Académique Documents

Professionnel Documents

Culture Documents

Auditis Daskvna 2012

Transféré par

refreshgTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Auditis Daskvna 2012

Transféré par

refreshgDroits d'auteur :

Formats disponibles

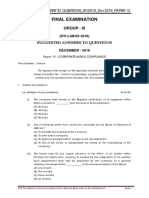

Microfinance Organization Easycred Georgia LLC Consolidated Financial Statements for the year ended 31 December 2012

Contents

Independent Auditors Report ...................................................................................................................... 3 Consolidated statement of comprehensive income ...................................................................................... 4 Consolidated statement of financial position ............................................................................................... 5 Consolidated statement of cash flows .......................................................................................................... 6 Consolidated statement of changes in equity ............................................................................................... 7 Notes to the consolidated financial statements ............................................................................................ 8

Microfinance Organization Easycred Georgia LLC Consolidated Statement of Financial Position as at 31 December 2012

Notes ASSETS Cash and cash equivalents Loans to customers Investment property Property, equipment and intangible assets Deferred tax asset Other assets Total assets 10 11 12 13 9 14

2012 GEL000

2011 GEL000

208 7,133 398 679 33 619 9,070

140 6,119 564 17 306 7,146

LIABILITIES Loans and borrowings Dividends payable Income tax payable Other liabilities Total liabilities EQUITY Charter capital Retained earnings Total equity Total liabilities and equity 17 3,653 1,173 4,826 9,070 3,213 940 4,153 7,146 16 15 3,858 230 46 110 4,244 2,912 3 78 2,993

The consolidated statement of financial position is to be read in conjunction with the notes to, and forming part of, the consolidated financial statements. 5

Microfinance Organization Easycred Georgia LLC Consolidated Statement of Cash Flows for the year ended 31 December 2012

Notes CASH FLOWS FROM OPERATING ACTIVITIES Profit for the year Adjustments for: Impairment losses/(recovery) Net foreign exchange loss Depreciation and amortization Loss on disposal of property and equipment Gain on disposal of repossessed assets Interest income Interest expense Fee and commission income Fee and commission expense Income tax expense Increase in operating assets Loans to customers Other assets Increase/(decrease) in operating liabilities Other liabilities

2012 GEL000

2011 GEL000

1,173

941

122 19 55 19 (5) (2,435) 454 (518) 2 218

(30) 128 56 8 (13) (2,024) 329 (319) 8 180

(1,049) (410)

(1,680) (202)

(5)

33

Interest and fees and commissions received Interest and fees and commissions paid Income tax paid Cash flows used in operations CASH FLOWS FROM INVESTING ACTIVITIES Acquisition of property and equipment Proceeds from sale of property and equipment Acquisition of investment property Proceeds from sale of repossessed assets Cash flows used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Payment of dividends Proceeds from borrowings Repayment of borrowings Cash flows from financing activities Net increase/(decrease) in cash and cash equivalents Effect of changes in exchange rates on cash and cash equivalents Cash and cash equivalents as at the beginning of the year Cash and cash equivalents as at the end of the year 10

2,852 (437) (191) (136)

2,309 (332) (321) (929)

(197) 8 (398) 93 (494)

(95) 14 33 (48)

(270) 1,248 (322) 656 26 42 140 208

(199) 1,376 (215) 962 (15) (10) 165 140

The consolidated statement of cash flows is to be read in conjunction with the notes to, and forming part of, the consolidated financial statements. 6

Microfinance Organization Easycred Georgia LLC Consolidated Statement of Changes in Equity for the year ended 31 December 2012

Charter capital GEL000 Balance as at 1 January 2011 Total comprehensive income Profit for the year Total comprehensive income for the year Transactions with owners, recorded directly in equity Increase in charter capital Dividends declared and paid Total transactions with owners Balance as at 31 December 2011 900 900 3,213 2,313

Retained earnings GEL000 1,098

Total equity GEL000 3,411

941 941

941 941

(900) (199) (1,099) 940

(199) (199) 4,153

Balance as at 1 January 2012 Total comprehensive income Profit for the year Total comprehensive income for the year Transactions with owners, recorded directly in equity Increase in charter capital Dividends declared and paid Dividends declared but not paid Total transactions with owners Balance as at 31 December 2012

3,213

940

4,153

1,173 1,173

1,173 1,173

440 440 3,653

(440) (270) (230) (940) 1,173

(270) (230) (500) 4,826

The consolidated statement of changes in equity is to be read in conjunction with the notes to, and forming part of, the consolidated financial statements. 7

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

1

(a)

Background

Organisation and operations

Microfinance Organization Easycred Georgia LLC (the Company) was established on 21 November 2008 to provide sustainable lending services to those individual entrepreneurs who are not able to access credit facilities through the conventional banking system. The Company helps in the development of the economy of Georgia by providing credit to very small entrepreneurs to grow their businesses and improve their economic situation. The Company was registered by the National Bank of Georgia on 20 February 2009. The legal address of the Company is 64 Mitskevich Street, Tbilisi, Georgia. On 29 November 2011 the Company established a subsidiary, Easycred Capital LLC (together the Group), an asset management company with 100% ownership. The Group structure is as follows:

Country of Name Easycred Capital LLC incorporation Georgia Principal activities Asset management 2012 100% Ownership % 2011 100%

(b)

Shareholders

The Groups immediate and ultimate parent company is Laponeto Commercial LLC and the ultimate controlling party is Elena Papachristodoulou Psintrou. As at 31 December 2012 and 2011 the Groups shareholders were as follows:

2012 Ownership interest, % 51.0% 25.0% 15.0% 9.0% 100.0% 2011 Ownership interest, % 51.0% 25.0% 15.0% 9.0% 100.0%

Laponeto Commmercial LLC Laerti Zubadalashvili Kakhaber Kakhiani Nodar Daushvili

Related party transactions are detailed in note 21.

(c)

Georgian business environment

The Groups operations are located in Georgia. Consequently, the Group is exposed to the economic and financial markets of Georgia which display characteristics of an emerging market. The legal, tax and regulatory frameworks continue development, but are subject to varying interpretations and frequent changes which together with other legal and fiscal impediments contribute to the challenges faced by entities operating in the Georgia. The consolidated financial statements reflect managements assessment of the impact of the Georgian business environment on the operations and the financial position of the Group. The future business environment may differ from managements assessment.

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

2

(a)

Basis of preparation

Statement of compliance

The accompanying consolidated financial statements are prepared in accordance with International Financial Reporting Standards (IFRS).

(b)

Basis of measurement

The consolidated financial statements are prepared on the historical cost basis.

(c)

Functional and presentation currency

The functional currency of the Company and its subsidiary is the Georgian Lari (GEL) as, being the national currency of Georgia, it reflects the economic substance of the majority of underlying events and circumstances relevant to them. The GEL is also the presentation currency for the purposes of these consolidated financial statements. Financial information presented in GEL is rounded to the nearest thousand.

(d)

Use of estimates and judgments

The preparation of consolidated financial statements in conformity with IFRSs requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results could differ from those estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimates are revised and in any future periods affected. Information about significant areas of estimation uncertainty and critical judgments in applying accounting policies relating to loan impairment is described in note 11 loans to customers.

Significant accounting policies

The accounting policies set out below are applied consistently to all periods presented in these consolidated financial statements, and are applied consistently by Group entities.

(a) (i)

Basis of consolidation Subsidiaries

Subsidiaries are entities controlled by the Company. Control exists when the Company has the power, directly or indirectly, to govern the financial and operating policies of an entity so as to obtain benefits from its activities. The financial statements of subsidiaries are included in the consolidated financial statements from the date that control effectively commences until the date that control effectively ceases.

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(ii)

Transactions eliminated on consolidation

Intra-group balances and transactions, and any unrealised gains arising from intra-group transactions, are eliminated in preparing the consolidated financial statements.

(b)

Foreign currency

Transactions in foreign currencies are translated to GEL at exchange rates at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies at the reporting date are retranslated to GEL at the exchange rate at that date. The foreign currency gain or loss on monetary items is the difference between amortised cost in the functional currency at the beginning of the period, adjusted for effective interest and payments during the period, and the amortised cost in foreign currency translated at the exchange rate at the end of the reporting period. Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rate at the date of the transaction. Foreign currency differences arising on retranslation are recognised in profit or loss.

(c)

Cash and cash equivalents

Cash and cash equivalents include notes and coins on hand, unrestricted balances and call deposits held with banks with maturities of three months or less from the acquisition date that are subject to insignificant risk of changes in their fair value. Cash and cash equivalents are carried at amortised cost in the consolidated statement of financial position.

(d) (i)

Financial instruments Classification

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market, other than those that the Group:

intends to sell immediately or in the near term upon initial recognition designates as at fair value through profit or loss upon initial recognition designates as available-for-sale or, may not recover substantially all of its initial investment, other than because of credit deterioration.

(ii)

Recognition

Financial assets and liabilities are recognized in the consolidated statement of financial position when the Group becomes a party to the contractual provisions of the instrument.

(iii) Measurement

A financial asset or liability is initially measured at its fair value plus transaction costs that are directly attributable to the acquisition or issue of the financial asset or liability. Subsequent to initial recognition, financial assets, comprising loans and receivables are measured at at amortized cost using the effective interest method. All financial liabilities are measured at amortized cost.

10

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(iv) Amortised cost

The amortised cost of a financial asset or liability is the amount at which the financial asset or liability is measured at initial recognition, minus principal repayments, plus or minus the cumulative amortisation using the effective interest method of any difference between the initial amount recognised and the maturity amount, minus any reduction for impairment. Premiums and discounts, including initial transaction costs, are included in the carrying amount of the related instrument and amortized based on the effective interest rate of the instrument.

(v)

Fair value measurement principles

Fair value is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arms length transaction on the measurement date. When available, the Group measures the fair value of an instrument using quoted prices in an active market for that instrument. A market is regarded as active if quoted prices are readily and regularly available and represent actual and regularly occurring market transactions on an arms length basis. If a market for a financial instrument is not active, the Group establishes fair value using a valuation technique. Valuation techniques include using recent arms length transactions between knowledgeable, willing parties (if available), reference to the current fair value of other instruments that are substantially the same, discounted cash flow analyses and option pricing models. The chosen valuation technique makes maximum use of market inputs, relies as little as possible on estimates specific to the Group, incorporates all factors that market participants would consider in setting a price, and is consistent with accepted economic methodologies for pricing financial instruments. Inputs to valuation techniques reasonably represent market expectations and measures of the risk-return factors inherent in the financial instrument. The best evidence of the fair value of a financial instrument at initial recognition is the transaction price, i.e., the fair value of the consideration given or received, unless the fair value of that instrument is evidenced by comparison with other observable current market transactions in the same instrument (i.e., without modification or repackaging) or based on a valuation technique whose variables include only data from observable markets. When transaction price provides the best evidence of fair value at initial recognition, the financial instrument is initially measured at the transaction price and any difference between this price and the value initially obtained from a valuation model is subsequently recognised in profit or loss on an appropriate basis over the life of the instrument but not later than when the valuation is supported wholly by observable market data or the transaction is closed out.

(vi) Gains and losses on subsequent measurement

For financial assets and liabilities carried at amortized cost, a gain or loss is recognized in profit or loss when the financial asset or liability is derecognized or impaired, and through the amortization process.

11

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(vii) Derecognition

The Group derecognises a financial asset when the contractual rights to the cash flows from the financial asset expire, or when it transfers the financial asset in a transaction in which substantially all the risks and rewards of ownership of the financial asset are transferred or in which the Group neither transfers nor retains substantially all the risks and rewards of ownership and it does not retain control of the financial asset. Any interest in transferred financial assets that qualify for derecognition that is created or retained by the Group is recognised as a separate asset or liability in the statement of financial position. The Group derecognises a financial liability when its contractual obligations are discharged or cancelled or expire. The Group writes off assets deemed to be uncollectible.

(viii) Offsetting

Financial assets and liabilities are offset and the net amount reported in the consolidated statement of financial position when there is a legally enforceable right to set off the recognised amounts and there is an intention to settle on a net basis, or realise the asset and settle the liability simultaneously.

(e) (i)

Property, equipment and intangible assets Owned assets

Items of property and equipment are stated at cost less accumulated depreciation and impairment losses. Acquired intangible assets are stated at cost less accumulated amortisation and impairment losses. Where an item of property and equipment comprises major components having different useful lives, they are accounted for as separate items of property and equipment.

(ii)

Leased assets

All leases are operating leases and the leased assets are not recognized in the consolidated statement of financial position.

(iii) Depreciation and amortization

Depreciation and amortization is charged to profit or loss on a straight-line basis over the estimated useful lives of the individual assets. Depreciation commences on the date of acquisition or, in respect of internally constructed assets, from the time an asset is completed and ready for use. Land is not depreciated. Acquired computer software licenses are capitalised on the basis of the costs incurred to acquire and bring to use the specific software. The estimated useful lives are as follows:

buildings intangible assets other 20 years 5 years 3 years

12

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(f)

Investment property

Investment property is property held either to earn rental income or for capital appreciation or for both, but not for sale in normal course of business, or for the use in production or supply of goods or services or for administrative purposes. Investment property is measured at cost less accumulated depreciation and impairment losses. Cost includes expenditure that is directly attributable to the acquisition of investment property. Cost includes the cost of materials and direct labour, and any other costs directly attributable to bringing the asset to working condition for its intended use. When the use of a property changes such that it is reclassified as property and equipment, its fair value at the date of reclassification becomes its cost for subsequent accounting.

(g)

Repossessed assets

The Group recognises repossessed assets in the consolidated statement of financial position when it has the full and final settlement rights to the collateral, and when it is entitled to retain any excess proceeds from the realisation of the collateral. Repossessed assets are measured at the lower of the carrying amount and the fair value less costs to sell. At initial recognition repossessed assets are measured based on the value of the defaulted loan, including expenditure incurred in the process of collateral foreclosure. Fair value less costs to sell is the estimated selling price of the collateral in the ordinary course of business, less the related selling costs. Subsequent to initial recognition, repossessed assets are reviewed for held for sale classification criteria and are reclassified accordingly when the criteria are met. Repossessed assets are included in other assets. Gains and losses on disposal of repossessed assets are recognised net in other operati ng income in profit or loss.

(h) (i)

Impairment Financial assets carried at amortized cost

Financial assets carried at amortized cost consist principally of loans and other receivables (loans and receivables). The Group reviews its loans and receivables to assess impairment on a regular basis. A loan or receivable is impaired and impairment losses are incurred if, and only if, there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the loan or receivable and that event (or events) has had an impact on the estimated future cash flows of the loan that can be reliably estimated. Objective evidence that financial assets are impaired can include default or delinquency by a borrower, breach of loan covenants or conditions, restructuring of a loan or advance on terms that the Group would not otherwise consider, indications that a borrower or issuer will enter bankruptcy, the disappearance of an active market for a security, deterioration in the value of collateral, or other observable data relating to a group of assets such as adverse changes in the payment status of borrowers in the group, or economic conditions that correlate with defaults in the group.

13

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

The Group first assesses whether objective evidence of impairment exists individually for loans and receivables that are individually significant, and individually or collectively for loans and receivables that are not individually significant. If the Group determines that no objective evidence of impairment exists for an individually assessed loan or receivable, whether significant or not, it includes the loan in a group of loans and receivables with similar credit risk characteristics and collectively assesses them for impairment. Loans and receivables that are individually assessed for impairment and for which an impairment loss is or continues to be recognised are not included in a collective assessment of impairment. If there is objective evidence that an impairment loss on a loan or receivable has been incurred, the amount of the loss is measured as the difference between the carrying amount of the loan or receivable and the present value of estimated future cash flows including amounts recoverable from guarantees and collateral discounted at the loan or receivables original effective interest rate. Contractual cash flows and historical loss experience adjusted on the basis of relevant observable data that reflect current economic conditions provide the basis for estimating expected cash flows. In some cases the observable data required to estimate the amount of an impairment loss on a loan or receivable may be limited or no longer fully relevant to current circumstances. This may be the case when a borrower is in financial difficulties and there is little available historical data relating to similar borrowers. In such cases, the Group uses its experience and judgement to estimate the amount of any impairment loss. All impairment losses in respect of loans and receivables are recognized in profit or loss and are only reversed if a subsequent increase in recoverable amount can be related objectively to an event occurring after the impairment loss was recognised. When a loan is uncollectable, it is written off against the related allowance for loan impairment. The Group writes off a loan balance (and any related allowances for loan losses) when management determines that the loans are uncollectible and when all necessary steps to collect the loan are completed.

(ii)

Non financial assets

Other non financial assets, other than deferred taxes, are assessed at each reporting date for any indications of impairment. The recoverable amount of non financial assets is the greater of their fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. For an asset that does not generate cash inflows largely independent of those from other assets, the recoverable amount is determined for the cash-generating unit to which the asset belongs. An impairment loss is recognised when the carrying amount of an asset or its cash-generating unit exceeds its recoverable amount. All impairment losses in respect of non financial assets are recognized in profit or loss and reversed only if there has been a change in the estimates used to determine the recoverable amount. Any impairment loss reversed is only reversed to the extent that the assets carrying amount does not exceed the carrying amount that would have been determined, net of depreciation or amortisation, if no impairment loss had been recognised.

14

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(i)

Charter capital

Charter capital is classified as equity. Incremental costs directly attributable to the issue of ordinary shares are recognised as a deduction from equity, net of any tax effects. The ability of the Group to declare and pay dividends is subject to the rules and regulations of the Georgian legislation. Dividends are reflected as an appropriation of retained earnings in the period when they are declared.

(j)

Taxation

Income tax comprises current and deferred tax. Income tax is recognised in profit or loss except to the extent that it relates to items of other comprehensive income or transactions with shareholders recognised directly in equity, in which case it is recognised within other comprehensive income or directly within equity. Current tax expense is the expected tax payable on the taxable income for the year, using tax rates enacted or substantially enacted at the reporting date, and any adjustment to tax payable in respect of previous years. Deferred tax is recognised in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is not recognised for the temporary differences on the initial recognition of assets or liabilities that affect neither accounting nor taxable profit and temporary differences related to investments in subsidiaries where the parent is able to control the timing of the reversal of the temporary difference and it is probable that the temporary difference will not reverse in the foreseeable future. Deferred tax is measured at the tax rates that are expected to be applied to the temporary differences when they reverse, based on the laws that have been enacted or substantively enacted by the reporting date. A deferred tax asset is recognised only to the extent that it is probable that future taxable profits will be available against which the temporary differences, unused tax losses and credits can be utilised. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit will be realised.

(k)

Income and expense recognition

Interest income and expense are recognised in profit or loss using the effective interest method. Loan origination fees, loan servicing fees and other fees that are considered to be integral to the overall profitability of a loan, together with the related transaction costs, are deferred and amortized to interest income over the estimated life of the financial instrument using the effective interest method. Other fees, commissions and other income and expense items are recognised in profit or loss when the corresponding service is provided. Dividend income is recognised in profit or loss on the date that the dividend is declared.

15

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

Payments made under operating leases are recognised in profit or loss on a straight-line basis over the term of the lease. Lease incentives received are recognised as an integral part of the total lease expense, over the term of the lease.

(l)

New standards and interpretations not yet adopted

A number of new standards, amendments to standards and interpretations are not yet effective as at 31 December 2012, and are not applied in preparing these consolidated financial statements. Of these pronouncements, potentially the following will have an impact on the financial position and performance. The Group plans to adopt these pronouncements when they become effective. Amendments to IFRS 7 Financial Instruments: Disclosures - Offsetting Financial Assets and Financial Liabilities contain new disclosure requirements for financial assets and liabilities that are offset in the statement of financial position or subject to master netting arrangements or similar agreements. The amendments are effective for annual periods beginning on or after 1 January 2013, and are to be applied retrospectively. The Group has not yet analysed the likely impact of the new standard on its financial position or performance. IFRS 9 Financial Instruments will be effective for annual periods beginning on or after 1 January 2015. The new standard is to be issued in phases and is intended ultimately to replace International Financial Reporting Standard IAS 39 Financial Instruments: Recognition and Measurement. The first phase of IFRS 9 was issued in November 2009 and relates to the classification and measurement of financial assets. The second phase regarding classification and measurement of financial liabilities was published in October 2010. The remaining parts of the standard are expected to be issued during 2013. The Group recognises that the new standard introduces many changes to the accounting for financial instruments and is likely to have a significant impact on the consolidated financial statements. The impact of these changes will be analysed during the course of the project as further phases of the standard are issued. The Group does not intend to adopt this standard early. The Group has not yet analysed the likely impact of the new standard on its financial position or performance. IFRS 10 Consolidated Financial Statements will be effective for annual periods beginning on or after 1 January 2013. The new standard supersedes IAS 27 Consolidated and Separate Financial Statements and SIC-12 Consolidation Special Purpose Entities. IFRS 10 introduces a single control model which includes entities that are currently within the scope of SIC-12. Under the new three-step control model, an investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with that investee, has the ability to affect those returns through its power over that investee and there is a link between power and returns. Consolidation procedures are carried forward from IAS 27 (2008). When the adoption of IFRS 10 does not result in a change in the previous consolidation or nonconsolidation of an investee, no adjustments to accounting are required on initial application. When the adoption results in a change in the consolidation or non-consolidation of an investee, the new standard may be adopted with either full retrospective application from date that control was obtained or lost or, if not practicable, with limited retrospective application from the beginning of the earliest period for which the application is practicable, which may be the current period. Early adoption of IFRS 10 is permitted provided an entity also early-adopts IFRS 11, IFRS 12, IAS 27 (2011) and IAS 28 (2011). The Group has not yet analysed the likely impact of the new standard on its financial position or performance.

16

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

IFRS 13 Fair Value Measurement will be effective for annual periods beginning on or after 1 January 2013. The new standard replaces the fair value measurement guidance contained in individual IFRSs with a single source of fair value measurement guidance. It provides a revised definition of fair value, establishes a framework for measuring fair value and sets out disclosure requirements for fair value measurements. IFRS 13 does not introduce new requirements to measure assets or liabilities at fair value, nor does it eliminate the practicability exceptions to fair value measurement that currently exist in certain standards. The standard is applied prospectively with early adoption permitted. Comparative disclosure information is not required for periods before the date of initial application. The Group has not yet analysed the likely impact of the new standard on its financial position or performance. Amendments to IAS 32 Financial Instruments: Presentation - Offsetting Financial Assets and Financial Liabilities do not introduce new rules for offsetting financial assets and liabilities; rather they clarify the offsetting criteria to address inconsistencies in their application. The Amendments specify that an entity currently has a legally enforceable right to set-off if that right is not contingent on a future event; and enforceable both in the normal course of business and in the event of default, insolvency or bankruptcy of the entity and all counterparties. The amendments are effective for annual periods beginning on or after 1 January 2014, and are to be applied retrospectively. The Group has not yet analysed the likely impact of the new standard on its financial position or performance. Various Improvements to IFRSs have been dealt with on a standard-by-standard basis. All amendments, which result in accounting changes for presentation, recognition or measurement purposes, will come into effect not earlier than 1 January 2013. The Group has not yet analysed the likely impact of the improvements on its financial position or performance.

Net interest income

2012 GEL000 Interest income Loans to customers Placements with banks 2,434 1 2,435 Interest expense Loans and borrowings (454) 1,981 (329) 1,695 2,024 2,024 2011 GEL000

Included within various line items under interest income for the year ended 31 December 2012 is a total of GEL 575 thousand (2011: GEL 369 thousand) accrued on impaired or overdue financial assets.

17

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

Fee and commission income

2012 GEL000 Settlement fees Other 509 9 518 2011 GEL000 316 3 319

Impairment (losses)/recovery

2012 GEL000 Loans to customers (122) 2011 GEL000 30

Personnel expenses

2012 GEL000 Employee compensation 677 2011 GEL000 512

Other general administrative expenses

2012 GEL000 Depreciation and amortization Professional services Rent Transportation Communications and information services Advertising and marketing Utilities Security Taxes other than on income Office supplies Other 55 46 30 21 15 14 11 8 7 5 123 335 2011 GEL000 56 82 27 19 23 6 6 7 5 3 46 280

18

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

Income tax expense

2012 GEL000 Current year tax expense Deferred taxation movement due to origination and reversal of temporary differences Total income tax expense 234 (16) 218 2011 GEL000 180 180

In 2012, the applicable tax rate for current and deferred tax is 15% (2011: 15%).

Reconciliation of effective tax rate for the year ended 31 December:

2012 GEL000 Profit before tax Income tax at the applicable tax rate Non-deductible costs 1,391 209 9 218 15% 1% 16% % 2011 GEL000 1,121 168 12 180 15% 1% 16% %

(a)

Deferred tax asset and liability

Temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes give rise to net deferred tax assets as at 31 December 2012 and 2011. Movements in temporary differences during the years ended 31 December 2012 and 2011 are presented as follows.

2012 GEL000 Loans to customers Property, equipment and intangible assets Loans and borrowings Other liabilities Balance 1 January 2012 17 (1) 1 17 2011 GEL000 Loans to customers Property, equipment and intangible assets Other liabilities Balance 1 January 2011 21 (4) 17 Recognised in profit or loss 18 (5) 4 (1) 16 Recognised in profit or loss (4) 3 1 Balance 31 December 2012 35 (6) 4 33 Balance 31 December 2011 17 (1) 1 17

19

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

10 Cash and cash equivalents

2012 GEL000 Petty cash Bank balances - rated BB- rated B+ - rated B - not rated Total cash and cash equivalents 5 3 4 208 7 3 2 140 196 2011 GEL000 128

No cash and cash equivalents are restricted, impaired or past due.

11 Loans to customers

2012 GEL000 Commercial loans loans to small businesses Loans to individuals Loans collateralized by real estate Consumer loans Auto loans Total loans to individuals Gross loans to customers Impairment allowance Net loans to customers 5,386 1,717 60 7,163 7,366 (233) 7,133 4,433 1,388 56 5,877 6,230 (111) 6,119 203 2011 GEL000 353

Movements in the loan impairment allowance by classes of loans to customers for the year ended 31 December 2012 are as follows:

Commercial loans GEL000 Balance at the beginning of the year Net (recovery) charge Balance at the end of the year 26 (7) 19 Loans to individuals GEL000 85 129 214 Total GEL000 111 122 233

Movements in the loan impairment allowance by classes of loans to customers for the year ended 31 December 2011 are as follows:

Commercial loans GEL000 Balance at the beginning of the year Net charge (recovery) Balance at the end of the year 20 6 26 Loans to individuals GEL000 121 (36) 85 Total GEL000 141 (30) 111

20

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(a)

Credit quality of loans to customers

The following table provides information on the credit quality of loans to customers as at 31 December 2012:

Impairment allowance GEL000 (1) (18) (18) (19) Impairment allowance to gross loans, % 0.9% 20.5% 20.5% 9.4%

Gross loans GEL000 Commercial loans Loans without individual signs of impairment Overdue or impaired loans: - overdue more than 90 days Total impaired loans Total commercial loans Loans to individuals Loans collateralized by real estate - not overdue - overdue less than 30 days - overdue 30-89 days - overdue 90-179 days - overdue 180-360 days - overdue more than 360 days Total loans collateralized by real estate Consumer loans - not overdue - overdue less than 30 days - overdue 30-89 days - overdue 90-179 days - overdue 180-360 days - overdue more than 360 days Total consumer loans Auto loans - not overdue Total auto loans Total loans to individuals Total loans to customers 60 60 7,163 7,366 1,172 66 47 85 284 63 1,717 4,661 54 349 131 161 30 5,386 88 88 203 115

Net loans GEL000 114 70 70 184

(47) (3) (17) (13) (32) (6) (118) (12) (3) (2) (9) (56) (13) (95) (1) (1) (214) (233)

4,614 51 332 118 129 24 5,268 1,160 63 45 76 228 50 1,622 59 59 6,949 7,133

1.0% 5.6% 4.9% 9.9% 19.9% 20.0% 2.2% 1.0% 4.5% 4.3% 10.6% 19.7% 20.6% 5.5% 1.7% 1.7% 3.0% 3.2%

21

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

The following table provides information on the credit quality of the loans to customers as at 31 December 2011:

Impairment allowance GEL000 (22) (4) (26) (26) Impairment allowance to gross loans, % 40.7% 33.3% 26.5% 7.4%

Gross loans GEL000 Commercial loans Loans without individual signs of impairment Overdue or impaired loans: -overdue less than 90 days - overdue more than 90 days and less than 1 year - overdue more than 1 year Total impaired loans Total commercial loans Loans to individuals Loans collateralized by real estate - not overdue - overdue less than 30 days - overdue 30-89 days - overdue 90-179 days - overdue 180-360 days Total loans collateralized by real estate Consumer loans - not overdue - overdue less than 30 days - overdue 30-89 days - overdue 90-179 days - overdue 180-360 days - overdue more than 360 days Total consumer loans Auto loans - not overdue - overdue 30-89 days - overdue 90-179 days - overdue 180-360 days - overdue more than 360 days Total auto loans Total loans to individuals Total loans to customers 24 4 7 18 3 56 5,877 6,230 1,236 38 31 9 65 9 1,388 4,076 48 42 85 182 4,433 32 54 12 98 353 255

Net loans GEL000 255 32 32 8 72 327

(2) (2) (6) (50) (60) (1) (17) (18) (6) (1) (7) (85) (111)

4,076 46 40 79 132 4,373 1,236 38 30 9 48 9 1,370 24 4 7 12 2 49 5,792 6,119

4.2% 4.8% 7.1% 27.5% 1.4% 3.2% 26.2% 1.3% 33.3% 33.3% 12.5% 1.4% 1.8%

22

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(b) (i)

Key assumptions and judgments for estimating the loan impairment Commercial loans

Loan impairment results from one or more events that occurred after the initial recognition of the loan and that have an impact on the estimated future cash flows associated with the loan, and that can be reliably estimated. Loans without individual signs of impairment do not have objective evidence of impairment that can be directly attributed to them. The objective indicators of loan impairment include the following: overdue payments under the loan agreement significant difficulties in the financial conditions of the borrower

The Group estimates loan impairment for commercial loans based on an analysis of the future cash flows for impaired loans and based on its past loss experience for portfolios of loans for which no indications of impairment has been identified. In determining the impairment allowance for commercial loans, management makes the following key assumptions: 1.0% historical loss rate for loans without individual signs of impairment based on the Groups past loss experience; a delay of 36 months in obtaining proceeds from the foreclosure of collateral for loans with individual signs of impairment.

Changes in these estimates could effect the loan impairment provision. For example, to the extent that the net present value of the estimated cash flows differs by one percent, the impairment allowance on commercial loans as at 31 December 2012 would be GEL 2 thousand lower/higher (2011: GEL 3 thousand lower/higher).

(ii)

Loans to individuals

The Group estimates loan impairment for loans to individuals based on its past historical loss experience on each type of loan. The significant assumptions used by management in determining the impairment losses for loans to retail customers include: loss migration rates are constant and can be estimated based on the historic loss migration pattern for the past 24 months for loans collateralized by real estate, auto loans and other consumer loans; loans to individuals overdue for more than 180 days are allocated 15%-50% probability of loss.

The significant assumptions used in determining the impairment losses for loans to individuals include the following loan loss rates: Loans collateralized by real estate 2.2% (2011: 1.4%) Consumer loans 5.5% (2011: 1.3%) Auto loans 1.7% (2011: 12.5%)

Changes in these estimates could effect the loan impairment provision. For example, to the extent that the net present value of the estimated cash flows differs by three percent, the impairment allowance on loans to individuals as at 31 December 2012 would be GEL 208 thousand lower/higher (2011: GEL 174 thousand lower/higher).

23

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(c) (i)

Analysis of collateral and other credit enhancements Commercial loans

The following tables provides information on collateral and other credit enhancements securing commercial loans, net of impairment, by types of collateral:

31 December 2012 Loans to customers, carrying amount 82 32 114 29 41 70 184 Fair value of collateral for collateral assessed as of loan inception date 82 32 114 29 41 70 184

GEL000 Loans without individual signs of impairment Precious metals Real estate Total loans without individual signs of impairment Overdue or impaired loans Real estate Precious metals Total overdue or impaired loans Total commercial loans 31 December 2011

GEL000 Loans without individual signs of impairment Precious metals Real estate Motor vehicles Total loans without individual signs of impairment Overdue or impaired loans Real estate Precious metals Total overdue or impaired loans Total commercial loans

Loans to customers, carrying amount 132 122 1 255 40 32 72 327

Fair value of collateral for collateral assessed as of loan inception date 132 122 1 255 40 32 72 327

The tables above are presented on the basis of excluding overcollateralization. The recoverability of loans which are neither past due nor impaired is primarily dependent on the creditworthiness of the borrowers rather than the value of collateral, and the Group does not necessarily update the valuation of collateral as at each reporting date. The Group has loans, for which fair value of collateral was assessed at the loan inception date and it was not updated for further changes. Information on valuation of collateral is based on when this estimate was made, if any. For loans secured by multiple types of collateral, collateral that is most relevant for impairment assessment is disclosed.

24

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(ii)

Loans to individuals

Loans collateralized by real estate are secured by the underlying housing real estate. The Groups policy is to issue loans collateralized by real estate with a loan-to-value ratio of a maximum of 50%. The following tables provides information on collaterals of the loans collateralized by real estate, net of impairment:

31 December 2012 Loans to customers, carrying amount 4,614 654 5,268 Fair value of collateral for collateral assessed as of loan inception date 4,614 654 5,268

GEL000 Not overdue loans Overdue loans Total loans collateralized by real estate 31 December 2011

GEL000 Not overdue loans Overdue loans Total loans collateralized by real estate

Loans to customers, carrying amount 4,076 297 4,373

Fair value of collateral for collateral assessed as of loan inception date 4,076 297 4,373

The table above is presented on the basis of excluding overcollateralization. For certain loans the Group updates the appraised values of collateral obtained at inception of the loan to the current values considering the approximate changes in property values. The Group may also obtain a specific individual valuation of collateral at each reporting date where there are indications of impairment. For impaired or overdue loans collateralized by real estate management believes that the fair value of collateral is at least 100% of the carrying amount of the loans at the reporting date. Auto loans are secured by the underlying cars. For impaired or overdue auto loans management believes that the amount of loans or its parts, collateral fair value coverage is 100% of the amount of the loans at the reporting date. Consumer loans are mostly secured by underlying precious metals. For consumer loans with a net carrying amount of GEL 196 thousand (2011: GEL 329 thousand), which are neither past due nor impaired, there is no collateral or it is impracticable to determine the fair value of the collateral. For impaired or overdue consumer loans with a net carrying amount of GEL 290 thousand (2011: GEL 53 thousand) there is no collateral or it is impracticable to determine the fair value of the collateral. Per management estimates recoverability of these loans is primarily dependent on the creditworthiness of the borrowers rather than the collateral. For remaining consumer loans with a net carrying amount of GEL 1,136 thousand (2011: GEL 988 thousand) management estimates that the fair value of underlying collateral is at least equal to their carrying amounts.

25

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(iii) Repossessed collateral

During the year ended 31 December 2012, the Group obtained certain assets with the carrying amount of GEL 427 thousand (2011: GEL 254 thousand) by taking possession of collateral for loans to customers. As at 31 December 2012 the repossessed collateral comprise real estate with the carrying amount of GEL 426 thousand (2011: GEL 233 thousand), respectively and precious metals with carrying amount of GEL 84 thousand (2011: nil), see note 14. The Groups policy is to sell these assets as soon as it is practicable.

(d)

Industry and geographical analysis of the loan portfolio

Loans to customers were issued primarily to customers located within Georgia who operate in the following economic sectors:

2012 GEL000 Loans to individuals Manufacturing Trade Service Agriculture Other 6,949 29 11 10 134 7,133 2011 GEL000 5,792 100 220 7 6,119

(e)

Significant credit exposures

As at 31 December 2012 and 2011 no individual loan balances or groups of connected borrowers balances exceed 10% of equity.

(f)

Loan maturities

The maturity of the loan portfolio is presented in note 18(d), which shows the remaining period from the reporting date to the contractual maturity of the loans. Due to the short-term nature of the loans issued by the Group, it is likely that many of the loans will be prolonged at maturity. Accordingly, the effective maturity of the loan portfolio may be significantly longer than the term based on contractual terms.

26

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

12 Investment property

2012 GEL000 Investment property at the beginning of the year Additions Investment property at the end of the year 398 398 2011 GEL000 -

As at 31 December 2012 management of the Group has estimated the fair value of the investment property. The fair value has been estimated using market approach. Managements estimate of the fair value yielded a range of values from a fair value approximately equal to the carrying amount to a fair value approximately 5% higher than the carrying amount. Management believes that there are no assumptions or estimation uncertainties that have a reasonable possibility of resulting in a material adjustment to the fair value amount of the investment property within the next financial year.

27

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

13 Property, equipment and intangible assets

GEL000 Cost Balance at 1 January 2012 Additions Disposals Balance at 31 December 2012 Depreciation and amortization Balance at 1 January 2012 Depreciation and amortization for the year Disposals Balance at 31 December 2012 Carrying amount At 31 December 2012 559 Land and buildings Balance at 1 January 2011 Additions Disposals At 31 December 2011 Depreciation and amortization Balance at 1 January 2011 Depreciation and amortization for the year Disposals Balance at 31 December 2011 Carrying amounts At 31 December 2011 At 1 January 2011 485 439 12 16 67 72 564 527 21 12 33 11 7 4 40 (7) 78 56 (7) 122 45 73 460 58 518 38 Intangible assets 23 23 82 Other 117 57 (29) 145 679 Total 600 115 (29) 686 33 12 45 16 11 5 38 (76) 40 55 (76) 101 78 122 518 101 (15) 604 54 23 31 145 65 (88) 122 686 197 (103) 780 Land and buildings Intangible assets Other Total

Land and buildings with the carrying amount of GEL 184 thousand are pledged under loans and borrowings (see note 15).

28

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

14 Other assets

2012 GEL000 Accounts receivables Total other financial assets Repossessed assets Prepayments Materials and supplies Total other non-financial assets Total other assets 82 82 510 27 537 619 2011 GEL000 37 37 233 34 2 269 306

15 Loans and borrowings

This note provides information about the contractual terms of interest-bearing loans and borrowings, which are measured at amortized cost. For more information about exposure to interest rate, foreign currency and liquidity risk, see note 18.

2012 GEL000 Non-current liabilities Secured bank loans Unsecured loans from individuals 791 200 991 Current liabilities Secured bank loans Unsecured loans from individuals 1,867 1,000 2,867 3,858 1,910 378 2,288 2,912 608 16 624 2011 GEL000

29

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(a) Terms and debt repayment schedule

Terms and conditions of outstanding loans were as follows:

31 December 2012 Nominal interest rate 12% 16% 16% 16% 12% 12% 12% 12% 11% 16% 12% 10% 12%-24% 18% 18% 18% 18% 12%-24% 14%-18% Year of maturity 2013 2014 2015 2017 2015 2013 2015 2012 2012 2012 2012 2012 2013 2014 2013 2014 2013 2012 2012 Face value 1,112 237 95 223 103 755 133 792 175 111 25 97 3,858 Carrying amount 1,112 237 95 223 103 755 133 792 175 111 25 97 3,858 31 December 2011 Face value 134 235 239 988 104 124 562 132 16 303 75 2,912 Carrying amount 134 235 239 988 104 124 562 132 16 303 75 2,912

GEL000 Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured bank loan Secured loans from individuals Secured loans from individuals Secured loans from individuals Secured loans from individuals Secured loans from individuals Secured loans from individuals Secured loans from individuals

Currency USD USD USD USD USD EUR EUR USD USD USD EUR EUR USD USD EUR EUR GEL USD EUR

Bank loans are secured by the following: land and buildings with the carrying amount of GEL 184 thousand, located on 64 Mitskevich street, Tbilisi, Georgia, the Groups head office; repossessed assets with the carrying amount of GEL 52 thousand located in Tbilisi, Georgia; term deposit of the shareholder of the Group.

Loans from individuals are secured by the assets of the Group, including precious metals and real estate.

30

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

16 Other liabilities

2012 GEL000 Accounts payable Total other financial liabilities Prepayments received Other taxes payable Total other non-financial liabilities Total other liabilities 57 57 49 4 53 110 2011 GEL000 5 5 63 10 73 78

17 Equity

(a) Charter capital

Charter capital represents the nominal amount of capital in the founding documentation of the Group. On 25 January 2012 the owners of the Group made a decision to declare dividends of GEL 400 thousand and on 31 August 2012 the owners decided to increase the declared dividends to GEL 500 thousand and to transfer balance of the retained earnings as at 31 December 2011 to the charter capital of the Group with a corresponding increase in the ownership percentage of owners in proportion to their holdings as at date of the decision.

(b)

Dividends

In accordance with Georgian legislation the Groups distributable reserves are limited to the balance of retained earnings as recorded in the Groups statutory consolidated financial statements prepared in accordance with IFRSs. As at 31 December 2012 the Group had retained earnings of GEL 1,173 thousand (2011: GEL 940 thousand). On 25 January 2012, the Group declared dividends of GEL 400 thousand and on 31 August 2012 the owners decided to increase the declared dividends to GEL 500 thousand. The dividends in the amount of GEL 270 thousand were paid to the shareholders during 2012.

31

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

18 Risk management

Management of risk is fundamental to the business of banking and is an essential element of the Groups operations. The major risks faced by the Group are those related to market risk, credit risk and liquidity risk.

(a)

Risk management policies and procedures

The risk management policies aim to identify, analyse and manage the risks faced by the Group, to set appropriate risk limits and controls, and to continuously monitor risk levels and adherence to limits. Risk management policies and procedures are reviewed regularly to reflect changes in market conditions, products and services offered and emerging best practice. The Supervisory Board has overall responsibility for the oversight of the risk management framework, overseeing the management of key risks and reviewing its risk management policies and procedures as well as approving significantly large exposures. Management is responsible for monitoring and implementation of risk mitigation measures and making sure that the Group operates within the established risk parameters. The Chief Executive Officer (CEO) is responsible for the overall risk management and compliance functions, ensuring the implementation of common principles and methods for identifying, measuring, managing and reporting both financial and non-financial risks. The CEO reports directly to the Supervisory Board.

(b)

Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises currency risk, interest rate risk and other price risks. Market risk arises from open positions in interest rate, currency and equity financial instruments, which are exposed to general and specific market movements and changes in the level of volatility of market prices. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, whilst optimizing the return on risk. Overall authority for market risk is vested with management. Market risks are approved by management.

(i)

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Group is exposed to the effects of fluctuations in the prevailing levels of market interest rates on its financial position and cash flows. Interest margins may increase as a result of such changes but may also reduce or create losses in the event that unexpected movements occur.

32

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

Interest rate gap analysis Interest rate risk is managed principally through monitoring interest rate gaps. A summary of the interest gap position for major financial instruments is as follows:

GEL000 31 December 2012 ASSETS Loans to customers LIABILITIES Loans and borrowings 121 595 GEL000 31 December 2011 ASSETS Loans to customers LIABILITIES Loans and borrowings 818 (292) 27 507 1,050 (216) 393 1,749 624 1,459 2,912 3,207 526 534 834 2,142 2,083 6,119 Demand and less than 1 month 247 453 From 1 to 3 months 85 875 2,614 (744) 791 2,096 More than 1 year 3,858 3,275 716 700 960 1,870 2,887 7,133 Demand and less than 1 month From 1 to 3 months From 3 to 6 months From 6 to 12 months More than 1 year

Total

From From 3 to 6 months 6 to 12 months

Total

Average interest rates The table below displays average effective interest rates for interest bearing assets and liabilities as at 31 December 2012 and 2011. These interest rates are an approximation of the yields to maturity of these assets and liabilities.

2012 Average effective interest rate, % GEL Interest bearing assets Loans to customers Interest bearing liabilities Loans and borrowings 18% 15% 13% 13% 12% 36% 34% 34% 31% 34% 34% USD EUR 2011 Average effective interest rate, % GEL USD EUR

The sensitivity of the Groups interest-bearing assets and liabilities to changes in interest rate repricing risk was not significant as at 31 December 2012 and 31 December 2011. Fair value sensitivity analysis for fixed rate instruments The Group does not account for any fixed rate financial assets and liabilities at fair value through profit or loss. Therefore a change in interest rates at the reporting date would not affect profit and loss.

33

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

(ii)

Currency risk

The Group has assets and liabilities denominated in several foreign currencies. Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign currency exchange rates. Although the Group hedges its exposure to currency risk, such activities do not qualify as hedging relationships in accordance with IFRS. The following table shows the currency exposure structure of financial assets and liabilities as at 31 December 2012:

GEL GEL000 ASSETS Cash and cash equivalents Loans to customers Other financial assets Total assets LIABILITIES Loans and borrowings Dividends payable Other financial liabilities Total liabilities Net position 97 230 13 340 (241) 2,737 44 2,781 4,109 1,024 1,024 (590) 3,858 230 57 4,145 3,278 31 55 13 99 152 6,669 69 6,890 25 409 434 208 7,133 82 7,423 USD GEL000 EUR GEL000 Total GEL000

The following table shows the currency structure of financial assets and liabilities as at 31 December 2011:

GEL GEL000 ASSETS Cash and cash equivalents Loans to customers Other financial assets Total assets LIABILITIES Loans and borrowings Other financial liabilities Total liabilities Net position 5 5 52 1,904 1,904 3,873 1,008 0 1,008 (546) 2,912 5 2,917 3,379 13 34 10 57 108 5,649 20 5,777 19 436 7 462 140 6,119 37 6,296 USD GEL000 EUR GEL000 Total GEL000

34

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

A weakening of the GEL, as indicated below, against the following currencies at 31 December 2012 and 2011 would have increased (decreased) profit or loss by the amounts shown below. This analysis is on net of tax basis and is based on foreign currency exchange rate variances that the Group considered to be reasonably possible at the end of the reporting period. The analysis assumes that all other variables, in particular interest rates, remain constant.

GEL000 10% appreciation of USD against GEL 10% appreciation of EUR against GEL 2012 349 (50) 2011 329 (46)

A strengthening of the GEL against the above currencies at 31 December 2012 and 2011 would have had the equal but opposite effect on the above currencies to the amounts shown above, on the basis that all other variables remain constant.

(c)

Credit risk

Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its contractual obligations. The Group has policies and procedures for the management of credit exposures including guidelines to limit portfolio concentration and the establishment of a Credit Committee, which actively monitors credit risk. The credit policy is reviewed and approved by the Supervisory Board. The credit policy establishes: procedures for review and approval of loan credit applications methodology for the credit assessment of borrowers methodology for the evaluation of collateral

Individual loan credit applications are originated by the relevant loan officers. Analysis reports are based on a structured analysis focusing on the customers business and financial performance. The Credit Committee reviews the loan credit application on the basis of submission by the loan officers. The loan credit application and the report are then independently reviewed by the CEO. The Group continuously monitors the performance of individual credit exposures and regularly reassesses the creditworthiness of its customers. The review is based on the customers most recent financial information and other information submitted by the borrower, or otherwise obtained by the Group. The maximum exposure to credit risk is generally reflected in the carrying amounts of financial assets on the consolidated statement of financial position. The impact of possible netting of assets and liabilities to reduce potential credit exposure is not significant. The maximum exposure to credit risk from financial assets at the reporting date is as follows:

2012 GEL000 ASSETS Loans to customers Bank balances Other financial assets Total maximum exposure 7,133 12 82 7,227 6,119 12 37 6,168 2011 GEL000

35

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

For the analysis of collateral held against loans to customers and concentration of credit risk in respect of loans to customers refer to note 11.

(d)

Liquidity risk

Liquidity risk is the risk that the Group will encounter difficulty in meeting obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. Liquidity risk exists when the maturities of assets and liabilities do not match. The matching and or controlled mismatching of the maturities and interest rates of assets and liabilities is fundamental to liquidity management. It is unusual for financial institutions ever to be completely matched since business transacted is often of an uncertain term and of different types. An unmatched position potentially enhances profitability, but can also increase the risk of losses. The Group maintains liquidity management with the objective of ensuring that funds will be available at all times to honor all cash flow obligations as they become due. The liquidity policy is reviewed and approved by management. The Group seeks to actively support a diversified and stable funding base comprising long-term and short-term loans from banks and other financial institutions, accompanied by diversified portfolios of highly liquid assets, in order to be able to respond quickly and smoothly to unforeseen liquidity requirements. The liquidity management practice includes the following: projecting cash flows by major currencies and considering the level of liquid assets necessary in relation thereto maintaining a diverse range of funding sources managing the concentration and profile of debts maintaining debt financing plans maintaining liquidity and funding contingency plans

The following tables show the undiscounted cash flows on financial liabilities on the basis of their earliest possible contractual maturity. The total gross outflow disclosed in the tables is the contractual, undiscounted cash flow on the financial liability. The maturity analysis for financial liabilities as at 31 December 2012 is as follows:

Demand and less than 1 month 166 230 49 445 From 1 to 3 months 349 8 357 From 3 to 6 months 172 172 From 6 to 12 months 2,700 2,700 More than 1 year 837 837 Total gross amount outflow 4,224 230 57 4,511

GEL000 Non-derivative liabilities Loans and borrowings Dividends payable Other financial liabilities Total liabilities

Carrying amount 3,858 230 57 4,145

36

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

The maturity analysis for financial liabilities as at 31 December 2011 is as follows:

Demand and less than 1 month 843 5 848 From 1 to 3 months 74 74 From 3 to 6 months 1,093 1,093 From 6 to 12 months 455 455 More than 1 year 697 697 Total gross amount outflow 3,162 5 3,167

GEL000 Non-derivative liabilities Loans and borrowings Other financial liabilities Total liabilities

Carrying amount 2,912 5 2,917

The table below shows an analysis, by expected maturities, of the amounts recognised in the statement of financial position as at 31 December 2012:

Demand and less than 1 month 208 716 66 990 121 230 46 52 449 541 From 1 to 3 months 700 11 711 247 8 255 456 From 3 to 6 months 960 26 986 85 48 133 853 From 6 to 12 months 1,870 6 1,876 2,614 2 2,616 (740)

GEL000 Non-derivative assets Cash and cash equivalents Loans to customers Investment property Property, equipment and intangible assets Deferred tax asset Other assets Total assets Non-derivative liabilities Loans and borrowings Dividens payable Income tax payable Other liabilities Total liabilities Net position

More than 1 year 2,887 2,887 791 791 2,096

No maturity 398 679 33 510 1,620 1,620

Total 208 7,133 398 679 33 619 9,070 3,858 230 46 110 4,244 4,826

37

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

The table below shows an analysis, by expected maturities, of the amounts recognised in the statement of financial position as at 31 December 2011:

Demand and less than 1 month 140 526 65 731 818 3 72 893 (162)

GEL000 Non-derivative assets Cash and cash equivalents Loans to customers Property, equipment and intangible assets Deferred tax asset Other assets Total assets Non-derivative liabilities Loans and borrowings Income tax payable Other liabilities Total liabilities Net position

From 1 to 3 months 534 8 542 27 6 33 509

From 3 to 6 months 834 834 1,050 1,050 (216)

From 6 to 12 months 2,142 233 2,375 393 393 1,982

More than 1 year 2,083 2,083 624 624 1,459

No maturity 564 17 581 581

Total 140 6,119 564 17 306 7,146 2,912 3 78 2,993 4,153

(e)

Fair values versus carrying amounts

Management believes that the fair value of financial assets and liabilities approximates their carrying amounts. The basis for determining fair values is disclosed in note 3(d).

19 Capital management

The Groups policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to sustain future development of the business. Capital consists of charter capital and retained earnings. The debt to capital ratio at the end of the reporting period is as follows:

2012 GEL000 Total liabilities Less cash and cash equivalents Net debt Total equity Debt to capital ratio 4,244 (208) 4,036 4,826 84% 2011 GEL000 2,993 (140) 2,853 4,153 69%

38

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

20 Contingencies

(a) Insurance

The insurance industry in Georgia is in a developing state and many forms of insurance protection common in other parts of the world are not yet generally available. The Group does not have full coverage for its premises and equipment, business interruption, or third party liability in respect of property or environmental damage arising from accidents on its property or relating to operations. Until the Group obtains adequate insurance coverage, there is a risk that the loss or destruction of certain assets could have a material adverse effect on operations and financial position.

(b)

Litigation

In the ordinary course of business, the Group is subject to legal actions and complaints. Management believes that the ultimate liability, if any, arising from such actions or complaints will not have a material adverse effect on the financial condition or the results of future operations.

(c)

Taxation contingencies

The taxation system in Georgia continues to evolve and is characterised by frequent changes in legislation, official pronouncements and court decisions, which are sometimes contradictory and subject to varying interpretation by different tax authorities. Taxes are subject to review and investigation by a number of authorities who have the authority to impose severe fines, penalties and interest charges. These circumstances may create tax risks in Georgia that are substantially more significant than in other countries. Management believes that it has provided adequately for tax liabilities based on its interpretations of applicable Georgian tax legislation, official pronouncements and court decisions. However, the interpretations of the relevant authorities could differ and the effect on the financial position, if the authorities were successful in enforcing their interpretations, could be significant.

21 Related party transactions

(a) Control relationships

The Groups immediate and ultimate parent company is Laponeto Commercial LLC. The party with ultimate control over the Group is Elena Papachristodoulou Psintrou. No publicly available financial statements are produced by the Groups parent company.

(b)

Transactions with the members of the Supervisory Board and Management Board

Total remuneration included in personnel expenses for the years ended 31 December 2012 and 2011 is as follows:

2012 GEL000 Employee compensation 279 2011 GEL000 250

These amounts include non-cash benefits in respect of the members of the Supervisory Board and the Management Board.

39

Microfinance Organization Easycred Georgia LLC Notes to, and forming part of, the consolidated financial statements for the year ended 31 December 2012

The outstanding balances and average interest rates as at 31 December 2012 and 2011 for transactions with the members of the Management Board are as follows:

2012 GEL000 Consolidated statement of financial position Loans to customers Loans and borrowings 6 (3) 18% 17% Average interest rate, % 2011 GEL000 Average interest rate, %

Amounts included in profit or loss in relation to transactions with the members of the Management Board for the year ended 31 December are as follows:

2012 GEL000 Profit or loss Interest income 1 2011 GEL000

(c)

Transactions with other related parties

Other related parties include close family members of key management personnel. The outstanding balances and the related average interest rates as at 31 December 2012 and 2011 with other related parties are as follows.

2012 GEL000 Consolidated statement of financial position Loans and borrowings 56 18% 23 18% Average interest rate, % 2011 GEL000 Average interest rate, %

22 Events subsequent to the reporting date

On 21 January 2013 the following decisions were made by the owners of the Group regarding distribution of retained earnings: pay dividends of GEL 700 thousand from the profit for the period ended 31 December 2012; after payment of dividends transfer the remaining profit for the year ended 31 December 2012 to the charter capital of the Group with a corresponding increase in the ownership percentage of owners in proportion to their holdings as at the date of decision.

In 2013 up to the issue date of these financial statements, dividends of GEL 175 thousand were paid to owners of the Group. On 7 March 2013 the Group amended its charter and the shareholder structure changed. The shareholding of Laponeto Commercial LLC of 51% was transferred to Laerti Zubadalashvili and the shareholding of Nodar Daushvili of 9% was transferred to Eliza Daushvili. As a result, the party with the ultimate control over the Group has been changed and as at the date of issue of these consolidated financial statements the party with the ultimate control over the Group is Laerti Zubadalashvili.

40

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)