Académique Documents

Professionnel Documents

Culture Documents

Activities of Exim Bank Its Support Functions

Transféré par

Jugal AgarwalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Activities of Exim Bank Its Support Functions

Transféré par

Jugal AgarwalDroits d'auteur :

Formats disponibles

ACTIVITIES OF EXIM BANK ITS SUPPORT FUNCTIONS

Bopanna M M - 1220011 Jugal Prakash Agarwal 1220022 Kiruthikka Devi 1220059 Supriya Sukumar 1220061 Ankit L - 122109

ACTIVITIES OF EXIM BANK ITS SUPPORT FUNCTIONS ORGANISATION THE INSTITUTION

Export-Import Bank of India is the premier export finance institution of the country, set up in 1982 under the Export-Import Bank of India Act 1981. Government of India launched the institution with a mandate, not just to enhance exports from India, but to integrate the countrys foreign trade and investment with the overall economic growth. Since its inception, Exim Bank of India has been both a catalyst and a key player in the promotion of cross border trade and investment. Commencing operations as a purveyor of export credit, like other Export Credit Agencies in the world, Exim Bank of India has, over the period, evolved into an institution that plays a major role in partnering Indian industries, particularly the Small and Medium Enterprises, in their globalisation efforts, through a wide range of products and services offered at all stages of the business cycle, starting from import of technology and export product development to export production, export marketing, pre-shipment and post-shipment and overseas investment THE

INITIATIVES

Exim Bank of India has been the prime mover in encouraging project exports from India. The Bank provides Indian project exporters with a comprehensive range of services to enhance the prospect of their securing export contracts, particularly those funded by Multilateral Funding Agencies like the World Bank, Asian Development Bank, African Development Bank and European Bank for Reconstruction and Development. The Bank extends lines of credit to overseas financial institutions, foreign governments and their agencies, enabling them to finance imports of goods and services from India on deferred credit terms. Exim Banks lines of Credit obviate credit risks for Indian exporters and are of particular relevance to SME exporters. The Banks Overseas Investment Finance programme offers a variety of facilities for Indian investments and acquisitions overseas. The facilities include loan to Indian companies for equity participation in overseas ventures, direct equity participation by Exim Bank in the overseas venture and non-funded facilities such as letters of credit and guarantees to facilitate local borrowings by the overseas venture. The Bank provides financial assistance by way of term loans in Indian rupees/foreign currencies for setting up new production facility, expansion/modernization/upgradation of existing facilities and for acquisition of production equipment/technology. Such facilities particularly help export oriented Small and Medium Enterprises for creation of export capabilities and enhancement of international competitiveness.

Under its Export Marketing Finance programme, Exim Bank supports Small and Medium Enterprises in their export marketing efforts including financing the soft expenditure relating to implementation of strategic and systematic export market development plans. The Bank has launched the Rural Initiatives Programme with the objective of linking Indian rural industry to the global market. The programme is intended to benefit rural poor through creation of export capability in rural enterprises. In order to assist the Small and Medium Enterprises, the Bank has put in place the Export Marketing Services (EMS) Programme. Through EMS, the Bank seeks to establish, on best efforts basis, SME sector products in overseas markets, starting from identification of prospective business partners to facilitating placement of final orders. The service is provided on success fee basis. Exim Bank supplements its financing programmes with a wide range of value-added information, advisory and support services, which enable exporters to evaluate international risks, exploit export opportunities and improve competitiveness, thereby helping them in their globalisation efforts.

INTRODUCTION Exim Bank plays four-pronged role with regard to India's foreign trade: those of a coordintator, a source of finance, consultant and promoter. Exim Bank is the Coordinator of the Working Group Mechanism for clearance of Project and Services Exports and Deferred Payment Exports (for amounts above a certain value currently US$ 100 million). The Working Group comprises Exim Bank, Government of India

representatives (Ministries of Finance, Commerce, External Affairs), Reserve Bank of India, Export Credit Guarantee Corporation of India Ltd. and commercial banks who are authorised foreign exchange dealers. This inter-institutional Working Group accords clearance to contracts (at the post-award stage) sponsored by commercial bank or Exim Bank,and operates as a onewindow mechanism for clearance of term export proposals. On its own, Exim Bank can now accord clearance to project export proposals up to US$ 100 million in value.

The Export-Import (EXIM) Bank of India is the principal financial institution in India for coordinating the working of institutions engaged in financing export and import trade. It is a statutory corporation wholly owned by the Government of India. It was established on January 1, 1982 for the purpose of financing, facilitating and promoting foreign trade of India. Capital: The authorised capital of the EXIM Bank is Rs. 200 crore and paid up capital is Rs. 100 crore, wholly subscribed by the Central Government. The bank can raise additional resources through: (i) Loans/grants from Central Government and Reserve Bank of India ; (ii) Lines of credit from institutions abroad ; (iii) Funds raised from Euro Currency markets ; (iv) Bonds issued in India. Functions:

Exim Bank plays four-pronged role with regard to India's foreign trade: those of a coordintator, a source of finance, consultant and promoter. The Bank's functions are segmented into several operating groups including: Corporate Banking Group which handles a vairety of financing programmes for Export Oriented Units (EOUs), Importers, and overseas investment by Indian companies. Project Finance / Trade Finance Group handles the entire range of export credit services such as supplier's credit, pre-shipment credit, buyer's credit, finance for export of projects & consultancy services, guarantees, forfaiting etc. Lines of Credit Group Lines of Credit (LOC) is a financing mechanism that provides a safe mode of non-recourse financing option to Indian exporters, especially to SMEs, and serves as an effective market entry tool. Agri Business Group, to spearhead the initiative to promote and support Agri-exports. The Group handles projects and export transactions in the agricultural sector for financing. Small and Medium Enterprises Group to the specific financing requirements of export oriented SMEs. The group handles credit proposals from SMEs under various lending programmes of the Bank. Export Services Group offers variety of advisory and value-added information services aimed at investment promotion Fee based Export Marketing Services Bank offers assistance to Indian companies, to enable them establish their products in overseas markets. The Support Services groups, which include: Research & Planning, Corporate Finance, Loan Recovery, Internal Audit, Management Information Services, Information Technology, Legal, Human Resources Management and Corporate Affairs.

Activities: Exim Bank is the Coordinator of the Working Group Mechanism for clearance of Project and Services Exports and Deferred Payment Exports (for amounts above a certain value currently US$ 100 million). Lines of Credit Exim Bank also extends Buyers credit and Suppliers credit to finance and promote countrys exports The Bank also provides financial assistance to export-oriented Indian companies by way of term loans in Indian rupees or foreign currencies for setting up new production facility, expansion/modernization or upgradation of existing facilities and for acquisition of production equipment or technology

Exim Bank helps Indian companies in their globalization efforts through a wide range of products and services offered at all stages of the business cycle, starting from import of technology and export product development to export production, export marketing, preshipment and post-shipment and overseas investment An Overview of EXIM Bank-

The main objective of Export-Import Bank (EXIM Bank) is to provide financial assistance to promote the export production in India. The financial assistance provided by the EXIM Bank widely includes the following:

Direct financial assistance Foreign investment finance Term loaning options for export production and export development Pre-shipping credit Buyer's credit Lines of credit Reloaning facility Export bills rediscounting Refinance to commercial banks

The Export-Import Bank also provides non-funded facility in the form of guarantees to the Indian exporters.

Various Stages of Exports Covered by EXIM Bank-

Development of export makers Expansion of export production capacity Production for exports Financing post-shipment activities Export of manufactured goods Export of projects Export of technology and softwares

Forms of Financial Assistance Provided by EXIM Bank to Indian Companies-

Delayed Payment Exports- Term loans are provided to those exporters who deal with exporting of goods and services and this enables them to offer delayed credit to the foreign buyers. This system of deferred credit covers Indian consultancies, technology,

and other services. Commercial banks take part in this program either directly or under risk syndication arrangements.

Pre-shipment credit-Indian companies which are highly involved in the execution of export activities beyond the cycle time of six months are funded by EXIM Bank. The construction or turnkey project exporters enjoy the provision of rupee mobilization.

Term loans for export production- EXIM Bank offers term loans to the 100 percent export oriented units, units involved in free trade zones, and exporters of various softwares in India. EXIM bank also works in association with International Finance Corporation, Washington, to provide financial assistance to the small scale and medium industrial units in terms of ameliorating the export production capacity of these units in India. EXIM Bank also provides funded and non- funded facilities to deemed exports from India.

Foreign Investment Finance- EXIM bank provides financial assistance for equity contribution to the Indian companies who form Joint Venture with the foreign companies.

Financing export marketing-It helps the exporters carry out their export market development plan in Indian market.

Financial Assistance Provided by EXIM Bank to Overseas Companies-

Foreign Buyer's Credit- the foreign players are entitled to a sum of financial assistance in order to import goods and services on deferred payments.

Lines of Credit- EXIM bank also offers financial assistance to the overseas financial institutions and various government agencies for import of goods and services from India.

Reloaning Options to Foreign Banks- The foreign banks are entrusted with funding from EXIM bank in order to provide the same to the their clients across the globe for importing of goods from India

Recent News: Exim Bank of India and the National Bank for Foreign Economic Activity of the Republic of Uzbekistan Ink Cooperation Pact- May 2011 Export-Import Bank of India (Exim Bank of India) and the National Bank for Foreign Economic Activity of the Republic of Uzbekistan have entered into a Cooperation Agreement for realizing business opportunities and facilitating increased trade and investment flows between the two countries. Trade between India and Uzbekistan has nearly doubled to USD 84 million in 2009-10 from USD 42.8 million in 2004-05. Bilateral trade with Uzbekistan has primarily mirrored trends in exports, which more than tripled from USD 15.1 million in 2004-05 to USD 54.0 million in 2009-10. India's exports to Uzbekistan during 2010-11 (April- December) were USD 42.1 million, a rise of 6.6% over that of the corresponding period of 2009-10. India's imports from Uzbekistan also have risen from USD 27.7 million in 2004-05 to USD 30.0 million in 2009-10. India's export basket to Uzbekistan in 2009-10 was dominated by pharmaceutical products, followed by machinery & instruments, manufactures of metals, dyes intermediates & coal tar chemicals, project goods, manmade yarn fabrics made-ups, and handicrafts excluding handmade carpets. Redefine MSMEs: May 2013 Exim Bank has asked the government to revise the definition of micro, small and medium enterprises (MSMEs) to make exports more competitive. The state-owned export promotion financier said that there was a need to classify larger businesses as MSMEs as international rivals in this segment were giants compared to Indian entities. In India , a medium-sized business is one below Rs 10 crore whereas in the US and Europe it is $50 million (nearly Rs 280 crore) and 50 million euros (over Rs 350 crore), respectively. Even in other Asian countries, the size ranges from Rs 80 crore to Rs 150 crore,". Exim Bank extends $19.5 million credit to Vietnam- July 2013 Exim Bank has, at the behest of Government of India, extended an additional LOC (line of credit) of dollar 19.50 million to the Vietnam government, for financing two projects in

Vietnam,". Exim Bank, till date, has extended three lines of credit (including the latest one). Under the latest agreement, Exim Bank will reimburse 100 per cent of contract value to the Indian exporters upon shipment of goods. "The LOC will be used for sourcing of goods and services from India,". Currently, Exim Bank has in place 173 LOCs covering over 75 countries in Africa, Asia, Latin America, Europe and the CIS, with credit commitments of over USD 9.13 billion available for financing exports from India. New Exim Policy 2012 - 2013 ods (including CKD/SKD thereof as well as computer software systems) for pre-production, production and post-production at zero Customs duty, subject to an export obligation equivalent to 6 times of duty saved on capital goods imported under EPCG scheme, to be fulfilled in 6 years reckoned from Authorization issue-date. of Status Holder Incentive Scheme under Paragraph 3.16 of FTP. In case they have already availed SHIS benefit they would be eligible for Zero Duty Scheme if they surrender or refund SHIS, with applicable interest in case SHIS has been utilized. would not be taken for computation of net duty saved, provided the same is not CENVATed. fixtures, dies and moulds. to be imported under EPCG Scheme. EPCG Scheme after approval from EFC at Headquarters. Authorization under EPCG Scheme shall not be issued for import of any Capital Goods (including Captive plants and Power Generator Sets of any kind) for i. ii. iii. iv. Export of electrical energy (power) Supply of electrical energy (power) under deemed exports Use of power (energy) in their own unit, and Supply/export of electricity transmission services.

56/2012-13 Exim Bank's Line of Credit of USD 13.095 million to the Government of the Republic of Togo 57/2012-13

Exim Bank's Line of Credit of USD 178.125 million to the Government of the United Republic of Tanzania 64/2012-13 Exim Bank's Line of Credit of USD 19 million to the Government of the Co-Operative Republic of Guyana 65/2012-13 Exim Bank's Line of Credit of USD 250 million to the Government of the Republic of Mozambique 91/2012-13 Exim Bank's Line of Credit of USD 42 million to the Government of the Republic of Cameroon 92/2012-13 Exim Bank's Line of Credit of USD 5 million to Banco Exterior De Cuba 93/2012-13 Exim Bank's Line of Credit of USD 15 million to the Government of the Republic of Benin

SERVICES

Finance and Services 1. EXPORT CREDITS Exim Bank offers the following Export Credit facilities, which can be availed of by Indian companies, commercial banks and overseas entities. For Indian Companies executing contracts overseas credit

Pre-shipment

Exim Bank's Pre-shipment Credit facility, in Indian Rupees and foreign currency, provides access to finance at the manufacturing stage - enabling exporters to purchase raw materials and other inputs. Supplier's Credit

This facility enables Indian exporters to extend term credit to importers (overseas) of eligible goods at the post-shipment stage. For Project Exporters

Indian project exporters incur Rupee expenditure while executing overseas project export contracts i.e. costs of mobilisation/acquisition of materials, personnel and equipment etc. Exim Bank's facility helps them meet these expenses. For Exporters of Consultancy and Technological Services

Exim Bank offers a special credit facility to Indian exporters of consultancy and technology services, so that they can, in turn, extend term credit to overseas importers. Guarantee Facilities

Indian companies can avail of these to furnish requisite guarantees to facilitate execution of export contracts and import transactions. 2. FINANCE FOR EXPORT ORIENTED UNITS Term

Finance (For

Exporting

Companies)

Project Finance Equipment Finance

Import of Technology & Related Services Domestic Acquisitions of businesses/companies/brands Export Product Development/ Research & Development General Corporate Finance Capital Finance (For Exporting Companies)

Working

Funded o Working Capital Term Loans [< 2 years] o Long Term Working Capital [upto 5 years] o Export Bills Discounting o Export Packing Credit o Cash Flow financing Non-Funded o Letter of Credit Limits o Guarantee Limits

Working Capital Finance (For Non- Exporting Companies)

Bulk Import of Raw Material

Term Finance (For Non- Exporting Companies)

Import of Equipment

Export Finance

Pre-shipment Credit Post Shipment Credit Buyers' Credit Suppliers' Credit [including deferred payment credit] Bills Discounting Export Receivables Financing Warehousing Finance Export Lines of Credit (Non-recourse finance)

Equity Participation (In Indian Exporting Companies)

To part finance project expenditure(Project, inter alia, includes new project/ expansion/ acquisition of business/company/ brands/research & development)

3. OVERSEAS INVESTMENT FINANCE

Finance for Indian Company's equity participation in the overseas Joint Venture (JV)/ Wholly Owned Subsidiary (WOS) Direct Finance (Term & Working Capital) to the overseas JV / WOS Finance (for equity/debt component) for acquisition of overseas businesses / companies including leveraged buy-outs including structured financing options Direct Equity by Exim Bank in the overseas JV/ WOS of an Indian Company

4. LINES OF CREDIT

Exim Bank gives special emphasis on extension of Lines of Credit (LOCs) as an effective market entry mechanism Exim Bank extends LOCs to overseas financial institutions, regional development banks, sovereign governments and other entities overseas LOCs enable buyers in those countries to import developmental and infrastructural projects, equipment, goods and services from India, on deferred credit terms. As on March 31, 2011, Exim Bank has 138 operative credit lines covering 72 countries in Africa, Asia, Latin America and CIS region with credit commitments of over US$ 6.66 billion, available for financing exports from India.

5. SME & AGRI FINANCE Small and Medium Enterprises (SME) Finance

The importance of SME sector is well-recognized world over owing to its significant contribution in achieving various socio-economic objectives, such as employment generation, contribution to national output and exports, fostering new entrepreneurship and to provide depth to the industrial base of the economy. India has a vibrant SME sector that plays an important role in sustaining economic growth, increasing trade, generating employment and creating new entrepreneurship in India. Indian SMEs require business advisory services to enhance their international competitiveness in a highly competitive globalising world. The SMEs find the services of reputed national and international consultants as not cost effective and often, not adequately focused. Recognising this knowledge gap, Exim Bank of India has been endeavouring to provide a suite of services to its SME clients. These include providing business leads, handholding during the process of winning an export contract and thus assisting the generation of export business on success fee basis, countries/ sector information dissemination, capacity building in niche areas such as quality, safety, export marketing, etc. and financial advisory services such as loan syndication, etc.

DEBT RESTRUCTURING ENTERPRISES(SMEs) Publications

SCHEME

FOR

SMALL

AND

MEDIUM

Export Performance of Small and Medium Enterprises in India Research Brief Occasional Paper : Institutional Support to SMEs A Study of Trade and Investment Potential Occational Paper : Institutional Support Systems for SMEs in India and International Experiences

AGRI

FINANCE

The globalization and post-WTO scenario offers considerable scope for exports of Indian agricultural products. Exim Bank has a dedicated Agri Business Group to cater to the financing needs of export oriented companies dealing in agricultural products. Financial assistance is provided by way of term loans, pre-shipment/post-shipment credit, overseas buyers' credit, bulk import finance, guarantees etc. Term loans with varying maturities are provided for setting up processing facilities, expansion, modernization, purchase of equipment, import of equipment/technology, financing overseas joint ventures and acquisitions etc. The Bank has strong linkages with other stakeholders in agri sector such as Ministry of Food Processing Industries, GoI, NABARD, APEDA, Small Farmers' Agri-Business Consortium (SFAC), National Horticultural Board etc. Apart from financing, the Bank also provides a range of advisory services to agri exporters. The Bank also publishes a number of Occasional Papers, Working Papers on export potential of various sub-sectors in agriculture and a bi-monthly publication in different languages on global scenario in agri-business and opportunities therein. For further details of Exim Bank's financial assistance and services pertaining to the agricultural sector, please visit our dedicated web-portal on agri business 6. INTEREST RATES Exim Banks Prime Lending Rate (PLR) is currently 15% p.a.

Exim Bank's Long-term Minimum Lending Rate (LTMLR), which is the minimum rate

applicable

to

all

rupee

loans

of

tenors

greater

than

year.

LTMLR is 10.20% p.a. for the quarter January 1, 2012 to March 31, 2012. LTMLR is 10.30% p.a. for the quarter October 1, 2011 to December 31, 2011. 7. FILM FINANCE The Bank has till date sanctioned loans more than Rs 33.15 crores for film production. The first three films financed by Exim Bank have been commercially successful across India and overseas markets. Nature

of

Finance

Cashflow financing for film production Cashflow financing for film distribution/exhibition in overseas markets Term loans for fixed assets finance Term financing for export market development

Films Released

financed

by

Exim

Bank

Honeymoon Travels Pvt. Ltd. Kabul Express Dhoom -2 Don - The Chase Begins Again Fanaa Bunty Aur Babli Salaam Namaste Veer Zaara The Rising Dhoom Hum Tum Cheeni Kum

Not

Released

Shringaara - Dance of Love Indian Film Industry

The Indian film industry is an integral part of the Indian socio-economic psyche and the most popular source of entertainment in the country. Indian film industry was conferred Industry Status in the year 2000 and is mainly private funded. Indian Film industry is the world's biggest film industry in terms of the number of movies produced and released in a year. In 2004, there were 934 films certified across, with Hindi accounting for 245 of them. The total number of admissions (people attending movies) is almost over 3 billion, which is almost double the US markets and three times that of the rest of Asia. The Indian film industry comprises of a cluster of regional film industries, like Hindi, Telugu, Tamil, Kannada, Malayalam, Bengali etc. This makes it one of the most complex and fragmented national film industries in the world. 8. Rural Initiatives Exim Bank believes that there is a strong linkage between export development and poverty reduction. For a country like India, with a large (70%) rural population, creation of export capability in rural grassroot enterprise is a must. Globalisation will be successful and acceptable only if benefits reach the rural population. Rural enterprises suffer from various handicaps including image, quality, capacity, packaging, delivery, etc. NGOs and SHGs are the front for rural enterprises. Through proper guidance and support, rural grassroot enterprises can access the global market and realize better prices for their products thereby contributing to poverty reduction. Exim Bank's experience in working with NGOs/SHGs and rural enterprises is encouraging. Exim Bank, leveraging its presence in both India as well as overseas, is facilitating linkage between rural grassroot enterprises and corporates and with overseas buyers and agencies with the objective of bringing the benefits of globalisation to the rural population.

PROJECT & SERVICES EXPORTS Exports of projects and services, broadly categorized into Civil engineering construction projects, Turnkey projects, Consultancy services. Over the past two decades, increasing number of contracts have been secured by Indian companies in West Asia, North Africa, Sub Saharan Africa, South & South East Asia, CIS Region and Latin America. Such projects have supplemented the efforts of the host country governments in achieving their developmental objectives.

PROMOTING INVESTMENT Comprehensive assistance: Pre investment advisory services; Finance through debt and equity Finance available for: Greenfield projects; Brownfield expansion; Overseas acquisitions directly or through special purpose vehicles Direct equity participation in Indian ventures abroad

Joint investments by Indian and overseas company in third country markets in addition to facilitating investments into India. As on March 31, 2011, Exim Bank has provided finance to 331 ventures set up by 268 Indian companies in 68 countries including countries in Asia region

EXIM BANK AND SMEs Term loans for Export Product Development and Export Marketing Export Marketing Services programme Seeks to help Indian SME sector to establish their products overseas and enter new markets through Exims overseas offices and MOU partner network No upfront fees, but operates on success-fee basis Eximius Centres of Learning in Bangalore/ Pune/ Ahmedabad for knowledge building & capacity creation for SMEs Set up to organise seminars and workshops for the benefit of exporting companies, particularly SMEs BUYERS CREDIT UNDER NEIA Exim Bank has, in conjunction with ECGC, introduced a new product/initiative viz. Buyers Credit under GOIs National Export Insurance Account (NEIA)

NEIA is a Trust, set up by Ministry of Commerce and Industry, Government of India, for providing export credit insurance cover for promoting project exports from India Under the NEIA, the Bank finances and facilitates project exports from India by way of extending credit facility to overseas sovereign governments and government owned entities for import of goods and services from India, on deferred credit terms Indian exporters can obtain payment of eligible value from Exim Bank, without recourse, against negotiation of shipping documents.

RESEARCH & ANALYSIS Research Studies on products, sectors, countries, macro economic issues relevant to international trade and investment Sector Studies assessing export potential Bilateral Trade and Investment Studies International Trade Related Studies Exim Newsletters Export Advantage (bilingual) Agri Export Advantage (in English, Hindi and 10 regional languages) Indo-China Newsletter (bilingual) Contribution to Public Policy formulation through inputs on WTO aspects, impact of exchange rates on exports, transaction costs, etc. PROMOTIONAL ACTIVITIES Setting up an Exim Bank in Malaysia Establishing an Export Credit Guarantee Company in Zimbabwe Feasibility study for setting up the Afrexim Bank Designing of Export Financing Programmes Turkey, South Africa Export Development Project : Ukraine, Vietnam, Armenia Mauritius Study on Projecting Mauritius as an Investment Hub for Indian Firms Feasibility study for establishment of an export credit and guarantee facility for Gulf Cooperation Council countries

EXIMS CATALYTIC ROLE Introduced innovative products such as Export Marketing Finance, Financing Program for Software Exports, etc. Set up Global Procurement Consultants Ltd. in 1996 as a joint venture with Indian private & public sector enterprises to take up overseas assignments in procurement advisory services expertise in procurement processes related to multilateral funded projects. Instrumental in creation of Asian Exim Banks Forum in 1996 to promote intraregional trade. Instrumental in creation of Global Network of Exim Banks and Development Financial Institutions (GNEXID) in 2006 to promote trade & development finance through cooperation and exchange of information. Granted observer status by UNCTAD in 2008.

Exim Bank : Partner in Globalisation

Technology Capital (Foreign Investment) Raw Materials Capital Goods

I

Final Products Capital Goods Capital (Overseas Ventures)

Product Development Production Marketing Pre shipment

Post shipment

ECONOMIC FACTORS

GDP Real GDP growth GDP at current price GDP at constant price PRICES Inflation rate Consumer price Index Export prices Import prices

4.8% 12.5% 4.8%

4.86% 228.00 223.00 243.00

MONEY Forex Reserve

15102 INR billion

Interbank rate Interest rate

7.48% 7.25%

TRADE Balance of Trade Exports Imports

-715.31 INR billion 1389.02 INR billion 2104.33 INR billion

Exim Bank supplements its financing programmes with a wide range of value-added information, advisory and support services, which enable exporters to evaluate international risks, exploit export opportunities and improve competitiveness, thereby helping them in their globalisationefforts.d improve competitiveness, thereby helping them in their globalisation efforts. Description Amount in Rs Crore Loan Sanctioned Loan disbursed 32805 27159 33629 28932 38843 33249 47798 34423 44412 37045 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012

Total Resources Financial Performance Profit Before Tax Profit After Tax Ratios Capital to Risk Asset Ratio (%) PBT to Capital (%) PBT to Capital (%) Sub Saharan Africa USD million Lines of credit(Amount) 3746 578

37301

44202

47072

54751

63673

533.4 333.0

610.1 477.4

772.4 513.5

867.7 583.6

1012.6 675.1

15.1 50.8 1.7

16.8 48.8 1.5

18.9 49.8 1.7

17.0 46.9 1.7

16.4 47.1 1.7

SE Asia, Latin America South Far East & & Caribbean Asia pacific

West Asia

CIS

North Africa

Total

148

2606

325

190

567

8160

BIBLIOGRAPHY

commerce.NIC. (n.d). Retrieved from http://commerce.nic.in/tradestats/Indiastrade_press.pdf EXIM Bank. (n.d.). Retrieved http://financialservices.gov.in/banking/exim.asp Indicators. (n.d.). Retrieved from http://www.tradingeconomics.com/india/indicators http://eximbankindia.in/corpo_pres.pdf from

Tradestatistics:

Banking:

Trading

conomics:

Vous aimerez peut-être aussi

- Role of EXIM Bank in International BusinessDocument5 pagesRole of EXIM Bank in International BusinessHarry02rocksPas encore d'évaluation

- Functions of Ecgc and Exim BankDocument12 pagesFunctions of Ecgc and Exim BankbhumishahPas encore d'évaluation

- EXIM BankDocument17 pagesEXIM BankChunnuri0% (1)

- ECCouncil 712-50 Free Practice Exam & Test Training - Part 4 PDFDocument16 pagesECCouncil 712-50 Free Practice Exam & Test Training - Part 4 PDFHien HuynhPas encore d'évaluation

- Ecgc, Exim, NasdaqDocument11 pagesEcgc, Exim, Nasdaqyamumini07Pas encore d'évaluation

- Exim BankDocument2 pagesExim BankShailesh SinghPas encore d'évaluation

- History: Exim Bank (Full Name: The Export-Import Bank of India)Document10 pagesHistory: Exim Bank (Full Name: The Export-Import Bank of India)Bunty YsPas encore d'évaluation

- About EXIM Bank The Institution Objective The Incentive Groups in Head Office Financial Assistance Provided by EXIM BankDocument8 pagesAbout EXIM Bank The Institution Objective The Incentive Groups in Head Office Financial Assistance Provided by EXIM Bankpunit021190Pas encore d'évaluation

- Exim Bank FinalDocument9 pagesExim Bank FinalSudha NadarPas encore d'évaluation

- Export-Import Bank of IndiaDocument17 pagesExport-Import Bank of IndiaFarheen Rashid ShaikhPas encore d'évaluation

- Exim BankDocument1 pageExim BankthilakrajanPas encore d'évaluation

- EXim BankDocument14 pagesEXim Banksaps156Pas encore d'évaluation

- EXim BankDocument12 pagesEXim Banksaps156Pas encore d'évaluation

- Exim BankDocument2 pagesExim BankAbid BackerPas encore d'évaluation

- Organization: Reserve Bank of India Export Credit Guarantee Corporation of India Financial Institution Public SectorDocument1 pageOrganization: Reserve Bank of India Export Credit Guarantee Corporation of India Financial Institution Public Sectorankitpatel611Pas encore d'évaluation

- EXIM BankDocument6 pagesEXIM BankKavish ChauhanPas encore d'évaluation

- Export-Import Bank of India-Agri Business GroupDocument4 pagesExport-Import Bank of India-Agri Business GroupRahul SavaliaPas encore d'évaluation

- Ib - Exim Bank FunctionsDocument22 pagesIb - Exim Bank FunctionsAnuja KingarPas encore d'évaluation

- Export-Import Bank of IndiaDocument1 pageExport-Import Bank of IndiasivapathasekaranPas encore d'évaluation

- Exim BankDocument14 pagesExim BankReema AroraPas encore d'évaluation

- ExportDocument2 pagesExportBoby SmilePas encore d'évaluation

- Exim Bank (India) - Wikipedia, The Free EncyclopediaDocument2 pagesExim Bank (India) - Wikipedia, The Free EncyclopediaAmitKumar100% (1)

- Export Import Bank of India (Exim Bank)Document3 pagesExport Import Bank of India (Exim Bank)JaiPas encore d'évaluation

- Role of Exiim BankDocument2 pagesRole of Exiim BankKadiwal SobanPas encore d'évaluation

- Role of EXIM BankDocument2 pagesRole of EXIM Bankultimatekp144100% (1)

- Export Finance by EXIM Bank IndiaDocument9 pagesExport Finance by EXIM Bank IndiaAmanPas encore d'évaluation

- Exim Bank of India: A Brief Overview of The Functioning of EXIM Bank and Its Role in Facilitating Trade Finance in IndiaDocument5 pagesExim Bank of India: A Brief Overview of The Functioning of EXIM Bank and Its Role in Facilitating Trade Finance in IndiaAshok GeorgePas encore d'évaluation

- Unit 2 EXIM BankDocument4 pagesUnit 2 EXIM BankDhruvi LimbadPas encore d'évaluation

- Role of ECGC and EXIM BankDocument4 pagesRole of ECGC and EXIM BankChirag ShahPas encore d'évaluation

- Exim IntroDocument2 pagesExim IntroMaridasrajanPas encore d'évaluation

- The Exim BankDocument17 pagesThe Exim BankvinayanithaPas encore d'évaluation

- Exim BankDocument79 pagesExim Banklaxmi sambre0% (1)

- Exim BankDocument18 pagesExim Bankdhara_kidPas encore d'évaluation

- EXIM BankDocument66 pagesEXIM BankSonu VaghelaPas encore d'évaluation

- Sources of Finance: Baishalee ChakrabartiDocument31 pagesSources of Finance: Baishalee ChakrabartiMohit GargPas encore d'évaluation

- Mission Background of The Exim Bank Significance of The Topic Objective of The StudyDocument50 pagesMission Background of The Exim Bank Significance of The Topic Objective of The StudyMitesh DamaPas encore d'évaluation

- A Study On Financial Facilities Provided To Exporters by Exim Bank With Specific Reference To IndiaDocument13 pagesA Study On Financial Facilities Provided To Exporters by Exim Bank With Specific Reference To IndiaPranav ViraPas encore d'évaluation

- Export Import Bank of India: Financing ProgrammesDocument4 pagesExport Import Bank of India: Financing ProgrammesLohnnee ThangaveluPas encore d'évaluation

- Unit 2Document10 pagesUnit 219BFT012 DharaneeswarPas encore d'évaluation

- Financial Institutional Support To Exporters: Sidbi EXIM Bank EcgcDocument10 pagesFinancial Institutional Support To Exporters: Sidbi EXIM Bank EcgcAshvin RavriyaPas encore d'évaluation

- Who Is Eligible For Post-Shipment Finance?Document17 pagesWho Is Eligible For Post-Shipment Finance?sunnybhabhakarPas encore d'évaluation

- Export-Import Bank of India: An OverviewDocument19 pagesExport-Import Bank of India: An OverviewAmit KainthPas encore d'évaluation

- Exim BankDocument9 pagesExim BankandrewpereiraPas encore d'évaluation

- I B Notes Final DR TMKDocument15 pagesI B Notes Final DR TMKKuthubudeen T MPas encore d'évaluation

- Role EXIM BankDocument5 pagesRole EXIM BankChidam BaramPas encore d'évaluation

- Role & Functions of Exim BankDocument19 pagesRole & Functions of Exim Bankvivek_vj1993Pas encore d'évaluation

- Role Functions of Exim Bank1Document19 pagesRole Functions of Exim Bank1Aneesha KasimPas encore d'évaluation

- A Critical Analysis of 'Export Credit Institutions in IndiaDocument13 pagesA Critical Analysis of 'Export Credit Institutions in IndiaMinh Tú HoàngPas encore d'évaluation

- Exim BankDocument8 pagesExim BankMani GuptaPas encore d'évaluation

- EXIM BankDocument79 pagesEXIM BankMishkaCDedhia0% (2)

- India's Premier Financial InstitutionDocument16 pagesIndia's Premier Financial InstitutionDr-Koteswara RaoPas encore d'évaluation

- Exim Bank?: Financial Institutions and MarketsDocument10 pagesExim Bank?: Financial Institutions and Marketssairuthwik2003Pas encore d'évaluation

- Attachment Financial InstitutionsDocument12 pagesAttachment Financial InstitutionsSanjeeva TejaswiPas encore d'évaluation

- Unit III Role and Functions of EXIM BankDocument17 pagesUnit III Role and Functions of EXIM BankbpsunilmbaPas encore d'évaluation

- Exim Bankof IndiaDocument41 pagesExim Bankof Indiaglorydharmaraj100% (1)

- EXIMDocument18 pagesEXIMPushpak RoyPas encore d'évaluation

- Meaning of Export FinanceDocument2 pagesMeaning of Export Financeforamdoshi86% (7)

- In Partial Fulfilment of M.B.A. For The Subject of Banking ManagementDocument13 pagesIn Partial Fulfilment of M.B.A. For The Subject of Banking Managementdipal987Pas encore d'évaluation

- Marketing of Consumer Financial Products: Insights From Service MarketingD'EverandMarketing of Consumer Financial Products: Insights From Service MarketingPas encore d'évaluation

- Resume Template (With Instructions)Document2 pagesResume Template (With Instructions)Jugal AgarwalPas encore d'évaluation

- Ing Vy Sy A Bank Limited Annual ReportDocument156 pagesIng Vy Sy A Bank Limited Annual ReportJugal AgarwalPas encore d'évaluation

- Contents RevisedDocument92 pagesContents RevisedAnoopKumarMangarajPas encore d'évaluation

- Quality Function Deployment (QFD) : The Voice of The CustomerDocument12 pagesQuality Function Deployment (QFD) : The Voice of The CustomerJugal AgarwalPas encore d'évaluation

- Project Financing in HUDCODocument20 pagesProject Financing in HUDCOJugal AgarwalPas encore d'évaluation

- Macroeconomic Developments and Securities MarketsDocument16 pagesMacroeconomic Developments and Securities MarketsJugal AgarwalPas encore d'évaluation

- Ing Vy Sy A Bank Limited Annual ReportDocument156 pagesIng Vy Sy A Bank Limited Annual ReportJugal AgarwalPas encore d'évaluation

- Project Finance Is The Long-TermDocument2 pagesProject Finance Is The Long-TermJugal AgarwalPas encore d'évaluation

- Facts:: Cemco Holdings V. National Life Insurance Company of Philippines, GR NO. 171815, 2007-08-07Document2 pagesFacts:: Cemco Holdings V. National Life Insurance Company of Philippines, GR NO. 171815, 2007-08-07Carl Marx FernandezPas encore d'évaluation

- Bigasan Financial Statement: Ofw Family Circle Barangay Villa Aglipay, San Jose TarlacDocument6 pagesBigasan Financial Statement: Ofw Family Circle Barangay Villa Aglipay, San Jose TarlacAldrin CardenasPas encore d'évaluation

- Case Study Presentation On Industrial RelationDocument9 pagesCase Study Presentation On Industrial Relationrglaae100% (1)

- Practice Questions Chapter 4Document26 pagesPractice Questions Chapter 4subash1111@gmail.com100% (1)

- Wbut Mba 1 Business Economics 2012Document7 pagesWbut Mba 1 Business Economics 2012Hiral PatelPas encore d'évaluation

- Ismael F. Mejia vs. People of The Philippines (G.R. No. 149937 June 21, 2007) FactsDocument2 pagesIsmael F. Mejia vs. People of The Philippines (G.R. No. 149937 June 21, 2007) FactsanntomarongPas encore d'évaluation

- Internal Audit & Verification ScheduleDocument1 pageInternal Audit & Verification ScheduleSean DelaunePas encore d'évaluation

- Yuksel (2001) The Expectancy Disconfirmation ParadigmDocument26 pagesYuksel (2001) The Expectancy Disconfirmation ParadigmMariana NunezPas encore d'évaluation

- SpringDocument12 pagesSpringEmma Zhang0% (2)

- P& G Company Project WorkDocument32 pagesP& G Company Project WorkKulsum RabiaPas encore d'évaluation

- Classic Pen ABCDocument5 pagesClassic Pen ABCdebojyoti88Pas encore d'évaluation

- Oracle E-Business Suite Release 12.2.6 Readme (Doc ID 2114016.1)Document18 pagesOracle E-Business Suite Release 12.2.6 Readme (Doc ID 2114016.1)KingPas encore d'évaluation

- CLASS TEST of Student B.S. Chapter-9,12Document2 pagesCLASS TEST of Student B.S. Chapter-9,12Jatin Mandloi (Jatin Panwar)Pas encore d'évaluation

- Reflection PaperDocument2 pagesReflection PaperJoceter DangiPas encore d'évaluation

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97Pas encore d'évaluation

- A Describe Some of The Stories Rites Rituals and Symbols 2Document1 pageA Describe Some of The Stories Rites Rituals and Symbols 2Amit PandeyPas encore d'évaluation

- Llanera Police Station: Daily JournalDocument5 pagesLlanera Police Station: Daily JournalLlanera Pnp NePas encore d'évaluation

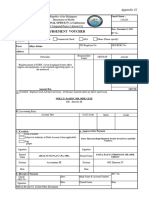

- DISBURSEMENT VOUCHER (JC) - AugustDocument2 pagesDISBURSEMENT VOUCHER (JC) - Augusthekeho3180Pas encore d'évaluation

- 320C10Document59 pages320C10Kara Mhisyella Assad100% (2)

- 100 Best Business BooksDocument8 pages100 Best Business BooksGiang Huong VuPas encore d'évaluation

- A Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFDocument5 pagesA Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFvyoung1988Pas encore d'évaluation

- Total Business - Model1Document1 pageTotal Business - Model1mohd.hanifahPas encore d'évaluation

- Corporation: Basic Concepts in Establishing OneDocument26 pagesCorporation: Basic Concepts in Establishing OnearctikmarkPas encore d'évaluation

- E-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Document345 pagesE-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Rekha MeghaniPas encore d'évaluation

- Procedure and Jurisdiction Philippine Labor LawDocument14 pagesProcedure and Jurisdiction Philippine Labor LawJohn DoePas encore d'évaluation

- Problems and Solution 3Document6 pagesProblems and Solution 3sachinremaPas encore d'évaluation

- Deviation Powers 07.12.16 BCC - BR - 108 - 587Document11 pagesDeviation Powers 07.12.16 BCC - BR - 108 - 587RAJAPas encore d'évaluation

- Multiple Choice Question 61Document8 pagesMultiple Choice Question 61sweatangePas encore d'évaluation

- Classification of BanksDocument7 pagesClassification of BanksBrian PapellerasPas encore d'évaluation