Académique Documents

Professionnel Documents

Culture Documents

Equity Research Release

Transféré par

Oladipupo Mayowa PaulCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Equity Research Release

Transféré par

Oladipupo Mayowa PaulDroits d'auteur :

Formats disponibles

Scotia Capital launches new investment rating system for equity research TORONTO, December 2, 2002 Scotia Capital

l announced today that it has revised its investment rating system for equity research. Effective immediately, the Firm has moved from a five-tier system to a three-tier system with ratings of Sector Outperform, Sector Perform and Sector Underperform. The new system defines recommendations in relation to all of the companies the analyst covers in the sector. At Scotia Capital, we take our responsibility to provide our clients with the best possible guidance on how to meet their financial goals very seriously, says Laurel Ward, Head of Equity Research, Scotia Capital. Clients must receive pertinent, timely, insightful perspectives from us. Our new rating system provides investors with our views within a portfolio context that can be tailored to each clients individual needs, whether retail or institutional. Analysts will now apply one of the following ratings to the stocks they cover: Sector Outperform The stock is expected to outperform the average total return of the analysts coverage universe over the next 12 months. Sector Perform The stock is expected to perform approximately in line with the average total return of the analysts coverage universe over the next 12 months. Sector Underperform The stock is expected to underperform the average total return of the analysts coverage universe over the next 12 months. The Firm has also enhanced its risk rating system to provide better transparency as to the underlying financial and operational risk of each stock covered. Historical financial results, share price volatility, credit ratings, and analyst forecasts are evaluated in this process. The final rating also incorporates judgement as well as statistical criteria. Consistency and predictability of earnings, earnings per share growth, dividends, cash flow from operations and strength of balance sheet are key factors considered. Scotia Capital has a committee responsible for assigning risk ratings for each stock. The risk ratings have been updated as follows: Low Low financial and operational risk, high predictability of financial results, low stock volatility. Medium Moderate financial and operational risk, moderate predictability of financial results, moderate stock volatility. High High financial and/or operational risk, low predictability of financial results, high stock volatility. Caution Warranted Exceptionally high financial and/or operational risk, exceptionally low predictability of financial results, exceptionally high stock volatility. For risk tolerant investors only. Venture Risk and return consistent with Venture Capital. For risk tolerant investors only.

We believe that high analyst standards together with appropriate compliance policies, disclosure and transparency are crucial to ensuring that our clients and investors have confidence in the integrity of our research and processes, says Ward. Scotia Capital is a leader in the corporate and investment banking industry, with a presence in both major and regional financial centres around the world. Scotia Capital is a member of the Scotiabank Group. For more information visit http://www.scotiacapital.com/ or http://www.scotiabank.com./ Ends For further information: Jane Shannon Scotiabank Public Affairs (416) 933-1795 jane_shannon@scotiacapital.com

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- 1.3.2 Lenovo + Steeple AnalysisDocument3 pages1.3.2 Lenovo + Steeple Analysisdavid tsai100% (2)

- Working Knowledge - How Organizations Manage What They Kno PDFDocument233 pagesWorking Knowledge - How Organizations Manage What They Kno PDFRafael Dorville100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Ebook PDF Competition Law 9th Edition by Richard WhishDocument62 pagesEbook PDF Competition Law 9th Edition by Richard Whishruth.thomas337100% (48)

- TransactionsDocument7 pagesTransactionsBHARAT TECHPas encore d'évaluation

- @OM QuestionaireDocument5 pages@OM QuestionaireJuhi BhattacharjeePas encore d'évaluation

- 1.introduction To Service MarketingDocument34 pages1.introduction To Service MarketingNeha RajputPas encore d'évaluation

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulPas encore d'évaluation

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulPas encore d'évaluation

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulPas encore d'évaluation

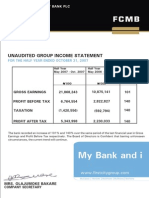

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulPas encore d'évaluation

- 2007 Q1resultsDocument1 page2007 Q1resultsOladipupo Mayowa PaulPas encore d'évaluation

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulPas encore d'évaluation

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulPas encore d'évaluation

- Full Year 2011 Results Presentation 2Document16 pagesFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulPas encore d'évaluation

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulPas encore d'évaluation

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulPas encore d'évaluation

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulPas encore d'évaluation

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulPas encore d'évaluation

- Unaudited Half Year Result As at June 30 2011Document5 pagesUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulPas encore d'évaluation

- June 2012 Investor PresentationDocument17 pagesJune 2012 Investor PresentationOladipupo Mayowa PaulPas encore d'évaluation

- Margin Requirement Examples For Sample Options-Based PositionsDocument2 pagesMargin Requirement Examples For Sample Options-Based PositionsOladipupo Mayowa PaulPas encore d'évaluation

- 2013 Year End Results Press Release - Final WebDocument3 pages2013 Year End Results Press Release - Final WebOladipupo Mayowa PaulPas encore d'évaluation

- 2012 Year End Results Press ReleaseDocument3 pages2012 Year End Results Press ReleaseOladipupo Mayowa PaulPas encore d'évaluation

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulPas encore d'évaluation

- International Hotel Appraisers4Document5 pagesInternational Hotel Appraisers4Oladipupo Mayowa PaulPas encore d'évaluation

- Val Project 6Document17 pagesVal Project 6Oladipupo Mayowa PaulPas encore d'évaluation

- Hotels and Motels - Industry Data and AnalysisDocument8 pagesHotels and Motels - Industry Data and AnalysisOladipupo Mayowa PaulPas encore d'évaluation

- Ratio Back SpreadsDocument20 pagesRatio Back SpreadsOladipupo Mayowa PaulPas encore d'évaluation

- Banking Finance Sectorial OverviewDocument15 pagesBanking Finance Sectorial OverviewOladipupo Mayowa PaulPas encore d'évaluation

- Marriott ValuationDocument16 pagesMarriott ValuationOladipupo Mayowa PaulPas encore d'évaluation

- Marketing MixDocument5 pagesMarketing Mixshubhangi gargPas encore d'évaluation

- Entrepreneurship Week 3 and 4Document10 pagesEntrepreneurship Week 3 and 4hyunsuk fhebiePas encore d'évaluation

- Competitive Strength of Pepsi in A Given Market PlaceDocument10 pagesCompetitive Strength of Pepsi in A Given Market Placesaurabh151Pas encore d'évaluation

- Strategic Management Assignment 4Document2 pagesStrategic Management Assignment 4NybexysPas encore d'évaluation

- Topic 1 International Financial MarketsDocument35 pagesTopic 1 International Financial MarketsAngie Natalia Llanos MarinPas encore d'évaluation

- Microeconomics HomeworkDocument16 pagesMicroeconomics HomeworkTaylor Townsend100% (1)

- Module BS1: The Business FrameworkDocument27 pagesModule BS1: The Business FrameworkMs. Yvonne CampbellPas encore d'évaluation

- Introduction To Securities MarketDocument13 pagesIntroduction To Securities MarketSandra PhilipPas encore d'évaluation

- Equity - Valuation Introduction PDFDocument17 pagesEquity - Valuation Introduction PDFhukaPas encore d'évaluation

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaPas encore d'évaluation

- Hero HondaDocument32 pagesHero HondanainatakPas encore d'évaluation

- Activity 11 AnswersDocument3 pagesActivity 11 AnswersJOHИ ТΛЯUƆΛИPas encore d'évaluation

- CH 6 Fixed - Income QuestionsDocument73 pagesCH 6 Fixed - Income QuestionsPunit SharmaPas encore d'évaluation

- The Harshad Mehta ScamDocument31 pagesThe Harshad Mehta ScamShraddha SakharkarPas encore d'évaluation

- 03chapters6 9Document94 pages03chapters6 9Anonymous BwLfvuPas encore d'évaluation

- 7 Chart Patterns That Consistently Make Money - Ed Downs - Page 7 To 15Document9 pages7 Chart Patterns That Consistently Make Money - Ed Downs - Page 7 To 15YapKJPas encore d'évaluation

- SAP CO - Material Ledger - Transfer PricingDocument22 pagesSAP CO - Material Ledger - Transfer PricingKaushik BosePas encore d'évaluation

- HexawareDocument29 pagesHexawareAmit SharmaPas encore d'évaluation

- Maf Seminar Slide SyafDocument19 pagesMaf Seminar Slide SyafNur SyafiqahPas encore d'évaluation

- Zara Case IiDocument2 pagesZara Case IiElisa PauluzziPas encore d'évaluation

- Fish Philosophy POADocument18 pagesFish Philosophy POAPius Osiriamhe Anyiador100% (1)

- Marketing Plan Presentation FINALDocument53 pagesMarketing Plan Presentation FINALAmiel Carreon0% (1)

- @assignment ElasticityDocument2 pages@assignment ElasticityAbhishekPas encore d'évaluation

- How Do You Define Success EssayDocument4 pagesHow Do You Define Success Essaysbbftinbf100% (2)