Académique Documents

Professionnel Documents

Culture Documents

Marketing Strategies of NIKE1

Transféré par

Manasi GhagTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Marketing Strategies of NIKE1

Transféré par

Manasi GhagDroits d'auteur :

Formats disponibles

MARKETING STRATEGY OF NIKE COMPANY

Chapter 1

MARKETING STRATEGY OF NIKE COMPANY

ABOUT THE NIKE INDUSTRY

HISTORY

Phil Knight Nike was founded in the year of 1968 by Philip H. Knight, who is currently the Owner, Chairman, and CEO of the company. Phil Knight completed his education from the University of Oregon and the Stanford Business School by 1962, (Moore, 128). As an aspiring young business man, he decided to travel to Japan and speak to the president of "Tiger shoes." He presented himself as an American distributor of athletic equipment when he actually had nothing. He was pretty sneaky; however, he got what he wanted and began selling running shoes under the name of Blue Ribbon Sports (BRS). Once he became bored with selling shoes at sporting events from the back of his truck, he began producing his own athletic apparel. He renamed his so-called company Nike and hoped for the best to happen. Within the first year, he sold $8000.00 worth of shoes and only received a $250.00 profit. After some time, Knight turned to his old coach from school, Bill Bowerman, for advice on what to do next. Phil Knight wanted Nike to stand out above the rest. Once Bill Bowerman came up with the idea for having traction on the bottom of shoes, Nike had finally made its mark. The Nike Waffle Trainer stood out and made Nike the most unique shoe company of the 1970s. By the year of 1979, Nike was the most well-known shoe company in the world. They no longer just sold shoes but sporting equipment as well. However, the joy 2

MARKETING STRATEGY OF NIKE COMPANY

of being on top came crashing down when Reebok surpassed Nike with the aerobic phase in athletics. In order to maintain the reputation of Nike, the worlds best shoe corporation, Nike struck back by diversifying their shoes for different kinds of sports activities. Nike continued to rise in success throughout its prosperity by signing famous sports players (Michael Jordan) and using intelligent advertising tactics. Today, Nike is a four billion dollar business that has had its ups and downs. As of now, Nike is having difficulties with the publicity it is receiving about its labor practices in China, South Korea, Indonesia, and Vietnam. The Nike athletic machine began as a small distributing outfit located in the trunk of Phil Knight's car. From these rather inauspicious beginnings, Knight's brainchild grew to become the shoe and athletic company that would come to define many aspects of popular culture and myriad varieties of 'cool.' Nike emanated from two sources: Bill Bowerman's quest for lighter, more durable racing shoes for his Oregon runners, and Knight's search for a way to make a living without having to give up his love of athletics. Bowerman coached track at the University of Oregon where Phil Knight ran in 1959. Bowerman's desire for better quality running shoes clearly influenced Knight in his search for a marketing strategy. Between them, the seed of the most influential sporting company grew. The story goes like this: while getting his MBA at Stanford in the early '60s, Knight took a class with Frank Shallenberger. The semester-long project was to devise a small business, including a marketing plan. Synthesizing Bowerman's attention to quality running shoes and the burgeoning opinion that high-quality/low cost products could be produced in Japan and shipped to the U.S. for distribution, Knight found his market niche. Shallenberger thought the idea interesting, but certainly no business jackpot. Nothing more became of Knight's project. By the late '70s, Blue Ribbon Sports officially became Nike and went from $10 million to $270 million in sales. Katz (1994) describes the success via Nike's placement within the matrix of the fitness revolution: 'the idea of exercise and game-playing ceased to be something the average American did for fun,' instead Americans turned to working out as a cultural signifier of status. Clearly, the circumstances surrounding the shift are not this simple; it is one of the aims of this project to discover other generators of popular attention to health. If Nike didn't start the fitness revolution, Knight says, "We were at least right there. And we sure rode it for one hell of a ride" (Katz, 66). The 80s and 90s would yield greater and greater profits as Nike began to assume the appearance of athletic juggernaut, rather than the underdog of old. "Advertising Age" named Nike the 1996 Marketer of the Year, citing the "ubiquitous swoosh...was more recognized and coveted by consumers than any other sports brand--arguably any brand" (Jensen, 12/96). That same year Nike's revenues were a staggering $6.74 billion. Expecting $8 billion sales in fiscal 1997, Nike has targeted $12 billion in sales by the year 2000. 3

MARKETING STRATEGY OF NIKE COMPANY INDUSTRY OVERVIEW

Bill Bowerman said this couple of decades ago. The guy was right. It defines how he viewed the world, and it defines how Nike pursues its destiny. Ours is a language of sports, a universally understood lexicon of passion and competition. A lot has happened at Nike in the 30 years since we entered the industry, most of it good, some of it downright embarrassing. But through it all, we remain totally focused on creating performance opportunities for everyone who would benefit, and offering empowering messages for everyone who would listen. We feel lucky to have a genuine, altruistic reason to be: the service of human potential. That's the great benefit of sports, and we're glad to be in the middle of it. What started with a handshake between two running geeks in sleepy Eugene, Oregon, are now the world's most competitive sports and Fitness Company. The World Headquarters is in Beaverton, Oregon. The Pacific Northwest is Nike's hometown, but like so many ambitious souls, we have expanded our horizons to every corner of the world. Nike employs around 23,000 people, and every one of them is significant to our mission of bringing inspiration and innovation to every athlete in the world. Along the way Nike joined up with some great partner companies that help extend our reach within and beyond sports. Nike partnered with Hurley International, a premium teen lifestyle brand founded by 20-year industry veteran Bob Hurley based in Costa Mesa, California. In 2003, Nike completed the acquisition of Converse, the globally recognized footwear brand with nearly a century of sports heritage, and home of the perennially popular Chuck Taylor All-Star and Jack Purcell footwear. Separate business units within the Nike brand include The Jordan/Jumpman 23 brand and Nike Golf. As small as we feel, the Nike family is a fairly vast enterprise. We operate on six continents. Our suppliers, shippers, retailers and service providers employ close to 1 million people. The diversity inherent in such size is helping Nike evolve its role as a global company. We see a bigger picture today than when we started, one that includes building sustainable business with sound labor practices. We retain the zeal of youth yet act on our responsibilities as a global corporate citizen. If you have a body, you are an athlete. And as long as there are athletes, there will be Nike.

MARKETING STRATEGY OF NIKE COMPANY PRODUCT TREND

Bovine skin was by far the most preferred leather material, followed by goat/kid/lamb/sheep skin and crocodile skin. Respondents overwhelmingly preferred the color black and, to a lesser extent, dark brown. For handbags/briefcases, popular colors included light brown, white and red. Consumer Segments with the Biggest Spending Power Male professionals, managers and executives are the segment with the biggest spending power for now and in the coming three years. Other major consumer segments include male office workers; sole proprietors/business owners; female office workers; and female professionals, managers and executives. The Competitiveness of Hong Kong Brands/Suppliers of Leather Consumer Goods. Most retailers consider Hong Kong brands to be either very competitive or quite competitive in both high-end and mid-range segments, but less competitive in the lowend segment. The competitiveness of Hong Kong brands mainly rests on their product style/design and quality, with most respondents picking those as the major reasons behind the attractiveness of Hong Kong brands in the high-end and mid-range segments respectively. PRODUCT PROFILE Apart from delivering a pair of comfortable sports shoes Nike also provides a number of value-added features with its products. The features that are a part of every Nike sports shoe are as follows. High Performance Sports Shoes: Nike has patented the Air system and has made it into a regular feature in most of its models. Many models feature an air pocket in the shoe that reduces the weight of the shoe and reduces pressure on the heels. Besides the overall design and compactness of the shoes have made it a favorite of many professional athletes around the world.

MARKETING STRATEGY OF NIKE COMPANY

NIKE sports gear is preferred by professional sports persons. Comfort Nike shoes are renowned all over the world for the comfort they provide. Well padded and cushioned, they provide a tremendous level of comfort to the wearer and reduce the strain to his feet while playing. Lightweight: This attribute is in line with the two described above. A lightweight shoe provides greater mobility and eases the pressure on the feet of the wearer. Durability People purchasing a pair of shoes at such a high price often feel that they have made an investment. They would obviously want to see their shoes last a long time. To prove this point we draw the example of the authors of this marketing plan. All of us own a pair of Nikes and have been wearing them for well over two years a symbol of the durability of Nike shoes. Style Nikes designs are considered to be the most stylish in the industry and beat all others as far as looks are concerned. Attractively packaged, it is a delight to bring a pair home. Add to this the Swoosh the most recognizable symbol in sports and you have a product that would give the user a definite sense of pride. 6

MARKETING STRATEGY OF NIKE COMPANY

NIKE 6.0

NIKE SB

Nike shoes also come with a guarantee card that enables the owner to return it in case of manufacturing defects. However, owing to the fact that the company implements strict quality control measures, coming across a defective pair in a store are a rarity. The most recent additions to their line are the Nike 6.0 and Nike SB shoes, designed for skateboarding. Nike has recently introduced cricket shoes, called Air Zoom Yorker, designed to be 30% lighter than their competitors'.[ Nike positions its products in such a way as to try to appeal to a "youthful....materialistic crowd".[5] It is positioned as a premium performance brand. Sports personalities who endorse NIKE

Roger Fedrer (Tennis)

Tiger woods (Golf)

MARKETING STRATEGY OF NIKE COMPANY

Chapter 2

MARKETING STRATEGY OF NIKE COMPANY

NIKE INDUSTRIES LTD. A COMPANY PROFILE

Nike India Ltd (BIL) is Indias largest footwear company. Nike first established itself in India in 1931 and commenced manufacturing shoes in Batanagar in 1936. The company has its Headquarters in Kolkata and manufactures over 33 million pairs per year in five plants located in Batanagar (West Bengal), Faridabad (Haryana), Bangalore (Karnataka), Patna (Bihar), Hosur (Tamil Nadu). It secures its leather supply from two tanneries in Mokamehghat (Bihar) and Batanagar (West Bengal). It has a distribution network of over 1,500 retail stores and 27 wholesale depots provide excellent access to consumers and wholesale customers throughout India. As on December 31, 2006, the Canadian parent had a 51 per cent stake while institutional holding was about 13 per cent.

RECENT DEVELOPMENTS Nike India has said that its Faridabad and Mokamehghat units are being taken over by Fashion Shoe Private Ltd and BDCL Enterprises Pvt Ltd, respectively. The company is also enabling the buy back provision in its Articles of association to enable buy back of shares. The assets and liabilities of both the units will be transferred to these companies and shares will be offered in the agreed ratio to the existing shareholders of Nike India Ltd on a record date, which will be fixed by the Calcutta High Court. In Simonsons words, The benefits and costs of fitting individual customer preference are more complex and less deterministic than has been assumed. Thats because customer preferences are often ill-defined and susceptible to various influences, and in many cases, customers have poor insight into their preferences. In one of his recent papers, Simonson tackles the issue of one-to-one marketing and mass customization. Supporters of these marketing approaches have suggested that learning what customers want and giving them exactly what they want will create customer loyalty and an insurmountable barrier to competition. But Simonson has this to say: The fact that consumer preferences are often fuzzy, unstable, and manipulatable is unlikely to change. So, the effectiveness of methods to give customers exactly what they (say they) want has been grossly exaggerated. His take on the long-held assumption that individual marketing will supplant targeted marketing is not so fast. In studies, he has learned that even when customers have well-defined preferences and receive offers that fit those preferences, it is far from certain that the response to such offers will consistently be more favorable than those directed at larger market segments. 9

MARKETING STRATEGY OF NIKE COMPANY

. FUTURE PLAN The management says that it is not averse to outsourcing if it worked out cheaper. It is also open to the idea of importing shoes - mostly from China - if it works out cheaper. Nike and Reebok India Company have announced an agreement to foray into retailing partnership for sale of Reebok and Rockport footwear in Nike outlets. The partnership entails retailing a range of sports shoes for walking, running, tennis and training for personal fitness and sports ranging between Rs 900-2,500. An attractive valuation compared to its peers is the main trigger for the scrip. Besides, the companys aggressive focus on retailing and revamping of business (a division into shoes and apparels) is also helping sentiment for the scrip. Plans are afoot to start selling apparel in India made by the joint venture North Star. Theres talk that the company is planning on a voluntary retirement scheme (VRS) to cut costs. For the third quarter ended 30 September 2007, Nike India reduced its losses to Rs 5.68 crore (Rs 8.51 crore) on a 9.2% increase in net profit to Rs 154.27 crore (Rs 141.26 crore). Despite reducing its losses for the quarter, Nike India has, over the last few quarters, been continuously recording weak performances as a result of an overall slowdown in the industry due to lower consumer spending. Increasing domestic competition, particularly from the unorganized sector, has also been eroding into the companys market share. The company is finding it difficult to maintain its market share in a highly pricesensitive Indian market, despite having strong brand recall 97% of the companys revenues are from the domestic market while the remainder is from exports. Nike India is the biggest player in the Indian shoe market. Nike Indias major problems include its high cost of production and low emphasis on marketing. The company may be able to address the first problem through outsourcing products. Batas brand image has been restricted to that of a company that emphasizes on utilitarian products more than trendy ones. Customers feel the company is lacking in innovation. Hence, their preference has shifted to other local brands. Nike India has a large marketing network with over 1,500 showrooms, 27 wholesale depots and eight retail distribution centers across the country. Besides, there is a network of 300 exclusive wholesalers servicing 25,000 dealers all over the country. However, in spite of this and the license to sell other brands like Nike, Hush Puppies and Lotto, Nike has not been able to improve sales consistently. The recent rise in sales during the third quarter ended September 2006 can be attributed to the festive season. Recently, it also entered into a retailing tie-up for Lee Cooper shoes. 10

MARKETING STRATEGY OF NIKE COMPANY

Nike India has also been trying to focus on aggressive marketing of its product. The company has been going through a period of transition for the past one year. With the expansion of the retail industry in New Delhi and Mumbai, the company has recently decided to shift its marketing operations to Delhi in order to provide value shopping for its customers. However, the manufacturing activity and the registered office will continue at Kolkata. Nike India has plans to invest in sophisticated machinery to retain its niche place in manufacturing. The company has put a fresh focus to its retail business. The company has decided to cleanse its wholesale operation by building relationships with creditworthy buyers. . Nike India has decided to appoint brand managers for each product group in a newfound aggression to tackle dwindling sales. Each of these managers assisted by a dedicated team would be like a brand champion responsible for procurement, production, advertisement, promotion and re-supply. Nike India has roped in Ogilvy & Mother for devising its festive season advertising, side-stepping JWT, its incumbent agency. The job involves developing special communication directed towards the festival season shoppers. Nike India Ltd (BIL) is Indias largest footwear company selling over 60 Mn pairs per year in India, USA, UK, Europe, Middle East and Far East. BIL has a market share of 60% in leather products and 70% in canvas shoes. The footwear industry in India is highly fragmented and dominated by the unorganized sector. The industry size is around Rs 75 Bn and is growing at around 10% annually. It competes with Indian players such as Liberty Shoes, Phoenix International, Mirza Tanners, Tatas, Action Shoes and Lakhani Shoes and global players like Adidas, Reebok and Nike. Accessories and garments contribute footwear sales account for more than 96% of sales while the balance. The turnover break up is as follows Products Volume (%) Value (%) Rubber and Canvas 50: 30 Leather 29:57 Plastic 21: 9

11

MARKETING STRATEGY OF NIKE COMPANY

GROWTH DRIVERS The Company has a very comprehensive distribution network which comprises its own and franchise stores. It has 1500 showrooms, 25 wholesale depots and 8 distribution centers. POPULAR BRANDS Nike owns brands like Hush Puppies, Signor, Marie Claire Power, Sandak, Hawai, Naughty boy and Ambassador. It also distributes other brands such as Nike and Lotto. Focus on middle-class and upper class Nike will continue to focus on middle and upper class customers. It is introducing budget stores which will help customers to identify with the brand. It is also increasing focus on rural thrust for volume growth in the lowpriced footwear segment. RISK AND CONCERN Lifting of quantitative restriction on import of footwear will lead to the market being flooded by imports. Labor issues have always bothered BIL and this resulted in disruption of manufacturing activities on numerous occasions. Competition is hotting up in the domestic market due to popular brands such as Gaitonde, Red Tape, Lotus Bawa and Tatas. These brands are gaining market share especially in the premium segment and in this segment BIL has no significant presence. Latest Results Sales for Q3 FY2000 increased by 5.5% yoy to Rs1.7bn. profits dropped by 90% yoy to Rs3.8 Mn due to lower operating margins and higher depreciation and interest. Depreciation increased by 6.3% yoy to Rs 37 Mn while interest cost increased by 9.3% yoy to Rs 23.4 Mn. Operating margins dropped by 3.3% due to increase in input cost. The Peenya plant has not commenced operations despite lifting up of the lock out since July 3, 2007.

12

MARKETING STRATEGY OF NIKE COMPANY

VALUATION BILs long-term success is dependent on the how labour issue is tackled and the flexibility, which it can adopt to meet threat of imports and competition from local footwear companies. Long term investors with a two-year investment horizon can accumulate the stock at current levels. It is also increasing focus on rural thrust for volume growth in the low-priced footwear segment. Lifting of quantitative restriction on import of footwear will lead to the market being flooded by imports. Labor issues have always bothered BIL and this resulted in disruption of manufacturing activities on numerous occasions. Competition is hotting up in the domestic market due to popular brands such as Gaitonde, Red Tape, Lotus Bawa and Tatas. These brands are gaining market share especially in the premium segment and in this segment BIL has no significant presence. Sales for Q1 CY2001 decreased marginally by 0.6% yoy to Rs 1590.7 mn. There was a net loss of Rs 30.2 mn as against a profit of Rs 39.6 mn in the corresponding period of the previous year. The loss is due to lower operating margins and higher interest. BILs long-term success is dependent on the labor issue and the flexibility, which it can adopt to meet threat of imports and competition from local footwear companies. Long term investors with a two-year investment horizon can accumulate the stock at current levels.

13

MARKETING STRATEGY OF NIKE COMPANY

LITERATURE REVIEW The study of consumer behavior has evolved since the Information Processing Model (Bettman, 1979) assumed that the individual is logical in his/her buying process. This model was criticized because it failed to treat different consumption phenomena motivated by symbolic meanings (Holbrook and Hirschman, 1982). Individuals are not always looking for efficiency and economy, but also for distraction, aesthetic, expression, etc. (Boyd and Levy, 1963). Calling for a broadening of theoretical frameworks of consumer behavior, many authors pleaded in favor of the study of all consumption forms (Holbrook, 1986), being inspired by European semi logy and American semiotic (Levy, 1959, 1963, 1981; Hirschman, 1980; Kehret-Ward, Johnson and Louie, 1985; Mick, 1986; Holbrook, 1986; OShaughnessy and Holbrook, 1988; Nth, 1988; Stern, 1988; Grafton-Small and Linstead, 1989). These are the study of signs, meanings and production of symbols. Fantasy, emotion and pleasant aspects of consumption were then tackled from an experiential point of view. The Experiential View is a phenomenological perspective that perceives consumption as a primary state of consciousness having a variety of symbolic meanings, responses and hedonist criteria (Holbrook and Hirschman, 1982; Olshavsky and Granbois, 1979). The basis of the traditional Information Processing Model is the optimization of the utility of a product under the basis of a utilitarian evaluation of its tangible characteristics. Nevertheless, it neglects emotional aspects. On the other hand, the Experiential View leaves out different factors such as economic conditions, expectations, some elements of the marketing mix (price, distribution), perceived risk and conflicts, but mostly the social influence of the consumers reference groups (Holbrook and Hirschman, 1982; Business Central Europe, 1994) which is the aim of the Symbolic Interactionism Perspective. Acquisition, possession and consumption are activities taking place in a process of impressions creation or identity management which is, according to Belk (1978), an interactive process concerning both the image of goods consumed and that of the individuals consuming them. She created a website where people could customize products to their individual preferences and needs. Crow selected three generic products: pizza, shoes, and a Personal Digital Assistant (PDA). Thirty-one college students took part in the study. "Students could customize the three products, and I provided a drop-down box on the site with attributes to choose from," she explained. Consumers could click on a dropdown box to customize a product they would want to purchase, she said. She found that more people relied on the default choices rather than selecting other choices that were offered. She said, some research suggests that many people do not want to put a lot of effort into purchase decisions. "A lot of times, people may not have preferences already in mind," she said. When consumers have the chance to create preferences, the question is whether they rely on previous preferences or if they develop new ones, she said. In the 14

MARKETING STRATEGY OF NIKE COMPANY

future, Crow says she will be studying strategies that consumers go through during purchase decisions. "I will be studying decision processes to develop computer aids that could help the consumer reach their purchase decision," she said. Although her current project involves analyzing the consumer behavior of college students in an online environment, in future projects she plans to analyze other demographic groups. Customization will be a key business opportunity in the future for businesses online or in more typical shopping environments," Crow said. She hopes her research will help consumers in making purchase decisions and help businesses determine products to offer and how to offer them. Hong Kong companies, including leather consumer goods suppliers, have shown a growing interest in tapping the mainland consumer market after China's accession to the World Trade Organization and gradual opening of its domestic market. For Hong Kong companies targeting this vast market, a good understanding of the behavior of mainland consumers is necessary in order to formulate an effective and suitable market strategy. In view of this, the HKTDC conducted a survey study in four major mainland cities in February 2007. The study was composed of two interlocking surveys. The first survey (survey on shoppers) successfully interviewed a total of 1,000 shoppers of leather consumer goods in four major cities, namely Beijing (BJ), Chengdu (CD), Guangzhou (GZ) and Shanghai (SH). The second survey (survey on retailers) interviewed managers/officers-in-charge of major department stores in these four cities. The survey study analyses leather consumer goods in terms of consumer behavior, the competitiveness of Hong Kong brands and the consumer segments with the greatest biggest spending power. The main survey findings are as follows:

15

MARKETING STRATEGY OF NIKE COMPANY

CONSUMER BEHAVIOR Shopping locations, Department stores were the most preferred type of retailers, followed by outlets in shopping malls and chain stores. Product variety, guaranteed quality, brand choice, price, services and store environment were cited as the major reasons for visiting a leather consumer goods store. SHOPPING TIME Thirty-eight percent of respondents visited leather consumer goods shops at least once a month. Shopping during weekends is common. Other popular shopping occasions include National Day (1st October), Chinese New Year (January/February), New Year's Day (January) and Labour Day (1st May). MARKETINGCHANNELS Promotional activities in shopping malls and department stores are the most popular promotional and sales activities, followed by discount/price reduction, TV commercials, discount coupons, promotional stands, exhibitions, buy-one- (or more) gets-one-free. PURCHASING POWER On average, respondents owned 4.2 pairs of shoes, 1.2 pieces of wallets, 1.3 pieces of belts and 1.3 pieces of handbags/briefcases. Over the past 12 months, an average respondent's spending on leather consumer goods was as follows: -Shoes: RMB 597 (total) RMB 328 (per pair) -Wallet: RMB 226 (total) and RMB 193 (per piece) -Belt: RMB 220 (total) and RMB 194 (per piece) - Handbag/briefcase: RMB 476 (total) and RMB 359 (per piece) SELECTION CRITERIA When choosing leather consumer goods, product quality stood out as the principal consideration for respondents, followed by product material, craftsmanship, style/design, price and brand.

16

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 4

17

MARKETING STRATEGY OF NIKE COMPANY

4PS OF NIKE

Nikes 4Ps comprised of the following approaches to pricing, distribution, advertising and promotion, and customer service: Pricing: Nikes pricing is designed to be competitive to the other fashion shoe retailers. The pricing is based on the basis of premium segment as target customers. Nike as a brand commands high premium. Place: Nike shoes are distributed to Multi Brand store front and the exclusive Nike stores across countries. While this necessitates a second trip for the customer to come and pick up the shoes, it allows Nike to offer a much wider selection than any of the competition.

18

MARKETING STRATEGY OF NIKE COMPANY

Promotion: Location, targeted advertising in the newspaper and strategic alliances serves as the foundation of Nike advertising and promotion effort. The athletes and other famous sports personalities are always taken as brand ambassadors. They form the prime building blocks of their portion strategy. Product: The product range of Nike comprise of shoes, sports wear, watches etc. Its product history began with long distance running shoes in 1963. (Past 17 years: Air Jordan basketball shoes). Wide range of shoes, apparel and equipment. For example: Nike Oregon Digital Super Watch Nike Presto Cee Digital Medium Watch Nike Presto Cee Digital Small Watch Nike Ron Analog Watch Nike Triax 10 Regular Watch Nike Triax Armored II Analog Super Watch Nike Women's Imara Fit Digital Watch

19

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 5

20

MARKETING STRATEGY OF NIKE COMPANY

S.W.O.T ANALYSIS

STRENGTHS Nike is a very competitive organization. Phil Knight (Founder and CEO) is often quoted as saying that 'Business is war without bullets.' Nike has a healthy dislike of is competitors. At the Atlanta Olympics, Reebok went to the expense of sponsoring the games. Nike did not. However Nike sponsored the top athletes and gained valuable coverage. Nike has no factories. It does not tie up cash in buildings and manufacturing workers. This makes a very lean organization. Nike is strong at research and development, as is evidenced by its evolving and innovative product range. They then manufacture wherever they can produce high quality product at the lowest possible price. If price rises, and products can be made more cheaply elsewhere (to the same or better specification), Nike will move production. Nike is a global brand. It is the number one sports brand in the world. Its famous 'Swoosh' is instantly recognizable, and Phil Knight even has it tattooed on his ankle. 21

MARKETING STRATEGY OF NIKE COMPANY

WEAKNESSES The organization does have a diversified range of sports products. However, the income of the business is still heavily dependent upon its share of the footwear market. This may leave it vulnerable if for any reason its market share erodes. The retail sector is very price sensitive. Nike does have its own retailer in Nike Town. However, most of its income is derived from selling into retailers. Retailers tend to offer a very similar experience to the consumer. Can you tell one sports retailer from another? So margins tend to get squeezed as retailers try to pass some of the low price competition pressure onto Nike. OPPORTUNITIES Product development offers Nike many opportunities. The brand is fiercely defended by its owners whom truly believe that Nike is not a fashion brand. However, like it or not, consumers that wear Nike product do not always buy it to participate in sport. Some would argue that in youth culture especially, Nike is a fashion brand. This creates its own opportunities, since product could become unfashionable before it wears out i.e. consumers need to replace shoes. There is also the opportunity to develop products such as sport wear, sunglasses and jewellery. Such high value items do tend to have associated with them, high profits. The business could also be developed internationally, building upon its strong global brand recognition. There are many markets that have the disposable income to spend on high value sports goods. For example, emerging markets such as China and India have a new richer generation of consumers. There are also global marketing events that can be utilized to support the brand such as the World Cup (soccer) and The Olympics. THREATS Nike is exposed to the international nature of trade. It buys and sells in different currencies and so costs and margins are not stable over long periods of time. Such an exposure could mean that Nike may be manufacturing and/or selling at a loss. This is an issue that faces all global brands. The market for sports shoes and garments is very competitive. The model developed by Phil Knight in his Stamford Business School days (high value branded product manufactured at a low cost) is now commonly used and to an extent is no longer a basis for sustainable competitive advantage. Competitors are developing alternative brands to take away Nike's market share. As discussed above in weaknesses, the retail sector is becoming price competitive. This ultimately means that consumers are shopping around for a better deal. So if one store charges a price for a pair of sports shoes, the consumer could go to the store along the street to compare prices for the exactly the same item, and buy the cheaper of the two. Such consumer price sensitivity is a potential external threat to Nike. 22

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 6

23

MARKETING STRATEGY OF NIKE COMPANY

DATA ANALYSIS

A). DEMOGRAPHY OF RESPONDANTS ANALYSIS: It was observed that the majority of the respondents consist of professional from various fields like engineers, software professionals, working executive etc. who effective form 38% of our database. While 36% were students from various fields. Others constitute designers and athletes etc. the further study is carried on the buying behavior of the above mentioned categories of consumer, which shows that our consumer is well educated and is very well informed about the product. 2). CONSUMERS INCOME LEVEL AND SPENDING CAPACITY ON SHOES ANALYSIS: In the survey conducted a direct relation between the income level and the spending capacity was observed. Also it was found that students were spending in the range of Rs 1000 Rs 3000 as compared to the working class professionals who were ready to spend between Rs 3000 Rs 6000, since they have higher spending power because of higher income levels. 3). SHOPPING SEASON ANALYSIS: Amongst the student and the professional it was found the consumer buying BEHAVIOR does not change with respect to the seasons and occasion as most of the consumer would like to buy their shoes as and when need arises, whereas the businessman generally do their shoes shopping during traveling or on special occasions.

24

MARKETING STRATEGY OF NIKE COMPANY

4). BRAND RECOLLECTION: ANALYSIS: When asked about reconciling a sports shoes brand about 70% of the respondent were able to recall REEBOK or ADDIDAS were as rest were able to remember NIKE and FILA brands. This was due to the fact that REEBOK has brand ambassador like RAHUL DRAVID and YUVRAJ SINGH.

5). FACTOR INFLUENCING THE BUYING PROCESS: ANALYSIS: Among the various factors like social, psychological, personal and cultural factors it was observed that the consumer give more preference to his personal choice and psychological factors like 50% of the people consider comfort and they generally do not consider durability as an important aspect because they believe that it comes along with the brand. Also the social factor like style was second most important factor behind the consumer buying motives.

25

MARKETING STRATEGY OF NIKE COMPANY

(B) COMPARISON WITH OTHER BRANDS ANALYSIS: In response to the question about giving, out of 100 point to the various factors affecting their buying BEHAVIOR between NIKE and OTHERS following was observed: OTHERS 20 10 30 10 30 NIKE 30 10 30 20 10

a. Style b. Price c. Comfort d. Brand e. Durability

This further shows that the consumer look for style in the NIKE more in comparison to the other brand hence, gave their 30 points to it whereas 20 in case of other brands it was seen that the comfort remains at equal place even while choosing a competitive brand. BUYING FORCES ANALYSIS: It was observed that consumer is forced by no factors like peer pressure, family and friends and some time people would like to buy a product because it is being endorsed by their favorite celebrity. It was observed that the beside that personal choice of the respondent, the pressure from the friends plays an important buying force for the students, while the peer and college in case of the professional and the least pursuing factor is family which was seen in case of the respondents belonging to age group 35 years and above. NO OF PEOPLE BUYING NIKESHOES & REEBOK SHOES: ANALYSIS: This question was asked to know the market capture by the REEBOK and the time period of association of the customers with REEBOK. It was deduced that more than 75% of the respondents were using the REEBOK shoes and were mainly associated with it for a period of 1 year or more. While the remaining respondents were using either the NIKE or ADDIDAS brand shoes.

26

MARKETING STRATEGY OF NIKE COMPANY

CUSTOMER SATISFACTION: ANALYSIS: Because of the quality product offered by the REEBOK about 60% of the respondents were either very satisfied or satisfied, while 10% did not gave any response as they were not using the REEBOK shoes. 1. Do you ask for a specific brand by name? 90% people say yes to this and the remaining 10% say no. 2. Which brand do you generally use? People in India prefer Nike the most as we can see that 24% people prefer Nike sports wear. Then comes Adidas and Reebok. 3. Has any sports shoes ad (seen on TV/in a magazine) made an impact on you? YES NO NIKE 43 57 ADIDAS 63 37 REEBOK 45 55 ACTION 30 70 Most of the people are influenced with Adidass ad, then with Reebok and then Nike. The most un-influential is that of action. 4. What according to you is the relative importance of the following? PRICE DURABILITY BRAND IMAGE COMFORTABLE LOOKS V. Imp 50 55 40 54 40 Imp. 28 45 20 36 40 Not so Imp. 12 0 15 10 15 Doesnt 10 0 15 0 5

By this we infer that the consumer wants the shoe to be durable that is of primary importance for them. Then the price is also very important for them. The shoe should be comfortable. Along with that looks and the brand image is also important. 27

MARKETING STRATEGY OF NIKE COMPANY

5. What features of Nike do you like the most? The most liked feature of Nike is the light weight shoe. Then it is the enhanced toe support. From here we can infer that most important aspect for the consumers is the comfort they get from the shoes. 6. What range you prefer? Larger number of people goes in for shoes that come under the range of Rs. 1500-3500. A s we know that Nike is a premium brand 27% of the buy shoes that falls under the range of Rs. 3500-7500 and lesser no. of people buy shoes ranging in between 3500 and 5500. 7. How often you buy Nike? 62% of the consumers buy Nike only once a year. Here we notice one thing that some dont buy Nike. 8. Are you satisfied buying Nike? The people who buy Nike are fully satisfied buying it, their percentage is 64%. Only 15 % are not satisfied buying it. 9. Do you think Nike serves the purpose of being a good brand, for Sports wear? 56% of the people agree that Nike serves its purpose for being a sport brand. Only 27% people dont agree with it.

10. Will you prefer Nike launching a new range which can serve the purpose of service class? 67% say yes to the idea of launching a new range for the service class. 36 dont have any idea of this.

28

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 7

29

MARKETING STRATEGY OF NIKE COMPANY

RECOMMENDATIONS & FINDINGS The specific brand objective of Nike India would be to build up its brand reputation, image and equity. A brand is not simply a collection of products and benefits, but also a storehouse of value stemming from awareness, loyalty, and association of quality and brand personality. A brand is a name, term, sign, symbol or design or a combination of them intended to identify the goods or services of one seller or group of sellers and to differentiate from those of competitors. In essence, a brand identifies the seller or maker. It can convey up to six levels of meaning: Attributes, Benefits, Values, Culture, Personality and User. If a company treats a brand only as a name it misses the point. The branding challenge is to develop a deep set of positive associations for the brand. Although these six meanings are noticeable in the Nike brand in the west and other parts of the world, they are yet to be cultivated in India. Nike has to ensure that their brand is built up on these pillars in India. The secondary brand objective of Nike India would be to ensure that they match the market share and sales volumes of its competitors. After all, a company is in business to make profits and stay ahead of its competitors. A company, product or brand may have a very good reputation and image, but if it is not profitable, it does serve its purpose. At the same time sales figures and data can be misleading. Hence market share has also to be paid attention to. Nike despite being one of the most popular brands in the world has not really caught on in India. Yet, there is reason to believe that Batas Power and Liberty would be ahead of Nike in terms of popularity. We also notice that Nike is at par with Reebok. This again does not reflect too well on the brand, considering that Nike outsells Reebok everywhere else in the world. Hence it is reasonable to state that Nikes popularity level in India could do with a boost. The best way to achieve this would be some serious brand building. The image of the brand has to be improved and people must be made aware of its presence. Thus, the rationale behind choosing improvement of brand image and reputation as the companys primary objective is quite clear. Nikes distinctive competency lies in the area of marketing, particularity in the area of consumer brand awareness and brand power. On the global scale this key distinctive competency towers over the competitors. As a result, Nikes market share is number-one in the athletic footwear industry in most places around the world. Catch phrases like, "Just Do It," and symbols like the Nike "Swoosh," couple with sports icons to serve as instant reminders of the Nike Empire. It is about time that this competency is leveraged on to India. Two key attributes of a distinctive competency are its inability to be easily replicated and 30

MARKETING STRATEGY OF NIKE COMPANY

the value or benefit it offers to consumers. Few companies have such a recognizable image and the resources to promote it. This ultimately translates into added value for consumers. The public benefits from the strength of Nikes image at the point of purchase. For decades, consumers have come to associate the Nike image with quality products. By associating star athletes and motivational slogans like, "Just Do It," with marketing campaigns that emphasize fitness, competition, and sportsmanship, consumers identify their purchases with the prospect of achieving greatness. Younger consumers especially benefit from this positive influence. This image is something that competing companies can not easily duplicate by simply enhancing the physical characteristics of their products. Nikes vision is to remain the leader in the industry. The company will continue to produce the quality products that have been provided in the past. Most importantly, Nike will continue to meet the ever-changing needs of the customers, through product innovation. In the past, the company has utilized product differentiation as the main competitive strategy. As Nikes reputation dictates, it will continue to place emphasis in this area. Nike has built its business on providing products that rise above all others and this has made it the worldwide success that it is today. Nike is known for its technologically advanced products and is the leader in this area. This allows Nikes products to stand out from the rest. The companys focus also allows it to maintain a somewhat narrow niche that enables it to effectively capture the needs and wants of the consumers. An example of Nikes superior and innovative technology is its new range of shoes called Air Presto. Termed as the first T-shirt for the feet, these shoes can take the shape and size of the wearers feet. Unlike regular shoes it comes are sizes like XL, L, M, S and XS. Each of these sizes can accommodate three conventional foot sizes. Nike will continue to produce such path-breaking products in the future and stay a step ahead of its competitors. Nike will also focus on making a strong effort in price leadership. Nikes products in the past have been concentrated in the higher end of the pricing category. An entrance will now be made into lower price categories with these quality products. This will enable Nike to capture an even greater hold on market share. Presently, the only form of customer relationship management activity that Nike has adopted in India is product warranty. Nike shoes come with a six-month warranty. If the shoe is found to be defective or wears out within six months due to no fault of the wearer, Nike replaces the product. This is only the first step and more needs to be dome in this area. Being a company that always strives towards excellence, Nike needs to know exactly what its customers think about their products. A good way of assessing this would be to have the customer fill in a form at the point of purchase. The form will ask the customer his / her opinion on the product as well as the showroom. Suggestions and comments would be welcome. However, care must be taken to ensure that these forms are not too 31

MARKETING STRATEGY OF NIKE COMPANY

cumbersome and do not take up too much of the customers time. Surveys have indicated that normally people dont mind filling in forms as long as they are not too long. Another good method would be to introduce a system of customer points. Every time a customer makes a purchase, he would earn himself a certain number of points, depending on the price of the product. After he crosses a certain point level, he would be entitled to a gift from the company or choose a product of a certain value from the range. This would be helpful in building customer loyalty and give them an incentive to make repeat purchases. A most valued customer database could be created from her e and various forms of direct marketing could be directed at them. This would help the company to retain its existing customers. A third way to improve customer relationship would be to issue gift coupons and vouchers. People would have the facility to buy these vouchers and present them to their dear ones. This would be a good way to reach out towards newer customers through existing ones. To explore the mainland market, Hong Kong companies should position themselves in areas in which they are strong. From the viewpoint of mainland consumers, Hong Kong's leather consumer goods are considered competitive in the high-end and mid-range. Mainland consumers are brand conscious, and it is vital to promote own brands which have clear image. This survey also shows that Hong Kong products are preferred for their design/style and quality. Bearing these in mind, Hong Kong companies should never compromise on quality, and they should allocate more resources to product design, selection of material and craftsmanship.

CHAPTER 8 32

MARKETING STRATEGY OF NIKE COMPANY

33

MARKETING STRATEGY OF NIKE COMPANY

CONCLUSION Department stores are the prime sales and marketing channel for leather consumer goods. In addition, store decorations and product displays should be designed to create a strong first impression. Seasonal promotion campaigns, like special discounts and advertisements, could be employed. New lines of collections should be introduced for festivals. In addition to promotional activities in shopping malls and department stores, discounts and TV commercials are considered effective channels for promotion. It is advisable to pay attention to the affordability of customers in different cities, while setting price points for different product categories. Meanwhile, leather shoes offer better growth potential. Due to their growing spending power, the rising middle class should be the target of Hong Kong's sellers of leather consumer goods. Hong Kong companies should put more emphasis on products for business use. In addition, it is useful to introduce appropriate designs that cater for the tastes of the middles class. Double Click 2006 Consumer Email Study October 2006, the fourth of Double-Click annual consumer email studies points to an increasing sophistication in consumer usage of email functionality and a corresponding complexity of purchasing behavior. The Spam crisis continues to affect consumer behavior online but does not necessarily cloud consumer receptiveness to legitimate marketers: an overwhelming majority of online consumers receive offers by email and have made a purchase online or offline as a result. Consumers are using available tools to limit spam and are employing operate email accounts for purchasing, all in attempts to increase control and improve their email experience. Working with Beyond Interactive and the NFO//net source panel of 900,000 US consumers, polled 1,000consumers via email from July 30 - August5, 2007. Key Findings The majority of consumers receive some kind of marketing email with special offers from retailers most common Sender recognition most impacts operates, while content relevance increases likeliness to purchase Frequency ascertain category, are very specific to the category of email but vary greatly from one consumer to the next; frequency of permission based email is clearly a great concern to consumers and has an impact on what they consider to be Spam. Email drives multi-channel purchases and has an immediate as well as a latent Nearly 64% of consumers cite the line as the most important factor in opening an email.2006 Consumer Email Study impact. It drives consumers most often to the online channel but also results in retail and catalog sales. Consumers have become sophisticated in their use of ISP-supplied tools to limits Pam and in their usage of various email addresses to manage their varied email activities Home and free email addresses are most often used for purchasing, within email address specifically designated for that usage. Men and women have radically different ideas of what spam is and different purchasing behavior related to Spam. Women are more receptive to promotions and discounts and correspondingly more interested in and 34

MARKETING STRATEGY OF NIKE COMPANY

tolerant of marketing emails than men. Receptiveness to Marketer Emails. The vast majority (91%) of consumers receive some form of permission-based email with 57.2% receiving special offers from online merchants, 55.4% receiving them from traditional retailers, and 48.5%receiving them from catalogers. Other popular types of marketing emails included account statements/online bill payment information (received by 49.8% of respondents), travel emails (43.3%), coupons for groceries (40.0%), health (41.1%) and household tips/recipes/crafts (42.1%). Of categories in which consumers do not currently receive e-mails, respondents are most interested in receiving grocery coupons (cited by 22.1%) and household tips/recipes/crafts (13.6%). Women remain the primary household purchasers, 2007 Consumer Email Study Respondents with multiple accounts likely to use a free one for online purchases Women more likely to be active purchasers, multi-channel purchasers. The fourth of Double-Click annual consumer email studies points to an increasing sophistication in consumer usage of email functionality and a corresponding complexity of purchasing behavior. The Spam crisis continues to affect consumer behavior online but does not necessarily cloud consumer receptiveness to legitimate marketers: an overwhelming majority of online consumers receive offers by email and have made a purchase online or offline as a result. Consumers are using available tools to limit spam and are employing separate email accounts for purchasing, all in attempts to increase control and improve their email experience. Objectives/Methodology Double-Click, working with Beyond Interactive and the NFO//net source panel of 900,000 US consumers, polled 1,000consumers via email from July 30 - August5, 2007. All respondents recruited use email/internet 1+ times per week, which reflects the usage of the larger online population (94% of the 18+ online population according to Nielsen, 2007).There was an equal segmentation of men and women and the average age was 42.7.This is the fourth of an annual series of consumer research studies and trending information was derived using the data from previous years. The sample mirrored previous studies and is reflective of the online population as a whole. Key Findings The majority of consumers receive some kind of marketing email with special offers from retailers, online merchants and catalogers most common Two to one consumers prefer to be contacted by their favorite retailer regarding new products, services or promotions via email rather than direct mail. Sender recognition most impacts operates, while content relevance increases likeliness to purchase Frequency preferences, or how often respondents prefer to receive emails of ascertain category, are very specific to the category of email but vary greatly from one Consumers prefer to be contacted by their favorite retailer via email.

35

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 10

BIBLIOGRAPHY & WEBLIOGRAPHY

BOOKS & NEWSPAPER Marketing Management - Philip Kotler Consumer Behavior, 6th Edition, by Hawkins, Best ad Coney. Economic Times

WEBSITES www.Nikebiz.com www.Business.com www.Indiainfoline.com

36

MARKETING STRATEGY OF NIKE COMPANY

CHAPTER 9 QUESTIONNAIRE 1) I buy my own shoes Very frequently frequently sometimes never 2) I find buying shoes a pleasurable event. Very frequently frequently sometimes never 3). I buy costly shoes Very frequently frequently sometimes never 4) For purchasing shoes, I can travel long distance Very frequently frequently sometimes never 5) I buy shoes which are liked by my family 37

MARKETING STRATEGY OF NIKE COMPANY

Strongly agree Agree Indifferent Disagree Strongly disagree 6) I buy shoes which are advertised attractitively Strongly agree Agree Indifferent Disagree Strongly disagree 7) I buy shoes which are advertised and endorsed by celebrity. Strongly agree Agree Indifferent Disagree Strongly disagree 8) I like to buy shoes which are imported from Paris or Italy. Strongly agree Agree Indifferent Disagree Strongly disagree 9). I like to buy shoes which are designed in Paris or Italy. Strongly agree Agree Indifferent Disagree Strongly disagree 10). I like to buy shoes which are very stylish & of latest design. 38

MARKETING STRATEGY OF NIKE COMPANY

Strongly agree Agree Indifferent Disagree Strongly disagree

11). I like to buy shoes which are less expensive but very stylish & of latest design. Strongly agree Agree Indifferent Disagree Strongly disagree 12). I Like to buy shoes which are not very stylish but comfortable (%.of Respondents) Strongly agree Agree Indifferent Disagree Strongly disagree 13). I Like to buy shoes which are not stylish but comfortable and long lasting Strongly agree Agree Indifferent Disagree Strongly disagree

39

MARKETING STRATEGY OF NIKE COMPANY

40

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Project On SaarcDocument52 pagesProject On SaarcManasi GhagPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Motivation New ProectDocument13 pagesMotivation New ProectManasi GhagPas encore d'évaluation

- A Project Report On Targeting and Positioning Strategy of Reliance MoneyDocument68 pagesA Project Report On Targeting and Positioning Strategy of Reliance MoneySamir Anand100% (106)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Employee MotivationDocument140 pagesEmployee MotivationManish RajanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- QuestionaireDocument25 pagesQuestionairemsaamir115851Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Preface This Report Focus On KFC Marketing Strategies, Its MarketingDocument27 pagesPreface This Report Focus On KFC Marketing Strategies, Its Marketingdaaman100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Mcdonald ProjectDocument36 pagesMcdonald ProjectShruti SrivastavaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Project Report On TATA SteelDocument38 pagesProject Report On TATA Steelamin pattani70% (43)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDDocument78 pagesThe Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDsahoo_iilm80% (5)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Selection Recruitment - IciciDocument82 pagesSelection Recruitment - IciciVinay PawarPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Saarc ProjectDocument22 pagesSaarc Project✬ SHANZA MALIK ✬Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Project On TATA MOTORSDocument54 pagesProject On TATA MOTORSpreeyankagupta82% (87)

- A Project Report On Targeting and Positioning Strategy of Reliance MoneyDocument68 pagesA Project Report On Targeting and Positioning Strategy of Reliance MoneySamir Anand100% (106)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

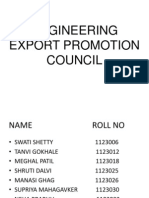

- Engineering Export Promotion CouncilDocument26 pagesEngineering Export Promotion CouncilManasi GhagPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Organisational Culture and Climate23Document52 pagesOrganisational Culture and Climate23Manasi GhagPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Kingfisher Airlines SMDocument25 pagesKingfisher Airlines SMkoolkktPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Hindustan Times Vs Times of India RasikaDocument74 pagesHindustan Times Vs Times of India RasikaManasi Ghag100% (2)

- Coke Vs Pepsi 120411025001 Phpapp01Document73 pagesCoke Vs Pepsi 120411025001 Phpapp01Manasi GhagPas encore d'évaluation

- The Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDDocument78 pagesThe Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDsahoo_iilm80% (5)

- Casestudy On Kingfisher AirlinesDocument5 pagesCasestudy On Kingfisher Airlinesbette_ruffles60% (10)

- The Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDDocument78 pagesThe Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDsahoo_iilm80% (5)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Project On TATA MOTORSDocument54 pagesProject On TATA MOTORSpreeyankagupta82% (87)

- Casestudy On Kingfisher AirlinesDocument5 pagesCasestudy On Kingfisher Airlinesbette_ruffles60% (10)

- All About BrandingcfDocument29 pagesAll About BrandingcfManasi GhagPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Project On TATA MOTORSDocument54 pagesProject On TATA MOTORSpreeyankagupta82% (87)

- Hindustan Times Vs Times of India RasikaDocument74 pagesHindustan Times Vs Times of India RasikaManasi Ghag100% (2)

- Maintaining The Competitiveness of A Global BrandDocument7 pagesMaintaining The Competitiveness of A Global BrandManasi GhagPas encore d'évaluation

- Marketing Strategies of NIKE1Document40 pagesMarketing Strategies of NIKE1Manasi GhagPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Project On TATA MOTORSDocument54 pagesProject On TATA MOTORSpreeyankagupta82% (87)

- Paradigm Shift in MarketingDocument16 pagesParadigm Shift in Marketingpinku_thakkarPas encore d'évaluation

- Research ProblemDocument44 pagesResearch ProblemBiju KumarPas encore d'évaluation

- Marketing Strategies: Market SegmentationDocument19 pagesMarketing Strategies: Market SegmentationseeumarPas encore d'évaluation

- Inventory ResumeDocument6 pagesInventory Resumeusutyuvcf100% (2)

- Sales and Inventory Record System FinalDocument63 pagesSales and Inventory Record System FinalFrances FernandezPas encore d'évaluation

- Evans, Et Al. v. United Bank, Et Al. Second Amended ComplaintDocument70 pagesEvans, Et Al. v. United Bank, Et Al. Second Amended Complaintjhbryan1715Pas encore d'évaluation

- Buy Sell MTN Medium Term Notes Contract With Pre AdviceDocument19 pagesBuy Sell MTN Medium Term Notes Contract With Pre AdviceChantal Sue PalerPas encore d'évaluation

- Chapter 1 - Marketing in Today's EconomyDocument43 pagesChapter 1 - Marketing in Today's EconomyEtpages IgcsePas encore d'évaluation

- Chapter 1 - Market AspectDocument43 pagesChapter 1 - Market AspectPiolen NicaPas encore d'évaluation

- MT9 Doucette Sliusarenko Yang Thesis Final DraftDocument61 pagesMT9 Doucette Sliusarenko Yang Thesis Final DraftHUỆ TRẦN THỊPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Philippine Competition Act NotesDocument5 pagesPhilippine Competition Act NotesRyDPas encore d'évaluation

- Gold Cup P11&14Document32 pagesGold Cup P11&14thierrylindoPas encore d'évaluation

- Inside The Locked BoxDocument8 pagesInside The Locked BoxvoizesPas encore d'évaluation

- Citn New Professional Syllabus - Indirect TaxationDocument95 pagesCitn New Professional Syllabus - Indirect TaxationtwweettybirdPas encore d'évaluation

- Cbi SheetDocument30 pagesCbi SheetS. BIKKI KUMARPas encore d'évaluation

- New Project of LaysDocument22 pagesNew Project of LaysBabar Arain50% (2)

- Group of Buyers and Sellers With The Potential To Trade: PrelimsDocument12 pagesGroup of Buyers and Sellers With The Potential To Trade: PrelimsSophia Varias CruzPas encore d'évaluation

- Week 6 Part 1 Module 3 AssignmentTemplateDocument10 pagesWeek 6 Part 1 Module 3 AssignmentTemplateRobert oumaPas encore d'évaluation

- CIR V Phil Daily InquirerDocument17 pagesCIR V Phil Daily InquirerIvy EdodollonPas encore d'évaluation

- Research About Business: Processes ofDocument24 pagesResearch About Business: Processes ofPhuong Anh NguyenPas encore d'évaluation

- Satyaprakash .Document491 pagesSatyaprakash .aecPas encore d'évaluation

- Planning and Preparation For Export: Export-Import Theory, Practices, and Procedures Belay Seyoum 3 Edition (Or Newer)Document29 pagesPlanning and Preparation For Export: Export-Import Theory, Practices, and Procedures Belay Seyoum 3 Edition (Or Newer)Farhan TanvirPas encore d'évaluation

- Sales Force in The Go-To-Market StrategyyDocument36 pagesSales Force in The Go-To-Market Strategyygilles.neumon6331Pas encore d'évaluation

- SMU MBA Final Project Vijay Sood 1302017393 LibreDocument61 pagesSMU MBA Final Project Vijay Sood 1302017393 Libresuresh9064Pas encore d'évaluation

- Poultry Farm Business PlanDocument25 pagesPoultry Farm Business PlanSunday Shido-ikwu Benjamin82% (164)

- Selling Today Partnering To Create Value Canadian 6th Edition Manning Test BankDocument21 pagesSelling Today Partnering To Create Value Canadian 6th Edition Manning Test Bankgiaoagnesq3t100% (25)

- Varco Pruden ManualDocument476 pagesVarco Pruden Manualelidstone@hotmail.comPas encore d'évaluation

- ResumeDocument3 pagesResumeBiswajit MishraPas encore d'évaluation

- About BlankDocument1 pageAbout BlankiamtheavijeetPas encore d'évaluation

- Relationship MarketingDocument40 pagesRelationship Marketingjaskahlon92100% (1)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticD'EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticÉvaluation : 3.5 sur 5 étoiles3.5/5 (10)

- Generative AI: The Insights You Need from Harvard Business ReviewD'EverandGenerative AI: The Insights You Need from Harvard Business ReviewÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedD'EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedÉvaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0D'EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Évaluation : 5 sur 5 étoiles5/5 (1)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffD'EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffÉvaluation : 5 sur 5 étoiles5/5 (61)

- Sales Pitch: How to Craft a Story to Stand Out and WinD'EverandSales Pitch: How to Craft a Story to Stand Out and WinÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherD'EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherPas encore d'évaluation