Académique Documents

Professionnel Documents

Culture Documents

H6 - Method Reserve Product

Transféré par

anc_k17Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

H6 - Method Reserve Product

Transféré par

anc_k17Droits d'auteur :

Formats disponibles

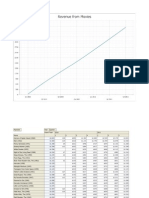

Product Long-term, Non-YRT

Reserve Old regulation (KMK 424/ 2003) New Regulation (PMK 53/2012) Net Level Premium/ Zillmer: Gross Premium Valuation: Premium Reserve = PV of Future Benefit PV Premium Reserve = (PV of Cash-out PV of Future Premium + amortization of 1st year Cash-in) + PAD at 75% CI expenses of minimum 30 Sum Assured Discount rate used is maximum at average of Discount rate used is maximum at 9% (IDR), : average 3 years Yield of Government bond 5% (USD) (benchmark series) + 0.5% Reserve = UPR + IBNR + RNYA UPR should be higher or equal to 40% of Net Premium Reserve = UPR + IBNR + RNYA UPR = Max { UPR pro-rate, URR} UPR pro-rate should be higher or equal to pro-rate of Net of Comm Gross Premium (daily basis) o Comm max = 20% * Gross Premium URR = Unexpired Loss + Unexpired Expense + 75% PAD Subject to: (a) No Negative Reserves, (b) Reserve > Premium Refund

Short-term, YRT

I.

Short-term (up to 1 year) and Renewable Products

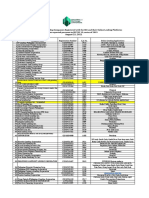

a. Method: The maximum between Unearned Premium Reserve and Unexpired Risk Reserve ST Reserve = Max (UPR; URR), where: UPR = (365 t )/365 x Gross Premium x (1 15% commission) URR = (365 t )/365 x Gross Premium x (Loss Ratio% x (1+PfAD%) + Expense Ratio%) The reserve is net of reinsurance Long-Term and Non-Renewable Products a. Method: Projected Net Cash-Flow (Gross Premium Valuation) b. Assumptions: Best-Estimate + PfAD c. Best Estimate Assumptions: Valuation Mortality Table Product Type Individual Life Group Life Credit Life (MRTA) TPD Critical Illness Expense Assumptions Product Type Acquisition Maintenance Mortality/Morbidity 100% CSO 1980 Ultimate 100% CSO 1980 Ultimate 100% Reinsurance Rate (ScoRe Vie) 100% TPD Ultimate 100% Critical Illness Ultimate

II.

per policy Non-Par IDR - Credit Life - Legacy Products - Regular Pay Unit Link Non-Par USD - Regular Pay Unit Link Par IDR - Group Endowment - Individual Endowment Par USD - Group Endowment - Individual Endowment Lapse Assumptions Product Type Non-Par IDR - Credit Life - Legacy Products Par IDR - Group Endowment - Individual Endowment Par USD - Group Endowment - Individual Endowment Lapse rate Regular Pay Unit Link (IDR and USD) Y-1 0 48 0 48 0 96 Y-1 25 200,000

% premium 5% 60% (Basic)/ 2% Top-UP 60% (Basic)/ 2% Top-UP 5% 5% -

per policy 7,000 10,000 100,000

% premium 5% 3% (Basic)/ 2% Top-UP 3% (Basic)/ 2% Top-UP 3% 5% 3% 5%

20

10

10,000 10,000 1 1

Lapse rate Y-2 0 18 0 18 0 40 Y-2 15

Y-3 .. 0 5 0 5 0 20 Y-3 12

Y-1 0 12 0 12 0 21 Y-4 5

PUP rate Y-2 0 5 0 5 0 10 Y-5 5

Y-3 .. 0 5 0 5 0 5 Y-6.. 5

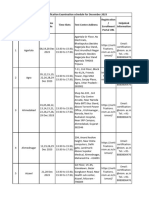

d. Provision for Adverse Deviation (PfAD)* PfADs Mortality Renewal Expenses Lapse

* PfAD is used as multiplication factor **for new RBC calculation purposes

75% Confidence level 10% 10% +/-15%

95% Confidence level** 10% 10% +/-15%

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Methods of Setting Reserves To Cover Ibnr Loss LiabilitiesDocument18 pagesMethods of Setting Reserves To Cover Ibnr Loss LiabilitiesAndrew A KiweluPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 4' &8Qnwog0Q: %Qnqtcfq5Rtkpiu/Ggvkpi, Wpgä 5guukqp2& /cpcikpi - Qpi6Gto%Ctg2Gtukuvgpe (4kumDocument22 pages4' &8Qnwog0Q: %Qnqtcfq5Rtkpiu/Ggvkpi, Wpgä 5guukqp2& /cpcikpi - Qpi6Gto%Ctg2Gtukuvgpe (4kumanc_k17Pas encore d'évaluation

- Best Estimate Loss Reserving An Actuarial PerspectiveDocument47 pagesBest Estimate Loss Reserving An Actuarial Perspectiveanc_k17Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Seminar Menghitung IBNRDocument19 pagesSeminar Menghitung IBNRRetno Dwi AndaniPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- MAXQDA10Coded SegmentsDocument3 pagesMAXQDA10Coded Segmentsanc_k17Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- DDDDocument4 pagesDDDanc_k17Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- CADANGAN!Document1 pageCADANGAN!anc_k17Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- IMPS Online SwitchingDocument91 pagesIMPS Online SwitchingGâñêsh Kâñøjíyâ100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Index: A Study of Credit Cards in Indian ScenarioDocument8 pagesIndex: A Study of Credit Cards in Indian Scenariorohit100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Analysis On The Basis of 7 Ps and SwotDocument28 pagesAnalysis On The Basis of 7 Ps and Swotvedanshjain100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Finacle Menu and TablesDocument71 pagesFinacle Menu and Tablescheluri_rubiyanaPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGirithar M SundaramPas encore d'évaluation

- Gic 115Document6 pagesGic 115Vilas DesaiPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Acknowledgement (Tanzil Khan - 14-97982-2)Document3 pagesAcknowledgement (Tanzil Khan - 14-97982-2)Md. Saiful IslamPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Attach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanDocument4 pagesAttach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanRovita TriyambudiPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- UNFFD Case Study Ethiopia PDFDocument13 pagesUNFFD Case Study Ethiopia PDFGondelcar1Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Document2 pagesList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Clark Adrian De Asis. Distor0% (1)

- Estate and Gift Tax Exam OutlineDocument55 pagesEstate and Gift Tax Exam OutlinejendiiPas encore d'évaluation

- FAR Study Plan - Becker 2018Document11 pagesFAR Study Plan - Becker 2018Gift ChaliPas encore d'évaluation

- 2090-1600-Const-T-03 R1Document497 pages2090-1600-Const-T-03 R1sefpl_delhi100% (1)

- HR DetailsDocument190 pagesHR DetailsMohit Yadav63% (8)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Document4 pagesJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nPas encore d'évaluation

- Master BudgetDocument6 pagesMaster BudgetPia LustrePas encore d'évaluation

- Rohan Dhall: Career SummaryDocument5 pagesRohan Dhall: Career SummarySudhir Kumar SinghPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Marketing Strategy of Axis Bank ( General Management) NewDocument39 pagesMarketing Strategy of Axis Bank ( General Management) NewrohitPas encore d'évaluation

- NEW Memorandum of LawDocument16 pagesNEW Memorandum of LawJohn Foster100% (3)

- Avishekh Idbi ProjectDocument43 pagesAvishekh Idbi ProjectzishanmallickPas encore d'évaluation

- Chapter 3Document2 pagesChapter 3saurabh hirekhanPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Level 3 Integrated Advisory ServicesDocument1 pageLevel 3 Integrated Advisory ServicesAce RamosoPas encore d'évaluation

- 15 Chapter 8Document66 pages15 Chapter 8Prabhu MoorthyPas encore d'évaluation

- 1 LicDocument1 page1 LicAshish BatraPas encore d'évaluation

- CFADocument2 pagesCFAedupristine6Pas encore d'évaluation

- Business - Public Storage Insurance Is A ScamDocument2 pagesBusiness - Public Storage Insurance Is A ScamEmpresarioPas encore d'évaluation

- December 2023 1Document41 pagesDecember 2023 1rs5002595Pas encore d'évaluation

- 03-Sep. Followup Call and LeadDocument5 pages03-Sep. Followup Call and Leadkrishna vermaPas encore d'évaluation

- Underwriting GuidelinesDocument6 pagesUnderwriting GuidelinesHitkaran Singh RanawatPas encore d'évaluation

- A Study On The Role of Bajaj Finserv in Consumer Durable FinanceeDocument58 pagesA Study On The Role of Bajaj Finserv in Consumer Durable Financeeshwetha17% (6)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)