Académique Documents

Professionnel Documents

Culture Documents

Paralegal Website

Transféré par

Wb Warnabrother HatchetCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Paralegal Website

Transféré par

Wb Warnabrother HatchetDroits d'auteur :

Formats disponibles

The court Will NOT waive the filing fee if you hire a bankruptcy attorney!

We include the fee waiver in every bankruptcy that we prepare so that you can get the court filing fee waived. This can save you more than $300 in court filing fees. But an attorney will not tell you this.

Why pay $300 or more in court fees if you do not have to?

The court usually assumes that if you can afford an a attorney, you can afford the court filing fee. If you cannot afford an attorney, the opposite is easily presumed. Handling bankruptcy is easy if you do it thousands of times a year but if you file a bankruptcy every now and then, you can get rusty. That is the problem with most attorney prepared bankruptcies. They often have to be redone because of attorney errors. We prepare bankruptcies by the thousands yearly, one at a time, whereas the average attorney prepares a just a few each year. In fact, most of the time, they do not even prepare them. They hire document experts like us to prepare their client's bankruptcy just because we can do it better. You may be surprised to learn that we have prepared bankruptcy filings for attorneys who turn around and sold it to their clients for a lot more. We are not attorneys but we are the best at preparing the documents. The average bankruptcy attorney is a salesman. Their job is to sign you up for as much money as they can and then they turn it over to their clerical staff to prepare. They are often not even as familiar with bankruptcy law as you would expect them to be. The reason is simple. Bankruptcy is more about piles of paperwork, sorted and collated -- numerous lists of all whatnot, calculated and summarized every which way, than it is about law per say. Bankruptcy attorneys can talk to you but they cannot talk for you at the trustee hearing. Trustees rely 100% on the paperwork and many trustees will not even allow the attorney to say anything,

other than to introduce themselves and to ask for a rescheduling if they have made mistakes. The trustee hearing lasts for only a few minutes and you are usually asked a few questions such as, if you want to go through with the bankruptcy and if you want to make changes. Your biggest surprise will be how quickly it is all over and why you let an attorney scare you into hiring him or her in the first place. Creditors cannot object to your bankruptcy at this hearing. Hardly ever does a creditor dispute the discharge and if it is going to happen, it CANNOT happen at the trustee hearing. In the rare event that a dispute is filed by a creditor, it is done by filing a motion. Also, a creditor can only dispute the discharge of the debt you owe them. They cannot dispute any other debts. If it happens though, you can hire an attorney or file a simple form to answer the dispute at that time. Creditor disputes are so rare that attorneys do not include them in the fee they charge you for filing bankruptcy. If that happens, they will charge you separately anyway, so it does not make sense to get scared into hiring an attorney you cannot afford, for something you will not need. A bankruptcy attorney cannot stop creditors from call you. The bankruptcy filing is what stops the creditors. The court sends them a notice to stop harassing you. Yet many bankruptcy attorneys collect thousands of dollars from naive clients, on the promise to stop the phone calls. Consumer bankruptcy is mostly accounting, but because attorneys wrote the law, they gave it the appearance of law rather than bookkeeper and accounting, where it naturally belongs. Unless you have a corporate business, you do not need a bankruptcy attorney to do what we can do for you at a mere fraction of the cost. Now you can get the same bankruptcy prepared for you at the wholesale prices that attorneys pay. You do not need to know anything about bankruptcy law to have us help you because we do everything for you. But if you like to educate yourself, we have an excellent section on the law that you can explore. Bankruptcy Law Reference Here is how it works.

We do everything for you.

We prepare 100% of everything you will need for a complete personal bankruptcy so all you do is sign your name and turn them in.

We hold your hand all the way.

After preparing your bankruptcy, we guide you through the process so that you are never alone. 1. We tell you exactly where and how to file it. It is as simple as mailing our documents to the court after you have signed them. 2. We guide you step by step so that you know what to expect at all times. 3. We will answer all of your questions, no matter how many they are. Contact as as often as you like, before, during and after filing and we will answer your questions. 4. We hold your hands so that you are never alone.

If you cannot afford to pay the filing fee, you do not have to.

We include a filing fee waiver in every bankruptcy that we prepare so that you can have the court fee waived. This alone will save you $300 or more.

Our bankruptcy law reference,

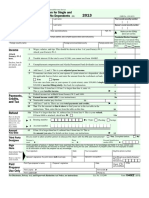

Has been rated the "best consumer bankruptcy law resource" on the internet and is often quoted by attorneys and by other bankruptcy services. It is right here and only a click away. We do more than prepare perfect bankruptcies -- we make the whole process incredibly easy! Here is what we will do for you... 1. We will prepare everything that you will need for a complete Chapter 7 bankruptcy. It includes all 40 or more pages of the schedules, statements, etcetera. All you do is sign your name and send them to the court. Here is a partial list of what we will prepare for you... Voluntary Petition Summary of Schedules Notice to consumer debtors Schedule-A: Real Property Schedule-B: Personal Property Schedule-C: Exempt Property Schedule-D: Secured Creditors Schedule-E: Priority Creditors Schedule-F: Unsecured Creditors Schedule-G: Executory Contracts and Leases

Schedule-H: Co-debtors Schedule-I: Current Income Schedule-J: Current Expenses Declaration Concerning Schedules Statement of Intention Statement of Financial Affairs Creditor Mailing Matrix Statement of Social Security Number Various local forms And more

2. Our documents are always up-to-date and accepted in every bankruptcy court in every state. We guarantee it. 3. We have prepared more than 15,000 bankruptcy cases and NONE have ever been rejected by any court in any state -- and that is the secret behind our 200% money-back guarantee. In contrast, most bankruptcy filings done by do-it-yourselfers get rejected repeatedly and many lawyer-prepared bankruptcies do not fare better. 4. If you need to file a joint bankruptcy with your spouse, we will include him or her at no extra cost. There are no hidden fees, no add-ons, no extras. 5. If your bankruptcy court requires the creditor address list on a diskette, we give it to you formatted for easy copying to diskette. (Bankruptcy kits and software cannot help you with this.) 6. If you want to keep on paying some debts in spite of bankruptcy, for example, your house, car or some cards, we provide you the reaffirmation agreement tools to make it possible. (No one else does this for you.) 7. We will accept an UNLIMITED number of creditors, collection companies, etcetera, so you do not have to fear getting bumped up in price for having many creditors. (Attorneys and paralegals often charge as much as $20 for each creditor after the first five.) Pile on the bills. We can take it. 8. We will also accept any number of property listings so that you don't have to worry about being charged extra. One low flat fee does it all. 9. What is bankruptcy preparation without oodles and oodles of changes? You can change your information as often as you like and we will not charge you a penny more.

10. Think about it. With paper forms and kits, if you type the forms and later remember another bill, you have to start all over again in order to keep the list in alphabetic order. You may be the best typist in the world but when you have to prepare intricate bankruptcy documents and tear them up to start all over again 7 or 8 times, it will get to you. (Pile up the changes on us. We can take it and there is no extra charge.) 11. We usually complete the documents in a few hours not days. If you hire an attorney or paralegal, be prepared to wait a couple of weeks to get your papers back. 12. Our bankruptcy will stop the creditors from calling or bothering you right away. You do not need to pay hundreds of dollars to an attorney to answer your collection calls. 13. You do not need to contact the creditors or to send them letters. We see to it that your bankruptcy documents have everything that the court clerks will need to send the notices for you. (It is about time the bureaucrats worked for you. Sit back and let them contact your creditors for you, telling them to leave you alone.) Please note that if you use bankruptcy software or paper forms, you run the risk of screwing up vital parts of it and then being asked by the court to manually contact the creditors yourself. 14. You do not need to make photo copies because you get as many copies with us as you need. 15. Imagine going to a doctor and being told to operate on yourself. That is pretty much what happens with almost all the bankruptcy attorneys, paralegals, and bankruptcy programs. They make you fill out 30 to 40 pages of the same bankruptcy forms that they are supposed to type for you, just so that they can have the information in an easy to retype form. (The thought of it is just unsettling.) With us, we give you the absolute easiest online questionnaire imaginable. You never type anything twice and what you do enter requires no thinking, pondering, figuring out or organizing. Give us your information in any order you want and as disorganized as you like and we will make sense out of it. You can fill out our questionnaire in minutes compared to literally days with others. 16. What's more, you do not have to finish giving us your information in one sitting. You can save your information in our online questionnaire with the click of a button and come back

days later and continue where you left off, change what you already entered or just add more. (By now you are beginning to get our slogan, "there is no extra charge".) 17. We answer all of your questions, no matter how many they are. Contact us as often as you like, before, during and after your bankruptcy. We are always there to help you. We hold your hands every step of the way so that you are never alone. 18. Our privacy policy is simple. We never share your information with anyone but you, PERIOD! 19. We guarantee that your bankruptcy will be accepted by the court or your money back! A common misconception is to think that hiring a lawyer will ensure a smooth bankruptcy. In fact, the truth is that as is the case with do-ityourselfers, a large number of lawyer prepared bankruptcies get rejected and have to be redone or corrected two or more times. Incredible as it sounds, you only have to read our past customer courtroom reports below to be convinced. Why do so many lawyer-prepared bankruptcies hit the rocks? To answer this question, you must understand that bankruptcy lawyers do not prepare bankruptcy documents. Preparing 40 to 100 pages of repetitive financial data and statistical mumbo-jumbo is not what they are good at. They are good at making the sale and getting you to sign their five page retainer agreements. It is their office staff that prepare the documents and quite often, these people do not have much experience or training. Also, because of their high prices, most lawyers do not prepare more than 10 to 15 bankruptcies all year and that is too little experience to rely on.

What is it like to appear in bankruptcy court? Here are eyewitness accounts.

Wouldn't it be nice if you could know exactly what happens when you go to bankruptcy court. Is there a judge? What do they look for? What do they ask you? What do you say when they call you up? What do you wear to the hearing?

Lucky for you, we asked the same question to dozens of other past customers .

Here is what we asked them:

"Describe what it was like for you when you went for your bankruptcy hearing." What we got back from them will amaze you. First, you do not appear in front of a judge. Second, they ask you only a coupe of questions such as whether or not you want to go through with the bankruptcy. For most people, the whole process lasts only one minute or less. Their responses are NOT testimonials but valuable insight that can help guide you and put your mind at ease about the court process. We have too many of them to post on this page but we have displayed a few in the display bar to the right. Perhaps the most notable part of it all is that the thousands of feedback we got said unanimously that they were very happy that they did not waste their hard earned money on hiring an attorney to go to the hearing with them. If that sounds strange, it is because at the bankruptcy hearing... 1. You cannot be represented by any attorney in the usual sense. An attorney can accompany you there but he or she cannot take your place or talk for you. You must appear in person. 2. If you appear with an attorney, he or she is not allowed to speak for you. You must answer the one or two easy questions that you will be asked. (So here is the picture. You pay many hundreds of dollars for an attorney to show up at the hearing with you. When you get there, the attorney only reads his or her name into the microphone, sits down and is done. He or she cannot answer any questions for you or even tell you what to say. The trustee asks you, "are you sure that you want to go through with it and is the information on your documents correct?" You answer yes to both questions and you are done, PERIOD.) 3. In fact, in some situations, you are better off going to the hearing without an attorney even if you can get one for free. That may sound radical but it is backed by eyewitness accounts of some debtors. How can going to your trustee meeting with an attorney be

disadvantageous in some situations? Granted, it is rare for an attorney to hurt your bankruptcy, but it can happen. Here is an actual event that took place for some unfortunate rich debtor. A man goes to his bankruptcy hearing and is asked by the trustee how much he paid his attorney. When the trustee hears the huge amount the man paid, he decides to really interrogate this debtor. In the process he turns up lots of stuff that was not on the bankruptcy papers and then compels the debtor to write him a fat check for many thousands of dollars. The moral of the story is that if you appear at the hearing without an attorney, the presumption is that you are too broke to afford one and that you deserve to have you debts discharged without wasting the time of the other people who are waiting their turn at the hearing. Stated another way, if you show up at the hearing with an attorney, it can often be seen as a possible sign that you might have something to hide and that you have been coached by the attorney on how to beat the system. Now, that does not mean that you should not hire an attorney if you are the nervous type or if you have medical or psychological issues and need an attorney to hold your hand. If you own a business or have a complicated case, consultation with an attorney is highly recommended.

Bankruptcy can be good for your credit...Better yet, bankruptcy can be removed from your credit in months rather than the usual 10 years.

This page covers Chapter 7 Click here Chapter 13

Bankruptcy Preparation We have prepared well over

15,000 bankruptcy cases and more than 225,000 bankruptcy documents.

We have the experience to handle yours.

And we have never had a bankruptcy rejected by any court!

And that is impressive when you consider that we have prepared more than 225,000 documents.

We can complete your bankruptcy in one day or in just a few hours.

And we back it with a 200% money-back guarantee.

The court Will NOT waive the filing fee if you hire a bankruptcy attorney!

We include the fee waiver in every bankruptcy that we prepare so that you can get the court filing fee waived. This can save you more than $300 in court filing fees. But an attorney will not tell you this.

Why pay $300 or more in court fees if you do not have to?

The court usually assumes that if you can afford an a attorney, you can afford the court filing fee. If you cannot afford an attorney, the opposite is easily presumed. Handling bankruptcy is easy if you do it thousands of times a year but if you file a bankruptcy every now and then, you can get rusty. That is the problem with most attorney prepared bankruptcies. They often have to be redone because of attorney errors.

We prepare bankruptcies by the thousands yearly, one at a time, whereas the average attorney prepares a just a few each year. In fact, most of the time, they do not even prepare them. They hire document experts like us to prepare their client's bankruptcy just because we can do it better. You may be surprised to learn that we have prepared bankruptcy filings for attorneys who turn around and sold it to their clients for a lot more. We are not attorneys but we are the best at preparing the documents. The average bankruptcy attorney is a salesman. Their job is to sign you up for as much money as they can and then they turn it over to their clerical staff to prepare. They are often not even as familiar with bankruptcy law as you would expect them to be. The reason is simple. Bankruptcy is more about piles of paperwork, sorted and collated -- numerous lists of all whatnot, calculated and summarized every which way, than it is about law per say. Bankruptcy attorneys can talk to you but they cannot talk for you at the trustee hearing. Trustees rely 100% on the paperwork and many trustees will not even allow the attorney to say anything, other than to introduce themselves and to ask for a rescheduling if they have made mistakes. The trustee hearing lasts for only a few minutes and you are usually asked a few questions such as, if you want to go through with the bankruptcy and if you want to make changes. Your biggest surprise will be how quickly it is all over and why you let an attorney scare you into hiring him or her in the first place. Creditors cannot object to your bankruptcy at this hearing. Hardly ever does a creditor dispute the discharge and if it is going to happen, it CANNOT happen at the trustee hearing. In the rare event that a dispute is filed by a creditor, it is done by filing a motion. Also, a creditor can only dispute the discharge of the debt you owe them. They cannot dispute any other debts. If it happens though, you can hire an attorney or file a simple form to answer the dispute at that time. Creditor disputes are so rare that attorneys do not include them in the fee they charge you for filing bankruptcy. If that happens, they will charge you separately anyway, so it does not make sense to get scared into hiring an attorney you cannot afford, for something you will not need.

A bankruptcy attorney cannot stop creditors from call you. The bankruptcy filing is what stops the creditors. The court sends them a notice to stop harassing you. Yet many bankruptcy attorneys collect thousands of dollars from naive clients, on the promise to stop the phone calls. Consumer bankruptcy is mostly accounting, but because attorneys wrote the law, they gave it the appearance of law rather than bookkeeper and accounting, where it naturally belongs. Unless you have a corporate business, you do not need a bankruptcy attorney to do what we can do for you at a mere fraction of the cost. Now you can get the same bankruptcy prepared for you at the wholesale prices that attorneys pay. You do not need to know anything about bankruptcy law to have us help you because we do everything for you. But if you like to educate yourself, we have an excellent section on the law that you can explore. Bankruptcy Law Reference Here is how it works.

We do everything for you.

We prepare 100% of everything you will need for a complete personal bankruptcy so all you do is sign your name and turn them in.

We hold your hand all the way.

After preparing your bankruptcy, we guide you through the process so that you are never alone. 1. We tell you exactly where and how to file it. It is as simple as mailing our documents to the court after you have signed them. 2. We guide you step by step so that you know what to expect at all times. 3. We will answer all of your questions, no matter how many they are. Contact as as often as you like, before, during and after filing and we will answer your questions. 4. We hold your hands so that you are never alone.

If you cannot afford to pay the filing fee, you do not have to.

We include a filing fee waiver in every bankruptcy that we prepare so that you can have the court fee waived. This alone will save you $300 or more.

You will receive the highest quality documents guaranteed to accepted by the courts or your money back.

Chapter 7 Orders Only

Click to Signup Also remember that we offer special discount pricing. Transaction Security: Payments processed on Secure Server (256-Bit SSL Encrypted) Use this link for Chapter 7 only. Click here for chapter 13. ---- A recent email message 11:14:09 AM ---My bk is done and I do not need anything more, but I wanted you to know that my Trustee hearing was today and he told me that he was actually suspicious of my filling because my submitted forms were perfect!! Thanks Bridgeport for your service! Joe ----Our reply sent at: 12:29:02 PM ---Some people ask if we are legit and even if we posted your words, they will still doubt that you are a real person. Thanks a million for your email and good luck with everything.

Eviction

If you are facing eviction, your biggest problem is time running out on you. The eviction process runs like clockwork and unfortunately, the judge, the landlord and their lawyer do not care whether you move out into the streets with your family. All they want is to get their apartment or house back. You do not have the time to figure things out and the judge will not delay the eviction because he or she feels sorry for you. For right now, the only thing that will buy you more time is to file a simple Chapter 7 bankruptcy. Filing bankruptcy is not a permanent solution though. It will only delay the eviction process, hopefully, enough for you to find another place to live. If you have debts that you wish to get rid of, the bankruptcy will get rid of those debts such as the past rent that they want from you, the landlord's

attorney fees, all your delinquent utility bills, credit card bills, medical bills, and just about any other debt you can think of. There are some people who file bankruptcy only for the purpose of slowing down the eviction process and do not really want to go through with it. What they do is that after filing bankruptcy, they fail to attend the mandatory trustee meeting in which case the trustee automatically dismisses the bankruptcy. It may be an easy way to buy time but many people consider it an abuse of the process since the original idea behind filing bankruptcy is to get rid of debts. Even though this method of filing bankruptcy and then having it dismissed works, we do not suggest that you do so. If you are going to file bankruptcy to delay your eviction, use the opportunity to wipe out all of your debts and get yourself a brand new start. How does bankruptcy buy you time and what exactly must you do? When you file bankruptcy, all law suits against you must stop, at lease for the time being. Also, the sheriffs, marshals or police are not allowed to proceed with throwing you out on the streets until a bankruptcy judge says that can. That means that after you file bankruptcy, your landlord's lawyer has to get a date in bankruptcy court to ask the bankruptcy judge to allow the eviction to resume. That process takes time and that is what buys you time. After filing bankruptcy, you need to immediately notify the landlord or his lawyer, and if the case is now in court, you need to notify the eviction judge. If it has passed the eviction judge and is now in the hands of the law enforcement officials who are supposed to put you out, then you need to notify them. You do this by showing them a copy of the bankruptcy bearing the bankruptcy file stamp that you will get when you file the bankruptcy. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Foreclosure

If you are facing eviction, your biggest problem is time running out on you. The foreclosure process runs like clockwork and unfortunately, the mortgage company and their lawyer do not care whether you move out into the streets with your family. All they want is to get their house back. The foreclosure process varies from state to state and by now you probably know what that process is in your state. If you are facing foreclosure and you do not know your legal rights, you should talk to a real estate attorney before doing anything. Do not file bankruptcy until you have been told that filing a bankruptcy will be in your best interest. Which type of bankruptcy you file will depend on your situation and on your goals. We have a detailed consumer law reference on our site that

you can read to become more familiar with the differences between Chapter 7 and 13 bankruptcies. If you know that you are not going to be able to keep your house and need to delay the foreclosure, filing a Chapter 7 bankruptcy may be your best bet, but if you know that given more time to get caught up on your back payments, you can keep your house, then you may want to talk to an attorney about the merits of a Chapter 13 bankruptcy. If you file a bankruptcy, it must be filed before the foreclosure sale. You may want to read our article on eviction since eviction usually follows foreclosure. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Wage Garnishment

If your wages are being garnished, you cannot afford to waste time deciding what to do. Wage garnishment can be stopped by bankruptcy and we can help. We know the ins and outs of how how wage garnishment works and what one must do to stop it. If you act quickly, you can even get some of the money that has been taken from your pay check returned to you. Most garnishments are for the repayment of court judgments against you and some are for the benefit of government agencies for such things as back taxes and child support. Bankruptcy will stop just about all wage garnishment except child support. Most wage garnishment is processed through law enforcement agencies such as the sheriffs, marshals or an agency empowered by your state for that purpose. What happens is that your employer takes the garnishment amount from your pay check and sends it to the law enforcement agency which in turn sends it to the creditor. In some states, the enforcement agency holds the amount collected for a couple of weeks before sending it to the creditor. If the creditor is a governmental agency, the garnishment is usually processed by a branch of the government authorized for that purpose. When you file bankruptcy, even though the court will on its own notify all of the creditors, it is best for you to notify the enforcement agency by yourself. This is because the creditor will most likely not want to obey the law immediately and stop the garnishment and the last thing you need is for the garnishment to drag on for several more weeks before it stops. Once you notify the enforcement agency, they will immediately terminate their collection of garnishment and will refuse to accept any more money from your employer. As a big side benefit, they will hold any money that they have collected which they have in their possession until the bankruptcy has been discharged, at which time they will return it to you. While the enforcement agency is not exactly a creditor, you should list them as creditor as well as list them as a party in possession of your property. You do so by listing the amount held by the enforcement agency as part

of the bankrupt estate and you apply exemption laws to protect that property. Listing the enforcement agency as a creditor will cause the court to send them official bankruptcy notices as the case progresses. If at the end of the bankruptcy, they do not return the amounts that they have in their possession, you can ask the court to compel them to do so. Notifying your employer may not help you since they are not a direct party in the collection process. You may need to notify your employer if your state uses the employer as the collection or enforcement agency and there is no other intermediary to whom the money is sent en route to the creditor. You notify the appropriate party by showing them a copy of the bankruptcy bearing the bankruptcy file stamp that you will get when you file the bankruptcy. Please note that you are not required to notify anyone about the filing of your bankruptcy since the court will do that for you. Notifying the enforcement agency just speeds up the process and could save you some dough. Hire us to prepare your bankruptcy and you can stop the garnishment as soon as today instead of several weeks as is the case with others. We will hold your hand from start to finish so that your are never alone. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Lawsuits

If you are being sued, bankruptcy can stop the lawsuit before it goes to judgment and if it has already gone to judgment, bankruptcy can wipe out the judgment. It is best to stop the lawsuit before it goes to judgment for a number of reasons. For one, some judgments turn into liens and liens often require additional court processing to get rid of. Hire us to prepare your bankruptcy and we will get it done quickly, usually within hours. And because we have prepared numerous bankruptcies involving lawsuits you can count on the highest quality possible. It does not matter how much you own or how much you are being sued for and it does not matter what threats the creditor has made against you. The lawsuit will stop immediately upon filing and you will not have to ever repay the debt. Hire us to prepare your bankruptcy and you can stop the lawsuit as soon as today instead of several weeks as is the case with others. We will hold your hand from start to finish so that your are never alone. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Repossession

If your car, boat or other property is about to be repossessed or has been repossessed, you cannot afford to waste time. Repossession can be stopped by bankruptcy and we can help. We know the ins and outs of how how repossession works and what one must do to stop it. If you act quickly, you can stop the repossession from taking place. If you can file bankruptcy quickly enough, you can stop the repossession of your car, boat or other

property as quickly as today and we can help. We can usually complete your bankruptcy within a few hours. Here is how it works. Once you file the bankruptcy documents that we prepare for you, the court clerk stamps a case number on your papers and give you a copy. The filing of the bankruptcy means that your creditors cannot proceed to repossess your property but what if they repossess it before they find out that you have filed bankruptcy. Yes, the court sends your creditors a notice in he mail but that could take a couple of weeks to happen, so what do you do in the mean time? Your best bet is to notify the creditor who is about to repossess your property by yourself. You notify the appropriate party by showing them a copy of the bankruptcy bearing the bankruptcy file stamp that you will get when you file the bankruptcy. Please note that you are not required to notify anyone about the filing of your bankruptcy since the court will do that for you. Notifying the creditor just speeds up the process and could save you some dough. If they repossess the property after they have been notified, you are entitled to get the property back. After stopping the repossession, you will still need to take additional steps to keep the property permanently if that is your intention. We discuss keeping property in our online law reference on this site. Hire us to prepare your bankruptcy and you can stop the repossession as soon as today instead of several weeks as is the case with others. We will hold your hand from start to finish so that your are never alone. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Taxes

Various types of tax debts can be discharged by filing a regular Chapter 7 bankruptcy, however there a few simple rules to observe. The basic rule is the three year rule which essentially requires the tax debt to be at least three years old. There a few minor procedural consideration dealing with the filing of tax returns and "service of process" which you can learn more about on our secure site after registering with us. Just about all types of back taxes can be discharged in bankruptcy and it does not matter how much the debt is. If you know what you are doing, it can be as simple as file a Chapter 7 bankruptcy and doing nothing else. Hire us to prepare your bankruptcy and you can have it done as soon as today instead of several weeks as is the case with others. You will also learn what steps to take to get rid of your taxes. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish so that you are never alone. If you need legal advice, talk to a licensed attorney.

Student Loans

Government guaranteed student loans are probably the least understood type of debt when it comes to what bankruptcy can do. Just about all other debts can be gotten rid of simply by filing a Chapter 7 bankruptcy and doing nothing else. For student loans, you still have to file Chapter 7 bankruptcy but after that, you would have to file a complaint to get the loan discharged. Not all student loans can be discharged by bankruptcy. There are two basic rules that govern the process and they are the seven year rule and the hardship rule. These rules are beyond the scope of this discussion, however we discuss these in greater detail on our free resource available to our registered customers. It is generally not smart to file bankruptcy only for student loans. If all you owe are student loans, then chances are that you have sufficient income to pay them off without bankruptcy. On the other hand, if you are overwhelmed by debt, chances are that you will qualify to discharge your student loans. Whether or not you have student loans, it all starts with filing an ordinary Chapter 7 bankruptcy like everyone else. Hire us to prepare your bankruptcy and you can have it done as soon as today instead of several weeks as is the case with others. You will also learn what steps to take to get rid of your student loan. We cannot give you legal advice but we will prepare everything you will need for your bankruptcy and we will hold your hands from start to finish. If you need legal advice, talk to a licensed attorney.

Credit Card Bankruptcy

Chapter 7 is usually the best type of bankruptcy to file if you have a lot of credit card debt. You almost could say that it was designed especially for credit card debt. There is no minimum or maximum amount you have to owe to in order to have Chapter 7 to work for you. Credit card debt is unsecured and there is no collateral to worry about loosing. Chapter 7 is good for much more than credit cards debts. It wipes out just about all imaginable debts. We have prepared more bankruptcies dealing with credit card debt that just about anyone else other there and that means experience. Hire us to prepare your bankruptcy and you can count on the fastest and easies bankruptcy possible. We will hold your hand from start to finish so that your are never alone. After your debts have been discharged, they never have to be repaid again. Also, you can start rebuilding your credit right away. We provide you information that will help you rebuild your credit later on this page. If you have decided to file bankruptcy, avoid the temptation of running up your debts just before filing. It is not

right to take money that you have no intention of repaying.

Vous aimerez peut-être aussi

- Winterization Checklist & Documentation: Safeguard PropertiesDocument1 pageWinterization Checklist & Documentation: Safeguard PropertiesWb Warnabrother HatchetPas encore d'évaluation

- Fred Killah DevonanDocument1 pageFred Killah DevonanWb Warnabrother HatchetPas encore d'évaluation

- How Music Royalties Work-Types of Rights and RoyaltiesDocument11 pagesHow Music Royalties Work-Types of Rights and RoyaltiesWb Warnabrother HatchetPas encore d'évaluation

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aPas encore d'évaluation

- Proof of Service MethodsDocument2 pagesProof of Service MethodsWb Warnabrother HatchetPas encore d'évaluation

- 55 Ideas Start Biz For Uner 50000Document11 pages55 Ideas Start Biz For Uner 50000Wb Warnabrother HatchetPas encore d'évaluation

- Resume 1Document4 pagesResume 1Wb Warnabrother HatchetPas encore d'évaluation

- Look Into The Mind of A Madman Ft. Excalibur Blame It On The White Guy FT - Ramz Minolo, Saint Siren & Gstats OCB-Prod - Track ProsDocument2 pagesLook Into The Mind of A Madman Ft. Excalibur Blame It On The White Guy FT - Ramz Minolo, Saint Siren & Gstats OCB-Prod - Track ProsWb Warnabrother HatchetPas encore d'évaluation

- 106Document4 pages106Wb Warnabrother HatchetPas encore d'évaluation

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aPas encore d'évaluation

- FirstNoticeforDiscovery PDFDocument7 pagesFirstNoticeforDiscovery PDFWb Warnabrother HatchetPas encore d'évaluation

- ParalegalDocument1 pageParalegalWb Warnabrother HatchetPas encore d'évaluation

- Certificate of Publication OFDocument2 pagesCertificate of Publication OFWb Warnabrother HatchetPas encore d'évaluation

- Lovewe Incense and Khumsi ContactDocument1 pageLovewe Incense and Khumsi ContactWb Warnabrother HatchetPas encore d'évaluation

- Zulu 40THDocument1 pageZulu 40THWb Warnabrother HatchetPas encore d'évaluation

- The 3 Most Profitable DIY Revenue Streams, and Why Many Artists Succeed at Only One of ThemDocument2 pagesThe 3 Most Profitable DIY Revenue Streams, and Why Many Artists Succeed at Only One of ThemWb Warnabrother HatchetPas encore d'évaluation

- StampDocument1 pageStampWb Warnabrother HatchetPas encore d'évaluation

- Guide To Mixing v1.0: Nick Thomas February 8, 2009Document56 pagesGuide To Mixing v1.0: Nick Thomas February 8, 2009nhomas94% (16)

- Independent Paralegals HandbookDocument401 pagesIndependent Paralegals HandbookWb Warnabrother Hatchet100% (13)

- NotesDocument1 pageNotesjmj9Pas encore d'évaluation

- NotesDocument1 pageNotesjmj9Pas encore d'évaluation

- Create Bigger Sounds Using Layering PDFDocument7 pagesCreate Bigger Sounds Using Layering PDFWb Warnabrother HatchetPas encore d'évaluation

- Create Bigger Sounds Using Layering PDFDocument7 pagesCreate Bigger Sounds Using Layering PDFWb Warnabrother HatchetPas encore d'évaluation

- Independent Paralegals HandbookDocument401 pagesIndependent Paralegals HandbookWb Warnabrother Hatchet100% (13)

- F 1099 ADocument6 pagesF 1099 AWb Warnabrother Hatchet50% (2)

- Examinee Information ClaDocument38 pagesExaminee Information ClaWb Warnabrother HatchetPas encore d'évaluation

- The RainDocument6 pagesThe RainWeeChuanChinPas encore d'évaluation

- How To Make Usb KeyDocument1 pageHow To Make Usb KeyWb Warnabrother HatchetPas encore d'évaluation

- Project Completion Certificate FiligreeDocument1 pageProject Completion Certificate FiligreeWb Warnabrother HatchetPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Effective Instruction OverviewDocument5 pagesEffective Instruction Overviewgene mapaPas encore d'évaluation

- 9 Specific Relief Act, 1877Document20 pages9 Specific Relief Act, 1877mostafa faisalPas encore d'évaluation

- Week 5 WHLP Nov. 2 6 2020 DISSDocument5 pagesWeek 5 WHLP Nov. 2 6 2020 DISSDaniel BandibasPas encore d'évaluation

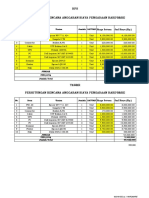

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocument2 pagesHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriPas encore d'évaluation

- CVA: Health Education PlanDocument4 pagesCVA: Health Education Plandanluki100% (3)

- Political Science Assignment PDFDocument6 pagesPolitical Science Assignment PDFkalari chandanaPas encore d'évaluation

- Scantype NNPC AdvertDocument3 pagesScantype NNPC AdvertAdeshola FunmilayoPas encore d'évaluation

- Geraads 2016 Pleistocene Carnivora (Mammalia) From Tighennif (Ternifine), AlgeriaDocument45 pagesGeraads 2016 Pleistocene Carnivora (Mammalia) From Tighennif (Ternifine), AlgeriaGhaier KazmiPas encore d'évaluation

- FI - Primeiro Kfir 1975 - 1254 PDFDocument1 pageFI - Primeiro Kfir 1975 - 1254 PDFguilhermePas encore d'évaluation

- Schematic Electric System Cat D8T Vol1Document33 pagesSchematic Electric System Cat D8T Vol1Andaru Gunawan100% (1)

- 14 Worst Breakfast FoodsDocument31 pages14 Worst Breakfast Foodscora4eva5699100% (1)

- dlp4 Math7q3Document3 pagesdlp4 Math7q3Therence UbasPas encore d'évaluation

- Presentations - Benefits of WalkingDocument1 pagePresentations - Benefits of WalkingEde Mehta WardhanaPas encore d'évaluation

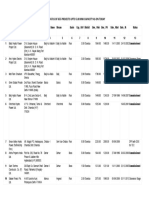

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDocument45 pagesList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21Pas encore d'évaluation

- How To Make Wall Moulding Design For Rooms Accent Wall Video TutorialsDocument15 pagesHow To Make Wall Moulding Design For Rooms Accent Wall Video Tutorialsdonaldwhale1151Pas encore d'évaluation

- DPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Document1 pageDPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Desiree YaganPas encore d'évaluation

- Week 1 ITM 410Document76 pagesWeek 1 ITM 410Awesom QuenzPas encore d'évaluation

- Ck-Nac FsDocument2 pagesCk-Nac Fsadamalay wardiwiraPas encore d'évaluation

- 10 1108 - Apjie 02 2023 0027Document17 pages10 1108 - Apjie 02 2023 0027Aubin DiffoPas encore d'évaluation

- El Rol Del Fonoaudiólogo Como Agente de Cambio Social (Segundo Borrador)Document11 pagesEl Rol Del Fonoaudiólogo Como Agente de Cambio Social (Segundo Borrador)Jorge Nicolás Silva Flores100% (1)

- Diagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaDocument10 pagesDiagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaciptaPas encore d'évaluation

- Investigation of Cyber CrimesDocument9 pagesInvestigation of Cyber CrimesHitesh BansalPas encore d'évaluation

- The Use of Humor in The Classroom - Exploring Effects On Teacher-SDocument84 pagesThe Use of Humor in The Classroom - Exploring Effects On Teacher-Sanir.elhou.bouifriPas encore d'évaluation

- General Ethics: The Importance of EthicsDocument2 pagesGeneral Ethics: The Importance of EthicsLegendXPas encore d'évaluation

- Mental Health Admission & Discharge Dip NursingDocument7 pagesMental Health Admission & Discharge Dip NursingMuranatu CynthiaPas encore d'évaluation

- Ruby Tuesday LawsuitDocument17 pagesRuby Tuesday LawsuitChloé MorrisonPas encore d'évaluation

- Compassion and AppearancesDocument9 pagesCompassion and AppearancesriddhiPas encore d'évaluation

- Case Study - Succession LawDocument2 pagesCase Study - Succession LawpablopoparamartinPas encore d'évaluation

- Once in his Orient: Le Corbusier and the intoxication of colourDocument4 pagesOnce in his Orient: Le Corbusier and the intoxication of coloursurajPas encore d'évaluation

- Lab Report FormatDocument2 pagesLab Report Formatapi-276658659Pas encore d'évaluation