Académique Documents

Professionnel Documents

Culture Documents

Basics On Derivatives

Transféré par

Sandeep BorseTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Basics On Derivatives

Transféré par

Sandeep BorseDroits d'auteur :

Formats disponibles

Only for Distributors (not for public circulation)

Basics on Derivatives

Introduction to Derivatives Derivatives! Well they are everywhere nowadays. Everybody wants to know about them, everybody wants to talk about them. This note seeks to provide an insight into the basics of derivatives - What are they? How are they used? and so on. A derivative is an instrument whose value is derived from the value of underlying, which can be equity/ stocks, commodities, currency, bonds, etc. Why are Derivatives Used? To manage Risk To speculate (taking a view on the future direction of the market) To change the nature of the liability &/or an investment Some common examples of derivative Forwards Futures Options Types of Traders Hedgers- Who seek to manage risk Speculators- who seek to profit by taking a view on future market direction Arbitrageur- who seeks to earn risk-free profits Forward & Futures Forward Contract Shyam wants to buy a TV, which costs Rs 10,000 but he has no cash to buy it immediately. He can only buy it 1 month from today when he gets his salary. He, however, fears that price of television might rise in the forthcoming budget which is due exactly 1 month from today.

So in order to protect himself from the rise in prices, Shyam enters into a contract with the TV Dealer which will enable him to buy the TV exactly 1 month from now, when he gets his salary for Rs 10,000. By entering into this contract Shyam has locked the current price of a TV for a forward contract. The dealer will deliver the TV to Shyam at the end of one month and Shyam in turn will pay cash to the TV Dealer on delivery. A forward contract is a customized contract between two parties, where settlement takes place on a specific date in future at a price agreed today Or It is an agreement to buy or sell an asset at a certain future time for certain pre-agreed price Future Contracts The above transaction becomes a future contract if the same happens through an intermediary. Therefore the differentiating factor in this contract is the terms of the contract and the existence of an intermediary which helps to do away with the risk of default by either of the parties involved in the transaction. Intermediary can be a Clearing House/ the exchange. Therefore a forward/ futures contract is an agreement To buy (long) or sell (short), An asset (underlying), At a predetermined price (forward/future price), On a specific date (maturity). Illustration I enter into a contract today: To buy 100 shares of Reliance At a price agreed now, say at Rs 720 per share One month from now

After 1 month, I would Make a profit if the spot price is more than the agreed Delivery Price (Rs 720 per share) Make a loss if the spot price is less than the agreed Delivery price ( Rs 720 per share) Difference between Forward and Future contracts

Contract Type Counter party Risk

Forward Customized (Negotiated) Exists (either parties to the contract can default)

Futures Standardized by the exchange Nil, as it gets transferred to Exchange/Clearing House High Transparent due to standardization and market reporting Reversed with any member of the exchange.

Liquidity Contract Price

Low Generally not available in public domain

Settlement of Contract

Reversed only with the same counter party with whom it was entered into.

Options Illustration An Oil Manufacture produces oil at a cost of $40 per barrel but he fears that the oil prices will go down in near future. In order to limit his losses he would want to lock in the sale price of the Oil manufactured by him. This manufacturer enters into a contract of selling the Oil at $40 per barrel to another party in near future. He incurs an expense of $2 per barrel to enter into this contract. This contract gives the manufacturer the right to sell Oil at an agreed price of $40 to another party if the oil prices go down in near future and forgo the cost of $2 per barrel. But if the Oil prices rise in near future contrary to his expectations, he always has an option of not executing this transaction and lose at the most $2 per barrel.

Therefore an Option is a contract which gives the buyer/ holder the right to buy (call option) or to sell (put option) a specified underlying asset at a certain price (strike) on or before a specified date (maturity)

To acquire this right, the buyer pays a premium to the seller/ writer of that right Parties to Options Transaction Buyer or holder of an option Seller or the writer of an option The clearing house (in case of exchange traded funds)

To begin, there are two kinds of options: Call Option and Put Option. Call Option: A Call Option is an option to buy a stock or any underlying at a specific price on or before certain date or in simple words it is the right to purchase a specified stock. Illustration: Mr. Kumar purchases a December call option at Rs 40 by paying a premium of Rs 15 That is, he has purchased the right to buy that share for Rs 40 in December. If the stock rises above Rs 55 (40+15) he will break even (neither gain nor make a loss) and he will start making a profit. Suppose the stock does not rise and instead falls he will choose not to exercise the option and forego the premium of Rs 15 which he has paid. Call Options-Long & Short Positions If you have a bullish view- i.e., when you expect price to rise, you take a long position by buying calls. If you have a bearish view- i.e., when you expect prices to fall, you take a short position by selling calls.

Put option: Put Options are options to sell a stock at a specific price on or before a certain date or in simple words it is the right to sell a specified stock. Illustration: Mr. Kumar is of the view that the a stock is overpriced and will fall in future, but he does not want to take the risk in the event of price falling so he buys a put option at Rs 70. By purchasing the put option Mr. Kumar has the right to sell the stock at Rs 70 but he has to pay a premium of Rs 15. So he will breakeven (neither gain nor make a loss) only after the stock falls below Rs 55 (70-15) and will start making profit if the stock falls below Rs 55. Put Options-Long & Short Positions If you have a bearish view- i.e., when you expect prices to fall, then you take a long position by buying Puts. If you have a bullish view- i.e., when you expect price to rise, then you take a short position by selling Puts.

Buying options is like buying insurance policies If one buys a car along with auto insurance, he pays an insurance premium and would therefore be protected if his car is damaged in an accident. If case of any mishap, he can use his policy to regain the insured value of the car. On the other hand if nothing happens and all goes well, the insurance cover is not used, the insurance company keeps your premium in return for taking on the risk. Moneyness of an Option In the Money- Profitable to exercise the option At the Money- No loss No Profit in exercising the option Out of the Money- Not profitable to exercise the option

Summing up - Options

OPTIONS If you expect a fall in price (Bearish) If you expect a rise in price (Bullish)

CALL OPTIONS Short Long

PUT OPTIONS Long Short

Exposures to Options

CALL OPTION BUYER

CALL OPTION WRITER (Seller)

Pays premium Right to exercise and buy the shares Profits from rising prices Limited gain losses, Potentially unlimited

Receives premium Obligation to sell shares if exercised Profits from falling prices or remaining neutral Potentially unlimited losses, limited gain

PUT OPTION BUYER

PUT OPTION WRITER (Seller)

Pays premium Right to exercise and sell shares Profits from falling prices Limited gain losses, Potentially unlimited

Receives premium Obligation to buy shares if exercised Profits from rising prices or remaining neutral Potentially unlimited losses, limited gain

Difference between Futures and options

Contract Obligation of Buyer & Seller

Options In case of options the buyer enjoys the right & not the obligation, to buy or sell the underlying asset.

Futures Both the buyer and seller are obligated to buy/sell the underlying asset.

An insight into Hedging and Short Selling Hedging: A strategy used to offset/ minimize market risk, whereby one position protects another. Therefore Long Hedge- To lock in a buying price Short Hedge- To lock in a selling price Derivatives instruments are used to minimize the downside risk on existing portfolio by entering into following transactions: Strategies Selling Index futures and calls Selling stock (that the fund owns) futures and calls Buy put option on index and stocks (that the fund owns)

Illustration Let the Spot price of XYZ stock be Rs 100 You enter into a contract to buy put option of XYZ stock at a strike price of Rs 100 by paying a premium of Re 1. If market goes down in the short term & XYZ stock declines to Rs 95 then on the holding side you will have a loss of Rs 5 per share However on the put option he has gross profit of Rs 5 per share and after deducting the premium for buying the put option you will make a net profit of Rs 4 on the put option side. So effectively your loss of Rs 5 per share (on holding side) is compensated to the extent of Rs 4 (on Option side) by buying the Put.

As a result the loss has been reduced or minimized by buying put options when the view on the stock is bearish or market is expected to go down in short term.

Net profit or loss if we buy put option in the above example= profit on put - loss on holding

= (strike price - current price-premium) - loss on holding = (100-95-1)-5 = 4-5 Loss= 1 So it is clear that by buying a put option the loss has been reduced to Re 1 per share which would have been Rs 5 per share had you not bought the put option. Short Selling: Short selling is the selling of a security that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller, but that is promised to be delivered. The selling of a security that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short sellers assume that they will be able to buy the stock at a lower amount than the price at which they sold short. When an investor goes short, he is anticipating a decrease in share price. That is, short sellers make money if the stock goes down in price. Conversely, when an investor goes long on an investment, it means that he has bought a security believing its price will rise in the future. Therefore, Selling short is the opposite of going long. Strategies Selling any Index futures and calls Selling stock (that the fund does not own) futures and calls Buy put option on index and stocks (that the fund does not own)

Sell stock futures If you expect that market may go down which will drag down the price of XYZ stock then he can straight forward sell a future of stock XYZ. You enter into a contract to sell futures of XYZ at a strike price of Rs 100. Now if the price of XYZ stock goes down, you will cover the short position by buying the future at the lower price. The difference between the selling price and buying price will be the profit.

Glossary Bear market: A market in which prices are declining. Bull market: A market in which prices are rising. Clearinghouse: An organisation connected with futures exchange through which all contracts are reconciled, settled, guaranteed and later either offset or fulfilled through delivery or cash settlement. Its function is to manage the margin and delivery systems, as well as to guarantee performance of exchange traded contracts. Counterparty: The other party (buyer or seller) to a transaction. Counterparty risk: The risk the counterparty will not fulfill the terms of the contract. Also called default risk. Exercise: To implement the right under which the holder of an option is entitled to buy (in the case of a call) or sell (in the case of a put) the underlying security Mark-to-market: The daily adjustment of margin accounts to reflect profits and losses. Underlying: It is the specific security / asset on which any contract is based on. Option Premium: Premium is the price paid by the buyer to the seller to acquire the right to buy or sell Strike Price or Exercise Price: The strike or exercise price of an option is the specified/ predetermined price of the underlying asset at which the same can be bought or sold if the option buyer exercises his right to buy/ sell on or before the expiration day. Expiration date: The date on which the option expires is known as Expiration Date. On Expiration date, either the option is exercised or it expires worthless. Option Holder: is the one who buys an option which can be a call or a put option. He enjoys the right to buy or sell the underlying asset at a specified price on or before specified time. His upside potential is unlimited while losses are limited to the Premium paid by him to the option writer. Option seller/ writer: is the one who is obligated to buy (in case of Put option) or to sell (in case of call option), the underlying asset in case the buyer of the option decides to exercise his option. His profits are limited to the premium received from the buyer while his downside is unlimited. Call Option - Option to buy. Put Option - Option to sell. Exercise Date - Date on which the option gets exercised by the option holder/buyer.

Sponsor: Reliance Capital Limited. Trustee: Reliance Capital Trustee Co. Limited. Investment Manager: Reliance Capital Asset Management Limited. Statutory Details: The Sponsor, the Trustee and the Investment Manager are incorporated under the Companies Act 1956. GENERAL RISK FACTORS: Mutual Funds and securities investments are subject to market risks and there is no assurance or guarantee that the objectives of the Scheme will be achieved. As with any investment in securities, the NAV of the Units issued under the Scheme can go up or down depending on the factors and forces affecting the capital markets. Past performance of the Sponsor/AMC/Mutual Fund is not indicative of the future performance of the Scheme. Reliance Equity Fund, Reliance Tax Saver (ELSS) Fund, Reliance Growth Fund, Reliance Vision Fund, Reliance Banking Fund, Reliance Diversified Power Sector Fund, Reliance Pharma Fund ,Reliance Media & Entertainment Fund, Reliance NRI Equity Fund & Reliance Equity Opportunities Fund are only the names of the Schemes and do not in any manner indicate either the quality of the Scheme; it's future prospects or returns. The Sponsor is not responsible or liable for any loss resulting from the operation of the Scheme beyond their initial contribution of Rs.1 lakh towards the setting up of the Mutual Fund and such other accretions and additions to the corpus. The Mutual Fund is not guaranteeing or assuring any dividend/ bonus. The Mutual Fund is also not assuring that it will make periodical dividend/bonus distributions, though it has every intention of doing so. All dividend/bonus distributions are subject to the investment performance of the Scheme. For details of scheme features apart from those mentioned above and scheme specific risk factors, please refer to the provisions of the offer document. Offer Document and Key Information Memorandum cum Application Forms are available at AMC office/ Investor Service centres/AMC website / Distributors. The information contained herein is meant only for information purposes. The AMC/Mutual Fund/Trustees accept no liability for the accuracy or adequacy of the information. If you wish to take any action on the basis of information provided herein, you shall do it at your own risk. The information provided is collected from various sources & is provided on as is basis. Please read the offer document carefully before investing. This document is meant only for the distributors/agents of Reliance Mutual Fund and is not meant for circulation to the public. Any distributor/agent circulating the same shall be responsible for any loss/damages & RCAM/RMF does not take any responsibility for such Acts. The content in this document does not constitute any guidelines or recommendation on the course of action to be followed. These are not necessarily the views of Reliance Capital Asset Management Limited. Reliance Capital Asset Management Limited does not accept any responsibility/liability/obligations in respect of any information provided herein.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Landmark Capital - Fund BrochureDocument37 pagesLandmark Capital - Fund BrochureSandeep BorsePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Class Participation 9 E7-18: Last Name - First Name - IDDocument2 pagesClass Participation 9 E7-18: Last Name - First Name - IDaj singhPas encore d'évaluation

- Indiareit Apartment FundDocument18 pagesIndiareit Apartment FundSandeep BorsePas encore d'évaluation

- Editing For BeginnersDocument43 pagesEditing For BeginnersFriktPas encore d'évaluation

- HACCP Coconuts 2019Document83 pagesHACCP Coconuts 2019Phạm Hồng Ngân100% (4)

- TCRP Wheel Rail Noise ReportDocument220 pagesTCRP Wheel Rail Noise ReportAnonymous OmwbxkB100% (1)

- PDS Air CompressorDocument1 pagePDS Air Compressordhavalesh1Pas encore d'évaluation

- 40 MTCNA QuestionsDocument10 pages40 MTCNA QuestionsM Aris Firjatullah FirdausPas encore d'évaluation

- Gilt Funds Traling Returns From 2015Document2 pagesGilt Funds Traling Returns From 2015Sandeep BorsePas encore d'évaluation

- Eastings and NorthingsDocument1 pageEastings and NorthingsSandeep BorsePas encore d'évaluation

- Geography Worksheet IsceDocument1 pageGeography Worksheet IsceSandeep BorsePas encore d'évaluation

- Gilt Funds Trailing Returns From 2019Document2 pagesGilt Funds Trailing Returns From 2019Sandeep BorsePas encore d'évaluation

- 7th ScienceDocument22 pages7th ScienceSandeep BorsePas encore d'évaluation

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsDocument5 pagesARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorsePas encore d'évaluation

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Document1 pageCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorsePas encore d'évaluation

- Transactions - Apartment FundDocument5 pagesTransactions - Apartment FundSandeep BorsePas encore d'évaluation

- CCP - One PagerDocument1 pageCCP - One PagerSandeep BorsePas encore d'évaluation

- IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocument1 pageIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorsePas encore d'évaluation

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocument1 pageBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorsePas encore d'évaluation

- PolicySchedule PDFDocument1 pagePolicySchedule PDFSandeep Borse100% (1)

- Asset AllocationDocument29 pagesAsset AllocationSandeep BorsePas encore d'évaluation

- Kalpataru AvanaDocument46 pagesKalpataru AvanaSandeep BorsePas encore d'évaluation

- Adil Sip FormDocument2 pagesAdil Sip FormSandeep BorsePas encore d'évaluation

- Neelkanth Woods, FLAT NO. 1003 (3 BHK) : ST ST ND TH TH TH TH TH TH TH TH TH ND TH THDocument1 pageNeelkanth Woods, FLAT NO. 1003 (3 BHK) : ST ST ND TH TH TH TH TH TH TH TH TH ND TH THSandeep BorsePas encore d'évaluation

- A Discussion On Mutual Funds: With The Employees of HSBCDocument57 pagesA Discussion On Mutual Funds: With The Employees of HSBCSandeep BorsePas encore d'évaluation

- WB BRR 8495948180Document672 pagesWB BRR 8495948180Sandeep BorsePas encore d'évaluation

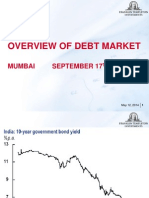

- Birla Meeting Sept 031Document19 pagesBirla Meeting Sept 031Sandeep BorsePas encore d'évaluation

- What Will Be The Impact of WTC Attack On Global MarketsDocument28 pagesWhat Will Be The Impact of WTC Attack On Global MarketsSandeep BorsePas encore d'évaluation

- Application For Leave - EODocument1 pageApplication For Leave - EOcomelec carmenPas encore d'évaluation

- Arvind Textiles Internship ReportDocument107 pagesArvind Textiles Internship ReportDipan SahooPas encore d'évaluation

- Technical Report: Determination of The Resistance To DelaminationDocument4 pagesTechnical Report: Determination of The Resistance To DelaminationStefan NaricPas encore d'évaluation

- Exit Exam Plan (New)Document2 pagesExit Exam Plan (New)Eleni Semenhi100% (1)

- Assignment Mid Nescafe 111173001Document5 pagesAssignment Mid Nescafe 111173001afnan huqPas encore d'évaluation

- Research On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaDocument5 pagesResearch On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaSiddharth ChaudharyPas encore d'évaluation

- Marc-André Ter Stegen PES 2021 StatsDocument1 pageMarc-André Ter Stegen PES 2021 StatsSom VasnaPas encore d'évaluation

- Ranking - Best Multivitamins in 2018Document7 pagesRanking - Best Multivitamins in 2018JosephVillanuevaPas encore d'évaluation

- A Packed Cultural Calendar - The Indian Music and Dance Festivals You Shouldn't Miss - The HinduDocument6 pagesA Packed Cultural Calendar - The Indian Music and Dance Festivals You Shouldn't Miss - The HindufisaPas encore d'évaluation

- Goal of The Firm PDFDocument4 pagesGoal of The Firm PDFSandyPas encore d'évaluation

- ADocument2 pagesAẄâQâŗÂlïPas encore d'évaluation

- DuraBlend 4T Newpi 20W50Document2 pagesDuraBlend 4T Newpi 20W50Ashish VashisthaPas encore d'évaluation

- Analisa SWOT Manajemen Pendidikan Di SMK Maarif 1 KebumenDocument29 pagesAnalisa SWOT Manajemen Pendidikan Di SMK Maarif 1 Kebumenahmad prayogaPas encore d'évaluation

- HP-exampleDocument30 pagesHP-exampleAnonymous 105zV1Pas encore d'évaluation

- Microsoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeDocument2 pagesMicrosoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeOmar PiñaPas encore d'évaluation

- 09 20 17Document26 pages09 20 17WoodsPas encore d'évaluation

- Orange Stripe # 57 EnglishDocument2 pagesOrange Stripe # 57 EnglishShahid RazaPas encore d'évaluation

- Effect of End Blocks On Anchorage Zone Stresses in Prestressed Concrete GirdersDocument15 pagesEffect of End Blocks On Anchorage Zone Stresses in Prestressed Concrete Girdersrohit kumarPas encore d'évaluation

- Normas FieldbusDocument3 pagesNormas FieldbusAlielson PazPas encore d'évaluation

- Food Truck Ordinance LetterDocument7 pagesFood Truck Ordinance LetterThe Daily News JournalPas encore d'évaluation

- Outline - Essay and Argumentative EssayDocument2 pagesOutline - Essay and Argumentative EssayGabbo GómezPas encore d'évaluation

- Latest Eassy Writing Topics For PracticeDocument18 pagesLatest Eassy Writing Topics For PracticeAnjani Kumar RaiPas encore d'évaluation

- Bank Soal LettersDocument17 pagesBank Soal Lettersderoo_wahidahPas encore d'évaluation

- 00 Saip 76Document10 pages00 Saip 76John BuntalesPas encore d'évaluation