Académique Documents

Professionnel Documents

Culture Documents

P01

Transféré par

srhaythornDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

P01

Transféré par

srhaythornDroits d'auteur :

Formats disponibles

Student Name: Class: Problem 01-07A GRAHAM COMPANY

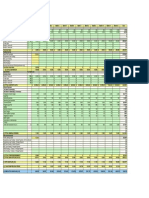

Date May 1 1 3 5 8 12 15 20 22 25 26 27 28 30 30 31

Cash

Assets = Accounts Receivable

Office Equipment

Liabilities Accounts Payable

+ H. Graham Capital

Equity H. Graham Withdrawals Revenues Expenses

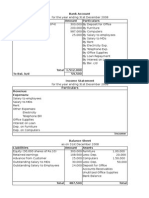

GRAHAM COMPANY Income Statement For Month Ended May 31 Revenues Consulting services revenue Expenses Rent expense Salaries expense Cleaning expense Telephone expense Utilities expense Advertising expense Total expenses Net income

GRAHAM COMPANY Statement of Owner's Equity For the Month Ended May 31 H. Graham, Capital, May 1 Add: Investment by Owner Net income Less: Withdrawals by owner H. Graham, Capital, May 31

Student Name: Class: Problem 01-07A GRAHAM COMPANY Balance Sheet May 31 Assets Cash Office equipment Accounts payable Owner's Equity H. Graham, Capital Total liabilities and equity Liabilities

Total assets

GRAHAM COMPANY Statement of Cash Flows For Month Ended May 31 Cash flows from operating activities Cash received from customers Cash paid for rent Cash paid for cleaning Cash paid for telephone Cash paid for utilities Cash paid to employees Net cash provided by operating activities Cash flows from investing activities Purchase of equipment Net cash used by investing activities Cash flows from financing activities Investments by owner Withdrawals by owner Net cash provided by financing activities Net increase in cash Cash balance, May 1 Cash balance, May 31

Given Data P01-07A: THE GRAHAM CO. Transactions May 1 1 3 5 8 12 15 20 22 25 26 27 28 30 30 31

Cash invested in company Cash paid for May rent Office equipment purchased on credit Cash paid for May cleaning services Cash collected for services provided Provided services on credit Cash paid for assistant's salary (1st half of May) Cash received for services provided May 12 Provided services on credit Cash received for services provided May 22 Cash paid for office equipment purchased May 3 Purchased May advertising, payment due June 1 Cash paid for assistant's salary (2nd half of May) Cash paid for May telephone bill Cash paid for May utilities Owner withdrew cash for personal use

$ 40,000 2,200 1,890 750 5,400 2,500 750 2,500 3,200 3,200 1,890 80 750 300 280 1,400

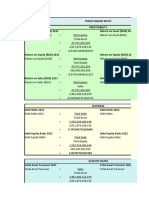

Check figures: (2) Ending balances Cash Expenses (3) Net income Total assets

$ 42,780 $ 5,110 $ 5,990 $ 44,670

Student Name: Class: Problem 01-08A

ANDER ELECTRIC Assets Accounts Date Dec. 1 2 Bal. 3 Bal. 5 Bal. 6 Bal. 8 Bal. 15 Bal. 18 Bal. 20 Bal. 24 Bal. 28 Bal. 29 Bal. 30 Bal. 31 Bal. Cash Receivable Office Supplies Office Equip. Elect. Equip. = Liabilities Accounts Payable H. Ander Capital + Equity H. Ander Withdrawals Revenues Expenses

Student Name: Class: Problem 01-08A ANDER ELECTRIC Income Statement For the Month Ended December 31 Revenues Electrical fees earned Expenses Rent expense Salaries expense Utilities expense Total expenses Net income

ANDER ELECTRIC Statement of Owner's Equity For the Month Ended December 31 H. Ander, Capital, December 1 Plus: Owner investments Net income Total Less: Withdrawals by owner H. Ander, Capital, December 31

ANDER ELECTRIC Balance Sheet December 31 Assets Cash Accounts receivable Office supplies Office equipment Electrical equipment Total assets Liabilities Accounts payable

Owner's Equity H. Ander, Capital Total liabilities and equity

Student Name: Class: Problem 01-08A ANDER ELECTRIC Statement of Cash Flows For Month Ended December 31 Cash flows from operating activities Cash received from customers Cash paid for rent Cash paid for supplies Cash paid for utilities Cash paid to employees Net cash provided by operating activities Cash flows from investing activities Purchase of office equipment Purchase of electrical equipment Net cash used by investing activities Cash flows from financing activities Investments by owner Withdrawals by owner Net cash provided by financing activities Net increase in cash Cash balance, December 1 Cash balance, December 31

Part 4:

Assume that the owner investment transaction on December 1 was $49,000 cash instead of $65,000 and that Ander Electric obtained another $16,000 in cash by borrowing it from the bank. Explain the effect of this change on total assets, total liabilities, and total equity.

Given Data P01-08A: ANDER ELECTRIC Transactions May 1 Transferred into business account 2 Cash paid for month's rent 3 Total paid for electrical equipment Cash paid at time of purchase 5 Cash paid for office supplies 6 Amount collected for work completed 8 Office equipment purchased on credit 15 Completed work on credit 18 Office supplies purchased on credit 20 Cash paid for office equipment purchased December 8 24 Billed client for work completed 28 Received for December 15th work 29 Paid assistant's salary 30 Paid monthly utility bill 31 Withdrew for personal use Check figures: (2) Ending balances Cash Accounts Payable (3) Net income Total assets

$ 65,000 1,000 13,000 4,800 800 1,200 2,530 5,000 350 2,530 900 5,000 1,400 540 950

$ 59,180 $ 8,550 $ 4,160 $ 76,760

Vous aimerez peut-être aussi

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- P01Document11 pagesP01loveshare0% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Excell 1 ShannanDocument7 pagesExcell 1 Shannansrhaythorn0% (1)

- Completing The Accounting Cycle - Prob 04-02A, 04-04ADocument33 pagesCompleting The Accounting Cycle - Prob 04-02A, 04-04ADushtu_HuloPas encore d'évaluation

- Bank Account Particulars Amount ParticularsDocument4 pagesBank Account Particulars Amount ParticularsmayshPas encore d'évaluation

- Aert EgyDocument90 pagesAert Egy65486sfasdkfhoPas encore d'évaluation

- Accounting Cycle Illustrated JDCDocument90 pagesAccounting Cycle Illustrated JDCjiiPas encore d'évaluation

- Chapter 1 - 2 Problems Problem 1: RequiredDocument5 pagesChapter 1 - 2 Problems Problem 1: RequiredManpreet SinghPas encore d'évaluation

- Project Cover Sheet: Higher Colleges of TechnologyDocument26 pagesProject Cover Sheet: Higher Colleges of Technologyapi-302300965Pas encore d'évaluation

- Balance Sheet ExamplesDocument10 pagesBalance Sheet Examples9036673667Pas encore d'évaluation

- Accounting Cycle IDocument21 pagesAccounting Cycle IChristine PeregrinoPas encore d'évaluation

- Assignment of Fundamental of Accounting IDocument12 pagesAssignment of Fundamental of Accounting IibsaashekaPas encore d'évaluation

- Comprehensive ProblemDocument17 pagesComprehensive Problemapi-27308818360% (5)

- JDC TemplatesDocument20 pagesJDC TemplatesjiiPas encore d'évaluation

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyPas encore d'évaluation

- DTE Electric 521 Filing 2013Document372 pagesDTE Electric 521 Filing 2013Stephen BoylePas encore d'évaluation

- Cost Production ClassDocument8 pagesCost Production ClassEdgar IbarraPas encore d'évaluation

- AC101-M8 Chapter 2Document30 pagesAC101-M8 Chapter 2Kephearum11Pas encore d'évaluation

- Total Development CostDocument1 pageTotal Development CostNedy SwiftPas encore d'évaluation

- Comprehensive Accounting Cycle Review Problem Copy 2Document12 pagesComprehensive Accounting Cycle Review Problem Copy 2api-252183085Pas encore d'évaluation

- AMDM Ch.3 SolDocument5 pagesAMDM Ch.3 SolrssnathanPas encore d'évaluation

- Itemized Expenses Form - From Kontento Ka Na Ba Sa kaPERAhan Mo?Document6 pagesItemized Expenses Form - From Kontento Ka Na Ba Sa kaPERAhan Mo?Jammie Akut100% (1)

- 7110 s12 QP 11Document12 pages7110 s12 QP 11mstudy123456Pas encore d'évaluation

- ACCT 101 Comprehensive Prob 1Document8 pagesACCT 101 Comprehensive Prob 1Jay NgPas encore d'évaluation

- Pod 2 Journal - EntriesDocument2 pagesPod 2 Journal - EntriesfdepianoPas encore d'évaluation

- Exercises: 4: AnswersDocument2 pagesExercises: 4: AnswersAnbarasanPas encore d'évaluation

- MMangels Comp 241 PDFDocument14 pagesMMangels Comp 241 PDFCSmallwood1825Pas encore d'évaluation

- Accounting - ProblemsDocument11 pagesAccounting - ProblemsAzfar JavaidPas encore d'évaluation

- Comprehensive Accounting Cycle Review ProblemDocument11 pagesComprehensive Accounting Cycle Review Problemapi-253984155Pas encore d'évaluation

- Book 1Document14 pagesBook 1Jap Ibe100% (2)

- Homework QuestionsDocument17 pagesHomework QuestionsAPas encore d'évaluation

- IPCC Accounts 31-10-10Document1 pageIPCC Accounts 31-10-10Esukapalli Siva ReddyPas encore d'évaluation

- 9706 s12 QP 22Document16 pages9706 s12 QP 22Faisal RaoPas encore d'évaluation

- ACCT 2112 2013/2014 Solution For Tutorial 2Document3 pagesACCT 2112 2013/2014 Solution For Tutorial 2Weiyee WongPas encore d'évaluation

- Acc For Busi AssignmentDocument12 pagesAcc For Busi Assignmentpramodh kumarPas encore d'évaluation

- The Accounting CycleDocument12 pagesThe Accounting CycleNichole John ErnietaPas encore d'évaluation

- Acctg 1 PS 1Document3 pagesAcctg 1 PS 1Aj GuanzonPas encore d'évaluation

- P3-2B IFRS 2ndDocument5 pagesP3-2B IFRS 2ndAfrishalPriyandhanaPas encore d'évaluation

- AccountingexplainedDocument3 pagesAccountingexplainedRamkrishna ChoudhuryPas encore d'évaluation

- Fa2 (Mba)Document53 pagesFa2 (Mba)Muhbat Ali JunejoPas encore d'évaluation

- NumberDocument2 pagesNumberHelplinePas encore d'évaluation

- Chapter 2 Accounting - ContinuationDocument2 pagesChapter 2 Accounting - ContinuationKatrinaPas encore d'évaluation

- Cash On Hand From The Previous Net: Principal IDocument13 pagesCash On Hand From The Previous Net: Principal IGil ArriolaPas encore d'évaluation

- Tutorial Letter 102/3/2019: Financial Accounting Principles For Law PractitionersDocument41 pagesTutorial Letter 102/3/2019: Financial Accounting Principles For Law Practitionersall green associatesPas encore d'évaluation

- 7110 w09 QP 1Document12 pages7110 w09 QP 1mstudy123456Pas encore d'évaluation

- Candidate Pakage1Document5 pagesCandidate Pakage1Bikila MalasaPas encore d'évaluation

- Module 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BDocument29 pagesModule 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BAbelPas encore d'évaluation

- PROBLEM 4 Accounting Cycle Journal Entries Without Chart of Accounts Case IIIDocument1 pagePROBLEM 4 Accounting Cycle Journal Entries Without Chart of Accounts Case IIIJean Dareel LimboPas encore d'évaluation

- N13 IPCC Tax Guideline Answers WebDocument12 pagesN13 IPCC Tax Guideline Answers WebGeorge MooneyPas encore d'évaluation

- Acct 2113Document5 pagesAcct 2113Nhon HoaiPas encore d'évaluation

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartPas encore d'évaluation

- PAL0022 T3 - Topic 3Document10 pagesPAL0022 T3 - Topic 3Samuel KohPas encore d'évaluation

- NW bp3Document1 pageNW bp3api-289869621Pas encore d'évaluation

- Accounting EquationDocument37 pagesAccounting Equationzubbu111Pas encore d'évaluation

- Comprehensive ProblemDocument13 pagesComprehensive ProblemUmair Zoberi100% (8)

- Power Notes: Introduction To Accounting and BusinessDocument71 pagesPower Notes: Introduction To Accounting and BusinessRoma Kristina BuloranPas encore d'évaluation

- Accounting Lesson Balance Sheet and Income StatementDocument7 pagesAccounting Lesson Balance Sheet and Income StatementSagar Sachdeva100% (2)

- Comprehensive Accounting Cycle Review Problem-1Document11 pagesComprehensive Accounting Cycle Review Problem-1api-296886708100% (1)

- STANDARD BANK Co Applicant Application FormDocument4 pagesSTANDARD BANK Co Applicant Application Formpokipanda69100% (1)

- MGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentDocument8 pagesMGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentKaran TrivediPas encore d'évaluation

- MIDTERMDocument23 pagesMIDTERMJanine LerumPas encore d'évaluation

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaPas encore d'évaluation

- PersonalFN Services GuideDocument4 pagesPersonalFN Services GuideafsplPas encore d'évaluation

- Agreed Upn Procedures Report 3 PDFDocument4 pagesAgreed Upn Procedures Report 3 PDFirfanPas encore d'évaluation

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelPas encore d'évaluation

- MOA As Per New Companies Act 2013Document5 pagesMOA As Per New Companies Act 2013Pawan KumarPas encore d'évaluation

- Auditing Chapters 1,2,17 ExamDocument4 pagesAuditing Chapters 1,2,17 Examaprilkathryn2_954243Pas encore d'évaluation

- CAEmploymentGuide2014 PDF 23april2014Document156 pagesCAEmploymentGuide2014 PDF 23april2014Jessica100% (1)

- Lesson 1 Definition of Finance Goals of The Financial ManagerDocument14 pagesLesson 1 Definition of Finance Goals of The Financial ManagerJames Deo CruzPas encore d'évaluation

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonPas encore d'évaluation

- 1 BusinessModelsBusinessStrategyInnovationDocument23 pages1 BusinessModelsBusinessStrategyInnovationflorenciaPas encore d'évaluation

- Republic Glass Corporation VS QuaDocument1 pageRepublic Glass Corporation VS QuaEarl LarroderPas encore d'évaluation

- Republic Vs CaguioaDocument6 pagesRepublic Vs CaguioaKim Lorenzo CalatravaPas encore d'évaluation

- Oberoi Realty Initiation ReportDocument16 pagesOberoi Realty Initiation ReportHardik GandhiPas encore d'évaluation

- 9 2023 1 06 27 AmDocument1 page9 2023 1 06 27 Amowei prosperPas encore d'évaluation

- Activity Questions 6.1 Suggested SolutionsDocument6 pagesActivity Questions 6.1 Suggested SolutionsSuziPas encore d'évaluation

- Bulkowsky PsicologiaDocument41 pagesBulkowsky Psicologiaamjr1001Pas encore d'évaluation

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- Optimal Capital Structure Is The Mix of Debt and Equity ThatDocument29 pagesOptimal Capital Structure Is The Mix of Debt and Equity ThatdevashneePas encore d'évaluation

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimPas encore d'évaluation

- ICCR DeputationDocument4 pagesICCR DeputationsmPas encore d'évaluation

- Acquisition of Merrill Lynch by Bank of AmericaDocument26 pagesAcquisition of Merrill Lynch by Bank of AmericaNancy AggarwalPas encore d'évaluation

- Updated VAT Rate 2018 PDFDocument6 pagesUpdated VAT Rate 2018 PDFAbdusSubhanPas encore d'évaluation

- Meaning of Financial StatementsDocument2 pagesMeaning of Financial StatementsDaily LifePas encore d'évaluation

- Ubte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Document18 pagesUbte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Jyiou YimushiPas encore d'évaluation

- Santa Clara County (CA) FY 2013 Recommended BudgetDocument720 pagesSanta Clara County (CA) FY 2013 Recommended Budgetwmartin46Pas encore d'évaluation

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288Pas encore d'évaluation

- Advanced Accounting MCQ Part-IDocument8 pagesAdvanced Accounting MCQ Part-ISavani KibePas encore d'évaluation