Académique Documents

Professionnel Documents

Culture Documents

Spe 160855 MS P

Transféré par

mafe_0830Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Spe 160855 MS P

Transféré par

mafe_0830Droits d'auteur :

Formats disponibles

SPE 160855

Comparisons and Contrasts of Shale Gas and Tight Gas Developments,

North American Experience and Trends

Robert L. Kennedy, SPE, William N. Knecht, SPE, and Daniel T. Georgi, SPE, Baker Hughes

Copyright 2012, Society of Petroleum Engineers

This paper was prepared for presentation at the SPE Saudi Arabia Section Technical Symposium and Exhibition held in Al-Khobar, Saudi Arabia, 811 April 2012.

This paper was selected for presentation by an SPE program committee following review of information contained in an abstract submitted by the author(s). Contents of the paper have not been

reviewed by the Society of Petroleum Engineers and are subject to correction by the author(s). The material, as presented, does not necessarily reflect any position of the Society of Petroleum

Engineers, its officers, or members. Papers presented at the SPE meetings are subject to publication review by Editorial Committee of Society of Petroleum Engineers. Electronic reproduction,

distribution, or storage of any part of this paper without the written consent of the Society of Petroleum Engineers is prohibited. Permission to reproduce in print is restricted to an abstract of not

more than 300 words; illustrations may not be copied. The abstract must contain conspicuous acknowledgment of where and whom the paper was presented. Write Librarian, SPE, P.O. Box

833836, Richardson, TX 75083-3836, U.S.A., fax 01-972-952-9435.

Abstract

All Shale Gas reservoirs are not the same. There are no typical Tight Gas reservoirs. These two statements can be

found numerous times in the literature on shale gas and tight gas reservoirs. The one common aspect of developing these

unconventional resources is that wells in both must be hydraulically fractured in order to produce commercial amounts of

gas. Operator challenges and objectives to be accomplished during each phase of the Asset Life Cycle (Exploration,

Appraisal, Development, Production, and Rejuvenation) of both shale gas and tight gas are similar. Drilling, well design,

completion methods and hydraulic fracturing are somewhat similar; but formation evaluation, reservoir analysis, and some of

the production techniques are quite different.

Much of the experience in shale and tight gas has been developed in the US and in Canada, to a lesser extent; and

most of the technologies that have been developed by operators and service companies are transferable to other parts of the

world. However, the infrastructure, including equipment and service company availability, governmental regulations,

logistics, processing, environmental considerations, and pricing are not the same as in the US. This may impact the rate of the

technology transfer as well as the selection of some of the technology. This paper is focused on operations challenges,

technologies, and experience associated with shale and tight gas projects. It is likely that environmental concerns and the drive

to reduce development costs of tight and shale gas reservoirs will drive new approaches to the development of these reservoirs

in China, Latin America, Middle East, North Africa, and other parts of the world.

Introduction

Unconventional shale and tight gas development in the US was sparked by the 1980 introduction of The Alternative

Fuel Production Credit of the Internal Revenue Code (an income tax credit). The 1980 WPT (windfall profit tax) included a

$3.00 (in 1979 dollars) production tax credit to stimulate the supply of selected unconventional fuels: oil from shale or tar

sands, gas produced from geo-pressurized brine, Devonian shale, tight formations, or coalbed methane, gas from biomass, and

synthetic fuels from coal. In current dollars this credit, which is still in effect for certain types of fuels, was $6.56 per barrel of

liquid fuels and about $1.16 per thousand cubic feet (mcf) of gas in 2004 (Lazzari 2006). Initially, the credit was set to run

until 1989; however, it was extended twice until the end of 1992 (Martin and Eid 2011).

Higher gas price was another reason for the continued development of tight gas and especially shale gas. Figure 1

shows Henry Hub spot prices from 2000 until J anuary of 2012. The spot price represents the price for natural gas sales

contracted for next day or weekend delivery and transfer at a given trading location. Henry Hub is the primary trading

location, centralized point, for natural gas trading in the United States, and is often a representative measure for wellhead

prices. Higher prices are reflected by the six year (2003-2009) run of gas prices over $6 per MMBtu after generally hovering

around $2 per MMBtu for the prior twenty-year period, 1980 to 2000. During this time, two significant peaks in gas prices

occurred. In the summer of 2005, hurricanes along the U.S. Gulf Coast caused more than 800 billion cubic feet (Bcf) of

natural gas production to be shut in between August 2005 and June 2006. As a result of these disruptions, natural gas spot

prices at times exceeded $15 per million Btu (MMBtu) in many spot market locations and fluctuated significantly over the

subsequent months, reflecting the uncertainty over supplies (Mastrangelo 2007). In 2008, due to physical and financial market

factors, spot prices broke from the $6-$8 per MMBtu range of the two previous years and peaked at $13.32 per MMBtu, but

ended the year at $5.63 per MMBtu. This was the beginning of the current fall in gas prices.

2 SPE 160855

USD / MMBtu

Figure 1Henry Hub spot prices for natural gas in the US www.tradingeconomics.com l NYMEX

The more recent growth in natural gas production from unconventional tight and especially shale reservoirs is a result

of technological advances (hydraulic fracturing and horizontal wells). Drilling in shale plays with high concentrations of

natural gas liquids and crude oil has shifted from drilling in dry gas plays. Figure 2 shows that by the end of 2010 shale gas

and tight gas comprised 23 and 26 percent, respectively, of the total US natural gas production. In the future (by 2035) tight

gas will decline slightly to 21 percent of the total, while shale gas will continue to increase to a level of 49 percent of the total

US natural gas production (Nitze and Gruenspecht 2012).

Figure 2US natural gas production, 1990-2035, EIA Annual Energy

Outlook 2012 Early Release (2012)

Beginning with a discussion of the location and size of shale and tight gas resources throughout the world, this paper

describes the characteristics of shale and tight gas showing how the two are different in a number of respects. The two

resources are different from play to play and in how the gas is evaluated, developed and produced. Shale and tight gas are

contrasted and compared as the operator challenges and objectives are enumerated at each phase of the Asset Life Cycle

(Exploration, Appraisal, Development, Production, and Rejuvenation). The single binding commonality is that both shale and

tight gas wells must be hydraulically fractured in order to produce commercial amounts of gas. Essentially all of the industry

experience with shale gas has been obtained and new technology developed in North America. Although the same is true for

tight gas, it is now being developed in other parts of the world, specifically the Middle East, North Africa, Argentina, and

Australia. This paper primarily documents the North American (with a focus on the US) experience and trends.

Shale and Tight Gas Resources Worldwide

Until April of 2011 when the US EIA published a study by Kuuskraa et al on World Shale Gas Resources the

industry has relied on 1996 data from Rogner for estimates of worldwide unconventional gas resources, gas in place (GIP). In

2001, Kawata and Fujita called Rogners gas resources rather optimistic assessment; however, the comment refers to the

numbers for Methane hydrate (which was also included in the estimates) and the ratio of unconventional gas (tight, shale, and

CBM) to the then assessed level of conventional gas resources. Table 1, which was published by Holditch (2006) shows the

distribution of worldwide unconventional gas resources, including CBM, Shale Gas, and Tight Gas. It should be noted that the

numbers are GIP and are the same as Rogners 1996 numbers.

The US EIA (Kuuskraa et al 2011) published the most recent estimates for worldwide unconventional gas resources

(albeit for shale gas only) since the Rogner estimates of 1996. However, Russia and Central Asia, Middle East, South East

Asia, and Central Africa were not addressed by the current report. This was primarily because there was either significant

quantities of conventional natural gas reserves noted to be in place (i.e., Russia and the Middle East), or because of a general

lack of information to carry out even an initial assessment (Kuuskraa et al 2011). Table 2 was developed by these authors in

order to provide a more complete comparison for worldwide total resources by region.

SPE 160855 3

Table 1Worldwide Unconventional Gas Resources, Table 2Worlwide Unconventional GIP Resources

GIP (Holditch, 2006 from Kawata, 2001, modified and adjusted from Kuuskraa et al

from Rogner, 1996) (2011) Study for EIA.

World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States, the 2011 EIA study

referenced above, went beyond developing estimates of only GIP resources and looked at recovery by providing estimates of

Technically Recoverable Resources for individual countries within the regions of the world. The consultants approach relied

upon publically available data from technical literature and studies on each of the selected international shale gas basins to first

provide an estimate of the risked gas in place, and then to estimate the technically recoverable resource for that region. This

methodology is intended to make the best use of sometimes scant data in order to perform initial assessments of this type

(Kuuskraa et al 2011). Figure 3 shows the Technically Recoverable Resources (TRR) for the top countries of those evaluated

by the 2011 EIA Study. The total TRR of the 32 countries evaluated in the report is 6,622 Tcf. Although the Middle East was

not included in the study, Saudi Arabia is shown as fifth largest with 645 Tcf. These authors began with GIP numbers from

Rogner, added a recovery factor and increased the total by the average percentage of all other countries.

Figure 3Shale Gas Technically Recoverable Resourses in trillion cubic feet (Tcf); top countries from Kuuskraa

et al (2011) Study for EIA, total of 6,622 Tcf for 32 countries Saudi Arabia resource number added by authors

1275

862

774

681

645

485

388

0

200

400

600

800

1000

1200

1400

T

R

R

,

T

c

f

4 SPE 160855

As noted, the Kruuskraa et al (2011) EIA study strictly focused on shale gas, excluding other unconventional gas, tight

gas and CBM, as well as shale oil. From Table 2 it can be seen that shale gas GIP is approximately six times greater than tight

gas. If a more detailed evaluation were conducted for tight gas, such as was done for shale gas, these authors expect that tight

gas resources would also increase, primarily due to advances in technology.

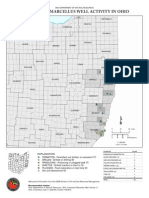

Figure 4 is a map showing the location of the 23 significant shale gas basins in the US. The six currently most active

gas basins/plays are the Barnett, Woodford, Fayetteville, Haynesville, Marcellus, and Eagle Ford. Other active US shale

basins/plays are the Bakken, primarily a tight oil and not a true shale; the emerging Niobrara, primarily shale oil, and the

liquids-rich Utica. Figure 5 is a map showing the location of the 14 significant tight gas basins in the US. Four of these

basins, Pinedale Anticline, Anadarko, Piceance, and Deep Bossier, produce most of the US tight gas (Warlick 2010).

Figure 4US map showing the 23 significant shale gas Figure 5US map showing 14 significant tight gas basins.

Basins. Currently most active are Barnett, The four basins in green produce most of the US

Woodford, Fayetteville, Haynesville, tight gas (Warlick International 2010).

Marcellus, and Eagle Ford.

Figure 6 is a map of Canada which shows the five significant shale gas basins/plays: Montney, Horn River, and

Colorado Group in Western Canada and the Utica and Horton Bluff Group in Eastern Canada. Another is the emerging

Duvernay in west-central Alberta (NEB-Canada, 2009). The three significant typical Canadian tight gas plays/basins are the

Shallow, J ean Marie, and Deep Basin (Dixon 2005). The Bakken tight oil play is also located in Canada.

Figure 6Map of Canada showing the five significant shale gas basins, Montney, Horn River, Colorado

Group, Utica, and Horton Bluff; and the three significant tight gas basins/plays, Shallow, Jean Marie,

and Deep Basin (Source: Modified from NEB Canada, 2009).

Total shale gas TRR from Figure 3 for the US and Canada are 862 Tcf and 388 Tcf, respectively. Currently the EIA

does not report reserve estimates for tight gas; as these are included with conventional gas (EIA 2010). Estimates of the

volume of recoverable gas in tight reservoirs in the U.S. range from 200 to 550 Tcf (Oil and Gas Investor, 2006). Meanwhile,

Warlick (2010) states that the total Reserves, Dec 2009 for the four leading US tight gas basins is equal to 92 Tcf (high of

ranges). There is also similar uncertainty with respect to tight gas TRR or reserves in Canada. The NEB even hedges on the

definition of tight gas; and does not offer any estimates of tight gas reserves or TRR. Therefore, for tight gas, we are left only

with Rogners GIP total for North America of 1,371 Tcf (Table 2). Assuming an increase for new technology and a

SPE 160855 5

conservative recovery factor of 20 percent, these authors estimate North Americas TRR tight gas to be approximately 430

Tcf.

The Unconventional Gas Resource Triangle

The concept of the resource triangle was used by Masters (1979) to find a large gas field and build a company in the

1970s. (Holditch 2006) Figure 7 illustrates the principle of the resource triangle. Conventional gas is located at the top of

the triangle with better reservoir characteristics/quality, uses conventional technology, easy to develop; but exists in small

volumes. As you go deeper down in the triangle passing tight gas and coalbed methane (CBM), shale gas (and gas hydrates)

are found at the bottom. Progression to the bottom of the triangle sees permeability and reservoir quality decreasing, level of

technology to develop increasing (becoming more complex), and difficulty of development increasing; however large volumes

of these resources can be found. The concept of the resource triangle applies to every hydrocarbon producing basin in the

world. Martin et al (2008) validated the resource triangle concept using a computer program, database and software they

developed. They also expanded the resource triangle to include liquid and solid hydrocarbons adding heavy oil and oil shale,

and referencing work from Gray (1977).

Figure 7The Unconventional Gas Resource Triangle The concept of the resource triangle applies

to every hydrocarbon producing basin in the world (Holditch from Masters, 1979).

Characteristics of Shale and Shale Gas

Shale gas is an unconventional gas reservoir contained in fine-grained, organic rich, sedimentary rocks, including

shale, but composed of mud containing other minerals like quartz and calcite (U.S. DOE 2009: Warlick 2010; U.S. EIA 2011).

A number of formations broadly referred to by the industry as shale, may contain very little shale lithology/mineralogy, but is

shale by grain size only. Passey et al (2010) describes shale as extremely fine-grained particles typically less than 4

microns in diameter, but may contain variable amounts of silt-sized particles (up to 62.5 microns). No two shales are alike;

they vary aerially and vertically within a trend and even along horizontal lateral wellbores (King 2010). Not only will shales

vary from basin to basin, but also within the same field (Economides and Martin 2007). These reservoirs are continuous gas

accumulations, and persist over very large geographic areas. The challenge in shale is not to find the gas, but to find the best

areas, or sweet spots, that will result in the best production and recovery (J enkins and Boyer 2008).

Shale reservoirs have no trap like conventional gas reservoirs, and do not contain a gas/water contact. They are the

source rock, which also now acts as the reservoir, where the total or partial volume of gas (hydrocarbon) remains. Shales have

been the source rock for much of the hydrocarbons in North America. In fact, these same shale source rocks are now being

exploited as shale reservoirs. The key is to find a shale play where the remaining hydrocarbon, that was not expulsed and

migrated into conventional formations, is now economically viable for development. Take caution Not all shales are source

rocks.

Natural matrix permeability of shales is extremely low, often in the nano Darcy range. It has been said that

measurement of shale permeability is difficult, and results are probably inaccurate. In this very low permeability environment,

gas (hydrocarbon) flow through the matrix is extremely limited and insufficient for commercial production. Various authors

have estimated that a gas molecule will move no more than 10 to 50 feet per year through shale matrix rock. Shale porosities

are also relatively low ranging from 6-12%. Therefore, shale reservoirs require hydraulic fracturing/induced fractures in order

to produce commercial amounts of gas.

A number of different reservoir parameters, that are not necessarily deemed important for conventional gas, are

significant for assessing economic viability, development, and well completion techniques for shale. Total Organic Carbon

(TOC) content, Kerogen type, Thermal Maturity, Mineralogy/Lithology, Brittleness, existence of Natural Fractures, Stress

6 SPE 160855

Regime, multiple locations and types of gas storage in the reservoir, characteristic production decline profile, Thermogenic or

Biogenic systems, as well as depositional environment, thickness, porosity and pressure are parameters than we must now

consider for shale reservoirs. The following discussion will briefly cover each of these parameters and the unique aspects of

shale to provide the reader with an understanding of their significance in play analysis and development.

Organic materials, microorganism fossils, and plant matter provide the required carbon, oxygen, and hydrogen atoms

needed to create natural gas and oil. TOC is the amount of material available to convert into hydrocarbons (depending on

kerogen type) and represents a qualitative measure of source rock potential (J arvie et al 2007). TOC is expressed as a percent

by weight; and is sometimes expressed as percent by volume (Volume % is approximately twice that of Weight %). Oil and

gas source rocks typically have greater than 1.0% TOC. TOC richness can range from Poor - <1%; Fair - 1-2%; and Good-

Excellent - 2-10% (PESGB 2008). TOC is not the same as kerogen content, as TOC is made up of both kerogen and bitumen.

Measurement of TOC in shale is determined from wireline logs and by direct measurement from cores and drill cuttings.

Kerogen is a solid mixture of organic chemical compounds that makes up a portion of the organic matter in

sedimentary rocks. It is insoluble in normal organic solvents because of the huge molecular weight of its component

compounds. The soluble portion of kerogen is known as bitumen (Wikipedia 2011). Understanding the kerogen type helps to

predict the hydrocarbon type (gas or liquid) in a play. There are basically four types of kerogen, three of which can generate

hydrocarbons. Type I generates oil, Type II wet gas, and Type III dry gas (Holditch 2011). Table 3 shows the types of

kerogen and their hydrocarbon generating potential.

Thermal Maturity measures the degree to which a formation has been exposed to high heat needed to breakdown

organic matter in hydrocarbons. As temperature increases with the increasing depth in the earths crust, the heat causes the

generation of hydrocarbons and can ultimately destroy them. Typical temperature ranges at which oil and gas are generated

are shown on Figure 8. The oil window is 60-175 C (140-350 F) and the gas window is 100-300 C (212-570 F). The

position of oil and gas windows within a basin is dependent on the type of organic matter and heating rate. Thermal maturity

is a function of both time and temperature (Holditch, 2011). Understanding the level of thermal maturity, or indeed whether

the shale is thermally mature at all, is key to understanding shale resource potential (PESGB 2008). Also, higher thermal

maturity leads to the presence of nanopores, which contribute to additional porosity in the shale matrix rock (Kuuskraa et al

2011).

Vitinite Reflectance, R

o

%, the most commonly used technique for source rock thermal maturity determination,

measures the intensity of the reflected light from polished vitrinite particles (a maceral group formed by lignified, higher-land

plant tissues, such as leaves, stems, and roots) in shale under a reflecting microscope. Increased reflectance is caused by

aromatization of kerogen and loss of hydrogen (J arvie et al 2007). Figure 9 is the Thermal Maturation Scale. Dry gas occurs

when R

o

is greater than 1.0%, wet gas when R

o

is between 0.5 and 1.0%, and oil when R

o

is between 0.5 and 1.3% (Kuuskraa

et al 2011).

Table 3Types of Kerogen and Their HC Figure 8Typical temperature Figure 9Themal Maturation

Potential (Holditch 2011) ranges which oil & gas are Scale (Kuuskra et al

generated (Holditch 2011) 2011)

SPE 160855 7

Mineralogy and lithology are important for 1. TOC quantification, 2. Reducing porosity uncertainty, 3. Identifying

shale lithofacies, 4. Indicating variations in mechanical rock properties including brittleness, and 5. Assisting in the planning

of well hydraulic fracturing and completion designs. Most shale reservoirs can be chemostratigraphically classified into three

primary lithofacies siliceous mudstone (such as the Barnett), calcareous mudstone lithofacies, and organic mudstone

lithofacies. Additional lithofacies have been identified in some reservoirs based on their unique characteristics.

Lithology/Mineralogy information is obtained from conventional and pulsed neuron log responses, laboratory analysis of cores

and cuttings, and mineral spectroscopy analyses. TOC is quantified by the amount and vertical distribution of kerogen,

kerogen type, level of maturity, and mineral spectroscopy plus core analysis. Log derived and computed geomechanical

properties include minimum horizontal stress (S

H, Min

), Poissons Ratio, Youngs Modulus, Fracture Migration, and static

mechanical properties. Brittleness indicators (for identifying best interval to initiate a fracture and location at the vertical from

which to drill horizontal laterals) are computed from mineralogy and geomechanical brittleness and hardness (J acobi et al

2009; LeCompte et al 2009; Pemper et al 2009; Mitra et al 2010).

Geomechanics is central to the development of shale gas resources. The stress regime in a basin must be considered

during well drilling, fracturing, and production. Well orientation is dictated by in-situ stress systems and wellbore stability

during drilling. In general, initiating a fracture depends on the stresses around the wellbore both from the geologic produced

tectonic effects and from changes in stresses produced by the growth of fractures. Fractures are difficult to initiate where total

rock stresses are very high. A major consideration during shale production is the stress evolution accompanying drawndown

and depletion. It is now well established that reservoir pressure changes have an effect on both the stress magnitudes and

direction in the sub-surface (Addis and Yassir 2010; King 2010).

Presence, location, and orientation of natural fractures in shales are significant with respect to the hydraulic fracturing

process. In these naturally fractured reservoirs the well placement for initial development is dictated by two sub-surface

factors:

a. location and orientation of the natural fracture sets, the orientation of the most conductive natural fracture set,

and the in-situ stress magnitudes and directions

b. the propagation direction of the hydraulic fractures from the wellbore and the intersection of the natural fracture

system (Addis and Yassir 2010)

One of the purposes of hydraulic fracturing is to connect the existing natural fractures, intersecting them in a near

perpendicular or transverse manner to create a complex network of pathways to enable hydrocarbons to enter the wellbore

(King 2010; J enkins and Boyer 2008).

Gas is stored in three ways in a shale reservoir:

1. Free Gas

a. In the rock matrix porosity

b. In the natural fractures

2. Sorbed Gas

a. Adsorbed (chemically bound) to the organic matter (kerogen) and mineral surfaces within the natural

fractures

b. Absorbed (physically bound) to the organic matter (kerogen) and mineral surfaces within the matrix rock

3. Dissolved

In the hydrocarbon liquids present in the bitumen

To obtain the total amount gas in place (GIP), free gas, sorbed gas, and dissolved gas must be added together. Free gas is the

initial flush production that occurs early, during the first few years of the life of a well. The absorbed gas volume is often

significantly more than the free gas stored in the matrix porosity itself. Gas contents can exceed apparent free gas-filled

porosity by 6 to 8 times where organic content is high (Warlick 2010). However; sorbed gas is produced by

diffusion/desorption and does not occur until later in the field life after the reservoir pressure has declined. It is generally

accepted that sorbed gas does not have an appreciable effect on shale field economics.

Most shale gas wells produce only dry gas (90% methane) and essentially no water. A notable exception to this is the

Eagle Ford with part of the play producing dry gas, part wet gas, and another part producing shale oil. The Antrim and New

Albany shales, which are minor and somewhat inactive, do produce formation water (this is discussed later). Water production

that causes concerns (handling, treating, re-use or disposal) for shale gas wells is frac flowback water.

Shale gas wells (and hydraulically fractured tight sands) display a rather unique decline profile character. Shale and

tight gas wells typically exhibit gas storage and flow characteristics uniquely tied to geology and physics (Rushing et al 2008).

IP (Initial Productivity) rates are relatively low, in the 2-10

+

MMcfd range (horizontal wells), and these rates decline rather

rapidly. During the first year, the rates can decline by 65-80

+

%; while the second year the decline is 35-45%; and the third

year decline is around 20-30%. After that, production levels out to about 5% decline per year. This flat production or the tail,

8 SPE 160855

as it has been called, could last for 25 to 30 years (Nome and Johnston 2008; U.S. EIA 2011). However; it seems that a well

producing, say less than 100 Mcfd would be approaching the economic limit. Some examples of typical decline type curves

are shown as Figure 10 Barnett shale; Figure 11 Haynesville shale; Figure 12 Eagle Ford shale; and Figure 13 Fayetteville

shale. These type curves were taken from U.S. EIA (2011).

Figure 10Barnett shale type curve and other Figure 11Haynesville shale type curves of decline and

information (U.S. EIA 2011) cumulative production (U.S. EIA 2011)

Figure 12Eagle Ford shale type curves of decline Figure 13Fayetteville shale type curves of decline and

and cumulative production (U.S. EIA 2011) cumulative production (U.S. EIA 2011)

Shale natural gas is either biogenic in origin, formed by the action of biologic organisms breaking down organic

material within the shale, or of thermogenic origin formed at depth and high temperatures. Relatively few biogenic gas

systems are producing economic gas within the United States. The Antrim shale in Michigan is one of those systems.

Another is the New Albany shale of Illinois and Indiana. Wells producing from the biogenic Antrim and New Albany shales

have relatively low production rates, e.g., 135 Mcfd; however they will produce for a long time, 20

+

years. In many cases

large quantities of water are produced with or before any gas is produced. Gas production is closely tied to dewatering the

system (like CBM) to gain economic production. Geochemistry analysis indicates that the water is usually fairly fresh.

The majority of producing shale gas reservoirs in the US are thermogenic systems. Thermogenic gas occurs as a

result of primary thermal cracking of the organic matter into a gaseous phase. Secondary thermal cracking of remaining

liquids also occurs. Thermal maturity (which has been previously discussed) in these reservoirs determines the type of

hydrocarbon that will be generated. The gas produced in a thermogenic environment will be relatively dry, previously

mentioned (Economides and Martin 2007).

Reservoir pressure is the key parametrer to how conventional gas (and oil) reservoirs perform. Pressure controls

production rates and is used to predict recovery. Most shale reservoirs range from normally pressured, to slightly

overpressured, to highly overpressured. The higher pressured shale reservoirs, like the Haynesville, have higher IPs and

higher recovery than others (see Figure 11). Higher reservoir pressures do have an effect on the hydraulic fracturing designs;

especially selection of appropriate proppants, as higher reservoir pressure can crush some types of proppants.

SPE 160855 9

Depositional environment of shales is important, particularly whether it is marine or non-marine. Marine-deposited

shales tend to have lower clay content and be high in brittle materials, such as quartz, feldspar and carbonates. Because of this

mineralogy, they respond favorably to hydraulic fracturing. Non-marine deposited shale, i.e., lacustrine and fluvial, tend to be

higher in clay, more ductile, and less responsive to hydraulic fracturing. Transgressive systems are characterized by higher

TOC and quartz and less clay. Shales deposited during transgressive systems not only respond favorably to hydraulic

fracturing, but also have higher hydrocarbon recoveries. Regressive systems are characterized by lower TOC and quartz and

higher clay content. Shales deposited during this time are less responsive to hydraulic fracturing and have lower hydrocarbon

recoveries. Depositional environment for shales can be even more important than thickness.

North American Shale Gas Basins and Statistics Comparison

The shale gas story in the US is placed in front of the public almost daily. Based on the observations of these authors

and available statistics from a number of sources, the following conclusions are drawn and information offered:

All shale reservoirs are not the same.

Shale wells must be fracture stimulated to produce commercially.

The two key elements of shale gas development in the US are:

1. Multi-stage hydraulic fracturing

2. Horizontal wells

These two elements together maximize the reservoir volume that is connected to the well, w/optimum lateral length.

The effectiveness (design, placement, implementation, flowback) of hydraulic fracturing has a significant effect on

production rates, drainage area, and recovery (of course, reservoir characteristics are significant factors).

Vertical wells are required to gather data.

Horizontal wells with lateral lengths ranging from 3,000 to 6,500 feet are used for development.

Average well spacing is approximately 80

+

acres.

Formation thickness ranges from 20 to 600 feet.

Formation depth ranges from 6,000 to 13,500 feet.

Well IPs range from 2 to 10

+

MMcfd.

Primarily dry gas production (90% Methane) exception is the Eagle Ford which also produces wet gas.

Most shales do not produce significant amounts of water.

Wells exhibit high decline rates in first few years on production.

A high number of wells are required to develop shale (low per well EURs).

The six major shale gas plays in the US are the Barnett, Fayetteville, Woodford, Haynesville, Marcellus, and the

Eagle Ford (the two major shale gas plays in Canada are the Horn River and the Montney). Table 4 is a comparison of the six

major US shale plays with respect to some of the physical aspects of the play and the individual wells. Most of the

information included in the table is from the recent U.S. EIA (2011). The well cost data were obtained from various sources.

Table 4Comparison of the six major US shale plays, physical aspects of the plays and wells (U.S. EIA 2011)

The next 12 figures are plots of production history, numbers of producing wells, and numbers of rigs operating in

each of these six major US shale plays. There are two plots for each play. The plot on the left includes the historical

producing well counts and number of rigs operating in the play; rig counts are shown beginning in 2009. Historical

production, gas, oil (if applicable), water, and condensate (if applicable) are shown on the plots on the right. The production

and producing well counts data are from the Drill Information Database, and the operating rig data are from Baker Hughes. It

should be noted that all plots begin with the year 2005, the Barnett, discovered in 1981, certainly has more historical data. The

Marcellus and Woodford also have just a couple more years of data. The sharp, abrupt, drop in producing wells in the

10 SPE 160855

Marcellus is due to incomplete data; a result of some states not reporting information on a timely basis. Drops in gas-directed

rigs for 2010-2011 can be seen, most notably, in the Barnett, Fayetteville, and Haynesville plays.

Figure 14Barnett Shale producing well Figure 15Barnett Shale production

and rig counts

Figure 16Fayetteville Shale producing well Figure 17Fayetteville Shale production

and rig counts

Figure 18Woodford Shale producing well Figure 19Woodford Shale production

and rig counts

SPE 160855 11

Figure 20Eagle Ford Shale producing well Figure 21Eagle Ford Shale production

and rig counts

Figure 22Haynesville Shale producing well Figure 23Haynesville Shale production

and rig counts

Figure 24Marcellus Shale producing well Figure 25Marcellus Shale production

and rig counts

12 SPE 160855

Canadian shale gas has been somewhat slower in developing than the US. In the Horn River shale, Canadas largest,

only 55 wells were drilled in 2008-2009, and an estimated 210 more wells in 2010-2011. The B.C. Ministry of Energy and

Mines National Energy Board (2011) estimated the Horn River Shale to contain up to 96 Tcf TRR. The earlier comparable

number for 2009 was approximately 120 Tcf (20% recovery of 600 Tcf, see Table 5). Note the 10% CO

2

content of the Horn

river shale gas. This gas is also reported to contain 0.01% H

2

S (Reynolds et al 2010).

Table 5Comparison of the five significant Canadian Shale Basins (NEB 2009)

Characteristics of Tight Gas

In the 1970s the U.S. government decided that the definition of a tight gas reservoir is one in which the expected

value of permeability to gas flow would be less than 0.1 md. This definition was a political definition that has been used to

determine which wells would receive federal and/or state tax credits for producing gas from tight reservoirs (Holditch 2006).

Holditch goes on to say that the tight gas definition is a function of a number of physical and economic factors. The best

definition of a tight gas reservoir is a reservoir that cannot be produced at economic flow rates nor recover economic volumes

of natural gas unless the well is stimulated by a large hydraulic fracture treatment or produced by the use of a horizontal

wellbore or multilateral wellbores (Holditch 2006; Shrivastava and Lawatia 2011). Other authors say that perhaps flowrate

rather than permeability should be the measure of what is termed a tight gas reservoir. Certainly that has merit, as some

reservoirs in countries outside of the US with 10

+

md permeability are being fractured and increasing flowrates.

There are no typical tight gas reservoirs. They can be (Holditch 2006):

Deep or shallow

High-pressure or low-pressure

High-temperature or low-temperature

Blanket or lenticular

Traps are usually stratigraphic

Homogeneous or naturally fractured

Single layer or multiple layers

Sandstone or carbonate

It is thought by some that gas shales and CBM are Tight Gas.

Tight gas, unlike shale gas, is sourced in another formation, migrates, and is trapped (like conventional gas) in the

formation where it is found. Discrete gas/water contacts are usually absent, but wells do produce water. Tight gas reservoirs

in the US Rocky Mountains can be grouped into four general geolocic and engineering categories: 1. marginal marine blanket,

2. lenticular, 3. chalk, and 4. marine blanket, shallow deposits (Spencer 1985). The Pinedale Anticline (Figure 5), the largest

tight gas reservoir in the US is a lenticular formation. Microscopic study of pore/permeability relationships indicates the

existence of two varieties of tight reservoirs. One variety is tight because of the fine grain size of the rock. The second variety

is tight because the rock is relatively tightly cemented and the pores are poorly connected by small pore throats and capillaries.

Most of the tight gas reservoirs of the Rocky Mountain region of the US are overpressured (Spencer 1985).

SPE 160855 13

North American Tight Gas Basins and Statistics Comparison

Based on the observations of these authors and available statistics from a number of sources, the following

conclusions are drawn and information offered:

There are no typical tight gas reservoirs.

Tight gas wells must be fracture stimulated to produce commercially.

Average well spacing is now 5 to 10acres in the lenticular formations, Pinedale Anticline and Piceance.

Formation thickness ranges from 600 to 6,000 feet.

Formation depth ranges from 4,700 to 20,000 feet.

Multi-wells pads wells are S-shaped, Directional or Vertical (Pinedale Anticline and Piceance).

Some horizontal and multilateral wells (Texas Panhandle, Anadarko Basin)

Well IPs range from 3 to 20 MMcfd.

Production is dry gas, some wet gas, and water.

Tight gas formations producing water require deliquification.

Wells exhibit high decline rates in first few years on production.

A high number of wells is required to develop shale (low per well EURs).

The four tight gas basins that produce most of the US tight gas are the Pinedale Anticline, Anadarko, Piceance, and

Deep Bossier. Table 6 is a comparison of these US tight gas basins.

Table 6Comparison of the four significant US tight gas basins (Source of information: Warlick 2010)

The Pinedale Anticline Field is the largest US tight gas play, holding 73 Tcf of TRR. It produces from stacked

lenticular sands and is typical of other lenticular US tight gas (Table 6). Figure 26 shows a plot of historical production and

well count of producing wells. Currently, Pinedale is producing over 1,500 MMcfd and 54 MBWPD from 1900 wells.

Currently there are 17 gas-directed rigs working in the Pinedale; that number has been about the average during 2011.

Figure 26Pinedale Field historical production and producing well counts

14 SPE 160855

Canadian tight gas information is limited; therefore only basic information is listed for each of the three typical plays

(Dixon 2005).

Shallow: Well Depth - 2,000 2,500 ft, Typically Vertical; Well Rate - 33 Mcfd Avg, some 1.0 MMcfd; Operators -

200; located - SE Alberta / SW Saskatchewan

J ean Marie: Well Depth - 4,000 4,500 ft TVD, Typically Horizontal, Lateral Length - 2,900 5,000 ft; Well Rate -

480 Mcfd Avg; located - NE British Columbia

Deep Basin: Well Depth 7,000 11,000 ft, Typically Vertical; Well Rate 400 Mcfd Avg; Operators 200;

located - West Central Alberta / parts of British Columbia

All tight gas wells display the unique decline curve profile similar to shale gas. Figure 27 shows several modeled

production profiles of various tight gas well scenarios compared to the profile for a conventional gas well plotted from actual

measurements obtained from a productive field. Plots show that the initial rates and EUR per well are significantly less than

those for conventional gas wells.

Figure 27Modeled typical tight gas production profiles compared

to a conventional gas well (Al Kindi et al 2011)

At this point it is deemed beneficial to make a total comparison of a number of the reservoir and producing

characteristics of shale gas, tight gas, and conventional gas. Table 7 is that comparison. The authors have assembled the data

for this table from various sources.

Table 7Comparison of Shale Gas, Tight Gas, and Conventional Gas

SPE 160855 15

The Asset Life Cycle

The authors have compiled the information included in the next section of this paper based on their experience in the

industry and with unconventional gas. It represents our thoughts, and it is the platform adopted by our company as the

suggested method for operators to use when analyzing, developing and producing unconventional shale and tight gas

reservoirs. The Asset Life Cycle, Figure 28, includes five phases A. Exploration, B. Appraisal, C. Development, D.

Production, and E. Rejuvenation. It is recognized that most of the terms have been around the industry for a number of years,

except for possibly Rejuvenation, a term coined by the authors. We are not implying that the phases of the Asset Life Cycle

are totally new, but only how they are implemented and the objectives to be accomplished during each phase. As the

discussion ensues, it will become obvious that the description of the objectives and challenges of the operator and technologies

required to implement each phase of the life cycle do address the uniqueness of both shale and tight gas.

Figure 28The Shale Gas and Tight Gas Asset Life Cycle

Choices made at every phase of the life cycle can affect ultimate recovery. We have seen that not all shale and tight

gas reservoirs are the same, and each may require different choices. Also, each choice can affect later options. Each phase of

the life cycle has a number of different objectives and challenges.

A. Exploration Phase Objectives

Conduct a basin/area screening study to identify core areas (sweet spots) and to determine an initial estimate

of gas in place (GIP).

Begin to characterize the reservoir.

Determine the initial economic value and reservoir potential.

A screening study is particularly important when entering a new basin or area. The primary purpose of the study is to

identify the core areas, i.e., locate the sweet spots. Well-by-well production data indicate that shale formations have small

spots of very productive wells (Sweet Spots), surrounded by large areas of wells that produce far less gas. Sweet spots are a

function of TOC, thermal maturity, thickness, GIP, natural fractures, mineralogy, and geomechanics stresses in the area.

Sweet geologic spots may not necessarily be sweet economic spots. Also, if an area possesses most of these attributes, but is

not a favorable area in which to frac (mineralogy or stresses), it is not a sweet spot. It may sound trite, but develop the sweet

spots first, then go back to the less attractive areas.

The basin screening study should involve gathering and analyzing data including:

Geology sedimentology, statigraphy, and depositional environment

Geochemistry TOC (initial reserve estimate), thermal maturity (type of hydrocarbon).

Is the shale a source rock?

Geomechanics stress regime for well drilling and fracturing design

Petrophysics rock type, lithology/mineralogy, porosity (from cores and logs)

Existing well data

To begin initial characterization of the reservoir, conduct geophysics - 3D seismic. From 3D seismic the usual

information on faults, formation thickness, depth, and lateral continuity can be obtained. However: 3D seismic can also:

Identify areas of highest TOC using acoustic impedance

Increase understanding of natural fractures using seismic attributes

Assist in identification of sweet spots using seismic cross-plots

16 SPE 160855

Seismic information is relevant through the Exploration, Appraisal, Development, and Rejuvenation phases of the life cycle.

Openhole logs (conventional, pulsed-neutron, and spectroscopy) and cores from exploratory wells provide the data

for petrophysical analysis for initial reservoir characterization for both shale and tight gas. Wellbore image logs and nuclear

magnetic resonance (NMR) logs provide necessary information for shales and useful information for tight gas (Holditch 2006).

An example of one of the special logs and analysis techniques is shown in Figure 29, an Integrated Shale Analysis plot that is

described below by Mitra et al (2010). This shale gas facies expert system provides operators with a quick and accurate

method of classifying shale gas reservoirs, identifying favorable zones for hydraulically fracturing, identifying frac barriers

and locating zones from which to drill horizontal laterals (J acobi et al 2009; LeCompte et al 2009; Pemper et al 2009; Mitra et

al 2010). Although this example is for shale, mineralogy/lithology is also being used for complex tight gas sands and

carbonates fracturing/lateral location and identifying reservoir layers. It should be noted that cores are a must, either whole

cores or sidewall cores for analysis and to calibrate logs.

An initial assessment of reservoir potential and economic value can be determined from all these data. Individual

operators have different drivers and specific financial and leasehold situations in the US. Gas price, regulatory, and

infrastructure are all different for countries outside the US. Martin and Eid (2010) cover these topics at length in their paper

on The Potential Pitfalls of Using North American Tight and Shale Gas Development Techniques in the North African and

Middle Eastern Environments.

B. Appraisal Phase Objectives

Drill the appraisal wells

Build reservoir model(s) for simulation

Generate a Field Development Plan

Validate the economics of the play

More wells are drilled during the Appraisal phase than in the Exploration phase; thus data from these additional wells

will continue to be used to further characterize the reservoir. Vertical wells are required to collect data; and some horizontal

appraisal wells are drilled to test hydraulic fracturing and mechanical well completion designs. Horizontal wells will also

provide information to assist in determining optimum lateral length, and to begin early drilling otimization.

Cox et al (2002) recognized that Tight gas reservoirs present unique challenges to the reservoir engineer. Applying

classic reservoir engineering techniques to these reservoirs is problematic due to the length of time to reach pseudo-steady

state flow and/or establish a constant drainage area. This leads to the inability to accurately estimate the recoverable reserves

in a timely and consistent manner. Both decline curve and material balance methods were found to have serious drawbacks

when applied to tight gas reservoirs that had not established a constant drainage area. Holditch (2006) concluded that the best

reserves evaluation techniques for tight gas were careful application of hyperbolic decline curves and reservoir modeling

simulations. Kupchenko et al (2008), upon recognizing that production performance from tight gas reservoirs displays steep

initial decline rates and long periods of transient flow, realized that inaccurate forecasts would result from using this transient

production data. Their work resulted in use of Arps original equation with certain exponent restrictions to obtain better

forecasts. Also in 2008, Ilk et al introduced the power law exponential decline (form of power law loss ratio) concluding

that it offered a better match to production rate than hyperbolic decline. Others, including Duong (2010), have also developed

and proposed decline curve analysis (DCA) methods, and some have offered new techniques for using the material balance

approach (Payne 1996; Engler 2000). Holditch (2006) concludes that the most accurate reservoir analysis technique for tight

gas is to build a reservoir model that includes layers, and these authors also suggest a dual porosity model.

The industry has taken a traditional approach to developing shale gas; looking at these unconventional shale plays in

a statistical manner. The classic DCA approach is being applied, but the average curves that have been developed are not

truly representative of the physics of shale gas flow. Actual performance has been found to be quite dissimilar from these

average or type curves. Since operators do not understand the exact reasons for the deviation, they have been limited in their

ability to optimize the development and properly prioritize operations based on sound engineering and geological information.

A more reliable analysis and predictive approach was needed. According to Vassilellis et al (2010), conventional reservoir

engineering tools have been found to be inadequate for use with the change in reservoir characteristics after hydraulically

fracturing a shale well. This complex newly-altered reservoir (after fracturing) must be described and properly modeled in

order to reliably predict long term production and recovery. They introduced a multi-disciplinary integrated approach called

shale engineering. Shale engineering involves building three models - reservoir, well, and fracturing models. Data and

analysis techniques involve the disciplines of geology, petrophysics, geomechanics, geochemistry, seismology, and, of course,

engineering. Application of the shale engineering techniques are documented by Vassilellis et al (2011) and Moos et al 2011).

Cipolla et al (2209a, 2009b) also has introduced a new approach to more comphensive modeling of complex shales.

SPE 160855 17

1 2 3 4 5 6 7 8 9 10 11 12 13

Figure 29An Integrated Shale Analysis plot of a representative well from the Barnett shale Tracks 8 and 9 show the

results of the shale gas facies system applied to this well. Track 8 represents the lithofacies from the Barnett model.

The organic-rich shale lithofacies is shown in black, the non-siliceous organic-rich shale is shown in orange, the low

organic shale lithofacies is shown in gray, the siliceous mudstone lithofacies is shown in yellow, the calcareous

mudstone lithofacies is shown in blue, the phosphatic zone lithofacies is shown in light green, and the pyritic zone

lithofacies is shown in red. Track 9 represents the stop-light component of the shale gas facies expert system, where

favorable frac zones are marked in green and unfavorable frac zones are marked in red. The predominant lithofacies

in the Barnett shale is the siliceous mudstone followed by the organic-rich shale lithofacies. Track 10 provides

information on frac migration, Track 11 geomechanical properties and Tracks 12 and 13 information on anisotrophy.

(Mitra et al, 2010).

Field Development Plans (FDP) for both shale and tight gas include well type, placement, attitude, direction, and

spacing. Drilling wells in the direction of maximum principal stress maximizes access to existing natural fractures when

transverse-trending hydraulic fractures intersect these natural fractures (previously discussed). Therefore, it is important to

understand the stress regime in the field. Usually a full plan also includes completion and fracturing designs. The industry has

been successful in generating FDPs in the past for conventional reservoirs. Tight gas, and especially shale gas, have

introduced uncertainty in the traditional approach. From the earlier discussion we have seen that it requires a large number of

wells to develop either a tight gas or shale gas play. Tight gas well spacing in Pinedale and Piceance Basins is down to 5 and

10 acres. Although typical shale gas well spacing is somewhat larger, approximately 80 acres, the continuous shale formations

extend over large geographical areas. Figure 30 shows the number of existing wells in the six major US shale plays and the

total number of wells required to develop the TRR from EUR per well for each play (Table 4) using the typical number of 200-

300 wells required to recover 1 Tcf of gas. Most plays have not yet even approached the required number of wells.

18 SPE 160855

Figure 30Typically it takes 200-300 wells to develop 1 Tcf of gas. Based on the total TRR of a

play and the EUR per well, required number of wells to develop is shown in red.

Current (12-1-12) total number of producing wells is shown in black.

Finally, with all of the data collected from the drilling and analysis of the appraisal wells, and with an understanding

of the unique aspects of these unconventional reservoirs and characterization data for the particular play, operators can

complete the final step of the Appraisal phase - validating the economics of the play. The decision whether to proceed with

play development is then taken.

C. Development Phase Objectives

Implement the Field Development Plan

Install surface production and export facilities, including compression and pipelines

Design wells and optimize drilling costs

Refine and optimize the hydraulic fracturing and well completion designs

In implementing a Field Development Plan, that includes a large number of wells, an operator is cautioned not to

become complacent and continue to allow the rig schedule to totally drive the plan. Interim analyses should be undertaken to

ensure that drilling and completion programs are delivering wells with the expected IP producing rates. That is the purpose of

steps three and four of the Development Phase.

Surface facilities will not be discussed in this paper. They are only included in the life cycle for completeness and to

ensure construction schedules match timing of well completion and availability.

Tight and shale gas well designs are different. Historically, most tight gas wells have been drilled conventionally,

over-balanced and with conventional rotary rigs. Typically, Pinedale has proved technically challenging to drill and cement.

It has over 5,000 feet of stacked lenticular sands. Pore pressures ranging from normal to over 16.5 lbm/gal, and unplanned

circulation losses have negatively impacted drilling and cementing. In 2002 desired top of cement was being achieved only

31% of the time (Garcia et al 2002). Operators have solved these problems by using geomechanics and integrating

information from fracturing completion design. As late as 2007 operators were still having drilling problems and facing the

inability to get casing to bottom. The solution was to forego openhole logs, run casing immediately, then run cased hole

pulsed neutron logs for evaluation. These cased hole logs provided equal or better results than openhole logs. In the Pinedale

and Piceance, S-shaped and J type wells are being drilled from 16-20 well pads, such that the well vertically penetrates the

2,000 to 6,000 feet thick formations. J anwadkar et al (2006a) introduced new technology to overcome the directional drilling

challenges of the S and J type wells. Pilisi et al (2010) introduced the Tight Sand Advisory System for selecting the best

drilling method and technologies for any specific tight gas well. Horizontal wells, and some multilateral wells (Goodlow et

al 2009), are being drilled in the tight gas of the Texas Panhandle, Anadarko Basin, as the formation allows. Some recent

drilling methods include, under-balanced drilling (Cade et al 2003) in US and Middle East, casing drilling, managed pressure

drilling, and coil tubing drilling.

The early shale gas wells in the Barnett were mostly verticals; it was not until 2003 that there was a total shift to

horizontal wells for developing shale in the Barnett as well as all other US shale basins. Now that the template has been set for

shale gas drilling in the US, service companies have been successfully reducing drilling costs through optimized drilling and

SPE 160855 19

new technology. To date there have been approximately 55,000 shale wells drilled in the US. Some of the technological

advances include J anwadkar et al (2006b), BHA and drilling string modeling to optimize Barnett drilling performance:

J anwadkar et al (2007), advanced LWD and directional drilling technologies to overcome completion challenges in Barnett

horizontals; J anwadkar et al (2009), innovative rotary steerable system to overcome challenges of the Woodford complex well

profiles: Isbell et al (2010), new use of PDC bits to improve performance in shale plays; and J anwadkar et al (2010), using

electromagnetic MWD to improve Fayetteville drilling performance.

Observations on drilling shale wells in the US by these authors:

All development wells are horizontals.

Typical drilling time in Barnett and Marcellus =12 days, Eagle Ford =17 days

Directional drilling with motors or rotary steerable systems or combinations

Using mostly PDC bits

After drilling the vertical part of hole, most (90

+

%) of the wells convert the drilling fluid to some form of oil

based mud (OBM) to drill the curve and lateral.

Some wells being drilled with environmentally friendly water based mud (WBM)

Mud weights depend on formation, which ranges from normal to overpressured.

High bottomhole temperatures are experienced in the deeper Haynesville and parts of the Eagle Ford.

On a fair number of wells the curve and lateral are being drilled in one run (one BHA, one bit, one trip) in

the Barnett, Marcellus, and Eagle Ford.

Early preference for drilling wells in the toe up attitude is gradually changing to drilling the lateral as flat

as possible and perfectly horizontal.

Completion part of hole typically drilled out of 7 in. casing set either before or after the curve

Cased hole wells typically use either a 4 in. or 5 in. completion string.

Optimum (and shorter) lateral lengths are now preferred over longer lateral lengths.

Longer laterals face increased risk of encountering a geohazard, problem with initiating the frac at the well

toe, and possibly even losing the wellbore.

Wells drilled in a direction normal to maximum principal stress

Some pad drilling is being used for both logistics and environment; 4-10 wells per pad in US; larger 16-well

pads in Canada.

The drilling cost constitutes 40 50% of the total well cost.

The last step of the Development phase of the life cycle involves optimizing the hydraulic fracturing and completion

designs. First, we will cover the types of mechanical completions that are necessary when conducting multi-stage fracturing of

tight gas wells. In the S and J type wells of the Pinedale and Piceance tight gas, operators usually run cased and cemented

completions. Drillable plugs are used to separate stages, and perforations are in clusters throughout the stage length. This

method is commonly termed Plug-N-Perf. In the Texas Panhandle granite wash tight gas, some 70% of the wells are now

horizontals; and the completions are primarily cased and cemented with Plug-N-Perf multi-stage fracturing. Some wells are

also completed openhole and use the mechanical completion method of frac sleeves separated by packers for isolation of

individual stages. These same two methods of mechanical completions, cased and cemented with Plug-N-Perf and openhole

with frac sleeves separated by packers, are being used for shales. There are advantages and disadvantages to the two these

types of mechanical completions; however, operators tend to prefer the cased and cemented method for shale gas completions.

Studies have been conducted, and generally conclude that there is no appreciable difference in well IPs by using either

method. Certainly there is a time difference with the frac spread being on the well for a typical Plug-N-Perf operation of about

a week versus about a day for the openhole frac sleeve and packers completion. As a note, operators tend to prefer the

openhole completions for shale oil. Wells are also being fractured stimulated using coil tubing (Ravensbergen 2011).

Although the hydraulic fracturing process has been around the oil and gas industry for over 60 years, combining it

with horizontal drilling (in existence even longer) has resulted in the shale gas boom. To cover the topic of hydraulic fracturing

in depth would take a much longer discussion than allowed in this paper. However, we will provide an overview frequently

calling on the two very comprehensive papers by King (2010 and 2012). Starting with No two shales alike, King also states

that There are no optimum, one-size-fits-all completion or stimulation designs for shale wells.

The hydraulic fracturing process consists of five steps:

1. Pump the Pad, mainly fluid that cracks the rock creating fractures to accept the proppant.

2. Pump the Slurry, fluid and Proppant (size-graded sand particles or man-made) which props open the fractures.

3. Flush to clean equipment/tubulars of proppant, then shutdown pumps.

4. Bleed off well pressure to allow fractures to close on proppant.

5. Recover injected fluid by flowing or lifting well (typically <30% of frac fluid recovered).

20 SPE 160855

The first fracs in the Barnett were gelled fracs until the successful slickwater fracs became the default design not only

in the Barnett, but also other US shales. Slickwater fracs are made up of 94% water (no polymer gelling agents) as the frac

fluid; 0.3% chemicals - friction reducers, surfactants, biocides, and clay stabilizers; and 5.6% sand proppant. These fracs are

pumped at very high rates. Slickwater fracs are less expensive than polymer gel fracs.

Hydraulic fracturing challenges in shale reservoirs:

Simple or complex geometry

Compatibility of fracturing fluid with reservoir

Proppant types and selection

Reservoir volume accessed

Number of stages, spacing; perforation clusters, spacing (Frac Design)

Geohazards faults, karsts, wet zones

Where did the frac go, and what did it touch (or not)?

Rules of Thumb for shale fracs (The Trend?):

Distance between frac stages =1 to 1.5 x zone height (250 350ft)

Distance between perf clusters =35 to 50+ft

Length of perf cluster =4 x well diameter (about 1 to 2 ft)

Number of perf clusters in each stage is 4 to 8 (roughly 1.5 bpm/perf 10-15 bpm per cluster

Number of stages depends on lateral length, normal 4 to 20+

Slickwater / Linear Gel / Hybrid / Cross-linked depends on type production:

- Slickwater or Linear Gel Fracs Dry gas shale or with little liquids

- Hybrid Fracs (Slickwater & Cross-linked fluids) Gas condensate/liquids/liquid bearing shales

- Crosslinked Frac Oil-bearing shale or with higher GORs

Table 8 shows typical fracture treatment parameters for some of the major US shale plays. Figure 31 shows the trend

in fracture treatment size.

Table 8Typical fracture treatment parameters for some major US shale plays (Various Sources)

Figure 31Trend in Shale fracture treatment size, fluid volumes (Various Sources)

SPE 160855 21

The fracturing procedure for the stacked lenticular sands of the Pinedale and Piceance involves selecting the best 30

from as many as 60 lenses (each 20 to 50 feet thick) to frac. The 30 lens are grouped in five to six to frac together as a stage.

Often post-frac well performance in tight gas reservoirs correlates more directly with fluid volume than proppant volume. For

the Piceance completions, several operators have improved well productivity by doubling fluid volume and maintaining the

same proppant volume by cutting the proppant concentration in half. Rules of Thumb like this and those above are being

used by operators, as there is a general lack of reliance in using complex hydraulic fracture simulators to design and optimize

fracture treatments (Cramer 2008). King (2010) states that there are many good fracture simulators developed primarily for

sand; however, these simulators may not be suited for shales. Table 8 and the preceding Rules of Thumb show that the

fracture treatments being used in shales today are what are called geometric fracs, i.e., a frac stage every 250 to 350 ft. with 4

to 8 perforation clusters per stage. This approach totally ignores the changing reservoir characteristics along the 4,000 to

5,000 ft. long lateral. Geometric fracs are being used, because those changing characteristics along the lateral are not known,

quantitatively at least. No logs or any characterization is being done for the laterals; which could provide information as to

where to place stages and perf clusters, and which places to avoid. These authors suggest running LWD imaging tools along

the lateral, as only a limited number of operators are doing. Costs are relatively inexpensive, and the process is transparent to

the drillers. Imaging tools can identify natural fractures, faults, bedding planes and even induced fractures from nearby offset

wells. One point is that resistivity imaging tools must be run in WBM or invert emulsion with part water in order to record

significant data. Other methods to further characterize the lateral are, analyzing drill cuttings for TOC and mineralogy, and

gas isotopes from mud logging.

Hydraulic Fracturing works for tight gas because we change the flow pattern in the reservoir. Fracturing can improve

the productivity of a well in a tight gas reservoir because a long conductive fracture transforms the flow path gas must take to

enter the wellbore (Holditch 2009). A number of operators are now opting to monitor fracturing treatments, shale and tight

gas (Warpinski et al 2010) in real-time using microseismic. Monitoring does require a nearby offset well in which to run

sondes for recording the data. Microseismic monitors the treatment as to the direction (azimuth) and height, and whether the

treatment is going out of zone, into a water zone, or being lost to a fault. This provides the operator with the ability to stop the

treatment if not going as planned. Microseismic does not indicate where the proppant or fluid actually goes, but where the

rock has slipped or cracked. The events being recorded are the faint sounds of slipping/cracking rock. Microseimic events

plotted as a cloud provide an approximation of the size and location of the stimulated reservoir volume (SRV).

D. Production Phase Objectives

Monitor and optimize producing rates

Manage the Water Cycle Sourcing for drilling and fracturing water, well flowback water, lifting, treating,

handling, and disposal of water

Reduce corrosion, scaling, and bacterial contamination in wells and facilities

Protect the environment

Managing and controlling well flowback rates are the first steps in optimizing production and ultimate recovery.

Multi-stage hydraulically fractured wells require a post-stimulation flow period to prepare a well for long-term production.

This is one of the most critical times in life of well; more so for shale gas wells as opposed to tight gas wells. Excessive

flowback rates are known to have caused proppant flowback or fracture collapse. Intensive management of flowback can

yield significant improvement in wells long-term performance (Crafton and Gunderson 2007; Crafton 2010). An operator in

the Haynesville reported in 2010 that Haynesville wells have been produced using restricted rate production practices.

Additionally, initial decline rates appear more gradual as a result of restricting production. This operator also said that the

decline curves modeled higher EURs from the restricted well rates. It appears that this is one instance of a technique that

could slow down the dramatic initial decline rates characteristic of shale gas wells. Total production from a multi-stage

hydraulically fractured well can be monitored, but there has not been a truly effective method of determining production rates

coming from individual perforated stages. Some operators have run production logging tools (PLT) in horizontal wells

(Heddleston 2009). It requires a tractor or coil tubing, and is somewhat problematic and with mixed success. These PLTs

have confirmed what operators have suspected that some 30 50% of the frac stages are not producing any gas at all. This

is good information to know, but the question begs as to whether any remedial work might be attempted aside from a possible

refrac. One other method of monitoring production from individual stages has been employed; that is DTS (Distributed

Temperature Sensing). A few wells have been equipped with DTS, but the fiber optic cable and equipment must be installed

as part of the original completion and the cost is difficult to justify based on the real benefit.

Most shale gas wells do not produce any significant amounts of water, and the water produced by tight gas wells is

handled with deliquification techniques plunger lift, foam sticks, gas lift, beam lift pumps and jet pumps. Water that is of

concern with shale wells is frac flowback water. Although not all of the water comes back, the amount that does brings with it

formation salts, scale, and sometimes low-level radiation (NORM). Frac flowback water must be treated, either for re-use or

disposal. With the water situation in many parts of the country and the world, re-use is strongly recommended. Service

22 SPE 160855

companies provide water treating services for flowback and produced water. Currently the most popular and effective

equipment uses electro-coagulation technology to remove suspended solids and heavy metals from flowback and produced

water. Fresh water is not required for fracturing wells. Formation brine water and seawater are other alternatives. Additional

frac additive chemicals are required due to salt content of these waters. Gaudlip et al (2008) describes the stringent regulatory

restrictions of the State of Pennsylvania for the Marcellus shale with respect water sourcing, handling and especially disposal.

There is more to managing the water cycle than treating and or disposal. Water sourcing for both drilling and fracturing has

become significant. In the Eagle Ford water is being sourced from shallow salt water formations and being lifted from wells

using large-volume electric submersible pumps (ESPs). In the Horn River Shale in Canada, Apache is taking brine source

water from a saltwater-containing formation just above the Horn River shale and using the water for fracturing (King 2012).

On the surface, produced and treated water must be handled and transported to central processing/treating facilities or removed

for disposal. This requires piping and surface pumps.

Preventing corrosion, scaling, and bacterial contamination in wells and facilities is handled much the same way as in

traditional oil and gas fields. Production chemical monitoring and treating programs must be developed and equipment

installed. Chemical automation systems can be used, especially for remote locations, wide-spread operations, and in low-

winter temperature operations. Protecting the environment should be included in every phase of the life cycle; however, it is

particularly critical during the Production phase.

E. Rejuvenation Phase Objectives

The Challenge for the Rejuvenation Phase is to remediate low-rate and sub-economic wells.

Evaluate wells for Re-Frac candidates

Analyze field for re-development potential (Infill Drilling)

It is the opinion of these authors that the most significant opportunity to accomplish rejuvenation lies with refracs. As

we have seen, unconventional wells decline rapidly reaching low unacceptable rates after only a few years on production. It

has not been proven that any form of production management or enhancement has been successful in arresting the rapid

decline or restoring original production rates. In his database of 100 published studies on refracs, Vincent (2010) attributed

refrac success to a number of mechanisms as listed below:

Enlarged fracture geometry, enhancing reservoir contact

Improved pay coverage through increased fracture height in vertical wells

More thorough lateral coverage in horizontal wells or initiation of more transverse fractures

Increased fracture conductivity compared to initial frac

Restoration of fracture conductivity loss due to embedment, cyclic stress, proppant degradation, gel damage,

scale, asphaltene precipitation, fines plugging, etc,

Increased conductivity in previously unpropped or inadequately propped portions of fracture

Improved production profile in well; preferentially stimulating lower permeability intervals [reservoir

management]

Use of more suitable fracture fluid

Re-energizing or re-inflating natural fractures

Reorientation due to stress field alterations, leading to contact of new rock

Production rates from refracs have matched, or sometimes exceeded, those from the original frac. Figure 32 is a

Barnett refrac with slickwater compared to the original gel frac (Cipolla 2005). Figure 33 is a refrac of a tight gas well, GRB

45-12 from Green River Basin, Wyoming (Reeves et al 1999).

Figure 32Refrac of Barnett shale well with Figure 33Refrac of tight gas well GRB 45-12

Slickwater (Cipolla 2005) (Reeves et al 1999)

SPE 160855 23

Re-development of a shale or tight gas field will more than likely involve infill drilling as a possible result from

downspacing. This has already been seen in the Pinedale and Piceance tight gas plays; where original spacing was on 160

acres and has now gone down to 5-10 acres.

Conclusions

Unconventional shale gas and tight gas are different in many respects, while similar in other respects.

All Shale Gas reservoirs are not the same; there are no typical Tight Gas reservoirs.

Shale reservoirs are source rocks where the gas (some or all) has remained; gas has migrated and is trapped

in tight gas reservoirs.

Organic-rich shale lithology/mineralogy is quite different from tight gas sands or carbonates.

Both shale and tight gas have low permeability and relatively low porosity.

Gas is stored as free, sorbed in matrix and natural fractures, and dissolved in bitumen in shales; gas is

stored only in the pores of tight gas reservoirs.

Reservoir and flow mechanisms are different.

Formation evaluation and reservoir analysis methods are quite different for each.

Drilling methods are different and dictated by type of formation.

Development well types are different; horizontals for shale and vertical, S-shape, directional, and some

horizontals for tight gas.

Most significant common link; hydraulic fracturing require for both to attain commercial gas rates.

Fracturing techniques are similar with different designs for each; there is no one-size-fits all fracturing

designs for either tight or shale gas.

Completion techniques are similar for both.