Académique Documents

Professionnel Documents

Culture Documents

Assess credit worthiness

Transféré par

Asim MahatoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assess credit worthiness

Transféré par

Asim MahatoDroits d'auteur :

Formats disponibles

OVERVIEW OF CREDIT APPRAISAL

Credit appraisal means an investigation/assessment done by the bank prior before providing any loans & advances/project finance & also checks the commercial, financial & technical viability of the project proposed its funding pattern & further checks the primary & collateral security cover available for recovery of such funds.

Brief overview of credit:

Credit Appraisal is a process to ascertain the risks associated with the extension of the credit facility. It is generally carried by the financial institutions which are involved in providing financial funding to its customers. Credit risk is a risk related to non repayment of the credit obtained by the customer of a bank. Thus it is necessary to appraise the credibility of the customer in order to mitigate the credit risk. Proper evaluation of the customer is performed which measures the financial condition and the ability of the customer to repay back the loan in future. Generally the credit facilities are extended against the security know as collateral. But even though the loans are backed by the collateral, banks are normally interested in the actual loan amount to be repaid along with the interest. Thus, the customer's cash flows are ascertained to ensure the timely payment of principal and the interest. It is the process of appraising the credit worthiness of a loan applicant. Factors like age, income, number of dependents, nature of employment, continuity of employment, repayment capacity, previous loans, credit cards, etc. are taken into account while appraising the credit worthiness of a person. Every bank or lending institution has its own panel of officials for this purpose. However the 3 C of credit are crucial & relevant to all borrowers/ lending which must be kept in mind at all times. Character Capacity Collateral

If any one of these are missing in the equation then the lending officer must question the viability of credit.

There is no guarantee to ensure a loan does not run into problems; however if proper credit evaluation techniques and monitoring are implemented then naturally the loan loss probability / problems will be minimized, which should be the objective of every lending officer. Credit is the provision of resources (such as granting a loan) by one party to another party where that second party does not reimburse the first party immediately, thereby generating a debt, and instead arranges either to repay or return those resources (or material(s) of equal value) at a later date. The first party is called a creditor, also known as a lender, while the second party is called a debtor, also known as a borrower. Credit allows you to buy goods or commodities now, and pay for them later. We use credit to buy things with an agreement to repay the loans over a period of time. The most common way to avail credit is by the use of credit cards. Other credit plans include personal loans, home loans, vehicle loans, student loans, small business loans, trade. A credit is a legal contract where one party receives resource or wealth from another party and promises to repay him on a future date along with interest. In simple terms, a credit is an agreement of postponed payments of goods bought or loan. With the issuance of a credit, a debt is formed.

Basic types of credit

There are four basic types of credit. By understanding how each works, you will be able to get the most for your money and avoid paying unnecessary charges. Service credit is monthly payments for utilities such as telephone, gas, electricity, and water. You often have to pay a deposit, and you may pay a late charge if your payment is not on time. Loans let you borrow cash. Loans can be for small or large amounts and for a few days or several years. Money can be repaid in one lump sum or in several regular payments until the amount you borrowed and the finance charges are paid in full. Loans can be secured or unsecured. Installment credit may be described as buying on time, financing through the store or the easy payment plan. The borrower takes the goods home in exchange for a promise to pay later. Cars, major appliances, and furniture are often purchased this way. You usually sign a contract, make a down payment, and agree

to pay the balance with a specified number of equal payments called installments. The finance charges are included in the payments. The item you purchase may be used as security for the loan. Credit cards are issued by individual retail stores, banks, or businesses. Using a credit card can be the equivalent of an interest-free loan--if you pay for the use of it in full at the end of each month.

Brief overview of loans:

Loans can be of two types fund base & non-fund base: FUND BASE includes: Working Capital Term Loan

NON-FUND BASE includes: Letter of Credit Bank Guarantee Bill Discounting

FUND BASE: WORKING CAPITAL: 1. General The objective of running any industry is earning profits. An industry will require funds to acquire fixed assets like land, building, plant, machinery, equipments, vehicles, tools etc., & also to run the business i.e. its day to day operations. Funds required for day to-day working will be to finance production & sales. For production, funds are needed for purchase of raw materials/ stores/ fuel, for employment of labour, for power charges etc., for storing finishing goods till they are sold out & for financing the sales by way of sundry debtors/ receivables. Capital or funds required for an industry can therefore be bifurcated as fixed capital & working capital. Working capital in this context is the excess of current assets over current liabilities. The excess of current assets over current liabilities is treated as net working capital or liquid surplus & represents that portion of the working capital, which has been provided from the long-term source. 2. DEFINITION Working capital is defined as the funds required to carry the required levels of current assets to enable the unit to carry on its operations at the expected levels uninterruptedly. Thus Working Capital Required is dependent on (a) The volume of activity (viz. level of operations i.e. Production & sales) (b) The activity carried on viz. mfg process, product, production programme, the materials & marketing mix.

3. Methods & Application SEGMENT SSI SBF C&I Trade LIMITS Upto Rs 5 cr Above Rs 5 cr All loans & Upto Rs 1 cr Above Rs 1 cr & upto Rs 5 cr Above Rs 5 cr Industrial Below Rs 25 lacs Rs 25 lacs & Over but upto Rs 5 cr Above Rs 5 cr METHOD Traditional Method & Nayak Committee method Projected Balance Sheet Method Traditional / Turnover Method Traditional Method for Trade & Projected Turnover Method Projected Balance Sheet Method & Projected Turnover Method Projected Balance Sheet Method Traditional Method Projected Balance Sheet Method & Projected Turnover Method Projected Balance Sheet Method

Services

C&I Units

4. Operating cycle method 4.1 Any manufacturing activity is characterized by a cycle of operations consisting of purchase of purchase of raw materials for cash, converting these into finished goods & realizing cash by sale of these finished goods. 4.2 Diagrammatically, the OPERATING CYCLE is represented as under 4.3 The time that lapses between cash outlay & cash realization by sale of finished goods & realization of sundry debtors is known as the length of the operating cycle.

4.4 That is, the operating cycle consists of:

Time taken to acquire raw materials & average period for which they are in store. Conversion process time Average period for which finished goods are in store & Average collection period of receivables (Sundry Debtors)

4.5 Operating cycle is also called the cash-to-cash cycle & indicates how cash is converted into raw materials, stocks in process, finished goods, bills (receivables) & finally back to cash. Working capital is the total cash that is circulating in this cycle. Therefore, working capital can be turned over or redeployed after completing the cycle.

4.6 The length of the operating cycle = a+b+c+d (as in 4.4)

If a = 60 days b = 10 days c = 20 days d = 30 days The operating cycle is 120 days (nearly 4 months). This means there are 365/120 = 3 cycles of operations in a year. Sales Operating expenses = Rs. 1,00,000 per annum = Rs. 72,000 per annum

But the working capital requirement, as you know, is not Rs. 72,000. In these cases, there are 3 operating cycles in a year. That means each rupee of working deployed in the unit is turned over 3 times in a year. (This is also known as working capital turnover ratio). Therefore WCR = Operating Expenses No. of cycles per annum = Rs. 72,000/- = Rs. 24,000/3

WCR is therefore not Rs. 72,000/- but only Rs. 24,000/-

4.7 Assessment of Working Capital Requirement & Permissible Bank Finance using Operating Cycle Concept

Let us consider a case of a unit where: Sales Raw Materials Wages = Rs. 20,000 p.m. (A) = Rs. 14,000 p.m. = Rs. 2,000 p.m.

Other manufacturing Expenses Total expenses Profit = Rs. 3,000 p.m. = Rs. 19,000 p.m. (B) = Rs. 1,000 P.m. (C)

The operating cycle is Raw Materials Stock in Process FG Sundry Debtors The total length of Operating cycle = 35 days (D) = 15 days = 2 days = 3 days = 15 days

WCR = B * D = 19,000 * 35 = Rs. 22,167/- (approx.) 30 30

Where B = Operating Expenses; & D = Length of Operating cycle

The length of the operating cycle is different from industry to industry and from one firm to another within the same industry. For instance, the operating cycle of a pharmaceutical unit would be quite different from one engaged in the manufacture of machine tools. The operating cycle concept enables us to assess the working capital need of each enterprise keeping in view the peculiarities of the industry it is engaged in and its scale of operations. Operating cycle is an important management tool in decisionmaking.

Traditional Method of Assessment of Working Capital Requirement The operating cycle concept serves to identify the areas requiring improvement for the purpose of control and performance review. But, as bankers, we require a more detailed analysis to assess the various components of working capital requirement viz., finance for stocks, bills etc. Bankers provide working capital finance for holding an acceptable level of current assets, viz. raw materials, stocks-in-process, finished goods and sundry debtors for achieving a predetermined level of production and sales. Quantification of these funds required to be blocked in each of these items of current assets at any time will, therefore provide a measure of the working capital requirement (WCR) of an industry.

It can thus be summarized as follows:

Projected Annual Turnover Method for SSI units (Nayak Committee) For SSI units which enjoy fund based working capital limits up to Rs.5 cr, the minimum working capital limit should be fixed on the basis of projected annual turnover. 25% of the output or annual turnover value should be computed as the quantum of working capital required by such unit .The unit should be required to bring in 5% of their annual turnover as margin money and the Bank shall provide 20% of the turnover as working capital finance. Nayak committee Guidelines correspond to working capital limits as per the Operating Cycle method where the average production / processing cycle is taken to be 3 months (i.e. working capital would be turned over 4 times in a year).

Projected Annual Turnover Method for C & I industrial units (limits upto Rs 5 cr) Bank has decided to extend Nayak Committee approach for assessment of limits to C&I industrial units requiring credit limits upto Rs.5 cr. That is, credit requirement up to Rs.5 crores of C&I borrowers (industrial units) may be assessed at a minimum of 20% of projected annual turnover. In other words, the working capital requirement will be assessed at 25% of projected annual turnover, of which 5% should be borne by entrepreneur as margin and 20% would be allowed as Bank Drawings. While accepting projected annual sales turnover, a cap of 25% over actual annual sales turnover in the immediately preceding year should be set, except where production capacity has been substantially increased.

Projected Annual Turnover Method for Business Enterprises in Trade & Services Sector:

i) For working Capital limits up to Rs. 5 cr to C&I(Trade) sector, the assessment of credit limit is to be based upon annual turnover. Thus, an across the board credit limit equal to 15% of projected annual turnover be offered to business enterprises in the T&S sector. It would be available for utilization generally as a cash credit limit. However, where needed an LC limit (as a sub-limit of total), may also be allowed. ii) The credit limit would be secured by hypothecation charge on the current assets of the enterprise. Periodical stock statements are to be obtained and margin of 25% be retained. iii) Credit limits under this assessment method may be offered to established (at least 3 years old) profit making business enterprises, eligible for credit rating of SB-4 and above. Mortgage of property valued at least at 33% of the limit is to be prescribed. Further, an interest rebate of 0.50% p.a. may be given to borrowers who offer mortgage of property valued at over 75% of the credit limit. iv) While accepting projected annual sales turnover, a cap of 25% over actual annual sales turnover in the immediately preceding year should be set. When circumstances warrant its breach, reasons therefor should be recorded. v) Where borrowers indicate need for credit limits which are higher than the amount indicated above, assessment under the traditional PBS method may be resorted to. Projected Balance Sheet Method (PBS) The PBS method of assessment will be applicable to all C&I borrowers who are engaged in manufacturing, services, and trading activities, including merchant exports and who require fund based working capital finance of Rs. 25 lacs and above. In the case of SSI borrowers, who require working capital credit limit up to Rs.5 cr, the limit shall be computed on the basis of Nayak Committee formula as well as that based on production and operating cycle of the unit and the higher of the two may be sanctioned. Fund based working capital credit limits beyond Rs 5 cr for SSI units shall be computed in the same way as for C&I units. For business enterprises in Trade and Services Sector, where the projected turnover method is not applicable, PBS method shall be followed. 8.1 In the Projected Balance Sheet (PBS) method, the borrowers total business operations, financial position, management capabilities etc. are analyzed in detail to assess the working capital finance required and to evaluate the overall risk of the exposure. The following financial analysis is also to be carried out:

Analysis of the borrowers Profit and Loss account, Balance Sheet, Funds Flow etc. for the past periods is done to examine the profitability, financial position, financial management, etc. in the business. Detailed scrutiny and validation of the projected income and expense in the business, and projected changes in the financial position (sources and uses of funds) are carried out to examine if these are acceptable from the angle of liquidity, overall gearing, efficiency of operations etc.

8.2 There will not be a prescription like mandatory minimum current ratio or maximum level of a current asset (inventory and receivables holding level norms) under PBS method. Under the PBS method, assessment of WC requirement will be carried out in respect of each borrower with proper examination of all parameters relevant to the borrower and their acceptability.

TERM LOAN: 1. A term loan is granted for a fixed term of not less than 3 years intended normally for financing fixed assets acquired with a repayment schedule normally not exceeding 8 years. 2. A term loan is a loan granted for the purpose of capital assets, such as purchase of land, construction of, buildings, purchase of machinery, modernization, renovation or rationalization of plant, & repayable from out of the future earning of the enterprise, in installments, as per a prearranged schedule. From the above definition, the following differences between a term loan & the working capital credit afforded by the Bank are apparent: The purpose of the term loan is for acquisition of capital assets. The term loan is an advance not repayable on demand but only in installments ranging over a period of years. The repayment of term loan is not out of sale proceeds of the goods & commodities per se, whether given as security or not. The repayment should come out of the future cash accruals from the activity of the unit.

The security is not the readily saleable goods & commodities but the fixed assets of the units.

3. It may thus be observed that the scope & operation of the term loans are entirely different from those of the conventional working capital advances. The Banks commitment is for a long period & the risk involved is greater. An element of risk is inherent in any type of loan because of the uncertainty of the repayment. Longer the duration of the credit, greater is the attendant uncertainty of repayment & consequently the risk involved also becomes greater. 4. However, it may be observed that term loans are not so lacking in liquidity as they appear to be. These loans are subject to a definite repayment programme unlike short term loans for working capital (especially the cash credits) which are being renewed year after year. Term loans would be repaid in a regular way from the anticipated income of the industry/ trade. 5. These distinctive characteristics of term loans distinguish them from the short term credit granted by the banks & it becomes necessary therefore, to adopt a different approach in examining the applications of borrowers for such credit & for appraising such proposals. 6. The repayment of a term loan depends on the future income of the borrowing unit. Hence, the primary task of the bank before granting term loans is to assure itself that the anticipated income from the unit would provide the necessary amount for the repayment of the loan. This will involve a detailed scrutiny of the scheme, its financial aspects, economic aspects, technical aspects, a projection of future trends of outputs & sales & estimates of cost, returns, flow of funds & profits.

7. Appraisal of Term Loans Appraisal of term loan for, say, an industrial unit is a process comprising several are four broad aspects of appraisal, namely Technical Feasibility - To determine the suitability of the technology selected & the adequacy of the technical investigation & design; Economic Feasibility - To ascertain the extent of profitability of the project & its sufficiency in relation to the repayment obligations pertaining to term assistance; steps. There

Financial Feasibility - To determine the accuracy of cost estimates, suitability of the envisaged pattern of financing & general soundness of the capital structure; &

Managerial Competency To ascertain that competent men are behind the project to ensure its successful implementation & efficient management after commencement of commercial production

Vous aimerez peut-être aussi

- September 13, 2018 Statement PDFDocument6 pagesSeptember 13, 2018 Statement PDFAnonymous MNcPT60% (1)

- Business Account Statement: Account Summary For This PeriodDocument2 pagesBusiness Account Statement: Account Summary For This PeriodBrian TalentoPas encore d'évaluation

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapPas encore d'évaluation

- A Study of Credit Assessment in Dena BankDocument48 pagesA Study of Credit Assessment in Dena BankDeepali MahilagiriPas encore d'évaluation

- Analysis of Credit Management of JanataDocument47 pagesAnalysis of Credit Management of Janataprokash halderPas encore d'évaluation

- Project Report HDFCDocument54 pagesProject Report HDFCBhaskar ShuklaPas encore d'évaluation

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowdavin nathan100% (1)

- Credit Appraisal ProcessDocument19 pagesCredit Appraisal ProcessVaishnavi khot100% (1)

- Assessment of Working CapitalDocument43 pagesAssessment of Working CapitalAshutosh VermaPas encore d'évaluation

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3APas encore d'évaluation

- Proof of Cash CelticsDocument3 pagesProof of Cash CelticsCJ alandyPas encore d'évaluation

- Insurance Midterms ReviewerDocument7 pagesInsurance Midterms ReviewerangelicaPas encore d'évaluation

- Credit AppraisalDocument89 pagesCredit AppraisalSkillpro KhammamPas encore d'évaluation

- Blackbook Project On Credit AppraisalDocument95 pagesBlackbook Project On Credit AppraisalMausam PanchalPas encore d'évaluation

- A Study On Credit Appraisal System in India With Special Reference To South Indian BanksDocument5 pagesA Study On Credit Appraisal System in India With Special Reference To South Indian BanksEditor IJTSRDPas encore d'évaluation

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDocument9 pagesAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamPas encore d'évaluation

- 205 - F - Icici-A Study On Credit Appraisal System at Icici BankDocument71 pages205 - F - Icici-A Study On Credit Appraisal System at Icici BankPeacock Live Projects0% (1)

- Banking Law Reviewer - Atty DyDocument37 pagesBanking Law Reviewer - Atty DyStarr WeigandPas encore d'évaluation

- Statement 20230202Document10 pagesStatement 20230202philip balsomPas encore d'évaluation

- DocumentationDocument36 pagesDocumentationRamesh BethaPas encore d'évaluation

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalPas encore d'évaluation

- Fund based working capital assessment with MPBF methodDocument28 pagesFund based working capital assessment with MPBF methodAbinash BiswalPas encore d'évaluation

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- SCFS Cooperative Bank LTDDocument64 pagesSCFS Cooperative Bank LTDLïkïth RäjPas encore d'évaluation

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaPas encore d'évaluation

- Uco BankDocument77 pagesUco BankSankalp PurwarPas encore d'évaluation

- Credit AppraisalDocument94 pagesCredit AppraisalpratikshaPas encore d'évaluation

- Questions: Company BackgroundDocument5 pagesQuestions: Company BackgroundVia Samantha de AustriaPas encore d'évaluation

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- Credit Appraisal PNBDocument48 pagesCredit Appraisal PNBURMI0% (1)

- A Study On Credit Appraisal System On SME of Union Bank of IndiaDocument56 pagesA Study On Credit Appraisal System On SME of Union Bank of IndiaSarva ShivaPas encore d'évaluation

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocument53 pagesGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiPas encore d'évaluation

- An Overview of Credit Appresal Process With Special Reference To Differnent Loans Offer by Indian BankDocument86 pagesAn Overview of Credit Appresal Process With Special Reference To Differnent Loans Offer by Indian BankAbhinandan SahooPas encore d'évaluation

- A Study On Bank of Maharashtra: Commercial Banking SystemDocument13 pagesA Study On Bank of Maharashtra: Commercial Banking SystemGovind N VPas encore d'évaluation

- PROBLEMS ON LIABILITIES AND CURRENTLY MATURING OBLIGATIONSDocument29 pagesPROBLEMS ON LIABILITIES AND CURRENTLY MATURING OBLIGATIONSDivine CuasayPas encore d'évaluation

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Credit Appraisal in SBIDocument123 pagesCredit Appraisal in SBIvivekdudejaPas encore d'évaluation

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12Pas encore d'évaluation

- HardikDocument28 pagesHardikKeyur PatelPas encore d'évaluation

- SBI Credit Appraisal ProcessDocument123 pagesSBI Credit Appraisal ProcessVinod DhonePas encore d'évaluation

- Chapter On NPA - 13032020 PDFDocument105 pagesChapter On NPA - 13032020 PDFs s singhPas encore d'évaluation

- Credit Policy Version 1.2Document157 pagesCredit Policy Version 1.2Amit SinghPas encore d'évaluation

- Working Capital of Borrower-Bank of BarodaDocument82 pagesWorking Capital of Borrower-Bank of BarodaRaj KopadePas encore d'évaluation

- A Compartive Study On Problems and Prospect of Tax System of Nepal 2016Document98 pagesA Compartive Study On Problems and Prospect of Tax System of Nepal 2016Saroj BhusalPas encore d'évaluation

- Loans &advances (Mantu) - Project - 1-2Document48 pagesLoans &advances (Mantu) - Project - 1-2Shivu BaligeriPas encore d'évaluation

- Lit Rview Credit AppraisalDocument4 pagesLit Rview Credit AppraisalHari KrishnanPas encore d'évaluation

- Credit Appraisal at Uco BankDocument115 pagesCredit Appraisal at Uco BankRaju Rawat0% (1)

- Icici Bank Project Summer Internship Program 2020Document45 pagesIcici Bank Project Summer Internship Program 2020Bhavna PatnaikPas encore d'évaluation

- Presentation On Export CreditDocument21 pagesPresentation On Export CreditArpit KhandelwalPas encore d'évaluation

- A Study On HDFC Bank LTDDocument17 pagesA Study On HDFC Bank LTDbahaaraujlaPas encore d'évaluation

- Analysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Document58 pagesAnalysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Nikhil BhaleraoPas encore d'évaluation

- Credit AppraisalDocument12 pagesCredit AppraisalAishwarya KrishnanPas encore d'évaluation

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument3 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingS100% (2)

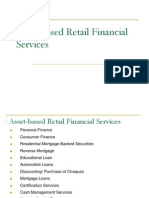

- Asset Retail Financial ServicesDocument37 pagesAsset Retail Financial Servicesjimi02100% (1)

- Non - Performing Assests (Npa'S)Document12 pagesNon - Performing Assests (Npa'S)Suhit SarodePas encore d'évaluation

- Canara Bank Home LoanDocument4 pagesCanara Bank Home LoanShekarPas encore d'évaluation

- Credit MonitoringDocument15 pagesCredit MonitoringTushar JoshiPas encore d'évaluation

- PNB Roi New Supplementry Agreement-WordDocument2 pagesPNB Roi New Supplementry Agreement-WordAnonymous XsYDXMVPas encore d'évaluation

- Study of NPA by Ajinkya (3) FinalDocument70 pagesStudy of NPA by Ajinkya (3) FinalAnjali ShuklaPas encore d'évaluation

- Cash Reserve RatioDocument40 pagesCash Reserve RatioMinal DalviPas encore d'évaluation

- RBI KYC guidelines for banks on customer identification and due diligenceDocument14 pagesRBI KYC guidelines for banks on customer identification and due diligenceraghav4231Pas encore d'évaluation

- Credit Appraisal SystemDocument48 pagesCredit Appraisal SystemRavi Joshi50% (2)

- Comparative Analysis Report On Npa of Pubic & Private Sector BankDocument10 pagesComparative Analysis Report On Npa of Pubic & Private Sector BankMBA SEM 3 2019Pas encore d'évaluation

- Loans and Advances of The Sutex Co-Opertive Bank Ltd.Document62 pagesLoans and Advances of The Sutex Co-Opertive Bank Ltd.sumesh8940% (1)

- MSME Government SupportDocument36 pagesMSME Government SupportBhaskaran BalamuraliPas encore d'évaluation

- Loan Assessment Process DescriptionDocument6 pagesLoan Assessment Process DescriptionNqobile KhumaloPas encore d'évaluation

- Programming in C and CPP UGC NETDocument1 pageProgramming in C and CPP UGC NETAsim MahatoPas encore d'évaluation

- Relational Database Design and SQL UGC NETDocument1 pageRelational Database Design and SQL UGC NETAsim MahatoPas encore d'évaluation

- Computer Arithmetic UGC NETDocument1 pageComputer Arithmetic UGC NETAsim MahatoPas encore d'évaluation

- Summary of Python 3's Built-In Types: Type Mutable Description Syntax ExampleDocument1 pageSummary of Python 3's Built-In Types: Type Mutable Description Syntax ExampleAsim MahatoPas encore d'évaluation

- Hindi Typing KeyboardDocument1 pageHindi Typing KeyboardAsim MahatoPas encore d'évaluation

- SL - Backtracking On 13th Amendment - Deal in 1987Document1 pageSL - Backtracking On 13th Amendment - Deal in 1987Asim MahatoPas encore d'évaluation

- Blank Calendar Landscape 4 PagesDocument4 pagesBlank Calendar Landscape 4 PagesAsim MahatoPas encore d'évaluation

- Complete List of Summits 2018 PDFDocument3 pagesComplete List of Summits 2018 PDFAsim MahatoPas encore d'évaluation

- Relational DatabaseDocument1 pageRelational DatabaseAsim MahatoPas encore d'évaluation

- Discrete Structures Ugc NetDocument1 pageDiscrete Structures Ugc NetAsim MahatoPas encore d'évaluation

- ESSAYDocument1 pageESSAYAsim MahatoPas encore d'évaluation

- Public Service Commission, West BengalDocument55 pagesPublic Service Commission, West BengalImate AnjanPas encore d'évaluation

- Oracle Data Access ComponentsDocument1 pageOracle Data Access ComponentsAsim MahatoPas encore d'évaluation

- One Liners Oct-15Document4 pagesOne Liners Oct-15Asim MahatoPas encore d'évaluation

- Quant QuizDocument4 pagesQuant QuizAsim MahatoPas encore d'évaluation

- September 2015-One LinersDocument8 pagesSeptember 2015-One LinersAsim MahatoPas encore d'évaluation

- HR Interview Questions and Answers For Senior ExecutivesDocument9 pagesHR Interview Questions and Answers For Senior ExecutivesAsim MahatoPas encore d'évaluation

- Versions of SQL ServerDocument1 pageVersions of SQL ServerAsim MahatoPas encore d'évaluation

- Timeline of India's Freedom StruggleDocument1 pageTimeline of India's Freedom StruggleAsim MahatoPas encore d'évaluation

- One Liners Aug 2015Document2 pagesOne Liners Aug 2015Asim MahatoPas encore d'évaluation

- Govt SchemesDocument4 pagesGovt SchemesAsim MahatoPas encore d'évaluation

- Overview of Important Issues in IndiaDocument17 pagesOverview of Important Issues in IndiaAsim MahatoPas encore d'évaluation

- What Is A Computer Network?Document20 pagesWhat Is A Computer Network?ssprudhviPas encore d'évaluation

- Timeline of India's Freedom StruggleDocument1 pageTimeline of India's Freedom StruggleAsim MahatoPas encore d'évaluation

- Diplomatic Immunity by ArunaDocument4 pagesDiplomatic Immunity by ArunaAsim MahatoPas encore d'évaluation

- Po Exam Paper 2014Document7 pagesPo Exam Paper 2014Asim MahatoPas encore d'évaluation

- SSC CGL Post CodesDocument1 pageSSC CGL Post CodesAsim MahatoPas encore d'évaluation

- Interview Capsule For Ibps Cwe Po Exam 2014Document6 pagesInterview Capsule For Ibps Cwe Po Exam 2014Asim MahatoPas encore d'évaluation

- China Bans Coal Use By 2020 In BeijingDocument54 pagesChina Bans Coal Use By 2020 In BeijingAsim MahatoPas encore d'évaluation

- Current Affairs 10th October 2014 PDFDocument11 pagesCurrent Affairs 10th October 2014 PDFAsim MahatoPas encore d'évaluation

- Test Bank For Financial Reporting and Analysis 13th Edition Charles H GibsonDocument36 pagesTest Bank For Financial Reporting and Analysis 13th Edition Charles H Gibsonbdelliumtiliairwoct100% (40)

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahPas encore d'évaluation

- Bank ReconciliationDocument10 pagesBank ReconciliationYogun BayonaPas encore d'évaluation

- HQP-HLF-007 Notice of Approval-Circular No. 300Document1 pageHQP-HLF-007 Notice of Approval-Circular No. 300maxx villaPas encore d'évaluation

- Answers FORMATIONDocument10 pagesAnswers FORMATIONAltea ArogantePas encore d'évaluation

- Aplicatii SeminarDocument7 pagesAplicatii SeminarAndra CarbunaruPas encore d'évaluation

- Pension expense and liability calculationsDocument1 pagePension expense and liability calculationsCassyPas encore d'évaluation

- Moranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFDocument1 pageMoranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFIlham TaufanPas encore d'évaluation

- Week 10capital Structure Theories IDocument12 pagesWeek 10capital Structure Theories Ikhan aghaPas encore d'évaluation

- The Handwritten Notes: New Syllabus May-2021 Onwards Module-3Document147 pagesThe Handwritten Notes: New Syllabus May-2021 Onwards Module-3Ankit GargPas encore d'évaluation

- Fixed Deposit Account Opening Form (For New Customers) PDFDocument8 pagesFixed Deposit Account Opening Form (For New Customers) PDFAli AldosPas encore d'évaluation

- 100% Net Investment IncomeDocument3 pages100% Net Investment IncomeFarabee FerdousPas encore d'évaluation

- Repo Market Strategies for Funding, Arbitrage and HedgingDocument17 pagesRepo Market Strategies for Funding, Arbitrage and HedgingJay KapadiaPas encore d'évaluation

- Payslip Januari 2022 (All Majalengka)Document24 pagesPayslip Januari 2022 (All Majalengka)rendra darminPas encore d'évaluation

- Ratio AnalysisDocument11 pagesRatio Analysisbhatriyan606Pas encore d'évaluation

- Merchant Banking Research PaperDocument3 pagesMerchant Banking Research PaperSajid ShaikhPas encore d'évaluation

- Saktipada Kayal All SoaDocument10 pagesSaktipada Kayal All Soabmfkolkata56Pas encore d'évaluation

- Kunhibava 2012Document11 pagesKunhibava 2012arin ariniPas encore d'évaluation

- Dissolution SolutionDocument32 pagesDissolution SolutionKomal RastogiPas encore d'évaluation

- Saral Nivesh POS plan detailsDocument1 pageSaral Nivesh POS plan detailsDeepak VaishnavPas encore d'évaluation

- Golden Rama Surabaya travel invoiceDocument3 pagesGolden Rama Surabaya travel invoiceimron alifiPas encore d'évaluation

- Negotiable Instruments - Midterms ExaminationDocument1 pageNegotiable Instruments - Midterms ExaminationNikki BucatcatPas encore d'évaluation