Académique Documents

Professionnel Documents

Culture Documents

Standard Costing

Transféré par

Leigh PerezDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Standard Costing

Transféré par

Leigh PerezDroits d'auteur :

Formats disponibles

Standard costing

Standard costing system The management evaluates the performance of a company by comparing it with some predetermined measures Therefore, it can be used as a process of measuring and correcting actual performance to ensure that the plans are properly set and implemented Procedures of standard costing system Set the predetermined standards for sales margin and production costs Collect the information about the actual performance Compare the actual performance with the standards to arrive at the variance Analyze the variances and ascertaining the causes of variance Take corrective action to avoid adverse variance

Adjust the budget in order to make the standards more realistic Functions of standard costing system Valuation Assigning the standard cost to the actual output Planning Use the current standards to estimate future sales volume and future costs Controlling Evaluating performance by determining how efficiently the current operations are being carried out Motivation Notify the staff of the managements expectations Setting of selling price

Variance

Variance analysis A variance is the difference between the standards and the actual performance When the actual results are better than the expected results, there will be a favourable variance (F) If the actual results are worse than the expected results, there will be an adverse variance (A)

Cost variance Cost variance Cost variance = Price variance + Quantity variance Cost variance is the difference between the standard cost and the Actual cost

Price variance = (standard price actual price)*Actual quantity A price variance reflects the extent of the profit change resulting from the change in activity level Quantity variance = (standard quantity actual quantity)* standard cost A quantity variance reflects the extent of the profit change resulting from the change in activity level Three types of cost variance Material cost variance Labour cost variance Variable overheads variance

Material and labour variance Material cost variance Material price variance

= (standard price actual price)*actual quantity Material usage variance = (Standard quantity actual quantity)* standard price = (Standard quantity for actual production actual quantity production) * standard price Labour cost variance Labour rate variance = (standard price actual price)*actual quantity Labour efficiency variance = (standard quantity actual quantity)*standard price = Standard quantity for actual production actual quantity used) * standard price

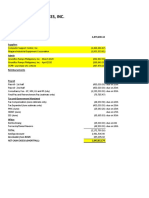

Example-----ABC Ltd. makes and sells a single product. The company uses a Standard marginal costing system. It plans to produce and sell 1000 units in May 2005. A budget statement is produced as follow: Budgeted income statement for the month ended 31 May 2005 $ Sales ($50*1000) Less: Variable cost of goods sold Direct materials ($3*4000) Direct labour ($5*3000) Variable overheads ($2*3000) Budget contribution Fixed overhead Budget profit 12000 15000 6000 33000 $ 50000

17000 3000 14000

The actual sales and production is 800 units. The actual income statement is shown as follows: Income statement for the month ended 31 May 2005 $ Sales ($60*800) Less: Variable cost of goods sold Direct materials ($3.2*2400) Direct labour ($6*3200) Actual Variable overheads 32380 Contribution Fixed overhead Net profit 12000 15000 5500 15620 2600 13020 $ 48000

Material cost variance Material price variance = (standard price actual price)*actual quantity = ($3 - $3.2)*2400 = $480 (A) Material usage variance = (Standard quantity actual quantity)* standard price = (Standard quantity for actual production actual quantity production) * standard price = (4*800 2400)*$3 = $2400 (F)

Material cost variance Material price variance Material usage variance Total Material cost variance $480 (A) $2400 (F) $1920 (F)

Overheads variance Variable overheads variance Fixed overheads variance

Variable overheads variance Variable overheads variance is the difference between the standard variable overheads absorbed into the actual output and the actual overheads incurred

Calculation on overhead absorbed

Variable overheads variance Variable overheads variance

= variable overheads absorbed actual variable overheads incurred Variable overheads expenditure variance = standard variable overheads for actual hours worked Actual variable overheads incurred Variable overheads efficiency variance = Standard variable overheads for standard hours of output Actual variable overhead absorbed = (standard hours for actual output Actual hours worked)* standard price Example---ABC Ltd. makes and sells a single product. The company uses a Standard marginal costing system. It plans to produce and sell 1000 units in May 2005. A budget statement is produced as follow: Budgeted income statement for the month ended 31 May 2005

$ Sales ($50*1000) Less: Variable cost of goods sold Direct materials ($3*4000) Direct labour ($5*3000) Variable overheads ($2*3000) Budget contribution Fixed overhead Budget profit

$ 50000

12000 15000 6000 33000 17000 3000 14000

The actual sales and production is 800 units. The actual income statement is shown as follows: Income statement for the month ended 31 May 2005 $ Sales ($60*800) Less: Variable cost of goods sold Direct materials ($3.2*2400) Direct labour ($6*3200) Actual Variable overheads Contribution Fixed overhead Net profit 12000 15000 5500 32380 15620 2600 13020 $ 48000

Variable overheads efficiency variance = Standard variable overheads for standard hours of output Actual variable overhead absorbed = (standard hours for actual output Actual hours worked)* standard price = (3 hr *800 units 4 hr *800 units)*$2 = $1600 (A) Variable overheads variance Variable overheads expenditure variance $900 F Variable overheads efficiency variance Total Variable overhead variance $1600 A $400 A

Sales variance

Sales variance (Marginal costing) Total sales margin variance = actual contribution budgeted contribution = [(Actual selling price Standard cost of sales )*Actual sales volume] Budgeted contribution Sales margin price variance = (Actual contribution per unit Standard contribution per unit) * Actual sales volume Sales margin volume variance

= (Actual volume Budget volume)* Standard contribution per unit

Sales variance (Absorption costing) Sales margin price variance = (Actual profit margin per unit Standard profit margin per unit) * Actual sales volume Sales margin volume variance = (Actual volume Budget volume)* Standard profit margin per unit Example---ABC Ltd. makes and sells a single product. The company uses a Standard marginal costing system. It plans to produce and sell 1000 units in May 2005. A budget statement is produced as follow: Budgeted income statement for the month ended 31 May 2005

$ Sales ($50*1000) Less: Variable cost of goods sold Direct materials ($3*4000) Direct labour ($5*3000) Variable overheads ($2*3000) Budget contribution Fixed overhead Budget profit

$ 50000

12000 15000 6000 33000 17000 3000 14000

The actual sales and production is 800 units. The actual income statement is shown as follows: Income statement for the month ended 31 May 2005 $ Sales ($60*800) Less: Variable cost of goods sold Direct materials ($3.2*2400) Direct labour ($6*3200) Actual Variable overheads Contribution Fixed overhead Net profit 12000 15000 5500 32380 15620 2600 13020 $ 48000

Sales variance (Marginal costing) Sales margin price variance Sales margin volume variance Total sales variance Sales variance (Absorption costing) $8000 F $3400 A $4600 F

Sales variance (Absorption costing) Sales margin price variance Sales margin volume variance Total sales variance $8000 F $2800 A $5200 F

Fixed overhead variance

Fixed overhead variance Fixed overheads variance = Fixed overheads absorbed Actual fixed overheads incurred Fixed overheads expenditure variance Budgeted fixed overheads Budgeted overheads absorbed Fixed overheads volume variance

= Absorbed fixed overheads Budgeted overheads absorbed

Example----

ABC Ltd. makes and sells a single product. The company uses a Standard marginal costing system. It plans to produce and sell 1000 units in May 2005. A budget statement is produced as follow: Budgeted income statement for the month ended 31 May 2005 $ Sales ($50*1000) Less: Variable cost of goods sold Direct materials ($3*4000) Direct labour ($5*3000) Variable overheads ($2*3000) Budget contribution Fixed overhead Budget profit 12000 15000 6000 33000 17000 3000 14000 $ 50000

The actual sales and production is 800 units. The actual income statement is shown as follows: Income statement for the month ended 31 May 2005 $ Sales ($60*800) Less: Variable cost of goods sold Direct materials ($3.2*2400) Direct labour ($6*3200) Actual Variable overheads Contribution Fixed overhead Net profit 12000 15000 5500 32380 15620 2600 13020 $ 48000

Fixed overhead variance Fixed overheads variance = Fixed overheads absorbed Actual fixed overheads incurred = ($1*3*800) - $2600 = $200 A Fixed overheads expenditure variance = Budgeted fixed overheads Budgeted overheads absorbed = $3000 - $2600 = $400 F Fixed overheads volume variance = Absorbed fixed overheads Budgeted overheads absorbed = ($1*3*800) - $3000 = $600 A

FO Variance in marginal and absorption costing In marginal costing: Fixed overheads are charged as period costs instead of charging to product in marginal costing. It is assumed that the fixed overheads remain unchanged with the change in the level of activity. Single fixed overhead expenditure variance will be used In absorption costing Fixed overheads are charged to the products and included in the valuation of closing stock. Total fixed overheads variance is divided into fixed overheads price variance and fixed overheads volume variance

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- USLS Solution Rights-StockholdersDocument3 pagesUSLS Solution Rights-StockholdersMarian Augelio PolancoPas encore d'évaluation

- Kenya: IEBC Polling Stations Without 3GDocument161 pagesKenya: IEBC Polling Stations Without 3GWanjikũRevolution Kenya100% (1)

- Audit Report Cash SalesDocument30 pagesAudit Report Cash SalesPlanco RosanaPas encore d'évaluation

- Big CharimanDocument39 pagesBig CharimanUpender BhatiPas encore d'évaluation

- Market Segmentation - Geographic SegmentationDocument7 pagesMarket Segmentation - Geographic SegmentationchondongPas encore d'évaluation

- MRP (Material Requirement Planning) - ADocument30 pagesMRP (Material Requirement Planning) - Amks210Pas encore d'évaluation

- Sas 1-18Document165 pagesSas 1-18btee2Pas encore d'évaluation

- Current Trends in FranchisingDocument1 pageCurrent Trends in FranchisingbinalotphPas encore d'évaluation

- Chapter 10 Sales Forecasting, Quotas and Territory Management-Sales and Distribution ManagementDocument35 pagesChapter 10 Sales Forecasting, Quotas and Territory Management-Sales and Distribution ManagementAmi Tanu100% (1)

- Grapevine CommunicationDocument1 pageGrapevine CommunicationPavan KoundinyaPas encore d'évaluation

- Merck Decision TreeDocument4 pagesMerck Decision Treeparth2k0% (1)

- ETOM Level-2 ProcessesDocument2 pagesETOM Level-2 ProcessesFahimPas encore d'évaluation

- Report in Inventory MNGMNTDocument17 pagesReport in Inventory MNGMNTEzel May ArelladoPas encore d'évaluation

- Marketing Report InsightsDocument20 pagesMarketing Report Insightsmewtoki33% (3)

- Maru Batting Center Case Study Excel Group YellowDocument26 pagesMaru Batting Center Case Study Excel Group YellowAshish PatwardhanPas encore d'évaluation

- Transfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtDocument18 pagesTransfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtLatest Laws TeamPas encore d'évaluation

- MM10 Service EntryDocument44 pagesMM10 Service Entryina23ajPas encore d'évaluation

- McGill IT Services Change Management Process GuideDocument81 pagesMcGill IT Services Change Management Process Guidediego_sq100% (1)

- Market Entry StrategyDocument6 pagesMarket Entry StrategyRavindu PereraPas encore d'évaluation

- OKR One PagerDocument1 pageOKR One Pagermyrudyku100% (1)

- LERAC M AND E Cash Forecast and Accounts Payable AgingDocument15 pagesLERAC M AND E Cash Forecast and Accounts Payable AgingLERAC AccountingPas encore d'évaluation

- Key Performance Indicators MST NDocument14 pagesKey Performance Indicators MST NmscarreraPas encore d'évaluation

- Project Stakeholder Management CH2Document12 pagesProject Stakeholder Management CH2Wahab Ahmad KhanPas encore d'évaluation

- ForecastingDocument12 pagesForecastingMich SalvatorēPas encore d'évaluation

- In Re: Dennis D. Windscheffel, 9th Cir. BAP (2017)Document14 pagesIn Re: Dennis D. Windscheffel, 9th Cir. BAP (2017)Scribd Government DocsPas encore d'évaluation

- Vouching ControlDocument42 pagesVouching ControlSundayPas encore d'évaluation

- Hargreaves Ch. 11 Bankruptcy FilingDocument24 pagesHargreaves Ch. 11 Bankruptcy FilingNick HalterPas encore d'évaluation

- My Peace Plan FormDocument2 pagesMy Peace Plan FormStephen PhiriPas encore d'évaluation

- MA CHAPTER 2 Budgeting Flexible BudgetDocument29 pagesMA CHAPTER 2 Budgeting Flexible BudgetMohd Zubair KhanPas encore d'évaluation

- Recent Trends in CompensationDocument2 pagesRecent Trends in Compensationhasanshs12100% (1)