Académique Documents

Professionnel Documents

Culture Documents

Engineering Economy Case 2

Transféré par

Minji LeeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Engineering Economy Case 2

Transféré par

Minji LeeDroits d'auteur :

Formats disponibles

CASE 2: USEFUL LIVES ARE DIFFERENT AMONG THE ALTERNATIVES

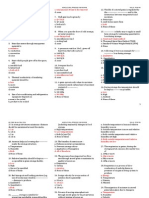

1.) THE REPEATABILITY ASSUMPTION Conditions: 1. Study period is either indefinitely long or equal to a common multiple of the lives of the alternative. 2. The cash flows associated with an alternative's initial life span are representative of what will happen in succeeding life spans. EXAMPLE: The following data have been estimated for two mutually exclusive investment alternatives, A and B, associated with a small engineering project for which revenues as well as expenses are involved. If the MARR = 10% per year, show which alternative is more desirable using equivalent worth methods. Use the repeatability assumption. Alternative A Capital investment Annual cash flow Useful life (years) Market value at end of useful life Solution by the PW method: PW(10%)A =-$3,500 - $3,500 [(P/F,10%,4)+(P/F,10%,8)]+($1,255)(P/A,10%,12) = $1,028 PW(10%)B =-$5,000 - $5,000(P/F,10%,6) + ($1,480)(P/A,10%,12) = $2,262 Based on the PW method, we would select Alternative B because it has the larger value ($2,262) Solution by the AW Method: (1.) The AW of each alternative over the 12-year analysis period based on the previous PW values. AW(10%)A = $1,028(A/P,10%,12) = $151 AW(10%)B = $2,262(A/P,10%,12) = $332 (2) Determining the AW of each alternative over one useful life cycle. AW(10%)A = -$3,500 (A/P,10%,4) + ($1,255) = $151 AW(10%)B = -$5,000(A/P,10%,6) = $332 When the repeatability assumption is applied, simply compare the AW amounts of each alternative over its own useful life and select the alternative that maximizes AW. So we would select Alternative B because it has the larger value ($332). $3,500 1,255 4 0 Alternative B $5,000 1,480 6 0

What if the study period is not a common multiple of the alternative lives or repeatability is not applicable? Use coterminated assumption!

CASE 2: USEFUL LIVES ARE DIFFERENT AMONG THE ALTERNATIVES

2.) THE COTERMINATED ASSUMPTION EXAMPLE: Suppose that (example) is modified to 6 years instead of 12 years. Suppose that the responsible manager did not agree with Repeatability Assumption and wanted 6 years analysis period. Solution: FW(10%)A = [-$3,500(F/P,10%,4)+($1,255)(F/A,10%,4)](F/P,10%,2) = $847 FW(10%)B = -$5,000 (F/P,10%,6)+($1,480)(F/A,10%,6) = $2,561 Based on the FW of each alternative at the end of the six-year study period, we would select Alternative B because it has the larger value ($2,561).

Study Period > Useful Life Procedure: The cash flows of the alternatives need to be adjusted to terminate at the end of the study period. Cost alternatives: Assuming repeatability, repeat part of the useful life of the original alternative, and then use an estimated MV to truncate it at the end of the study period. Without repeatability, we must purchase/lease the service/asset for the remaining years. Investment alternatives: Assume all cash flows will be reinvested at the MARR to the end of the study period (i.e., calculate FW at end of useful life and move this to the end of the study period using the MARR). Study Period < Useful Life When the study period is explicitly stated to be shorter than the useful life, use the cotermination assumption. Procedure: The cash flows of the alternatives need to be adjusted to terminate at the end of the study period. Truncate the alternative at the end of the study period using an estimated Market Value.

Vous aimerez peut-être aussi

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielPas encore d'évaluation

- Lecture 3 BernoulliDocument27 pagesLecture 3 BernoulliChristal PabalanPas encore d'évaluation

- CH.2 InterestDocument41 pagesCH.2 InterestJenalyn MacarilayPas encore d'évaluation

- CE365 Hydro, HW 1 SolutionDocument6 pagesCE365 Hydro, HW 1 SolutionbrayanPas encore d'évaluation

- The Golden Ratio and Fibonacci Sequences in Nature Art and ArchitectureDocument5 pagesThe Golden Ratio and Fibonacci Sequences in Nature Art and Architectureomeryounos100% (2)

- Continuous & Discrete CompoundingDocument3 pagesContinuous & Discrete CompoundingJohnlloyd BarretoPas encore d'évaluation

- Quiz Fluid LabDocument3 pagesQuiz Fluid LabMuhammad BilalPas encore d'évaluation

- 2.2 Moist Air PropertiesDocument9 pages2.2 Moist Air PropertiesMark MoraPas encore d'évaluation

- War 2103 PrecipitationDocument52 pagesWar 2103 PrecipitationEgana IsaacPas encore d'évaluation

- Universal Soil Loss EquationDocument31 pagesUniversal Soil Loss EquationSagnik MannaPas encore d'évaluation

- Roofing Materials: Roof ComponentsDocument17 pagesRoofing Materials: Roof ComponentsMero Mero100% (1)

- Review QuestionsDocument9 pagesReview QuestionsRuel PeneyraPas encore d'évaluation

- EE1Document22 pagesEE1Jeiel ValenciaPas encore d'évaluation

- Problem Set - Settling and SedimentationDocument1 pageProblem Set - Settling and SedimentationKTINE08100% (1)

- Problem Set 005 Q AnswersDocument5 pagesProblem Set 005 Q AnswersDennis Korir100% (1)

- Engineering Economy ReviewerDocument5 pagesEngineering Economy ReviewerBea Abesamis100% (1)

- Engineering Economy Module 4Document38 pagesEngineering Economy Module 4Jared TeneberPas encore d'évaluation

- CH.3 Annuity PDFDocument29 pagesCH.3 Annuity PDFJenalyn MacarilayPas encore d'évaluation

- Fluid Mechanics Hydraulic BenchDocument8 pagesFluid Mechanics Hydraulic BenchMr. Mark B.Pas encore d'évaluation

- Examples 1Document17 pagesExamples 1Nahom GebremariamPas encore d'évaluation

- Final Exam Economy.Document2 pagesFinal Exam Economy.keith tambaPas encore d'évaluation

- Lab 5Document9 pagesLab 5Orshelene Oel Javier RamirezPas encore d'évaluation

- Geotech1Lab-Laboratory Work No. 2 PDFDocument4 pagesGeotech1Lab-Laboratory Work No. 2 PDFMarc Carlo IbañezPas encore d'évaluation

- Annex IiiDocument47 pagesAnnex IiiRenato AguilarPas encore d'évaluation

- Engineering Economy ExaminationDocument21 pagesEngineering Economy ExaminationElmarc CodenieraPas encore d'évaluation

- Engineering Economy Lectures Solved Examples and Problems IntroductionDocument11 pagesEngineering Economy Lectures Solved Examples and Problems IntroductionKynt Al I. HinampasPas encore d'évaluation

- Solutions in CheDocument145 pagesSolutions in CheAnonymous 0zrCNQPas encore d'évaluation

- Sharing Is CaringDocument4 pagesSharing Is CaringChris bongalosaPas encore d'évaluation

- Chapter 2 Approximation of Error 1 PDFDocument55 pagesChapter 2 Approximation of Error 1 PDFJomari Tobes SatorrePas encore d'évaluation

- SolveDocument11 pagesSolveShamanAcolytePas encore d'évaluation

- Year Book Value at The Beginning of The Year (P) Depreciation (P) Book Value at The End of The Year (P) 1 2 3 4 5Document9 pagesYear Book Value at The Beginning of The Year (P) Depreciation (P) Book Value at The End of The Year (P) 1 2 3 4 5Kevin SimonsPas encore d'évaluation

- Selection in Present Economy (Extra Problems)Document4 pagesSelection in Present Economy (Extra Problems)Lawrence BelloPas encore d'évaluation

- AGRICULTURAL WASTE MANAGEMENT ENGINEERING - ReviewerDocument9 pagesAGRICULTURAL WASTE MANAGEMENT ENGINEERING - Reviewerxandermacawile09Pas encore d'évaluation

- Fluid StaticsDocument40 pagesFluid StaticsAbdul AhadPas encore d'évaluation

- Engineering Economy ch2Document22 pagesEngineering Economy ch2Omar AljilaniPas encore d'évaluation

- Name: Maladian, Patrick S. Yr./Course/Section: Bsabe - 3C Instructor: Ryan Art M. Tuling, Abe, Enp Date Submitted: September 1, 2022Document5 pagesName: Maladian, Patrick S. Yr./Course/Section: Bsabe - 3C Instructor: Ryan Art M. Tuling, Abe, Enp Date Submitted: September 1, 2022Maladian Sangay PatrickPas encore d'évaluation

- Area Ii With AnswersDocument16 pagesArea Ii With AnswersJUNDAVE BORJAPas encore d'évaluation

- Fluid Mechanicsunit 1Document31 pagesFluid Mechanicsunit 1srajubasavaPas encore d'évaluation

- ASSIGNMENTDocument5 pagesASSIGNMENTMikael DionisioPas encore d'évaluation

- Design of Contour & Graded Bunds-1Document22 pagesDesign of Contour & Graded Bunds-1roy4gaming.ytPas encore d'évaluation

- Problem Set 1Document6 pagesProblem Set 1Emilee Noven RamirezPas encore d'évaluation

- Overview+Soil Quiz 1Document241 pagesOverview+Soil Quiz 1Elmer Cabulisan JrPas encore d'évaluation

- ES 33 - Plate No. 1Document10 pagesES 33 - Plate No. 1Maybelline DipasupilPas encore d'évaluation

- DC Motor Losses and EfficiencyDocument7 pagesDC Motor Losses and EfficiencyAbdelrhman Essam AttiaPas encore d'évaluation

- Hydraulics, Pump HeadDocument5 pagesHydraulics, Pump HeadMoch Radhitya Sabeth TaufanPas encore d'évaluation

- 370 HW 9 SDocument7 pages370 HW 9 SNikka Lopez100% (1)

- DLSUD Soil Mechanics Lab ManualDocument49 pagesDLSUD Soil Mechanics Lab ManualblehPas encore d'évaluation

- Farmstead PlanningDocument22 pagesFarmstead PlanningKristeen PrusiaPas encore d'évaluation

- Eloisa Mae S. Semilla - ABE 131 2nd LEDocument2 pagesEloisa Mae S. Semilla - ABE 131 2nd LEEloisa Mae Sotelo SemillaPas encore d'évaluation

- 2c TheoryDocument34 pages2c Theory5ChEA DrivePas encore d'évaluation

- Engineering EconomyDocument5 pagesEngineering EconomyDayLe Ferrer AbapoPas encore d'évaluation

- Solid Mensuration ReviewDocument25 pagesSolid Mensuration ReviewGinto Aquino100% (1)

- Engineering Utilities 2 MODULEDocument84 pagesEngineering Utilities 2 MODULEJoanePas encore d'évaluation

- Chapter 3Document25 pagesChapter 3abdullah 3mar abou reashaPas encore d'évaluation

- Lab Practical 1 (Moisture Content)Document7 pagesLab Practical 1 (Moisture Content)Saiful IsmawiPas encore d'évaluation

- Problem #1Document3 pagesProblem #1Dianne VillanuevaPas encore d'évaluation

- Normal and Tangential ComponentsDocument19 pagesNormal and Tangential ComponentsGarrey BrionesPas encore d'évaluation

- Rhodes Solutions ch9 PDFDocument5 pagesRhodes Solutions ch9 PDFJesus M. Arias APas encore d'évaluation

- Chapter 6Document21 pagesChapter 6Shida ShidotPas encore d'évaluation

- Chapter 5 - Present Worth Analysis PDFDocument34 pagesChapter 5 - Present Worth Analysis PDFSana MerajPas encore d'évaluation

- Engineering Economy: Replacement & RetentionDocument13 pagesEngineering Economy: Replacement & RetentiononatbrossPas encore d'évaluation

- Effects of Water PollutionDocument4 pagesEffects of Water PollutionMinji LeePas encore d'évaluation

- Types of Water TestingDocument18 pagesTypes of Water TestingMinji Lee100% (2)

- Water Pollution Group Ii QuizDocument2 pagesWater Pollution Group Ii QuizMinji LeePas encore d'évaluation

- Water SamplingDocument14 pagesWater SamplingMinji Lee100% (1)

- Water Pollution Group 1Document8 pagesWater Pollution Group 1Minji LeePas encore d'évaluation

- Water Pollution Group Ii QuizDocument2 pagesWater Pollution Group Ii QuizMinji LeePas encore d'évaluation

- Noise Pollution (3) - LDocument4 pagesNoise Pollution (3) - LMinji LeePas encore d'évaluation

- Accounting For Merchandising Operations: Key Terms and Concepts To KnowDocument25 pagesAccounting For Merchandising Operations: Key Terms and Concepts To KnowMinji LeePas encore d'évaluation

- Vocabulary Qwords PhysicsDocument1 pageVocabulary Qwords PhysicsMinji LeePas encore d'évaluation

- Water Pollution Group 1Document8 pagesWater Pollution Group 1Minji LeePas encore d'évaluation

- Calculas FormulasDocument2 pagesCalculas FormulasSaurabh Ray100% (1)

- What Is Programming LanguageDocument9 pagesWhat Is Programming LanguageMinji Lee100% (1)

- Ohms Law and Basic Circuit TheoryDocument7 pagesOhms Law and Basic Circuit TheoryMinji LeePas encore d'évaluation

- Unit Roof Trusses: StructureDocument45 pagesUnit Roof Trusses: StructureAnkit SuriPas encore d'évaluation

- Ch3: Frequency Analysis For DT Signals: Questions To Be AnsweredDocument31 pagesCh3: Frequency Analysis For DT Signals: Questions To Be AnsweredAnonymous T4YHyOFmPas encore d'évaluation

- Expected Price Functionof Price SensitivityDocument10 pagesExpected Price Functionof Price SensitivityMr PoopPas encore d'évaluation

- Chapter 8Document34 pagesChapter 8Ummu Fahmi FikriyantoPas encore d'évaluation

- DICE ManualDocument102 pagesDICE ManualMarcela Barrios RiveraPas encore d'évaluation

- Handprint Perspective Part 0Document11 pagesHandprint Perspective Part 0savrtuthdPas encore d'évaluation

- PAA Dynamic ProgrammingDocument14 pagesPAA Dynamic ProgrammingRichmafia21Pas encore d'évaluation

- MELC 2 Use Conditionals in Expressing ArgumentsDocument2 pagesMELC 2 Use Conditionals in Expressing ArgumentsMar Sebastian100% (1)

- Miaa 350Document7 pagesMiaa 350api-245618331Pas encore d'évaluation

- LAS Q2 Gen Math Week 7 - LogicDocument4 pagesLAS Q2 Gen Math Week 7 - LogicFlor LegaspiPas encore d'évaluation

- Es1 Mathematics Program t3Document14 pagesEs1 Mathematics Program t3api-249015874Pas encore d'évaluation

- Final Exam Class 11 Maths Exam2020-2021 Rashmi PDocument5 pagesFinal Exam Class 11 Maths Exam2020-2021 Rashmi Pnabhijain9Pas encore d'évaluation

- Seminar 5, 6,7,8Document28 pagesSeminar 5, 6,7,8Євгеній БондаренкоPas encore d'évaluation

- CUP - Mathematics Resources 2018 - EducationDocument24 pagesCUP - Mathematics Resources 2018 - EducationPaulo SoaresPas encore d'évaluation

- MPC of Complex SystemsDocument232 pagesMPC of Complex SystemsDimitris TzPas encore d'évaluation

- MATHSDocument3 pagesMATHSSneha 8A & Shubham 5BPas encore d'évaluation

- Ben 2019 22Document11 pagesBen 2019 22OthmanHamdyPas encore d'évaluation

- Top 5 KPIsDocument45 pagesTop 5 KPIsDean DekovićPas encore d'évaluation

- Portal Method of Approximate AnalysisDocument4 pagesPortal Method of Approximate AnalysisXacoScribdPas encore d'évaluation

- Electric Field and PotentialDocument27 pagesElectric Field and Potentialthinkiit100% (1)

- 0580 s19 QP 11Document12 pages0580 s19 QP 11Dedy SahanaPas encore d'évaluation

- Computing Point-to-Point Shortest Paths From External MemoryDocument15 pagesComputing Point-to-Point Shortest Paths From External MemoryJacco EerlandPas encore d'évaluation

- SPII - Grade 8 Mathematics - Curriculum REVISEDDocument50 pagesSPII - Grade 8 Mathematics - Curriculum REVISEDJay B Gayle0% (1)

- Ps 8Document1 pagePs 8Yoni GefenPas encore d'évaluation

- SOP3Document2 pagesSOP3subhajit chakrabortyPas encore d'évaluation

- Lecture - 05 Properties of Walrasian DemandDocument22 pagesLecture - 05 Properties of Walrasian DemandAhmed GoudaPas encore d'évaluation

- An LVDT-based Self-Actuating Displacement TransducerDocument7 pagesAn LVDT-based Self-Actuating Displacement TransducerGeorge PetersPas encore d'évaluation

- Computer Graphics (CSE 4103)Document34 pagesComputer Graphics (CSE 4103)Atik Israk LemonPas encore d'évaluation