Académique Documents

Professionnel Documents

Culture Documents

Capital Market Line and The Efficient Frontier

Transféré par

Pushpa BaruaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Market Line and The Efficient Frontier

Transféré par

Pushpa BaruaDroits d'auteur :

Formats disponibles

Capital market theory ASSUMPTIONS OF CAPM MODEL

The CAP-model is a ceteris paribus model. It is only valid within a special set of assumptions. They are: Investors are risk averse individuals who maximize the expected utility of their end of period wealth. Implication: The model is a one period model. Investors have homogenous expectations (beliefs) about asset returns. Implication: all investors perceive identical opportunity sets. This is, everyone have the same information at the same time. Asset returns are distributed by the normal distribution. There exists a risk free asset and investors may borrow or lend unlimited amounts of this asset at a constant rate: the risk free rate (k f). There is a definite number of assets and their quantities are fixed within the one period world. All assets are perfectly divisible and priced in a perfectly competitive marked. Implication: e.g. human capital is non-existing (it is not divisible and it cant be owned as an asset). Asset markets are frictionless and information is costless and simultaneously available to all investors. Implication: the borrowing rate equals the lending rate. There are no market imperfections such as taxes, regulations, or restrictions on short selling.

Capital Market Line and the Efficient Frontier

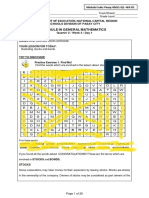

the efficient frontier is trying to do is determine the best possible combination of assets in a portfolio that maximises the expected level of returns for a given level of risk (as defined by volatility / standard deviation). In effect the efficient frontier gives a very formal relationship between risk and returns. Any portfolio that is below the efficient frontier line is deemed to be suboptimal this is quite intuitive as any point below will offer the same return for greater risk or same risk and less return. This leads to 2 formal definitions: 1) Maximise expected return for a given level of volatility

2) Minimise volatility for a given level of returns The set of optimal portfolios that we get from all the possible combinations of portfolios in the riskreturn is known as the efficient frontier. You can see a very clear illustration below where the lighter pinkish area is the set of all possible portfolios and the dark red line is the actual efficient frontier.

Efficient Frontier

Investors can make a choice of how they allocate funds between the risk free asset and the risky portfolio. This can range from all assets in the risk free asset to all (or more than all with leverage) in the risky portfolio. When we plot this in a graphical fashion we get a linear line with mean on the Y axis and the volatility on the x axis. Note that the line is linear as the risk free asset has no volatility. The important point to take away here is that each risky portfolio will have its own capital allocation line. The capital allocation line that lies at a tangent to the efficient frontier and is the highest possible line is known as the Capital Market line (because it is the market portfolio). Given the mean-variance criterion all investors will hold their portfolio in the same weights as the market portfolio (and hence lie on the capital market line). The CML is derived by drawing a tangent line from the intercept point on the efficient frontier to the point where the expected return equals the risk-free rate of return. The CML is considered to be superior to the efficient frontier since it takes into account the inclusion of a risk-free asset in the portfolio. The capital asset pricing model (CAPM) demonstrates that the market portfolio is essentially the efficient frontier. This is achieved visually through the security market line (SML).

Limitations of Capital Asset Pricing Model in Capital Markets

The Capital Asset Pricing Model (CAPM) states that it uses various assumptions about markets and investment behavior to predict the rate of return of an asset for a systematic risk. However, there are many flaws with the valuation model. Different investors require different required rate of return,there are no transaction costs or no taxes, holding period varies from one investor to another and borrowing rate is not equal as lending rate and many others. CAPM fails to act as an efficient valuation model in reality because the model works on a generalized principle rather than breaking it apart for different kind of investments.

The beta coefficient used in CAPM is basically a variance of an assets price to the market. Investors usually use beta for stocks to generate the required rate of return. The time value does matter when evaluating the required rate of return. The short-term and long-term rate would be affected so does the borrowing and lending cost. CAPM should consider the short-term rates as a risk-free rates rather than using long-term rates because the outlook for the country is negative and perhaps they may get downgraded again. Capital Asset Pricing Model- CAPM valuation model is not a suitable model to use in stock exchange or for any other investments for many reasons.

It is based on a number of unrealistic assumptions. It is difficult to test the validity. Betas do not remain stable over time. (Beta is a measure of a securitys risk).

Implifications of cml for investors

. Capital asset pricing model (CAPM) based on a number of assumptions. Given those assumptions, it provides a logical basis for measuring risk and linking risk and return Capital asset pricing model (CAPM) has the following implications,

Investors will always combine a risk free asset with a market portfolio of risky assets. They will invest in risky assets in proportion to their market value. Investors will be compensated only for that risk which they cannot diversify. This is the market related systematic risk. Beta which is a ratio of the covariance between the asset returns and the market returns divided by the market variance is the most appropriate measure of an assets risk. Investors can expect returns from their investment according to the risk. This implies a liner relationship between the assets expected return and its beta.

The concepts of risk and return as developed under capital asset pricing model (CAPM) have intuitive appeal and they are quite simple to understand. Financial managers use these concepts in a number of financial decisions making such as valuation of securities, cost of capital measurement, investment risk analysis excreta. However in spite of its intuitive appeal and simplicity capital asset pricing model (CAPM) suffers from a number of practical problems.

Assumptions of CAPM

There are many investors. They behave competitively (price takers). All investors are looking ahead over the same (one period) planning horizon. All investors have equal access to all securities. No taxes. No commissions. Each investor cares only about ErC and C. All investors have the same beliefs about the investment opportunities: rf , Er1,. . .,Ern, all i, and all correlations (homogeneous beliefs) for the n risky assets. Investors can borrow and lend at the one riskfree rate. Investors can short any asset, and hold any fraction of an asset

Aim to maximize economic utilities. Are rational and risk-averse. Are broadly diversified across a range of investments. Trade without transaction or taxation costs. Deal with securities that are all highly divisible into small parcels. Assume all information is available at the same time to all investors.

What is Portfolio Revision ? The art of changing the mix of securities in a portfolio is called as portfolio revision. The process of addition of more assets in an existing portfolio or changing the ratio of funds invested is called as portfolio revision. The sale and purchase of assets in an existing portfolio over a certain period of time to maximize returns and minimize risk is called as Portfolio revision. Need for Portfolio Revision An individual at certain point of time might feel the need to invest more. The need for portfolio revision arises when an individual has some additional money to invest. Change in investment goal also gives rise to revision in portfolio. Depending on the cash flow, an individual can modify his financial goal, eventually giving rise to changes in the portfolio i.e. portfolio revision. Financial market is subject to risks and uncertainty. An individual might sell off some of his assets owing to fluctuations in the financial market. Portfolio Revision Strategies There are two types of Portfolio Revision Strategies. 1. Active Revision Strategy Active Revision Strategy involves frequent changes in an existing portfolio over a certain period of time for maximum returns and minimum risks. Active Revision Strategy helps a portfolio manager to sell and purchase securities on a regular basis for portfolio revision. 2. Passive Revision Strategy Passive Revision Strategy involves rare changes in portfolio only under certain predetermined rules. These predefined rules are known as formula plans. According to passive revision strategy a portfolio manager can bring changes in the portfolio as per the formula plans only. What are Formula Plans ? Formula Plans are certain predefined rules and regulations deciding when and how much assets an individual can purchase or sell for portfolio revision. Securities can be purchased and sold only when there are changes or fluctuations in the financial market. Why Formula Plans ? Formula plans help an investor to make the best possible use of fluctuations in the financial market. One can purchase shares when the prices are less and sell off when market prices are higher.

With the help of Formula plans an investor can divide his funds into

aggressive and defensive portfolio and easily transfer funds from one portfolio to other. Aggressive Portfolio Aggressive Portfolio consists of funds that appreciate quickly and guarantee maximum returns to the investor. Defensive Portfolio Defensive portfolio consists of securities that do not fluctuate much and remain constant over a period of time. Formula plans facilitate an investor to transfer funds from aggressive to defensive portfolio and vice a versa.

Assumptions of Markowitz Theory The Modern Portfolio Theory of Markowitz is based on the following assump-tions: 1. Investors are rational and behave in a manner as to maximise their. utility with a given level of income or money. 2. Investors have free access to fair and correct information on the returns and risk. 3. The markets are efficient and absorb the information quickly and perfectly. 4. Investors are risk averse and try to minimise the risk and maximise return. 5. Investors base decisions on expected returns and variance or standard deviation of these returns from the mean. 6. Investors prefer higher returns to lower returns for a given level of risk. A portfolio of assets under

Vous aimerez peut-être aussi

- Behavioural FinanceDocument64 pagesBehavioural FinanceAnusha CPas encore d'évaluation

- Unit 5 Iapm CapmDocument11 pagesUnit 5 Iapm Capmshubham JaiswalPas encore d'évaluation

- Markowitz ModelDocument15 pagesMarkowitz ModelNayan kakiPas encore d'évaluation

- DocumentDocument24 pagesDocumentKavita PawarPas encore d'évaluation

- Investment and Portfolio Management 5Document51 pagesInvestment and Portfolio Management 5madihashkh100% (1)

- Topic: Explain CAPM With Assumptions. IntroductionDocument3 pagesTopic: Explain CAPM With Assumptions. Introductiondeepti sharmaPas encore d'évaluation

- Portfolio Management Principles and TechniquesDocument36 pagesPortfolio Management Principles and Techniquesrajujaipur1234Pas encore d'évaluation

- How Portfolio Management Can Help Investors Capitalize on Growth OpportunitiesDocument13 pagesHow Portfolio Management Can Help Investors Capitalize on Growth OpportunitiesKavita PawarPas encore d'évaluation

- Sapm ModelsDocument20 pagesSapm ModelsAvinash TripathiPas encore d'évaluation

- Chapter 9.3 (Final)Document5 pagesChapter 9.3 (Final)NGUYET LO MINHPas encore d'évaluation

- Chapter 3. Theory of Portfolio ChoiceDocument67 pagesChapter 3. Theory of Portfolio Choicenguyen tungPas encore d'évaluation

- Investment Analysis - Chapter 5Document28 pagesInvestment Analysis - Chapter 5Linh MaiPas encore d'évaluation

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing ModelLiezel AgloboPas encore d'évaluation

- Ch04 Capm and AptDocument167 pagesCh04 Capm and AptAmit PandeyPas encore d'évaluation

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabePas encore d'évaluation

- CAPM & APT: Risk-Return Models ExplainedDocument24 pagesCAPM & APT: Risk-Return Models ExplainedDevikaPas encore d'évaluation

- Reading 53: Portfolio Risk and Return: Part IIDocument37 pagesReading 53: Portfolio Risk and Return: Part IIAlex PaulPas encore d'évaluation

- ASSET ALLOCATION AND PERFORMANCE MEASUREMENTDocument42 pagesASSET ALLOCATION AND PERFORMANCE MEASUREMENTAdnan KamalPas encore d'évaluation

- Capital Market Theory and CAPMDocument10 pagesCapital Market Theory and CAPMIsma NizamPas encore d'évaluation

- Returns Are Either Ex-Post or Ex-Anti Returns From An Investment Avenue. Ex-Post ReturnsDocument5 pagesReturns Are Either Ex-Post or Ex-Anti Returns From An Investment Avenue. Ex-Post ReturnsIvraj HarlalkaPas encore d'évaluation

- 3b. Managing InvestmentsDocument27 pages3b. Managing InvestmentsSasquarch VeinPas encore d'évaluation

- IAPM AnswersDocument3 pagesIAPM AnswersSukhchain patel PatelPas encore d'évaluation

- CHAPTER 7-InvestmentDocument6 pagesCHAPTER 7-InvestmentMelody LisaPas encore d'évaluation

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument78 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareEuphoric ArtistPas encore d'évaluation

- Systematic and Unsystematic Risk: Understanding the CAPM and APT ModelsDocument41 pagesSystematic and Unsystematic Risk: Understanding the CAPM and APT ModelsharishPas encore d'évaluation

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioD'EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- CAPM - Capital Asset Pricing Model ExplainedDocument36 pagesCAPM - Capital Asset Pricing Model ExplainedJithesh JanardhananPas encore d'évaluation

- CAPM and APT Models ExplainedDocument24 pagesCAPM and APT Models ExplainedRicha AroraPas encore d'évaluation

- Portfolio MGTDocument98 pagesPortfolio MGTNishantPas encore d'évaluation

- Portfolio Construction and EvaluationDocument5 pagesPortfolio Construction and Evaluations_s_swapnaPas encore d'évaluation

- Bahria University, Islamabad Omar Safdar, CPADocument30 pagesBahria University, Islamabad Omar Safdar, CPAwasimggPas encore d'évaluation

- Portfolio Management GuideDocument40 pagesPortfolio Management GuideIndu MathiPas encore d'évaluation

- Papier 7Document3 pagesPapier 7haifa dhPas encore d'évaluation

- Portfolio Construction: Traditional and Modern Approach: by Dr. Muhammad AliDocument28 pagesPortfolio Construction: Traditional and Modern Approach: by Dr. Muhammad AliAliyanPas encore d'évaluation

- MPT, BEtaDocument5 pagesMPT, BEtaAnil PargainPas encore d'évaluation

- Bond Portfolio Management StrategiesDocument11 pagesBond Portfolio Management StrategiesDimple Sutaria100% (1)

- F-206 (Class-20)Document15 pagesF-206 (Class-20)Mostafizur Rahman AlifPas encore d'évaluation

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument77 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwarekhandakeralihossainPas encore d'évaluation

- Unit4 SAPMDocument11 pagesUnit4 SAPMBhaskaran BalamuraliPas encore d'évaluation

- Solution To Previous Year Questions Course Code: Course Name: AdvancedDocument20 pagesSolution To Previous Year Questions Course Code: Course Name: AdvancedSHAFI Al MEHEDIPas encore d'évaluation

- Inv. Chapter 7Document23 pagesInv. Chapter 7Mahamoud HassenPas encore d'évaluation

- 05 Risk-Return and Asset Pricing ModelsDocument75 pages05 Risk-Return and Asset Pricing ModelsNailiah MacakilingPas encore d'évaluation

- Assumptions of the CAPM ModelDocument1 pageAssumptions of the CAPM Modelrizwankhan59100% (1)

- Chapter 3 Portfolio Selection PDFDocument6 pagesChapter 3 Portfolio Selection PDFMariya BhavesPas encore d'évaluation

- Muy Buena Treynor Black Sin MatlabDocument13 pagesMuy Buena Treynor Black Sin MatlabManuel Alberto Tapia VicentePas encore d'évaluation

- CAPMDocument40 pagesCAPMkrishnendu maji100% (2)

- Formulation of Portfolio Strategy - IMDocument9 pagesFormulation of Portfolio Strategy - IMKhyati KhokharaPas encore d'évaluation

- Formulation of Portfolio StrategyDocument9 pagesFormulation of Portfolio StrategyKhyati KhokharaPas encore d'évaluation

- A philosophical basis for valuationDocument87 pagesA philosophical basis for valuationaugustoPas encore d'évaluation

- Moduel 3Document13 pagesModuel 3sarojkumardasbsetPas encore d'évaluation

- Capital Asset Pricing Model ExplainedDocument11 pagesCapital Asset Pricing Model ExplainedVaishali Trivedi OjhaPas encore d'évaluation

- Portfolio TheoryDocument6 pagesPortfolio TheorykrgitPas encore d'évaluation

- Chapter 5 - Multifactor Value at RiskDocument44 pagesChapter 5 - Multifactor Value at RiskVishwajit GoudPas encore d'évaluation

- Managing Bond PortfoliosDocument11 pagesManaging Bond PortfoliosLucela InocPas encore d'évaluation

- Capital Market TheoryDocument36 pagesCapital Market TheoryNeelam MadarapuPas encore d'évaluation

- CAPM Lecture 1Document16 pagesCAPM Lecture 1Amit GuptaPas encore d'évaluation

- Portfolio Mastery: Navigating the Financial Art and ScienceD'EverandPortfolio Mastery: Navigating the Financial Art and SciencePas encore d'évaluation

- Chapter 2.achieving Strategic Fit & ScopeDocument41 pagesChapter 2.achieving Strategic Fit & ScopePushpa BaruaPas encore d'évaluation

- Chapter 2.achieving Strategic Fit & ScopeDocument41 pagesChapter 2.achieving Strategic Fit & ScopePushpa BaruaPas encore d'évaluation

- Does Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyDocument9 pagesDoes Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyPushpa BaruaPas encore d'évaluation

- JavedDocument22 pagesJavedPushpa BaruaPas encore d'évaluation

- Term Paper On: Stock Market Crisis in BangladeshDocument24 pagesTerm Paper On: Stock Market Crisis in BangladeshPushpa BaruaPas encore d'évaluation

- IntroductionDocument23 pagesIntroductionPushpa BaruaPas encore d'évaluation

- Year 2012 2013 2014 2016 2016: Source: Annual ReportDocument13 pagesYear 2012 2013 2014 2016 2016: Source: Annual ReportPushpa BaruaPas encore d'évaluation

- Internship Report Foreign Exchange Operations: Mercantile Bank LimitedDocument163 pagesInternship Report Foreign Exchange Operations: Mercantile Bank LimitedPushpa BaruaPas encore d'évaluation

- ParthaDocument39 pagesParthaPushpa BaruaPas encore d'évaluation

- Part 03Document55 pagesPart 03Pushpa BaruaPas encore d'évaluation

- Table of Content: Chapter - 1Document1 pageTable of Content: Chapter - 1Pushpa BaruaPas encore d'évaluation

- Asif FinalDocument24 pagesAsif FinalPushpa BaruaPas encore d'évaluation

- EblDocument8 pagesEblPushpa BaruaPas encore d'évaluation

- Shahadat HossainDocument70 pagesShahadat HossainPushpa BaruaPas encore d'évaluation

- Bangladesh Small and Cottage Industries CorporationDocument9 pagesBangladesh Small and Cottage Industries CorporationPushpa BaruaPas encore d'évaluation

- 6.mistake #6: Marketing To Hispanics Without Multicultural StafDocument1 page6.mistake #6: Marketing To Hispanics Without Multicultural StafPushpa BaruaPas encore d'évaluation

- The and Willingness To, Organize and A Along With Any of Its in To Make A - The Most Obvious Example of Entrepreneurship Is The Starting of NewDocument28 pagesThe and Willingness To, Organize and A Along With Any of Its in To Make A - The Most Obvious Example of Entrepreneurship Is The Starting of NewPushpa BaruaPas encore d'évaluation

- Ebl OriginalDocument18 pagesEbl OriginalPushpa BaruaPas encore d'évaluation

- IntroductionDocument28 pagesIntroductionPushpa BaruaPas encore d'évaluation

- Fundamental Rights in Bangladesh: English Legal System BangladeshDocument8 pagesFundamental Rights in Bangladesh: English Legal System BangladeshPushpa BaruaPas encore d'évaluation

- AditiDocument2 pagesAditiPushpa BaruaPas encore d'évaluation

- DhakaDocument26 pagesDhakaPushpa BaruaPas encore d'évaluation

- Corporate Finance is the Area of Finance Dealing With the Sources of Funding and the Capital Structure of Corporations and the Actions That Managers Take to Increase the Value of the Firm to the ShareholdersDocument6 pagesCorporate Finance is the Area of Finance Dealing With the Sources of Funding and the Capital Structure of Corporations and the Actions That Managers Take to Increase the Value of the Firm to the ShareholdersPushpa BaruaPas encore d'évaluation

- Mamun 2Document5 pagesMamun 2Pushpa BaruaPas encore d'évaluation

- Corporate Finance is the Area of Finance Dealing With the Sources of Funding and the Capital Structure of Corporations and the Actions That Managers Take to Increase the Value of the Firm to the ShareholdersDocument6 pagesCorporate Finance is the Area of Finance Dealing With the Sources of Funding and the Capital Structure of Corporations and the Actions That Managers Take to Increase the Value of the Firm to the ShareholdersPushpa BaruaPas encore d'évaluation

- Criteria For Project Selection: Non-Numeric ModelsDocument4 pagesCriteria For Project Selection: Non-Numeric ModelsPushpa BaruaPas encore d'évaluation

- InternationalizationDocument72 pagesInternationalizationPushpa BaruaPas encore d'évaluation

- Dentifying and Determining Impact AreasDocument16 pagesDentifying and Determining Impact AreasPushpa BaruaPas encore d'évaluation

- Assignment of Strategic ManagementDocument14 pagesAssignment of Strategic ManagementPushpa BaruaPas encore d'évaluation

- AyanDocument11 pagesAyanPushpa BaruaPas encore d'évaluation

- Setting Product Strategy and DifferentiationDocument11 pagesSetting Product Strategy and Differentiationmini2jain2000Pas encore d'évaluation

- Der2019 enDocument194 pagesDer2019 enAbdul AzizPas encore d'évaluation

- Full Text of Federal Reserve Chairman Ben Bernanke's Speech in Jackson Hole, Wyo.Document8 pagesFull Text of Federal Reserve Chairman Ben Bernanke's Speech in Jackson Hole, Wyo.lawrencePas encore d'évaluation

- 3.1 Protectionism Practice ActivityDocument8 pages3.1 Protectionism Practice ActivityAbhinav Rakesh PatelPas encore d'évaluation

- I Was Paying Fee For Neet Application Form. But Due To Some Technical Error Payment Was Not Completed But The Money Is DeductedDocument1 pageI Was Paying Fee For Neet Application Form. But Due To Some Technical Error Payment Was Not Completed But The Money Is DeductedGanisius 2020Pas encore d'évaluation

- Quality Ranking Whitepaper FinalDocument38 pagesQuality Ranking Whitepaper Finalpeter990xPas encore d'évaluation

- Unit 2.3 Market Equilibrium Study NotesDocument5 pagesUnit 2.3 Market Equilibrium Study NotesRichard XunPas encore d'évaluation

- 2019 All L2 Exam QuestionsDocument304 pages2019 All L2 Exam QuestionsGodfrey BukomekoPas encore d'évaluation

- Problem 4B: 1. VisionDocument7 pagesProblem 4B: 1. VisionAlpha100% (1)

- CONSUMERDocument5 pagesCONSUMERMeenaPas encore d'évaluation

- PDF Book Read MeDocument3 pagesPDF Book Read MenevatiamlmPas encore d'évaluation

- Business Combinations CalculationsDocument1 pageBusiness Combinations CalculationsMel paloma0% (1)

- Corporate Bond Listed On The Exchange - Public IssueDocument174 pagesCorporate Bond Listed On The Exchange - Public IssuePrachi MaheshwariPas encore d'évaluation

- New InvoiceDocument2 pagesNew InvoiceRitesh BansalPas encore d'évaluation

- Update March 08Document25 pagesUpdate March 08api-27370939100% (2)

- Corporate Governance of The Football Industry (PDFDrive) PDFDocument327 pagesCorporate Governance of The Football Industry (PDFDrive) PDFDinh HiepPas encore d'évaluation

- Prec. Wires (I)Document9 pagesPrec. Wires (I)AnilKumarPas encore d'évaluation

- Forex 1Document24 pagesForex 1Ashutosh Singh YadavPas encore d'évaluation

- Resume Melissa RileyDocument1 pageResume Melissa Rileyapi-285844136Pas encore d'évaluation

- 03 Stem 11 Pasay Genmath q2 w4Document20 pages03 Stem 11 Pasay Genmath q2 w4Jay Kenneth Baldo0% (1)

- Business Mathematics Module 6.1 Margin and Mark UpDocument15 pagesBusiness Mathematics Module 6.1 Margin and Mark UpDavid DuePas encore d'évaluation

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)Pas encore d'évaluation

- Trends Toward Globalization And Marketing ConceptsDocument28 pagesTrends Toward Globalization And Marketing ConceptsUyên TốPas encore d'évaluation

- International School of Asia and The Pacific Management Advisory Services Institutional ReviewDocument27 pagesInternational School of Asia and The Pacific Management Advisory Services Institutional ReviewCharles BarcelaPas encore d'évaluation

- IB Pitchbook Valuation AnalysisDocument3 pagesIB Pitchbook Valuation AnalysisSumeer BeriPas encore d'évaluation

- Market-Driven Versus Driving MarketsDocument10 pagesMarket-Driven Versus Driving MarketsmkyenPas encore d'évaluation

- TR Web Final Yes Supp1 PDFDocument104 pagesTR Web Final Yes Supp1 PDFEdith Trejos de MejíaPas encore d'évaluation

- Summer Internship Report: at Edelweiss Financial ServicesDocument7 pagesSummer Internship Report: at Edelweiss Financial ServicesJatin GuptaPas encore d'évaluation

- Starbucks Segmentation, Targeting, and Positioning - PDF AgileDocument12 pagesStarbucks Segmentation, Targeting, and Positioning - PDF AgileMehdi BekriPas encore d'évaluation

- Media Lecture Notes: 2.1 Mass Media Vs Personal MediaDocument5 pagesMedia Lecture Notes: 2.1 Mass Media Vs Personal MediaASUPREMEAPas encore d'évaluation