Académique Documents

Professionnel Documents

Culture Documents

TB 2 Dan TB 1

Transféré par

Andita Arum CintyawatiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TB 2 Dan TB 1

Transféré par

Andita Arum CintyawatiDroits d'auteur :

Formats disponibles

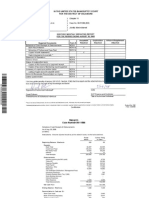

VALLEY PUBLISHING COMPANY Working Trial Balance - Operating Accounts 12-31-81 Working Paper Ref.

Per Audit 12-31-80 470,501 175,555 180,106 256,170 1,082,332 Balances Per Books 12-31-81 526,901 198,610 203,460 341,206 1,270,177

Accounts Revenue Advertising Revenue - Local Display Advertising Revenue - National Display Advertising Revenue - Classified Publication Sales Total Revenue

Operating Expenses Salaries Advertising commissions Correspondents' fees Newspaper services Photo and engraving Newsprint and ink Repairs and maintanance Supplies Circulation and delivery Rent Depreciation Property taxes Insurance Utilities Payroll taxes Professional fees Bad debt expense Miscellaneous expense Total Operating Expenses

429,648 67,380 8,840 18,650 6,980 149,593 12,075 9,130 5,880 18,000 50,662 7,193 3,450 24,100 24,767 18,870 7,730 9,886 872,834

451,090 77,276 9,350 21,380 8,740 273,895 30,650 9,740 6,470 42,000 55,715 7,445 4,760 28,540 25,717 22,350 10,900 22,780 1,108,798 161,379 6,280 3,757 25,000 14,570 393 160,986 60,000 100,986

Net Income from Operations Other incomes and (expenses) Income from investments Miscelaaneous income Interest expense Gain (loss) on disposal of assets Net Other Net income before taxes Estimated federal income tax Net income after taxes Footing checked Checked Balances to Ledger

209,498 13,200 1,846 30,000 1,800 13,154 196,344 68,722 127,622

Adjustment Journal Entries Supplies Expense Repair and Maintanance Expense Petty Cash

371 480 851

T/B 2

Adjustments Dr. Cr.

480 371

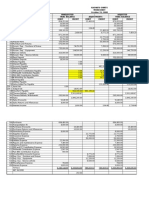

VALLEY PUBLISHING COMPANY Working Trial Balance - Balance Sheets Accounts 12-31-81 Working Paper Ref. Per Audit 12-31-80 41,965 10,000 1,820 96,480 (8,100) Balances Per Books 12-31-81 92,772 30,000 2,000 103,640 (10,530)

T/B 1

Adjustments Dr.

Accounts Assets Cash - Central State Bank Cash - Albany National Bank Pety Cash Accounts Receivable Allowances for Bad Debts Income Tax Refund Receivable - Insurance Claim Newsprint Inventory Prepaid Insurance Prepaid Rent Investments - General Investments - Savings Land and Building Under Capital Lease Accum. Depreciation - Capital Lease Furniture and Fixtures Accum. Depr. - Furniture and Fixtures Printing Equipment Accum. Depr. - Printing Equipment Deferred Income Taxes

1,230

84,016 1,360 12,000 151,380

108,196 17,400 65,950 210,000

60,850 (24,830) 894,840 (421,090) 900,691

68,850 (31,045) 1,084,840 (470,590) 1,271,483 121,675 16,273 10,552 7,445

Liabilities : Vouchers Payable Accrued Payroll - Net Accrued Payroll Taxes Accrued Property Taxes Accrued Interest Payable Dividends Payable Current Portion of L/T Debt Notes Payable Obligation Under Capital Lease Deferred Gain on Sale and Lease Back Federal Income Taxes Payable Deferred Income Taxes Equity Common Stock Paid-in Capital Retained Earnings Deferred Loss on Equity Securities 300,000 76,930 330,000 204,552 60,380 5,844 7,193 60,000 250,000 475,000

12,722

5,000

Current Net Income Footing checked Checked Balances to Ledger

127,622 900,691

100,986 1,271,483

T/B 1

Adjustments Cr. 1,230 851

Vous aimerez peut-être aussi

- Kunci Jawaban Soal Review InterDocument5 pagesKunci Jawaban Soal Review InterWinarto SudrajadPas encore d'évaluation

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaPas encore d'évaluation

- Income: Total Gross SalesDocument4 pagesIncome: Total Gross Salesapi-327527846Pas encore d'évaluation

- Societe de Commerce International Tameza Inc. 9251-1559 QUEBEC INCDocument31 pagesSociete de Commerce International Tameza Inc. 9251-1559 QUEBEC INCLuis Alberto Taborda SchotborgPas encore d'évaluation

- Polytechnic University of The PhilippinesDocument16 pagesPolytechnic University of The PhilippinesYesTaratPas encore d'évaluation

- Chapter 23 - Worksheet and SolutionsDocument21 pagesChapter 23 - Worksheet and Solutionsangelbear2577Pas encore d'évaluation

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenPas encore d'évaluation

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Document30 pagesTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaPas encore d'évaluation

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairPas encore d'évaluation

- Principles of Accounting Simulation - Student's Answer - Excel FileDocument55 pagesPrinciples of Accounting Simulation - Student's Answer - Excel FilekoopamonsterPas encore d'évaluation

- Chaper 1 - FS AuditDocument12 pagesChaper 1 - FS AuditLouie De La Torre60% (5)

- AT&T Vs MegafonDocument18 pagesAT&T Vs MegafonMikhay IstratiyPas encore d'évaluation

- 10000006490Document17 pages10000006490Chapter 11 DocketsPas encore d'évaluation

- Example of Financial TemplateDocument2 pagesExample of Financial Templatezeus33Pas encore d'évaluation

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainPas encore d'évaluation

- Excel Advanced Excel For Finance - EXERCISEDocument106 pagesExcel Advanced Excel For Finance - EXERCISEghodghod123100% (1)

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniPas encore d'évaluation

- Art 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsDocument9 pagesArt 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsSamad RehmanPas encore d'évaluation

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiPas encore d'évaluation

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqPas encore d'évaluation

- Budget 2016-2017 Parks (23 - 05 - 2015)Document187 pagesBudget 2016-2017 Parks (23 - 05 - 2015)Odumodu UmuleriPas encore d'évaluation

- Working CapitalDocument24 pagesWorking CapitalTushar SharmaPas encore d'évaluation

- CA Excel .Problem - Set A.BDocument65 pagesCA Excel .Problem - Set A.BStephen McSweeneyPas encore d'évaluation

- Cash Flow Statements For 3 Years: Year 1 2 3 Out Flows KSH KSH KSHDocument5 pagesCash Flow Statements For 3 Years: Year 1 2 3 Out Flows KSH KSH KSHAbdiladif AdowPas encore d'évaluation

- LBP NO. 3A (Consolidated Programmed Appropriation and Obligation by Object of Expenditure) (2013)Document6 pagesLBP NO. 3A (Consolidated Programmed Appropriation and Obligation by Object of Expenditure) (2013)Bar2012Pas encore d'évaluation

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJelwin Enchong BautistaPas encore d'évaluation

- AREONAR Business PlanDocument57 pagesAREONAR Business Planmahendrakadam2Pas encore d'évaluation

- Fd2dbTraditional & Mordern Formats of Finanancial StatementsDocument6 pagesFd2dbTraditional & Mordern Formats of Finanancial StatementsAmitesh PandeyPas encore d'évaluation

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinPas encore d'évaluation

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarPas encore d'évaluation

- Your Audiology Practice, Inc. Operating Expenses Per MONTH Yearly TotalDocument3 pagesYour Audiology Practice, Inc. Operating Expenses Per MONTH Yearly TotalPaul KwonPas encore d'évaluation

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.Pas encore d'évaluation

- New DollDocument2 pagesNew DollJuyt HertPas encore d'évaluation

- Hercule Monthly AC APR 2014 11.5.2014Document38 pagesHercule Monthly AC APR 2014 11.5.2014Kyaw Htin WinPas encore d'évaluation

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlPas encore d'évaluation

- FY 2012 Audited Financial StatementsDocument0 pageFY 2012 Audited Financial StatementsmontalvoartsPas encore d'évaluation

- Dyeing CalculationDocument6 pagesDyeing CalculationRihan Ahmed RubelPas encore d'évaluation

- Financial Statements: December 31, 2011Document55 pagesFinancial Statements: December 31, 2011b21t3chPas encore d'évaluation

- Sales 204,490: Opening Inventory PurchasesDocument15 pagesSales 204,490: Opening Inventory PurchasesvickylePas encore d'évaluation

- A1 Accounting Pg176-177Document8 pagesA1 Accounting Pg176-177Onnik GabriellaPas encore d'évaluation

- Hercule Monthly AC JUNE 2014Document34 pagesHercule Monthly AC JUNE 2014Kyaw Htin WinPas encore d'évaluation

- ACC1002 Team 8Document11 pagesACC1002 Team 8Yvonne Ng Ming HuiPas encore d'évaluation

- AccouningDocument17 pagesAccouningAnirban ChandaPas encore d'évaluation

- D/S Cover Computation: Trading Profit & Loss A/CDocument4 pagesD/S Cover Computation: Trading Profit & Loss A/CRajeev NiroshanPas encore d'évaluation

- FRA AssignmentDocument18 pagesFRA AssignmentPratik GaokarPas encore d'évaluation

- Profit&Loss May 2010Document2 pagesProfit&Loss May 2010Andre KjPas encore d'évaluation

- CH 05Document15 pagesCH 05ercis6421Pas encore d'évaluation

- Kashato Shirts - SolutionsDocument18 pagesKashato Shirts - SolutionsAldrian Ala75% (4)

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionPierre Heneine86% (7)

- NHDC SolutionDocument5 pagesNHDC SolutionShivam Goyal71% (24)

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueD'EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueÉvaluation : 1 sur 5 étoiles1/5 (1)

- Business Service Center Revenues World Summary: Market Values & Financials by CountryD'EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryD'EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Finance for IT Decision Makers: A practical handbookD'EverandFinance for IT Decision Makers: A practical handbookPas encore d'évaluation

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryD'EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryD'EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Collection Agency Revenues World Summary: Market Values & Financials by CountryD'EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentPas encore d'évaluation

- Differential Analysis and Product PricingDocument60 pagesDifferential Analysis and Product Pricingmentari cahyaPas encore d'évaluation

- A Study On Ratio Analysis of Axis BankDocument70 pagesA Study On Ratio Analysis of Axis BankVishal SinghPas encore d'évaluation

- Accounting Level 3: LCCI International QualificationsDocument17 pagesAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- Christensen 12e Chap08 EffectiveInterest 2019Document72 pagesChristensen 12e Chap08 EffectiveInterest 2019Difa100% (1)

- Business Mathemati CS: - Profit and Loss - Simple Interest and MortgagesDocument20 pagesBusiness Mathemati CS: - Profit and Loss - Simple Interest and MortgagesMay ManongsongPas encore d'évaluation

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDocument26 pagesQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaPas encore d'évaluation

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxRed YuPas encore d'évaluation

- Partnership Formation Part 3 PDFDocument2 pagesPartnership Formation Part 3 PDFazzenethfaye.delacruz.mnlPas encore d'évaluation

- Consolidation TheoryDocument22 pagesConsolidation TheorySmruti RanjanPas encore d'évaluation

- Solution Financial Accounting FundamentalsDocument7 pagesSolution Financial Accounting Fundamentalsone thymePas encore d'évaluation

- Istilah Akuntansi EnglishDocument2 pagesIstilah Akuntansi Englishpramesari dinarPas encore d'évaluation

- AKKUDocument3 pagesAKKUdavidwijaya1986Pas encore d'évaluation

- KPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsDocument114 pagesKPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsKrishna ShahPas encore d'évaluation

- Caso ChryslerDocument7 pagesCaso ChryslerAntonioPas encore d'évaluation

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1Pas encore d'évaluation

- Signing A Note Payable To Purchase Equipment: A) B) C) D)Document31 pagesSigning A Note Payable To Purchase Equipment: A) B) C) D)Kim FloresPas encore d'évaluation

- Introduction To Accounting: Basic Financial StatementsDocument15 pagesIntroduction To Accounting: Basic Financial StatementsStellaPas encore d'évaluation

- Advanced Accounting: Intercompany Profit Transactions - Plant AssetsDocument45 pagesAdvanced Accounting: Intercompany Profit Transactions - Plant AssetsWang JukPas encore d'évaluation

- Accounting Reviewer - DoneDocument18 pagesAccounting Reviewer - DoneKassandra AlbertoPas encore d'évaluation

- 6 Variable Full Costing Ue Caloocan May 2023Document8 pages6 Variable Full Costing Ue Caloocan May 2023Trisha Marie LeePas encore d'évaluation

- Fac511s - Financial Accounting 101 - 1st Op - June 2023Document5 pagesFac511s - Financial Accounting 101 - 1st Op - June 2023nettebrandy8Pas encore d'évaluation

- Corporate Budget Memo No. 39Document95 pagesCorporate Budget Memo No. 39mcla28Pas encore d'évaluation

- BBA - JNU - 101 Fundamentals of Accounting PDFDocument201 pagesBBA - JNU - 101 Fundamentals of Accounting PDFJTSalesPas encore d'évaluation

- Brennan, Niamh and Clarke, Peter (1985) Objective Tests in Financial Accounting, ETA Publications, DublinDocument90 pagesBrennan, Niamh and Clarke, Peter (1985) Objective Tests in Financial Accounting, ETA Publications, DublinProf Niamh M. BrennanPas encore d'évaluation

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauPas encore d'évaluation

- Financial Statement Analysis: Select A Tab To Get StartedDocument33 pagesFinancial Statement Analysis: Select A Tab To Get StartedHarold Beltran DramayoPas encore d'évaluation

- Computation of Income: Nazneen Mohammed Javed ShaikhDocument3 pagesComputation of Income: Nazneen Mohammed Javed ShaikhRahul RampalPas encore d'évaluation

- Fin 542Document3 pagesFin 542hanuman001Pas encore d'évaluation

- Introduction To Accounting: Meaning of Key Terms Used in The ChapterDocument277 pagesIntroduction To Accounting: Meaning of Key Terms Used in The ChapterLegEND MANPas encore d'évaluation