 $60.4 12.7 %

2016P $84.8 5.0 % $84.8 (33.5) $51.3 28.1 (16.5) 0.0 $62.9 13.3 %

2017P $89.0 5.0 % $89.0 (35.2) $53.8 29.0 (17.4) 0.0 $65.5 13.8 %

EBIT growth ND. goodwill amortization EBITA Taxes Unlevered Net Income D&A Capex incl acquisition costs Increase in working capital Unlevered Free Cash Flow FCF Yield

Discount Rate (WACC)

Total Enterprise Value Terminal Perpetuity Growth Rate 3.0% 3.5% 4.0% 9.0% $967.8 $1,038.1 $1,122.4 10.0% 829.4 878.5 935.8 11.0% 725.6 761.5 802.6 Implied Terminal EBITDA Multiple Terminal Perpetuity Growth Rate 3.0% 3.5% 4.0% 9.0% 12.6x 13.8x 15.3x 10.0% 10.8x 11.7x 12.7x 11.0% 9.5x 10.2x 10.9x

Total Equity Value Terminal Perpetuity Growth Rate 3.0% 3.5% 4.0% 9.0% $828.5 $898.8 $983.1 10.0% 690.1 739.2 796.5 11.0% 586.3 622.2 663.3 Total Price Per Share Terminal Perpetuity Growth Rate 3.0% 3.5% 4.0% 9.0% $78.68 $85.35 $93.36 10.0% 65.53 70.20 75.64 11.0% 55.68 59.09 62.99

Value in a buyout scenario: 77.5 While larger publicly listed players like APOL may not view STRA with much interest at the moment, STRA may be an interesting PE target given its low leverage and high and normally stable cash flow profile.Based on recent transactions in the education industry, I estimate the buyout value of STRA to be 77.5 USD/share. According to Berkery Noyes and Bank of Montreal, the median EV/EBITDA multiple in the last 213 transactions were details were disclosed was 10. This would imply a stock price of 127 USD. Looking at EV/revenue multiples, the median multiple in the same transactions has been 1.5. Since the output from this latter metric is substantially below that of the first, I choose to stick with the lower of the two in order to be conservative. 1.5 x 2012 revenues imply a buyout value of 77.5 USD per share.

20

Strayer Education (STRA US) | 8/20/2013

Possible catalysts + Pre-mortem

Possible catalysts to unlock value: Stabilizing or improving enrollment trends in the industry Impact of increased marketing in Q3 and beyond of the Graduation fund improves enrollment Buyout offer from PE or industry peer (the latter is less likely in my opinion) More clarity on regulatory issues Unemployment decline in target demographic If the share price stays low, buybacks can be expected (stated strategy to return excess cash. 70m USD remaining on the most recent share repurchase authorization)

Pre-mortem: (if your investment thesis does not play out like you thought, what is most likely to have caused this to happen?)

1. Regulatory pressures increase more than I have imagined possible, and this negatively impacts enrollment trends Mitigant: Senate reports are complete. Regulatory pressures has so far been less draconian than first assumed. The minority-heavy demographic makes shutting down the industry political suicide. Regulation also acts as barriers to entry in the for-profit industry

Strayer Education (STRA US) | 8/20/2013

2. Non-profit schools capture more market share than industry analysts assume and this impacts for-profit enrollment trends negatively. Margin pressures ensue and the operational leverage embedded in for-profit model lead to large losses over the next few years Mitigant: Industry trends suggest impact of non-profits entering online are limited when considering the simultaneous growth in the prospective student base. Non-profits on average are not cheaper than the cheapest for-profits, in fact the opposite is often the case .In addition, STRA is not only an online school.

3. The economy goes into recession and employment trends worsen considerably. Mitigant: No mitigant really. Although enrollment trends are improving slightly for the target demographic currently, this of course does not mean that they will continue to do so going forward.

21

Balance sheet 2007-2012

Balance sheet

Assets

Cash and Equiv Short-Term Investments Net Receivables

% change from prev year

2007

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 95.0 $ 76.3 $ 100.7 $ 24.6% $ $ $ $ $ $

2008

56.4 $ 51.0 $ 135.0 $ 34.1% $ $ $ $ $ $

2009

64.0 $ 52.6 $ 165.1 $ 22.3% $ $ $ $ $ $

2010

64.1 $ 12.4 $ 199.6 $ 20.9% $ $ $ $ $ $

2011

57.1 $ $ 25.4 $ -87.3% $ $ $ $ $ $

2012

47.5 27.7 9.1% 14.4 89.7 7.1 56.6 153.6 0.7 218.0 121.5 6.8 3.3 6.5 138.1 227.8

Inventories, raw materials Inventories, work in progress Inventories, purchased components Inventories, finished goods Inventories, other Inventories

% change from prev year

Prepaid Expenses Current Deferred Income Taxes Other Current Assets Total Current Assets Land and Improvements Building and Improvements Machinery, Furniture & Equipment Construction in Progress Other Fixed Assets Total Fixed Assets Net Fixed Assets Intangible Assets Goodwill Non Current Deferred Income Taxes Other Long-Term Assets Total Long-Term Assets Total Assets

$ $ 4.1 $ 276.1 5.7 36.8 48.6 2.8 94.0 57.9 8.8 0.9 67.7 $ $ $ $ $ $ $ $ $ $ $ $ $

$ $ 7.2 $ 249.5 5.7 44.3 62.1 1.0 113.1 66.3 7.8 1.0 75.1 $ $ $ $ $ $ $ $ $ $ $ $ $

$ $ 8.3 $ 290.0 5.7 49.2 79.7 8.7 143.3 84.7 9.3 1.8 95.8 $ $ $ $ $ $ $ $ $ $ $ $ $

$ $ 10.2 $ 286.3 7.1 51.9 96.8 34.8 190.6 116.1 8.4 2.0 126.4 $ $ $ $ $ $ $ $ $ $ $ $ $

$ $ 12.1 $ 94.7 7.1 51.7 146.5 0.8 206.2 121.1 6.8 3.3 5.2 136.5 $ $ $ $ $ $ $ $ $ $ $ $ $

343.8 $

324.6 $

385.8 $

412.8 $

231.1 $

Liabilities & Stockholders' Equity

Accounts payable Short-Term Debt Taxes Payable Accrued Expenses Accrued Liabilities Deferred Revenues Current Deferred Income Taxes Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Deferred Income Taxes Total Long-Term Liabilities Total Liabilities Retained Earnings Preferred Equity Total Equity Total Liabilities & Equity $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 15.7 $ $ $ 3.3 $ $ $ $ 125.4 $ 144.3 $ $ 10.9 $ $ 10.9 $ 155.3 $ 101.1 $ $ 188.5 $ 343.8 $ 17.1 4.6 115.2 $ $ $ $ $ $ $ $ 21.3 7.8 149.8 5.4 $ $ $ $ $ $ $ $ 31.3 10.5 181.1 1.2 224.1 12.6 12.6 $ $ $ $ $ $ $ $ $ $ $ $ $ 34.0 27.5 15.4 0.3 77.2 90.0 21.7 111.7 $ $ $ $ $ $ $ $ $ $ $ $ $ 39.1 3.1 0.5 0.3 43.0 121.9 21.9 143.8 186.8 41.3 41.0 227.8

136.8 $ $ 11.7 $ $ 11.7 $ 148.5 $ 158.8 $ $ 176.1 $ 324.6 $

184.2 $ $ 11.7 $ $ 11.7 $ 196.0 $ 188.2 $ $ 189.8 $ 385.8 $

236.8 $ 174.6 $ $ 176.0 $ 412.8 $

188.8 $ 42.5 $ $ 42.3 $ 231.1 $

22

Strayer Education (STRA US) | 8/20/2013

Vous aimerez peut-être aussi

- Emergency Debris Hauling - Dade BiddersDocument5 pagesEmergency Debris Hauling - Dade Biddersgiorgiogarrido6Pas encore d'évaluation

- Funds Rebound Strongly in Q2 Despite Economic UncertaintyDocument13 pagesFunds Rebound Strongly in Q2 Despite Economic Uncertaintygiorgiogarrido6Pas encore d'évaluation

- Survival Rates of Service Business - StudyDocument14 pagesSurvival Rates of Service Business - Studygiorgiogarrido6Pas encore d'évaluation

- 5 de 5 A 3408 F 57150Document27 pages5 de 5 A 3408 F 57150Tony RocasPas encore d'évaluation

- History of Beiersdorf & CoDocument28 pagesHistory of Beiersdorf & Cogiorgiogarrido6Pas encore d'évaluation

- Moving The Market - Mro ManagementDocument3 pagesMoving The Market - Mro Managementgiorgiogarrido6Pas encore d'évaluation

- Aviation Maintenance Intelligence Issue 00354Document53 pagesAviation Maintenance Intelligence Issue 00354giorgiogarrido6Pas encore d'évaluation

- Manias and Mimesis: Applying René Girard To Financial BubblesDocument34 pagesManias and Mimesis: Applying René Girard To Financial Bubblesbyrneseyeview100% (4)

- MRO 2017 Aeroturbine and AJW PG 52Document170 pagesMRO 2017 Aeroturbine and AJW PG 52giorgiogarrido6Pas encore d'évaluation

- MRI Interventions, Inc. Investor Presentation PDFDocument30 pagesMRI Interventions, Inc. Investor Presentation PDFgiorgiogarrido6Pas encore d'évaluation

- Aero - Dynamic - Ajw GroupDocument19 pagesAero - Dynamic - Ajw Groupgiorgiogarrido6Pas encore d'évaluation

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocument26 pagesLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6Pas encore d'évaluation

- AerCap Reshapes Used Parts Subsidiary To Supporting RoleDocument16 pagesAerCap Reshapes Used Parts Subsidiary To Supporting Rolegiorgiogarrido6Pas encore d'évaluation

- Sum of The Parts - Mro ManagementDocument4 pagesSum of The Parts - Mro Managementgiorgiogarrido6Pas encore d'évaluation

- Yelp A Fresh Perspective SQN Investors 01.16.2019Document112 pagesYelp A Fresh Perspective SQN Investors 01.16.2019Phan AnPas encore d'évaluation

- MS - ThemathofvalueandgrowthDocument13 pagesMS - ThemathofvalueandgrowthmilandeepPas encore d'évaluation

- This Post Was Originally Included in Our Quarterly Letter To Our LPs in Q4 2012Document10 pagesThis Post Was Originally Included in Our Quarterly Letter To Our LPs in Q4 2012giorgiogarrido6Pas encore d'évaluation

- Reflections of A Value Investors in AfricaDocument20 pagesReflections of A Value Investors in AfricaKevin MartelliPas encore d'évaluation

- Value Investors Club - Post Holdings Inc (Post)Document11 pagesValue Investors Club - Post Holdings Inc (Post)giorgiogarrido6Pas encore d'évaluation

- Rail RenaissanceDocument27 pagesRail RenaissanceEvan TindellPas encore d'évaluation

- Payments Outlook For 2016 January 7 20161Document36 pagesPayments Outlook For 2016 January 7 20161giorgiogarrido6Pas encore d'évaluation

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocument26 pagesLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6Pas encore d'évaluation

- 2015 Pacific Crest SaaS Survey 10.16.15 2Document72 pages2015 Pacific Crest SaaS Survey 10.16.15 2giorgiogarrido6Pas encore d'évaluation

- Pitcairn Book ListDocument11 pagesPitcairn Book Listgiorgiogarrido6Pas encore d'évaluation

- Platform EconomicsDocument459 pagesPlatform Economicsgiorgiogarrido6100% (1)

- Wp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101Document2 pagesWp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101giorgiogarrido6Pas encore d'évaluation

- Investment Process and Valuation GuideDocument43 pagesInvestment Process and Valuation Guidegiorgiogarrido6Pas encore d'évaluation

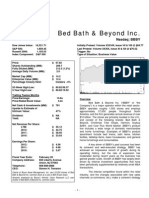

- BBBYDocument13 pagesBBBYgiorgiogarrido6Pas encore d'évaluation

- Valuation of ABB: Organic vs M&A GrowthDocument113 pagesValuation of ABB: Organic vs M&A Growthgiorgiogarrido6Pas encore d'évaluation

- Navigating Planet Ad Tech: A Guide For MarketersDocument10 pagesNavigating Planet Ad Tech: A Guide For Marketersgiorgiogarrido6Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Segmenting The Business Market and Estimating Segment DemandDocument24 pagesSegmenting The Business Market and Estimating Segment Demandlilian04Pas encore d'évaluation

- Economy Current Affairs by Teju, Nextgen Ias - November 2020Document50 pagesEconomy Current Affairs by Teju, Nextgen Ias - November 2020akshaygmailPas encore d'évaluation

- Kimball International case studyDocument4 pagesKimball International case studyVedantBhasinPas encore d'évaluation

- Ias 2Document5 pagesIas 2nnwritiPas encore d'évaluation

- Perry Belcher - Secret Selling System - Nerd NotesDocument118 pagesPerry Belcher - Secret Selling System - Nerd Notesgeorge100% (4)

- Describing Statistics in GraphsDocument4 pagesDescribing Statistics in GraphsNurul AuliaPas encore d'évaluation

- Notes On Classification of Costs and Cost ConceptsDocument5 pagesNotes On Classification of Costs and Cost ConceptsAngela Mae Balanon RafananPas encore d'évaluation

- C Boe Taxes and InvestingDocument27 pagesC Boe Taxes and InvestingWillie DeVriesPas encore d'évaluation

- Ic38 Q&a-2Document29 pagesIc38 Q&a-2Anonymous O82vX350% (2)

- 115 Internet Marketing IdeasDocument17 pages115 Internet Marketing Ideasjluvzdtcdddd100% (1)

- Analysis of Monopolistically Competitive MarketDocument4 pagesAnalysis of Monopolistically Competitive MarketQueensenPas encore d'évaluation

- Pakistani Middle Class Growth and PrecarityDocument8 pagesPakistani Middle Class Growth and PrecarityMaherban HaiderPas encore d'évaluation

- MKT Management AssainmentDocument11 pagesMKT Management AssainmentEhsan Ul HaquePas encore d'évaluation

- Foundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDocument19 pagesFoundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDebesh GhoshPas encore d'évaluation

- BDO UITFs 2017 PDFDocument4 pagesBDO UITFs 2017 PDFfheruPas encore d'évaluation

- Intl. Finance Test 1 - CompleteDocument6 pagesIntl. Finance Test 1 - CompleteyaniPas encore d'évaluation

- Coins of SrilankaDocument1 pageCoins of Srilankasaliya07Pas encore d'évaluation

- Environgrad Corporation: Evaluating Three Financing AlternativesDocument25 pagesEnvirongrad Corporation: Evaluating Three Financing AlternativesAbhi Krishna ShresthaPas encore d'évaluation

- The Western Outfitters Store Specializes in Denim Jeans The Variable Cost of The Jeans Varies PDFDocument3 pagesThe Western Outfitters Store Specializes in Denim Jeans The Variable Cost of The Jeans Varies PDFCharlottePas encore d'évaluation

- International Oil Trader Academy Winter School - Virtual DeliveryDocument6 pagesInternational Oil Trader Academy Winter School - Virtual DeliveryMuslim NasirPas encore d'évaluation

- Lecture 14 25062022 060915pmDocument37 pagesLecture 14 25062022 060915pmSyeda Maira BatoolPas encore d'évaluation

- Qualifying Exam - FAR - 1st YearDocument11 pagesQualifying Exam - FAR - 1st YearKristina Angelina ReyesPas encore d'évaluation

- Mutual Funds Vs Real Estate - Which Is Better For Investing in India - Stable InvestorDocument12 pagesMutual Funds Vs Real Estate - Which Is Better For Investing in India - Stable InvestorleninbapujiPas encore d'évaluation

- Purchase Agreement for Farm Land, Buildings, Equipment & LivestockDocument2 pagesPurchase Agreement for Farm Land, Buildings, Equipment & LivestockSimona MarinPas encore d'évaluation

- U4L8 Externalities EssayDocument4 pagesU4L8 Externalities Essayhtbnservice100% (1)

- Hughes Engineering CaseDocument3 pagesHughes Engineering CaseElainePas encore d'évaluation

- Chapter 11 Foreign ExchangeDocument17 pagesChapter 11 Foreign Exchangebuzov_dPas encore d'évaluation

- Price Elasticity of Demand ExplainedDocument20 pagesPrice Elasticity of Demand ExplainedShubham DeshmukhPas encore d'évaluation

- Case Study 2 DogsDocument5 pagesCase Study 2 DogsNaveed AkhterPas encore d'évaluation

- Steven Belkin Case AnalysisDocument7 pagesSteven Belkin Case AnalysisDiva PatriciaPas encore d'évaluation