Académique Documents

Professionnel Documents

Culture Documents

Subject: - Penalty Proceedings Under Section 271A of The Income Tax Act., 1961 For The Assessment Year 2010-11 in The Case of M/s J K Public School, Humhama, Budgam-Matter Regarding

Transféré par

peeraajizDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Subject: - Penalty Proceedings Under Section 271A of The Income Tax Act., 1961 For The Assessment Year 2010-11 in The Case of M/s J K Public School, Humhama, Budgam-Matter Regarding

Transféré par

peeraajizDroits d'auteur :

Formats disponibles

To

Income Tax Officer, Ward-3(1), Srinagar.

Subject : - Penalty proceedings under section 271A of the Income Tax Act., 1961 for the assessment year 2010-11 in the case of M/s J K Public School, Humhama, Budgam-matter regarding.

Sir,

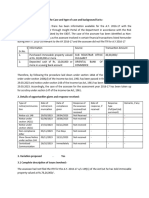

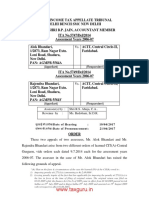

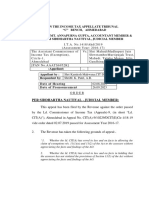

This is regarding the captioned subject. In this regard it is submitted that the penalty u/s 271A in the case of above mentioned assessee can not be levied. This contention of ours is based on the following facts: 1. The AO in his assessment order dated 01/03/2013 under para 4 mentions that no books of accounts were produced by the assessee. This does not mean that the assessee has not maintained books of accounts for the year under reference. Further, kindly refer our reply dated 12/11/2012. On this date books of accounts along with other desired information/documents were produced. If asked for, the books of accounts maintained by the assessee can be produced afresh. 2. The auditors of the trust have audited the books of accounts and audit report along with other financial statements was provided during the assessment proceedings. The auditor clearly mentions in his audit report that the trust has maintained and produced proper books of accounts during the audit process (Copy of audit report enclosed). So, based on the above mentioned facts it is evident that the penalty u/s 271A can not be levied. Thanking You For M/s J K Public School CA S A Mir (Counsel)

To

Income Tax Officer, Ward-3(1), Srinagar.

Subject : - Penalty proceedings under section 271(1)(b) of the Income Tax Act., 1961 for the assessment year 2010-11 in the case of M/s J K Public School, Humhama, Budgam-matter regarding.

Sir, This is in response to your notice u/s 271(1)(b) dated 02/09/2013. In this regard it is submitted that we have replied to all most all the notices issued during the assessment proceedings for the above mentioned assessment year. However, there were also one or two non-compliances. Such noncompliances were with genuine reasons. Synopsys of the notices served upon the assessee during the assessment proceedings is given as under: S. No. Nature of Notice 01. Notice u/s 143(2) 02. 03. 04. Notice u/s 143(1) Notice u/s 142(1) Notice u/s 142(1) Date of Hearing 14/10/2011 12/11/2012 12/12/2012 14/01/2013 Remarks Attended (refer para 2 of the Assessment order) -doWhole Kashmir was under Curfew like situation. There was a heavy snowfall on the day before the date of hearing.

So, keeping in view the above mentioned facts of the case it is clear that there were no deliberate noncompliance of the notices. It is requested that the penalty proceedings u/s 271(1)(b) initiated against the assessee may be dropped. Thanking You For M/s J K Public School

CA S A Mir (Counsel)

Vous aimerez peut-être aussi

- Seeking Direction U/s 144A For Completion of Assessment U/s 144 of The IT. Act, 1961 in The Sh. Anil Gupta (PAN: ARUPG8350Q), A.Y. 2017-18Document3 pagesSeeking Direction U/s 144A For Completion of Assessment U/s 144 of The IT. Act, 1961 in The Sh. Anil Gupta (PAN: ARUPG8350Q), A.Y. 2017-18Dilip KumarPas encore d'évaluation

- Advanced Tax Laws Question Paper 2021-2022Document4 pagesAdvanced Tax Laws Question Paper 2021-2022sorien panditPas encore d'évaluation

- Calcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)Document6 pagesCalcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)rigiyanPas encore d'évaluation

- Cheque ForwardingDocument5 pagesCheque Forwardingajaykarn_2011Pas encore d'évaluation

- Veritas Q-II 2009-10Document2 pagesVeritas Q-II 2009-10Himanshu ChouhanPas encore d'évaluation

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalPas encore d'évaluation

- JHC 491832Document11 pagesJHC 491832Kunal NawalePas encore d'évaluation

- Final SCN SOP Non ResponsiveDocument2 pagesFinal SCN SOP Non Responsiveanil deswalPas encore d'évaluation

- CCADocument182 pagesCCAHemlata SharmaPas encore d'évaluation

- PGDLL - SIP Report Vikas ManeDocument20 pagesPGDLL - SIP Report Vikas ManeRakhi kamblePas encore d'évaluation

- 03.06.22 - Brahmanand Construction - Synopsis and List of DatesDocument3 pages03.06.22 - Brahmanand Construction - Synopsis and List of DatesRahul kumarPas encore d'évaluation

- Dell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Document30 pagesDell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Rıtesha DasPas encore d'évaluation

- Cit Vs Manjunath CottonDocument109 pagesCit Vs Manjunath Cottondhanishta906Pas encore d'évaluation

- MEENA KOTECHA 271 (1) (C) LetterDocument20 pagesMEENA KOTECHA 271 (1) (C) LetterAnonymous pOGrNqPas encore d'évaluation

- Types of Income Tax NoticeDocument2 pagesTypes of Income Tax NoticetayaisgreatPas encore d'évaluation

- 1614060815-5446 Bhupendra JainDocument8 pages1614060815-5446 Bhupendra Jainakhil layogPas encore d'évaluation

- Dossier of Rs. 1 Crore and Above - Quarter Ending - December - 2019Document5 pagesDossier of Rs. 1 Crore and Above - Quarter Ending - December - 2019JudicialPas encore d'évaluation

- PR PDFDocument17 pagesPR PDFVIGNESHPas encore d'évaluation

- SB OrdersDocument16 pagesSB OrdersyenyesraoPas encore d'évaluation

- Alok Bhandari Anr. vs. ACIT ITAT DelhiDocument7 pagesAlok Bhandari Anr. vs. ACIT ITAT DelhivedaPas encore d'évaluation

- Appeal of Jai NarainDocument3 pagesAppeal of Jai NarainAmar MoryaPas encore d'évaluation

- Macp CaseDocument13 pagesMacp CaseSambasivam GanesanPas encore d'évaluation

- UntitledDocument1 pageUntitledshmn sPas encore d'évaluation

- Types of Income Tax AssessmentDocument3 pagesTypes of Income Tax AssessmenttayaisgreatPas encore d'évaluation

- Gold Investment TrustDocument8 pagesGold Investment Trusttanuj.agarwalPas encore d'évaluation

- Monthly Covering - OdtDocument1 pageMonthly Covering - OdtAnonymous 4L4x5aCGifPas encore d'évaluation

- "Noticee"/ "The Company") Had Failed To Redress The Investor Grievances. TheDocument4 pages"Noticee"/ "The Company") Had Failed To Redress The Investor Grievances. TheJairaam PrasadPas encore d'évaluation

- 2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024Document8 pages2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024meghan googlyPas encore d'évaluation

- Directorate of Treasuries and Accounts Andhra Pradesh: Amaravati at Ibrahimpatnam FIN02-11044/22/2019-A SEC-DTA 1026331Document7 pagesDirectorate of Treasuries and Accounts Andhra Pradesh: Amaravati at Ibrahimpatnam FIN02-11044/22/2019-A SEC-DTA 1026331NAGA SATYANARAYANA NELLURIPas encore d'évaluation

- Abbottabad Audit 2013Document39 pagesAbbottabad Audit 2013Lila GulPas encore d'évaluation

- Bio DataDocument10 pagesBio DataRavinder KaurPas encore d'évaluation

- Anil Marda 143 2 NoticeDocument32 pagesAnil Marda 143 2 NoticeLPas encore d'évaluation

- 274 and 271 (1) (C)Document2 pages274 and 271 (1) (C)Rajeshkumar RabidasPas encore d'évaluation

- Evidence: The Detail of Source of Income Has Been Mentioned in TheDocument2 pagesEvidence: The Detail of Source of Income Has Been Mentioned in TheDrone TewatiaPas encore d'évaluation

- Taxpayers CharterDocument3 pagesTaxpayers CharterShahaan ZulfiqarPas encore d'évaluation

- CoveringDocument1 pageCoveringombirdahiaPas encore d'évaluation

- Swati Malove Divetiavs Income Tax OfficerDocument4 pagesSwati Malove Divetiavs Income Tax OfficerAnandd BabunathPas encore d'évaluation

- Raj Kumar Bhatia Vs M O Finance On 10 April 2019Document7 pagesRaj Kumar Bhatia Vs M O Finance On 10 April 2019srstidco1965Pas encore d'évaluation

- ALPHA 91KP Solutions Brief Facts of The CaseDocument2 pagesALPHA 91KP Solutions Brief Facts of The CaseAdv Shyam KGPas encore d'évaluation

- The Institute of Chartered Accountants of India: (Set Up by An Act of Parliament)Document2 pagesThe Institute of Chartered Accountants of India: (Set Up by An Act of Parliament)Purna AcharyaPas encore d'évaluation

- 00 - Checklist - Past Audit Reports - TransmissionDocument4 pages00 - Checklist - Past Audit Reports - Transmissionpave.scgroupPas encore d'évaluation

- MBL Exam Schedule Dec2013Document4 pagesMBL Exam Schedule Dec2013Sooraj SubramanianPas encore d'évaluation

- Pca Ii InstallmentDocument1 pagePca Ii InstallmentTNGTFPas encore d'évaluation

- Cit (A)Document8 pagesCit (A)Raaja ThalapathyPas encore d'évaluation

- Fin e 46373 2014 0Document2 pagesFin e 46373 2014 0Papu KuttyPas encore d'évaluation

- M/S.Ashok Leyland LTD Vs The Assistant Commissioner of On 10 February, 2016Document2 pagesM/S.Ashok Leyland LTD Vs The Assistant Commissioner of On 10 February, 2016shantXPas encore d'évaluation

- Income Tax LetterDocument1 pageIncome Tax LetterBritish ConstructionPas encore d'évaluation

- Tutorial Letter 102/3/2019: Financial Accounting Principles For Law PractitionersDocument41 pagesTutorial Letter 102/3/2019: Financial Accounting Principles For Law Practitionersall green associatesPas encore d'évaluation

- 1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFDocument64 pages1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFParas GuliaPas encore d'évaluation

- Fin e 143 2023Document3 pagesFin e 143 2023star xeroxPas encore d'évaluation

- Blank FormateDocument1 pageBlank FormatePriyadharshini HRPas encore d'évaluation

- Anil Kumar Bhatia and Ors Vs Asstt Commissioner ofID100010COM554512Document10 pagesAnil Kumar Bhatia and Ors Vs Asstt Commissioner ofID100010COM554512Jung AleehsusPas encore d'évaluation

- In The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberDocument12 pagesIn The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberKushwanth Soft SolutionsPas encore d'évaluation

- Indo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiDocument6 pagesIndo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiAshish GoelPas encore d'évaluation

- CAS Puri 2023 JanDocument2 pagesCAS Puri 2023 JanChinmay MohapatraPas encore d'évaluation

- NotingDocument160 pagesNotingdpkonnetPas encore d'évaluation

- Income Statement For The Year Ending On 30.6.2000 (Assessment Year 2000-2001)Document8 pagesIncome Statement For The Year Ending On 30.6.2000 (Assessment Year 2000-2001)api-3745637Pas encore d'évaluation

- AKTPS1245A - Notice Us 142 (1) - 06032022Document3 pagesAKTPS1245A - Notice Us 142 (1) - 06032022Birdhi ChandPas encore d'évaluation

- Pipeline EssayDocument6 pagesPipeline EssayChavon pattersonPas encore d'évaluation

- Philippines in The 19th CenturyDocument7 pagesPhilippines in The 19th CenturyGuevarra, Kristine Joy J.Pas encore d'évaluation

- Sociology Class NotesDocument29 pagesSociology Class NotesblinkeyblockPas encore d'évaluation

- Marx and Hegel On AlienationDocument10 pagesMarx and Hegel On AlienationVenkata PraneethPas encore d'évaluation

- The Nature & Sources of Liberal International Order (Deudney & Ickenberry)Document19 pagesThe Nature & Sources of Liberal International Order (Deudney & Ickenberry)Rachel Dbbs100% (1)

- Chapter 1 ECON NOTESDocument5 pagesChapter 1 ECON NOTESMarkPas encore d'évaluation

- Karma CapitalismDocument4 pagesKarma CapitalismAshu Joshi Anandvardhan DasPas encore d'évaluation

- Edexcel GCE History A World Divided Superpower Relations Unit 3 PDFDocument225 pagesEdexcel GCE History A World Divided Superpower Relations Unit 3 PDFJK67% (3)

- PDE Lecture 3Document48 pagesPDE Lecture 3fanusPas encore d'évaluation

- Lockwood David Social Integration and System Integration PDFDocument8 pagesLockwood David Social Integration and System Integration PDFEmerson93Pas encore d'évaluation

- Excerpt From "America: Imagine A World Without Her" by Dinesh D'Souza.Document4 pagesExcerpt From "America: Imagine A World Without Her" by Dinesh D'Souza.OnPointRadioPas encore d'évaluation

- Alain Touraine and Manuel Castells and Social Movement Theory - A Critical AppraisalDocument21 pagesAlain Touraine and Manuel Castells and Social Movement Theory - A Critical Appraisalsssssss2Pas encore d'évaluation

- Theories of GlobalizationDocument16 pagesTheories of GlobalizationolaobembePas encore d'évaluation

- Winner Do Artifacts Have Politics 1980Document17 pagesWinner Do Artifacts Have Politics 1980Florina FrancuPas encore d'évaluation

- OM3 CH 11 Forecasting and Demand PlanningDocument30 pagesOM3 CH 11 Forecasting and Demand PlanningGeorge VilladolidPas encore d'évaluation

- Obligations of A PartnerDocument7 pagesObligations of A PartnerArvin AndayaPas encore d'évaluation

- CSS Governance and Public PoliciesDocument21 pagesCSS Governance and Public Policiestouqeer zahra100% (1)

- Ofp 015 - Economics PDFDocument187 pagesOfp 015 - Economics PDFAllie ChilamboPas encore d'évaluation

- ITBDocument37 pagesITBQaiser MehmoodPas encore d'évaluation

- An Essay On Extreme Gangbang Sex.20121104.225403Document2 pagesAn Essay On Extreme Gangbang Sex.20121104.225403anon_186461206Pas encore d'évaluation

- Britton - Tourism Capital and PlaceDocument28 pagesBritton - Tourism Capital and PlaceGuillermoPas encore d'évaluation

- Industrial RelationsDocument226 pagesIndustrial RelationsSugar Plums50% (2)

- Deegan - FAT3e - Chapter - 12: StudentDocument17 pagesDeegan - FAT3e - Chapter - 12: StudentKamal samaPas encore d'évaluation

- (Language Policy 11) Robert Kirkpatrick (Eds.) - English Language Education Policy in Asia-Springer International Publishing (2016) - 1 PDFDocument388 pages(Language Policy 11) Robert Kirkpatrick (Eds.) - English Language Education Policy in Asia-Springer International Publishing (2016) - 1 PDFSalsabila Kaamalia100% (2)

- Moral Sentiments Part One The Myth of CapitalDocument11 pagesMoral Sentiments Part One The Myth of CapitalJ CooperPas encore d'évaluation

- Previous Years Questions and AnswersDocument26 pagesPrevious Years Questions and Answerslucky420024Pas encore d'évaluation

- The Ground Report India - 2010 May Edition PDFDocument45 pagesThe Ground Report India - 2010 May Edition PDFThe Ground Report IndiaPas encore d'évaluation

- Topic 8Document11 pagesTopic 8Jihad Mufry AnnahlPas encore d'évaluation

- Reviewer Contemp SS 113 101 MidtermDocument2 pagesReviewer Contemp SS 113 101 MidtermLanie AlbertoPas encore d'évaluation