Académique Documents

Professionnel Documents

Culture Documents

COH Response To The Municipalities Act 10 13

Transféré par

patburchall6278Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

COH Response To The Municipalities Act 10 13

Transféré par

patburchall6278Droits d'auteur :

Formats disponibles

2 October 2013

To: All Members of Parliament

Reference: Response from City Hall Council to the Draft Municipalities Amendment Act 2013

The original town of Hamilton was incorporated by an Act of the Bermuda Legislature in 1793. For more than 200 years the Corporation of Hamilton has been directly responsible for providing excellent service to all people in Bermuda; whether Bermudian or visitors, city business or city resident - all have benefited from the essential services provided under this Municipality. Although it can surely be said that the history of the city is not a perfect one, if we look at the unprecedented success of Bermuda as a small island nation, it can hardly be doubted that we in Bermuda hold an enormous stature on the world stage, enjoying financial and economic rewards that can hardly be understood by many outsiders. The Corporation of Hamilton has played a leading and vital role in Bermuda`s continued economic success. To date the city is managed well on a balanced budget, which has been extremely challenging given the periodic economic and political changes particularly in the last few decades. The question needs to be asked, what possible motivation exists to move in this direction and in this manner? Globally the process of the devolving of National Government authority is occurring at an ever increasing rate, decentralising Government authority within various local government frameworks to allow for more independent actions to deal with local priorities. Given this backdrop it is difficult to envisage the motivation to create legislation that would effectively shut down the municipality as an independent local government entity. In fact the effect is to reduce the municipality to less authority to operate than WEDCO which is an appointed board controlled entity or the BHB which is a quango. On the one hand, the Municipalities Amendment Bill 2013 restores the authority of the Municipalities to charge wharfage and revives a number of Ordinances revoked by the Municipalities Reform Act 2010 relating to such charges. In addition, the Bill

has adopted some of the recommended changes put forward by the Municipalities in 2009. However, on the other hand, the Bill then goes on to remove the authority of the Municipality in relation to the disposition of land and Corporation powers. Disposition of Land Part 2 The Corporations of both Municipalities hold their land in freehold. This section completely removes all authority the municipality has over its own property. This may turn out to be a contentious constitutional argument at some point thus creating more angst and legal wrangling. It appears that the Amendment is toned as if the land in question is somehow public land when in truth the land belongs to a legal entity called the Corporation of Hamilton. Instead of oversight of areas or terms, which does occur in other jurisdictions particularly pertaining to a national interest, here is a wholesale removal of rights and a series of processes to effectively remove any authority in the disposition of the land and whole subject to whims of the government of the day. On the surface this might seem somewhat draconian but at least the government of the day is not authorised to initiate a sale or lease of the city property. This however is not true because later the Amendment Act states that if the Minister deems it in the public interest the Government can assume stewardship of the Corporations infrastructure, function and service. This would then create the situation whereby the Corporation property is then under the direct stewardship of the Minister with Cabinet approval. This should raise concerns on multiple levels particularly since the corporation is a legal and independent entity and if its property can be virtually acquired in this manner what is to stop other similar entities befalling the same fate. Another area of concern is the retroactive approach to contracts and leases. While initially it appears that compensation might be possible in the instances of a retroactive invalidation there is nothing in the Amendment Act that compensates for an unfinished plan/ dream / idea. The Acquisition of Land Act does not address compensation outside of the purchases of land. Ordinances Part 3 Clause 17 Ordinances are required by the Corporation to manage the affairs of the municipality. Without them the Corporation cannot adjust to changing conditions with the city in a timely manner. For over two hundred years the Municipal Ordinances have been used effectively and contributed to the success of the city. The Amendment Act introduces a review by the Minister and Attorney-General which does not cause a problem unless the review means it is on hold until approved. Then the Ordinance will be subject to either an affirmative resolution or negative resolution of the legislature depending on whether or not a fee or charge, tax or toll is being levied. The former affirmative resolution was revived from prior to the Reform

Act of 2010 but the negative resolution is new and the effect of the legislative route is that the Corporation will no longer be able to attend to the needs of the city in a timely manner. This removes all possibility of the city being able to address the city priorities and thus the control of the management of the city at this level moves to the Minister and the legislature. Further, voiding Ordinances that have been long established without a valid review and plan to transition will cause chaos and challenges particularly since the Government does not recognise them on the online version of Bermuda Laws so there is no knowledge of the scope and impact. This appears to be unwise and seems attributable to the impasse attempted by some members of the civil service in blocking a number of Ordinances from both Municipalities by trying to introduce an implied process rather than the process followed for decades by both of the Municipalities. Good Governance Clause 5 The Municipalities already have a code of conduct, financial policies / instructions and an asset management strategy/ plan. This section provides for a review of the documents and authorises the Minister to make changes as he deems fit. The issues of a Standards Committee should be addressed to provide accountability of the Members of the Council during their time in office. Oversight by the Government is generally a good thing to underpin the public confidence in the operations of the two Municipalities. However, there is a very significant difference between oversight to underpin confidence and direct ministerial control. The concern is raised with (6) of this clause whereby the Minister can assume stewardship of a Corporations infrastructure, function or service if he believes it is in the public interest. The clause states as a result of force majeure, maladministration, disrepair or lack of funding this can be the result. However, this appears to be at the discretion or opinion of the Minister who, supported by Cabinet, can remove the stewardship of the Corporation. There are no standards at which this will be tested nor any restrictions on how much or how long the assumed control would remain. This would appear to be based on the theory that either the Corporation is not a legal entity that owns property or if deemed in the national interest the Minister can assume the ownership of the Corporations property which is concerning from a constitutional and corporate perspective. If the Government can take the Corporation of Hamiltons property what is to say they wont repeat for another corporate entity if deemed to be appropriate. This is particularly troublesome when combined with the inability of the Municipality to address revenue and provide management control because all authority has been put in the hands of the Minister. Further (7) seems to be completely redundant to (8) or vice versa. Forcing the Municipalities to follow Governments Financial Instructions is an unnecessary

burden and expense. This is ironic as numerous reports from Government demonstrate that no department appears to follow these instructions to the letter hence nothing is done. Applying the instructions to the municipalities is an unnecessary operational burden as the Corporation staff and functions are not so complex that a much simpler form of financial policies or instructions should apply. The Corporation of Hamilton has such financial policies so if the Minister would drop (7) and follow (8) a review of the current policies that if needed could be supplemented with additions or changes as he deems appropriate, would be a more effective way forward. This Amendment follows the archaic view that local government should operate as an agent of the principal. This view is changing globally and the devolving of government authority to local government and authorisation to be fully empowered (within a legal framework) to meet the needs at the local level in a timely and effective manner is the more modern view. The empowered Municipality can apply solutions which best fit the priority and requirements of the city in a more timely and effective manner. To do this the Municipality must have full control over all resources required for the proper discharge of their mandate. The system of participatory local governance should be properly addressed in an appropriate legal framework. This amendment removes the authority of the Municipality to meet its mandate by direct control of the Minister and by overburdening the financial and operational processes to effectively strangle the Municipality to be completely ineffective. This would seem to be at odds to the changes to expand the number of voters in municipal elections. The inclusion of the ratepayer vote, which in itself can be contentious and backward-looking for some, is met with a complete removal of authority to manage the affairs of the city in a timely and effective manner. Who would put themselves forward to serve where every decision is second guessed and controlled by another? This places the Municipality in the unenviable position of being burdened and controlled as if they were a government department but with no benefits of same. In addition to these overall observations from a more functional perspective, I have attached some further comments from a more legal perspective for you to consider. It is this Councils hope that our comments and concerns are taken into consideration and we welcome further discussion to improve some of the more workable aspects of the proposed bill and encourage further meaningful consultation between Government and the Corporation. Yours sincerely,

Rt. Wor. Graeme P. Outerbridge, JP Mayor of Hamilton

Vous aimerez peut-être aussi

- Revocable Versus Irrevocable TrustsDocument7 pagesRevocable Versus Irrevocable TrustsTony Evans100% (1)

- Supreme Court Declares Pork Barrel System UnconstitutionalDocument9 pagesSupreme Court Declares Pork Barrel System UnconstitutionalLudica OjaPas encore d'évaluation

- 2019 Assessor PDFDocument15 pages2019 Assessor PDFJohn Karlo P. FernandezPas encore d'évaluation

- New Frontier Discharge Reversionary Interest PDFDocument8 pagesNew Frontier Discharge Reversionary Interest PDFApril ClayPas encore d'évaluation

- Everything You Need to Know About EasementsDocument20 pagesEverything You Need to Know About EasementsPrekshaSingh0% (1)

- CASE DIGEST - Belgica v. Executive Secretary (G.R. Nos. 208566, 208493 and 209251, 2013) - Emir MendozaDocument5 pagesCASE DIGEST - Belgica v. Executive Secretary (G.R. Nos. 208566, 208493 and 209251, 2013) - Emir MendozaPatronus GoldenPas encore d'évaluation

- Philex Mining Corporation V CIR GR No 125704Document9 pagesPhilex Mining Corporation V CIR GR No 125704Jacel Anne DomingoPas encore d'évaluation

- Property Dealers Phone NumbersDocument29 pagesProperty Dealers Phone Numberszaim tech100% (2)

- Reflection 2 - Campos, Grace R.Document3 pagesReflection 2 - Campos, Grace R.Grace Revilla CamposPas encore d'évaluation

- Tax Set 1 Case 1 2Document5 pagesTax Set 1 Case 1 2Patatas SayotePas encore d'évaluation

- Ra 7899Document4 pagesRa 7899Hayvenae StamariaPas encore d'évaluation

- Supreme Court Declares PDAF UnconstitutionalDocument4 pagesSupreme Court Declares PDAF UnconstitutionalBGodPas encore d'évaluation

- Mactan Cebu Airport Authority Tax Exemption CaseDocument31 pagesMactan Cebu Airport Authority Tax Exemption CaseLAW10101Pas encore d'évaluation

- Contract to Sell Land BulacanDocument2 pagesContract to Sell Land BulacanAnn Camille JoaquinPas encore d'évaluation

- Mactan Cebu Airport Authority Tax Exemption RepealDocument34 pagesMactan Cebu Airport Authority Tax Exemption RepealFait Hee100% (1)

- Constitutional Limitations of TaxationDocument2 pagesConstitutional Limitations of TaxationZoilo Renzo AmadorPas encore d'évaluation

- Abakada Guro Vs Ermita (Sep and Oct) DigestDocument4 pagesAbakada Guro Vs Ermita (Sep and Oct) DigestLizzie GeraldinoPas encore d'évaluation

- ABAKADA Guro Party List Vs Executive Secretary ErmitaDocument3 pagesABAKADA Guro Party List Vs Executive Secretary ErmitaAnonymous iUs2y1vNPas encore d'évaluation

- Tax Q&aDocument18 pagesTax Q&aPat EspinozaPas encore d'évaluation

- ABAKADA Guro Party List vs. Executive Secretary Ermita: Constitutionality of Sections 4, 5, and 6 of RA 9337Document3 pagesABAKADA Guro Party List vs. Executive Secretary Ermita: Constitutionality of Sections 4, 5, and 6 of RA 9337Samantha ReyesPas encore d'évaluation

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Case DigestDocument10 pagesCase DigestEqui TinPas encore d'évaluation

- Privatization in The PhilippinesDocument6 pagesPrivatization in The PhilippinesbeatezaPas encore d'évaluation

- A Democratic Political System Is An Essential Condition For Sustained Economic ProgressDocument2 pagesA Democratic Political System Is An Essential Condition For Sustained Economic ProgressAsim QureshiPas encore d'évaluation

- 8 - Jakosalem Vs Rafols (D)Document2 pages8 - Jakosalem Vs Rafols (D)Angelic ArcherPas encore d'évaluation

- South City Homes Fails to Prove Ownership by PrescriptionDocument1 pageSouth City Homes Fails to Prove Ownership by PrescriptionMikhel Beltran100% (1)

- Cases For PrelimDocument49 pagesCases For PrelimDILG XIII- Atty. Robelen CallantaPas encore d'évaluation

- UntitledDocument3 pagesUntitledapi-110464801Pas encore d'évaluation

- Taxation Cases RulingDocument8 pagesTaxation Cases RulingnorzePas encore d'évaluation

- Meeting 2 DigestDocument5 pagesMeeting 2 Digestdianne rosalesPas encore d'évaluation

- IntroductionDocument4 pagesIntroductionPranshu SinghPas encore d'évaluation

- Jay West WPDocument14 pagesJay West WPtekeba lakePas encore d'évaluation

- An 011101005Document1 pageAn 011101005vivianclementPas encore d'évaluation

- Bloomington, Ind. Memo 11.23.22 - Options For Convention Center ExpansionDocument11 pagesBloomington, Ind. Memo 11.23.22 - Options For Convention Center ExpansionHolden AbshierPas encore d'évaluation

- History Question On Kenya GovernmentDocument17 pagesHistory Question On Kenya GovernmentgithinjipeterPas encore d'évaluation

- Answer For Final Assessment Pad320 - Muhammad Athif Wajdi Bin Mohd Rizal - N4am1105kDocument7 pagesAnswer For Final Assessment Pad320 - Muhammad Athif Wajdi Bin Mohd Rizal - N4am1105kMUHAMMAD ATHIF WAJDI MOHD RIZALPas encore d'évaluation

- Ias 2010Document3 pagesIas 2010Harish ReddyPas encore d'évaluation

- Tax DigestsDocument13 pagesTax DigestsMosarah AltPas encore d'évaluation

- Tax Case Digest Sept 9Document31 pagesTax Case Digest Sept 9ARCHIE AJIASPas encore d'évaluation

- Implementing The Thirteenth Amendment The First Step of A Long JourneyDocument10 pagesImplementing The Thirteenth Amendment The First Step of A Long JourneyThavam RatnaPas encore d'évaluation

- Comparison About Local GovernmentDocument2 pagesComparison About Local GovernmentABD.ROOFI MUTAALI BILLAH ABD.AZZIMPas encore d'évaluation

- COA RULING UPHELDDocument16 pagesCOA RULING UPHELDMarie PadillaPas encore d'évaluation

- UIPA Response To SLC Letter On PIDDocument6 pagesUIPA Response To SLC Letter On PIDThe Salt Lake TribunePas encore d'évaluation

- 4358159Document3 pages4358159KamalDeep SidhuPas encore d'évaluation

- Taxes vs Fees and Special AssessmentsDocument9 pagesTaxes vs Fees and Special AssessmentsKenneth Abarca SisonPas encore d'évaluation

- On Petitioner's Imposition of Franchise Tax As A Violation of The Non-Impairment Clause of The ConstitutionDocument7 pagesOn Petitioner's Imposition of Franchise Tax As A Violation of The Non-Impairment Clause of The ConstitutionRYWELLE BRAVOPas encore d'évaluation

- Local Public EnterpriseDocument23 pagesLocal Public EnterpriseAngelica De Castro ObianoPas encore d'évaluation

- MMB Legislative Meeting 7-28-20Document6 pagesMMB Legislative Meeting 7-28-20Martin AustermuhlePas encore d'évaluation

- Supreme Court Rules VAT Applies to Tollway FeesDocument10 pagesSupreme Court Rules VAT Applies to Tollway Feessherwin pulidoPas encore d'évaluation

- Issues-And-Problems 12.28.52 PMDocument3 pagesIssues-And-Problems 12.28.52 PMShera LopezPas encore d'évaluation

- Part 2Document66 pagesPart 2CampSolPas encore d'évaluation

- Municipal Finance Act impactDocument9 pagesMunicipal Finance Act impactwycliff brancPas encore d'évaluation

- Executive Summary - Final 05-31-2011Document8 pagesExecutive Summary - Final 05-31-2011Montreal GazettePas encore d'évaluation

- Quiz No. 3Document3 pagesQuiz No. 3JOY ELPIDESPas encore d'évaluation

- A Plain English Guide To The Localism Bill: UpdateDocument24 pagesA Plain English Guide To The Localism Bill: UpdateEarlswood LakesPas encore d'évaluation

- CIR vs. British Overseas Airways Corporation (BOAC)Document7 pagesCIR vs. British Overseas Airways Corporation (BOAC)Kent Alvin GuzmanPas encore d'évaluation

- Political Law Cases - Part4Document50 pagesPolitical Law Cases - Part4kenshinrkPas encore d'évaluation

- National Power Corporation v. City of CabanatuanDocument21 pagesNational Power Corporation v. City of CabanatuanXyril Ü LlanesPas encore d'évaluation

- Taxes Are The Enforced Proportional Contribution From Persons and Property Levied byDocument3 pagesTaxes Are The Enforced Proportional Contribution From Persons and Property Levied byKenneth Abarca SisonPas encore d'évaluation

- PRIVILEGE SPEECH ON AMENDING THE PPP LAWDocument2 pagesPRIVILEGE SPEECH ON AMENDING THE PPP LAWKaren Cate Ilagan Pinto100% (1)

- Public EnterpriseDocument3 pagesPublic Enterprisevincent manuelPas encore d'évaluation

- Issue 2 Respondent BR Sawhny 2Document5 pagesIssue 2 Respondent BR Sawhny 2Avinash DangwalPas encore d'évaluation

- Raw Consti Module 8Document19 pagesRaw Consti Module 8Ryan Derrick GacayanPas encore d'évaluation

- Modern Law Review - October 1947 - Friedmann - The New Public Corporations and The LawDocument19 pagesModern Law Review - October 1947 - Friedmann - The New Public Corporations and The LawSupriya GavaliPas encore d'évaluation

- Rivlin Testimony9212011Document5 pagesRivlin Testimony9212011Committee For a Responsible Federal BudgetPas encore d'évaluation

- CDF Status ReportDocument10 pagesCDF Status ReportJustus K GatheruPas encore d'évaluation

- Insolvency Law Body - NotesDocument179 pagesInsolvency Law Body - NotesGumisiriza BrintonPas encore d'évaluation

- Basco Vs PagcorDocument5 pagesBasco Vs PagcorChrisel Joy Casuga SorianoPas encore d'évaluation

- 2015 XL Catlin BNAA Championships Schedule of EventsDocument6 pages2015 XL Catlin BNAA Championships Schedule of Eventspatburchall6278Pas encore d'évaluation

- 2015 Award ProgramDocument2 pages2015 Award Programpatburchall6278Pas encore d'évaluation

- Telford Mile ResultsDocument15 pagesTelford Mile Resultspatburchall6278Pas encore d'évaluation

- Madison Digicel Road Race Aug 15 ResultsDocument2 pagesMadison Digicel Road Race Aug 15 Resultspatburchall6278Pas encore d'évaluation

- BASA Swimming Results Jan 3 2015Document3 pagesBASA Swimming Results Jan 3 2015patburchall6278Pas encore d'évaluation

- 1St Innings: Runs Mins Balls 4's 6's FOW Batsman How Out BowlerDocument2 pages1St Innings: Runs Mins Balls 4's 6's FOW Batsman How Out Bowlerpatburchall6278Pas encore d'évaluation

- Bermuda Four Ball - Final ResultsDocument2 pagesBermuda Four Ball - Final Resultspatburchall6278Pas encore d'évaluation

- 2015 Cruise Ship ScheduleDocument8 pages2015 Cruise Ship Schedulepatburchall6278Pas encore d'évaluation

- Eventcontent Hippoonline deDocument1 pageEventcontent Hippoonline depatburchall6278Pas encore d'évaluation

- Flying Colours Series Race 6 ResultsDocument1 pageFlying Colours Series Race 6 Resultspatburchall6278Pas encore d'évaluation

- TPC Judgment OrderDocument1 pageTPC Judgment Orderpatburchall6278Pas encore d'évaluation

- Madison Digicel Criterium October 5th, 2014Document2 pagesMadison Digicel Criterium October 5th, 2014patburchall6278Pas encore d'évaluation

- CURB Position Paper - Bermuda Immigration FINALDocument35 pagesCURB Position Paper - Bermuda Immigration FINALpatburchall6278Pas encore d'évaluation

- Aon Triathlon ResultsDocument6 pagesAon Triathlon Resultspatburchall6278Pas encore d'évaluation

- (313332591) Commonwealth Games 2014Document1 page(313332591) Commonwealth Games 2014patburchall6278Pas encore d'évaluation

- Ninth Annual Report 2013Document36 pagesNinth Annual Report 2013patburchall6278Pas encore d'évaluation

- Peoples Campaign LettersDocument4 pagesPeoples Campaign Letterspatburchall6278Pas encore d'évaluation

- Public Bodies Reform Act 2014Document25 pagesPublic Bodies Reform Act 2014patburchall6278Pas encore d'évaluation

- May 2014 Public Evaluations v1.1Document4 pagesMay 2014 Public Evaluations v1.1patburchall6278Pas encore d'évaluation

- PRC FactsDocument2 pagesPRC Factspatburchall6278Pas encore d'évaluation

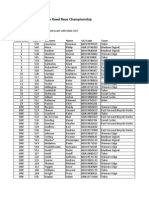

- 2014 RMS Construction Road Race Championships ResultspdfDocument2 pages2014 RMS Construction Road Race Championships Resultspdfpatburchall6278Pas encore d'évaluation

- Bermuda Immigration and Protection Amendment Act 2014 - Opposition BillDocument2 pagesBermuda Immigration and Protection Amendment Act 2014 - Opposition Billpatburchall6278Pas encore d'évaluation

- Consumer Price Index - Apr 2014Document4 pagesConsumer Price Index - Apr 2014patburchall6278Pas encore d'évaluation

- BoBF Foundation Time Trial Championships 2014 (Category) All CompetitorsDocument3 pagesBoBF Foundation Time Trial Championships 2014 (Category) All Competitorspatburchall6278Pas encore d'évaluation

- Bike 140615Document3 pagesBike 140615patburchall6278Pas encore d'évaluation

- PAC - Misuse of Public Funds PAC REPORT - FINAL Dd. 6 JUNE 2014 (+ Written Submissions)Document12 pagesPAC - Misuse of Public Funds PAC REPORT - FINAL Dd. 6 JUNE 2014 (+ Written Submissions)patburchall6278Pas encore d'évaluation

- 2014 FIFA World Cup Authorised Broadcaster Letter - BBC - BermudaDocument2 pages2014 FIFA World Cup Authorised Broadcaster Letter - BBC - Bermudapatburchall6278Pas encore d'évaluation

- 5385 Lmi 2014 FinalDocument8 pages5385 Lmi 2014 Finalpatburchall6278Pas encore d'évaluation

- Final Race Results For BernewsDocument4 pagesFinal Race Results For Bernewspatburchall6278Pas encore d'évaluation

- Final Draft UKOTBS Update 2Document28 pagesFinal Draft UKOTBS Update 2patburchall6278Pas encore d'évaluation

- Agrarian Reform Policy Under President Corazon AquinoDocument3 pagesAgrarian Reform Policy Under President Corazon AquinoTrisha Grace ManangoPas encore d'évaluation

- in Re Mario Chanliongco, 79 SCRA 364 (1977)Document9 pagesin Re Mario Chanliongco, 79 SCRA 364 (1977)KristineSherikaChyPas encore d'évaluation

- Contract Lux Agency 1.1Document1 pageContract Lux Agency 1.1sharif sayyid al mahdalyPas encore d'évaluation

- SESSION 6.3 - Authority Levers For Implementing The CLUPDocument12 pagesSESSION 6.3 - Authority Levers For Implementing The CLUPrain06021992Pas encore d'évaluation

- Mortgage and ChargeDocument5 pagesMortgage and Chargeriddhi tulshianPas encore d'évaluation

- Yinlu Bicol Mining Patents UpheldDocument4 pagesYinlu Bicol Mining Patents UpheldErwin SabornidoPas encore d'évaluation

- State Law Journal: Ownership of Interests in Oil and GasDocument17 pagesState Law Journal: Ownership of Interests in Oil and GasAbhay MalikPas encore d'évaluation

- 3 SogaDocument94 pages3 SogaBARSHAPas encore d'évaluation

- Recio VS ArguedaDocument1 pageRecio VS ArguedaPaula TorobaPas encore d'évaluation

- John Keane Civil Society and The StateDocument63 pagesJohn Keane Civil Society and The StateLee ThachPas encore d'évaluation

- Rent agreement titleDocument3 pagesRent agreement titleHemant ChaudharyPas encore d'évaluation

- Lladoc v. CIRDocument6 pagesLladoc v. CIRKyrzen NovillaPas encore d'évaluation

- Fintech in Nigeria - Procedure For Establishing A Fintech Company in Nigeria - SSRNDocument5 pagesFintech in Nigeria - Procedure For Establishing A Fintech Company in Nigeria - SSRNKofi Antwi AporiPas encore d'évaluation

- Mabeza vs. NLRCDocument20 pagesMabeza vs. NLRCRustom IbañezPas encore d'évaluation

- The Indian Easement Act 1882Document36 pagesThe Indian Easement Act 1882Ajit ChauhanPas encore d'évaluation

- Memorandum of AssociationDocument8 pagesMemorandum of AssociationRitwik SahayPas encore d'évaluation

- Agriculture and Its External LinkagesDocument515 pagesAgriculture and Its External LinkagesNguyễn Tấn LậpPas encore d'évaluation

- Legitime Legitimate Children and Descendants Legitimate Parents and AscendantsDocument4 pagesLegitime Legitimate Children and Descendants Legitimate Parents and AscendantsVel JunePas encore d'évaluation

- Florencio B. Nedira, Substituted by His Wife Emma G. Nedira, Petitioner, vs. NJ World Corporation, Represented by Michelle Y. Bualat, Respondent.Document16 pagesFlorencio B. Nedira, Substituted by His Wife Emma G. Nedira, Petitioner, vs. NJ World Corporation, Represented by Michelle Y. Bualat, Respondent.Anonymous DDyjiQEEPas encore d'évaluation

- Estate Dispute Over American's WillDocument15 pagesEstate Dispute Over American's WillKPPPas encore d'évaluation