Académique Documents

Professionnel Documents

Culture Documents

Act std4

Transféré par

Helen B. EvansTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Act std4

Transféré par

Helen B. EvansDroits d'auteur :

Formats disponibles

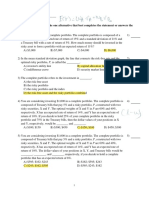

TUTORIAL 1 ECONOMICS OF RISK Where not specified, assume the utility formula for a portfolio with expected return

n E(r), standard deviation of return of , with investors risk aversion factor of A, is U = E(r) A2 Q1 C6-4 Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $70,000 or $200,000 with equal probabilities of .5. The alternative risk-free investment in Tbills pays 6% per year. a) If you require a risk premium of 8%, how much will you be willing to pay for the portfolio? b) Suppose that the portfolio can be purchased for the amount you found in ( a ). What will be the expected rate of return on the portfolio? c) Now suppose that you require a risk premium of 12%. What is the price that you will be willing to pay? d) Comparing your answers to ( a ) and ( c ), what do you conclude about the relationship between the required risk premium on a portfolio and the price at which the portfolio will sell? Q2 C6-5 Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 18%. T-bills offer a risk-free 7% rate of return. What is the maximum level of risk aversion for which the risky portfolio is still preferred to bills? Q3 C6-21 Consider the following information about a risky portfolio that you manage [E(r)=11%, = 15%], and a risk-free asset with E(r) = 5% a) Your client wants to invest a proportion of her total investment budget in your risky fund to provide an expected rate of return on her overall or complete portfolio equal to 8%. What proportion should she invest in the risky portfolio, P, and what proportion in the risk-free asset? b) What will be the standard deviation of the rate of return on her portfolio? c) Another client wants the highest return possible subject to the constraint that you limit his standard deviation to be no more than 12%. Which client is more risk averse? Q4 C6-CFA1-3 Use the following data in answering questions 4 to 6 Utility Formula = U = E(r) A2 where A = 4 Investment 1 2 3 4 E(r) 0.12 0.15 0.21 0.24 0.30 0.50 0.16 0.21

INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 1 Economics of Risk Page 1 of 3

Q5 C6-CFA1 On the basis of the utility formula above, which investment would you select if you were risk averse with A = 4? Q6 C6-CFA2 On the basis of the utility formula above, which investment would you select if you were risk neutral? Q7 C6-CFA3 The variable (A) in the utility formula represents the: a) investors return requirement. b) investors aversion to risk. c) certainty equivalent rate of the portfolio. d) preference for one unit of return per four units of risk. Q8 C6-CFA6 Given $100,000 to invest, what is the expected risk premium in dollars of investing in equities versus risk-free T-bills on the basis of the following table? Action Equities Tbills Probability 0.6 0.4 1 Expected return $50,000 -$30,000 $5,000

Q9 C6-CFA8 You manage an equity fund with an expected risk premium of 10% and an expected standard deviation of 14%. The rate on Treasury bills is 6%. Your client chooses to invest $60,000 of her portfolio in your equity fund and $40,000 in a T-bill money market fund. What is the expected return and standard deviation of return on your clients portfolio? Q10 C6-CCA1 Suppose the utility function is U(W) = a) What is the utility level at wealth levels $50,000 and $150,000? b) What is expected utility if probability of each wealth level in (a) above is 0.5? c) What is the certainty equivalent of the risky prospect? d) Does this utility function also display risk aversion? e) Does this utility function display more or less risk aversion than the log utility function? Q11 C6-A1 Suppose that your wealth is $250,000. You buy a $200,000 house and invest the remainder in a risk-free asset paying an annual interest rate of 6%. There is a probability of .001 that your house will burn to the ground and its value will be reduced to zero. With a log utility of end-of-year wealth [ie U = ln(wealth)], how much would you be willing to pay for insurance

INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 1 Economics of Risk Page 2 of 3

(at the beginning of the year)? (Assume that if the house does not burn down, its end-of-year value still will be $200,000.) Q12 C6-A2 If the cost of insuring your house is $1 per $1,000 of value, what will be the certainty equivalent of your end-of-year wealth if you insure your house at: a) its value. b) Its full value. c) 1 times its value.

INTRODUCTION TO ACTUARIAL SCIENCE 2013-14/S1: Tutorial 1 Economics of Risk Page 3 of 3

Vous aimerez peut-être aussi

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- EC3333 Midterm Fall 2014.questionsDocument7 pagesEC3333 Midterm Fall 2014.questionsChiew Jun SiewPas encore d'évaluation

- 4 - Problem - Set FRM - PS PDFDocument3 pages4 - Problem - Set FRM - PS PDFValentin IsPas encore d'évaluation

- Problem Set 4Document3 pagesProblem Set 4teoluoPas encore d'évaluation

- 435 Solution 3Document7 pages435 Solution 3Shahin Oing0% (1)

- Unit 2 Organisational CultureDocument28 pagesUnit 2 Organisational CultureJesica MaryPas encore d'évaluation

- Homework 1Document3 pagesHomework 1wrt.ojtPas encore d'évaluation

- Corporate Finance QuizDocument9 pagesCorporate Finance QuizRahul TiwariPas encore d'évaluation

- Ch6 Risk Aversion and Capital Allocation To Risky AssetsDocument28 pagesCh6 Risk Aversion and Capital Allocation To Risky AssetsAmanda Rizki BagastaPas encore d'évaluation

- Questões Cap6Document5 pagesQuestões Cap6João EspositoPas encore d'évaluation

- CML Vs SMLDocument9 pagesCML Vs SMLJoanna JacksonPas encore d'évaluation

- Tutorial 4 - SolutionsDocument7 pagesTutorial 4 - SolutionsstoryPas encore d'évaluation

- CFA Chapter Six PROBLEMS With SolutionsDocument3 pagesCFA Chapter Six PROBLEMS With SolutionsFagbola Oluwatobi OmolajaPas encore d'évaluation

- Practice 1Document3 pagesPractice 1Shahida Akter 1520691631Pas encore d'évaluation

- Tutorial 3-IpmDocument6 pagesTutorial 3-IpmNguyễn Phương ThảoPas encore d'évaluation

- Problem Set 1Document3 pagesProblem Set 1ikramraya0Pas encore d'évaluation

- HW01Document5 pagesHW01lhbhcjlyhPas encore d'évaluation

- Problem Set 2Document4 pagesProblem Set 2Omar SrourPas encore d'évaluation

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- Compared To Investing in A Single Security, Diversification Provides Investors A Way ToDocument8 pagesCompared To Investing in A Single Security, Diversification Provides Investors A Way ToDarlyn ValdezPas encore d'évaluation

- Chap 06Document32 pagesChap 06Mihai StoicaPas encore d'évaluation

- Tutorial Solutions2-1Document9 pagesTutorial Solutions2-1Yilin YANGPas encore d'évaluation

- Tutorial 4Document3 pagesTutorial 4Huế HoàngPas encore d'évaluation

- Topic 4 Tutorial QuestionsDocument2 pagesTopic 4 Tutorial QuestionsThirusha balamuraliPas encore d'évaluation

- #1 - Midterm Self Evaluation SolutionsDocument6 pages#1 - Midterm Self Evaluation SolutionsDionizioPas encore d'évaluation

- 313 Practice Exam III 2015 Solution 2Document9 pages313 Practice Exam III 2015 Solution 2Johan JanssonPas encore d'évaluation

- HWK2Document3 pagesHWK2inder3999Pas encore d'évaluation

- Homework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupDocument5 pagesHomework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupJosh GirnunPas encore d'évaluation

- FTX3044F Tutorial 7Document3 pagesFTX3044F Tutorial 7vrshaf001Pas encore d'évaluation

- Utility Theory and Portfolio ManagementDocument3 pagesUtility Theory and Portfolio ManagementMd Roni HasanPas encore d'évaluation

- COMM308 Intro To Corporate Finance: Midterm 2 Practice Problems Fall 2021Document45 pagesCOMM308 Intro To Corporate Finance: Midterm 2 Practice Problems Fall 2021WinniePas encore d'évaluation

- Act7 2Document4 pagesAct7 2Helen B. EvansPas encore d'évaluation

- Foundations of Financial Markets and InstitutionsDocument8 pagesFoundations of Financial Markets and InstitutionsMichiOSTPas encore d'évaluation

- FIN300 Homework 3Document4 pagesFIN300 Homework 3JohnPas encore d'évaluation

- Foundations of Finance 8th Edition Keown Test Bank 1Document40 pagesFoundations of Finance 8th Edition Keown Test Bank 1carita100% (44)

- Midterm 2021Document10 pagesMidterm 2021miguelPas encore d'évaluation

- Security Analysis and Portfolio Management V1Document7 pagesSecurity Analysis and Portfolio Management V1solvedcarePas encore d'évaluation

- Chap006 Text BankDocument14 pagesChap006 Text BankAshraful AlamPas encore d'évaluation

- Mock Test QuestionsDocument7 pagesMock Test QuestionsMyraPas encore d'évaluation

- Exercise chapter 6 - ChẵnDocument4 pagesExercise chapter 6 - ChẵnAnh Lê Thị LanPas encore d'évaluation

- FIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)Document13 pagesFIN 335 Exam III Spring 2008 For Dr. Graham's Class: (With An Addendum Including Some Additional Practice Questions.)An HoàiPas encore d'évaluation

- Review Notes FinalDocument12 pagesReview Notes FinalJoseph AbalosPas encore d'évaluation

- Assig 2Document7 pagesAssig 2Katie CookPas encore d'évaluation

- Assignment - 4 Jul 31Document5 pagesAssignment - 4 Jul 31spectrum_48Pas encore d'évaluation

- Tute 5 PDFDocument4 pagesTute 5 PDFRony Rahman100% (1)

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinPas encore d'évaluation

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDPas encore d'évaluation

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDocument14 pagesChapter 6: Risk Aversion and Capital Allocation To Risky AssetsBiloni KadakiaPas encore d'évaluation

- Problem Set 3 - Portfolio AllocationDocument3 pagesProblem Set 3 - Portfolio Allocationmattgodftey1Pas encore d'évaluation

- Investment Analysis (FIN 670) Fall 2009Document13 pagesInvestment Analysis (FIN 670) Fall 2009BAHADUR singhPas encore d'évaluation

- Lcture 3 and 4 Risk and ReturnDocument8 pagesLcture 3 and 4 Risk and ReturnNimra Farooq ArtaniPas encore d'évaluation

- Chap006 Text BankDocument9 pagesChap006 Text BankPratik JainPas encore d'évaluation

- FIN MGT 2 Quiz 1Document3 pagesFIN MGT 2 Quiz 1Alelie dela CruzPas encore d'évaluation

- Quiz 1Document8 pagesQuiz 1HUANG WENCHENPas encore d'évaluation

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWNPas encore d'évaluation

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsstoryPas encore d'évaluation

- FIN604 MID - Farhan Zubair - 18164052Document7 pagesFIN604 MID - Farhan Zubair - 18164052ZPas encore d'évaluation

- Finance 1 For IBA - Tutorial 5: Pranav Desai Joren Koëter Lingbo ShenDocument15 pagesFinance 1 For IBA - Tutorial 5: Pranav Desai Joren Koëter Lingbo ShenLisanne Ploos van AmstelPas encore d'évaluation

- Chapter 5Document5 pagesChapter 5Khue NgoPas encore d'évaluation

- Tutorial 4 - Loan ScheduleDocument2 pagesTutorial 4 - Loan ScheduleHelen B. EvansPas encore d'évaluation

- Old Chapter 5 On Estimating DemandDocument48 pagesOld Chapter 5 On Estimating DemandOmar Ibrahim0% (1)

- Solutions: Tutorial 2Document2 pagesSolutions: Tutorial 2Helen B. EvansPas encore d'évaluation

- Act std1Document8 pagesAct std1Helen B. EvansPas encore d'évaluation

- Act std3Document7 pagesAct std3Helen B. EvansPas encore d'évaluation

- Accounting Principles or ConceptsDocument15 pagesAccounting Principles or ConceptsHelen B. EvansPas encore d'évaluation

- 9709 w11 Ms 32Document7 pages9709 w11 Ms 32Helen B. EvansPas encore d'évaluation

- Act7 2Document4 pagesAct7 2Helen B. EvansPas encore d'évaluation

- Act7 3Document6 pagesAct7 3Helen B. EvansPas encore d'évaluation

- 2020 Rattlers Fall Sports ProgramDocument48 pages2020 Rattlers Fall Sports ProgramAna CosinoPas encore d'évaluation

- Marking SchemeDocument8 pagesMarking Schememohamed sajithPas encore d'évaluation

- Text and Meaning in Stanley FishDocument5 pagesText and Meaning in Stanley FishparthPas encore d'évaluation

- Questionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Document6 pagesQuestionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Kowshik SPas encore d'évaluation

- General Nursing Council of Zambia: Summary of Results For Each School December 2019 Qualifying Examinations SessionDocument15 pagesGeneral Nursing Council of Zambia: Summary of Results For Each School December 2019 Qualifying Examinations SessionAndrew LukupwaPas encore d'évaluation

- Wine Express Motion To DismissDocument19 pagesWine Express Motion To DismissRuss LatinoPas encore d'évaluation

- Journey Toward OnenessDocument2 pagesJourney Toward Onenesswiziqsairam100% (2)

- Infinivan Company Profile 11pageDocument11 pagesInfinivan Company Profile 11pagechristopher sunPas encore d'évaluation

- I'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Document13 pagesI'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Chantel100% (3)

- Citizen Charter Of: Indian Oil Corporation LimitedDocument9 pagesCitizen Charter Of: Indian Oil Corporation LimitedAbhijit SenPas encore d'évaluation

- Ocampo - v. - Arcaya-ChuaDocument42 pagesOcampo - v. - Arcaya-ChuaChristie Joy BuctonPas encore d'évaluation

- Deed OfAdjudication Cresencio Abuluyan BasilioDocument4 pagesDeed OfAdjudication Cresencio Abuluyan BasilioJose BonifacioPas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument7 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledYanna ManuelPas encore d'évaluation

- Yahoo Tabs AbbDocument85 pagesYahoo Tabs AbbKelli R. GrantPas encore d'évaluation

- Sales-Management Solved MCQsDocument69 pagesSales-Management Solved MCQskrishna100% (3)

- (Mr. Nigel West, Oleg Tsarev) TRIPLEX Secrets Fro (B-Ok - Xyz)Document377 pages(Mr. Nigel West, Oleg Tsarev) TRIPLEX Secrets Fro (B-Ok - Xyz)conbePas encore d'évaluation

- 10 Grammar, Vocabulary, and Pronunciation ADocument7 pages10 Grammar, Vocabulary, and Pronunciation ANico FalzonePas encore d'évaluation

- Principles of Natural JusticeDocument20 pagesPrinciples of Natural JusticeHeracles PegasusPas encore d'évaluation

- July 22, 2016 Strathmore TimesDocument24 pagesJuly 22, 2016 Strathmore TimesStrathmore TimesPas encore d'évaluation

- ICargo Mobility QantasDocument4 pagesICargo Mobility QantasViswateja KrottapalliPas encore d'évaluation

- sc2163 ch1-3 PDFDocument40 pagessc2163 ch1-3 PDFSaeed ImranPas encore d'évaluation

- Chapter 2 - How To Calculate Present ValuesDocument21 pagesChapter 2 - How To Calculate Present ValuesTrọng PhạmPas encore d'évaluation

- Firewall Training, Checkpoint FirewallDocument7 pagesFirewall Training, Checkpoint Firewallgaurav775588Pas encore d'évaluation

- 1 PDFDocument176 pages1 PDFDigna Bettin CuelloPas encore d'évaluation

- No Man An IslandDocument10 pagesNo Man An IslandIsabel ChiuPas encore d'évaluation

- I See Your GarbageDocument20 pagesI See Your GarbageelisaPas encore d'évaluation

- Excursion Parent Consent Form - 2021 VSSECDocument8 pagesExcursion Parent Consent Form - 2021 VSSECFelix LePas encore d'évaluation

- Lectio Decima Septima: de Ablativo AbsoluteDocument10 pagesLectio Decima Septima: de Ablativo AbsoluteDomina Nostra FatimaPas encore d'évaluation

- Asking Who Is On The TelephoneDocument5 pagesAsking Who Is On The TelephoneSyaiful BahriPas encore d'évaluation