Académique Documents

Professionnel Documents

Culture Documents

ECB - Financial Statement As at September 27, 2013

Transféré par

Eduardo PetazzeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ECB - Financial Statement As at September 27, 2013

Transféré par

Eduardo PetazzeDroits d'auteur :

Formats disponibles

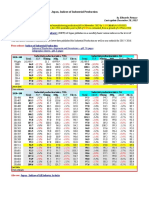

ECB Financial Statement as at September 27, 2013

by Eduardo Petazze

On September 23, Mario Draghi appeared before the Committee on Economic and Monetary Affairs of the European Parliament.

To ensure an adequate transmission of monetary policy .. effective measures be taken ..

By giving unlimited access to central bank refinancing against adequate collateral,

Ensuring that solvent banks remain liquid has contributed to avoiding an abrupt deleveraging which would have deeply damaged the

economy.

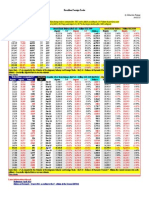

On September 27, 2013 the ECB has increased its support to the EA financial system by about 101.4 billion euros in the past year.

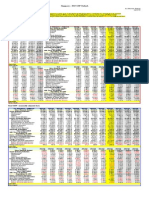

European Central Bank (ECB) - Lastest open market operations - EUR millions

Consolidated financial statement of the Eurosystem as at

Sep 28, 12

Lending to banks Maturity Date

30 Aug 13 6 Sep 13 13 Sep 13 20 Sep 13 27 Sep 13 4 Oct 13 N of Bidders EUR millions

4. Sep. 2013

97,126

63

11. Sep. 2013

95,621

66

11. Sep. 2013

3,910

3,910

24

18. Sep. 2013

97,170

70

25. Sep. 2013

96,249

79

26. Sep. 2013

9,477

9,477

9,477

9,477

50

2. Oct. 2013

97,027

74

9. Oct. 2013

94,466

73

9. Oct. 2013

3,430

3,430

3,430

3,430

23

31. Oct. 2013

2,683

2,683

2,683

2,683

2,683

2,683

43

28. Nov. 2013

6,823

6,823

6,823

6,823

6,823

6,823

38

19. Dec. 2013

8,607

8,607

51

29. Jan. 2015

275,040 274,940 271,235 270,494 267,844 266,309 (*)

523

26. Feb. 2015

423,177 418,632 416,432 414,057 408,797 407,175 (#)

800

Adjusted in the LT operations

-27,816 -27,821 -27,821 -28,041 -28,027 -28,027

estimate

Marginal lend and credit margin call

131

2,249

67

246

121

689

estimate

Annual chg.

1,178,184

Total Gross Lending (1)

790,549 786,512 779,495 775,417 767,304 762,154

-410,880

107,021

plus: Reserve requirements (2)

104,939 104,939 103,753 103,753 103,753 103,753

-3,268

525,830

less: Current accounts (3)

272,260 269,181 275,819 274,478 258,760 246,785

-267,070

315,754

less: Deposit facility (4)

70,569 79,934

71,425

50,060

52,870 66,856

-262,884

443,621

Net Lending in Euros [(5)=(1)+(2)-(3)(4)]

552,659 542,336 536,004 554,632 559,427 552,266

115,806

Weekly change

743 -10,323

-6,332

18,628

4,795 -7,161

Annual change 122,711 106,017

92,610 116,540 115,806 100,735

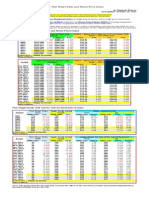

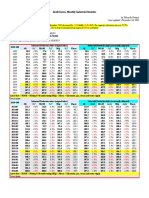

Fixed-term deposits

30 Aug 13 6 Sep 13 13 Sep 13 20 Sep 13 27 Sep 13 4 Oct 13

Account balances

190,500 190,500 190,500 190,500 190,500 187,500

209,000

Weekly change

-2,000

0

0

0

0 -3,000

N of Bidders

123

133

128

122

116

117

Total Bid Amount 287,539 314,840 297,762 272,916 248,472 265,066

Monetary policy portfolios

30 Aug 13 6 Sep 13 13 Sep 13 20 Sep 13 27 Sep 13 4 Oct 13

Annual chg.

280,207

Securities held for monetary policy purposes

250,139 250,139 250,087 249,767 246,703

-32,944

54,612

Covered bond purchases # 1

43,648 43,648

43,601

43,282

43,282

-11,330

16,205

Covered Bond Purchase # 2

15,815 15,815

15,809

15,809

15,710

-495

208,830

Securities Markets Program (SMP)

190,676 190,676 190,676 190,676 187,711

-21,119

Difference

1

0

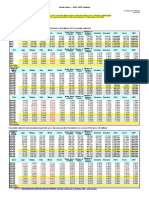

(*) Exercise of repayment option on main refinancing tender 20110149

N million EUR

(*) cumulative repayments

222,882

Oct 2, 2013

4

1,535

Sep 25, 2013

4

2,650

Sep 18, 2013

2

741

Sep 11, 2013

5

3,705

Sep 4, 2013

1

100

Aug 28, 2013

1

100

(#) Exercise the repayment option on main refinancing tender 201200034

# million EUR

(#) cumulative repayments

122,356

Oct 2, 2013

5

1,622

Sep 25, 2013

5

5,260

Sep 18, 2013

3

2,375

Sep 11, 2013

2

2,200

Sep 4, 2013

5

4,545

Aug 28, 2013

2

205

estimate

Postscript:

On September 27, 2013, the ECB has published a new Framework for the assessment of securities settlement systems and links to

determine their eligibility for use in Eurosystem credit operations(pdf, 26 pages)

Consequently, the ECB has adopted two Decision

ECB/2013/35 on additional measures relating to Eurosystem refinancing operations and eligibility of collateral, and

ECB/2013/36 on additional temporary measures relating to Eurosystem refinancing operations and eligibility of collateral.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzePas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- U.S. Federal Open Market Committee: Federal Funds RateDocument1 pageU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzePas encore d'évaluation

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzePas encore d'évaluation

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzePas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzePas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzePas encore d'évaluation

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzePas encore d'évaluation

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzePas encore d'évaluation

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzePas encore d'évaluation

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzePas encore d'évaluation

- Mainland China - Interest Rates and InflationDocument1 pageMainland China - Interest Rates and InflationEduardo PetazzePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzePas encore d'évaluation

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzePas encore d'évaluation

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzePas encore d'évaluation

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzePas encore d'évaluation

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzePas encore d'évaluation

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzePas encore d'évaluation

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzePas encore d'évaluation

- Disruptive Innovation: Technology, Whereas Disruptive Innovations Change Entire Markets. For ExampleDocument4 pagesDisruptive Innovation: Technology, Whereas Disruptive Innovations Change Entire Markets. For Exampledagniv100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- KPL Swing Trading SystemDocument6 pagesKPL Swing Trading SystemRushank ShuklaPas encore d'évaluation

- Impact of Global Economic Changes on Australia's Balance of PaymentsDocument2 pagesImpact of Global Economic Changes on Australia's Balance of PaymentsAleeya BanoPas encore d'évaluation

- Evaluation of TrainingDocument2 pagesEvaluation of TrainingKav99Pas encore d'évaluation

- Economics, Taxation Land ReformDocument8 pagesEconomics, Taxation Land ReformKaren Faye TorrecampoPas encore d'évaluation

- Review of Literature on EntrepreneurshipDocument5 pagesReview of Literature on EntrepreneurshipPamela GalangPas encore d'évaluation

- Topic 3Document2 pagesTopic 3Lion JimPas encore d'évaluation

- IMPACT OF PAKISTAN’S ENERGY CRISIS ON MANUFACTURINGDocument22 pagesIMPACT OF PAKISTAN’S ENERGY CRISIS ON MANUFACTURINGsyedumernoman50% (2)

- Danshui Plant No. 2Document10 pagesDanshui Plant No. 2AnandPas encore d'évaluation

- CAPE Economics SyllabusDocument69 pagesCAPE Economics SyllabusDana Ali75% (4)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Lender of Last ResortDocument2 pagesLender of Last ResortMohd SafwanPas encore d'évaluation

- HIstorical MaterialismDocument270 pagesHIstorical MaterialismVictoria VictorianaPas encore d'évaluation

- Jnu (SSS) 2019Document14 pagesJnu (SSS) 2019Kaushal meenaPas encore d'évaluation

- Expert Witness RG Harris Appendix 1 PB V TW TRO 28.nov.12Document26 pagesExpert Witness RG Harris Appendix 1 PB V TW TRO 28.nov.12MikeIsaacPas encore d'évaluation

- Ferreiro Serrano 2011 Uncertainity and Pension Systems ReformsDocument7 pagesFerreiro Serrano 2011 Uncertainity and Pension Systems ReformsClaudiu_1105Pas encore d'évaluation

- National Income: Where It Comes From and Where It Goes: MacroeconomicsDocument60 pagesNational Income: Where It Comes From and Where It Goes: Macroeconomicsshabeer khanPas encore d'évaluation

- Aggregate Supply - Boundless EconomicsDocument17 pagesAggregate Supply - Boundless EconomicsAshura ShaibPas encore d'évaluation

- CH 9 Capital Asset Pricing ModelDocument25 pagesCH 9 Capital Asset Pricing ModelShantanu ChoudhuryPas encore d'évaluation

- Shalimar Room Air Coolers SukkurDocument3 pagesShalimar Room Air Coolers SukkurKhizar Hayat JiskaniPas encore d'évaluation

- Benchmarking Strategic Sourcing PracticesDocument2 pagesBenchmarking Strategic Sourcing PracticesPepe CMPas encore d'évaluation

- Ecocomy at WarDocument40 pagesEcocomy at Wargion trisaptoPas encore d'évaluation

- Sixth Form Option Booklet 2011Document54 pagesSixth Form Option Booklet 2011aaronk195Pas encore d'évaluation

- CH 7 EcoDocument4 pagesCH 7 Ecosanchita kapoorPas encore d'évaluation

- Bread and CircusesDocument514 pagesBread and Circuseslkejsdkjfolkej100% (6)

- Plant Design and Economics Lect 1Document46 pagesPlant Design and Economics Lect 1Negese TeklearegayPas encore d'évaluation

- Caie Igcse Economics 0455 Theory v2Document18 pagesCaie Igcse Economics 0455 Theory v2omPas encore d'évaluation

- Entrep NotesDocument17 pagesEntrep NotesAvril EnriquezPas encore d'évaluation

- Marble IndustryDocument6 pagesMarble IndustryPrateek ShuklaPas encore d'évaluation

- India's Problem of Rising PricesDocument4 pagesIndia's Problem of Rising PricesritikaPas encore d'évaluation

- The Basic Tenets of Marxism Power PointDocument29 pagesThe Basic Tenets of Marxism Power PointShiela Fherl S. Budiongan100% (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsD'EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsPas encore d'évaluation