Académique Documents

Professionnel Documents

Culture Documents

Rajnikant Patel - The NSEL Effect - A Case For 'Indocom' - BS

Transféré par

Investors of NSELTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rajnikant Patel - The NSEL Effect - A Case For 'Indocom' - BS

Transféré par

Investors of NSELDroits d'auteur :

Formats disponibles

9/18/13

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1

Rajnikant Patel September 17, 2013 Last Updated at 21:47 IST

Rajnikant Patel: The NSEL effect - A case for 'Indocom'

The current crisis is a good trigger for merging the four smaller futures comexes and integrating the spot and futures markets Although everybody is busy trying to unravel the crisis on the National Spot Exchange Ltd (NSEL), another core issue may be waiting in the wings. India has six commodity futures exchanges (comexes). The Multi Commodity Exchange of India (MCX) is the dominant player with a nearly 85 per cent market share, followed by National Commodity & Derivatives Exchange (NCDEX) with approximately 10 per cent. The remaining 5 per cent market share is divided among four others: National Multi Commodity Exchange, Indian Commodity Exchange, Ace and Universal Commodity Exchange. Having two dominant players commanding 95 per cent of the market is tough for any newcomer in any field. More so in a market that is regulated, so introducing product innovations and differentiation is difficult, and the first-mover advantage is probably non-existent. Getting liquidity from other exchanges is also tough. Hence, the continued financial viability of such small exchanges becomes a major concern. How is all this related to the NSEL crisis? The crisis has sharply focused the important issue of exchange default. Although the current default concerns a spot exchange (spotex) and not a comex, the Forward Market Commission (FMC), as the regulator, is concerned about the possibility of a default on a comex and rightly so. FMC has already asked comexes to set aside an amount for a Settlement Guarantee Fund (SGF). The treasury income from that corpus will accrue to the SGF and not the exchange. That's how it is done on the stock exchanges (SEs). Although this stricter regulation is a move in the right direction since it brings parity between the commodity and capital markets, it will impose a financial pressure on the comexes that are fighting among themselves for a very small pie and are already under stress in terms of financial sustainability. This situation is similar to the capital market more than a decade ago with respect to the regional stock exchanges (RSEs). With the introduction of the electronic trading system through the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), the RSEs became insignificant. They couldn't afford new technology, did not have the reach of BSE and NSE, lacked manpower and a brand image. Companies came to the RSEs for listing as long as it was mandatory; when that stipulation was lifted in 2003, the RSEs became redundant. The Securities and Exchange Board of India (Sebi) came out with a survival solution by allowing RSEs to float brokerage subsidiaries for their broker-members and become broker-member of BSE or NSE. However, the corporatisation and demutualisation of SEs in 2004-05 presented a huge challenge to RSEs to continue as exchanges.

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1 1/3

9/18/13

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1

Two solutions were then explored. The first was the formation of the Interconnected Stock Exchange (ISE) with 14 RSEs as owners. The objective was to make ISE a third platform from which RSE broker-members and their clients could trade on a national electronic platform such as BSE and NSE. It didn't take off and, ultimately, ISE became a broker on BSE and NSE. The other measure was IndoNext at BSE. For this, section 13 of Securities Contract Regulation Act was amended to allow broker-members of other exchanges (read RSEs) to trade on national exchange (read BSE/NSE) with RSEs acting as a clearing house to clear trades of its broker-members. A body of all RSEs, called the Federation of Indian Stock Exchanges (FISE), was formed for this purpose. P Chidambaram, finance minister then as now, launched FISE at BSE. IndoNext, however, also didn't work. Which brings us to the four smaller comexes fighting for 5 per cent of the market. Each is trying to garner a 1 to 3 per cent share. Sooner or later the question of financial viability will raise its ugly head. Fresh equity infusion by existing shareholders or new investors could help but does not solve the sustainability issue. The promoterentities of comexes are big names in the public and private sector and, along with financial institutions, they represent a huge financial and technical resource base. If they were to come together on a single platform, the possibility of the survival and growth of the merged entity becomes almost a certainty. A single entity called, say, Indocom, formed by merging the smaller comexes will have a 5 to 7 per cent market share on day one. With a combined average daily turnover of about Rs 10,000 crore, the issue of sustainability is addressed. This would offer them a reasonable opportunity to fight for market share and grow. Already, there is a broad specialisation in the market with MCX being a leader in metals and energy and NCDEX in agricommodities. The others also have minor segment specialisation, which could become their combined USP. This will also help develop the market by offering specialisation in products and services and encouraging product innovation. Unlike Indonext, however, where the RSEs simply joined hands to work together, Indocom should entail a deeper consolidation involving resource synergies in finance, products, technology and human capital and economies of scale in terms of costs. Doing so would reduce duplication of efforts such as marketing, business development and technology. This development would also mean that the regulator will have to supervise fewer comexes, leading to better oversight. Better regulation with financially sound comexes would mean better governance and higher compliance levels. Ultimately, investor confidence is a function of better regulation and financial capabilities in the marketplace. Bringing all parties to the table may be difficult but not impossible. The private parties will see the business case; the public institutions will see the benefit of strengthening the market structure. The government and regulator should see it as a systemic solution arising out of the current crisis to create a robust market. Issues like being competitors, brand image and management control and so on can be solved, though the original owners may be minority stakeholders after the merge. Management should be left in the hands of professionals. This would solve the conflict-of-interest issue. A word of caution here from the Indonext experience. Let this initiative be led by the government arising out of

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1 2/3

9/18/13

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1

the current crisis as a regulatory measure for enhancing the safety and strength of the market. With the finance ministry coming into the picture, now is the time to make our commodity market stable and secure with financially sound market intermediaries. A consolidated comex with a diverse and disbursed shareholding, independent management and close regulatory oversight could well be the systemic solution for which all are looking. Globally, comexes are larger than equity markets in terms of dollar turnover. Another positive outcome of the consolidation could be the integration of the spotex with the comex. In 2000, when badla was banned and derivatives introduced, Sebi considered a separate exchange for derivatives. But the close linkage of the underlying cash-equity market with derivatives meant that both segments needed to be under the same SE. This has proven a good risk-management tool across both segments. This integration of the spot and futures segments is required in commodity markets too. An orderly, nationallevel, electronic spot market can be developed to reduce risks such as collateral management, warehousing and, most importantly, and for broker/client-level margining and capital adequacy. Although this integration may require a holistic approach for regulators, Comex consolidation would be quick and easy to implement. The Indian financial system needs the government and regulators to rise above the current crisis and implement systemic solutions for a robust and credible marketplace. Only then will the work done by initial players to take Indian comexes to global levels have served its purpose.

The writer is former MD & CEO, BSE

www.business-standard.com/article/printer-friendly-version?article_id=113091701073_1

3/3

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- M8 EbookDocument186 pagesM8 EbookKar Yan100% (1)

- Treasury ManagementDocument15 pagesTreasury Managementharrykey John100% (3)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- FTIL Open Interest F&O July Aug 2013Document1 pageFTIL Open Interest F&O July Aug 2013Investors of NSELPas encore d'évaluation

- FTIL EQ Analysis July Aug 2013Document1 pageFTIL EQ Analysis July Aug 2013Investors of NSELPas encore d'évaluation

- BS: NSEL Owes Rs 253 Crore To Motilal Oswal GroupDocument1 pageBS: NSEL Owes Rs 253 Crore To Motilal Oswal GroupInvestors of NSELPas encore d'évaluation

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELPas encore d'évaluation

- ET - I'm A Victim, Pleads Shah, But FMC'LL Have None of It - 2013 09 19Document1 pageET - I'm A Victim, Pleads Shah, But FMC'LL Have None of It - 2013 09 19Investors of NSELPas encore d'évaluation

- JSA Letter Dated 16 September 2013 PDFDocument4 pagesJSA Letter Dated 16 September 2013 PDFInvestors of NSELPas encore d'évaluation

- SGS Audit Progress Report As On 17 Sept 2013Document3 pagesSGS Audit Progress Report As On 17 Sept 2013Investors of NSELPas encore d'évaluation

- BHAVCOPY Data From The NSE Data For Jyuly Aug 2013Document7 pagesBHAVCOPY Data From The NSE Data For Jyuly Aug 2013Investors of NSELPas encore d'évaluation

- HBL - Investors Take NSEL Issue To Mumbai Police's Economic Offences Wing - 2013 09 19Document1 pageHBL - Investors Take NSEL Issue To Mumbai Police's Economic Offences Wing - 2013 09 19Investors of NSELPas encore d'évaluation

- NAFED A Background PresentationDocument20 pagesNAFED A Background PresentationInvestors of NSELPas encore d'évaluation

- Affidavit Anjani Sinha 2013 09 11Document13 pagesAffidavit Anjani Sinha 2013 09 11Investors of NSELPas encore d'évaluation

- Jignesh Shah Knew A Crisis Was Brewing?Document2 pagesJignesh Shah Knew A Crisis Was Brewing?Investors of NSELPas encore d'évaluation

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELPas encore d'évaluation

- NSEL Fiasco Looks Like Another Satyam Scam - ET Guest Article by MR Motilal OswalDocument2 pagesNSEL Fiasco Looks Like Another Satyam Scam - ET Guest Article by MR Motilal OswalInvestors of NSELPas encore d'évaluation

- Letter - Uday KotakDocument1 pageLetter - Uday KotakInvestors of NSELPas encore d'évaluation

- Letter From NIF Re Sale of Shares (130913)Document4 pagesLetter From NIF Re Sale of Shares (130913)Investors of NSELPas encore d'évaluation

- Letter - Chairman WDRA From NIFDocument3 pagesLetter - Chairman WDRA From NIFInvestors of NSELPas encore d'évaluation

- NSEL Saga Audit by Swiss Firm SGSDocument3 pagesNSEL Saga Audit by Swiss Firm SGSInvestors of NSELPas encore d'évaluation

- Letter - FMC Chairman From NIFDocument4 pagesLetter - FMC Chairman From NIFInvestors of NSELPas encore d'évaluation

- ET - FMC To Move Next Week On MCX 'Fit Test 2013 09 13Document1 pageET - FMC To Move Next Week On MCX 'Fit Test 2013 09 13Investors of NSELPas encore d'évaluation

- HBL - NSEL Defaults Yet Again, Pays Only Rs.7.77 Crore - 2013 09 11Document1 pageHBL - NSEL Defaults Yet Again, Pays Only Rs.7.77 Crore - 2013 09 11Investors of NSELPas encore d'évaluation

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELPas encore d'évaluation

- Mint - Jharkhand Scam Accused Stakeholder in NSEL Firm - 2013 09 06Document4 pagesMint - Jharkhand Scam Accused Stakeholder in NSEL Firm - 2013 09 06Investors of NSELPas encore d'évaluation

- HBL - Forward Markets Commission Brought Under FinMin Control - 2013 09 11Document1 pageHBL - Forward Markets Commission Brought Under FinMin Control - 2013 09 11Investors of NSELPas encore d'évaluation

- BS - Chronicles of An NSEL Investor - 2013 09 06Document1 pageBS - Chronicles of An NSEL Investor - 2013 09 06Investors of NSELPas encore d'évaluation

- WSJ Suit Claims Merkin Knew Madoff's Business Was A FraudDocument2 pagesWSJ Suit Claims Merkin Knew Madoff's Business Was A FraudInvestors of NSELPas encore d'évaluation

- ET - NSEL Borrower Used Dummy To Divert Funds - 2013 09 11Document1 pageET - NSEL Borrower Used Dummy To Divert Funds - 2013 09 11Investors of NSELPas encore d'évaluation

- HBL - Steps Taken To Protect Investors, NSEL Assures High Court - 2013 09 06Document1 pageHBL - Steps Taken To Protect Investors, NSEL Assures High Court - 2013 09 06Investors of NSELPas encore d'évaluation

- Marriott Rewards Silver Elite Card - Uday Punj.-0215Document1 pageMarriott Rewards Silver Elite Card - Uday Punj.-0215Investors of NSELPas encore d'évaluation

- Business Start-Up Pre-Feasibility ReportDocument9 pagesBusiness Start-Up Pre-Feasibility ReportJishnu ChaudhuriPas encore d'évaluation

- INNOVATIVE ISLAMIC HEDGINGDocument20 pagesINNOVATIVE ISLAMIC HEDGINGAzlin AlisaPas encore d'évaluation

- 3.00 - 61 Over 70 - TAKEDocument38 pages3.00 - 61 Over 70 - TAKEVon Andrei MedinaPas encore d'évaluation

- Valuation in A World of CVA and DVADocument226 pagesValuation in A World of CVA and DVAdislorthPas encore d'évaluation

- Trading Strategies Market Colour Ravi Kashyap 2018Document25 pagesTrading Strategies Market Colour Ravi Kashyap 2018Mete İlker Sari0% (1)

- Other ASX Research 4Document92 pagesOther ASX Research 4asxresearchPas encore d'évaluation

- SID - DWS Global Agribusiness Offshore FundDocument28 pagesSID - DWS Global Agribusiness Offshore FundpvmoneyPas encore d'évaluation

- Creditflux 1 June 2006 OCRDocument32 pagesCreditflux 1 June 2006 OCRfodriscollPas encore d'évaluation

- Warren Buffet CaseDocument4 pagesWarren Buffet Casetania shaheenPas encore d'évaluation

- Equity Derivatives: Take A CORRECT TURN WithDocument31 pagesEquity Derivatives: Take A CORRECT TURN WithSudipa RouthPas encore d'évaluation

- Accenture Capital Markets Vision 2022Document36 pagesAccenture Capital Markets Vision 2022manugeorgePas encore d'évaluation

- Law and Policy in Latin America Transforming Courts Institutions and RightsDocument372 pagesLaw and Policy in Latin America Transforming Courts Institutions and RightsJorge Acosta JrPas encore d'évaluation

- Finalised Interest Rate Swaps ConfirmationDocument18 pagesFinalised Interest Rate Swaps ConfirmationSurbhi GuptaPas encore d'évaluation

- Spot Trading Rulebook v1.2 enDocument114 pagesSpot Trading Rulebook v1.2 enΗλίας ΣταυρόπουλοςPas encore d'évaluation

- Derivatives - Cheat SheetDocument12 pagesDerivatives - Cheat SheetUchit MehtaPas encore d'évaluation

- Cumulative Normal Distribution Calculator and Inverse CDF Calculator Exam MFE Questions and SolutionsDocument39 pagesCumulative Normal Distribution Calculator and Inverse CDF Calculator Exam MFE Questions and SolutionsAbhinav ShahPas encore d'évaluation

- IFC 2006 Annual Report ReviewDocument181 pagesIFC 2006 Annual Report ReviewMgn SanPas encore d'évaluation

- SEBI as a regulator of the capital marketDocument25 pagesSEBI as a regulator of the capital marketraj vardhan agarwalPas encore d'évaluation

- PWC Guide To Accounting For Derivative Instruments and Hedging ActivitiesDocument594 pagesPWC Guide To Accounting For Derivative Instruments and Hedging Activitieshui7411100% (2)

- 2009 May04 No368 Ca TheedgesporeDocument19 pages2009 May04 No368 Ca TheedgesporeThe Edge SingaporePas encore d'évaluation

- TN DTTCDocument40 pagesTN DTTC050609211552Pas encore d'évaluation

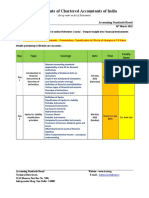

- The Institute of Chartered Accountants of India: Accounting Standards BoardDocument3 pagesThe Institute of Chartered Accountants of India: Accounting Standards BoardHitesh KarmurPas encore d'évaluation

- Test Bank For Essentials of Investments 8th Edition Zvi BodieDocument23 pagesTest Bank For Essentials of Investments 8th Edition Zvi Bodiebarrulettitbitc9vo100% (46)

- Mfe Formula Sheet 2017Document6 pagesMfe Formula Sheet 2017Anila RathiPas encore d'évaluation

- Krea University: Understanding Credit DerivativesDocument41 pagesKrea University: Understanding Credit DerivativesMukul BaviskarPas encore d'évaluation

- Financial Futures MarketsDocument48 pagesFinancial Futures MarketsAnthony KwoPas encore d'évaluation

- Fundamental & Technical Analysis of Automobile StocksDocument19 pagesFundamental & Technical Analysis of Automobile StocksShahzad SaifPas encore d'évaluation

- Basics of Derivatives Division CDocument10 pagesBasics of Derivatives Division Cmihir popatPas encore d'évaluation