Académique Documents

Professionnel Documents

Culture Documents

National Bank For Agriculture and Rural Development-11

Transféré par

Naveen BansalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

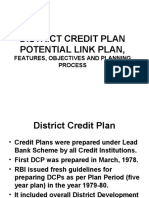

Formats disponibles

National Bank For Agriculture and Rural Development-11

Transféré par

Naveen BansalDroits d'auteur :

Formats disponibles

www.reportjunction.

com

www.sansco.net

ANNUAL REPORT 2010-2011

NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENT

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Letter of Transmittal

NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENT Plot: C-24/G, Bandra-Kurla Complex Post Box: 8121, Bandra (East) Mumbai - 400 051 CHAIRMAN Ref.No.NB.Secy./ 697 / AR-1/2011-12 11 July 2011 20 Ashadha 1933 (Saka) The Secretary Government of India Ministry of Finance Department of Financial Services New Delhi- 110 001 The Governor Reserve Bank of India Central Office Mumbai- 400 001 Dear Sir In pursuance of Section 48(5) of the National Bank for Agriculture and Rural Development Act, 1981, I transmit herewith the following documents : i. A copy of the audited Annual Accounts for the year ended 31 March 2011 alongwith a copy of the Auditors Report and Two copies of the Annual Report of the Board of Directors on the working of st National Bank during the year ended 31 March 2011.

st

ii.

Yours faithfully

Prakash Bakshi

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Board of Directors

Rakesh Singh Chairman

Directors appointed under Section 6(1)(c) of the NABARD Act, 1981

Dr. K. C. Chakrabarty

Lakshmi Chand

Shashi Rekha Rajagopalan

Directors appointed under Section 6(1)(d) of the NABARD Act, 1981

P. K. Basu

B. K. Sinha

Alok Nigam

Directors appointed under Section 6(1)(e) of the NABARD Act, 1981

R. K. Meena

A. K. Sinha

K. Jayakumar

M. I. Khandey

Dr. K. G. Karmakar Managing Director

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Contents

Page No. NABARD at a Glance Key Data References Principal Officers Highlights .................................................................................................................................................................................... i I. Economic Environment .................................................................................................................................................... 1 Global Economy ........................................................................................................................................................... 1 Indian Economy ............................................................................................................................................................ 2 II. Development and Promotional Initiatives .................................................................................................................. 17 Credit Planning ........................................................................................................................................................... 17 Farm Sector ................................................................................................................................................................. 17 Rural Non-Farm Sector ............................................................................................................................................... 26 Financial Inclusion ...................................................................................................................................................... 28 Micro-Finance .............................................................................................................................................................. 30 NABARD Consultancy Services .................................................................................................................................. 34 Research and Development Activities ......................................................................................................................... 35 III. Business Operations ....................................................................................................................................................... 39 Production Credit ........................................................................................................................................................ 39 Investment Credit ........................................................................................................................................................ 43 Rural Infrastructure Development Fund ...................................................................................................................... 54 IV. Capacity Building of Client Institutions ..................................................................................................................... 63 Institutional Development ........................................................................................................................................... 63 Supervision of Banks .................................................................................................................................................. 76 V. Organisation, Corporate Governance and Management .......................................................................................... 79 Management ............................................................................................................................................................... 79 Human Resources Management ................................................................................................................................. 80 Administration and Other Matters ............................................................................................................................... 82 VI. Financial Performance & Management of Resources ............................................................................................... 87 Sources of Funds ......................................................................................................................................................... 87 Uses of Funds .............................................................................................................................................................. 89 Income and Expenditure ............................................................................................................................................. 90 Annual Accounts 2010-11 ...................................................................................................................................................... 91 Auditors Report ....................................................................................................................................................................... 92 Balance Sheet .......................................................................................................................................................................... 93 Profit and Loss Account .......................................................................................................................................................... 94 Schedules to Balance Sheet ................................................................................................................................................... 95 Cash Flow Statement ............................................................................................................................................................. 117 Consolidated Financial Statements 2010-11 ....................................................................................................................118 E-mail Addresses of NABARD Head Office Departments at Mumbai ................................................................... 124 Regional Offices/Cell/Training Establishments ................................................................................................................. 125 Abbreviations ........................................................................................................................................................................ 127

Boxes

1.1 Union Budget 2011-12: Highlights on Agriculture and Rural Development ................................................ 8 1.2 Working Groups for Twelfth Five Year Plan (2012-2017) .................................................................... 8 2.4 UPNRM Projects - A Success Story ............................ 25 2.5 Salient features of Natueco Farming (10 Gunta Model) ......................................................... 26 2.6 Dalbandhus of Tripura ................................................. 32 2.7 Findings of the Study on Organised Agri-food Retailing and Supply Chain Management ................. 36 3.1 Evaluation Studies on RIDF Projects : Feedback on Benefits Realised .......................................................... 61 3.2 NABARD Infrastructure Development Assistance ...... 62 4.1 Impact of GoI Revival Package for STCCS ............... 72 5.1 Repositioning of NABARD - Pilot interventions ........ 80

1.3 Task Force "to look into the issue of a large number of farmers, who had taken loans from private moneylenders, not being covered under the loan waiver scheme" : Recommendations .......................... 14 2.1 Mid-Course Evaluation of Watershed Projects supported under WDF ................................................. 18 2.2 Outcome of Village Development Programmes Phase I .......................................................................... 19 2.3 Exotic Vegetables in Low Cost Poly-houses .............. 20

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Tables

Table 1.1 : Overview of Global Economy .............................. 1 Table 1.2 : Production of Cereals, Vegetables & Milk in the World ................................................. 2 Table 1.3 : Economic Indicators ............................................. 3 Table 1.4 : Sectoral Growth Rates of GDP ............................. 3 Table 1.5 : Trends in Exports and Imports ............................. 5 Table 1.6 : Trends in Rainfall and Water Storage ................... 5 Table 1.7 : Area Sown under Major Crops ............................. 6 Table 1.8 : Agency-wise Ground Level Credit Flow ............... 7 Table 1.9 : Sub-sector-wise Ground Level Credit Flow for Agriculture & Allied Activities ............................... 9 Table 1.10 : Production of Major Crops ................................ 10 Table 1.11 : Production, Consumption and Exports of Major Plantation Crops ..................... 11 Table 1.12 : Area and Production of Major Horticulture Crops . 12 Table 1.13 : Gross Capital Formation in Agriculture .............. 12 Table 1.14 : Agency-wise, Year-wise Kisan Credit Cards Issued .. 13 Table 1.15 : Minimum Support Prices for Major Crops ................ 15 Table 2.1 : Artificial Groundwater Recharge through dugwells 23 Table 3.11 : Tranche-wise Sanctions and Disbursements On-going RIDF XI to XVI ................................ 56 Table 3.12 : Utilisation Percentage under RIDF (I TO XVI) ... 57 Table 3.13 : Year/Tranche-wise Disbursements and Deposits received under RIDF ............................ 58 Table 3.14 : Cumulative Economic and Social Benefits of RIDF Projects ......................... 59 Table 3.15 : State-wise Benefits Estimated Under RIDF I to XVI . 60 Table 4.1 : Growth of PACS ................................................. 63 Table 4.2 : Growth of Short-Term Co-operative Banks ........ 63 Table 4.3 : Growth of Long-Term Co-operative Banks ........ 64 Table 4.4 : Working Results of Co-operative Banks ............. 64 Table 4.5 : Accumulated Losses ............................................ 64 Table 4.6 : Region-wise Working Results of SCB ................. 65 Table 4.7 : Region-wise Working Results of DCCB .............. 65 Table 4.8 : Region-wise Working Results of SCARDB ......... 66 Table 4.9 : Region-wise Working Results of PCARDB ......... 66 Table 4.10 : Composition of NPA of Co-operative Banks ..... 67 Table 4.11 : Percentage of Recovery of loans to Demand ..... 68 Table 4.12 : Frequency Distribution of Co-operative Banks according to Range of Loan Recovery Percentage ................................. 68 Table 4.13 : Frequency Distribution of States/UT according to Level of Loan Recovery of SCB and DCCB .................................................. 69 Table 4.14 : Frequency Distribution of States/UT according to Levels of Loan Recovery of SCARDB and PCARDB ...................................... 69 Table 4.15 : Elected Boards under Supersession ................... 70 Table 4.16 : Indicators of Performance of RRB ........................ 73 Table 4.17 : Region-wise Working Results of RRB ................. 74 Table 4.18 : Frequency Distribution of States According to Levels of Recovery of RRB ................................. 74 Table 4.19 : Status of Financial Inclusion - RRB .................... 76 Table 5.1 : Promotions Effected During the Year ................. 81 Table 5.2 : Total Staff Strength ............................................. 81 Table 6.1 : Sources of Funds .................................................. 87 Table 6.2 : Uses of Funds ...................................................... 89

Table 2.2 : Externally Aided on-going Projects ................... 24 Table 2.3 : Funds Utilisation - FIF and FITF ........................ 29 Table 2.4 : Progress of the Micro-Finance Programme ........ 30 Table 2.5 : Grant Assistance Extended to various Partners in SHG-Bank Linkage Programme ....... 31 Table 2.6 : Training of RFI Personnel ................................... 37 Table 3.1 : Short-Term Refinance (Production Credit) for the Last Five Years ........................................ 39 Table 3.2 : Sanction of ST(SAO) Credit Limits to SCB ...... 39 Table 3.3 : Sanction of ST(SAO) Credit Limits to RRB ...... 41 Table 3.4 : Rates of Interest on Refinance ............................ 42 Table 3.5 : Agency-wise Disbursements ................................ 44 Table 3.6 : Region-wise Disbursements ................................ 45 Table 3.7 : Sector-wise Disbursements ................................ 46 Table 3.8 : Projects Sanctioned under Cold Storages and Rural Godowns .................... 47 Table 3.9 : Units Financed and Completed under Refinance Support .............................................. 53 Table 3.10 : Sector-wise Projects and Amounts Sanctioned .. 55

Charts

Chart 1.1-(a) : Annual Average Inflation Rate for Major Sub-groups of WPI .................................... 4 Chart 1.1-(b) : Monthly Inflation Rate for Major Sub-groups of WPI .............................................. 4 Chart 3.1 Chart 3.2 : Financial Support by NABARD ......................... 39 : Agency-wise Share in Refinance Disbursements . 44 Chart 3.6 Chart 3.3 Chart 3.4 Chart 3.5 : Region-wise Share in Refinance Disbursements . 45 : Tranche-wise Sanction-RIDF I to XVI ................. 55 : Sector- wise Share in Amounts Sanctioned under RIDF ..................... 55 : Year-wise Disbursements under RIDF I to XVI ... 56

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

NABARD AT A GLANCE

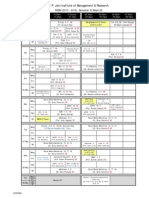

(` crore) Sources of Fund 2011 2010 Net Accretion Capital 2,000 2,000 0 Cash and Bank Balances Collateralised Borrowing and Lending Obligation Investments in NRC(LTO) Fund 14,468 14,417 51 a) GOI Securities NRC (Stabilisation) Fund 1,577 1,566 11 b) ADFC Equity c) AFC Equity Deposits 277 505 (-)228 d) SIDBI Equity e) AICI Ltd. Bonds and Debentures 26,788 20,004 6,784 f) NCDEX Ltd. & MCX Ltd. g) Nabcons Borrowings from GoI 124 147 (-)23 h) Mutual Fund i) Biotech Venture Fund Borrowings from Commercial Banks 0 500 (-)500 j) Treasury Bills k) Commercial Paper Foreign Currency Loan 503 494 9 l) Non Convertible Bonds m) Equity Shares of other Institutions n) Debentures in Nature of Advance Certificate of Deposits 137 379 (-)242 Loans and Advances Commercial Paper 6,448 2,680 3,768 a) Production & Marketing Credit b) Conversion of Production Credit into MT Loans c) Liquidity Support Term Money Borrowings 110 763 (-)653 d) MT & LT Project Loans e) Interim Finance RIDF Deposits 67,878 59,869 8,009 f) LT Non-Project Loans g) Other Loans STCRC Fund 14,622 9,622 5,000 h) RIDF Loans i) Co-finance (Net of Provision) Fixed Assets Other Funds Total 6,171 1,58,872 7,593 1,36,292 (-)1,422 22,580 Others Assets Total 0 1,862 225 1 0 744 0 0 0 1,118 225 1 2,548 19 1 48 60 18 5 390 10 1,991 15 1 48 60 15 5 900 5 557 4 0 0 0 3 0 (-)510 5 11,218 9,628 Uses of Funds 2011 2010 Net Utilisation 1,590

Reserves & Surplus

11,863

10,675

1,188

228

228

Borrowings against STD

360

360

13,461

13,461

33,885

24,073

9,812

Collateralised Borrowing and Lending Obligation 0 215 (-)215

193 0 25,435 0 167 182 66,078 88

0 20 35,742 1 199 131 60,255 84

193 (-)20 (-)10,307 (-)1 (-)32 51 5,823 4

Other Liabilities

5,546

4,863

683

230 2,520

235 2,140

(-)5 380 22,580

1,58,872 1,36,292

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

KEY DATA REFERENCES

Page No. Particulars Unit Numerical Value 2009-10 Economic Indicators Overall GDP1 % Growth Agri GDP1+ % Growth Share of Agri GDP in total GDP % South-west Monsoon % deviation from normal North-east Monsoon GLC % increase Foodgrains production million tonnes Oilseeds production million tonnes Sugarcane production million tonnes Cotton production million bales++ KCC Issued million Development and Promotional initiatives Watersheds No. Tribal development projects No. FIPF- projects No. FTTF No. of projects Farmers Club No. of clubs NABARD-KfW Projects No. RIF- promotional programmes No. of projects REDP No. SCC Issued lakh FITF & FIF No. of projects SHG Loan Disbursed* lakh Consultancy Assignments - Contracted No. of projects R&D Fund - Sanction No. of projects Business Operations Financial Support by NABARD Refinance - ST Credit ST (SAO) - SCB No. Weavers - SCB No. - RRB No. ST (OSAO) - RRB Refinance - Investment Credit Farm Sector NFS SHG Co-financing projects No. RIDF Loans - Sanction No. of projects - Disbursement Capacity Building of Client Institutions ST Co-operatives SCB in profit @ No. DCCB in profit @ No. LT Co-operatives @ SCARDB in profit No. PCARDB in profit @ No. ST Co-operatives - NPA Position SCB - NPA @ % to loan O/S DCCB - NPA @ % to loan O/S LT Co-operatives - NPA Position SCARDB - NPA@ % to loan O/S PCARDB - NPA @ % to loan O/S RRB RRB in profit No. RRB - NPA Position % to loan O/S ^@@ Inspection of banks No. Co-operative banks@@ No. RRB@@ No. Financial Performance & Management of Resources Market Borrowings Total Financial Resources 8.0 QE 0.4 QE 14.6 (-)23 8 27.36 218.11 24.88 292.30 24.22 9.01 59 79 17 151 16,590 8 155 2,627 0.63 47 16.09 83 9 20 5 74 8 39,015 2010-11 8.5 RE 6.6 RE 14.4 RE 2 21 16.19 235.88 3rd AE 30.25 3rd AE 340.54 3rd AE 33.92 3rd AE 7.26 66 126 45 512 21,903 8 122 3,327 1.20 205 15.86 62 10 21 4 80 3 41,779 Amount (` crore) 2009-10 3,84,514 34,982 196 236 1.55 4.9 7 17.7 10.48 240 40.97 12,253 17.11 1.01 57,068 24,715 18,109 177 6,832 542 12,009.08 4,029 3,466 3,174 12 15,630 18,888 2010-11 4,46,779 43,370 220.57 373.97 5.47 44.97 135.75 11 12.34 514.26 120.10 14,453 24.13 1.09 60,483 34,196 23,759 215.75 9,799.69 600 13,485.87 5,055 3,446 2,545 14 18,314.88 12,060.04

1 2 2 4 5 7 9 10 10 10 13 18 20 20 21 21 24 26 27 27 29 30 34 35 39 40 40 41 41 42 46 46 46 46 55 55

64 64 64 64 65 65 66 66 73 73 76 76 76

26 321 12 343 11.91 18.02 30 42 79 3.72 343 282 61

28 323 11 307 9.08 13.00 33 43 79 3.50 302 260 42

395 1,603 404 220 5,764 17,928 4,948 4,742 2,515

463 1,545 97 154 4,469.16 16,015.45 5,627.56 4,867.04 3,470

87 87

25,254 1,36,292

34,747 1,58,872

RE : Revised Estimate + : Includes agriculture, forestry and fishing @ : Data pertains to financial years 2008-09 & 2009-10

1 : At Factor Cost at 2004-2005 prices ++: Of 170 kgs each ^ : Voluntary inspections * : Data pertain to 2008-09&2009-10

AE : Advanced Estamate @@ : Statutory Inspections

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

PRINCIPAL OFFICERS

(31 March 2011) EXECUTIVE DIRECTORS

S. K. Mitra

Amaresh Kumar

Dr. A. K. Bandyopadhyay

Dr. Prakash Bakshi

CHIEF GENERAL MANAGERS (Rural Development Banking Service)

V. Ramakrishna Rao

C. R. Patnaik (Odisha)

B. S. Shekhawat

R. Narayan (Tamil Nadu)

C. K . Gopalakrishna

P . Satish (Maharashtra)

K C Shashidhar (Kerala)

Pankaj Pandit (Uttarakhand)

Dr. Venkatesh Tagat (Karnataka)

S . C . Kaushik (Punjab )

P . Mohanaiah (Andhra Pradesh)

S. T. Raghuraman

Suraj Bhan

J. C. Mishra

D. P . Mishra (Uttar Pradesh)

M. V. Ashok (Jharkhand)

G. C. Panigrahi

S. G. Siddesh (Gujarat)

K . K. Gupta

S. Akbar (Madhya Pradesh)

A. K. Srivastava (Assam)

B. B. Nayak

S. Balan

H. K. Talreja (Haryana)

M. L. Sukhdeve (Jammu & Kashmir)

K. Muralidhara Rao (Rajasthan)

Dr. S. L. Kumbhare

P . C. Mishra

J. G. Menon

V. Mohan Doss (Bihar)

S. K . Singh

Niraj Kumar Gupta

A. D. Ratnoo (Himachal Pradesh)

M. V. Patro (NABCONS)

N. S. P . Rao (West Bengal)

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

K. S. Padmanabhan

R. Amalorpavanathan NBSC, Lucknow

Dr. H. N. V. Prasad

A. N. Rajwani

P . C. Sahoo (Chhattisgarh)

CHIEF GENERAL MANAGERS (Legal/Technical Service)

U. N. Srivastava (Legal)

Neeraj Kumar (Technical)

Dr. P . Renganathan (Technical)

OFFICERS-IN-CHARGE OF REGIONAL OFFICES/CELL TRAINING INSTITUTIONS

H. R. Dave (New Delhi)

A. P . Sandilya (Goa)

B. G. Mukhopadhyay (Arunachal Pradesh)

G. R. Chintala (Andaman & Nicobar Islands)

B. K. Dey (Sikkim)

M. M. Baheti (RTC, Mangalore)

Dr. P . M. Ghole (Mizoram)

Dr. U. S. Saha (Nagaland)

R. S. Jodha (Meghalaya)

R. Sundar (Tripura)

S. V. Nemlekar (Manipur)

P. L. Negi (Srinagar Cell)

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Highlights

Economic Environment

1. The World Economic Outlook (WEO) of the 6. Total crop acreage under both kharif and rabi

International Monetary Fund has projected the growth in global output at 4.4 per cent in 2011, a decline of 0.6 percentage points relative to 2010. The Gross Domestic Product (GDP) of the country has registered a growth of 8.5 per cent in 2010-11 compared to a growth of 8.0 per cent in 2009-10. 2. The high growth trajectory of GDP has been

during 2010-11 indicated an increase of 9.40 million hectares over the previous year. The crop acreage under various crops during kharif 2010 was 103.90 million hectares, which was 6.88 million hectares more than the area covered during the corresponding period of kharif 2009. The major increase in area was under rice (2.3 million hectares). Area sown under rabi crops in 2010-11 was more by 2.52 million hectares, with growth in area under rabi foodgrains at 3.41 per cent. 7. The production of breeder and foundation seed is

facilitated due to a rebound in agriculture from 0.4 per cent during 2009-10 to 6.6 per cent during 2010-11. The contribution of agriculture sector to the GDP was 14.2 per cent during 2010-11, a marginal decline of 0.2 per cent, as compared to 2009-10. The livestock sector contributed 3.5 per cent to the GDP and 28.4 per cent to GDP from agriculture. 3. The overall inflation rate as measured by changes in the Wholesale Price Index on a monthly basis was 9.4 per cent during 2010-11 as compared to 3.6 per cent during the fiscal 2009-10. Food inflation was high due mainly to rise in prices of rice, vegetables, fruits, milk, eggs, meat and fish. 4. Agricultural exports increased from ` 81,750 crore

estimated at 1.1 and 18.5 lakh quintals, respectively, while certified/quality seed distribution was 321.36 lakh quintals during 2010-11. The irrigation potential created under all types of irrigation structures has increased from 81.10 million hectares in 1991-92 to 108.2 million hectares by March 2010. Utilisation was to the extent of 85 per cent. 8. As against the target of ` 3,75,000 crore of credit flow

to agriculture for 2010-11, the banking system disbursed during 2008-09 to ` 85,269 crore during 2009-10, registering a growth of 4.30 per cent. The percentage share of agriculture and allied products in the total exports was 9.9 during 2009-10 as compared to 9.0 in 2008-09. The share of food and allied products in the total imports of the country increased from 2.1 per cent in 2008-09 to 3.7 per cent in 2009-10. 5. The country as a whole received 912.8 mm of ` 4,46,779 crore, as on 31 March 2011, achieving 119.14 per cent of the target. Commercial Banks, Co-operative Banks and Regional Rural Banks (RRB) disbursed ` 3,32,706 crore, ` 70,105 crore and ` 43,968 crore, contributing 74 per cent, 16 per cent and 10 per cent respectively, of the total credit flow during 2010-11. 9. During 2010-11, 7.26 million Kisan Credit Cards

were issued by banks with sanctioned credit limit of ` 43,370 crore. Of the cumulative 100.93 million credit cards issued, as at the end of March 2011, 45.03 million cards were issued by commercial banks, followed by Banks. 40.70 million cards by co-operative banks and 15.20 million cards by Regional Rural

rainfall, which was 2.0 per cent more than the Long Period Average (LPA) during the South-West monsoon (June-September) 2010, as compared to 23 per cent less than the LPA in the corresponding period last year. Rainfall during the North-East monson was also 21 per cent more than the LPA.

i

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

10.

Out of ` 29,240 crore received under the

12. According to the 3rd Advance Estimates, the foodgrain production during 2010-11 has been estimated at 235.88 million tonnes, as compared to 218.11 million tonnes (final estimate) during 2009-10, registering an increase of over 8 per cent compared to the previous year. Area and production under horticulture crops increased from 20.7 million hectares and 214.7 tonnes, respectively, during 2008-09, to 20.9 million hectares and 223.1 million tonnes, respectively, during 2009-10. Indias global share in world production, on a two year average basis, as per Food and Agriculture Organisation (FAO) estimates, was 10.29 per cent for cereals, 9.23 per cent for vegetables and 15.81 percent for milk.

Agriculture Debt Waiver and Debt Relief Scheme 2008, the cumulative disbursements by NABARD was ` 29,071 crore against claims of ` 29,102 crore. The share of SCB, SCARDB and RRB stood at ` 18,289 crore, ` 3,810 crore and ` 6,972 crore, respectively. 11. The GCF in agriculture and allied sectors from ` 86,611 crore in 2005-06 to

increased

` 1,33,377 crore (at 2004-05 prices) in 2009-10. The GCF in agriculture and allied activities, as a proportion to GDP in the sector, increased from 14.57 per cent in 2005-06 to 20.30 per cent in 2009-10.

Development and Promotional Initiatives

Credit Planning

13. During the year, Potential Linked Credit Plans (PLP) were prepared for 624 districts in the country, to guide the banks in the credit planning excercise and for infrastructure development in 2011-12. State Focus Papers, presenting a comprehensive picture of the potential available in various sectors of the rural economy and critical infrastructure gaps to be bridged, were discussed with all State Governments and banks. these components were ` 350.03 crore and ` 33.18 crore, respectively. Under the Special Plan for Bihar component of the Rashtriya Sam Vikas Yojana (RSVY), a total of 79 projects covering an area of 84,444 ha., had been sanctioned, of which six are at Capacity Building Phase and 73 at Full Implementation Phase. A sum of ` 20.18 crore was disbursed during the year under the programme and the cumulative disbursement, as on 31 March 2011, stood at ` 34.17 crore. 16. The Climate Change Adaptation Project in implemented Trust is the by first of the its Watershed kind being

Farm Sector

14. During the year, 66 watershed projects were sanctioned, taking the cumulative number of such projects to 579, covering an area of 4.86 lakh ha., in 14 states, with a total commitment (loan and grant component) of ` 220.57 crore. Under the Prime Minister's Relief package for 31 distressed districts in four States, 71,127 ha., were taken up for implementation during the year, taking the cumulative area and financial commitment to 9.42 lakh ha., and ` 1,023 crore, respectively. 15. An amount of ` 152.26 crore and ` 3.18 crore were

Akole & Sangamner Talukas of Ahmednagar District, Maharashtra Organistion

considered under WDF. Swiss Agency for

It involves a total financial and Cooperation

outlay of ` 34.15 crore, with grant assistance from Development (` 10.80 crore) & NABARD (` 20.62 crore) and contributions from villagers (` 2.73 crore). The project is expected to develop a replicable model for Climate Change Adaptation in semi-arid and rainfed regions of the country.

disbursed under watershed projects as grants and loans during the year; the cumulative disbursements under

17.

The Village Development Programme is now

being implemented in 801 villages spread across 25

ii

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

States. The programme was completed in 115 villages and is under different stages of implementation in 686 villages.

respectively, were released for Sultanpur and Rae Bareli districts of Uttar Pradesh, during the year, taking the cumulative disbursements to ` 7.72 crore. ` 8.98 crore and An amount of ` 27.48 crore was

18.

During the year, financial assistance of ` 373.97

sanctioned for 2,816 units under Dairy Venture Capital Fund (DVCF), ` 28.57 crore for 342 units under Poultry Venture Capital Fund (PVCF) and ` 9.69 crore for 1,978 units under Dairy Entrepreneurship Development Scheme (DEDS). The cumulative sanctions as on 31 March 2011 stood at ` 174.39

crore under Tribal Development Fund was sanctioned for 126 projects benefiting 94,163 tribal families in various states. Cumulatively, ` 917.60 crore was sanctioned to 317 projects covering 2.50 lakh families. 19. During 2010-11, under Farm Innovation and

crore for 18,184 units under DVCF, ` 48.18 crore for 633 units under PVCF, and ` 9.69 crore for 1,978 units under DEDS. Under the programme of Artificial Groundwater Recharge through Dugwells, net subsidy of ` 280.637 crore was released by NABARD, for construction of 7.13 lakh Artificial Recharge Structures.

Promotion Fund (FIPF), 45 projects were sanctioned in 15 states, with grant assistance of ` 5.47 crore. Cumulatively, 123 projects were sanctioned with a financial support of ` 11.65 crore. Under the Farmers Technology Transfer Fund (FTTF), 512 diverse and innovative projects in 27 states were sanctioned during the year 2010-11 with grant assistance of ` 44.97 crore. 20. During the year, 21,903 Farmers' Clubs (FC) were launched, taking the total number of clubs to 76,708, as on 31 March 2011. Agency-wise, NGO promoted maximum number of clubs (13,599), followed by cooperative banks (2,922), commercial banks (2,733), RRB (2,215), State Agricultural Universites (SAU)/Krishi Vigyan Kendras (KVK) [255] and other agencies (179). During 2010-11, three Farmers' Training and Rural Development Centres (FTRDC) were provided a total grant assistance of ` 1.02 crore under FTTF. During the year, 282 exposure visits for 7,548 farmers were arranged in collaboration with select research institutes, KVK and SAU. 21. During the year, 44 projects covering 220

23.

NABARD received ` 132.27 crore during 2010-11

and disbursed ` 135.76 crore as grant assistance during the year under the Kreditanstalt fr Wiederaufbau (KfW) supported externally aided projects, which are at various stages of implementation.

Rural Non-Farm Sector

24. During the year, 122 innovative projects were

sanctioned under the NABARD-SDC Rural Innovation Fund, taking the cumulative number to 375. An amount of ` 10.42 crore was sanctioned for these projects, taking the cumulative sanctions to disbursement ` 49.28 crore. The during the year, including for projects

sanctioned earlier, was ` 14.42 crore.

25.

Under the 'Scheme for Strengthening of Rural

villages were launched with a financial commitment of ` 15.41 crore under Pilot Project on augmenting productivity of lead crops/activities through adoption of sustainable agricultural practices. 22. Under the Special Project on Livelihood Based ` 0.41 crore and ` 0.33 crore

Haats', grant support of ` 5.74 crore was sanctioned to 118 rural haats during 2010-11. Cumulative grant assistance was ` 13.19 crore for 307 rural haats across 23 States. A total of 113 clusters across 84 districts in 22 States had been approved during the year, while 3,327 Rural Entrepreneurship Development Programme (REDP) / Skill Development Programme

Development,

iii

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

(SDP) were supported with financial assistance of ` 12.34 crore. As many as 20 clusters are supported in the NER. Cumulatively, 17,859 REDP/SDP have been supported with grant of ` 83.35 crore.

29.

Under

the

Microfinance

Development

and

Equity Fund,

` 47.38 crore was released during 2010-

11, of which ` 29.95 crore was grant support for promotional activities and ` 17.43 crore for Capital Support / Revolving Fund Assistance to Micro Finance Institutions, as against ` 20.49 crore and ` 60.42 crore, respectively, in the previous year. During the year, grant assistance of ` 37.86 crore was sanctioned to various agencies for promoting and credit linking 81,890 groups, taking the cumulative assistance sanctioned to ` 146.22 crore for 5.81 lakh groups. Grant assistance of ` 51.06 crore was released during the year for the formation of 4.01 lakh SHG. Nearly 2.60 lakh SHG were credit linked.

26.

During the year, 1.20 lakh Swarojgar Credit

Cards (SCC) with credit limit of ` 514.26 crore were issued for facilitating hassle-free availability of credit for investment and working capital requirements of small / micro-entrepreneurs. The cumulative total of SCC was 12.12 lakh involving credit limit of ` 4,949.51 crore.

Financial Inclusion

27. RBI contributed ` 3.46 crore [` 3.05 crore towards Financial Inclusion Fund (FIF) and ` 0.41 crore towards Financial Inclusion Technology Fund (FITF)], during the year 2010-11, while the GoI contributed ` 30 crore each to the two Funds. NABARD contributed ` 30 crore (FIF) and ` 40 crore (FITF). An amount of ` 19 crore under FIF and ` 101.10 crore under FITF were sanctioned during the year. As on 31 March 2011, ` 38.66 crore for 150 projects under FIF and ` 122.41 crore under FITF for 55 projects had been utilised during have been sanctioned. 2010-11 for activities Under NABARD-UNDP collaboration, ` 173.22 lakh conducted by NABARD in seven focus states : Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Odisha, Rajasthan and Uttar Pradesh.

30.

Under

the

Rajiv

Gandhi

Mahila

Vikas

Pariyojana, 25,571 SHG were promoted, of which 14,979 were credit linked by end March 2011. In addition, 951 Cluster Level Federations and 26 Block Level Federations have been formed.

31.

An amount of ` 24.74 crore was sanctioned as

grant for promoting 1.25 lakh Joint Liability Groups across the country till March 2011. During the year, 1,606 Micro Enterprise Development Programmes were conducted for 37,138 members on various location-specific farm, non-farm and service sector activities. Cumulatively, 4,449 MEDP were conducted for 1.09 lakh participants.

Micro-Finance

28. There were more than 69.53 lakh savings-linked SHG and more than 48.51 lakh credit-linked SHG covering 9.7 crore poor households, as on 31 March 2010, under the microfinance programme. The share of outstanding bank loans to SHG as a percentage of bank loans to weaker sections by scheduled commercial banks (31 March 2010) was 16.3 per cent, compared to 15.8 per cent in the previous year.

32. for

NABARD continued to support the project implementing 'Micro-Finance Vision 2011'.

sanctioned to the Government of Arunachal Pradesh The project involves promoting and credit linking of 1,650 SHG at a cost of ` 39.15 lakh. An amount of ` 9.49 lakh has been released so far.

33.

NABARD Financial Services Ltd. disbursed an

amount of ` 50.64 crore to 2,019 groups through 31

iv

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Business

Correspondents

(BC)

during

2010-11.

In

36.

During the year, grant assistance of ` 1.27 crore was

addition, disbursements to the extent of ` 1.50 crore were made to MFI and Federations, taking the aggregate disbursements during the year to ` 52.14 crore. Grant assistance of ` 153.18 lakh was released during the year to Centre for Microfinance Research (CMR) established by NABARD in Bankers Institute of Rural Development (BIRD), taking the cumulative assistance to ` 347.36

sanctioned to various universities, research institutes and other agencies for organising 131 seminars, conferences, symposia and workshops covering subjects/ areas related to agriculture and rural development including

agricultural marketing.

37. During the year, five Occasional Papers titled Kisan Credit Card, Infrastructure for Agriculture and Rural Development, Economics of sugarcane production and processing, Micro-finance for micro-enterprises and

lakh. Of the prioritised 27 themes for research, 6 have been completed and the remaining are ongoing.

NABARD Consultancy Services

34. NABARD the Consultancy wholly Services owned Pvt Ltd of

Promoting Rural non-farm sector were published. Under the NABARD Chair Professor Scheme, three Professors affiliated to IARI, Alagappa University and Xavier Institute of Management, Bhubaneswar were appointed by the Bank. 38. Grant assistance of ` 15.58 crore was utilised

(NABCONS),

subsidiary

NABARD, achieved ` 24.13 crore of contracts and executed `16.65 crore worth assignments during

2010-11; the profit after tax was ` 5.80 crore. During the current year, NABCONS its business by entering into significantlly diversified new areas of business,

from the Fund during the year on training of staff of client banks. During were the year, by 576 the training Training

viz., development of web based MIS for various State Government Programmes, monitoring of various

programmes

conducted

Establishments of the Bank for 14,667 participants. BIRD conducted a special on-location programme on Credit Planning and Development Finance for IAS probationers undergoing Phase I course, at the Lal Bahadur Shastri National Academy of Administration,

infrastructure projects in different states adjoining the international borders of the country, under Border Area Development Programme (BADP).

Research and Development Activities

35. During the year, ` 17.68 crore was utilised from

Mussorie and an in-house programme on financial system and development finance for probationers of the Indian Economic Service. RTC, Mangalore

the Research and Development Fund for supporting activities like research projects/studies (` 0.80 crore), seminars (` 0.80 crore), training/summer placement (` 15.77 crore), occasional papers (` 0.02 crore), NABARD Chair Professor Scheme (` 0.14 crore) and other activities (` 0.15 crore). The cumulative

organised an International Exposure Programme on Micro Finance for a batch of 14 officers from SANASA Development Bank, Sri Lanka during the year. 39. During the year 2010-11, the bank provided

technical and financial support to seven Junior Level Training Centres, 12 Agricultural Co-operative Staff Training Institutions and three Integrated Training Institutes to enable them to improve their training system.

disbursement stood at ` 136.19 crore. During 2010-11, ten research projects involving a grant assistance of ` 1.09 crore were sanctioned. Further, six projects/studies sanctioned earlier were completed during the year.

v

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Business Operations

40. The total financial support extended by Population and ` 16.20 crore for National Pulses Development Programme. The aggregate limit for STOSAO sanctioned to RRB during 2010-11 was ` 600 crore, as against ` 542 crore in the previous year. The maximum utilisation was ` 598 crore. 45. The continuance of the interest subvention

NABARD during 2010-11 stood at `60,483 crore, registering a growth of 5.98 per cent over 2009-10.

Production Credit

41. The total production credit disbursed, at endDuring 2010-11, to 21 State March 2011, was ` 34,196 crore. credit limits were sanctioned

scheme was announced in the Union Budget 2010-11. Interest subvention of 1.5 per cent per annum was available to public sector banks, co-operative banks and RRB for deploying their own funds for crop loan upto ` 3 lakh per farmer, provided the ultimate borrower got such loans at 7.0 per cent interest rate per annum. Additional subvention of one per cent, announced in the year 2009-10 to those farmers who repaid crop loans promptly within one year of disbursement was enhanced to 2 per cent during 2010-11. During the year, an amount of ` 1,261.40 crore was disbursed as for subvention 2010-11 for has 2009-10. been Interest at subvention estimated

Short-term Seasonal Agricultural Operation (SAO) Co-operative Banks (SCB) aggregating `23,759 crore, as against `18,109 crore sanctioned to 20 SCB during 2009-10. The credit limits included ` 2,249.90 crore for the Oilseeds Production Programme, `210.97 crore for National Pulses Development Programme and `752.76 crore for credit requirements of tribals under the Development of Tribal Population. The maximum outstanding was `23,696.72 crore. 42. During 2010-11, Short-Term weavers credit

limits aggregating ` 215.75 crore were sanctioned to four SCB (Andhra Pradesh, Karnataka, Pondicherry and Tamil Nadu), as against ` 177.32 crore during 2009-10. Further, during the last three years, 4,607 Handloom Weavers Groups were formed by banks in various States. Of these, 1,989 HWG have been credit linked. 43. The scheme of extending ST refinance to State Agriculture and Rural Development

` 2,000 crore. 46. NABARD continued to act as nodal agency for

GoI package for restructuring of Term Loans of Co-operative sugar mills. Out of ` 170.14 crore received from GoI towards interest subvention, ` 169.94 crore was disbursed to 77 co-operative sugar mills in Maharashtra and Odisha. NABARD also acted as nodal agency for channelising the interest subvention to Co-operative Banks and RRB under the "Scheme for Extending Financial Assistance to Sugar Undertakings -2007". Out of ` 383.59 crore received from GoI towards interest subvention, ` 249 crore was released to 212 sugar mills operating in 11 states.

Co-operative

Banks for SAO was continued during the year. Refinance of ` 140.01 crore was extended to Kerala ( ` 79.39 crore) and Rajasthan ( ` 60.62 crore) SCARDB at 4.5 per cent interest rate for lending to the ultimate borrowers at 7 per cent. 44. During 2010-11, limits of ` 9,799.69 crore were

Investment Credit

47. During the year, the total investment credit (including co-finance) disbursed was ` 13,485.87 crore, as against the target of ` 12,980 crore. The achievement against target was 103.90 per cent. The growth in refinance disbursed during the year was 12.30 per cent over that of the previous year. The

sanctioned to 80 RRB under ST-SAO as against ` 6,832.13 crore sanctioned to 74 RRB in 2009-10. The limits included ` 820.31 crore for Oilseeds Production Programme, ` 201.23 crore for Development of Tribal

vi

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

policy of preferential treatment to states in NorthEastern, Eastern, was Hilly also Regions, extended to Sikkim and Lakshadweep Chhattisgarh

Under

the

scheme Grading

for and

Agricultural

Marketing 654

Infrastructure,

Standardisation,

projects with TFO of ` 978.45 crore were considered for sanction. Subsidy of ` 83.15 crore was released to the banks during the year. Cumulatively, 4,492 units involving TFO of ` 2,912 crore were granted subsidy of ` 274.03 crore. Subsidy of ` 1.49 crore was disbursed for 110 projects, involving a TFO of ` 7.75 crore under the Scheme for Agri Clinics and Agri Business Centres (ACABC). Cumulatively, 390 projects were sanctioned under the scheme involving TFO of ` 28.62 crore and release of subsidy of ` 5.38 crore. Under the Schemes on Animal Husbandry, an An amount of ` 1.69 crore was released as subsidy for poultry processing and sheep/goat rearing units. amount of ` 3.61 crore towards the subsidy

during 2010-11. RRB, SCB and SCARDB continued to be classified under A/B/C/D categories based on the level of Net NPA reckoned as a percentage to net loans and advances outstanding/ recovery performance and profitability. 48. Changing market conditions, impacting cost of

funds for NABARD, necessitated the revision of interest rates on refinance five times during the year. Interest rates, with effect from 07 February 2011 stood at 9.75 per cent for Commercial Banks, 9.25 per cent for RRB, 9.15 per cent for co-operative banks/ PUCB/ NEDFi, 8.15 per cent for ADFC/NABFINS and 10.5 per cent for NBFC. However, for NER, including Sikkim, the rate of interest for all agencies was pegged at 9.15 per cent. 49. Refinance distribution across regions varied

component, was released for 8,987 units under the Jawaharlal Nehru National Solar Mission. 52. Under National Project on Organic Farming

(NPOF), a total of 667 units (vermi-hatchery units-627, bio-fertilizers units-36 and fruit & vegetable waste compost units-13) had been sanctioned with net subsidy release of ` 12.45 crore till 31 March 2011. 53. During the year 2010-11, NABARD conducted

widely with the south accounting for the highest share (43%), followed by north (21%), central (14%) and other regions (22%). During the year, the major share of sector-wise refinance (25.6%), followed by was accounted for by NFS SHG (18.9%), Farm

Mechanisation (13.1%), Minor Irrigation (6.8%) and Dairy Development (6.8%). Of the total refinance disbursed, 43.80 per cent was for thrust areas. 50. During the year, MoU for co-financing were with 5 RRB in Andhra Pradesh and

seven evaluation studies covering four investments, viz., rural godowns, agricultural market infrastructure, agri-clinics Investment and agri-business Studies centres and and 8 solar Special homelighting system. Specific NABARD also conducted 16 (ISS)

executed

Studies (SS) covering farm and rural non-farm sectors.

a commercial bank. In all, MoU were executed with 27 banks. During the year, three new projects were sanctioned, taking the cumulative number of sanctioned projects to 51, with a total financial outlay to the extent of crore, respectively. 51. NABARD is the nodal agency for channelising (TFO) of ` 840.64 crore. The disbursement during 2010-11 was ` 14.00 crore. Cumulative sanction and disbursement were ` 240.35 crore and ` 153.64

Rural Infrastructure Development Fund

54. The annual allocation under the Rural Infrastructure Development Fund (RIDF) was ` 16,000 crore during 2010-11 taking the cumulative allocation to ` 1,16,000 crore. Additionally, a separate window was introduced in 2006-07 for funding rural roads component of Bharat Nirman Programme, with allocation of ` 18,500 crore, till 2009-10. The total allocation for RIDF, thus, stood at ` 1,34,500 crore, as on 31 March 2011.

subsidy, monitoring and coordinating with others under the Capital Investment Subsidy Scheme of GoI.

vii

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

55.

During 2010-11, a total of 41,779 projects

Haryana and Maharashtra (88%), Punjab and Gujarat (87%), and UP , Jammu & Kashmir (86%). The cumulative amount of loan sanctioned and disbursed to States in the North-Eastern region, including Sikkim, aggregated ` 6,328.24 crore and ` 3,293.18 crore, respectively, as at the end of March 2011.

involving loan amount of ` 18,314.88 crore was sanctioned under RIDF XVI, taking the cumulative number of projects to 4,44,162 and cumulative amount sanctioned to ` 1,21,888.40 crore. 56. During the year, disbursements were made to the tune of ` 12,060.04 crore. The cumulative disbursements under RIDF (I to XVI) and Bharat Nirman aggregated to ` 98,999.78 crore. The statewise analysis of ratio of disbursements to the approved phasing of sanctions revealed that Mizoram topped with 120 per cent, followed by Uttarakhand and Goa (100%), Meghalaya (90%), Tamil Nadu (89%),

57.

NABARD is exploring possibilities of funding

implementation of specific projects under the Public Private Partnership model. The bank is in the process of networking with the private sector and encouraging partnerships to bring about private sector competence and funds into the realm of rural infrastructure.

Capacity Building of Client Institutions

Institutional Development

58. The total membership of Primary Agricultural 60. The borrowings of State Co-operative

Agriculture and Rural Development Banks (SCARDB) as on 31 March 2010, decreased by 0.5 per cent over the previous year while that of Primary Cooperative Agriculture increased Rural Development Banks (PCARDB) Credit Societies (PACS) during 2009-10 stood at 12.64 crore, of which borrowing members were 5.98 crore, constituting 47.31 per cent of total membership. Both deposits and loans issued of PACS (as on 31 March 2010) showed increase of 34.45 per cent and 27.47 per cent, respectively, over the previous year. The borrowings of PACS, however, registered only a

by 2 per cent, during the corresponding

period. Loans issued by SCARDB and PCARDB increased by 19 per cent and 13 per cent respectively, while their loans outstanding increased by 4 per cent and 1 per cent, respectively, over the previous year.

marginal increase of 5.77 per cent over the previous year. 61. SCB as a group earned a positive net margin of 1.02 per cent during 2009-10 as compared to the net margin of 0.57 per cent during 2008-09. The DCCB, 59. The financial position of the SCB and District as a group, earned net margin of 1.80 per cent during 2009-10. During the year 2008-09, out of 19 Central Co-operative Bank (DCCB), as on 31 March 2010, indicate that while their deposits increased by 15 per cent each, the borrowings of SCB and DCCB increased by 12 per cent and 3 per cent, respectively, over the previous year. Loans issued by SCB 62. During 2010-11, under Co-operative

SCARDB, 13 had positive net margins and the remaining 6 had negative net margins. PCARDB in only 4 States had positive net margin.

decreased by 17 per cent and that of DCCB increased by 26 per cent. Loans outstanding of SCB and DCCB increased by 2 per cent and 24 per cent, respectively.

Development Fund (CDF), financial assistance of `6.43 crore was sanctioned and ` 6.05 crore disbursed.

viii

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

As on 31 March 2011, cumulative sanctions and disbursements were ` 98.17 crore and ` 87.57 crore, respectively. The balance in the Fund as on 31 March 2011 stood at ` 125 crore.

67.

Based on the recommendations of Amaresh

Kumar Committee, the GoI issued the RRB Service Regulations 2010. GoI also notified the RRB

Appointment & Promotion Rules 2010, in July 2010.

63.

The impact studies conducted

by

different

agencies on the implementation of GoI revival package for Short Term Co-operative Credit Structure in 10 States, revealed positive features like improved share capital position of PACS and DCCB, increase in volume of busines and credit flow of DCCB, reduction in NPA of PACS and DCCB, increased coverage of Small and Marginal Farmers and improved recovery rates of SCB and DCCB.

Supervision of Banks

68. During 2010-11, statutory inspection of 302

banks (31 SCB, 229 DCCB and 42 RRB) and voluntary inspections of 18 SCARDB and 3 Apex Societies, were conducted. The inspections brought out supervisory concerns relating to these institutions, which were communicated to the banks concerned, Registrar of Co-operative Societies, State Governments (in respect

64.

Post

amalgamation,

the

number

of

RRB

of cooperative banks) and Sponsor Banks (in respect of RRB) for corrective action.

operating in the country, as on 31 March 2011, stood at 82, with a network of 15,938 branches. During the year, the aggregate reserves of RRB, deposits and investments increased by 20 per cent each, while loans & advances (outstanding) increased by 22 per cent.

69.

During

the

year

2010-11,

twenty

DCCB

improved their financial position and recomplied with the provisions of Section 11(1) of B.R. Act,

1949(AACS). As on 31 March 2011, 68 banks (5 SCB 65. Financial results of RRB for the year 2010-11 and 63 DCCB) were not complying with the provisions of Section 11(1) of the B.R. Act, 1949(AACS), i.e., minimum capital requirement. Applications for grant

indicated that 79 out of 82 RRB had earned pre-tax profit to the extent of ` 3,470 crore. While all RRB in the Eastern, Western and Northern regions were in profit, one RRB each in the Central, North-Eastern and Southern region incurred losses. The recovery

of exemption in respect of 50 banks (1 SCB and 49 DCCB) were under the consideration of RBI/GoI.

performance of RRB was estimated at 80.03 per cent, as on 30 June 2010, as compared to 80.09 per cent as on 30 June 2009.

70.

Pursuant to the recommendations of Committee

on Financial Sector Assessment, RBI issued licences, based on revised norms, to 2 SCB and 49 DCCB during the year, thus, increasing the number of licensed banks to 246 (24 SCB and 222 DCCB) as on 31 March 2011. During the year, no SCB was included in the Second Schedule to the RBI Act, 1934. Thus, the number of scheduled SCB remained unchanged at 16.

66.

Regional Rural Bank have emerged as a strong

intermediary for Financial Inclusion in rural areas by opening a large number of No Frills accounts and financing under General Credit Cards (GCC). Total number of business accounts with RRB stood at 11.88 crore as on 31 March 2010.

ix

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

71.

Thirty-nine amalgamated RRB were included by

calculation of Demand and Time Liabilities (DTL) for maintenance of CRR / SLR.

RBI in the Second Schedule to the RBI Act, 1934, after they were found complying with Section 42(6)(a)(ii) of the Act. With this, the number of Scheduled RRB stood at 75 as on 31 March 2011. Inclusion of five more RRB in the Second Schedule to the RBI Act, 1934, was recommended to RBI in 2010-11.

73.

During the year, (i) RRB were permitted to

induct Nominee Director of NABARD on the Audit Committee of the Banks, with approval of the Board; (ii) a Model KYC / AML Policy was circulated to all RRB for adoption with suitable modifications and (iii)

72.

During the year, instructions / circulars were

clarifications were issued to RRB on Disclosure in Financial Statement in Half Yearly Review.

issued to SCB and DCCB on (i) issuing engagement letters to Statutory Auditors, specifying the areas to be covered, (ii) a questionnaire / check list for the use of concurrent auditors to ensure that all aspects are covered by the auditors while reviewing the Investment Portfolio of banks, (iii) fraud prevention measures and constituting Fraud Risk Management Group, (iv) a Model Know Your Customer (KYC)/Anti-Money

74. For a holistic and more effective approach towards supervision, especially in strengthening the internal checks and control systems in the supervised banks, NABARD continued to forge partnerships with other agencies under the GIZ-RFIP programme and with ICAI for preparation of Audit Manual for Co-operatives and RRB. NABARD also actively supported National

Laundering (AML) Policy for adoption, (v) detailed guidelines for inspection of DCCB, branches of SCB/ DCCB and affiliated societies and (vi) clarification on

Federation of State Co-operative Banks in revising the operational manuals for Co-operative Banks.

Organisation, Corporate Governance and Management

75. The Board of Directors met six times during the RBI. During the year, diagnostic and design phases under Project Reposition were completed.

year, while the Executive Committee and the Boards Projects Sanctioning Committee for Loans under RIDF, met thrice and seven times, respectively. The Audit Committee of the Board (ACB) as well as the Risk Management Committee of the Board (RMCB) met thrice during the year.

77. 13

th

Reserve

Bank

of

India

conducted

the

Financial Inspection of NABARD (with reference

to its financial position, as on 31 March 2010) from 01 November 2010 to 13 December 2010. Under RTI Act, 737 applications were provided requisite Ninety-four

76.

NABARD started the Project Reposition in

information within the stipulated time.

March 2010, with a view to networking resources, building capabilities and partnering institutions for bringing about effective integrated rural

appeals were responded to and 15 hearings on the appeals made to Central Information Commission were attended by officials of the Bank.

development in India. The project seeks to address the present day challenges without conflict with the long-term role mandated to NABARD by GoI and 78. A total of 2,131 officers were imparted training

through 103 programmes conducted during the year

x

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

by the National Bank Staff College, Lucknow. Further, 18 on-location programmes were conducted for 425 officers on various topics. During the year, 145 officers from NABARD, three from client institutions and 18 NGO participants were deputed for various Overseas programmes. Two batches of 10 senior officers each were deputed to a programme on Risk Management and Performance organised by World Savings Bank Institute and to RIPA, London.

providing compassionate appointment to dependents of ten deceased employees.

81.

Based

on

the

report

of

KPMG by

and

the BCG

subsequent

study

undertaken

(the repositioning consultant), the Bank finalised its future IT architecture and IT road map to be implemented in phases. These consist of the following: (a) Human Resources Management (Phase I), (b) Centralised Loan Management & Accounts (Phase II), (c) Business Processes (Phase III), (d) Enterprise Data Warehouse (Phase IV).

79.

During the year, 126 officers were appointed in

Grade A in the Rural Development Banking Service of the Bank. A total of 396 staff was promoted during the year. The total staff strength of the Bank, as on 31 March 2011, was 4,607. Of these, 18 per cent belonged to Scheduled Castes and 9 per cent to Scheduled Tribes. The strength of ex-servicemen and physically handicapped employees stood at 80 and 94, respectively.

82.

During

the

year

2010-11,

the

Inspection

Department of the Bank carried out inspection of 16 HO Departments, 22 Regional Offices and two Training Establishments, i.e., RTC Mangalore and NBSC Lucknow. Inspection Reports were issued and compliance ensured. 83. During the year, five Parliamentary Committees NABARD. Two RO, viz., Karnataka and

80.

Industrial relations in the Bank continued to be Three meetings each of

visited

harmonious during the year.

Chhattisgarh were notified under Section 10(4) of Official Languages Act by the GoI. Implementation Office, Department The Regional of Official

the Grievances Redressal Committee and the Appellate Committee were held during the year. Two pre-

Language, Ministry of Home Affairs, GoI awarded prizes to Andhra Pradesh RO, Maharashtra RO and RTC, Mangalore. During the year, 109 Potential-linked Credit Plans and 69 Inspection Reports were prepared/ issued in Hindi.

promotional training programmes for 120 SC/ST staff were conducted at training centres. Other benefits extended to SC/ST employees included granting

scholarship to 12 wards of the employees and

Financial Performance & Management of Resources

84. The total financial resources of NABARD 85. The paid up capital, as on 31 March 2011, was ` 2,000 crore against the authorised capital of ` 5,000 crore; with the share of GoI being 99 per cent and that of the RBI at one per cent. The amount of reserves and surplus increased by ` 1,188 crore, as on 31 March 2011.

increased to ` 1,58,872 crore, as on 31 March 2011, registering an increase of 16.57 per cent, over the previous year. Total market borrowings of ` 34,747

crore, as on March 31, 2011, constituted 21.87 per cent of the total resources of the bank.

xi

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

86.

The amount outstanding under the non-project

tax were at ` 1,824 crore and ` 1,279 crore respectively as on 31 March 2011, as compared to ` 2,272 crore and ` 1,558 crore respectively, in the previous year. The average cost of borrowings (interest expenditure as a per cent of average borrowings) decreased from 6.83 per cent per annum during 2009-10 to 6.64 per cent per annum during 2010-11. The capital to risk-

long-term (LT) loans granted to State Governments for contributing to the share capital of co-operative credit institutions, amounted to ` 167 crore as on

31 March 2011. There was a decrease of ` 32 crore as compared to the position as on 31 March 2010.

87.

The total income of NABARD during the year

weighted assests ratio (CRAR) was 21.76 per cent as on 31 March 2011, as compared to 24.95 per cent as on 31 March 2010.

amounted to ` 9,202 crore as against ` 7,965 crore for the year 2009-10. The profit before tax and profit after

xii

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

I

Economic Environment

The global economy witnessed a growth of 5.0 per cent in 2010, which is the highest in the post-crisis period. The Indian economy is also expected to regain the precrisis growth levels with the growth rate estimated at 8.5 per cent in 2010-11 as compared to 8.0 per cent in 2009-10. This broad based growth is due to the growth of 6.6 per cent in agriculture, 7.8 per cent in industry and 9.3 per cent in services. The impressive growth performance has enabled the per capita income (at 2004-05 prices) to increase from ` 33,731 during 2009-10 to ` 35,917 during 2010-11. Inflation, at 9.4 per cent during 2010-11, largely driven by primary food articles as against 3.6 per cent during 2009-10, has emerged as a major cause of concern.

Global Economy

1.2 The World Economic Outlook of the International Monetary Fund has projected growth in global output at 4.4 per cent in 2011, a decline of 0.6 percentage points relative to 2010. Economic growth in advanced economies was a modest 3 per cent in 2010 and is projected at 2.4 per cent in 2011. In the emerging and developing economies, the growth rate improved in 2010 as compared to 2009 and is expected to remain buoyant at 6.5 per cent in 2011. Economic growth of China (10.3 per cent) and India (10.4 per cent) rebounded in 2010 and it is estimated that the growth in China and India would be 9.6 per cent and 8.2 per cent, respectively, in 2011 (Table 1.1). 1.3 Commodity prices (both oil and non-oil) per cent for cereals, 9.23 per cent and 15.81 per cent for vegetables and milk, respectively (Table 1.2).

Table 1.1: Overview of Global Economy (Annual per cent change) Growth A. GDP (Real) a. World output b. Advanced Economies United States Euro Area (-)0.5 (-)3.4 (-)2.6 (-)4.1 (-)6.3 (-)0.8 2.7 7.2 9.2 6.8 1.7 0.1 5.2 5.0 3.0 2.8 1.7 3.9 8.4 7.3 9.5 10.3 10.4 6.9 1.6 6.2 4.4 2.4 2.8 1.6 1.4 4.9 6.5 8.4 9.6 8.2 5.4 2.2 6.9 2009 2010 2011*

i. i.

iii. Japan iv. Newly Industrialised Asian Economies c. Other Emerging and Developing Economies i. Developing Asia ii. China iii. India iv. ASEAN - 5** B. Consumer Prices a. Advanced Economies b. Other Emerging and Developing Economies C. World Trade Volume (goods & services) a. Imports by Emerging and Developing Economies b. Exports by Emerging and Developing Economies D. Commodity Prices a. Oil Prices b. Non-Fuel Prices * : ** : Projections

increased by 27.9 per cent and 26.3 per cent, respectively in 2010, due to strong global demand and supply shocks. The commodity prices are projected to remain high in 2011 due to continued robust demand and slow supply response to the market conditions. The consumer price inflation in the emerging and developing economies at 6.2 per cent in 2010 was attributed mainly to higher food prices and is expected to rise to 6.9 per cent in 2011. Comparatively, inflation in the advanced economies was 1.6 per cent in 2010 and is projected at 2.2 per cent in 2011. 1.4 As per the Food and Agriculture Organisation data, the world production of cereals decreased by 1.2 per cent; vegetables and milk increased by 2.44 per cent and 0.87 per cent, respectively, in 2009 as compared to 2008. Asia is a major producer of cereals (47.46%), vegetables (75.55%) and milk (35.83%). Indias share on a two-year average basis was 10.29

(-)8.3 (-)7.5 (-)36.3 (-)15.8

13.5 14.5 27.9 26.3

10.2 8.8 35.6 25.1

Includes Indonesia, Malaysia, Philippines, Thailand and Vietnam

Source: World Economic Outlook, IMF, April 2011

1

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Table 1.2: Production of Cereals, Vegetables & Milk in the World, 2008 and 2009 (Million Tonnes) Country/Group 2008 India Africa Americas Asia Europe Oceania World

* Incudes Melons

Cereals 2009 248.81 158.67 634.18 1198.81 465.83 36.1 2493.61 % share in World@ 10.29 6.20 25.56 47.46 19.34 1.44 100 2008 91.73 64.10 81.56 744.48 93.81 3.43 987.37

Vegetables* 2009 92.77 63.68 81.71 765.55 97.07 3.44 1011.46 % share in World@ 9.23 6.39 8.17 75.55 9.55 0.34 100 2008 109.00 37.94 170.11 247.69 215.86 24.51 696.11

Milk % share in 2009 World@ 112.11 38.65 171.45 253.24 213.94 24.86 702.14 15.81 5.48 24.43 35.83 30.74 3.53 100

267.56 152.46 648.28 1182.29 504.39 36.4 2523.84

@ Share based on the average of 2008 & 2009

Source : FAOSTAT @ FAO Statistics Division, 21 June 2011

Indian Economy

A. Economic Scenario

a.

1.5 is estimated to grow at 2.9 per cent during 2007-08 to 2010-11 as against the Plan target of 4.0 per cent.

Gross Domestic Product

As per Revised Estimates, the Gross Domestic 1.6 Sectoral analysis of growth rates revealed an increase in agricultural growth by 6.2 per cent; decrease in services and industrial growth by 0.80 and 0.20 per cent respectively, during 2010-11 as compared to the previous year. The contributions of agriculture, industry and services to the GDP were 14.4, 27.9 and 57.7 per cent, respectively, during 2010-11 (Table 1.4).

Product (GDP) of the country has registered a growth of 8.5 per cent in 2010-11 as compared to 8.0 per cent in 2009-10 and 6.8 per cent in 2008-09 (Table 1.3). The high growth trajectory of the GDP has been facilitated due to a rebound in agriculture growth from 0.4 per cent during 2009-10 to 6.6 per cent during 2010-11. Industry and services registered a growth of 7.8 and 9.3 per cent, respectively, during 2010-11 as compared to 8.0 per cent and 10.1 per cent, respectively, during 2009-10. Against an average growth rate of 9.0 per cent envisaged in the Eleventh Five Year Plan, the average growth was 8.0 per cent for the period 2007-08 to 2010-11. The agriculture sector

b.

Consumption, Savings and Investments

The relative share of Private Final Consumption (PFCE) and Government Final

1.7

Expenditure

Consumption Expenditure (GFCE) (at 2004-05 prices),

2

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

Table 1.3: Economic Indicators (Annual percent change) Particulars Gross Domestic Product GDP from Agriculture & Allied Activities Foodgrains Production Industrial Production Inflation as measured by WPI Gross Domestic Savings (as % of GDP) Gross Domestic Investment (as % of GDP) Fiscal Deficit (as % of GDP) Imports Exports Trade Balance (as % of GDP*) External Debt (as % of GDP*)

QE: Quick Estimates *At current market prices Source: Economic Survey 2010-11; CMIE, May 2011; Central Statistical Organisation, GoI RE: Revised Estimates

2008-09 6.8 (-)0.1 1.0 3.2 8.0 32.2 34.5 6.0 20.7 13.6 (-)9.5 20.5

2009-10 8.0 (QE) 0.4 (QE) (-)7.1 10.5 3.6 33.7 36.5 6.3 (-)5.0 (-) 3.5 (-)7.9 18.1

2010-11 8.5 (RE) 6.6 (RE) 6.8 7.8 9.4 35.6 38.0 4.8 21.8 37.7 (-)6.06 -

as

estimated

by

Central

Statistical

Organisation,

2010-11. While private sector savings has remained virtually stagnant at 31 per cent, public sector savings increased from 0.5 per cent during 2008-09 to 2.1 per cent during 2009-10. The Gross Capital Formation (GCF), as a proportion of GDP, is estimated at 36.5 per cent with the contribution of public and private sectors at 9.2 and 24.9 per cent, respectively during 2009-10. Within the private sector, the investment rate for the corporate sector increased from 11.5 per cent in 2008-09 to 13.2 per cent in 2009-10 while that of the household sector declined from 13.1 per cent to 11.7 per cent.

Government of India increased by 8.60 and 4.76 per cent respectively in 2010-11 over 2009-10. The private expenditure on food items as a proportion to total private consumption, as per the Economic Survey, 2010, has been gradually declining since 2004-05 from 40.0 per cent to 32.6 per cent in 2009-10 while that of miscellaneous goods and services has been increasing.

1.8

The Gross Domestic Savings (GDS), as a

proportion of GDP is estimated to have increased from 33.7 per cent during 2009-10 to 35.6 per cent during

Table 1.4: Sectoral Growth Rates of GDP (2004-05 prices) Sector Agriculture & Allied Industry# Services Total GDP at factor cost 2006-07 3.7(17.2) 12.7(28.7) 10.2(54.2) 9.7(100.0) 2007-08 4.7(16.4) 9.5(28.8) 10.5(54.8) 9.2(100.0) 2008-09 (-)0.1(15.7) 4.4(28.1) 10.1(56.2) 6.8(100.0) 2009-10 0.4(14.6) 8.0 (28.1) 10.1(57.3) 8.0(100.0) 2010-11(RE) 6.6(14.4) 7.8(27.9) 9.3(57.7) 8.5(100.0)

Figures in parentheses indicate percentage shares in GDP RE: Revised Estimates #: Includes mining & quarrying, manufacturing, electricity, gas and water supply and construction Source: 1. Monthly Economic Report (April 2011), Ministry of Finance, GoI 2. Economic Survey 2010-11

3

ISIEmergingMarketsPDF in-spjainmr from 115.115.176.107 on 2013-09-02 17:18:09 EDT. DownloadPDF. Downloaded by in-spjainmr from 115.115.176.107 at 2013-09-02 17:18:09 EDT. ISI Emerging Markets. Unauthorized Distribution Prohibited.

www.reportjunction.com

www.sansco.net

c.

1.9

Inflation

A revised Wholesale Price Index (WPI) series

fuel & power has also risen by 5.43 per cent and 12.24 per cent, respectively (Chart 1.1 (a) & (b)).

with changes in weights and commodities, and with the base year as 2004-05 has been released. The WPI also includes an addition of 241 items in the commodity basket and increase in the number of price quotations from 1,918 to 5,482.

d.

Trade

1.12 Exports and imports are projected to grow by 22.5 and 13.2 per cent, respectively, during 2010-11. Agricultural exports increased from ` 81,710 crore