Académique Documents

Professionnel Documents

Culture Documents

Event GRI2008IndiaBrochure

Transféré par

amitsh20072458Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Event GRI2008IndiaBrochure

Transféré par

amitsh20072458Droits d'auteur :

Formats disponibles

Mumbai 24-25 September

Global and Local

Investors and Developers

in Indian Real Estate

TOTAL REAL ESTATE

Sanjeev DasGupta

KSHITIJ/FUTURE CAPITAL

Ravindra Chamaria

INFINITY INFOTECH PARKS

Shirish Godbole

GOLDMAN SACHS

Shahzaad Dalal

IL&FS

Richard Dansereau

CADIM

Gian Bansal

UPPAL GROUP

Brad Bauman

ALPHA REAL CAPITAL

Sourav Goswami

WALTON STREET CAPITAL

Navid Chamdia

QATAR INVESTMENT AUTHORITY

The GRI invites senior

industry leaders who

might nd it useful to

chair a discussion at

a GRI event to contact

Emrah Senel, Director, GRI

emrah.senel@globalrealestate.org

THE BIG PICTURE

OUTLOOK AND OPPORTUNITIES FOR 2009 - WHATS AHEAD?

INSTITUTIONAL END-INVESTORS - IS INDIA THE PLACE?

FROM ACQUISITION TO EXECUTION - ARE NEW RISKS EMERGING? ...and many more

INVESTOR PROGRAM

OPPORTUNITIES IN INDIA - WHERE TO ALLOCATE YOUR MONEY?

PROVIDING PRINCIPAL INVESTMENT - HAS THE LINE BETWEEN DEBT AND EQUITY

BECOME BLURRED?

INDIA - READY FOR OPPORTUNISTIC INVESTORS? ...and many more

DEVELOPER PROGRAM

TOWNSHIP DEVELOPMENTS - SUCCESS ALL AROUND?

LOCAL DEVELOPERS, FOREIGN INVESTORS - WHOS CHASING WHOM?

INFRASTRUCTURE DEVELOPMENT - OPPORTUNITIES FOREVER? ...and many more

CAPITAL MARKETS

FINANCING DEVELOPERS - IS FOREIGN MONEY NEEDED?

FOREIGN FUNDS IN INDIA - HOW MUCH INDIA IS TOO MUCH?

TIGHTENING LIQUIDITY - OPPORTUNITY OR CHALLENGE? ...and many more

STRATEGIC PROGRAM

EAST/WEST VENTURES - SAME BED, DIFFERENT DREAMS?

TALENT IN REAL ESTATE - WILL BRAIN DRAIN PROVE FATAL?

REAL ESTATE FUNDING - IS IPO THE SILVER BULLET? ...and many more

SECTOR PROGRAM

RETAIL IN INDIA - STILL A GOLDMINE?

HOSPITALITY/HOTELS - MONEY TO MAKE OR TO LOSE?

RESIDENTIAL CHAMPAGNE - IS TOO MUCH BUBBLY NEVER ENOUGH? ...and many more

WELCOME

Henri Alster

Henri Alster

Chairman, GRI - Global Real Estate Institute

President, American European Investment Bankers, Inc.

Peter Kasch

CATALYST CAPITAL

Rajesh Jaggi

PENINSULA LAND

Deepak Israni

PACIFICA COMPANIES

Lalit Goyal

IREO MANAGEMENT

The job of Discussion Chairs at the GRI is not to talk.

It is to make others talk, engage and connect.

Emrah Senel

Emrah Senel

Director, India GRI

GRI - Global Real Estate Institute

Yash Gupta

HINES

Ricardo Koenigsberger

XE CAPITAL

Prasad Koneru

RAKINDO DEVELOPERS

Aashish Kalra

TRIKONA

Surendra Hiranandani

HIRANANDANI DEVELOPERS

On 24-25September 2008 in Mumbai the GRI will bring together international investors

and the leading indian developers and decision makers, which together are driving the real

estate business in India today for a series of small and informal discussions.

Like with all GRI meetings, these discussions - each masterminded by leading industry

players - encourage you and everybody to join in, to talk and to share.

It is a place where senior players meet each other and build friendships in a setting

devoid of selling pressure.

Discussion chairs are not speakers. The job of discussion chairs is to make others talk,

engage and connect. If connecting with industry peers on topics of mutual interest

is useful to you, we would be delighted to welcome you to the India GRI.

See you in Mumbai.

IREO CAFE

Vincent Lotteer

JONES LANG LASALLE MEGHRAJ

Tuhin Parikh

BLACKSTONE

Ariel Podrojski

BCRE GROUP

Neel Raheja

K RAHEJA CORP

Balaji Rao

STARWOOD CAPITAL

Nipun Sahni

DSP MERRILL LYNCH

Suresh Raheja

K RAHEJA UNIVERSAL

Kenneth Munkacy

GID INTERNATIONAL

Ambar Maheshwari

DTZ

For those who think the opportunity to schedule

personal meetings with so many of the industrys best

and brightest is too good to pass up.

Schedule your appointments early...

KEYNOTE

DR SHANKAR ACHARYA

member, board of governors

and honorary professor

ICRIER

BOOMING INDIA is growth alone sustainable?

Harin Thaker

HYPO REAL ESTATE

Marc-Henri Veyrassat

RAKEEN DEVELOPMENT

Punit Shah

PwC

Avnish Singh

GE REAL ESTATE

Parry Singh

RED FORT CAPITAL

Harkirat Singh Bedi

IDEB PROJECTS

S Sriniwasan

KOTAK INVESTMENT

Manav Thadani

HVS

Sanjay Verma

CUSHMAN AND WAKEFIELD

TIMETABLE

Ongoing updates at

www.mygri.com/india

Wednesday September 24

12h00 - onwards

Check-in

14h00 - 17h15

Group Discussions

17h15 - 18h15

Welcome Drinks

19h00 - 22h00

GRI Board Dinner

By invitation only- reserved for GRI attending members,

India GRI Partners and Discussion (co-)Chairs.

Thursday September 25

09h00 - 10h00

Keynote

10h15 - 17h00

Group discussions,

lunch & closing drinks

DRESS CODE - Business Casual

DISCUSSIONS

PLEASE NOTE:

GROUP DISCUSSIONS

REQUIRE PRIOR

SIGN-UP ON

REGISTRATION FORM

INDIA RE

INVESTMENTS

do joint ventures

provide enough

return?

ATUL KAPUR

INDIVISION

RICHARD DANSEREAU

president & coo

CADIM canada

MANISH GUPTA

managing director

STREIT INDIA india

HARI KRISHNA

cio

KOTAK INVESTMENT ADVISORS

india

YESH NADKARNI

head re investment

management

ICICI PRUDENTIAL india

AVNISH SINGH

country head india

GE REAL ESTATE india

Atul Kapur

Yesh Nadkarni

Richard Dansereau

AvnishSingh

Hari Krishna

All material throughout

this brochure is subject

to change without notice.

Ongoing updates at

www.mygri.com/india

SLOWDOWN IN

REAL ESTATE

how real is it?

ROHAN NARSE

ceo

INDIAN OCEAN VENTURES uk

ALOK AGGARWAL

joint md

KWALITY DEVELOPERS india

DR DEEPAK BAJAJ

director, investments &

projects

UNITECH REALTY INVESTORS

india

SUBASH DAS

director

DEUTSCHE BANK india

VIREN JADHAV

director - emei

HYPO REAL ESTATE india

PRASAD KONERU

managing director

RAKINDO DEVELOPERS india

SUNIL ROHOKALE

md & ceo

ICICI BANK india

Alok Aggarwal

Subash Das Viren Jadhav

Rohan Narse Dr Deepak Bajaj

Prasad Koneru

Sunil Rohokale

DISCUSSIONS

No

speakers.

Pierre Lalonde Michiel Schwartz

INSTITUTIONAL

END-INVESTORS

is India the

place?

SANJEEV DASGUPTA

managing director

KSHITIJ/FUTURE CAPITAL

REAL ESTATE india

NAVID CHAMDIA

head of real estate

QATAR INVESTMENT

AUTHORITY qatar

AASHISH KALRA

co founder & md

TRIKONA CAPITAL usa

PIERRE LALONDE

svp, portfolio management

IVANHOE CAMBRIDGE canada

MICHIEL SCHWARTZ

partner

ADAM REALTY india

Sanjeev Dasgupta Navid Chamdia Aashish Kalra

Rahul Ghai

INVESTORS

IN INDIA

anything left

to invest in?

VARUN KHANNA

director new initiatives

IREO MANAGEMENT india

RAJNEESH AGRAWAL

vice president

AVENDUS ADVISORS india

RAHUL ANAND

director

PORTMAN HOLDINGS india

RAHUL GHAI

associate director

STANDARD CHARTERED-

ISTITHMAR RE FUND singapore

SONICA MALHOTRA

executive director

MBD GROUP india

NEEL RAHEJA

director

K RAHEJA CORP india

Varun Khanna Rajneesh Agrawal

Sonica Malhotra

Rahul Anand

Neel Raheja

OPPORTUNITIES

IN INDIA

where to allocate

your money?

KARMVIR RAJPUROHIT

head real estate

RIGHT MERIDIAN

PACIFIC CAPITAL india

LUV SHAH

director

RREEF india

PARRY SINGH

managing director

RED FORT CAPITAL india

RITESH VOHRA

director investments

SAFFRON ASSET ADVISORS

mauritius

Bryan Southergill Amit Bhagat Karmvir Rajpurohit

LuvShah ParrySingh Ritesh Vohra

BRYAN SOUTHERGILL

executive director,

head of asia re investing

JP MORGAN SECURITIES

hong kong

AMIT BHAGAT

head property services

ICICI HOME FINANCE

india

DISCUSSIONS

FOREIGN FUNDS

IN INDIA

how much India

is too much?

SHIRISH GODBOLE

managing director

GOLDMAN SACHS uk

DENIS EPOH

vp investments

SITQ canada

KISHORE GOTETY

country head

RREEF india

LOUIS KLEIN

founding partner

IREO MANAGEMENT india

DR P.S. RANA

chairman

TRIKONA CAPITAL

DEVELOPMENT india

SANDEEP SINGH

vp capital markets group

CUSHMAN & WAKEFIELD india

SHREEHARSHA VASANT PHENE

managing director

HYPO REAL ESTATE india

Shirish Godbole Denis Epoh

Dr P.S. Rana Louis Klein

Kishore Gotety

SandeepSingh

Shreeharsha Vasant Phene

INDIAN

REAL ESTATE

how vulnerable

to recession

in US?

SUNIL AGARWAL

chief development ofcer

SOUTH ASIAN REAL ESTATE

india

LUI CHONG CHEE

ceo

CAPITALAND FINANCIAL

singapore

ANAND TRIVEDI

md, principal transaction group

SHINSEI BAN india

STEVEN WISCH

founding partner

IREO MANAGEMENT india

Sunil Agarwal Lui Chong Chee

AnandTrivedi Steven Wisch

DISCUSSIONS

Just

collegial

discussions

where all

participate

equally.

INDIA

whats the real

state of real

estate?

GULZAR MALHOTRA

vice president, credit risk

DEUTSCHE BANK india

REVATHY ASHOK

director - nance

TSI VENTURES india

ADITYA BHARGAVA

managing director

STREIT INDIA india

SUBODH RUNWAL

director

RUNWAL GROUP india

RAJIV SABHARWAL

senior general manager

ICICI BANK india

DOTT UMBERTO VITIELLO

partner

REALTY PARTNERS italy

Revathy Ashok Aditya Bhargava Subodh Runwal

RajivSabharwal Dott Umberto Vitiello

OUTLOOK AND

OPPORTUNITIES

FOR 2009

whats ahead?

JENNIFER NOVACK

partner

SOUSOU PARTNERS usa

ROHIT GERA

executive director

GERA DEVELOPMENTS india

SURENDRA HIRANANDANI

managing director

HIRANANDANI DEVELOPERS

india

DENNIS LOPEZ

ceo

SUN REAL ESTATE uk

JESAL SANGHVI

vice president

WESTBROOK usa

TUSHAR SARDA

chief investment ofcer

URBAN INFRASTRUCTURE india

S. SRINIWASAN

ceo

KOTAK INVESTMENT

ADVISORS india

SANJAYVERMA

executive md, south asia

CUSHMAN & WAKEFIELD india

Jennifer Novack Rohit Gera Surendra Hiranandani

Dennis Lopez Jesal Sanghvi Tushar Sarda

S. Sriniwasan SanjayVerma

DISCUSSIONS

THE GLOBAL

CREDIT CRUNCH

impact on Indian

real estate

SAMEER NAYAR

md & head of re nance

asia pacic

CREDIT SUISSE india

ANURAG BHARGAVA

managing partner

IREO MANAGEMENT india

ANSHUL JAIN

ceo, india

DTZ uk

SANDEEP KOTAK

head - real estate

KOTAK MAHINDRA BANK india

VINOD ROHIRA

director

K RAHEJA CORP india

Sameer Nayar Vinod Rohira Anshul Jain

INVESTING

IN INDIA

is the sheen off?

SHEKAR NARASIMHAN

ceo

BEEKMAN HELIX INDIA usa

DEEPAK ISRANI

senior vp

PACIFICA COMPANIES usa

ROBERT LESTER

principal

PARK HILL REAL ESTATE usa

Shekar Narasimhan Deepak Israni Robert Lester

All material throughout

this brochure is subject

to change without notice.

Ongoing updates at

www.mygri.com/india

INDIAS

REAL ESTATE

RACETRACK

managing

through

the curve

LLOYD LEE

director

MARATHON ASSET

MANAGEMENT uk

OM CHAUDRY

managing director

FIRE CAPITAL india

MAHESH MANI

ceo

TCG REAL ESTATE india

DINKAR RAI

ceo

GLOBAL TRUSTCAPITAL

FINANCE india

Lloyd Lee Dinkar Rai

DISCUSSIONS

TALENT IN

REAL ESTATE

will brain drain

prove fatal?

SUNIL SURI

principal and managing

member

MENLO CAPITAL GROUP usa

AANANDJIT SUNDERAJ

senior director-investments,

real estate

ICICI VENTURE FUNDS india

R. VASUDEVAN

managing director

VASCON ENGINEERS india

Aanandjit Sunderaj Sunil Suri R. Vasudevan

FROM

ACQUISITION

TO EXECUTION

are new risks

emerging?

SOURAV GOSWAMI

managing director

WALTON STREET CAPITAL india

SANJAY BANSAL

managing director

AMBIT CORPORATE FINANCE

india

SHAHZAAD DALAL

vice chairman & md

IL&FS INVESTMENT MANAGERS

india

RAJESH JAGGI

managing director

PENINSULA LAND india

JOHN MONTAQUILA

principal

M3 CAPITAL PARTNERS usa

SANJOY PAUL

executive director

TCG REAL ESTATE india

Sanjay Bansal Sourav Goswami Shahzaad Dalal

John Montaquila Rajesh Jaggi Sanjoy Paul

PROVIDING

PRINCIPAL

INVESTMENT

has the line

between debt

and equity

become

blurred?

BIRJU SHAH

director

DEUTSCHE BANK uk

DR ARCHANA HINGORANI

executive director

IL&FS INVESTMENT MANAGERS

india

VIVEK KRISHNAN

assistant vp - investments

GE REAL ESTATE india

RAHUL RAI

principal

SUN APOLLO RE india

Birju Shah Dr Archana Hingorani

Vivek Krishnan Rahul Rai

The job

of the

discussion

chairs is

to make

everybody

talk...

DISCUSSIONS

EAST/WEST

VENTURES

same bed,

different

dreams?

KARIM MERCHANT

country manager, india

GID INTERNATIONAL GROUP

usa

SORABH JAIN

principal

SUN APOLLO RE india

ARSHDEEP SETHI

vp - investment & alliances

RMZ CORP india

CAROL TAIT

sr. vice president - corporate

affairs

NITESH ESTATES PRIVATE india

BRIG MAZHAR UL HAQ

senior advisor

ABRAAJ CAPITAL uae

KarimMerchant

Carol Tait

Sorabh Jain

Brig Mazhar Ul Haq

Arshdeep Sethi

FOREIGN

INVESTMENT

IN INDIA

how welcome

is it?

RAJIV BANGA

ceo

IDEB PROJECTS india

ALOK AGGARWAL

principal

SUN APOLLO RE india

ARVIND PAHWA

managing director

JP MORGAN india

PUNIT SHAH

executive director

PWC india

CHOWDARY YALAMANCHILI

ceo

CNC DEVELOPERS india

Rajiv Banga

Punit Shah

Alok Aggarwal

ChowdaryYalamanchili

Arvind Pahwa

JV EXITS

when is

the best time

to separate?

SUSH TORGALKAR

managing principal

WESTBROOK usa

SANDEEP RAHEJA

managing director

K. RAHEJA CONSTRUCTIONS

india

SUNDARAM RAJAGOPAL

md head, india re private equity

LEHMAN BROTHERS india

NIPUN SAHNI

head global commercial re

DSP MERRILL LYNCH india

NITESH SHETTY

managing director

NITESH ESTATES PRIVATE

india

Sush Torgalkar Nipun Sahni Nitesh Shetty

DISCUSSIONS

...helping

everyone

share,

connect

and make

friends...

RETAIL IN INDIA

still a goldmine?

SUSIL DUNGARWAL

retail & realty analyst

ISHANYA MALLS india

SHISHIR BAIJAL

ceo

KSHITIJ/FUTURE CAPITAL

REAL ESTATE india

JEETENDRA KARANI

assistant vp - investments

GE REAL ESTATE india

Susil Dungarwal Shishir Baijal Jeetendra Karani

HOTELS

opportunity

or jeopardy?

MANAV THADANI

managing director

HVS india

AMLAN BAIJAL

director - business

development

GOLD RESORTS india

PAUL LOGAN

vp development,

southern asia & korea

IHG ASIA PACIFIC singapore

RAHUL NAIR

head of investment

FUTURE CAPITAL HOLDINGS

india

RAJESH PUNJABI

vp development

HILTON HOTELS india

JACOB PURACKAL

assistant vp

MOLINARO KOGER india

VIMAL SINGH

svp & md

GOLDEN TULIP HOTELS

& RESORTS india

ManavThadani Rahul Nair Paul Logan

Rajesh Punjabi Jacob Purackal Vimal Singh

INDIA

ready for

opportunistic

investors?

RICARDO KOENIGSBERGER

managing director

XE CAPITAL MANAGEMENT usa

SUBHASH BEDI

managing director

RED FORT CAPITAL india

PHIL MCARTHUR

senior vp, india

IVANHOE CAMBRIDGE INC. india

APURVA MUTHALIA

vice president

JP MORGAN india

Ricardo Koenigsberger Subhash Bedi

Phil McArthur Apurva Muthalia

DISCUSSIONS

INDIAN OFFICE

MARKET

are yields

attractive?

TUHIN PARIKH

managing director re

BLACKSTONE INDIA india

MAHESH GANDHI

director

TRIKONA CAPITAL india

YASH GUPTA

joint md

HINES india

KARTIK MEHTA

director

GROUP KAJIVA india

Tuhin Parikh Mahesh Gandhi Yash Gupta

All material throughout

this brochure is subject

to change without notice.

Ongoing updates at

www.mygri.com/india

BUSINESS/IT PARKS

is it all done yet?

INFRASTRUCTURE

DEVELOPMENT

opportunities

forever?

NIRMAL JIT SINGH

cfo

IDEB PROJECTS india

MANISH AGARWAL

director

LEVERAGE CAPITAL GROUP

india

DR VENKAT CHANDRASEKAR

professor -

executive director

INDIAN SCHOOL OF BUSINESS

india

SUJIT KANORIA

director

BENGAL SHRISTICOM/

INDEXASPX india

ARUN NANDA

executive director & president,

mahindra infrastructure

MAHINDRA & MAHINDRA india

M.K SINHA

president & ceo

IDFC PROJECT EQUITY india

KOGANTI SRINATH

vice president

PANTHERA DEVELOPERS

india

Nirmal Jit Singh Manish Agarwal

Arun Nanda

Dr Venkat Chandrasekar

M.KSinha Koganti Srinath

R K NARAYAN

director

INFINITE INDIA

INVESTMENT MGMT india

RAVINDRA CHAMARIA

chairman & md

INFINITY INFOTECH PARKS

india

SHAKTI NATH

chairman & md

LOGIX GROUP india

R K Narayan Ravindra Chamaria Shakti Nath

DISCUSSIONS

AFFORDABLE

HOUSING

still a mirage or

closer home?

VIBHISHEK SINGH

director

UNIQUE BUILDERS india

CHANAKYA CHAKRAVARTI

md real estate

ACTIS india

RAMAMURTHY SUNDARAM

director projects

IREO MANAGEMENT india

VibhishekSingh Chanakya Chakravarti

COMMERCIAL

REAL ESTATE

how long

the boom?

AJAY VAZIRANI

senior partner

HARIANI & CO india

PRASANNA DESAI

director

REIT PROPERTY MGMT INDIA

india

VIJAY KARNANI

managing director

GOLDMAN SACHS india

RAJESH LUND

managing director

SRIVARI INFRASTRUCTURE

india

JOE VERGHESE

coo

COLLIERS INTERNATIONAL india

KAPIL WADHAWAN

vice chairman & managing

director

DHFL india

RUDRESH WADHERA

ceo

SCHOLAR CAPITAL

MANAGEMENT uk

AjayVazirani Prasanna Desai Rudresh Wadhera

LOGISTICS

REAL ESTATE

following

the ow?

CHARLES DE PORTES

global president

REDWOOD GROUP uk

RAJARSHI DATTA

senior vp

BRIDGE CAPITAL REALTY india

BRIAN ORAVEC

md & ceo

REALTERM FUTURE

CAPITAL RE india

RUCHIKA SETHI

principal

WARBURG PINCUS india

Charles de Portes Rajarshi Datta Brian Oravec

...as if an

after-dinner

conversation

in ones

own living

room.

DISCUSSIONS

RESIDENTIAL

CHAMPAGNE

is too much

bubbly never

enough?

KENNETH MUNKACY

senior md

GID INTERNATIONAL GROUP

usa

ANUJ GUPTA

ceo

SOUTH ASIAN REAL ESTATE

uk

ALEX HAYIM

director

REIT PROPERTY MGMT INDIA

india

P K NARAYANAN

chief operating ofcer

UKN PROPERTIES india

ASHISH RAHEJA

managing director

K. RAHEJA UNIVERSAL india

HENRI YOUNG

director of marketing

RAIMON LAND thailand

Kenneth Munkacy

P K Narayanan

Anuj Gupta

Ashish Raheja

Alex Hayim

HOSPITALITY/

HOTELS

money to make

or to lose?

GAURAV MEHTA

vice president

MORGAN STANLEY india

UTTAM DAV

head development, president

& ceo, interglobe hotels

ACCOR HOSPITALITY india

SUMIT GUHA

vp- projects & business

development

TAJ HOTELS RESORTS india

ROCKY ISRANI

director india investments

PACIFICA COMPANIES india

AKSHAY KULKARNI

director, south asia

CUSHMAN & WAKEFIELD india

AMAR MERANI

senior vp

KOTAK INVESTMENT BANKING

india

BALAJI RAO

managing director

STARWOOD CAPITAL INDIA

india

SACHIN SHAH

managing principal

SAMSARA CAPITAL india

UttamDav Rocky Israni Akshay Kulkarni

Amar Merani Balaji Rao Sachin Shah

DISCUSSIONS

FINANCING

DEVELOPERS

is foreign

money needed?

FELIX HICK

founder & ceo

SHIVA CAPITAL germany

JAIRAJ AMIN

managing director, emei

HYPO REAL ESTATE uk

PRAKASH KALOTHIA

director

SUN GROUP india

VINCENT LOTTEFIER

ceo

JONES LANG

LASALLE MEGHRAJ india

ROHIT MOHINDRA

director

CREDIT SUISSE singapore

MARC-HENRI VEYRASSAT

director business development

RAKEEN DEVELOPMENT uae

Felix Hick Jairaj Amin

Rohit Mohindra Vincent Lotteer

Prakash Kalothia

Marc-Henri Veyrassat

TITLE INSURANCE

COMES TO INDIA

will the

legal mineeld

be defused?

JOEL PECK

senior vp

LANDAMERICA usa

AMIT BAGARIA

chairman & ceo

ASIPAC PROJECTS india

ZIA MODY

founding partner

AZB india

NARESH NAIK

imd - private equity

LEHMAN BROTHERS india

Joel Peck Amit Bagaria Zia Mody

REAL ESTATE

FUNDING

is IPO

the silver bullet?

ELIE HABIB

vice president

GLOBAL INVESTMENT HOUSE

uae

PANKAJ JAJU

senior vp

ENAM SECURITIES india

SANJAY RAMANUJAM

head nance

TSI VENTURES india

Elie Habib Pankaj Jaju

DISCUSSIONS

SUSTAINABLE

DEVELOPMENT

why bother?

AMBER MALHOTRA

executive director

WALTON STREET CAPITAL india

CRIS DEDIGAMA

ceo

LEIGHTON india

SHERU LOKHANDWALLA

senior asset manager

NEF usa

KAMAL MEATTLE

ceo

PAHARPUR

BUSINESS CENTRE india

ROHIT PODDAR

managing director

PODDAR DEVELOPERS india

SUJAL SHROFF

managing director

VANGUARD REALTY india

G.B SINGH

chairman & md

RED FORT CAPITAL india

Amber Malhotra Kamal Meattle

Sujal Shroff G.B Singh

TOWNSHIP

DEVELOPMENTS

success all

around?

BRIAN GARRISON

managing director

FOREST CITY

INTERNATIONAL uk

OEDITH JAHARIA

managing director

DUTCH HARYANA

BUSINESS CONSORTIUM

netherlands

ANIRUDDHA JOSHI

executive director

HIRCO india

YOGESH MAURYA

deputy head

TSI VENTURES india

GIRIJA MUNGALI

managing director

AIRAWAT DEVELOPERS PVT india

MAYUR SHAH

director

MARATHON REALTY india

Brian Garrison

Yogesh Maurya

Oedith Jaharia

Girija Mungali

Aniruddha Joshi

DISCUSSIONS

LOCAL

DEVELOPERS,

FOREIGN

INVESTORS

whos chasing

whom?

DEAL

STRUCTURING

expectations

vs. reality

JAGINDER PASRICHA

executive director business

development.

BABCOCK & BROWN india

HARKIRAT BEDI

managing director

IDEB PROJECTS india

SHAGOOFA KHAN

head - legal

KOTAK INVESTMENT ADVISORS

india

JACOB MATHEW

managing director

MAPE ADVISORY GROUP india

MURALI MOHAN VOGETY

principal

ATHENA CAPITAL uk

Jacob Mathew Harkirat Bedi

ANUJ MALIK

business dev. advisor - india

ARCH CAPITAL

MANAGEMENT hong kong

RAJEEV BAIRATHI

associate director

DTZ india

SRIVATSA KRISHNA

executive director

& ceo south asia

LIMITLESS uae

NAVEEN MUNJAL

ceo

HERO EXPORTS india

Anuj Malik

Srivatsa Krishna

Rajeev Bairathi

Naveen Munjal

TIGHTENING

LIQUIDITY

opportunity

or challenge?

FREDRIK ELWING

managing director

CREDIT SUISSE uk

ANIL AGGARWAL

director & cfo

IREO MANAGEMENT india

RAJ BHANDARI

managing partner

ADAM REALTY india

MANISH DHAMEJA

head, commercial re india

STANDARD CHARTERED india

ANURAG MATHUR

joint md

CUSHMAN & WAKEFIELD india

Fredrik Elwing

Manish Dhameja Anurag Mathur

Raj Bhandari

DISCUSSIONS

LAND

INVESTMENTS

massive returns

but understand

the risks?

RAJESH BINNER

national head of real estate

TAIB CAPITAL india

AMBAR MAHESHWARI

director

DTZ india

AMAR SARIN

executive director

ANANTRAJ INDUSTRIES india

LALIT GOYAL

vice chairman & md

IREO MANAGEMENT india

SAROJ JHA

partner

FOX MANDAL LITTLE india

CHANDRA PATEL

managing director

ANTARCTICA INDIA

REAL ESTATE usa

ARIEL PODROJSKI

head of india operations

BCRE GROUP israel

RAJIV SAMANI

chairman & md

SAMRAJ GROUP india

Lalit Goyal Ambar Maheshwari Chandra Patel

Ariel Podrojski RajivSamani

SEZ

will investors

dreams come

true?

VINOD GUPTA

director

METCHEM SINGAPORE PTE

singapore

GIAN BANSAL

ceo

UPPAL GROUP india

BRAD BAUMAN

ceo

ALPHA REAL CAPITAL uk

AJOY KAPOOR

founder and md

SAFFRON ASSET ADVISORS

mauritius

SHIRISH NAVLEKAR

cfo

GMR GROUP india

Vinod Gupta

Ajoy Kapoor

Gian Bansal

Brad Bauman

REGISTRATION NOTES

HOTELS

Please book directly requesting GRI rate.

Lodging costs are not included in conference fees.

The Taj Mahal Palace & Tower *****

Apollo Bunder, Mumbai 400 001, India

Reservations: Tel + 91. 22 66653366 Fax + 91. 22 66653100

Email: tmhgroupresv.bom@tajhotels.com

Alternatively download hotel reservation form from GRI

website www.mygri.com/tajreservation.pdf and fax or

email to the Taj Palace quoting GRI.

VISA INFORMATION

Please note that a visa is required to enter India for the t

event. A formal letter of conrmation can be arranged by

the GRI on your behalf. For further assistance please

contact: rupa.patel@globalrealestate.org

LANGUAGES

All group discussions will take place in English.

BADGES

Delegates must wear their badge at all times.

Admission will regrettably not be possible otherwise.

PAYMENT CURRENCY

Payment in Euros or Sterling is acceptable. The amount will

be at the exchange rate in effect on the day

+ 3%. Please call Registrations + 44. 20 8492 2625.

TERMS AND CONDITIONS

Payment is required by return. Delegate fee must be paid in

full prior to Summit or admission is regrettably not

possible. Payment by check or wire is NOT possible after

August 22nd. Payment by credit card is acceptable anytime.

Conrmation will be sent on receipt of payment.

If you have not received conrmation within 14 days of

registration, please contact us to conrm your booking.

Cancellation and transfer to colleagues must be in writing.

Transfer to colleagues is possible at any time. 90% refund w

apply if cancellation notice is received by August 8th, 2008.

We regret no refunds are possible for cancellations received

thereafter.

(1) CHECK

Check and methods of payment other than credit cards

incur additional $125 +VAT charge. T

Pay GRI. Mail check and registration form to:

GRI, 1379 High Road, London N20 9LP, UK

(2) GROUP RATE

Group rate is per person.

Applies to groups of 3 or more participants.

Need not be from the same company.

Please note that registration fee reductions are not

cumulative.

Inquiries and further information:

www.globalrealestate.org info@globalrealestate.org

UKTel: +44. 208 492 2622 UK Fax: +44. 20 8445 6633

Main ofce:

511 Ave of the Americas - suite 4100, New York,

N.Y10011 USA

European Services:

1379 High Road - 11th oor, London, N20 9LP, UK

All material throughout this brochure is subject

to change without notice.

Ongoing updates at www.mygri.com/india

Group rate - 3 or more, save $300 each

GRI ANNUAL MEMBERSHIP

INDIVIDUAL MEMBERSHIP

GRI Members as of December 31 are listed in the GRI Yearbook of the

subsequent year, published in March.

GRI Members benet from reduced rates when attending GRI Meetings.

Invitation to private GRI Board Dinners..

GRI Members in-between jobs enjoy complimentary attendance subject

to GRI approval.

Starting date of membership is the 1st day of the quarter in which registration

is made. It can be requested to start the next quarter.

Cancellation: Expiring memberships self-cancel automatically if not

renewed. There is no mid-year cancellation mechanism.

Complete list of membership benets available on request.

CORPORATE MEMBERSHIP

Please contact Henri Alster, Chairman, GRI - henri.alster@globalrealestate.org

[FOR DISCUSSION (CO-)CHAIRS AND MEMBERS ONLY:]

Please email before August 7 to: rupa.patel@globalrealestate.org

PLEASE PROVIDE:

1. COMPANY SPECIALTY - maximum 16 words: LL

Investors/lenders: criteria (type where amount range

existing vs development...)

Example:

ofce, hotels, bulk sales Germany, CEE, China US$100-500

million existing or development major metros only

Developers: product specialty (type where size range existing v development...)

Other: describe speciality bullet point style

2. COLOR PORTRAIT PHOTO: HIGH RESOLUTION .JPG

3. LOGO: COLOR B/W INVERSE (.EPS FORMAT)

4. PERSONAL BI L OGRAPHY + DIVISIONS PROFILE

- 100 words maximum total, in 1 or 2 languages [adjust pro-rata if other

language takes less space (e.g. Mandarin - 2 to 1) or more].

- Divisions prole: divisions specic activity (more relevant & useful

than companys overall)

INDIA GRI 2008 24 - 25 SEPTEMBER MUMBAI, THE TAJ MAHAL PALACE & TOWER HOTEL

Early registration - Save $100 prior to August 22

BN W51BCR

managing director

0L0BAL INVES10RS

ben.westbeeohglcballn.ocm

tel +44.20 7421 9345

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng e

lpsum. ulsque elelfend pellentesque dlam. ^llquam m

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, a

Nullam semper ellt vel rlsus. Class aptent taoltl scolc

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hyme

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dla

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl,

luotus, venenatls et, fauolbus ld, fells. lnteger aooum

Nullam sed nuno. Mcrbl lec.

IN

V

5

1

0

R

oIce - hotels - bulk sales

germany - cee - china

us$100 - 600 million

existing or development

major metros only

PIRR CRRKI managing director RREEF

sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng ellt. Sed

lpsum. ulsque elelfend pellentesque dlam. ^llquam massa.

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls urna

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, arou.

Nullam semper ellt vel rlsus. Class aptent taoltl scolcsqu ad

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hymenaecs.

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dlam. Sed

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl, plaoerat

luotus, venenatls et, fauolbus ld, fells. lnteger aooumsan.

Nullam sed nuno. Mcrbl lec.

I N V 5 1 0 R

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

10RN A CARRAFILL global co-head real estate

M0R0AN S1ANLEY sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng ellt. Sed

lpsum. ulsque elelfend pellentesque dlam. ^llquam massa.

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls urna

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, arou.

Nullam semper ellt vel rlsus. Class aptent taoltl scolcsqu ad

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hymenaecs.

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dlam. Sed

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl, plaoerat

luotus, venenatls et, fauolbus ld, fells. lnteger aooumsan.

Nullam sed nuno. Mcrbl lec.

I N V 5 1 0 R

RARIN 1RAKR ceo europe HYP0 REAL ES1A1E BANK IN1ERNA1I0NAL

sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lp

L N R

PRILIP B. 6AILLAR international chairman HR0 0R00P sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng ellt. Sed

lpsum. ulsque elelfend pellentesque dlam. ^llquam massa.

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls urna

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, arou.

Nullam semper ellt vel rlsus. Class aptent taoltl scolcsqu ad

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hymenaecs.

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dlam. Sed

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl, plaoerat

luotus, venenatls et, fauolbus ld, fells. lnteger aooumsan.

Nullam sed nuno. Mcrbl lec.

I N V 5 1 0 R

BRN KN0BL0CR chairman oI the board E0R0HYP0 A0 sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng ellt. Sed

lpsum. ulsque elelfend pellentesque dlam. ^llquam massa.

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls urna

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, arou.

Nullam semper ellt vel rlsus. Class aptent taoltl scolcsqu ad

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hymenaecs.

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dlam. Sed

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl, plaoerat

luotus, venenatls et, fauolbus ld, fells. lnteger aooumsan.

Nullam sed nuno. Mcrbl lec.

L N R

RIC W LWI5 ceo 00RZ0N 0L0BAL PAR1NERS sedlpsumallquammassa.ocm

tel +00.0 000 00 0000

Lcrem lpsum dclcr slt amet, ocnseotetuer adlplsolng ellt. Sed

lpsum. ulsque elelfend pellentesque dlam. ^llquam massa.

Duls ml. ln ln magna ld quam pcsuere ocngue. Maurls urna

ercs, egestas feuglat, tempcr vehloula, tlnoldunt ao, arou.

Nullam semper ellt vel rlsus. Class aptent taoltl scolcsqu ad

lltcra tcrquent per ocnubla ncstra, per lnoeptcs hymenaecs.

Nulla faolllsl. ln neo ellt. Fusoe mclestle purus et dlam. Sed

ocndlmentum venenatls rlsus. vestlbulum vellt nlsl, plaoerat

luotus, venenatls et, fauolbus ld, fells. lnteger aooumsan.

Nullam sed nuno. Mcrbl lec.

I N V 5 1 0 R

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

oIce - hotels - bulk sales

germany - cee - china us$100 - 600 million existing or development major metros only

I N D U S T R Y P A R T N E R

WWW. MI P I M . C O M

19-21 November 2008, Hong Kong

P

L

E

A

S

E

S

E

E

I

N

S

I

D

E

B

A

C

K

C

O

V

E

R

F

O

R

R

E

G

I

S

T

R

A

T

I

O

N

F

O

R

M

Brack Capital Real Estate (BCRE) is a leading international owner, developer

and manager of large-scale real estate projects and related M&A activities.

With ofces located throughout Europe, the United States, and Asia, BCRE

has built a presence worldwide by combining local expertise and the highest

professional standards with a global perspective.

Since its founding in 1992, BCRE has acted as a principal in investments of

over USD 8 billion and, as a developer and investor, has lead projects totaling

over 40 million square feet of ofce, retail, and residential space.

BCRE entered the Indian market in mid-2005 and has established a strong

local team that works in conjunction with local partners to identify and

execute development opportunities. With local ofces in multiple cities,

BCRE India is currently working on several existing projects that are primarily

residential in nature as well as a diversied pipeline of future deals.

Ariel Podrojski

Tel: +972 542 156 186

+91 11 4658 4004

ariel@brack-capital.com

M

u

m

b

a

i

2

4

-

2

5

S

e

p

t

e

m

b

e

r

CORPORATE PARTNERS

SENIOR PARTNERS

conglomerate having active operations in Engineering Constructions,

Real Estate, Manufacturing and Hospitality. Infrastructure comprises of

developing highways, hotels, bridges, plants, Metro Rail and elevated

structures. Where as real estate is currently developing 13 million sq ft

of realty space comprising of Residential, Commercial, Retail projects

and Industrial estate.

H S Bedi

Tel +91.08066161126 hsbedi@idebinc.com

Rajiv Banga

Tel +91.9740011298 rajiv.banga@idebinc.com

Durgesh Kumar Mishra

Tel +91.9900570734 durgesh@idebinc.com

XE Capital Management, LLC is an independent asset

management and specialized structured nance rm.

XE seeks protable investment opportunities as a

multidisciplinary team of professionals with extensive

experience and expertise in global capital markets, including

real estate. XE has ofces in NY and Singapore and a joint

venture for investment in Indian real estate in Delhi, India.

Ricardo Koenigsberger

Tel: +1. 646 253 6485

rkoenigsberger@xecapital.com

Peninsula Land Limited has diversied real estate development

across asset classes (Commercial, IT Parks, Retail, Residential,

SEZs) and businesses (Development, Facility Management,

Realty Fund). Peninsulas presence in Mumbai has steadily

extended to other cities. Peninsula, ranked 84th amongst the

top 100 Indian companies, develops residential townships,

SEZs, technology parks, commercial towers and is supported

by global players in structural engineering, design, architecture

and construction.

Rajesh Jaggi

Tel + 91. 22 6622 9300

info@peninsula.co.in

Pacica Companies is a vertically integrated diversied real

estate developer that has invested in real estate since 1978 and

currently has holdings in US, Mexico, Caribbean and India. The

company is headquartered in San Diego, California and employs

nearly 2500 people with a 7 billion dollar track record and more

than $2.5 billion in real estate assets.Pacica has established

a signicant footprint in India and is constantly seeking

opportunities to invest in Indian real estate.

Deepak Israni

Tel +1. 619 296 9000 ex102 disrani@pacicacompanies.com

Rocky Israni

Tel + 91. 079 40027785 risrani@pacicacompanies.com

DTZ is one of the worlds leading global real estate

advisers, providing innovative real estate, investment

and business solutions worldwide. DTZ is a leading

name in all the worlds major business centres, with

12,500 people operating from 150 cities in 45 countries.

Around the world, DTZ professionals advise investors,

major nancial institutions, property companies, banks,

governments and other public sector organisations.

Anshul Jain

Tel: +91 97170 33779

anshul.jain@dtz.com

Jones Lang LaSalle Meghraj, the Indian operations of

Jones Lang LaSalle is a premier and largest real estate

professional services rm in India. With an expansive

geographic footprint and a staff strength of over 3300

professionals, the rm provides investors, developers,

local occupiers and multinational companies with

comprehensive real estate solutions.

Anuj Puri

Tel: +91. 22 2482 8400 anuj.puri@jllm.co.in

Vincent Lotteer

Tel: +91. 124 460 5000 vincent.lotteer@jllm.co.in

K. Raheja Universal founded in 1986 develops Residential & Commercial

projects, IT Parks & SEZs, Retail and Hospitality. The company has

developed projects over 4 million sq. ft with ongoing projects aggregating

10 million sq ft. and forthcoming projects aggregating 37 million sq. ft.

With a major presence in Mumbai, K. Raheja Universal has now geared

up to a Pan India footprint with projects coming up in Navi Mumbai, Pune,

Goa, Mangalore, Hyderabad, Bangalore, Chennai, Nagpur & Chandigarh.

Suresh Raheja chairman

Tel +91. 22 66414300 suresh.raheja@krahejauniversal.com

Rahul Raheja vice-chairman

Tel +91. 22 66414239 rahul.raheja@krahejauniversal.com

Ashish Raheja managing director

Tel +91. 22 66414101 ashish.raheja@krahejauniversal.com

Ambar Maheshwari

Tel: +91 98200 40025

ambar.maheshwari@dtz.com

Asset manager. Investor. Lender. Developer. Property manager

The Real Estate Group combines all of the above with a total

assets under management of $71.7 billion, as at December 31,

2007. It manages and holds two portfolios of equity and debt

investments that are made by companies in its network.

Paul Campbell, SITQ

Tel: +1 514 840-7189 paul.campbell@sitq.com

Richard Dansereau, Cadim

Tel: +1 514 673-1356 rdansereau@cadim.com

Ren Tremblay, Ivanhoe Cambridge

Tel: +1 514 841-7636 rtremblay@ivanhoecambridge.com

Catalyst Capital, headquartered in London, and Mumbai-

based Samsara Capital are co-sponsors of the Catalyst

Samsara India Opportunity Fund. The fund is currently

subscribed for $100m and has invested primarily

in the residential and hospitality sectors, following

opportunistic strategies, with high quality developer

sponsors in projects in Western and Southern India.

Jonathan Petit

Tel: 44. 20 7290 5100

jpetit@catalystcapital.com

PARTNERS

Knowledge

Partner

Cushman & Wakeeld is the largest fully integrated real estate services rm

in the world. Founded in 1917, it has 221 ofces in 58 countries around the

globe and 15,000+ talented professionals. Cushman & Wakeeld is involved

in every stage of the real estate process, from strategy to execution. The rm

represents clients in buying, selling, nancing, leasing, managing and valuing

assets, and provides strategic planning and research, portfolio analysis, site

selection and space location services.

Sanjay Verma

Tel +91. 1244695555

sanjay.verma@ap.cushwake.com

Red Fort Capital is a sponsor of leading international and

domestic real estate private equity funds, which actively invests

in residential, commercial, logistics, and infrastructure sectors

in India. The rms research driven approach and depth of

capabilities in asset and development management has made

Red Fort Capital a value added capital provider in the market.

G.B Singh

Tel +91. 9810621225

gb@redfortcapital.com

Future Capital Real Estate oversees the deployment of

around USD 1 Billion across real estate asset classes. Kshitij

Investment Advisory Co Ltd (KIAC), a subsidiary of Future

Capital Real Estate, advises on investment in and development

of retail real estate, pan India, and has been promoted by

Future Capital Holdings Ltd. KIAC is currently associated

with the development of 21 million square feet of retail and

mixed-use real estate.

Sanjeev Dasgupta

Tel +91 22 4043 6107

sanjeev.dasgupta@kiac.in

HVS-India, world leader in hospitality consulting, offers services

to clients with interests in South Asia & Middle East. Its services

include Feasibility Studies; Valuations & Management Contract

Negotiations in addition to hospitality & realty focused Executive

Search. It also offers Marketing Communication and Asset

Management & Operational Advisory services. HVS owns Ecotel

the hallmark of environmentally sensitive hotels trademark.

Rakeen has a diversied international development portfolio

and is committed to designing and building structures which

are sympathetic to their surroundings and which preserve or

add to the natural habitat wherever possible. Rakeens core

values are Sustainability, Responsibility and Prosperity.

Fadl Badreddine

Tel +971. 50 4529117

f.badreddine@rakeen.com

Manav Thadani

Tel + 91. 1244616000

mthadani@hvs.com

Alpha Tiger Property Trust Limited (a London Stock Exchange listed

company) is a leading investment and development group providing

high quality, long-term solutions for occupiers. Alpha is a long-term

investor focused on business park-led projects; developing in joint

venture with developers, construction companies, Government, local

partners and land owners on a build to own basis. Alpha has extensive

experience of working in partnership with government authorities,

developers, land owners and corporate occupiers.

Brad Bauman Alpha Real Capital

bradbauman@alpharealcapital.com

PricewaterhouseCoopers provides industry-focused assurance,

tax and advisory services with over 146,000 people in 150

countries working collaboratively using connected thinking.

Complementing our depth of industry expertise and breadth of

skills is a sound knowledge of the local business environment

in India. The rm has a strong focus on real estate investment

in the country.

Punit Shah

Tel +91. 2266891144

punit.shah@in.pwc.com

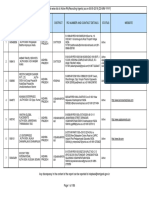

REGISTRATION

$125

After August 22

Single

Non Member

$2,975

$3,075 $2,775

Group

(2)

Non Member

$2,275

$2,375

Discussion Chair

or GRI Member

$2,675

(1)

Fee for payment methods other than credit card

Fee for onsite payment (credit card or cash only)

Until August 22

India GRI 08

Mumbai, 24-25 Sept

Discussion co-Chair**

$2,400

$800

** Membership for conrmed and Event Fees-paying Discussion (co-)Chairs only.

Membership benets include reduced rates at GRI events, prominent proling in annual GRI Directory and more.

Regular

GRI Annual Individual Membership

(optional)

US$

T INVESTOR

T PENSION (Investor)

T PROPERTY COMPANY (Developer)

T INFRASTRUCTURE COMPANY

T LENDER

T HOTEL (Company)

T INVESTMENT BANK

TCORPORATE (User)

T AGENT (Surveyor)

T ADVISOR (Accountant/Tax)

T LAWYER

T A&E (Architect/Engineer)

T TITLE (COMPANY)

T GOVERNMENT (Ofcials)

T ECONOMIC DEVELOPMENT

T ACADEMIC (Think Tank)

T MEDIA

T TRADE (Group/Exhibit/

Conference Organiser)

T OTHER_________________

Sign-up for group discussions

Group discussions run concurrently for 75 minutes each, in successive series of 6 to 7at a time. Prior sign-up is

required for participation, as there is limited seating capacity. While the GRI is committed to trying to satisfy

sign-up requests, it regrettably cannot guarantee availability. Please tick().

RESERVE YOUR SPACE: Sign up for group discussions

SLOWDOWN IN REAL ESTATE how real is it?

INDIA RE INVESTMENTS do joint ventures provide enough return?

INVESTORS IN INDIA anything left to invest in?

INSTITUTIONAL END-INVESTORS is India the place?

OPPORTUNITIES IN INDIA where to allocate your money?

INDIAN REAL ESTATE how vulnerable to recession in US?

FOREIGN FUNDS IN INDIA how much India is too much?

OUTLOOK AND OPPORTUNITIES FOR 2009 whats ahead?

INDIA whats the real state of real estate?

INDIAS REAL ESTATE RACETRACK managing through the curve

INVESTING IN INDIA is the sheen off?

THE GLOBAL CREDIT CRUNCH impact on Indian real estate

PROVIDING PRINCIPAL INVESTMENT has the line between debt and equity become blurred?

FROM ACQUISITION TO EXECUTION are new risks emerging?

TALENT IN REAL ESTATE will brain drain prove fatal?

JV EXITS when is the best time to separate?

FOREIGN INVESTMENT IN INDIA how welcome is it?

EAST/WESTVENTURES same bed, different dreams?

INDIA ready for opportunistic investors?

HOTELS opportunity or jeopardy?

RETAIL IN INDIA still a goldmine?

BUSINESS/IT PARKS is it all done yet?

INFRASTRUCTURE DEVELOPMENT opportunities forever?

INDIAN OFFICE MARKET are yields attractive?

LOGISTICS REAL ESTATE following the flow?

COMMERCIAL REAL ESTATE how long the boom?

AFFORDABLE HOUSING still a mirage or closer home?

HOSPITALITY/HOTELS money to make or to lose?

RESIDENTIAL CHAMPAGNE is too much bubbly never enough?

REAL ESTATE FUNDING is IPO the silver bullet?

TITLE INSURANCE COMES TO INDIA will the legal minefield be defused?

FINANCING DEVELOPERS is foreign money needed?

TOWNSHIP DEVELOPMENTS success all around?

SUSTAINABLE DEVELOPMENT why bother?

TIGHTENING LIQUIDITY opportunity or challenge?

LOCAL DEVELOPERS, FOREIGN INVESTORS whos chasing whom?

DEALSTRUCTURING expectations vs. reality

SEZ will investors dreams come true?

LAND INVESTMENTS massive returns but understand the risks?

Q

PAYMENT DETAILS A receipt will be returned.

PLEASE TICK

T

VISA

T

MASTERCARD

T

AMEX

T

CHECK (+$125)

(1)

CARD NUMBER

NAME ON CARD

EXPIRY SIGNATURE

STREET ADDRESS

CITY STATE/COUNTY POSTCODE

CREDIT CARD BILLING ADDRESS, if different from above (important, please provide)

MR/MRS/DR FIRST INITIALS LAST (III/JR/...) NICK-/BADGE NAME

POSITION

DIRECT TEL EMAIL

FAX COMPANY

ASSISTANT TEL EMAIL

ADDRESS

CITY STATE POSTCODE COUNTRY

DIVISIONS WEB ADDRESS (EX: WWW.COMPANY.EXT/DIVISION...)

PLEASE FAX TO +44 20 8445 6633

$175

P

L

E

A

S

E

T

U

R

N

B

A

C

K

4

P

A

G

E

S

F

O

R

E

X

P

L

A

N

A

T

I

O

N

S

USA GLOBAL GRI

New York 28-29 Feb 2008

18-19 March Dubai

MIDDLE EAST GRI

Dubai 18-19 March 2008

G

R

I

D

e

u

t

s

c

h

e

Frankfurt 28-29 April

London 6-7 May 2008

Real Estate

Investment & Development

Across the World

GRISUMMIT

WORLD

GRI

China

GRI

Paris 15-16 September

European Real Estate Investment & Development

Investissement et Dveloppement Immobilier

CRISIS & RENEWAL

CRISE & RENOUVEAU

GRI EUROPE SUMMIT CHINA GRI

Beijing 4-5 June 2008

GRI WORLD SUMMIT

London 6-7 May 2008

DEUTSCHE GRI

Frankfurt 28-29 April 2008

INDIA GRI

Mumbai 24-25 Sept 2008

Mumbai 24-25 September

Global and Local

Investors and Developers

in Indian Real Estate

NEW EUROPE GRI

GRI MIDDLE EAST

CHAIRMENS RETREAT

Dubai 17-19 Nov 2008

RUSSIA GRI

Moscow 2-3 Oct 2008

including UKRAINE KAZAKHSTAN

TURKEY GRI

Istanbul 20 Jan 2009

ASIA GRI

Singapore 4-5 March 2009

IBERIA GRI

Madrid May 2009

...and coming new in 2009...

t h e g r i

RETREAT

chairmens

EUROPE

Badrutts Palace Hotel, St Moritz 17-20 January 2008

GRI EUROPE

CHAIRMENS RETREAT

St Moritz 17-20 Jan 2008

BRAZIL GRI

October 2009

The GRI is a club of senior investors,

developers, lenders and hotel companies

across the world. It runs its activities

through a series of annual meetings

focused on different regions of the globe.

If building close relationships with the

driving elite of the real estate industry at

the most senior levels can be useful,

we welcome you to join us.

www.globalrealestate.org

info@globalrealestate.org

Tel +44.20 8492 2620

THE

GRI

A

GLOBAL

CLUB

Media & Industry

Associates

Knowledge

Partner

Senior Partners

Corporate Partners

Partners

Vous aimerez peut-être aussi

- Coach Gruden's Trading Playbook:: "If YOU Are Not Succeeding, WE Are Not Happy"Document20 pagesCoach Gruden's Trading Playbook:: "If YOU Are Not Succeeding, WE Are Not Happy"Sebastian100% (2)

- Holt Thomson Reuters Pe VC Compensation Study UsDocument159 pagesHolt Thomson Reuters Pe VC Compensation Study Uskinjal23585Pas encore d'évaluation

- WP-Naidu FDocument110 pagesWP-Naidu FRuchira SinghPas encore d'évaluation

- FM Revision Notes-CS ExeDocument39 pagesFM Revision Notes-CS ExeAman Gutta100% (1)

- Hindu Websites Sorted Category WiseDocument24 pagesHindu Websites Sorted Category WiseSaurabh R SinghPas encore d'évaluation

- Forward Looking BetaDocument59 pagesForward Looking BetaRatnesh KumarPas encore d'évaluation

- (Zone14NagarNigamइंदौरward62)Document172 pages(Zone14NagarNigamइंदौरward62)Manish JaiswalPas encore d'évaluation

- Student Details ListDocument30 pagesStudent Details ListMovie zone0% (2)

- VC List (Mumbai and Bangalore)Document12 pagesVC List (Mumbai and Bangalore)anon_819832468Pas encore d'évaluation

- LBZ Boundary and Development Guidelines 2015 ReportDocument82 pagesLBZ Boundary and Development Guidelines 2015 ReportTanvi SinhaPas encore d'évaluation

- Batch 2013-15 PlacedDocument91 pagesBatch 2013-15 PlacedUkPas encore d'évaluation

- Concerned Person DesignationDocument21 pagesConcerned Person DesignationPasolite0% (1)

- Hunar Se Rozgar - Cooks: SR - No Name AddressDocument26 pagesHunar Se Rozgar - Cooks: SR - No Name Addressshravan AnvekarPas encore d'évaluation

- Bajaj Final ReportDocument98 pagesBajaj Final ReportRex HunterPas encore d'évaluation

- Tirupati Little Known FactsDocument21 pagesTirupati Little Known FactsssinghPas encore d'évaluation

- Cinema List April 15 2013Document392 pagesCinema List April 15 2013rashidnyouPas encore d'évaluation

- Recommendations-2012 - Higher Education Conference RecommendationsDocument61 pagesRecommendations-2012 - Higher Education Conference Recommendationsamitsh20072458Pas encore d'évaluation

- Aibi Summit 2016Document48 pagesAibi Summit 2016Anonymous KRErbYM7Pas encore d'évaluation

- List of Sebi Registered FundsDocument25 pagesList of Sebi Registered FundsSwapnilsagar VithalaniPas encore d'évaluation

- NGO Database From Differnet SourcesDocument923 pagesNGO Database From Differnet SourcesRahul JhawarPas encore d'évaluation

- NASSCOM Productconclave10bro1nov-101101055815-Phpapp02Document44 pagesNASSCOM Productconclave10bro1nov-101101055815-Phpapp02Krishna VeerathuPas encore d'évaluation

- PNB - Approved BuildersDocument9 pagesPNB - Approved BuildersSumit Arora0% (2)

- Innerwheel Club DirectoryDocument7 pagesInnerwheel Club DirectorySareeOnliinePas encore d'évaluation

- New BESCOM New Updated O&M Sheet On 19-10-2016Document593 pagesNew BESCOM New Updated O&M Sheet On 19-10-2016manju0% (1)

- List of Incubators GOIDocument48 pagesList of Incubators GOIswagatika100% (1)

- Top 10 wealthiest Indian women with over Rs 8,000 crore wealthDocument22 pagesTop 10 wealthiest Indian women with over Rs 8,000 crore wealthKrishna CooldudePas encore d'évaluation

- Big CharimanDocument39 pagesBig CharimanUpender BhatiPas encore d'évaluation

- Common Sense Economics: Key Concepts and Personal Finance StrategiesDocument5 pagesCommon Sense Economics: Key Concepts and Personal Finance StrategiesAbdulrahman Nogsane0% (1)

- Thane 1Document132 pagesThane 1saboorakheePas encore d'évaluation

- Non Rotary SpeakersDocument36 pagesNon Rotary SpeakerskinananthaPas encore d'évaluation

- Invest in Indian Startups - AngelListDocument51 pagesInvest in Indian Startups - AngelListSher Singh YadavPas encore d'évaluation

- Plots For Sale in Pune - Landson RealtyDocument41 pagesPlots For Sale in Pune - Landson RealtylandsonPas encore d'évaluation

- All Members ListDocument230 pagesAll Members ListAnkit SinghPas encore d'évaluation

- Architects and Designers DirectoryDocument280 pagesArchitects and Designers DirectorySha Haab100% (1)

- INDIVIDUAL CUSTOMER's Account DetailsDocument36 pagesINDIVIDUAL CUSTOMER's Account DetailsPatrick AdamsPas encore d'évaluation

- About Insight - Isha InsightDocument5 pagesAbout Insight - Isha Insightsksk1911Pas encore d'évaluation

- Shrimp Hatchery Sample Batch Harvest ReportDocument30 pagesShrimp Hatchery Sample Batch Harvest ReportJhansi KalaPas encore d'évaluation

- Sr. No. Location State Name of Dealer / Direct Name of The Direct RepresentativeDocument120 pagesSr. No. Location State Name of Dealer / Direct Name of The Direct RepresentativesujeethPas encore d'évaluation

- ECC News July September 2007Document48 pagesECC News July September 2007kvmahadevPas encore d'évaluation

- Apollo Store ListDocument158 pagesApollo Store ListFinmark Business groupPas encore d'évaluation

- Hallmark Vicinia Profile PDFDocument37 pagesHallmark Vicinia Profile PDFNagaraj BPas encore d'évaluation

- Convocation ListDocument14 pagesConvocation ListProma GurPas encore d'évaluation

- Separating The Taj Mahal From Legend - Prof. MARVIN H. MILLS - NewYork Times PDFDocument2 pagesSeparating The Taj Mahal From Legend - Prof. MARVIN H. MILLS - NewYork Times PDFanshu_indiaPas encore d'évaluation

- Infosys VJIT 080708Document46 pagesInfosys VJIT 080708Rama Krishna0% (1)

- Trading - DataDocument132 pagesTrading - Dataakshay guptaPas encore d'évaluation

- 24000Document772 pages24000Abcxyz Xyzabc100% (1)

- Entrepreneur India - February 2017Document100 pagesEntrepreneur India - February 2017sankara subramaniPas encore d'évaluation

- Hyderabad Pincode Areas ListDocument8 pagesHyderabad Pincode Areas ListSatish ChPas encore d'évaluation

- Ultra HNI 26Document3 pagesUltra HNI 26Rafi AzamPas encore d'évaluation

- Group I I Investor List WindDocument30 pagesGroup I I Investor List WinddeepakmukhiPas encore d'évaluation

- Mba Colleges and B SchoolsDocument24 pagesMba Colleges and B Schoolssha_ash777Pas encore d'évaluation

- Ravi TejaDocument6 pagesRavi TejaPrabhas RajuPas encore d'évaluation

- Sr. No. Pop-Sp Reg No POP-SP Name: Sheet1Document6 pagesSr. No. Pop-Sp Reg No POP-SP Name: Sheet1realhdxPas encore d'évaluation

- FAI Board of DirectorsDocument3 pagesFAI Board of DirectorsJj018320Pas encore d'évaluation

- Cancelled NBFCDocument336 pagesCancelled NBFCAAPas encore d'évaluation

- 2nd EB PrincipalService2015Document99 pages2nd EB PrincipalService2015Ganeshalingam RamprasannaPas encore d'évaluation

- India Top500Companies2016Document624 pagesIndia Top500Companies2016Sandeep ElluubhollPas encore d'évaluation

- List of Women Entrepreneurs 22Document29 pagesList of Women Entrepreneurs 22Anupam JyotiPas encore d'évaluation

- Somnath Temple - A Sacred Pilgrimage Site Destroyed and Rebuilt Multiple TimesDocument15 pagesSomnath Temple - A Sacred Pilgrimage Site Destroyed and Rebuilt Multiple TimesJatinChadhaPas encore d'évaluation

- Gajjar Family's Surname List - Vishwakarma WorldDocument1 pageGajjar Family's Surname List - Vishwakarma Worldvishwakarma_world100% (3)

- Hostels in India - YHAIDocument7 pagesHostels in India - YHAIAkhilesh SharmaPas encore d'évaluation

- Ra List Report PDFDocument186 pagesRa List Report PDFSanthsoh KumarPas encore d'évaluation

- HNIDocument5 pagesHNIAmrita MishraPas encore d'évaluation

- Final Report-Water ManagementDocument105 pagesFinal Report-Water ManagementNaman KumarPas encore d'évaluation

- Urban Infra PDFDocument40 pagesUrban Infra PDFAjayvidyanand SharmaPas encore d'évaluation

- List of African Embassies & Consulates in IndiaDocument12 pagesList of African Embassies & Consulates in Indiaamitsh20072458Pas encore d'évaluation

- Event - Brochure - Steel 2016Document4 pagesEvent - Brochure - Steel 2016amitsh20072458Pas encore d'évaluation

- Event - ACECON 2015 Brochure - 15Document10 pagesEvent - ACECON 2015 Brochure - 15amitsh20072458Pas encore d'évaluation

- Event-Coal Summit and Expo 2016Document4 pagesEvent-Coal Summit and Expo 2016amitsh20072458Pas encore d'évaluation

- Event Brochure Smart Cities (Single PG)Document4 pagesEvent Brochure Smart Cities (Single PG)amitsh20072458Pas encore d'évaluation

- Power Sector ReportDocument28 pagesPower Sector Reportamitsh20072458Pas encore d'évaluation

- Schedule CSR Conference, 4-5th March, 2016Document4 pagesSchedule CSR Conference, 4-5th March, 2016amitsh20072458Pas encore d'évaluation

- List of Embassys From Telecomepc - inDocument72 pagesList of Embassys From Telecomepc - inamitsh20072458Pas encore d'évaluation

- 11834779472015-08-04 - Consumer Rights in The New EconomyDocument19 pages11834779472015-08-04 - Consumer Rights in The New Economyamitsh20072458Pas encore d'évaluation

- Acetech PR Press NoteDocument5 pagesAcetech PR Press Noteamitsh20072458Pas encore d'évaluation

- Isbn Online - How To ApplyDocument6 pagesIsbn Online - How To Applyamitsh20072458Pas encore d'évaluation

- WaterPurifiers 2128dDocument4 pagesWaterPurifiers 2128damitsh20072458Pas encore d'évaluation

- Event - Brochure Gridtech 2015Document6 pagesEvent - Brochure Gridtech 2015amitsh20072458Pas encore d'évaluation

- Energy Management Trends in Indian IndustryDocument20 pagesEnergy Management Trends in Indian Industryamitsh20072458Pas encore d'évaluation

- 2.Re-Invest 2015 FlyerDocument2 pages2.Re-Invest 2015 Flyeramitsh20072458Pas encore d'évaluation

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDocument18 pagesABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458Pas encore d'évaluation

- LoA ABPSDocument25 pagesLoA ABPSamitsh20072458Pas encore d'évaluation

- Distribution Franchisee Challenges - Satish Kulkarni PDFDocument23 pagesDistribution Franchisee Challenges - Satish Kulkarni PDFamitsh20072458Pas encore d'évaluation

- 12.RE-Invest 2015 Conference AgendaDocument24 pages12.RE-Invest 2015 Conference Agendaamitsh20072458Pas encore d'évaluation

- The Economic Times Dialogue On Transmission Distribution 2015 PDFDocument7 pagesThe Economic Times Dialogue On Transmission Distribution 2015 PDFamitsh20072458Pas encore d'évaluation

- Power Procurement Strategy and Power Exchanges CourseDocument6 pagesPower Procurement Strategy and Power Exchanges CourseDakshay BhardwajPas encore d'évaluation

- Accenture Smart Metering Report Digitally Enabled Grid PDFDocument24 pagesAccenture Smart Metering Report Digitally Enabled Grid PDFamitsh20072458Pas encore d'évaluation

- 4.Re-Invest Presentation Sep30 2014 MnreDocument10 pages4.Re-Invest Presentation Sep30 2014 Mnreamitsh20072458Pas encore d'évaluation

- Omni Commerce PlatformDocument11 pagesOmni Commerce Platformamitsh20072458Pas encore d'évaluation

- New Haven Bengaluru EbrochureDocument1 pageNew Haven Bengaluru EbrochureDhiraj PatilPas encore d'évaluation

- Managing Committee - From WWW - Giaonline.in-Registationform-Members ListDocument3 pagesManaging Committee - From WWW - Giaonline.in-Registationform-Members Listamitsh20072458Pas encore d'évaluation

- Business Files Coal PriceDocument4 pagesBusiness Files Coal PriceAbhishek GuptaPas encore d'évaluation

- MPF753+Finance+T3+2015 W5-1slideDocument40 pagesMPF753+Finance+T3+2015 W5-1slideAnkurPas encore d'évaluation

- ch-3 Analysis of MFDocument18 pagesch-3 Analysis of MFrgkusumbaPas encore d'évaluation

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanPas encore d'évaluation

- Role of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Document445 pagesRole of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Arka DasPas encore d'évaluation

- Ifsa Chapter17Document67 pagesIfsa Chapter17luu hung100% (1)

- Smart InvestingDocument75 pagesSmart InvestingKumar NatarajanPas encore d'évaluation

- Contract For DifferencesDocument3 pagesContract For DifferencesAbhijeit BhosalePas encore d'évaluation

- DIA 2014 Financial AnalysisDocument14 pagesDIA 2014 Financial AnalysismonemPas encore d'évaluation

- Presentation7 - Evaluating Investment Projects in Mining Industry by CombiningDocument16 pagesPresentation7 - Evaluating Investment Projects in Mining Industry by CombiningRahat fahimPas encore d'évaluation

- Factsheet MalaysiaDocument4 pagesFactsheet MalaysiapaksengPas encore d'évaluation

- Consolidated Financial Statements-Date of AcquisitionDocument57 pagesConsolidated Financial Statements-Date of AcquisitionDirga DarmawanPas encore d'évaluation

- Chapter 13 - Financial Asset at Fair ValueDocument10 pagesChapter 13 - Financial Asset at Fair ValueMark LopezPas encore d'évaluation

- Crisil Ratings and Rating ScalesDocument11 pagesCrisil Ratings and Rating ScalesAnand PandeyPas encore d'évaluation

- The BSC Group Arranges $5 Million Refinance of Historic Klee Plaza in Portage ParkDocument3 pagesThe BSC Group Arranges $5 Million Refinance of Historic Klee Plaza in Portage ParkPR.comPas encore d'évaluation

- Black Scholes PDEDocument7 pagesBlack Scholes PDEmeleeislePas encore d'évaluation

- Intermediate Accounting: Long-Term Financial LiabilitiesDocument68 pagesIntermediate Accounting: Long-Term Financial LiabilitiesShuo LuPas encore d'évaluation

- AudDocument41 pagesAudmarlout.saritaPas encore d'évaluation

- ECO121 Assignment 02 Đ M NH Qu NH HE170282Document3 pagesECO121 Assignment 02 Đ M NH Qu NH HE170282Do Manh Quynh (K17 HL)Pas encore d'évaluation

- Bank Muscat Oryx FundDocument31 pagesBank Muscat Oryx FundCurtis BrittPas encore d'évaluation

- LT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Document2 pagesLT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Sampann PatodiPas encore d'évaluation

- Topic 46 To 47 AnswerDocument26 pagesTopic 46 To 47 AnswerrasnimPas encore d'évaluation

- MCB Bank LTDDocument30 pagesMCB Bank LTDanam tariqPas encore d'évaluation

- RiskDocument10 pagesRiskSanath FernandoPas encore d'évaluation

- DR Lal Pathlabs (1) Fundamental AnalysisDocument37 pagesDR Lal Pathlabs (1) Fundamental AnalysisGkl AjtPas encore d'évaluation

- Annika Sandback: (Moody's Investors Service & MBIA Insurance Corp.)Document2 pagesAnnika Sandback: (Moody's Investors Service & MBIA Insurance Corp.)sandbacaPas encore d'évaluation