Académique Documents

Professionnel Documents

Culture Documents

F 8822

Transféré par

BilboDBagginsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

F 8822

Transféré par

BilboDBagginsDroits d'auteur :

Formats disponibles

Form

8822

Change of Address

(For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns)

Please type or print. See instructions on back. Do not attach this form to your return.

(Rev. January 2012) Department of the Treasury Internal Revenue Service

OMB No. 1545-1163

Part I

1

Complete This Part To Change Your Home Mailing Address

Check all boxes this change affects: Individual income tax returns (Forms 1040, 1040A, 1040EZ, 1040NR, etc.) If your last return was a joint return and you are now establishing a residence separate from the spouse with whom you filed that return, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . Gift, estate, or generation-skipping transfer tax returns (Forms 706, 709, etc.) For Forms 706 and 706-NA, enter the decedents name and social security number below.

Decedents name

Social security number 3b

Your social security number

3a

Your name (first name, initial, and last name)

4a

Spouses name (first name, initial, and last name)

4b

Spouses social security number

5a

Your prior name(s). See instructions.

5b

Spouse's prior name(s). See instructions.

6a

Your old address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

6b

Spouses old address, if different from line 6a (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

New address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

Part II

Signature

Daytime telephone number of person to contact (optional)

Sign Here

Your signature If joint return, spouses signature

Date Date

Signature of representative, executor, administrator/if applicable Title Cat. No. 12081V Form

Date

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

8822

(Rev. 1-2012)

Form 8822 (Rev. 1-2012)

Page

Purpose of Form

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate Form 8822 for each child. If you are a representative signing for the taxpayer, attach to Form 8822 a copy of your power of attorney. Changing both home and business addresses? Use Form 8822-B to change your business address. Future developments. The IRS has created a page on IRS.gov for information about Form 8822 and its instructions, at www.irs.gov/ form8822. Information about any future developments affecting Form 8822 (such as legislation enacted after we release it) will be posted on that page.

Where To File

Send this form to the Department of the Treasury, Internal Revenue Service Center, and the address shown next that applies to you. Generally, it takes 4 to 6 weeks to process your change of address. Note. If you checked the box on line 2, or you checked the box on both lines 1 and 2, send this form to: Cincinnati, OH 45999-0023.

IF your old home mailing address was in . . . Alabama, Connecticut, Delaware, District of Columbia, Georgia, Kentucky, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia Florida, Louisiana, Mississippi, Texas THEN use this address . . . Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0023

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Our legal right to ask for information is Internal Revenue Code sections 6001 and 6011, which require you to file a statement with us for any tax for which you are liable. Section 6109 requires that you provide your social security number on what you file. This is so we know who you are, and can process your form and other papers. Generally, tax returns and return information are confidential, as required by section 6103. However, we may give the information to the Department of Justice and to other federal agencies, as provided by law. We may give it to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. The use of this form is voluntary. However, if you fail to provide the Internal Revenue Service with your current mailing address, you may not receive a notice of deficiency or a notice and demand for tax. Despite the failure to receive such notices, penalties and interest will continue to accrue on the tax deficiencies. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 16 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service Individual and Specialty Forms and Publications Branch SE:W:CAR:MP:T:I 1111 Constitution Ave. NW IR-6526 Washington, DC 20224 Do not send the form to this address. Instead, see Where To File on this page.

Prior Name(s)

If you or your spouse changed your name because of marriage, divorce, etc., complete line 5. Also, be sure to notify the Social Security Administration of your new name so that it has the same name in its records that you have on your tax return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits.

Department of the Treasury Internal Revenue Service Austin, TX 73301-0023 Department of the Treasury Internal Revenue Service Fresno, CA 93888-0023

Addresses

Be sure to include any apartment, room, or suite number in the space provided.

P.O. Box

Enter your box number instead of your street address only if your post office does not deliver mail to your street address.

Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, Wyoming A foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code section 933), or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien or non bona fide resident of Guam or the Virgin Islands. Guam: bona fide residents

Foreign Address

Follow the countrys practice for entering the postal code. Please do not abbreviate the country.

Department of the Treasury Internal Revenue Service Austin, TX 73301-0023

In Care of Address

If you receive your mail in care of a third party (such as an accountant or attorney), enter C/O followed by the third partys name and street address or P.O. box.

Signature

The taxpayer, executor, donor, or an authorized representative must sign. If your last return was a joint return, your spouse must also sign (unless you have indicated by checking the box on line 1 that you are establishing a separate residence). If you are a representative signing on behalf of the taxpayer, you must attach to Form 8822 a copy CAUTION of your power of attorney. To do this, you can use Form 2848. The Internal Revenue Service will not complete an address change from an unauthorized third party.

Department of Revenue and Taxation Government of Guam P.O. Box 23607 GMF, GU 96921 V.I. Bureau of Internal Revenue 6115 Estate Smith Bay Suite 225 St. Thomas, VI 00802

Virgin Islands: bona fide residents

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Partnership AgreementDocument3 pagesPartnership AgreementRocketLawyer67% (9)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- GUIDE NoticeofLiability PDFDocument13 pagesGUIDE NoticeofLiability PDFdashrillaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Salesforce Useful Validation FormulasDocument32 pagesSalesforce Useful Validation Formulassahithi1223Pas encore d'évaluation

- Common App Secondary School ReportDocument5 pagesCommon App Secondary School Reportelica81topsPas encore d'évaluation

- IEN FORMS RPT EmploymentFormDocument3 pagesIEN FORMS RPT EmploymentFormGuru Ramdas Hospital0% (2)

- NEW - Onehub EGobyerno Company Enrollment Form 12272017Document3 pagesNEW - Onehub EGobyerno Company Enrollment Form 12272017Elya Abillon100% (1)

- Music of Eric ZannDocument6 pagesMusic of Eric ZannBilboDBagginsPas encore d'évaluation

- The Obamarang: 131 CommentsDocument2 pagesThe Obamarang: 131 CommentsBilboDBagginsPas encore d'évaluation

- Hospitals: Schedule H (Form 990)Document9 pagesHospitals: Schedule H (Form 990)BilboDBagginsPas encore d'évaluation

- Statement of Activities Outside The United States: Open To Public InspectionDocument5 pagesStatement of Activities Outside The United States: Open To Public InspectionBilboDBagginsPas encore d'évaluation

- Claim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustDocument2 pagesClaim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustBilboDBagginsPas encore d'évaluation

- Colorado Zip Code Map PDFDocument2 pagesColorado Zip Code Map PDFTanikaPas encore d'évaluation

- Use of A Representative (IMM 5476)Document2 pagesUse of A Representative (IMM 5476)Bright OkunkpolorPas encore d'évaluation

- Us FDA Updated 2024 TWT Protein PowderDocument6 pagesUs FDA Updated 2024 TWT Protein PowderAbishek AbiPas encore d'évaluation

- Barbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1Document10 pagesBarbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1fiqiPas encore d'évaluation

- Fda - Food Facility RegistrationDocument6 pagesFda - Food Facility RegistrationJay McKearnPas encore d'évaluation

- University of Colorado Denver CompletionDocument7 pagesUniversity of Colorado Denver CompletionFranciscoPas encore d'évaluation

- Medicare Claims Processing ManualDocument52 pagesMedicare Claims Processing ManualRama krishnaPas encore d'évaluation

- Postal Code London - Google SearchDocument1 pagePostal Code London - Google SearchOladimeji ShinaayoPas encore d'évaluation

- Request For An Official USMLE Transcript Form 172: Request Form. Include A Payment of US$65.00 For Each Form You SubmitDocument3 pagesRequest For An Official USMLE Transcript Form 172: Request Form. Include A Payment of US$65.00 For Each Form You SubmitAmiroh AllabibahPas encore d'évaluation

- NCNZ1 Employment Validation FormDocument3 pagesNCNZ1 Employment Validation FormEmma IntiaPas encore d'évaluation

- 封面信范例Document5 pages封面信范例buioxkwlfPas encore d'évaluation

- 2012 Jay Feather Ultra Lite Owners ManualDocument101 pages2012 Jay Feather Ultra Lite Owners ManualRachel Naiman WilsonPas encore d'évaluation

- No 1 Background Rept Joseph K RD Williams RDDocument98 pagesNo 1 Background Rept Joseph K RD Williams RDmaria-bellaPas encore d'évaluation

- Test - Letter and EnvelopeDocument4 pagesTest - Letter and EnvelopeCecilia GarfiasPas encore d'évaluation

- Combined Declaration of Use and Incontestability Under: After You FileDocument6 pagesCombined Declaration of Use and Incontestability Under: After You Fileerik5733Pas encore d'évaluation

- PTR Event Descriptions - 20230221 - 0Document18 pagesPTR Event Descriptions - 20230221 - 0lianqiang caoPas encore d'évaluation

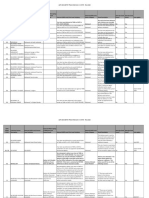

- Active DataDocument352 pagesActive DataTehmina HanifPas encore d'évaluation

- Membership DirectoryDocument6 pagesMembership Directorymicheline kalachehPas encore d'évaluation

- Modul Bahasa Inggris Xi and The KeyDocument26 pagesModul Bahasa Inggris Xi and The KeyAxum khabibPas encore d'évaluation

- ISC Student Preparation HandbookDocument50 pagesISC Student Preparation HandbookKarla Sidney NoveloPas encore d'évaluation

- Marijuana Agent ApplicationDocument13 pagesMarijuana Agent ApplicationAndrew VegaPas encore d'évaluation

- Application For Enrollment: Permanent Mailing Address: Student DetailsDocument5 pagesApplication For Enrollment: Permanent Mailing Address: Student DetailsStatus VideosPas encore d'évaluation

- Statement in Support of ClaimDocument2 pagesStatement in Support of ClaimDerrick D. CochranPas encore d'évaluation

- MTA Membership 2017Document9 pagesMTA Membership 2017Marko JelavićPas encore d'évaluation