Académique Documents

Professionnel Documents

Culture Documents

As A Preliminary To Requesting Budget Estimates of Sales

Transféré par

Chiodos OliverDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

As A Preliminary To Requesting Budget Estimates of Sales

Transféré par

Chiodos OliverDroits d'auteur :

Formats disponibles

1.

As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 2011, the following tentative trial balance as of December 31, 2010, is prepared by the Accounting Department of Spring Garden Soap Co.:

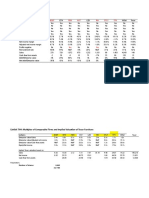

Factory output and sales for 2011 are expected to total 225,000 units of product, which are to be sold at $5.20 per unit. The quantities and costs of the inventories at December 31, 2011, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows:

Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of $90,000 on 2011 taxable income will be paid during 2011. Regular quarterly cash dividends of $1.00 a share are expected to be declared and paid in March, June, September, and December on 19,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for $75,000 cash in May. a. b. Prepare a budgeted income statement for 2011. Prepare a budgeted balance sheet as of December 31, 2011,with supporting calculations

2.

The controller of Sedona Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information:

The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $25,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in July, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of March 1 include cash of $30,000, marketable securities of $105,000, and accounts receivable of $750,000 ($600,000 from February sales and $150,000 from January sales). Sales on account for January and February were $500,000 and $600,000, respectively. Current liabilities as of March 1 include a $120,000, 15%, 90- day note payable due May 20 and $60,000 of accounts payable incurred in February for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. It is expected that $1,800 in dividends will be received in March. An estimated income tax payment of $46,000 will be made in April. Sedonas regular quarterly dividend of $12,000 is expected to be declared in April and paid in May. Management desires to maintain a minimum cash balance of $40,000. Prepare a monthly cash budget and supporting schedules for March, April, and May.

3.

The controller of Dash Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information:

The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in February, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of June 1 include cash of $45,000, marketable securities of $65,000, and accounts receivable of $143,400 ($105,000 from May sales and $38,400 from April sales). Sales on account in April and May were $96,000 and $105,000, respectively. Current liabilities as of June 1 include a $60,000, 12%, 90-day note payable due August 20 and $8,000 of accounts payable incurred in May for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. It is expected that $3,500 in dividends will be received in June. An estimated income tax payment of $18,000 will be made in July. Dash Shoes regular quarterly dividend of $8,000 is expected to be declared in July and paid in August. Management desires to maintain a minimum cash balance of $35,000. Prepare a monthly cash budget and supporting schedules for June, July, and August 2010.

4.

Rejuvenation Physical Therapy Inc. is planning its cash payments for operations for the third quarter (July September), 2011. The Accrued Expenses Payable balance on July 1 is $24,000. The budgeted expenses for the next three months are as follows:

Other operating expenses include $10,500 of monthly depreciation expense and $600 of monthly insurance expense that was prepaid for the year on March 1 of the current year. Of the remaining expenses, 70% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on July 1 relates to the expenses incurred in June. Prepare a schedule of cash payments for operations for July, August, and September. 5. Office Mate Supplies Inc. has cash and carry customers and credit customers. Office Mate estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 20% pay their accounts in the month of sale, while the remaining 80% pay their accounts in the month following the month of sale. Projected sales for the first three months of 2010 are as follows:

The Accounts Receivable balance on July 31, 2010, was $200,000. Prepare a schedule of cash collections from sales for August, September, and October.

Vous aimerez peut-être aussi

- Hilton7e SM Ch06 Final RevisedDocument82 pagesHilton7e SM Ch06 Final RevisedJohn100% (4)

- Accounting PS03Document3 pagesAccounting PS03G. I. IvanovPas encore d'évaluation

- 6 BudgetingDocument2 pages6 BudgetingClyette Anne Flores BorjaPas encore d'évaluation

- Cash Budget Problem 1. Mercury Shoes IncDocument7 pagesCash Budget Problem 1. Mercury Shoes IncMaritess Munoz100% (1)

- Cash BudgetDocument3 pagesCash BudgetJann Kerky0% (1)

- CH 11 - Smartbook Accounting 201Document6 pagesCH 11 - Smartbook Accounting 201Gene'sPas encore d'évaluation

- Short Term Financial PlanningDocument8 pagesShort Term Financial PlanningHassan MohsinPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- SAMPLE Church Accounting Policies and Procedures ManualDocument36 pagesSAMPLE Church Accounting Policies and Procedures ManualFaith Joel Shimba100% (3)

- 6int 2005 Jun QDocument9 pages6int 2005 Jun Qapi-19836745Pas encore d'évaluation

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- Cash BudetDocument1 pageCash BudetHasan JamilPas encore d'évaluation

- AccountingDocument14 pagesAccountingDavid DavidPas encore d'évaluation

- Cash BudgetDocument2 pagesCash BudgetYu BabylanPas encore d'évaluation

- Selected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamDocument4 pagesSelected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamAdam Khaleel0% (1)

- God Is GoodDocument12 pagesGod Is GoodBekama Abdii Koo TesfayePas encore d'évaluation

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamPas encore d'évaluation

- Ex06 - Comprehensive BudgetingDocument14 pagesEx06 - Comprehensive BudgetingANa Cruz100% (2)

- Nordic CompanyDocument6 pagesNordic CompanySally ZansPas encore d'évaluation

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesPas encore d'évaluation

- Lecture Budgeting Trading Co 205Document4 pagesLecture Budgeting Trading Co 205Sh Mati Elahi0% (3)

- Cost II Chap3Document11 pagesCost II Chap3abelPas encore d'évaluation

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- 6e Brewer CH07 B EOCDocument20 pages6e Brewer CH07 B EOCLiyanCenPas encore d'évaluation

- Completing A Master BudgetDocument2 pagesCompleting A Master BudgetPines MacapagalPas encore d'évaluation

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cash BudgetDocument2 pagesCash BudgetanupsuchakPas encore d'évaluation

- Budget Assignment VaDocument4 pagesBudget Assignment Vamiss independent0% (1)

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanPas encore d'évaluation

- Instructions ACCT 505 Project ADocument3 pagesInstructions ACCT 505 Project ANot listingPas encore d'évaluation

- Preparation of Cash BudgetDocument3 pagesPreparation of Cash BudgetFaye RoceroPas encore d'évaluation

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- BFIN400 Quiz One V3Document1 pageBFIN400 Quiz One V3Mohammad Al AkoumPas encore d'évaluation

- Master Budget With Supporting SchedulesDocument15 pagesMaster Budget With Supporting Schedulesanika fierroPas encore d'évaluation

- Cost and Management Accounting II AssignmentDocument8 pagesCost and Management Accounting II AssignmentbetsegawabebeaPas encore d'évaluation

- 55 - Chapter 7 HomeworkDocument2 pages55 - Chapter 7 Homeworkgio gioPas encore d'évaluation

- CP 7 TemplatesDocument13 pagesCP 7 Templatessunnitd10Pas encore d'évaluation

- Cost Accounting - Cash BudgetDocument4 pagesCost Accounting - Cash BudgetRealGenius (Carl)Pas encore d'évaluation

- 1 - MB Group Assignment I 21727Document2 pages1 - MB Group Assignment I 21727RoPas encore d'évaluation

- Review Problem: Budget Schedules: RequiredDocument9 pagesReview Problem: Budget Schedules: Requiredalice horanPas encore d'évaluation

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaPas encore d'évaluation

- Quiz Budgeting and Standard CostingDocument2 pagesQuiz Budgeting and Standard CostingAli SwizzlePas encore d'évaluation

- Op Budget SampleDocument2 pagesOp Budget SampleAngelica MalpayaPas encore d'évaluation

- Day 12 Chap 7 Rev. FI5 Ex PRDocument11 pagesDay 12 Chap 7 Rev. FI5 Ex PRkhollaPas encore d'évaluation

- Cash Budgeting TutorialDocument4 pagesCash Budgeting Tutorialmichellebaileylindsa100% (1)

- CAT T-10 Mock TestDocument4 pagesCAT T-10 Mock TestPrashant PokharelPas encore d'évaluation

- Asignación 4 LSFPDocument3 pagesAsignación 4 LSFPElia SantanaPas encore d'évaluation

- KorpratsiDocument4 pagesKorpratsidelgermurun deegiiPas encore d'évaluation

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

- Master Budget AssignmentDocument1 pageMaster Budget AssignmentAbreham AwokePas encore d'évaluation

- AE24 Lesson 5Document9 pagesAE24 Lesson 5Majoy BantocPas encore d'évaluation

- GA5 - Master Budget - QuesDocument3 pagesGA5 - Master Budget - QuesThy Hoang GiaPas encore d'évaluation

- Accmana Exercise Master Budget AY 2016Document2 pagesAccmana Exercise Master Budget AY 2016NaomiGeronimoPas encore d'évaluation

- Master Budget Exercise - Royal Case - QUESTIONDocument3 pagesMaster Budget Exercise - Royal Case - QUESTIONAzka Feba Fadil Muhammad0% (2)

- Week 7 - Master Budget Activity IVDocument11 pagesWeek 7 - Master Budget Activity IVgabrielPas encore d'évaluation

- Financial AssumptionsDocument13 pagesFinancial AssumptionsnorliePas encore d'évaluation

- Cash BudgetingDocument6 pagesCash BudgetingTalha Idrees100% (1)

- Auditing 2019 P S CH 8Document16 pagesAuditing 2019 P S CH 8barakat801Pas encore d'évaluation

- Problem 1: It Is Required To PrepareDocument7 pagesProblem 1: It Is Required To PrepareGaurav ChauhanPas encore d'évaluation

- Course Project A - ACCT505Document3 pagesCourse Project A - ACCT505xlh1hdv50% (2)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetD'EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetPas encore d'évaluation

- Tools to Beat Budget - A Proven Program for Club PerformanceD'EverandTools to Beat Budget - A Proven Program for Club PerformancePas encore d'évaluation

- ObjectivesDocument1 pageObjectivesChiodos OliverPas encore d'évaluation

- Reference LinksDocument1 pageReference LinksChiodos OliverPas encore d'évaluation

- CSSSample SpecificationsDocument1 pageCSSSample SpecificationsChiodos OliverPas encore d'évaluation

- Absorption Costing and Variable CostingDocument4 pagesAbsorption Costing and Variable CostingChiodos OliverPas encore d'évaluation

- Absorption Costing and Variable CostingDocument4 pagesAbsorption Costing and Variable CostingChiodos OliverPas encore d'évaluation

- Cost Behavior and CVPDocument4 pagesCost Behavior and CVPChiodos OliverPas encore d'évaluation

- Income From Employment FormatDocument3 pagesIncome From Employment FormatsatyaPas encore d'évaluation

- Financial Reeporting: February 2022 EditionDocument169 pagesFinancial Reeporting: February 2022 EditionAnu GraphicsPas encore d'évaluation

- Problem Chapter Iii: Report of Condition Total Assets $2,500Document7 pagesProblem Chapter Iii: Report of Condition Total Assets $2,500Nhựt AnhPas encore d'évaluation

- Topic 9 PartnershipDocument24 pagesTopic 9 PartnershipWong Yong Sheng WongPas encore d'évaluation

- Assignment From Text P2Document3 pagesAssignment From Text P2pedroPas encore d'évaluation

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Alternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIDocument4 pagesAlternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIgeethPas encore d'évaluation

- Philippine Constitution Association v. Enriquez 1994Document31 pagesPhilippine Constitution Association v. Enriquez 1994edwardmlimPas encore d'évaluation

- Cash Flow FormulaDocument2 pagesCash Flow FormulaSubhas ChettriPas encore d'évaluation

- Answer (Question) MODULE 4 - Quiz 2Document2 pagesAnswer (Question) MODULE 4 - Quiz 2kakaoPas encore d'évaluation

- Inventory ModelsDocument38 pagesInventory ModelsAngela MenesesPas encore d'évaluation

- J and Vlack Income Statement 3 Months Acquisition of Assets/ Payment For Pre-Operating ExpensesDocument8 pagesJ and Vlack Income Statement 3 Months Acquisition of Assets/ Payment For Pre-Operating ExpensesPrincess HernandezPas encore d'évaluation

- LM Business Finance Q3 W6 8 Module 8Document17 pagesLM Business Finance Q3 W6 8 Module 8Minimi LovelyPas encore d'évaluation

- Prof. (DR.) Paresh Shah: Fundamentals of Accounts and Finance Part I - Basics of AccountingDocument18 pagesProf. (DR.) Paresh Shah: Fundamentals of Accounts and Finance Part I - Basics of AccountingParesh ShahPas encore d'évaluation

- Food and Beverage Management AssignmentDocument7 pagesFood and Beverage Management AssignmentKuda L-jay MugairiPas encore d'évaluation

- Accountancy Master Test 4 PDFDocument5 pagesAccountancy Master Test 4 PDFRaghav PrajapatiPas encore d'évaluation

- Review of Income Tax Reporting For Individuals & Corporate TaxpayersDocument159 pagesReview of Income Tax Reporting For Individuals & Corporate TaxpayersRyan Christian BalanquitPas encore d'évaluation

- Cap 16A The Council of Legal Education ActDocument10 pagesCap 16A The Council of Legal Education ActEkai NabenyoPas encore d'évaluation

- FM - 200 MCQDocument41 pagesFM - 200 MCQmangesh75% (12)

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaPas encore d'évaluation

- Preweek Auditing Problems 2014 PDFDocument41 pagesPreweek Auditing Problems 2014 PDFalelliePas encore d'évaluation

- Account Model QuestionsDocument41 pagesAccount Model QuestionsPrerana NepaliPas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- AFA 100 - Chapter 1 NotesDocument4 pagesAFA 100 - Chapter 1 NotesMichaelPas encore d'évaluation

- Chapter 2 Accounting Policies, Change in Estimates and ErrorsDocument26 pagesChapter 2 Accounting Policies, Change in Estimates and ErrorsAklil TeganewPas encore d'évaluation

- Employment QuestionDocument14 pagesEmployment QuestionAnusha carkeyPas encore d'évaluation