Académique Documents

Professionnel Documents

Culture Documents

Navarra Digest

Transféré par

tiny aCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Navarra Digest

Transféré par

tiny aDroits d'auteur :

Formats disponibles

Navarra vs Planters Bank The Navarras are the owners of five (5) parcels of subject of this controversy.

They obtained a loan from Planters Bank (P1,200,000.00) and executed a deed of mortgage over the 5 parcels of land as security. They failed to pay the loan. Hence, Planters Bank foreclosed on the mortgage. The bank was also the highest bidder in the auction sale. The Navarras still failed to redeem the foreclosed property despite the 1-year redemption period. On the other hand, co-petitioner RRRC Development Corporation (RRRC) is a real estate company owned by the parents of Carmelita Bernardo Navarra. RRRC itself obtained a loan from Planters Bank secured by a mortgage over another set of properties owned by RRRC. The loan having been likewise unpaid, Planters Bank similarly foreclosed the mortgaged assets of RRRC. Unlike the Navarras, however, RRRC was able to negotiate with the Bank for the redemption of its foreclosed properties by way of a concession whereby the Bank allowed RRRC to refer to it would-be buyers of the foreclosed RRRC properties who would remit their payments directly to the Bank, which payments would then be considered as redemption price for RRRC. Eventually, the foreclosed properties of RRRC were sold to third persons whose payments therefor, directly made to the Bank, were in excess by P300,000.00 for the redemption price. In the meantime, Jorge Navarra sent a letter to Planters Bank, proposing to repurchase the five (5) lots earlier auctioned to the Bank, with a request that he be given until August 31, 1985 to pay the down payment of P300,000.00. In response, Planters Bank, thru its Vice-President Ma. Flordeliza Aguenza, wrote back Navarra via a letter dated August 16, 1985. It said that the Collection Committee has agreed to Navarras request. And the latter was referred to see Rene Castillo, Head, Acquired Assets Unit, as soon as possible for the details of the transaction so that they may work on the necessary documentation. Accordingly, Jorge Navarra went to the Office of Mr. Rene Castillo on August 20, 1985, bringing with him a letter requesting that the excess payment of P300,000.00 in connection with the redemption made by the RRRC be applied as down payment for the Navarras repurchase of their foreclosed properties. The Bank required Navarra to submit a board resolution from RRRC authorizing him to negotiate for and its behalf and empowering him to apply the excess amount of P300,000.00 in RRRCs redemption payment as down payment for the repurchase of the Navarras foreclosed properties. Then, on January 21, 1987, Planters Bank sent a letter to Jorge Navarra informing him that it could not proceed with the documentation of the proposed repurchase of the foreclosed properties on account of his non- compliance with the Banks request for the submission of the needed board resolution of RRRC. It required the Navarras to vacate the premises. Petitioners contend that a perfected contract of sale came into being when respondent Bank, thru a letter dated August 16, 1985, formally accepted the offer of the Navarras to repurchase the subject properties. Issue: WON there was a perfected sale? Was the offer certain and the acceptance absolute enough so as to engender a meeting of the minds between the parties? Definitely not. Ruling: While the correspondence of letters indicate the amount of P300,000.00 as down payment, they are, however, completely silent as to how the succeeding installment payments shall be made. At most, the letters merely acknowledge that the down payment of P300,000.00 was agreed upon by the parties. However, this fact cannot lead to the conclusion that a contract of sale had been perfected. Quite recently, this Court held that before a valid and binding contract of sale can exist, the manner of payment of the purchase price must first be established since the agreement on the manner of payment goes into the price such that a disagreement on the manner of payment is tantamount to a failure to agree on the price. Too, the Navarras letter/offer failed to specify a definite amount of the purchase price for the sale/repurchase of the subject properties. It merely stated that the purchase price will be based on the redemption value plus accrued interest at the prevailing rate up to the date of the sales contract. The ambiguity of this statement only bolsters the uncertainty of the Navarras so-called offer for it leaves much rooms for such questions, as: what is the redemption value? what prevailing rate of interest shall be followed: is it the rate stipulated in the loan agreement or the legal rate? when will the date of the contract of sale be based, shall it be upon the time of the execution of the deed of sale or upon the time when the last installment payment shall have been made? To our mind, these questions need first to be addressed, discussed and negotiated upon by the parties before a definite purchase price can be arrived at. And as to the request for a long-term payment scheme, the offer was not clear insofar as concerned the exact number of years that will comprise the long-term payment scheme. As we see it, the absence of a stipulated period within which the repurchase price shall be paid all the more adds to the indefiniteness of the Navarras offer. Here, what is dramatically clear is that there was no meeting of minds vis-a-vis the price, expressly or impliedly, directly or indirectly. Further, the tenor of Planters Banks letter-reply specifically stated that there is a need to negotiate on the other details of the transaction before the sale may be formalized. Such clearly manifests lack of agreement between the parties as to the terms of the purported contract of sale/repurchase, particularly the mode of payment of the purchase price and the period for its payment. The law requires acceptance to be absolute and unqualified. Aside from their first letter dated July 18, 1985, the Navarras wrote another letter dated August 20, 1985, this time requesting the Bank that the down payment of P300,000.00 be instead taken from the excess payment made by the RRRC in redeeming its own foreclosed properties. The very circumstance that the Navarras had to make this new request is a

clear indication that no definite agreement has yet been reached at that point. As we see it, this request constitutes a new offer on the part of the Navarras, which offer was again conditionally accepted by the Bank as in fact it even required the Navarras to submit a board resolution of RRRC before it could proceed with the proposed sale/repurchase. The eventual failure of the spouses to submit the required board resolution precludes the perfection of a contract of sale/repurchase between the parties. As earlier mentioned, contracts are perfected when there is concurrence of the parties wills, manifested by the acceptance by one of the offer made by the other.[9] Here, there was no concurrence of the offer and acceptance as would result in a perfected contract of sale.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Mini Case On Risk Return 1-SolutionDocument27 pagesMini Case On Risk Return 1-Solutionjagrutic_09Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Repo HandbookDocument38 pagesRepo Handbooknick_williams_38Pas encore d'évaluation

- (Bank of America) Understanding Mortgage Dollar RollsDocument18 pages(Bank of America) Understanding Mortgage Dollar RollsJay Kab100% (2)

- Deped Policy Framework For The Implementation of The Alternative Dispute Resolution System-MediationDocument21 pagesDeped Policy Framework For The Implementation of The Alternative Dispute Resolution System-MediationMichelle MatiasPas encore d'évaluation

- IBPS Clerk 5 Capsule 2015 by Affairscloud PDFDocument86 pagesIBPS Clerk 5 Capsule 2015 by Affairscloud PDFBala SubramanianPas encore d'évaluation

- Global Money Notes #21Document9 pagesGlobal Money Notes #21shortmycds75% (4)

- DTC PARTICIPANTS Listing Numerical ListDocument12 pagesDTC PARTICIPANTS Listing Numerical Listjacque zidanePas encore d'évaluation

- Magna CartaDocument19 pagesMagna Cartatiny aPas encore d'évaluation

- A Study On Investment Analysis and Portfolio ManagementDocument94 pagesA Study On Investment Analysis and Portfolio ManagementKeerthi100% (2)

- Locator Slip For DepedDocument1 pageLocator Slip For Depedtiny aPas encore d'évaluation

- Anti-Graft and Corrupt Practices Act RA 3019Document13 pagesAnti-Graft and Corrupt Practices Act RA 3019Michelle MatiasPas encore d'évaluation

- DepEd Grievance Procedure GuideDocument36 pagesDepEd Grievance Procedure GuideMichelle MatiasPas encore d'évaluation

- Elementary Digital Choice Boards by SlidesgoDocument53 pagesElementary Digital Choice Boards by SlidesgoJeRi RojasPas encore d'évaluation

- Petitioners Challenge Fake ReceiptDocument3 pagesPetitioners Challenge Fake Receipttiny aPas encore d'évaluation

- Affidavit of AccidentDocument1 pageAffidavit of Accidenttiny aPas encore d'évaluation

- Affidavit of ParentDocument1 pageAffidavit of Parenttiny aPas encore d'évaluation

- Self AdjudicationDocument3 pagesSelf Adjudicationtiny aPas encore d'évaluation

- Affidavit of No RelativesDocument1 pageAffidavit of No Relativestiny aPas encore d'évaluation

- ITB Security ServicesDocument32 pagesITB Security Servicestiny aPas encore d'évaluation

- Affid of ClaimDocument2 pagesAffid of Claimtiny aPas encore d'évaluation

- Affid of Legal CapacityDocument1 pageAffid of Legal Capacitytiny aPas encore d'évaluation

- Affidavit: COOPERATIVE, Located at Sitio Panipasan, Brgy, Marilog, Marilog DistrictDocument1 pageAffidavit: COOPERATIVE, Located at Sitio Panipasan, Brgy, Marilog, Marilog DistrictKeepy FamadorPas encore d'évaluation

- ACKNOWLDGMENTDocument1 pageACKNOWLDGMENTtiny aPas encore d'évaluation

- Aff. of ApologyDocument2 pagesAff. of ApologyChristian Paul PinotePas encore d'évaluation

- Prohibition on disclosure of relations under RA 9184Document2 pagesProhibition on disclosure of relations under RA 9184tiny aPas encore d'évaluation

- Affidavit of Additional CapitalDocument1 pageAffidavit of Additional CapitalChristian Paul PinotePas encore d'évaluation

- ST JudeDocument1 pageST Judetiny aPas encore d'évaluation

- Data PrivacyDocument36 pagesData Privacytiny aPas encore d'évaluation

- DOS1Document2 pagesDOS1tiny aPas encore d'évaluation

- Authority To TravelDocument1 pageAuthority To Traveltiny aPas encore d'évaluation

- Data Privacy Act prohibits disclosure of student excuse letters without parental consentDocument1 pageData Privacy Act prohibits disclosure of student excuse letters without parental consenttiny aPas encore d'évaluation

- Case 2Document1 pageCase 2tiny aPas encore d'évaluation

- While Philippine Schools This June Are Busy Orienting Parents and Students Regarding School RegulationsDocument1 pageWhile Philippine Schools This June Are Busy Orienting Parents and Students Regarding School Regulationstiny aPas encore d'évaluation

- Child Protection Case 1Document1 pageChild Protection Case 1tiny aPas encore d'évaluation

- Authority To Travel: Division of Panabo CityDocument1 pageAuthority To Travel: Division of Panabo Citytiny aPas encore d'évaluation

- Understanding Liabilities of Public OfficersDocument22 pagesUnderstanding Liabilities of Public Officerstiny aPas encore d'évaluation

- Office functions guideDocument6 pagesOffice functions guidetiny aPas encore d'évaluation

- RBI Functions: 1. Monopoly of Note IssueDocument5 pagesRBI Functions: 1. Monopoly of Note Issueshivam shandilyaPas encore d'évaluation

- HTML Conversion Bug TextDocument136 pagesHTML Conversion Bug Textnew_guy_1997Pas encore d'évaluation

- Burnaman Art 77 ReportDocument72 pagesBurnaman Art 77 ReportChris HerzecaPas encore d'évaluation

- Impact of Monetary Policy.Document90 pagesImpact of Monetary Policy.PiyushPas encore d'évaluation

- Features of MICR ChequeDocument10 pagesFeatures of MICR ChequeAssignment HelperPas encore d'évaluation

- Lesson 1 Inflation What Is Inflation?Document72 pagesLesson 1 Inflation What Is Inflation?ajejePas encore d'évaluation

- USDP Monthly Stablecoin Reporting July 2023Document1 pageUSDP Monthly Stablecoin Reporting July 2023LOPEZ MARIN JOSE LUISPas encore d'évaluation

- Results Reporter: Multiple Choice QuizDocument4 pagesResults Reporter: Multiple Choice QuizVinit ChawlaPas encore d'évaluation

- Ch13: Commercial Bank Operations: Major Sources of Bank FundsDocument6 pagesCh13: Commercial Bank Operations: Major Sources of Bank FundsBruno U. YabutaPas encore d'évaluation

- Treasury ManagementDocument37 pagesTreasury ManagementDeepak OswalPas encore d'évaluation

- CP ProjectDocument63 pagesCP ProjectJITENDRA VISHWAKARMAPas encore d'évaluation

- 06 ch18Document132 pages06 ch18Yana Aida FitriahPas encore d'évaluation

- Understanding Sofr FuturesDocument16 pagesUnderstanding Sofr FuturesGeorge LiuPas encore d'évaluation

- Banking in India For WbcsDocument29 pagesBanking in India For WbcsSubhasis MaityPas encore d'évaluation

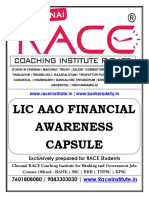

- Financial Awareness Race PDFDocument28 pagesFinancial Awareness Race PDFSunil KumarPas encore d'évaluation

- M11 MishkinEakins3427056 08 FMI C11Document53 pagesM11 MishkinEakins3427056 08 FMI C11habiba ahmedPas encore d'évaluation

- Banking and Insurance NotesDocument12 pagesBanking and Insurance NotesPooja SinghPas encore d'évaluation

- Banks CHDocument8 pagesBanks CHabeerPas encore d'évaluation

- Structured trade financing techniquesDocument11 pagesStructured trade financing techniquesnexus0104464Pas encore d'évaluation

- Introduction to Financial Markets and Their RoleDocument12 pagesIntroduction to Financial Markets and Their RoleRenda QiutiPas encore d'évaluation

- Shelf ProspectusDocument528 pagesShelf Prospectushsinghal1Pas encore d'évaluation

- Financial markets, treasury functions, and risk management in banksDocument12 pagesFinancial markets, treasury functions, and risk management in banksDiwakar PasrichaPas encore d'évaluation

- Chapter - 1 - Investment ManagementDocument15 pagesChapter - 1 - Investment ManagementNetsanet ShikurPas encore d'évaluation