Académique Documents

Professionnel Documents

Culture Documents

International Cotton Market Weekly Update Report...

Transféré par

cottontradeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

International Cotton Market Weekly Update Report...

Transféré par

cottontradeDroits d'auteur :

Formats disponibles

Dt : 19/10/2013

New York cotton futures move sideways this week

Just when it felt like the market was getting ready to challenge major support below 82 cents, a late session rally lifted values back into the comfort zone. It is not clear what prompted the buying of some 2500 December near the close, with potential reasons ranging from the lifting of hedges against export business to rumors about Chinas Reserve sales policy. China was an active buyer this week, as mills were trying to fill newly issued quotas, rumored to be in excess of 250000 tons, that require cotton to be imported before the 20th of December. With prompt availability being one of the main factors, buyers considered a wide variety of high grades from origins like Greece, Mexico, India, the US, Australia, Spain or Brazil, and prices paid were in the mid 90s. This latest round of Chinese buying has further reduced the remaining old crop inventory, both at origin and on consignment in China, and with new crop arriving slower than normal this season, we have yet to see any supply pressure. Some traders begin to question whether we will see much crop pressure at all, because China continues to import at a decent pace and many other markets still have plenty of holes to fill, while the US and India have already committed sizable volumes that they need to cover first. In other words, it may take a while before the pipeline fills up to level at which there is excess supply to pressure the market. The pace of Chinese imports remains the main price driver in our opinion, with China currently expected to more or less absorb the production surplus of around 11 million bales in the rest of the world. This week we learned that China imported 925'000 bales in September, which brings the total for the first two months of the season to 2.13 million bales, which equates to an annualized pace of 12.8 million bales. Considering that mills just received a batch of quotas of over a million bales and that there will be another TRQ (Tariff Rate Quota) of 4.0 million bales issued in early 2014, imports of 10+ million bales seem certainly within reach. The Certified Stock continued to grow this week and as of this morning it measured nearly 95000 bales, including bales under review. One has to wonder why this cotton, most of which consists of 3135 and higher

grades, is not being moved to China given their appetite for ready to ship imports. Maybe the reason is that merchants prefer to use it as a tool to force carry into the market, which seems to be working, since the Dec/March spread has gone from a 300-point inversion to more than 100 points carry over the past couple of months. However, we wouldnt rule out a sudden disappearance of this certified stock just yet! Yesterday the US government finally ended its shutdown by kicking the can further down the road, hoping to find a resolution to the debt issue over the next couple of months. It will still be several days before the USDA and CFTC are up and running again, so we will have to wait a little longer before we get updated export and commitment of traders data. Despite all the negative local and international press the US is getting these days, there are a number of positives for the US economy going forward. Who would have thought a few years back that US oil production would rise to a 20-year high of 7.5 million barrels a day in 2013, thanks mainly to large-scale oil shale exploration in North Dakota and Texas. This upward trend in oil production is likely to continue and forecasts call for up to 9.5 million barrels/day by 2015, close to the record 9.6 million barrels/day of 1970. If natural gas liquids and biofuels are added to crude, then the US will become the world's biggest producer of liquids in 2013 with 12.1 million barrels/day, ahead of Saudi Arabia and Russia. Including other energy sources such as natural gas, coal, solar and wind, the US is currently meeting 87 percent of its energy needs and is on its way to become energy independent. With Canada added to the equation, it is already there! By contrast, the EU produces less than 50% of its energy needs and dependency on crude oil imports is at over 80% and for natural gas it is over 60%. This US energy boom has far-reaching economic and geo-political implications. With US oil imports at just 40 percent of 2005 levels, the US trade deficit is improving rapidly and the fact that the US can offer cheaper energy to companies than other countries is bringing some manufacturing back to the States, especially since labor arbitrage is less of a factor these days in view of improved automatization and robotics. Definitely something to consider before getting too negative on the US economy and the dollar! So where do we go from here? Prices are still in a long-term sideways trend, with long and short-term moving averages basically flatlined, volatility at a multi-year low and momentum almost nonexistent. As long as China keeps absorbing the surplus in the rest of the world, stocks outside China won't change much and the market may therefore not have a lot of wiggle room going forward. Looking out for potential game changers, a Chinese policy shift is still on top of the list, although we don't think that it would necessarily have to be bearish like most analysts believe. Weather is still a factor at this point, although harvest conditions have been surprisingly benign so far and time for something bad to happen is soon running out. All things considered we currently see no reason for the market to break out of its boring sideways trend.

Chinas Yarn Expo Autumn to start from Oct 21

With an increase in the number of exhibitors at this years Yarn Expo Autumn, visitors to the fair are guaranteed a greater sourcing choice of fibres and yarns. Nearly 150 suppliers from 13 countries and regions, including China, Bangladesh, Hong Kong, India, Indonesia, Italy, Korea, Lithuania, Pakistan, Singapore, Sri Lanka, Thailand and Turkey will be present from 21 23 October at the Shanghai New International Expo Centre. A large factor in the growth this year is the increased participation from South Asia. The India Pavilion plays host to over 50 exhibitors who will display the latest dyed and fancy cotton yarns and natural fibres, varieties of single, twisted, compact, gassed, mercerised and crepe yarns for knitwear and weaving, as well as 100% cotton and linen yarns. The strong presence of Indian exhibitors again this year proves the continual growing business opportunities in the Chinese market, the Joint Director at pavilion organiser Texprocil, Ravi Narayanaswamy believes. There is a large gap between the supply and demand of yarn in China at the moment, he says. Whats more, in recent years the awareness of the high quality of Indian yarn has increased in China so many exhibitors are returning to the fair again to take advantage of these factors. The Pakistan Zone is also larger with 21 manufacturers offering competitively priced cotton yarns, more than triple compared with last year. The exhibitor growth from both of these countries confirms the status of this fair as the best platform for gaining access to the Chinese market, said Wendy Wen, Senior General Manager of Messe Frankfurt (HK) Ltd. It also shows that despite the recent economic slowdown overseas suppliers are optimistic and feel there is still room for growth in this market. Industry-leading domestic suppliers to feature In addition to the increased international presence, a number of leading Chinese suppliers will also take part to increase trading opportunities which include Fulida Group Hangzhou, one of Chinas top 500 private companies. They produce cotton, chemical fibres, differentiated chemical fibre blended yarns, viscose staple fibres, dyed polyester filament and more. Shanghai Tenbro Bamboo Textile were one of the first producers of bamboo fibre in China, and also supply bamboo pulp and siro yarn. And Shandong Helon are specialists in viscose fibres and tyre cord fabrics. Key domestic yarn suppliers include China Resources Textile and Changtai Xindeli Textiles Development. The former produces high-count yarn, knitting yarn, twisted yarn and other varities, while the later is a supplier of twisted yarn that is free of knots, is heat-set and is suitable for warping. Three other events will take place concurrently with Yarn Expo Autumn, thus creating synergy effects for buyers. This includes Intertextile Shanghai Apparel Fabrics 2013 which is located in halls E1 E7, N1 N3 and W1 W5, as well as the PH Value fair (previously known as the China International Knitting Trade Fair) in halls N4 N5. On 22 October the Planet Textiles Conference will be held in the Kerry Hotel, which is located alongside the Shanghai New International Expo Centre.

China 2013 cotton output seen down 5.1pc on year

China, the world's top cotton consumer, is likely to produce 5.1 percent less of the fibre this year due to lower acreage and bad weather, a Ministry of Agriculture official was cited as saying on Thursday. Output from the harvest due this month was seen at 6.315 million tonnes, down 337,000 tonnes from the previous year, Xiang Yu, an official from the ministry's planting department, told a conference. His speech was posted on the China Cotton Association. Cotton acreage fell for the second year in a row this year, while persistent drought in July and August in central China also hurt the crop, Xiang was cited as saying. The ministry's estimate was lower than a previous estimate by the China Cotton Association, which put this year's output at 6.93 million tonnes. Cotton Reserve Purchases Slow in China as Quality Standards Rise

Cotton reserve purchases in China have slowed as the government raises quality requirements and withholds a portion of payments until the fiber passes inspection, according to textiles research firm Sinotex.cn. China National Cotton Reserves Corp. bought 100,630 metric tons of new-crop local cotton as of Sept. 30, down 74 percent from a year earlier, according to estimates by Qingdao-based Sinotex.cn. Purchases from Xinjiang province, the top-producing region, fell 76 percent to 71,400 tons, according a report dated Oct. 4 and released during a week-long holiday in China. Farmers had sold just 3.4 percent of their crop while the harvest was 21.6 percent complete as of Sept. 15, Sinotex said. Two calls today to the reserves corporation seeking comment werent answered. Some cotton companies have slowed down purchases from farmers or stopped altogether because theyre struggling to meet the new standards, Sinotex said. The government started this seasons stockpiling program on Sept. 9, buying cotton from companies when market prices stayed below 20,400 yuan for five straight days. Qualified companies buy from farmers first, then sell the cotton to the government through a trading platform. Cotton futures for January delivery on Zhengzhou Commodity Exchange were little changed at 19,930 yuan a metric ton ($1.48 a pound) at 11:29 a.m. local time. The contract is currently the most active and has closed below 20,400 yuan a ton since inception at the start of year. Prices on the Chinese bourse compares with 83.70 cents a pound on ICE in New York, where futures have advanced 11 percent this year on concern that global output is dropping.

The government this year will withhold 500 yuan a ton of payment for cotton until the fiber and the packaging is judged to have met quality standards, according to a statement on Sept. 9 by the China National Development and Reform Commission.

Uzbekistan signs contracts to export 680,000 tons of cotton fibre

Uzbekistan has signed contracts to export 680,000 tons of cotton fibre at the International Uzbek Cotton and Textile Fair held in Tashkent on October 16 -17, Deputy Minister of Foreign Economic Relations, Investments and Trade of Uzbekistan Akmal Kamalov said at the fair's closing ceremony. In addition, he said contracts were concluded to export production of Uzbekistan's textile enterprises worth over one billion dollars. As reported earlier, during the twelfth Cotton Fair, held in 2012, contracts were concluded on the purchase of more than 670,000 tons of Uzbek cotton fibre. The contracts for the purchase of export production of Uzbekistan's textile enterprises were concluded at a sum exceeding $600 million, an increase of 9.1 per cent. In 2013, the fair was attended by over a thousand foreign companies from 40 countries around the world specialising in the cotton and textile industry. According to the Ministry of Foreign Economic Relations, Investments and Trade, the contracts for the export of Uzbek cotton this year are being concluded with companies from China, Bangladesh, Russia, France, Moldova, the Czech Republic, the United Arab Emirates and Turkey. The buyers of Uzbekistan's textile products were companies from Russia, Iran, Belarus, South Korea, China, Kazakhstan, Spain and Singapore. The Cotton and Textile Fair has been held in Uzbekistan annually since 2005. It is organized by the Uzbek government with the assistance of the International Cotton Advisory Committee (ICAC). In total, during the fairs Uzbekistan has concluded contracts for exports in the amount of 5.2 million tons of cotton fibre. Uzbekistan holds sixth place in the world on cotton fibre production and second place in the export. Uzbekistan annually produces around 3.5 million tons of raw cotton and 1-1.2 million tons of cotton fibre. Over 95 per cent of the cotton account for medium fibre bred varieties with a fibre length of 32-33 millimetres, and the rest account for long fibre at 36-39 millimetres.

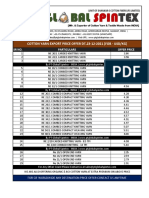

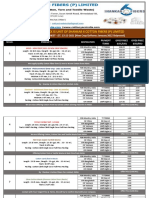

WE KNOW COTTON BETTER. FOR INDIAN COTTON REQUIREMENT YOU CAN ALWAYS RELY US

Regd. Office: The Cotton Trade India Co. (An ISO 9001: 2008 & AQSIQ Certified Cotton-Yarn Agency) B-310, Titanium City Center, Near Sachin Tower, Prahlad Nagar Corporate Road, Ahmedabad-380015. Gujarat, INDIA. Direct Fax : +91 78781 87758 Tele: +91 79 40307878 / 65450151 Mobile : +91 92272 00704 / 81413 41430 Board Line No: +91 78783 88783 (10 Line) Email : info@indiancottonexport.com

Web URL : www.indiancottonexport.com / www.cottontradeindia.com / www.cottonyarnindia.com

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 23 12 2021 Yarn Export Price OfferDocument1 page23 12 2021 Yarn Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- PT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedDocument3 pagesPT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedcottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)