Académique Documents

Professionnel Documents

Culture Documents

Nego

Transféré par

RD LopezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nego

Transféré par

RD LopezDroits d'auteur :

Formats disponibles

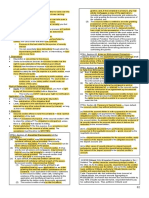

1.

X acted as an accommodation party in signing as a maker of a promissory note. Which phrase best completes the sentence - This means that X is liable on the instrument to any holder for value: a. b. c. d. for as long as the holder does not know that X is only an accommodation party. even though the holder knew all along that X is only an accommodation party. for as long as X did not receive any consideration for acting as accommodation party. provided X received consideration for acting as accommodation party.

2.

X issued a promissory note which states, "I promise to pay Y or order Php100,000.00 or one (1) unit Volvo Sedan." Which statement is most accurate? a. b. c. d. The promissory note is negotiable because the forms of payment are clearly stated. The promissory note is non-negotiable because the option as to which form of payment is with the maker. The promissory note is an invalid instrument because there is more than one form of payment. The promissory note can be negotiated by way of delivery.

3.

X issued a promissory note which states "I promise to pay Y or bearer the amount of HK$50,000 on or before December 30, 2013." Is the promissory note negotiable? a. b. c. d. No, the promissory note becomes invalid because the amount is in foreign currency. Yes, the promissory note is negotiable even though the amount is stated in foreign currency. No, the promissory note is not negotiable because the amount is in foreign currency. Yes, the promissory note is negotiable because the Hong Kong dollar is a known foreign currency in the Philippines.

4.

X delivered a check issued by him and payable to the order of CASH to Y in payment for certain obligations incurred by X in favor of Y. Y then delivered the check to Z in payment for certain obligations. Which statement is most accurate? a. b. c. d. Z can encash the check even though Y did not indorse the check. Z cannot encash the check for lacking in proper endorsement. Y is the only one liable because he was the one who delivered the check to Z. The negotiation is not valid because the check is an instrument payable to order.

5.

A stale check is a check a. b. c. d. that cannot anymore be paid although the underlying obligation still exists. that cannot anymore be paid and the underlying obligation under the check is also extinguished. that can still be negotiated or indorsed so that whoever is the holder can which has not been presented for payment within a period of thirty (30) days.

6.

In payment for his debt in favor of X, Y gave X a Manager's Check in the amount of Php100,000 dated May 30, 2012. Which phrase best completes the statement - A Manager's Check: a. b. is a check issued by a manager of a bank for his own account. is a check issued by a manager of a bank in the name of the bank against the bank itself for the account of the bank.

c. d. 7.

is like any ordinary check that needs to be presented for payment also. is better than a cashier's check in terms of use and effect.

Which phrase best completes the statement -- A check which is payable to bearer is a bearer instrument and: a. b. c. d. negotiation can be made by delivery only; negotiation must be by written indorsement; negotiation must be by specific indorsement; negotiation must be by indorsement and delivery.

8.

As payment for a debt, X issued a promissory note in favor of Y but the promissory note on its face was marked nonnegotiable. Then Y instead of indorsing the promissory note, assigned the same in favor of Z to whom he owed some debt also. Which statement is most accurate? a. b. c. Z cannot claim payment from X on the basis of the promissory note because it is marked non-negotiable. Z can claim payment from X even though it is marked non-negotiable. Z can claim payment from Y because under the Negotiable Instrument Law, negotiation and assignment is one and the same. Z can claim payment from Y only because he was the endorser of the promissory note.

d. 9.

Negotiable instruments are used as substitutes for money, which means a. b. c. d. that they can be considered legal tender. that when negotiated, they can be used to pay indebtedness. that at all times the delivery of the instrument is equivalent to delivery of the cash. that at all times negotiation of the instruments requires proper indorsement.

10. The signature of X was forged as drawer of a check. The check was deposited in the account of Y and when deposited was accepted by AAA Bank, the drawee bank. Subsequently, AAA Bank found out that the signature of X was actually forged. Which statement is most accurate? a. b. c. d. The drawee bank can recover from Y, because the check was deposited in his account. The drawee bank can recover from X, because he is the drawer even though his signature was forged. The drawee bank is estopped from denying the genuineness of the signature of the X, the drawer of the check. The drawee bank can recover from Y because as endorser he warrants the genuineness of the signature.

11. A issued a check in the amount of Php20,000 payable to B. B endorsed the check but only to the extent of Php1 0,000. Which statement is most accurate? a. b. c. d. The partial indorsement is not a valid indorsement, although will result in the assignment of that part. The partial indorsement will invalidate the whole instrument. The endorsee will be considered as a holder in due course. The partial indorsement is valid indorsement up to the extent of the Php10,000.

12. A promissory note which does not have the words "or order" or "or bearer" will render the promissory note non-negotiable, and therefore -

a. b. c. d.

it will render the maker not liable; the note can still be assigned and the maker made liable; the holder can become holder in due course; the promissory note can just be delivered and the maker will still be liable.

13. A check is a. b. c. d. a bill of exchange; the same as a promissory note; is drawn by a maker; a non-negotiable instrument.

14. A check was issued to Tiger Woods. But what was written as payee is the word "Tiger Woods". To validly endorse the check a. b. c. d. Tiger Woods must sign his real name. Tiger Woods must sign both his real name and assumed name. Tiger Woods can sign his assumed name. the check has become non-negotiable.

15. Y, as President of and in behalf of AAA Corporation, as a way to accommodate X, one of its stockholders, endorsed the check issued by X. Which statement is most acurate? a. b. c. d. It is an ultra vires act. It is a valid indorsement. The corporation will be held liable to any holder in due course. It is an invalid indorsement.

16. In a negotiable instrument, when the sum is expressed both in numbers and in words and there is discrepancy between the words and the numbers a. b. c. d. the sum expressed in words will prevail over the one expressed in numbers. the sum expressed in numbers will prevail over the one expressed in words. the instrument becomes void because of the discrepancy. this will render the instrument invalid.

17. A promissory note which is undated is presumed to be a. b. c. d. dated as of the date of issue; dated as of the date of the first indorsement; promissory note is invalid because there is no date; dated on due date.

Vous aimerez peut-être aussi

- Fin101 QuizDocument6 pagesFin101 QuizAlan MakasiarPas encore d'évaluation

- Law On Sales ReviewerDocument1 pageLaw On Sales ReviewerNath BongalonPas encore d'évaluation

- Rights of Unpaid Seller and Buyer in Sales ContractsDocument21 pagesRights of Unpaid Seller and Buyer in Sales ContractsAmie Jane MirandaPas encore d'évaluation

- Report On Subject Matter of SalesDocument7 pagesReport On Subject Matter of SalesGianna CantoriaPas encore d'évaluation

- NEGOTIABLE INSTRUMENTS LAWDocument4 pagesNEGOTIABLE INSTRUMENTS LAWLing EscalantePas encore d'évaluation

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsJeaner AckermanPas encore d'évaluation

- Law - Obligation of The VendeeDocument3 pagesLaw - Obligation of The VendeeIris Grace CulataPas encore d'évaluation

- Feu Notes 231Document7 pagesFeu Notes 231Naiv Yer NagaliPas encore d'évaluation

- Act 3952 (Bulk Sales Law)Document2 pagesAct 3952 (Bulk Sales Law)toshkenbergPas encore d'évaluation

- Intermediate Accounting, Part 1Document7 pagesIntermediate Accounting, Part 1dfsdfdsfPas encore d'évaluation

- Philippine Civil Code Articles on Sale of GoodsDocument2 pagesPhilippine Civil Code Articles on Sale of GoodsSintas Ng SapatosPas encore d'évaluation

- PDIC Illustrative ProblemsDocument5 pagesPDIC Illustrative ProblemsDiscord HowPas encore d'évaluation

- Negotiable Instruments PrelimsDocument6 pagesNegotiable Instruments PrelimsCattleyaPas encore d'évaluation

- CREDIT TRANSACTIONS - Escarez Reviewer - Part IIIDocument9 pagesCREDIT TRANSACTIONS - Escarez Reviewer - Part IIIPaul Aaron Esguerra EscarezPas encore d'évaluation

- Recto and Maceda LawDocument2 pagesRecto and Maceda LawChristine Joy OroPas encore d'évaluation

- Determining Negotiability of Instruments Based on Sum, Time and Additional ProvisionsDocument9 pagesDetermining Negotiability of Instruments Based on Sum, Time and Additional ProvisionsMikaerika AlcantaraPas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument76 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledFrancis Coronel Jr.Pas encore d'évaluation

- Hotelkeeper Liability for Guest DepositsDocument7 pagesHotelkeeper Liability for Guest DepositsJoanne besoyPas encore d'évaluation

- Sample Exercise Legal ResearchDocument1 pageSample Exercise Legal ResearchenuhskiPas encore d'évaluation

- Negotiable Instruments Law Notes PDFDocument12 pagesNegotiable Instruments Law Notes PDFRaffy LopezPas encore d'évaluation

- Negotiable Instruments Law (Sec 60-69)Document22 pagesNegotiable Instruments Law (Sec 60-69)roxiel chuaPas encore d'évaluation

- NIRC - Notes On Accounting Periods and Methods of AccountingDocument5 pagesNIRC - Notes On Accounting Periods and Methods of AccountingJeff SarabusingPas encore d'évaluation

- SEC Memo 11-08Document9 pagesSEC Memo 11-08Matthew TiuPas encore d'évaluation

- Nego Notes - Summary of Doctrines - 2kDocument11 pagesNego Notes - Summary of Doctrines - 2kElla MarceloPas encore d'évaluation

- Negotiable Instruments GuideDocument9 pagesNegotiable Instruments GuideAlyssa MabalotPas encore d'évaluation

- Civil Code Provisions on Guaranty, Suretyship, Pledge, Mortgage and AntichresisDocument12 pagesCivil Code Provisions on Guaranty, Suretyship, Pledge, Mortgage and AntichresisdenelizaPas encore d'évaluation

- Civil Law Reviewer Sales Chapter 1: IntroductionDocument20 pagesCivil Law Reviewer Sales Chapter 1: Introductionpaula palangeoPas encore d'évaluation

- Nego Reviewer (Finals)Document12 pagesNego Reviewer (Finals)jianmargareth100% (4)

- LAW Sales - Pahina 6 - WattpadDocument8 pagesLAW Sales - Pahina 6 - WattpadrobertjonascribdPas encore d'évaluation

- Legal RedemptionDocument8 pagesLegal RedemptionGenard Neil Credo Barrios100% (1)

- FAQs on Philippine Trademark RegistrationDocument4 pagesFAQs on Philippine Trademark Registrationpeanut47Pas encore d'évaluation

- Effect of Special Indorsement of A Document of Title Which States That The Goods Are Deliverable To BearerDocument10 pagesEffect of Special Indorsement of A Document of Title Which States That The Goods Are Deliverable To BearerTrixie CasiplePas encore d'évaluation

- Contracts Law 1 Contracts Law 1Document41 pagesContracts Law 1 Contracts Law 1Ma. Rhona Mee BasongPas encore d'évaluation

- Reviewer Financial Rehabilitation and Insolvency ActDocument18 pagesReviewer Financial Rehabilitation and Insolvency ActShalala HernandezPas encore d'évaluation

- Mock Bar Examination in Negotiable Instruments LawDocument10 pagesMock Bar Examination in Negotiable Instruments LawGilbertGalope0% (1)

- BP22Document62 pagesBP22PhilipBrentMorales-MartirezCariagaPas encore d'évaluation

- Ppsa 4Document1 pagePpsa 4queenPas encore d'évaluation

- BL 3 - Final Exam Answer SheetDocument1 pageBL 3 - Final Exam Answer SheetCarren Abiel OberoPas encore d'évaluation

- PDIC Maximum Deposit Insurance CoverageDocument7 pagesPDIC Maximum Deposit Insurance CoverageChiemy Atienza YokogawaPas encore d'évaluation

- Notes On Double SalesDocument2 pagesNotes On Double SalesVanessa SanchezPas encore d'évaluation

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETAndrew Miguel SantosPas encore d'évaluation

- REGULATORY FRAMEWORK FOR CREDIT TRANSACTIONSDocument18 pagesREGULATORY FRAMEWORK FOR CREDIT TRANSACTIONSJames CantornePas encore d'évaluation

- Sales Part 8: Coverage of Discussion: Obligations of The VendeeDocument7 pagesSales Part 8: Coverage of Discussion: Obligations of The VendeeAmie Jane MirandaPas encore d'évaluation

- Contracts Undercredit Transaction S - Lecture NotesDocument51 pagesContracts Undercredit Transaction S - Lecture NotesJanetGraceDalisayFabreroPas encore d'évaluation

- Maceda Law protects real estate buyers in PhilippinesDocument3 pagesMaceda Law protects real estate buyers in PhilippinestumasitoePas encore d'évaluation

- Negotiable Instruments LawDocument57 pagesNegotiable Instruments LawKimberly BanuelosPas encore d'évaluation

- Order SlipDocument1 pageOrder SlipdhafPas encore d'évaluation

- CIVIL LAW REVIEW II KEY SALES CONCEPTSDocument59 pagesCIVIL LAW REVIEW II KEY SALES CONCEPTSJImlan Sahipa IsmaelPas encore d'évaluation

- Business Law Chapter-4Document3 pagesBusiness Law Chapter-4Gita KnowledgePas encore d'évaluation

- Obligations NotesDocument22 pagesObligations NotesVivian BulataoPas encore d'évaluation

- Assignment of Credits and Other Incorporeal RightsDocument8 pagesAssignment of Credits and Other Incorporeal Rightsisamoker0% (1)

- INCOME TAX BASICSDocument38 pagesINCOME TAX BASICSElson TalotaloPas encore d'évaluation

- Law 4: Sales, Agency and Other Special Contracts: By: Atty. Raymiejella R. Sususco-ViagedorDocument101 pagesLaw 4: Sales, Agency and Other Special Contracts: By: Atty. Raymiejella R. Sususco-ViagedorKeight NuevaPas encore d'évaluation

- IFRS 11 Joint ArrangementsDocument6 pagesIFRS 11 Joint ArrangementsElla MaePas encore d'évaluation

- UP Solid Civil Law ReviewerDocument761 pagesUP Solid Civil Law ReviewerLyra Cecille Vertudes AllasPas encore d'évaluation

- Negotiable Instruments LawDocument45 pagesNegotiable Instruments LawPnix HortinelaPas encore d'évaluation

- Court upholds non-payment of check due to delay in presentmentDocument14 pagesCourt upholds non-payment of check due to delay in presentmentroxiel chuaPas encore d'évaluation

- NegoIn Section 1-10Document13 pagesNegoIn Section 1-10Aries James67% (3)

- Hire PurchaseDocument19 pagesHire PurchaseFaris Hanis100% (1)

- Nego Bar QsDocument5 pagesNego Bar QsSam FajardoPas encore d'évaluation

- Baguio, Sagada, Bolinao 3Q Escape GuideDocument3 pagesBaguio, Sagada, Bolinao 3Q Escape GuideRD LopezPas encore d'évaluation

- Sample PrayerDocument6 pagesSample PrayerRD LopezPas encore d'évaluation

- Falsification, Art. 171, RPCDocument1 pageFalsification, Art. 171, RPCRD Lopez100% (1)

- Phil. ChurchesDocument19 pagesPhil. ChurchesRD Lopez100% (1)

- Court of Appeals Administration ListDocument1 pageCourt of Appeals Administration ListRD LopezPas encore d'évaluation

- National Labor Relations Commission: National Capital Region Quezon CityDocument1 pageNational Labor Relations Commission: National Capital Region Quezon CityRD LopezPas encore d'évaluation

- 2012 Filro Cases On WagesDocument12 pages2012 Filro Cases On WagesRD LopezPas encore d'évaluation

- Refection Moses/BibleDocument1 pageRefection Moses/BibleRD LopezPas encore d'évaluation

- Civil Service Law and Foreign Investments ActDocument17 pagesCivil Service Law and Foreign Investments ActRD LopezPas encore d'évaluation

- Sample Verified DeclarationDocument1 pageSample Verified DeclarationRD LopezPas encore d'évaluation

- Survey of Provision Legal EthicsDocument2 pagesSurvey of Provision Legal EthicsRD LopezPas encore d'évaluation

- Political LawDocument4 pagesPolitical LawRD LopezPas encore d'évaluation

- Jurisprudence Table LawDocument1 pageJurisprudence Table LawRD LopezPas encore d'évaluation

- Lease ContractDocument2 pagesLease ContractRD LopezPas encore d'évaluation

- Jurisprudence Table LawDocument1 pageJurisprudence Table LawRD LopezPas encore d'évaluation

- NegoDocument3 pagesNegoRD LopezPas encore d'évaluation

- NegoDocument3 pagesNegoRD LopezPas encore d'évaluation

- Labor Materials For ReviewDocument2 pagesLabor Materials For ReviewRD LopezPas encore d'évaluation

- Jurisprudence TableDocument1 pageJurisprudence TableRD LopezPas encore d'évaluation

- Oral Arguments CEU LawDocument2 pagesOral Arguments CEU LawRD LopezPas encore d'évaluation

- Draw The Figure Described - Divide It Into Parts and Color or Shade The Part Indicated by The FractionDocument10 pagesDraw The Figure Described - Divide It Into Parts and Color or Shade The Part Indicated by The FractionRD LopezPas encore d'évaluation

- Labor Law IDocument185 pagesLabor Law IMara Corteza San PedroPas encore d'évaluation

- SpeechDocument1 pageSpeechRD LopezPas encore d'évaluation

- SyllabusDocument9 pagesSyllabusRD LopezPas encore d'évaluation

- Need to Reform 1987 Philippine Constitution for Economic GrowthDocument2 pagesNeed to Reform 1987 Philippine Constitution for Economic GrowthRD LopezPas encore d'évaluation

- Maskara Festival 1Document3 pagesMaskara Festival 1RD LopezPas encore d'évaluation

- Lorenzo VsDocument8 pagesLorenzo VsRD LopezPas encore d'évaluation

- The Call of CthulhuDocument15 pagesThe Call of CthulhuCerrüter LaudePas encore d'évaluation

- 55850bos45243cp2 PDFDocument58 pages55850bos45243cp2 PDFHarshal JainPas encore d'évaluation

- 0 - Dist Officers List 20.03.2021Document4 pages0 - Dist Officers List 20.03.2021srimanraju vbPas encore d'évaluation

- ICS ModulesDocument67 pagesICS ModulesJuan RiveraPas encore d'évaluation

- Accounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheDocument3 pagesAccounting Time Allowed - 2 Hours Total Marks - 100: You Are Required To Calculate TheNew IdPas encore d'évaluation

- Soil Color ChartDocument13 pagesSoil Color ChartIqbal AamerPas encore d'évaluation

- Forty Years of PopDocument24 pagesForty Years of PopHelci RamosPas encore d'évaluation

- Bid for Solar Power Plant under Institute for Plasma ResearchDocument10 pagesBid for Solar Power Plant under Institute for Plasma ResearchDhanraj RaviPas encore d'évaluation

- Measat 3 - 3a - 3b at 91.5°E - LyngSatDocument8 pagesMeasat 3 - 3a - 3b at 91.5°E - LyngSatEchoz NhackalsPas encore d'évaluation

- Đa S A The PESTEL Analysis of VinamilkDocument2 pagesĐa S A The PESTEL Analysis of VinamilkHiền ThảoPas encore d'évaluation

- March 3, 2014Document10 pagesMarch 3, 2014The Delphos HeraldPas encore d'évaluation

- EVADocument34 pagesEVAMuhammad GulzarPas encore d'évaluation

- Cpar Q1 Las 1Document10 pagesCpar Q1 Las 1Jaslor LavinaPas encore d'évaluation

- VisitBit - Free Bitcoin! Instant Payments!Document14 pagesVisitBit - Free Bitcoin! Instant Payments!Saf Bes100% (3)

- STP Analysis of ICICI BANK vs SBI for Savings AccountsDocument28 pagesSTP Analysis of ICICI BANK vs SBI for Savings AccountsUmang Jain0% (1)

- Audio Script + Key (Updated)Document6 pagesAudio Script + Key (Updated)khoareviewPas encore d'évaluation

- The Value of EquityDocument42 pagesThe Value of EquitySYAHIER AZFAR BIN HAIRUL AZDI / UPMPas encore d'évaluation

- Impact of corporate governance on firm performanceDocument4 pagesImpact of corporate governance on firm performancesamiaPas encore d'évaluation

- MNC diversity factors except expatriatesDocument12 pagesMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- Key Ideas of The Modernism in LiteratureDocument3 pagesKey Ideas of The Modernism in Literaturequlb abbasPas encore d'évaluation

- Altar Server GuideDocument10 pagesAltar Server GuideRichard ArozaPas encore d'évaluation

- Tawfīq Al - Akīm and The West PDFDocument12 pagesTawfīq Al - Akīm and The West PDFCosmin MaricaPas encore d'évaluation

- Carnival Panorama Deck Plan PDFDocument2 pagesCarnival Panorama Deck Plan PDFJuan Esteban Ordoñez LopezPas encore d'évaluation

- 27793482Document20 pages27793482Asfandyar DurraniPas encore d'évaluation

- Name Designation Division/Section Telephone Head Office: New DelhiDocument6 pagesName Designation Division/Section Telephone Head Office: New DelhiHarshaditya Singh ChauhanPas encore d'évaluation

- Inspirational Quotes ThesisDocument6 pagesInspirational Quotes Thesisanngarciamanchester100% (2)

- R164Document9 pagesR164bashirdarakPas encore d'évaluation

- Class 3-C Has A SecretttttDocument397 pagesClass 3-C Has A SecretttttTangaka boboPas encore d'évaluation

- Business Math Notes PDFDocument12 pagesBusiness Math Notes PDFCzareena Sulica DiamaPas encore d'évaluation

- English GradeDocument4 pagesEnglish GradeLloydDagsilPas encore d'évaluation