Académique Documents

Professionnel Documents

Culture Documents

Kenya Country Analysis

Transféré par

Sai VasudevanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Kenya Country Analysis

Transféré par

Sai VasudevanDroits d'auteur :

Formats disponibles

PEST ANALYSIS OF KENYA

POLITICAL 1. form and type of government Unitary Multiparty Republic 2. ministerial hierarchy (separate ministers under each section) chief of state: President Mwai KIBAKI (since 30 December 2002); Vice President Stephene Kalonzo MUSYOKA (since 10 January 2008); head of government: President Mwai KIBAKI (since 30 December 2002); Vice President Stephene Kalonzo MUSYOKA (since 10 January 2008); note the roles of the president and prime minister are not well defined at this juncture; constitutionally, the president remains chief of state and head of government, but the prime minister is charged with coordinating government business cabinet: Cabinet appointed by the president and headed by the prime minister, who is the leader of the largest party in parliament elections: president elected by popular vote for a five-year term (eligible for a second term); in addition to receiving the largest number of votes in absolute terms, the presidential candidate must also win 25% or more of the vote in at least five of Kenya's seven provinces. https://www.cia.gov/library/publications/the-world-factbook/geos/ke.html 3. Exim policy FOREIGN POLICY Kenya is a member of the Common Market for Eastern and Southern Africa (COMESA), the East African Co-operation (EAC), the Organization of African Unity (OAU), and the Inter Governmental Authority on Development (IGAD). TRADE POLICY Trade policy formulation is the responsibility of several Ministries, which constitute the Cabinet's Economic Sub-committee, and the Central Bank. Its the founding member of WTO. 4. FDI /FII STRUCTURE Investment Promotion Centre is a public funded institution, which was established in 1992 as a one-stop shop geared to promote investment in the country. IPC processes all applications for new investments and forwards recommendations to the Ministry of Finance and Planning for approval by the Minister. A General Authority license is issued within one month with prior approval from the relevant authority in charge of issuing \the license.

The Foreign Investments Protection Act (FIPA) (Cap518) guarantees repatriation of capital, after tax profits and remittance of dividends and

interests accruing from investing in the country. The constitution also provides guarantee against expropriationof private property unless for security or public interest and when this happens fair and prompt compensation is paid.

investment allowance - is provided as an incentive for investment in the manufacturing and hotel sectors the rate of 60% countrywide; depreciation - liberal rates are allowed for depreciation of assets based on value as follows: buildings and hotels machinery e.g. tractors and aircrafts;

loss carried forward - business enterprises that suffer losses can carry forward such losses to be offset against future taxable profits; Duty remission facility - material imported for use in manufacture for export or for the production of raw materials for use in export oriented manufacture or for the production of duty free items for sale domestically are eligible for duty remissions. Applications for this facility may be made to the Export Promotion Programme Office in the Ministry of Finance and Planning.

Manufacturing Under Bond (MUB) To encourage manufacturing in Kenya for world markets, the Government has established an in-bond programme open to both local and foreign investors. IPC and Ministry of Finance and Planning (Department of Customs and Excise) administer the program. Enterprises operating under the programme are offered the following incentives: exemption from duty and VAT on imported plant, machinery and equipment, raw material and other imported inputs; and 100% investment allowance on plant machinery equipment and buildings. Export Processing Zones Authority (EPZA) 25. Export Processing Zones are coordinated by the Export Processing Zones Authority (EPZA). A number of EPZs have already been established. Enterprises operating in export processing zones in Kenya enjoy the following benefits: 10 years tax holiday and a float 25% tax for the next 10 years;

exemption from all withholding taxes on dividends and other payments to non-residents during the first 10 years; exemption from import duties on machinery raw materials and intermediate inputs; no restriction on management or technical arrangement; exemption from stamp duty; and Exemption from VAT and operate on one license only.

5. treaties / economic integration WTO and stated above ECONOMIC 1. economic policy

fiscal policy - Expansionary fiscal policy, contractionary fiscal policy and neutral fiscal policy monetary policy trade policy

Banking structure (national and private) both private and govt controlled banks , Nairobi stock exchange one of the largest boards in Kenya. 2. income patterns (GDP) - $1,600 (2008 est.) 3. disposable income patterns 4. investment (domestic, national, individual) SOCIAL 1. psychographics and sociographics

Age structure: 0-14 years: 42.3% (male 8,300,393/female 8,181,898) 15-64 years: 55.1% (male 10,784,119/female 10,702,999) 65 years and over: 2.6% (male 470,218/female 563,145) (2009 est.) Population growth rate: 2.691% (2009 est.) country comparison to the world:25 Birth rate: 36.64 births/1,000 population (2009 est.) country comparison to the world: 31 Death rate: 9.72 deaths/1,000 population (July 2009 est.) country comparison to the world: 69 Net migration rate: 0 migrant(s)/1,000 population (2009 est.) country comparison to the world: 78 Urbanization: est.)

urban population: 22% of total population (2008) rate of urbanization: 4% annual rate of change (2005-10 Sex ratio: Land1.02 Mass Total- 224,962 sq mi (582,650 sq km) at birth: male(s)/female

Land219,788 sqmale(s)/female mi (569,250 sq km) under 15 years: 1.01 15-64 years: 1.01sq male(s)/female Water5,173 mi (13,400 sq km) 65 years and over: 0.84 male(s)/female total population: 1 male(s)/female (2009 est.) Infant mortality rate: http://www.tradeport.org/countries/kenya/01grw.html

total: 54.7 deaths/1,000 live births country comparison to the world: 44 male: 57.56 deaths/1,000 live births female: 51.78 deaths/1,000 live births (2009 est.) Life expectancy at birth: total population: 57.86 years country comparison to the world: 188 male: 57.49 years female: 58.24 years (2009 est.)

2. Culture & religious- Mostly Christians with 27% of the population Protestant while 26% are Roman Catholic. Around 19% of the population follow local native tribal beliefs and 6% are Muslims country of diverse and rich cultural traditions, seeks to cultivate and develop those traditions to ensure that its valuable cultural assets are not irretrievably lost and that social cohesion is not undermined in the process of change to newer ways 3. mindset and lifestyle of people Kenyans love their beer almost as much as their dancing and there's a thriving local brewing industry Kenyans love music and the style known as benga is the contemporary dance music that rules http://au.encarta.msn.com/sidebar_1461501337/Kenya_Customs_and_Lif estyle.html 4. urban and subunban population Rural and urbanization is on the rise since the past two years. TECHNOLOGICAL 1. R & D R&D organization that constituted one of our case studies is the Kenya Industrial R&D Institute (abbreviated KIRDI). Like the Coffee Research Foundation, KIRDI's origin lies in the colonial period, when in 1942, the East African Industrial Research Organization was established to develop local industries, with the objective of relieving shortages brought about by World War II. After the collapse of the East African Community in 1977, the Kenyan government first transferred the Organization to the Ministry of Commerce and Industry, and then, two years later, gave it autonomy.

Vous aimerez peut-être aussi

- Egypt PEST AnalysisDocument34 pagesEgypt PEST AnalysisAhmed M. Ezzat58% (26)

- Porters Five Force On U.A.EDocument15 pagesPorters Five Force On U.A.ESai Vasudevan50% (2)

- AUSTRALIA - Porters 5 ForcesDocument14 pagesAUSTRALIA - Porters 5 ForcesSai Vasudevan100% (1)

- BSBDIV501 Assessment 1Document7 pagesBSBDIV501 Assessment 1Junio Braga100% (3)

- 4th MAILING - Validation Letter - SampleDocument6 pages4th MAILING - Validation Letter - SampleJeromeKmt100% (20)

- Egypt PEST AnalysisDocument34 pagesEgypt PEST AnalysisahmedmaePas encore d'évaluation

- Special Topics in Income TaxationDocument78 pagesSpecial Topics in Income TaxationPantas DiwaPas encore d'évaluation

- UtilitarianismDocument37 pagesUtilitarianismLeiya Lansang100% (2)

- PEST Analysis (Egypt Market) External Audit - Threats - OpportunitiesDocument13 pagesPEST Analysis (Egypt Market) External Audit - Threats - OpportunitiesBassem Safwat Boushra75% (4)

- Financial Sector in MauritiusDocument55 pagesFinancial Sector in Mauritiuschirag125Pas encore d'évaluation

- Trade and Business Activities 1Document4 pagesTrade and Business Activities 1Umer RaziPas encore d'évaluation

- Democratic Republic of Congo Pharma IndustryDocument17 pagesDemocratic Republic of Congo Pharma IndustryTirth ShahPas encore d'évaluation

- Five Year PlansDocument14 pagesFive Year PlansKhushi HingePas encore d'évaluation

- Group Project MKT-417 Sec. 1 Instructor: Samy Ahmed: Submitted BY Name IDDocument29 pagesGroup Project MKT-417 Sec. 1 Instructor: Samy Ahmed: Submitted BY Name IDHabibullah SarkerPas encore d'évaluation

- Macroeconomic Framework-Performance and Policies: Chapter #2Document28 pagesMacroeconomic Framework-Performance and Policies: Chapter #2Annam InayatPas encore d'évaluation

- SC Workshop Mombasa Lemecha enDocument31 pagesSC Workshop Mombasa Lemecha enTewodros2014Pas encore d'évaluation

- PEST AnalysisDocument13 pagesPEST AnalysisMiriam FahimPas encore d'évaluation

- Market ReportDocument111 pagesMarket ReportYoseph MelessePas encore d'évaluation

- Kenya PresentationDocument33 pagesKenya PresentationYohn QuicenoPas encore d'évaluation

- How Countries CompeteDocument137 pagesHow Countries CompeteJim Freud100% (3)

- SEZ Notes - February 18th, 2009: DegreeDocument5 pagesSEZ Notes - February 18th, 2009: DegreeZofail HassanPas encore d'évaluation

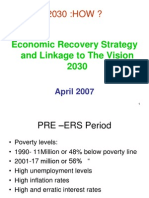

- ERS and Vision 2030 - April 2008Document64 pagesERS and Vision 2030 - April 2008Elijah NyangwaraPas encore d'évaluation

- Abhinav Agarwal Ankit Agarwal Piyush BhardwajDocument30 pagesAbhinav Agarwal Ankit Agarwal Piyush Bhardwajvinaygupta18Pas encore d'évaluation

- China Today FinalDocument32 pagesChina Today FinalPranav AnandPas encore d'évaluation

- 2010/2011 BUDGET Taxation Proposals: Theme: Towards Inclusive and Sustainable Rapid Economic GrowthDocument25 pages2010/2011 BUDGET Taxation Proposals: Theme: Towards Inclusive and Sustainable Rapid Economic GrowthAkhil SharmaPas encore d'évaluation

- MexicoDocument11 pagesMexicoapi-276226198Pas encore d'évaluation

- Bus 102 Introduction To Business II Lecture Notes Prof. Adeyeye Mr. Cassius Ogar and Mrs UdezeDocument6 pagesBus 102 Introduction To Business II Lecture Notes Prof. Adeyeye Mr. Cassius Ogar and Mrs Udezeoluwadamilola136Pas encore d'évaluation

- AdelmanDocument12 pagesAdelmanSuniel ChhetriPas encore d'évaluation

- Key Policy Areas That Can Spur Industrialization in KenyaDocument4 pagesKey Policy Areas That Can Spur Industrialization in KenyaPaul MachariaPas encore d'évaluation

- Policy and Institutional Changes For Promoting Investment of Remittances in Kenya'S Agricultural SectorDocument6 pagesPolicy and Institutional Changes For Promoting Investment of Remittances in Kenya'S Agricultural SectoramadpocrcPas encore d'évaluation

- Emerging Market StrategyDocument21 pagesEmerging Market StrategyKritika KushwahaPas encore d'évaluation

- Rostow Model Group AssignmentDocument11 pagesRostow Model Group AssignmentMwaura NdutaPas encore d'évaluation

- Strategic Management: Presented by Shabeer Babu Roshni Suresh.PDocument25 pagesStrategic Management: Presented by Shabeer Babu Roshni Suresh.PShabeer BabuPas encore d'évaluation

- NAFTA, EOUs, EHTPs, STPs ,.group 1 IttpDocument15 pagesNAFTA, EOUs, EHTPs, STPs ,.group 1 IttpHariom LohiaPas encore d'évaluation

- Eco ProjectDocument8 pagesEco ProjectSahanaPas encore d'évaluation

- Egypt PEST AnalysisDocument34 pagesEgypt PEST AnalysisAbdul Quadir0% (1)

- Vision IAS CSP20 Test 34 Q PDFDocument35 pagesVision IAS CSP20 Test 34 Q PDFBharathPas encore d'évaluation

- Pol and Legal Env of IndiaDocument101 pagesPol and Legal Env of Indiarajat_singlaPas encore d'évaluation

- Chocolate Factory in Ivory Coast (West Africa)Document32 pagesChocolate Factory in Ivory Coast (West Africa)Ruchir FalodiyaPas encore d'évaluation

- Lok Sabha Elections 2009Document13 pagesLok Sabha Elections 2009Siddhartha MishraPas encore d'évaluation

- ODM BrochureDocument2 pagesODM BrochuretnkPas encore d'évaluation

- Foreign Direct Investment in Service Sector-Policy For India's Services SectorDocument22 pagesForeign Direct Investment in Service Sector-Policy For India's Services Sectorgeeta009singhPas encore d'évaluation

- 2 1 South Africa The Context and Growth StraregiesDocument22 pages2 1 South Africa The Context and Growth StraregiesCaesar AdiPas encore d'évaluation

- Course: PUB Lecturer: in Sophal Student's Name: NGOUN Soksan Major: EconomicsDocument16 pagesCourse: PUB Lecturer: in Sophal Student's Name: NGOUN Soksan Major: EconomicsSoksan NgounPas encore d'évaluation

- 2007 Investing in IndiaDocument32 pages2007 Investing in IndiaDee JayPas encore d'évaluation

- 2-Joints Mafia BoboDocument11 pages2-Joints Mafia BoboElla Marziela Villanueva SelloriaPas encore d'évaluation

- EAF AnalysisDocument4 pagesEAF AnalysisGks06Pas encore d'évaluation

- 11.5 Geography of Services: Patterns and TrajectoriesDocument12 pages11.5 Geography of Services: Patterns and TrajectoriesDuong Binh PhamPas encore d'évaluation

- Group 4 - M1 Assignment 1 Group (International Trade and Business) Sample CompanyDocument9 pagesGroup 4 - M1 Assignment 1 Group (International Trade and Business) Sample Companyxo xoPas encore d'évaluation

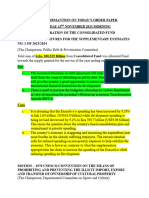

- National Assembly Thurday 23-11-23 Morning Basic InformantionDocument7 pagesNational Assembly Thurday 23-11-23 Morning Basic InformantionFidelis MurgorPas encore d'évaluation

- GlobalizationDocument31 pagesGlobalizationGaurav MahajanPas encore d'évaluation

- IBM Assign IndiviDocument15 pagesIBM Assign IndiviMasresha TasewPas encore d'évaluation

- Cabinet Brief - 10 March 2015Document7 pagesCabinet Brief - 10 March 2015State House Kenya100% (1)

- Kenya's Diaspora CapitalDocument5 pagesKenya's Diaspora CapitalAgnes Wanjiku Wa Gitau100% (1)

- EconomyDocument42 pagesEconomyZulaikha panhwarPas encore d'évaluation

- Doing Business in UAE PresentationDocument10 pagesDoing Business in UAE PresentationDinesh AdwaniPas encore d'évaluation

- Assess Commercial Risk For Doing Business With Congo and SudanDocument29 pagesAssess Commercial Risk For Doing Business With Congo and SudanIshani PotfodePas encore d'évaluation

- Africa Disneyland: Prepared byDocument38 pagesAfrica Disneyland: Prepared byNoha KawannaPas encore d'évaluation

- Macro Economics: Cote D'ivoire Macro Economics: Cote D'ivoireDocument16 pagesMacro Economics: Cote D'ivoire Macro Economics: Cote D'ivoireOliMixPas encore d'évaluation

- Session 3 World Bank, The East Asian Miracle, 1993, Pp. 1-26Document3 pagesSession 3 World Bank, The East Asian Miracle, 1993, Pp. 1-26Muhd Hafiz PatolgaPas encore d'évaluation

- ĐTQTDocument7 pagesĐTQTbangtam9903Pas encore d'évaluation

- FY BCOM Professional FC NotesDocument12 pagesFY BCOM Professional FC NotesVijay SharanPas encore d'évaluation

- Investment, Trade DevelopmentDocument32 pagesInvestment, Trade Developmentemy anishaPas encore d'évaluation

- The Pinnacle February 2021Document49 pagesThe Pinnacle February 2021Anay MehrotraPas encore d'évaluation

- Live, work, retire, buy property and do business in Mauritius: Make Mauritius your second homeD'EverandLive, work, retire, buy property and do business in Mauritius: Make Mauritius your second homePas encore d'évaluation

- Pest Analysis of MalaysiaDocument8 pagesPest Analysis of MalaysiaSai VasudevanPas encore d'évaluation

- Business and Operations of Li & FungDocument4 pagesBusiness and Operations of Li & FungSai Vasudevan0% (1)

- Pest Analysis Sri LankaDocument8 pagesPest Analysis Sri LankaSai VasudevanPas encore d'évaluation

- Orchid Hotel-An IntroductionDocument1 pageOrchid Hotel-An IntroductionSai VasudevanPas encore d'évaluation

- Pest Analysis Sri LankaDocument8 pagesPest Analysis Sri LankaSai VasudevanPas encore d'évaluation

- Li and FungDocument3 pagesLi and FungSai VasudevanPas encore d'évaluation

- Corporate Governance in TATA MotorsDocument9 pagesCorporate Governance in TATA MotorsSai VasudevanPas encore d'évaluation

- Geographic Segmentation - Demographic Segmentation - Psychographic SegmentationDocument6 pagesGeographic Segmentation - Demographic Segmentation - Psychographic SegmentationSai VasudevanPas encore d'évaluation

- IndiaDocument6 pagesIndiaSai VasudevanPas encore d'évaluation

- Insurance Regulatory and Development ActDocument13 pagesInsurance Regulatory and Development ActSai VasudevanPas encore d'évaluation

- How Mutlinationals Can Win in IndiaDocument17 pagesHow Mutlinationals Can Win in IndiaSai VasudevanPas encore d'évaluation

- Siemens LimitedDocument12 pagesSiemens LimitedSai VasudevanPas encore d'évaluation

- GermanyDocument9 pagesGermanySai VasudevanPas encore d'évaluation

- HCL TechnologiesDocument8 pagesHCL TechnologiesSai VasudevanPas encore d'évaluation

- Import and Export Policy 2009-2014Document14 pagesImport and Export Policy 2009-2014Sai VasudevanPas encore d'évaluation

- Import and Export Policy 2009-2014Document14 pagesImport and Export Policy 2009-2014Sai VasudevanPas encore d'évaluation

- INFOSYSDocument9 pagesINFOSYSSai VasudevanPas encore d'évaluation

- Collective BargainingDocument7 pagesCollective BargainingSai VasudevanPas encore d'évaluation

- Tata Motors LimitedDocument10 pagesTata Motors LimitedSai VasudevanPas encore d'évaluation

- NTPC (CSR, MGT, Financil RPT)Document15 pagesNTPC (CSR, MGT, Financil RPT)ashish_5112Pas encore d'évaluation

- Kotak Mahindra BankDocument23 pagesKotak Mahindra BankSai VasudevanPas encore d'évaluation

- IRDADocument3 pagesIRDASai VasudevanPas encore d'évaluation

- Globalization and Indian EconomyDocument12 pagesGlobalization and Indian EconomySai VasudevanPas encore d'évaluation

- BRICDocument8 pagesBRICSai VasudevanPas encore d'évaluation

- Strategic Management-I: Presentation On Hero MotocorpDocument5 pagesStrategic Management-I: Presentation On Hero MotocorpSai VasudevanPas encore d'évaluation

- Nternational Companies of ArgentinaDocument16 pagesNternational Companies of ArgentinaSai VasudevanPas encore d'évaluation

- Vishal Mega MartDocument22 pagesVishal Mega MartSai Vasudevan100% (1)

- DPP 01 Gravitation + Geometrical Optics + Electrostatics PhysicsDocument17 pagesDPP 01 Gravitation + Geometrical Optics + Electrostatics PhysicsAditya TripathyPas encore d'évaluation

- Hydro Resources Contractors Corp V Pagalilauan G.R. No. L-62909Document3 pagesHydro Resources Contractors Corp V Pagalilauan G.R. No. L-62909fgPas encore d'évaluation

- Britain and The Resistance in Occupied YugoslaviaDocument29 pagesBritain and The Resistance in Occupied YugoslaviaMarko Cvarak100% (1)

- Nelson Piquet Fined $945,000 For Racist Remark About Lewis HamiltonDocument5 pagesNelson Piquet Fined $945,000 For Racist Remark About Lewis HamiltonNivPas encore d'évaluation

- University of ZimbabweDocument21 pagesUniversity of ZimbabweMotion ChipondaPas encore d'évaluation

- Rawls TheoryDocument4 pagesRawls TheoryAcademic ServicesPas encore d'évaluation

- Sameer Vs NLRCDocument2 pagesSameer Vs NLRCRevz Lamoste100% (1)

- Imm5786 2-V1V20ZRDocument1 pageImm5786 2-V1V20ZRmichel foguePas encore d'évaluation

- BalayanDocument7 pagesBalayananakbalayanPas encore d'évaluation

- Chapter Eight Cross-National Cooperation and Agreements: ObjectivesDocument13 pagesChapter Eight Cross-National Cooperation and Agreements: ObjectivesSohni HeerPas encore d'évaluation

- Business Ethics Session 5Document9 pagesBusiness Ethics Session 5EliaQazilbashPas encore d'évaluation

- MOM StatusDocument7 pagesMOM StatusReynaldi Be TambunanPas encore d'évaluation

- 1st Indorsement RYAN SIMBULAN DAYRITDocument8 pages1st Indorsement RYAN SIMBULAN DAYRITAnna Camille TadeoPas encore d'évaluation

- TRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseDocument2 pagesTRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseBea Clarence IgnacioPas encore d'évaluation

- Medieval India 2022 1007Document30 pagesMedieval India 2022 1007Kumar ShivrajPas encore d'évaluation

- Quiz 1 2nd Quarter MAPEHDocument23 pagesQuiz 1 2nd Quarter MAPEHKevin Jay Mendoza MagbooPas encore d'évaluation

- Physical Education ProjectDocument7 pagesPhysical Education ProjectToshan KaushikPas encore d'évaluation

- K-8 March 2014 Lunch MenuDocument1 pageK-8 March 2014 Lunch MenuMedford Public Schools and City of Medford, MAPas encore d'évaluation

- Barandon Vs FerrerDocument3 pagesBarandon Vs FerrerCorina Jane Antiga100% (1)

- Tenancy Contract 1.4 PDFDocument2 pagesTenancy Contract 1.4 PDFAnonymous qKLFm7e5wgPas encore d'évaluation

- Retainer Contract - Atty. AtoDocument2 pagesRetainer Contract - Atty. AtoClemente PanganduyonPas encore d'évaluation

- Right To Social JusticeDocument13 pagesRight To Social Justicejooner45Pas encore d'évaluation

- Political Teaching of T. HobbesDocument15 pagesPolitical Teaching of T. HobbesАЛЬБИНА ЖАРДЕМОВАPas encore d'évaluation

- Military Discounts For Universal Studio Tours 405Document2 pagesMilitary Discounts For Universal Studio Tours 405Alex DA CostaPas encore d'évaluation

- About Alok Industries: Insolvency FilingDocument4 pagesAbout Alok Industries: Insolvency FilingHarshit GuptaPas encore d'évaluation

- Background To The Arbitration and Conciliation Act, 1996Document2 pagesBackground To The Arbitration and Conciliation Act, 1996HimanshuPas encore d'évaluation