Académique Documents

Professionnel Documents

Culture Documents

Principles of Insurance

Transféré par

psawant77Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Principles of Insurance

Transféré par

psawant77Droits d'auteur :

Formats disponibles

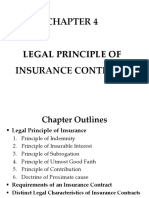

PRINCIPLES OF INSURANCE Insurance is a contract between two parties.

Hence, all the element of a valid contract should present in every insurance contract. Besides these elements, there are certain other principles also to be followed essentially at the time entering insurance contract. 1. Principle of utmost good faith (Uberrimae Fidei): All types of insurance contracts requires utmost good faith towards each other. The insurer and the insured must also disclosed all material facts, clearly, correctly and completely. If the insurer finds that certain material facts relating to the contract was not disclosed the insurer may avoid the contract, this principle is more important for life insurance as the information disclosed will affect the decision of the insurance company to decide whether to accept or reject the proposal. 2. Principle of Insurable Interest: The insured must have insurable interest (financially) in the subject matter of insurance. In life Insurance it refers to the life insured. In Fire and General Insurance, it must be present at the time of the occurrence of loss and in marine Insurance, the insurable interest exists only at the time of the occurrence of the loss. It is applicable to all contracts of insurance. Following are the causes of insurable interest. a) A person has insurable interest in his own life and his property. b) A wife has insurable interest in life of her husband. c) A businessman has insurable interest in the good he deal with and in the business property. d) A creditor has insurable interest in the life of the debtors to the extent of loan given. e) A partner has insurable interest in the life of other partners (partnership firm). 3. Principle of Indemnity: Indemnity means a guarantee or assurance to put the insured in the same position in which he was immediately prior to the happening of the uncertain event. The insurer undertakes to make payment of actual loss incurred by the insured. Insurance contract is signed only for getting protection against unpredicted financial losses arising to the future uncertainties. Insurance contract is not made for making losses arising due to the future uncertainties.

4. Principle of contribution: This principle is a corollary to the principle of indemnity. It is applicable to all contracts of indemnity. Under this principle the insured can claim the compensation only to the extent of actual loss either from any one insurer or all the insurers. If one insurer pays full compensation then that insurer can claim proportionate claim from the other insurers. 5. Principle of subrogation: According to principle of subrogation, after the insured is compensated for the loss due to damage to property insured then the right of ownership of such property passes on to the insurer. This principle is applicable only when the damaged property has any value after the event causing the damage. The insurer can benefit out of subrogation rights only to the extent of the amount he has paid to the insured as compensation. 6. Principle of mitigation of loss: under this principle, insured must always try his level best to minimize the loss of his insured must take all possible

Vous aimerez peut-être aussi

- Lecture On Insurance LawDocument8 pagesLecture On Insurance LawGianaPas encore d'évaluation

- Insurance Law in IndiaDocument44 pagesInsurance Law in IndiaVaibhav AhujaPas encore d'évaluation

- Risk Chapter 4Document14 pagesRisk Chapter 4Wonde BiruPas encore d'évaluation

- Life Insurance, Marine Insurance, Fire Insurance, Business Insurance ProgramsDocument10 pagesLife Insurance, Marine Insurance, Fire Insurance, Business Insurance Programsvijayadarshini vPas encore d'évaluation

- Chapter 9 Test Risk ManagementDocument18 pagesChapter 9 Test Risk ManagementNicole LabbaoPas encore d'évaluation

- 250 Question Insurance LawDocument43 pages250 Question Insurance LawShivansh MishraPas encore d'évaluation

- Department of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IDocument18 pagesDepartment of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IAman SharmaPas encore d'évaluation

- Iii Semester, Insurance and Risk Management ModuleDocument10 pagesIii Semester, Insurance and Risk Management ModuleSofi KhanPas encore d'évaluation

- ReinsuranceDocument20 pagesReinsuranceJay KoliPas encore d'évaluation

- Principles of Insurance - CHP 3Document25 pagesPrinciples of Insurance - CHP 3Hairul AziziPas encore d'évaluation

- Chapter 9 Test Risk ManagementDocument18 pagesChapter 9 Test Risk ManagementEymard Siojo0% (1)

- Ins 210-1-1Document40 pagesIns 210-1-1Daniel AdegboyePas encore d'évaluation

- Insurance Intermediaries: Agents IC 223: Fundamentals of InsuranceDocument10 pagesInsurance Intermediaries: Agents IC 223: Fundamentals of InsuranceMerupranta SaikiaPas encore d'évaluation

- Salient Features o The Insurance ActDocument15 pagesSalient Features o The Insurance Actchandni babunuPas encore d'évaluation

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelPas encore d'évaluation

- Agent Question BankDocument47 pagesAgent Question BankshinukrajanPas encore d'évaluation

- And Development Authority of India: Insurance RegulatoryDocument21 pagesAnd Development Authority of India: Insurance RegulatoryHaseef LoveforeverPas encore d'évaluation

- Miscellaneous InsuranceDocument27 pagesMiscellaneous InsuranceRavneet KaurPas encore d'évaluation

- B. Principle of Insurance - 6Document28 pagesB. Principle of Insurance - 6Han HanPas encore d'évaluation

- Principles of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)Document5 pagesPrinciples of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)ANURAGPas encore d'évaluation

- Fybms Business Law Wid AnswersDocument11 pagesFybms Business Law Wid AnswersnilPas encore d'évaluation

- LeasingDocument6 pagesLeasingSamar MalikPas encore d'évaluation

- Indemnity and Guarantee PPT LawDocument8 pagesIndemnity and Guarantee PPT LawMuhammad Khawaja100% (1)

- QUESTION One (Multiple Choice) : Insurance Company OperationsDocument14 pagesQUESTION One (Multiple Choice) : Insurance Company Operationsmamush fikaduPas encore d'évaluation

- Excercise Questions - Part 1 - With AnswerDocument8 pagesExcercise Questions - Part 1 - With AnswerFelicia VpPas encore d'évaluation

- Essentials of Life InsuranceDocument15 pagesEssentials of Life InsuranceAayush AgrawalPas encore d'évaluation

- Ic 57 Fire Insurane One LinerDocument14 pagesIc 57 Fire Insurane One Linerprabhat87aish50% (2)

- Insurance QBDocument63 pagesInsurance QBkrishna chaitanyaPas encore d'évaluation

- Insurance - Subrogation, Contribution, Re-InsuranceDocument26 pagesInsurance - Subrogation, Contribution, Re-InsuranceShivam kumar YadavPas encore d'évaluation

- Company Law QuestionsDocument9 pagesCompany Law QuestionsBadrinath ChavanPas encore d'évaluation

- Fire ClausesDocument62 pagesFire ClauseschriscalarionPas encore d'évaluation

- Insurance NotesDocument58 pagesInsurance Notespauline1988Pas encore d'évaluation

- Guideline Answers: Executive Programme (New Syllabus)Document88 pagesGuideline Answers: Executive Programme (New Syllabus)Jasmeet KaurPas encore d'évaluation

- Re InsuranceDocument6 pagesRe InsuranceVijay100% (4)

- Misrepresentation in InsuranceDocument4 pagesMisrepresentation in InsuranceDileep ChowdaryPas encore d'évaluation

- Ic 88 MCQDocument78 pagesIc 88 MCQSamba SivaPas encore d'évaluation

- Question Bank Business LawDocument2 pagesQuestion Bank Business LawNeha BhatiaPas encore d'évaluation

- IPCC - 33e - Differences & True or False Statements in Indian Contract ActDocument58 pagesIPCC - 33e - Differences & True or False Statements in Indian Contract Actmohan100% (3)

- Chapter 5 - Insurance LawDocument36 pagesChapter 5 - Insurance LawAnis AmirahPas encore d'évaluation

- Partnership Act MBADocument21 pagesPartnership Act MBABabasab Patil (Karrisatte)100% (1)

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaPas encore d'évaluation

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyPas encore d'évaluation

- Regulation of Stock ExchangesDocument12 pagesRegulation of Stock ExchangesShibashish GiriPas encore d'évaluation

- Core - Principles of InsuranceDocument32 pagesCore - Principles of InsuranceavinashkakarlaPas encore d'évaluation

- Insurance IntermediariesDocument9 pagesInsurance IntermediariesarmailgmPas encore d'évaluation

- Inflation AccountingDocument34 pagesInflation AccountingUnbeatable 9503Pas encore d'évaluation

- F - UnderwritingDocument15 pagesF - UnderwritingRavid Villa Arya100% (5)

- IC 38 Short Notes (2) 40Document1 pageIC 38 Short Notes (2) 40Anil KumarPas encore d'évaluation

- MCQ of Lab 2018Document41 pagesMCQ of Lab 2018sachinPas encore d'évaluation

- 613a - Principles of Insurance IIDocument23 pages613a - Principles of Insurance IIRavi ShankarPas encore d'évaluation

- Amalgamation, Absorption & External Reconstruction: Chapter-IDocument9 pagesAmalgamation, Absorption & External Reconstruction: Chapter-Iayushi aggarwalPas encore d'évaluation

- Company Law Ii PDFDocument95 pagesCompany Law Ii PDFNYAMEKYE ADOMAKOPas encore d'évaluation

- Professional Indemnity Insurance: Aims Learning OutcomesDocument12 pagesProfessional Indemnity Insurance: Aims Learning OutcomesPRASENJIT DHARPas encore d'évaluation

- MCQ 464Document10 pagesMCQ 464Tonmoy MajumderPas encore d'évaluation

- Gmail - International Investment Law (Quiz Test-1)Document11 pagesGmail - International Investment Law (Quiz Test-1)Ishwar MeenaPas encore d'évaluation

- Insurance SectorDocument45 pagesInsurance Sectorverma786786100% (1)

- RI GlossaryDocument33 pagesRI Glossarynk2k100% (1)

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- What Is Risk ManagementDocument4 pagesWhat Is Risk Managementsudipta deyPas encore d'évaluation

- Principles of InsuranceDocument3 pagesPrinciples of InsuranceNikita DesaiPas encore d'évaluation

- ImpDocument1 pageImppsawant77Pas encore d'évaluation

- Ocm Objective XiiDocument15 pagesOcm Objective Xiipsawant77Pas encore d'évaluation

- Admision Form 18.6.2014Document2 pagesAdmision Form 18.6.2014psawant77Pas encore d'évaluation

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Answer Sheet v-1 24052014Document7 pagesAnswer Sheet v-1 24052014psawant77Pas encore d'évaluation

- Mvat Computation 2014-2015Document23 pagesMvat Computation 2014-2015psawant77Pas encore d'évaluation

- CPT PaperDocument4 pagesCPT Paperpsawant77Pas encore d'évaluation

- BFMDocument28 pagesBFMPratik RambhiaPas encore d'évaluation

- SP Paper 1Document2 pagesSP Paper 1psawant77Pas encore d'évaluation

- Tds Rate Chart AY 14 15Document1 pageTds Rate Chart AY 14 15dhyanuPas encore d'évaluation

- DraftDocument1 pageDraftpsawant77Pas encore d'évaluation

- Deficit Finance MeaningDocument3 pagesDeficit Finance Meaningpsawant77Pas encore d'évaluation

- Secretarial Practice 2Document2 pagesSecretarial Practice 2psawant77Pas encore d'évaluation

- XI PaperDocument1 pageXI Paperpsawant77Pas encore d'évaluation

- Functions of RBIDocument3 pagesFunctions of RBITarun BhatejaPas encore d'évaluation

- KulluDocument2 pagesKullupsawant77Pas encore d'évaluation

- Answer Sheet BK Papers1Document34 pagesAnswer Sheet BK Papers1psawant77Pas encore d'évaluation

- Partnership FirmDocument25 pagesPartnership FirmAarush Jain90% (10)

- Oc Paper1Document1 pageOc Paper1psawant77Pas encore d'évaluation

- PartnershipDocument4 pagesPartnershippsawant77Pas encore d'évaluation

- Cost Acc. 27-10-14Document5 pagesCost Acc. 27-10-14psawant77100% (1)

- Different Types of ForestsDocument7 pagesDifferent Types of Forestspsawant77Pas encore d'évaluation

- Types of Bank AccountDocument5 pagesTypes of Bank Accountpsawant77Pas encore d'évaluation

- Dematofshares PDFDocument3 pagesDematofshares PDFpsawant77Pas encore d'évaluation

- Demat Simplified: A Guide To Dealing in Dematerialised SecuritiesDocument2 pagesDemat Simplified: A Guide To Dealing in Dematerialised SecuritiesBalraj PadmashaliPas encore d'évaluation

- Prepared By: CA. Abhijeet N. BobadeDocument9 pagesPrepared By: CA. Abhijeet N. Bobadepsawant77Pas encore d'évaluation

- Project Report: Overview of E-Commerce Impacts On Telecommunications ManagementDocument24 pagesProject Report: Overview of E-Commerce Impacts On Telecommunications Managementpsawant77Pas encore d'évaluation

- XL Shortfreecut KeysDocument25 pagesXL Shortfreecut Keyspsawant77Pas encore d'évaluation

- Time: 3 Hrs Economics Marks: 80: Group A' Group B'Document13 pagesTime: 3 Hrs Economics Marks: 80: Group A' Group B'psawant77Pas encore d'évaluation

- Case LawsDocument37 pagesCase LawsKiran Sebastian RozarioPas encore d'évaluation

- Reviewer BL 3Document1 pageReviewer BL 3Sheena ClataPas encore d'évaluation

- Consolidated Bank & Trust Corporation vs. CA, GR No. 138569 PDFDocument2 pagesConsolidated Bank & Trust Corporation vs. CA, GR No. 138569 PDFxxxaaxxx100% (1)

- Module 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Document52 pagesModule 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Anna CharlottePas encore d'évaluation

- Bonnevie vs. Court of Appeals, G.R. No. L-49101 October 24, 1983Document3 pagesBonnevie vs. Court of Appeals, G.R. No. L-49101 October 24, 1983Han NahPas encore d'évaluation

- 3rd Quiz ObliconDocument4 pages3rd Quiz ObliconEzra Denise Lubong RamelPas encore d'évaluation

- Rescind The Sale Should The Vendee Fail To Pay Any Installment. (X)Document32 pagesRescind The Sale Should The Vendee Fail To Pay Any Installment. (X)Alyssa TordesillasPas encore d'évaluation

- Chapter 27 Leases (Student)Document29 pagesChapter 27 Leases (Student)Kelvin Chu JYPas encore d'évaluation

- Suitability Assessment - V2Document2 pagesSuitability Assessment - V2Anshu GuptaPas encore d'évaluation

- Photography Services Payment Plan AgreementDocument3 pagesPhotography Services Payment Plan AgreementRia KudoPas encore d'évaluation

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationKashan KhanPas encore d'évaluation

- Sample Loan With REMDocument14 pagesSample Loan With REMYcel CastroPas encore d'évaluation

- Petty Cash Liquidation 4.12.2021Document215 pagesPetty Cash Liquidation 4.12.2021Pamela Mae Derecho BatuigasPas encore d'évaluation

- Concurrence and Preference of Credit: Concurrence of Credits Implies The Possession by Two orDocument6 pagesConcurrence and Preference of Credit: Concurrence of Credits Implies The Possession by Two orLara DellePas encore d'évaluation

- Law of PledgeDocument47 pagesLaw of PledgeAadhitya NarayananPas encore d'évaluation

- Arbitration Agreement Between PartnersDocument3 pagesArbitration Agreement Between PartnersMahebub GhantePas encore d'évaluation

- Manganese Ore Draft Contract: Alya Mad. Ve Tic. Ltd. Şti. Ninjin Agi LLCDocument3 pagesManganese Ore Draft Contract: Alya Mad. Ve Tic. Ltd. Şti. Ninjin Agi LLCUndrakh MunkbatPas encore d'évaluation

- Introduction To P&IDocument35 pagesIntroduction To P&ISitchakornPas encore d'évaluation

- Agreement of FabricDocument2 pagesAgreement of FabricSazeed Sha52hPas encore d'évaluation

- Terms and Conditions (Bracket Order) : Mis+ T&CDocument1 pageTerms and Conditions (Bracket Order) : Mis+ T&Cpinakin medhatPas encore d'évaluation

- LL.B.6TH Sem (Role of Ministry of Company Affairs)Document8 pagesLL.B.6TH Sem (Role of Ministry of Company Affairs)GuruduttPas encore d'évaluation

- Deductible Vs Excess (Insurance)Document1 pageDeductible Vs Excess (Insurance)gopinathan_karuthedaPas encore d'évaluation

- B. Com. Semester II Financial Accounting II - SyllabusDocument1 pageB. Com. Semester II Financial Accounting II - SyllabusShubham ShubbhuPas encore d'évaluation

- Robledo v. NLRC (Liability For Wages in Case of Change of Personality)Document1 pageRobledo v. NLRC (Liability For Wages in Case of Change of Personality)Xandredg Sumpt LatogPas encore d'évaluation

- Wa0068Document11 pagesWa0068Nirmal SinghPas encore d'évaluation

- Exclusive Distributorship AgreementDocument3 pagesExclusive Distributorship AgreementNestor TagulaoPas encore d'évaluation

- Law Bachawat Scanner SOGADocument61 pagesLaw Bachawat Scanner SOGAgvramani51233Pas encore d'évaluation

- 1world Online, Inc., A California Corporation vs. Blockchain Generation, An Unknown Business Entity, Et AlDocument26 pages1world Online, Inc., A California Corporation vs. Blockchain Generation, An Unknown Business Entity, Et AlfleckaleckaPas encore d'évaluation

- 2021 Top 5 U.S. Tax Mistakes To Avoid When Forming An LLC: Scott LetourneauDocument4 pages2021 Top 5 U.S. Tax Mistakes To Avoid When Forming An LLC: Scott LetourneauMalik SarfrazPas encore d'évaluation

- Addendum MB ToolDocument3 pagesAddendum MB ToolCarol LeónPas encore d'évaluation

- POA & JV AgreementDocument2 pagesPOA & JV Agreementbhimshrestha554Pas encore d'évaluation