Académique Documents

Professionnel Documents

Culture Documents

The Business Cycle Approach To Investing - Fidelity Investments

Transféré par

Kitti WongtuntakornDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Business Cycle Approach To Investing - Fidelity Investments

Transféré par

Kitti WongtuntakornDroits d'auteur :

Formats disponibles

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

CUSTOMER SERVICE

OPEN AN ACCOUNT

LOG IN

Accounts & Trade

News & Insights

Research

Guidance & Retirement

Investment Products

Email Share

Home News & Insights Fidelity Viewpoints Investing Ideas

AAA

How to invest using the business cycle

Use economic signals to see what investments may shine at what turn in the business cycle.

BY LISA EMSBO-MA TTINGLY, MILES BETRO, DIRK HOFSCHIRE, AND LI TAN, FIDELITY VIEWPOINTS 02/13/2013

Related Articles Rates and dividends Companies that can grow payouts and pro it from rising rates may thrive. Olympics are risky The games are great for national pride, but may not be a golden investing opportunity. Materials sector Housing and plentiful gas could help, while cyclical commodity prices may be a headwind. A paperless world? With the paper industry in transition, containerboard companies have made improvements. View all Stocks articles

Investing Strategies

Saving for Retirement Mutual Funds

Asset Allocation Funds

Bond Funds

Bonds

Cash Management

Exchange-Traded Funds

Stocks

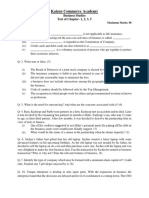

In the aftermath of the worst inancial crisis since the Great Depression, the U.S. has experienced a slow pace of economic growth. Since 2009, the post-crisis periodcharacterized by private-sector deleveraging and extraordinary levels of monetary and iscal policy interventionhas caused some experts to assert that this economic climate will not resemble the typical business cycle patterns of recent decades. However, our historical analysis suggests that the rhythm of recent cyclical luctuations in the economy has been similar to the traditional pattern. As a result, a business cycle approach to asset allocation can still add value as part of an intermediate-term investment strategy. Key takeaways

The business cycle re lects the aggregate luctuations of economic activity, which can be a critical determinant of asset performance over the intermediate term. Changes in key economic indicators have historically provided a fairly reliable guide to recognizing the business cycles four distinct phasesearly, mid, late, and recession. Our quantitatively backed approach seeks to identify the shifting economic phases, providing a framework for making asset allocation decisions according to the probability that assets may outperform or underperform. Although the slow-growth post-crisis expansion has differences with other periods since World War II, the current cycles pattern so far con irms that the business cycle approach is still a relevant tool for todays environment.

Asset allocation framework

At any given time, asset price luctuations are driven by a con luence of various short-, intermediate-, and long-term factors. For this reason, adopting a comprehensive asset allocation framework that analyzes underlying factors and trends among the following three temporal segments can be an effective approach: tactical (one to 12 months), business cycle (six months to ive years), and secular ( ive to 30 years).

Over the intermediate term, asset performance is often driven largely by cyclical factors tied to the state of the economysuch as corporate earnings, interest rates, and in lation. The business cycle, which encompasses the cyclical luctuations in an economy over many months or a few years, can therefore be a critical determinant of asset market returns and the relative performance of various asset classes. Asset price fluctuations are driven by a confluence of various short-, intermediate-, and long-term factors.

Source: Fidelity Investments (Asset Allocation Research Team).

1 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

Understanding the business cycle

Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Fluctuations in the business cycle are essentially distinct changes in the rate of growth in economic activity, particularly changes in three key cyclesthe corporate pro it cycle, the credit cycle, and the inventory cycleas well as changes in the employment backdrop and monetary policy. While unforeseen macroeconomic events or shocks can sometimes disrupt a trend, changes in these key indicators historically have provided a relatively reliable guide to recognizing the different phases of an economic cycle. Our quantitatively backed, probabilistic approach makes it possible to identifywith a reasonable degree of con idencethe state of the business cycle at any point in time. Speci ically, there are four distinct phases of a typical business cycle (see graph below): Early-cycle phase: Generally a sharp recovery from recession, marked by an in lection from negative to positive growth in economic activity (e.g., gross domestic product, industrial production), then an accelerating growth rate. Credit begins to expand amid easy monetary policy, creating a healthy environment for rapid margin expansion and pro it growth. Business inventories are low, while sales growth improves signi icantly. Mid-cycle phase: Typically the longest phase of the business cycle. The mid cycle is characterized by a positive but more moderate rate of growth than that experienced during the early-cycle phase. Economic activity gathers momentum, credit growth becomes strong, and pro itability is healthy against an accommodative though increasingly neutralmonetary policy backdrop. Inventories and sales grow, reaching equilibrium relative to each other. Late-cycle phase: Emblematic of an overheated economy poised to slip into recession and hindered by above-trend rates of in lation. Economic growth rates slow to stall speed against a backdrop of restrictive monetary policy, tightening credit availability, and deteriorating corporate pro it margins. Inventories tend to build unexpectedly as sales growth declines. Recession phase: Features a contraction in economic activity. Corporate pro its decline and credit is scarce for all economic actors. Monetary policy becomes more accommodative and inventories gradually fall despite low sales levels, setting up the next expansion. The business cycle has four distinct phases, with the U.S. in a mid-cycle expansion in late 2012.

Note: This is a hypothetical illustration of a typical business cycle. There is not always a chronological progression in this order, and there have been cycles when the economy has skipped a phase or retraced an earlier one. Economically sensitive assets include stocks and high-yield corporate bonds, while less economically sensitive assets include Treasury bonds and cash. Please see endnotes for a complete discussion. Source: Fidelity Investments (AART).

Asset class performance patterns

Looking at the performance of stocks, bonds, and cash from 1950 to 2010, we can see that shifts between business cycle phases create differentiation in asset price performance (see graph to the right). In general, the performance of economically sensitive Historically, performance for stocks and bonds has been heavily influenced by the business cycle.

2 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

assets such as stocks tends to be the strongest when growth is rising at an accelerating rate during the early cycle, then moderates through the other phases until returns generally decline during recessions. By contrast, defensive assets such as investment-grade bonds and cash-like short-term debt have experienced the opposite pattern, with their highest returns during a recession and the weakest relative performance during the early cycle. Asset allocation decisions are rooted in relative asset class performance, and there is signi icant potential to enhance portfolio performance by tilting exposures to the major asset classes based on shifts in the business cycle. Investors can implement the business cycle approach to asset allocation by overweighting asset classes that tend to outperform during a given business cycle phase, while underweighting those asset classes that tend to underperform. In the early cycle, for example, the investor using this approach would overweight stocks and underweight bonds and cash.

Asset classes represented by: Stocks Top 3,000 U.S. stocks ranked and weighted by market capitalization; Bonds Barclays U.S. Aggregate Bond Index for 19762010, 66% IA U.S. Intermediate-Term Government Bond Index and 34% IA U.S. Long-Term Corporate Bond Index for 19501975; Cash Barclays U.S. Treasury Bills Index (13 Month). Source: Fidelity Investments (AART) as of Apr. 30, 2010.

In the analysis that follows, we consider asset class performance patterns across the phases of the business cycle, both on an absolute basis and using several measures relative to a long-term strategic allocation to a balanced benchmark portfolio of 50% stocks, 40% bonds, and 10% cash (see "Analyzing relative asset class performance," to the right). Business cycles since 1950 are represented, and all data are annualized for comparison purposes.

Early-cycle phase

Lasting an average of 13 months, the early phase of the business cycle has historically produced the most robust stock performance on an absolute basis, with the broad market enjoying a 26% average annual total return during this phase (see graph, up and right). Stocks have typically bene ited more than bonds (6%) and cash (4%) from the backdrop of low interest rates, the irst signs of economic improvement, and the rebound in corporate earnings. Relative to the long-term strategic allocation, stocks have exhibited the greatest outperformance in the early cycle, while bonds and cash have experienced the deepest underperformance (see graph below). A hallmark of this phase is that hit rates against the balanced benchmark are the most de initive, which may give investors greater conviction to overweight riskier assets and underweight more defensive asset classes during the early cycle.

Analyzing relative asset class performance Certain metrics help us evaluate the historical performance of each asset class relative to the strategic allocation by revealing the potential magnitude of out- or underperformance during each phase, as well as the reliability of those historical performance patterns (see the Relative to balanced benchmark chart below). Full-phase average performance: Calculates the average performance of an asset class in a particular phase of the business cycle and subtracts the performance of the benchmark portfolio. This method better captures the impact of compounding and performance that is experienced across full market cycles (i.e., longer holding periods). However, performance outliers carry greater weight and can skew results. Median monthly difference: Calculates the difference in the monthly performance for an asset class compared to the benchmark portfolio, and then takes the midpoint of those observations. This measure is indifferent to when a return period begins during a phase, which makes it a good measure for investors who may miss signi icant portions of each business cycle phase. This method mutes the extreme performance differences of outliers, and also underemphasizes the impact of compounding returns. Cycle hit rate: Calculates the frequency of an asset class outperforming the benchmark portfolio over each business cycle phase since 1950. This measure represents the consistency of asset class performance relative to the broader market over different cycles, removing the possibility that outsized gains during one period in history in luence overall averages. This method suffers somewhat from small sample sizes, with

Mid-cycle phase

Averaging 38 months, the mid-cycle phase tends to be signi icantly longer than any other phase of the business cycle. As the economy moves beyond its initial stage of recovery and growth rates moderate during the mid cycle, the leadership of economically sensitive assets has typically tapered. On an absolute basis, stock market performance, at 15% per year on average, has tended to be fairly strong though not as robust as in the early-cycle phase, while bonds and cash have continued to post average annual returns of 6% and 4% in the mid cycle. This phase is also when most stock market corrections have taken place. Measured by average and median differences as well as hit rates, the mid-cycle pattern of performance relative to the strategic allocation is similar to that of the early cycle, with bonds and cash trailing stocks. However, both the magnitude and frequency of out- and underperformance have been

3 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

more muted, justifying more moderate portfolio tilts than during the early phase.

only 11 full cycles during the period, but persistent out- or underperformance can still be observed.

Relative to a balanced benchmark, economically sensitive stocks have tended to do well in the early- and mid-cycle phase, bonds have tended to do well in the recessionary phase, and performance has been mixed during the late-cycle phase.

Asset classes represented by: Stocks Top 3,000 U.S. stocks ranked and weighted by market capitalization; Bonds Barclays U.S. Aggregate Bond Index for 19762010, 66% IA U.S. Intermediate-Term Government Bond Index and 34% IA U.S. Long-Term Corporate Bond Index for 19501975; Cash Barclays U.S. Treasury Bills Index (13 Month). Source: Fidelity Investments (AART) as of Apr. 30, 2010. See Annualizing relative asset class performance on page 3.

Late-cycle phase

The late-cycle phase has an average duration of 17 months. As the recovery matures, in lationary pressures build, interest rates rise, and investors start to shift away from economically sensitive areas. On an absolute basis, average stock performance at 6% per year is roughly in line with cash. The rising interest rates that typically accompany this phase of the business cycle tend to weigh on the performance of longer-duration bonds which, at 4% per year on average, lags the absolute returns to shorter-duration cash. Across the asset classes, the late cycle has the most mixed performance relative to the strategic allocation, and the hit rates and relative performance are the lowest of the expansion phases. In general, stocks have performed better than both cash and bonds during the late cycle, but the inde inite frequency and magnitude of relative performance warrant a more neutral risk allocation.

Recession phase

The recession phase has historically been the shortest, lasting nine months on average from 1950 to 2010. As economic growth stalls and contracts, assets that are more economically sensitive fall out of favor and those that are defensively oriented move to the front of the performance line. The stock market has performed poorly during this phase, declining an average of 6% per year on an absolute basis. Cash has continued to play a defensive role, gaining 6% per year on average, while the falling interest-rate environment typically seen during recessions acts as a major tailwind for bonds, which post their most robust gains of 13% per year on average. Performance patterns relative to the strategic allocation have been signi icantly different in recessions than in the other three phases, most notably in the high frequency of outperformance for bonds, and the opposite for stocks. Cash positions also enjoy their best performance relative to the balanced benchmark, albeit with only moderate hit rates. This phase of the business cycle tends to favor a high conviction in more defensive allocations.

Sector performance rotations within asset classes

Similar patterns of relative performance can be Equity sector relative performance has

4 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

identi ied across sectors of the major asset classes, such as equity sectors or different credit qualities in the ixed income universe. Within equity markets, more economically sensitive sectors such as technology and industrials tend to do better in the early- and mid-cycle phases, while more defensively oriented sectors such as consumer staples and health care have historically exhibited better performance during the more sluggish economic growth in the late-cycle and recession phases (see graph to the right and How to invest in sectors using the business cycle).

tended to be differentiated across business cycle phases.

Bond market sectors have also exhibited economic sensitivity. More credit-sensitive ixed income sectorssuch as high-yield corporate bondshave Source: Fidelity Investments (AART). Unshaded = no clear relative performance pattern. See endnotes for sector tended to do better in the early phase of the cycle, de initions. while less economically sensitive areassuch as government and other investment-grade bondshave done relatively well in slowdowns and recessions. For instance, high-yield corporates have averaged 19% annual gains during the early cycle, but have been roughly lat in recessions, when interest ratesensitive investment-grade bonds have returned 13% per year on average. Many ixed income categories that are fairly new to the marketplace have limited history and hence smaller sample sizes that make historical performance analysis less useful. Nevertheless, comparing the performance of credit and interest-rate sensitive bonds across the phases illustrates that business cyclebased asset allocation within a ixed income portfolio has considerable potential to generate active returns (see graph to the right and down).

Merits of the business cycle approach

There is generally broad agreement among many academics and market participants that economic factors in luence asset prices. However, while academic research has shown that asset allocation decisions can be responsible for anywhere between 40% and 90% of return variability among portfolios, there is still debate over the best way to incorporate economic factors into asset allocation approaches. 1 The economic sensitivity of high-yield bonds has caused them to behave more like equities than investment grade bonds.

Other business cycle approaches

Some approaches feature economic indicators as important drivers. One of the most widely used paradigms for economically linked asset allocation decisions is to specify the economy as being in one of two states, expansion or contraction. The National Bureau of Economic Research (NBER) is generally considered to be the of icial arbiter of U.S. recessions, and its methodology tends to be either wholly or partly borrowed by market participants. Because recessions have generally experienced signi icant differentiation among asset class performance relative to the rest of the cycle, the NBERs dating scheme has historically offered solid opportunities for active asset allocation.

Asset classes represented by: Investment-Grade Bonds Barclays U.S. Aggregate Bond Index for 19762010, 66% IA U.S. Intermediate-Term Government Bond Index and 34% IA U.S. Long-Term Corporate Bond Index for 19501975; High-Yield Bonds Bank of America/Merrill Lynch U.S. High Yield Master II Index for 19862010, Barclays U.S. High Yield Corporate Bond Index for 19501985. Source: Fidelity Investments as of Apr. 30, 2010.

However, many of these economic approaches have signi icant shortcomings. First, some may have a strong theoretical backing but lack the ability to be practically applied, often relying on data that are revised frequently or not released on a timely basis. For instance, the NBER announced the beginning of the most recent recession a full 12 months after the fact. Second, the binary approach is not granular enough to catch major shifts in asset price performance during the lengthy expansion phase, which reduces the potential for capturing active returns. Other asset allocation paradigms also include market-based asset price signals. These tend to shift phase identi ications more quickly than models based purely on the economy, likely due to the fast pace of asset market price movements. For example, one prominent strategy uses earnings yielda function of corporate pro its and stock pricesand recent stock market returns as primary inputs to an asset allocation model, which at times has shifted through all four phases in a one- or two-year period. While such strategies may capture more trading opportunities than the more economically based models, frequent portfolio composition changes often generate higher turnover and transaction costs. Those strategies based more on asset price movements also have a greater likelihood of being whipsawed by price volatility, and they can be susceptible to false signals based on temporary investor optimism or pessimism.

5 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

Some alternative asset allocation approaches center on forecasting gross domestic product (GDP) and inferring asset market performance from those forecasts, but historical analysis has shown a relatively low correlation between GDP growth rates and stock or bond market investment rates of return.

Our approach to business cycle investing

Our quantitatively backed, probabilistic approach encompasses a number of key attributes: First, the approach focuses on critical drivers of relative asset performance. As demonstrated above, there is a large differential in asset performance across the various phases of the business cycle. A key to identifying the phase of the cycle is to focus on the direction and rate of change of key indicators, rather than the overall level of activity. We focus on economic indicators that are most closely linked with asset market returns, such as corporate pro itability, the provisioning of credit throughout the economy, and inventory buildups or drawdowns across various industries. Second, we employ a practical and repeatable framework that provides a solid foundation and can be applied more consistently. Our business cycle dating scheme measures high quality indicators that have a greater probability of representing economic reality and are not dependent on perfect hindsight. For instance, tangible measures such as inventory data are less likely to be revised or present false signals compared to other, broader indicators such as GDP growth. We use a disciplined, model-driven approach that helps minimize the behavioral tendency to pay too much attention to recent price movements and momentum, called the extrapolation bias, which is a common pitfall suffered by many investors. Third, the cycle phases we employ are grounded in distinct, intermediate-term fundamental trends, typically only shifting over periods of several months or longer. This approach unfolds more slowly than tactical approaches, whose frequent shifts can whipsaw investors during periods of high volatility. Our approach is best-suited to strategies with an intermediate-term time horizon and a lower ability or willingness to trade into and out of positions quickly. On the other hand, this approach captures more frequent phases than the two-state NBER strategies, thus providing more scope for generating active returns.

Business cycle still relevant

The period since the 2008 inancial crisis has been marked by posthousing bubble deleveraging and a lackluster economic recovery, leading some investors to question the value of investment frameworks based on typical pre-crisis patterns. While the nature of this post-crisis era does have signi icant differences with other periods since World War II, the broad contours of the business cycle so far con irm that the business cycle approach is a relevant tool for todays environment. As the U.S. economy began to exit the recession in the irst half of 2009, it shifted into the early-cycle phase, and the strong returns of stocks and other economically sensitive asset categories were consistent with the historical early-cycle experience. Subsequently, the deceleration in economic growth in mid-2010 marked the shift into the mid-cycle phase, which accordingly coincided with more muted but continued outperformance of stocks, high-yield corporate bonds, and other economically sensitive assets. In mid-2011, the stock market underwent a sharp correction, as investors nerves were frayed by the combination of the sovereign debt crisis in the eurozone and the rancorous debt-ceiling debate in the U.S. Deteriorating sentiment and other indicators gave rise to fears of falling back into recession. Despite those headwinds, our analysis showed that the U.S. economy remained in the mid-cycle phase of the business cycle, with a relatively low risk of returning to recession. The levelheaded nature of our quantitative, model-driven framework proved to be correct: Economic conditions softened but held up well, and asset markets rallied into the end of the year. Since the transition of the business cycle to the mid-cycle phase in the spring of 2010, relative asset class performance has been consistent with past patterns: Stocks have posted average annual total returns of 13%, bonds have returned 6%, and cash has held steady around 0% from May 2010 to October 2012.2

The role of exogenous shocks

Like any other approach, our business cycle approach has limitations, and understanding these limitations is critical to using the framework appropriately as part of an investment strategy. Identifying the current phase of the business cycle determines the underlying trend of economic activity, but that trend can always be disrupted by an exogenous shock, such as natural disasters, geopolitical events, or major policy actions. A number of factors may make an economy more susceptible to such a shock, including a relatively slow pace of expansion or a heavy dependence on other economies or external drivers of growth. For example, Japans slow pace of growth since 1990 has made its economy more inclined to move quickly through the business cycle phases and more frequently into and out of recession. Meanwhile, Germanys dependence on exports makes its business cycle more susceptible to changes in the global business cycle. Today in the U.S., the relatively slow pace of expansion likely makes the economy more exposed to shocks that could disrupt the underlying cycle than it was during the stronger growth environments of the past few decades. In addition, a potential shock from the relatively weak global economy could negatively affect the U.S. cycle.

Investment implications

As a result, complementing the business cycle approach with additional strategies may further enhance the

6 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

ability to generate active returns from asset allocation over time. For instance, tactical shifts in portfolio positioning may be used to mitigate the risks or opportunities presented either by the threat of external shocks or by major market moves that may be unrelated to changes in the business cycle. Another possibility is to analyze the domestic business cycle combined with the business cycles of major trading partners or the entire world, in order to capture more of the exogenous risks facing an economy. Using additional complementary strategies may be particularly relevant during phases when the relative performance differential from the business cycle framework tends to be more muted. For example, performance differences have been less pronounced during the late-cycle phase among stocks, bonds, and cash, or the mid-cycle for equity sector relative performance. During these phases, it may make sense to take fewer active allocation tilts and more security selection bets. Every business cycle is different, and so are the relative performance patterns among asset categories. However, by using a disciplined business cycle approach, it is still possible to identify key phases in the economys natural ebb and low. These signals can provide the potential to generate active returns from asset allocation over an intermediate-term investment horizon.

Learn more

Find more coverage of the business cycle, and the business cycle approach to sector investing. Use Portfolio Review to see if your investment mix is in line with your long-term goals. Research stocks, equity funds, and ETFs.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments. Fidelity does not assume any duty to update any of the information. Past performance is no guarantee of future results. Keep in mind that investing involves risk. The value of your investment will luctuate over time and you may gain or lose money. Diversi ication does not ensure a pro it or guarantee against loss. Stock markets are volatile and can decline signi icantly in response to adverse issuer, political, regulatory, market, or economic developments. In general the bond market is volatile, and ixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry in lation, credit, and default risks for both issuers and counterparties. References to speci ic investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Investment decisions should be based on an individuals own goals, time horizon, and tolerance for risk. All indices are unmanaged. You cannot invest directly in an index. Portfolio Review is an educational tool. The Typical Business Cycle depicts the general pattern of economic cycles throughout history, though each cycle is different. In general, the typical business cycle demonstrates the following: During the typical early-cycle phase, the economy bottoms and picks up steam until it exits recession, then begins the recovery as activity accelerates. In lationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Economically sensitive asset classes such as stocks tend to experience their best performance during the cycle. During the typical mid-cycle phase, the economy exits recovery and enters into expansion, characterized by broader and more self-sustaining economic momentum but a more moderate pace of growth. In lationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some lattening. Economically sensitive asset classes tend to continue bene iting from a growing economy, but their relative advantage narrows. During the typical late-cycle phase, the economic expansion matures, in lationary pressures continue to rise, and the yield curve may eventually become lat or inverted. Eventually, the economy contracts and enters recession, with monetary policy shifting from tightening to easing. Less economically sensitive asset categories tend to hold up better, particularly right before and upon entering recession. Please note there is no uniformity of time among phases, nor is there always a chronological progression in this order. For example, business cycles have varied between two and 10 years in the U.S., and there have been examples when the economy has skipped a phase or retraced an earlier one. Endnotes 1 Ibbotson, Roger G., and Paul D. Kaplan. 2000. Does Asset Allocation Policy Explain 40, 90, or 100 Percent of Performance? Financial Analysts Journal, vol. 56, no. 1 (January/February): 2633.

2

Performance for stocks, bonds, and cash from May 2010 to Oct. 2012. Stocks Top 3,000 U.S. stocks ranked and weighted by market capitalization; Bonds Barclays U.S. Aggregate Bond Index; Cash Barclays U.S. Treasury Bills Index (13 Month). Source: Fidelity Investments (AART) as of Oct. 31, 2012. Index de initions Barclays U.S. Aggregate Bond Index is a broad-based, market valueweighted benchmark that measures the performance of the investment-grade, U.S. dollardenominated, ixed-rate taxable bond market. Sectors include Treasuries, government-related and corporate securities, MBS (agency ixed-rate and hybrid ARM pass-throughs), ABS, and CMBS. IA U.S. Intermediate-Term Government Bond Index is a custom index designed to measure the performance of intermediate-term U.S. government bonds. IA U.S. Long-Term Government Bond Index is a custom index designed to measure the performance of long-term U.S. corporate bonds. Barclays U.S. Treasury Bills Index (13 Month) includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of more than one month and less than three months, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be ixed-rate, nonconvertible, and denominated in U.S. dollars. Barclays U.S. High Yield Corporate Bond Index includes publicly issued U.S. dollardenominated, non-investment-grade, ixed-rate, taxable corporate bonds that have a remaining maturity of at least one year. Bank of America/Merrill Lynch U.S. High Yield Master II Index tracks the performance of U.S. dollardenominated, below-investmentgraderated corporate debt publicly issued in the U.S. domestic market that has a remaining maturity of at least one year. S&P 500 sectors are de ined by Global Industry Classi ication Standards (GICS) as follows: Consumer Discretionary Companies that tend to be the most sensitive to economic cycles. Consumer Staples Companies whose businesses are less sensitive to economic cycles.

7 of 8

24/8/2556 11:39

The business cycle approach to investing - Fidelity Investments

https://www.fidelity.com/viewpoints/investing-ideas/business-c...

Energy Companies whose businesses are dominated by either of the following activities: the construction or provision of oil rigs, drilling equipment, and other energy-related services and equipment, including seismic data collection; or the exploration, production, marketing, re ining, and/or transportation of oil and gas products, coal, and consumable fuels. Financials Companies involved in activities such as banking, consumer inance, investment banking and brokerage, asset management, insurance and investments, and real estate, including REITs. Health Care Companies in two main industry groups: health care equipment suppliers, manufacturers, and providers of health care services; and companies involved in research, development, production, and marketing of pharmaceuticals and biotechnology products. Industrials Companies whose businesses manufacture and distribute capital goods, provide commercial services and supplies, or provide transportation services. Information Technology Companies in technology software & services and technology hardware & equipment. Materials Companies that are engaged in a wide range of commodityrelated manufacturing. Telecommunication Services Companies that provide communications services primarily through ixed line, cellular, wireless, high bandwidth, and/or iber-optic cable networks. Utilities Companies considered electric, gas, or water utilities, or companies that operate as independent producers and/or distributors of power. Products and services are provided through Fidelity Personal & Workplace Investing (PWI) to investors and plan sponsors by Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smith ield, RI 02917. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smith ield, RI 02917 632421.6.0

Mutual Funds ETFs Fixed Income Bonds CDs

Stock Research Online Trading Annuities Life Insurance 529 Plans

IRAs Retirement Products Retirement Planning Small Business Retirement Plans

Stay Connected

Locate an Investor Center by ZIP Code

YouTube

Fidelity Mobile

Careers

News Media

Inside Fidelity

International

Copyright 1998-2013 FMR LLC. All Rights Reserved. Terms of Use Privacy Security Site Map This is for persons in the U.S. only.

8 of 8

24/8/2556 11:39

Vous aimerez peut-être aussi

- Third Point 2011 ADV Part 2a BrochureDocument23 pagesThird Point 2011 ADV Part 2a BrochureWho's in my FundPas encore d'évaluation

- Infrastructure Funds PrimerDocument4 pagesInfrastructure Funds PrimermayorladPas encore d'évaluation

- Pitchprogram 10 Minutepitch 131112165615 Phpapp01 PDFDocument16 pagesPitchprogram 10 Minutepitch 131112165615 Phpapp01 PDFpcmtpcmtPas encore d'évaluation

- CLO Investing: With an Emphasis on CLO Equity & BB NotesD'EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesPas encore d'évaluation

- Capital IQ Excel Plug-In GuideDocument21 pagesCapital IQ Excel Plug-In GuideAndi EjronPas encore d'évaluation

- Introduction To: Capital MarketsDocument57 pagesIntroduction To: Capital MarketsTharun SriramPas encore d'évaluation

- Kevin Buyn - Denali Investors Columbia Business School 2009Document36 pagesKevin Buyn - Denali Investors Columbia Business School 2009g4nz0Pas encore d'évaluation

- Global Corporate and Investment Banking An Agenda For ChangeDocument96 pagesGlobal Corporate and Investment Banking An Agenda For ChangeSherman WaltonPas encore d'évaluation

- Evaluation Chapter 11 LBO M&ADocument32 pagesEvaluation Chapter 11 LBO M&AShan KumarPas encore d'évaluation

- A Review of Valuation Tech - 13-1-09Document22 pagesA Review of Valuation Tech - 13-1-09weiycheePas encore d'évaluation

- 1634 - MLA M - A Quick Reference GuideDocument157 pages1634 - MLA M - A Quick Reference Guideshinil_b100% (1)

- JPM DellDocument26 pagesJPM DelljwkPas encore d'évaluation

- Managing MA RiskDocument14 pagesManaging MA RiskBartosz SobotaPas encore d'évaluation

- M&a Private FirmsDocument24 pagesM&a Private FirmsmarwanPas encore d'évaluation

- Lbo ReportDocument9 pagesLbo ReportNikhilesh MorePas encore d'évaluation

- Fidelity Model Worksheet Mar 2019Document25 pagesFidelity Model Worksheet Mar 2019Bobby ChristiantoPas encore d'évaluation

- Distressed Ma 2010Document194 pagesDistressed Ma 2010gbana999Pas encore d'évaluation

- Babson Capital Mezz Middle Market WPDocument8 pagesBabson Capital Mezz Middle Market WPrhapsody1447Pas encore d'évaluation

- Debt Service Coverage Ratio DSCR Net Income/ DebtDocument10 pagesDebt Service Coverage Ratio DSCR Net Income/ DebtAlvaroDeCampsPas encore d'évaluation

- Pershing Square European Investor Meeting PresentationDocument67 pagesPershing Square European Investor Meeting Presentationmarketfolly.com100% (1)

- Investment Banking Valuation - Equity Value - and Enterprise ValueDocument18 pagesInvestment Banking Valuation - Equity Value - and Enterprise ValuejyguygPas encore d'évaluation

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocument12 pagesBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonPas encore d'évaluation

- UBS Equity Compass May - EN (1) - 1Document41 pagesUBS Equity Compass May - EN (1) - 1Bondi BeachPas encore d'évaluation

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojPas encore d'évaluation

- BarCap Credit Research 110312Document32 pagesBarCap Credit Research 110312Henry WangPas encore d'évaluation

- Mezzanine CapitalDocument8 pagesMezzanine CapitalDhananjay SharmaPas encore d'évaluation

- SP-Distressed Company ValuationDocument18 pagesSP-Distressed Company ValuationfreahoooPas encore d'évaluation

- KKR - Consolidated Research ReportsDocument60 pagesKKR - Consolidated Research Reportscs.ankur7010Pas encore d'évaluation

- Leveraged Buyout (LBO)Document40 pagesLeveraged Buyout (LBO)Souhail TihaniPas encore d'évaluation

- WST Circular ReferenceDocument1 pageWST Circular Referencecool_stuffsalePas encore d'évaluation

- High Yield Covenants - Merrill Lynch - Oct 2005Document21 pagesHigh Yield Covenants - Merrill Lynch - Oct 2005fi5hyPas encore d'évaluation

- What To Do With Excess Cash - UBSDocument48 pagesWhat To Do With Excess Cash - UBSno namePas encore d'évaluation

- Private Equity Unchained: Strategy Insights for the Institutional InvestorD'EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorPas encore d'évaluation

- 33.jefferies FootballFieldDocument10 pages33.jefferies FootballFieldAlexandreLega100% (1)

- Convertible Bonds CourseDocument34 pagesConvertible Bonds CourseAsmae KhamlichiPas encore d'évaluation

- ING Trups DiagramDocument5 pagesING Trups DiagramhungrymonsterPas encore d'évaluation

- IBD Technical Interview Prep - 10nov15Document1 pageIBD Technical Interview Prep - 10nov15PogotoshPas encore d'évaluation

- Tts Core 2015Document6 pagesTts Core 2015Gianluca TurrisiPas encore d'évaluation

- The Real Estate Development Process: Lot and Unit Assumptions - Bateman ApartmentsDocument7 pagesThe Real Estate Development Process: Lot and Unit Assumptions - Bateman Apartmentsw_fibPas encore d'évaluation

- A Piece of The Action - Employee Stock Options in The New EconomyDocument45 pagesA Piece of The Action - Employee Stock Options in The New Economypjs15Pas encore d'évaluation

- Asset Schedule Corality ModelOff Worked Solution Asset ScheduleDocument23 pagesAsset Schedule Corality ModelOff Worked Solution Asset ScheduleFelicia Shan SugataPas encore d'évaluation

- Eusprig 2015 CoralityDocument20 pagesEusprig 2015 CoralityserpepePas encore d'évaluation

- Semi-Annual Debt in A Quarterly ModelDocument2 pagesSemi-Annual Debt in A Quarterly ModelSyed Muhammad Ali SadiqPas encore d'évaluation

- Equities Crossing Barriers 09jun10Document42 pagesEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- ABCs of ABCP, 2009Document42 pagesABCs of ABCP, 2009ed_nycPas encore d'évaluation

- Chapter 11 Leveraged Buyout Structures and ValuationDocument27 pagesChapter 11 Leveraged Buyout Structures and ValuationanubhavhinduPas encore d'évaluation

- Industry Handbook - The Banking IndustryDocument9 pagesIndustry Handbook - The Banking IndustryTMc1908Pas encore d'évaluation

- Aerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationDocument21 pagesAerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationAlex HongPas encore d'évaluation

- Investment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFDocument24 pagesInvestment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFQuantDev-MPas encore d'évaluation

- Asset ManagementDocument12 pagesAsset ManagementSantosh JhawarPas encore d'évaluation

- Value Measurement PresentationDocument18 pagesValue Measurement Presentationrishit_93Pas encore d'évaluation

- Goldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldDocument109 pagesGoldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldPol BernardinoPas encore d'évaluation

- The Rise of The Leveraged LoanDocument7 pagesThe Rise of The Leveraged LoanTanit PaochindaPas encore d'évaluation

- Corporate Banking Summer Internship ProgramDocument2 pagesCorporate Banking Summer Internship ProgramPrince JainPas encore d'évaluation

- Deleveraging Investing Optimizing Capital StructurDocument42 pagesDeleveraging Investing Optimizing Capital StructurDanaero SethPas encore d'évaluation

- DB US Airlines PDFDocument65 pagesDB US Airlines PDFGeorge ShevtsovPas encore d'évaluation

- JP摩根公司的公司估值培训资料 (英文) PDFDocument33 pagesJP摩根公司的公司估值培训资料 (英文) PDFbondbondPas encore d'évaluation

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisD'EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisPas encore d'évaluation

- Dangers of DCF MortierDocument12 pagesDangers of DCF MortierKitti WongtuntakornPas encore d'évaluation

- De Dollarization in Two PageDocument1 pageDe Dollarization in Two PageKitti WongtuntakornPas encore d'évaluation

- Global Debt Leverage - Is A Great Reset Coming - S&P GlobalDocument12 pagesGlobal Debt Leverage - Is A Great Reset Coming - S&P GlobalKitti WongtuntakornPas encore d'évaluation

- NICABM DavidGrand BrainspottingDocument27 pagesNICABM DavidGrand BrainspottingKitti Wongtuntakorn100% (1)

- Complex NumbersDocument26 pagesComplex NumbersJom AgullanaPas encore d'évaluation

- Principle of MathematicsDocument20 pagesPrinciple of MathematicsKitti WongtuntakornPas encore d'évaluation

- DialogueDocument1 pageDialogueKitti WongtuntakornPas encore d'évaluation

- สันติวรบท, ท่านธัมมวิตกโก ภิกขุ หรือท่านเจ้าคุณนรรัตน์ราชมานิตย์Document37 pagesสันติวรบท, ท่านธัมมวิตกโก ภิกขุ หรือท่านเจ้าคุณนรรัตน์ราชมานิตย์WISDOM-INGOODFAITHPas encore d'évaluation

- Iitjee 2004 MathDocument7 pagesIitjee 2004 MathKitti WongtuntakornPas encore d'évaluation

- David E. - Ben CarsonDocument15 pagesDavid E. - Ben CarsonKitti WongtuntakornPas encore d'évaluation

- Exponential Logarithm ProblemDocument11 pagesExponential Logarithm ProblemKitti WongtuntakornPas encore d'évaluation

- All-Soviet Union Math CompetitionDocument76 pagesAll-Soviet Union Math Competitionbenemerito123Pas encore d'évaluation

- Positive ThinkingDocument40 pagesPositive ThinkingMarouen MaazounPas encore d'évaluation

- Anesthesia in Traumatic Patients PDFDocument11 pagesAnesthesia in Traumatic Patients PDFKitti WongtuntakornPas encore d'évaluation

- Insights Into Awareness - Book I - A Collection of ArticlesDocument84 pagesInsights Into Awareness - Book I - A Collection of Articlesbentinhom100% (1)

- Positive ThinkingDocument40 pagesPositive ThinkingMarouen MaazounPas encore d'évaluation

- Positive ThinkingDocument40 pagesPositive ThinkingMarouen MaazounPas encore d'évaluation

- A Little BookDocument75 pagesA Little Bookfati_cenPas encore d'évaluation

- Meditation and Voice DialogueDocument2 pagesMeditation and Voice DialogueKitti WongtuntakornPas encore d'évaluation

- Tamil Nadu Board Matriculation Exam Mathematics Paper I Sample Paper 1Document8 pagesTamil Nadu Board Matriculation Exam Mathematics Paper I Sample Paper 1Vinoth RockerPas encore d'évaluation

- Theorem of Ceva, Menelaus and Van AubelDocument10 pagesTheorem of Ceva, Menelaus and Van AubelKitti WongtuntakornPas encore d'évaluation

- Let Your Life SpeakDocument12 pagesLet Your Life Speakjosuevillatoro100% (5)

- A Study On Impact of Foregin Stock Markets On Indian Stock MarketDocument20 pagesA Study On Impact of Foregin Stock Markets On Indian Stock MarketRaj KumarPas encore d'évaluation

- Final Paper (Assignment of Globalization Problems) - TFR 1.1KDocument1 pageFinal Paper (Assignment of Globalization Problems) - TFR 1.1KJayboy SARTORIOPas encore d'évaluation

- Globalisation and The Emerging Trends of NationalismDocument23 pagesGlobalisation and The Emerging Trends of NationalismSwayam SambhabPas encore d'évaluation

- Problem 2Document2 pagesProblem 2Anonymous qiAIfBHnPas encore d'évaluation

- Financially Efficient Dig-Line Delineation Incorporating Equipment Constraints and Grade UncertaintyDocument23 pagesFinancially Efficient Dig-Line Delineation Incorporating Equipment Constraints and Grade UncertaintyhamidPas encore d'évaluation

- Types of Economic SystemsDocument14 pagesTypes of Economic Systemsshaheen47Pas encore d'évaluation

- Event Managment Project MbaDocument26 pagesEvent Managment Project Mbasuruchi100% (1)

- Case Study 18 PresentationDocument11 pagesCase Study 18 PresentationZara KhanPas encore d'évaluation

- Calling DataDocument54 pagesCalling DatainfoPas encore d'évaluation

- Thurstone Interest Test by Marie ReyDocument9 pagesThurstone Interest Test by Marie Reymarie annPas encore d'évaluation

- List of TSD Facilities July 31 2019Document15 pagesList of TSD Facilities July 31 2019Emrick SantiagoPas encore d'évaluation

- Notice 11120 02 Apr 2024Document669 pagesNotice 11120 02 Apr 2024bhattacharya.devangana2Pas encore d'évaluation

- UN-Habitat Country Programme Document - KenyaDocument32 pagesUN-Habitat Country Programme Document - KenyaUnited Nations Human Settlements Programme (UN-HABITAT)Pas encore d'évaluation

- Section 125 Digested CasesDocument6 pagesSection 125 Digested CasesRobPas encore d'évaluation

- A Final Board Packet August 7, 2013 - 0.... 5Document199 pagesA Final Board Packet August 7, 2013 - 0.... 5نيرمين احمدPas encore d'évaluation

- Actions Required For Building A Strong Startup Ecosystem in ManipurDocument3 pagesActions Required For Building A Strong Startup Ecosystem in ManipuryibungoPas encore d'évaluation

- Policy Brief - Food Insecurity in AfghanistanDocument3 pagesPolicy Brief - Food Insecurity in AfghanistanAPPROCenterPas encore d'évaluation

- Business Economics PPT Chap 1Document18 pagesBusiness Economics PPT Chap 1david sughapriyaPas encore d'évaluation

- Business Listing SitesDocument8 pagesBusiness Listing SitesMuhammad UmerPas encore d'évaluation

- Pune MetroDocument11 pagesPune MetroGanesh NichalPas encore d'évaluation

- WEG India Staff Contact Numbers PDFDocument10 pagesWEG India Staff Contact Numbers PDFM.DINESH KUMARPas encore d'évaluation

- Employee Stock Ownership PlansDocument3 pagesEmployee Stock Ownership PlansmanoramanPas encore d'évaluation

- Bata FactsDocument3 pagesBata FactsPrashant SantPas encore d'évaluation

- The Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinDocument33 pagesThe Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinRanyDAmandaPas encore d'évaluation

- Population GrowthDocument3 pagesPopulation GrowthJennybabe PetaPas encore d'évaluation

- PERRUCI Millennials and Globalization 2012 PDFDocument6 pagesPERRUCI Millennials and Globalization 2012 PDFgomiuxPas encore d'évaluation

- Iran Letter JCPOA Compliance 090617Document1 pageIran Letter JCPOA Compliance 090617The Iran ProjectPas encore d'évaluation

- Study Notes: Entrepreneurship DevelopmentDocument80 pagesStudy Notes: Entrepreneurship DevelopmentDevid S. StansfieldPas encore d'évaluation

- Fin 254 SNT Project Ratio AnalysisDocument29 pagesFin 254 SNT Project Ratio Analysissoul1971Pas encore d'évaluation

- Business StudiesDocument2 pagesBusiness StudiesSonal JhaPas encore d'évaluation