Académique Documents

Professionnel Documents

Culture Documents

Stamp Duty and Registration Fee Detail PDF

Transféré par

yashpalahujaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Stamp Duty and Registration Fee Detail PDF

Transféré par

yashpalahujaDroits d'auteur :

Formats disponibles

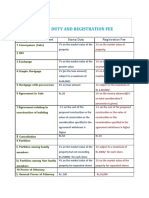

Stamp Duty and Registration Fee Detail Common Fee for all the Documents Surcharge on Stamp Duty

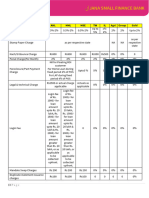

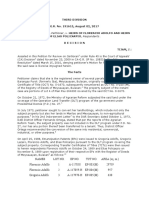

CSI Charges (If property Value is not exceed Rs. 50,000) CSI Charges (Where it exceed 50,000) CSI Charges (In any other case ) S. No. 1 2 3 Adoption Agreement Agreement of Deposit of Title Deed / Equitable Martgage Deed 4 5 6 7 8 9 10 11 12 13 14 Agreement of Developer Agreement of Loan Agreement related to BOT System / Project Agreement to sale with possession Agreement to sale without possession Any document in favour of Govt. Award Cancellation Deed Certificate of sale Concent Deed for mining lease Copy of Document (i) if the original was not chargeable with duty or if the duty with which it was chargeable does not exceed 1 rupees (ii) in any other case 15 16 Counter part or duplicate Deed of amalgamation by order of HC/RBI 17 Deposit-opening-withdrawl of sealed cover of will Partnership(1) Instrument of pertnership :18 (a) where there in is no share or Page 1 of 7 500 rupees 1% contribution partnership 0 100 rupees 5 rupees 10 rupees 4% 0 100 rupees 1% 3 rupees 0 5% of the market value of the property 3% of the total consideration 0 100 rupees 100 rupees 5% of total consideration 5% of the market value 1% 0 300 rupees 200 rupees 1% 1% 1% 1% 0.1% 0.1% 1% 0.1% 1% 100 rupees 100 rupees 0.1% Document Name : : : : 10% Rs. 200 Rs. 300 Rs. 200 Registration Fees 200 rupees 300 rupees 0.1%

Stamp Duty

Stamp Duty and Registration Fee Detail

where

such

share

contribution

brought in by way of cash does not exceed Rs. 50,000/19 (b) where such share contribution brought in by way of cash is in excess of Rs. 50,000/-, for every Rs. 50,000/- or part thereof; 20 21 22 23 24 25 26 27 28 29 50,001 to 1,00,000 1,00,001 to 1,50,000 1,50,001 to 2,00,000 2,00,001 to 2,50,000 2,50,001 to 3,00,000 3,00,001 to 3,50,000 3,50,001 to 4,00,000 4,00,001 to 4,50,000 4,50,001 or above (c) Where such share contribution is brought brought in by way of immovable property (2) Dissolution of partnership or retirement or partner :30 (a) Where on a dissolution of the partnership or on retirement of a partner any property is taken as his share by a partner other than a partner who brought in that property as his share of contribution in the partnership 31 32 33 34 35 (b) in any other case. Divorce Deed Exchange of property Instrument Exchange Deed (Agriculture- US-48 RTA) (a) Further charge with possession 5% of the consideration equal to the amount of the further charges secured (b) Further charge without possession 36 (i) possession of the property is 5% of the consideration 1% Page 2 of 7 1% 500 rupees 50 rupees 5% 0 300 rupees 300 rupees 1% 0 5% on the market value of such property, subject to a minimum of rupees one hundred. 1% 1,000 rupees. 1,500 rupees. 2,000 rupees. 2,500 rupees. 3,000 rupees. 3,500 rupees. 4,000 rupees. 4,500 rupees. 5,000 rupees. The same duty as on Conveyance (No. 21) on the market value of such property. 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 500 rupees, subject to maximum duty of rupees five thousand. 1%

Stamp Duty and Registration Fee Detail

given, or agreed to be given 37 (ii) if possession is not given 2% of the amount of the further charges secured 38 39 Gift Instrument Gift in favour of father, mother, son, brother, sister, daughter-in-law, husband, sons son, daughters son, sons daughter, daughters daughter 40 Gift in favour of wife or daughter a widow by :41 (a) her deceased husbands mother, father, brother, or sister; 42 (b) her own mother, father, brother, sister, son or daughter; 43 44 45 Inspection And Search (per year) Lease Deed (less than 1 year) Lease Deed (less than 20 years, in case of advance security) 46 47 48 49 50 51 Lease Deed (More than 20 years) Lease Lease Deed Deed [Rent] [Rent] (<20 (<20 years) years) Commercial and other 1% 5% 5% 1% 1% 1% 1% 0.1% Residential Lease for Local Bodies (PATTA) Mining Lease & Transfer of Mining Lease Mortgage Deed by servants of reg insti for housing loan 52 53 54 55 56 Mortgage Deed Government servant Mortgage Deed of Housing Loan from Band/Coop Mortgage Deed with possession Mortgage Deed without possession Mortgage for Agriculture purpose 5% 2% 0 1% 1% 0 Page 3 of 7 0 1% 0 0.1% 5% 2% 1% 1% 0 2% for the whole amount payable 5% 1% 50 rupees 1% 0 1% 0 1% 1% or rupees 1 lac, 1% whichever is less 5% of the market value 2.5% 1% 1% 1%

Stamp Duty and Registration Fee Detail

57 58

Mortgage for Housing Loan in LIG Mortgage for Non-Agriculture Purpose from Bank & any Financial Inst.

0 1%

0.1% 0.1%

59 60 61 62 63

Movable Property Partition (Ancestral) Partition (Non-Ancestral) Partition deed of ancestral Agricultural land Posting/Postal charges Power of Attorney :-

0 1%, (Maximum Rs. 10,000) 5% 0 0

1% 1% 1% 0 100 rupees

64

(a) when executed for the sole purpose of procurting the registration of one or more documents in relation to a single transaction or for admitting execution of one or more such documents;

50 rupees

500 rupees

65

(b) when authorizing one person or more to act in single transaction other than the sace mentioned in clause (a);

50 rupees

500 rupees

66

(c) when authorizing not more than five persons to act jointly and severally in more than one transaction or generally;

100 rupees

500 rupees

67

(d) when authorizing more than five persons to but not more than ten persons to act jointly and severally in more than one transaction or generally.

100 rupees

500 rupees

68

(e) when given for consideration and authorizing the attorney to sell any immovable property; (ee) when power of attorney is given without consideration to sell immovable property to -

5% of the consideration

1%

69

(i) the father, mother, brother, sister, wife, husband, son, daughter, grandson or grand

2,000 rupees

500 ruees

Stamp Duty and Registration Fee Detail

Page 4 of 7

daughter of the executant 71 72 (ii) any other person. (eee) When given to promoter or developer by whatever name called for construction on, or development of, or sale or transfer (in any manner whatsoever) of, any immovable property, 73 74 (f) In any other case Re-Conveyance of mortgage by govt, In case of house loan 75 76 Re-Conveyance of mortgage property Release Deed (Ancestral) 100 rupees 1% (Maximum 500 rupees) 77 Release Deed (Non-Ancestral) Settlement (A) Instrument of, including a deed of dower 78 (i) where the settlement iss made for a religious of charitable purpose; 79 (ii) in any other case 2% for a sum equal to the amount settled or the market value of the property (i) 5% in respect of immovable property equal to the market value of immovable property. 80 (ii) 2% in respect of other property or amount, equal to the market value of property. (B) Revocation of ,81 (i) in respect of settlement described in sub-clause (i) of clause(A); 2% the sum of equal to the amount settled or market value of the property concerned, but not exceeding 1% 1% 1% 1% 5% 1% 100 1% 50 rupees for each person authorised. 0 0 500 rupees 2% of the market value 1% of the market value 1% 1%

Stamp Duty and Registration Fee Detail

Page 5 of 7

Rs. 50 82 (ii) in respect of settlement described in sub-clause (ii) of clause (A). (i) 5% in respect of immovable property for a consideration equal to the market value of the property. 83 (ii) 2% in respect of other property or amount for a consideration equal to the amount settled or the market value of the property concerned but not exceeding 5,000 rupees. 84 85 86 87 88 RIICO Sick Unit (Industrial) Sale Deed (Conveyance Deed) Sale Deed for Female/40% and Above Disable Security/Indemnity Bond Supplementary Deed/ Correction Deed 89 90 Surrender of Lease Transfer of Lease by way of assignment Trust (A) Declaration of- of, or concerning, any property when made by any writing not being Will,(a) where there is disposition of property,91 (i) where the trust is made for a religious or charitable purpose, 92 (ii) in any other case. 2% sum equal to the amount settled or the market value of the property (i) 5% in respect of immovable property, for a sum equal to the market value of the immovable property. 1% 1% 100 rupees 5% 200 rupees 1% 0.1% 100 rupees 300 200 rupees 0 5% 4% 1% 1% 1% 1% 1%

Stamp Duty and Registration Fee Detail

Page 6 of 7

93

(ii) 2% in respect of other property or amount for a sum equal to the amount settled or the market value of the property settled.

1%

94

(b) where there is no disposition of property

2% for a sum equal to the amount or value of the property concerned, but not exceeding 60 rupees.

1%

95

(B) Revocation of- of, or concern any property made by any instrument other than a Will

2% for a sum equal to the amount or value of the property concerned, but not exceeding 50 rupees.

1%

96 97 98 99

Will Works Contract Up to 10 lakh Works Contract above 10 lakh to 50 lakh Works Contract above 50 lakh

0 500 rupees 1000 rupees 5000 rupees 0 10 rupees

200 rupees 300 rupees 300 rupees 300 rupees 200 rupees 300 rupees

100 Filing of translation us-62 101 Affidavit

Stamp Duty and Registration Fee Detail

Page 7 of 7

Vous aimerez peut-être aussi

- Deed of Assignment and Transfer of Rights SampleDocument2 pagesDeed of Assignment and Transfer of Rights SampleMario P. Trinidad Jr.92% (13)

- Florida Quit Claim Deed Form-7-16-20L PDFDocument4 pagesFlorida Quit Claim Deed Form-7-16-20L PDFkayla guerrier100% (1)

- Deed of Assignment and Transfer of RightsDocument2 pagesDeed of Assignment and Transfer of RightsjosefPas encore d'évaluation

- POSTON: Sweet Suffolk Owl - For Voice and Piano in AbDocument3 pagesPOSTON: Sweet Suffolk Owl - For Voice and Piano in AbSuzanne MurphyPas encore d'évaluation

- Last Will and TestamentDocument4 pagesLast Will and TestamentEra MazePas encore d'évaluation

- Real Estate Law 11th Edition Jennings Test BankDocument32 pagesReal Estate Law 11th Edition Jennings Test Bankmatthew100% (15)

- Stamp Duty in RajasthanDocument22 pagesStamp Duty in RajasthanPooja MisraPas encore d'évaluation

- Registration of Document, HaryanaDocument5 pagesRegistration of Document, HaryanaSunil PrasadPas encore d'évaluation

- Duty & Fees - Stamp Duty and Registration FeeDocument5 pagesDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyPas encore d'évaluation

- Haryana Stamp ActDocument4 pagesHaryana Stamp ActRupali SamuelPas encore d'évaluation

- Estate Tax - Bureau of Internal RevenueDocument15 pagesEstate Tax - Bureau of Internal RevenueKristarah HernandezPas encore d'évaluation

- Everything About EstateDocument19 pagesEverything About EstateAlas OplasPas encore d'évaluation

- Stamps Duty in APDocument3 pagesStamps Duty in APsarathirv6Pas encore d'évaluation

- Estate Tax SummaryDocument9 pagesEstate Tax SummaryRb BalanayPas encore d'évaluation

- Description: BIR Form 1801Document14 pagesDescription: BIR Form 1801Nicole TondoPas encore d'évaluation

- Https WWW - Karnataka.gov - in Karigr Modeldeeds SaledDocument4 pagesHttps WWW - Karnataka.gov - in Karigr Modeldeeds SaledAnonymous 1uGSx8bPas encore d'évaluation

- Estate Tax - BIRDocument15 pagesEstate Tax - BIRdolina.joeyPas encore d'évaluation

- Chit Fund FeesDocument5 pagesChit Fund Feesvinod kumarPas encore d'évaluation

- 2020-03-26 Stamp Duty and Registration Fee T NaduDocument5 pages2020-03-26 Stamp Duty and Registration Fee T Naduvganapathy1000Pas encore d'évaluation

- EstateDocument6 pagesEstateJAYAR MENDZPas encore d'évaluation

- Compulsory Documents To Be RegisteredDocument7 pagesCompulsory Documents To Be RegisteredAbhishek NarayananPas encore d'évaluation

- IPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsDocument18 pagesIPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsAdnan MoquaddamPas encore d'évaluation

- Stamp Duty and Registration FeeDocument3 pagesStamp Duty and Registration FeeJerard francis victorPas encore d'évaluation

- Donor's Tax - Bureau of Internal RevenueDocument11 pagesDonor's Tax - Bureau of Internal RevenueKristarah HernandezPas encore d'évaluation

- GO ChangeInStampDutyDocument9 pagesGO ChangeInStampDutySANTHOSH SANTHOSHPas encore d'évaluation

- Changes Made in Income Tax Act 2058Document10 pagesChanges Made in Income Tax Act 2058shankarPas encore d'évaluation

- MARCH Estate and Inheritance TaxDocument6 pagesMARCH Estate and Inheritance TaxJewelyn CioconPas encore d'évaluation

- Transferring Land TitlesDocument2 pagesTransferring Land TitlesDEBRA L. BADIOLA-BRACIAPas encore d'évaluation

- Description Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsDocument15 pagesDescription Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsJamel torresPas encore d'évaluation

- Donor's Tax - Bureau of Internal RevenueDocument12 pagesDonor's Tax - Bureau of Internal RevenueAna CosmePas encore d'évaluation

- Roc - Fees 1Document3 pagesRoc - Fees 1Kamaal AkhtarPas encore d'évaluation

- Possession. (Per SQ - FT) : Merlin Price ListDocument9 pagesPossession. (Per SQ - FT) : Merlin Price Listbigdealsin14Pas encore d'évaluation

- Melody Launch Price List 19.03.2021Document1 pageMelody Launch Price List 19.03.2021Amit MitraPas encore d'évaluation

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- Registration FeesDocument3 pagesRegistration Feessrivani217Pas encore d'évaluation

- RLA Rate Card 2020 2021Document13 pagesRLA Rate Card 2020 2021Muhammad EjazPas encore d'évaluation

- KCO-Rate-Card 2021Document13 pagesKCO-Rate-Card 2021Aqib SheikhPas encore d'évaluation

- West Pakistan Notaries Rules 19651Document17 pagesWest Pakistan Notaries Rules 19651Shah FahadPas encore d'évaluation

- PO130959Document42 pagesPO130959antz12345Pas encore d'évaluation

- Final BU POT Fall 2023Document4 pagesFinal BU POT Fall 2023sohail199aliPas encore d'évaluation

- Bond ManagementDocument17 pagesBond ManagementTahabur Rahman FirojPas encore d'évaluation

- DRDDDDocument12 pagesDRDDDWaqar HussainPas encore d'évaluation

- Schedule of Bank Charges: General BankingDocument1 pageSchedule of Bank Charges: General Bankingfaisal_ahsan7919Pas encore d'évaluation

- Price List - The MeadowsDocument2 pagesPrice List - The MeadowsParthiv ShahPas encore d'évaluation

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizPas encore d'évaluation

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationPas encore d'évaluation

- Payment Schedule & Pricing Details of Prabha Aikyam: Rs.4250/-Per SQ - FTDocument1 pagePayment Schedule & Pricing Details of Prabha Aikyam: Rs.4250/-Per SQ - FTBibek DeyPas encore d'évaluation

- Taxation RegulationsDocument31 pagesTaxation RegulationsIsaacPas encore d'évaluation

- List of Registrable ChargesDocument3 pagesList of Registrable Chargesadv_vinayakPas encore d'évaluation

- Estate Tax - Bureau of Internal RevenueDocument14 pagesEstate Tax - Bureau of Internal RevenueJorel DiocolanoPas encore d'évaluation

- Registration FeeDocument12 pagesRegistration FeeNarasimham GuggillaPas encore d'évaluation

- Stamp Duty & FeesDocument12 pagesStamp Duty & FeesranjithxavierPas encore d'évaluation

- Woodshire Price List: SQ - FT.)Document1 pageWoodshire Price List: SQ - FT.)bigdealsin14Pas encore d'évaluation

- Golden Nest Price SheetDocument2 pagesGolden Nest Price SheetRajesh KomatineniPas encore d'évaluation

- Description: BIR Form 1800Document11 pagesDescription: BIR Form 1800Vangie AntonioPas encore d'évaluation

- Index For Donor 21325Document8 pagesIndex For Donor 21325Timothy Mark MaderazoPas encore d'évaluation

- Annexure F' Specimen Verification Certificate (For Passport Under Tatkaal Only)Document3 pagesAnnexure F' Specimen Verification Certificate (For Passport Under Tatkaal Only)Nickazaz1Pas encore d'évaluation

- Description: BIR Form 1800Document10 pagesDescription: BIR Form 1800Dura LexPas encore d'évaluation

- Test 2 CafDocument3 pagesTest 2 CafBrown BoiPas encore d'évaluation

- FeesDocument21 pagesFeesrajugs_lgPas encore d'évaluation

- Legal ChargesDocument2 pagesLegal ChargesSDTV SriLankaPas encore d'évaluation

- Foreign Exchange Transactions ActD'EverandForeign Exchange Transactions ActPas encore d'évaluation

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2D'EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2Pas encore d'évaluation

- Jktlfkku Yksd Lsok VK KSX) Vtesj: Jktlfkku JKT, Oa V/Khulfk Lsok, A La QDR Izfr KSXH Ijh (KK) 2012Document8 pagesJktlfkku Yksd Lsok VK KSX) Vtesj: Jktlfkku JKT, Oa V/Khulfk Lsok, A La QDR Izfr KSXH Ijh (KK) 2012Voice NgoPas encore d'évaluation

- Mqatr - SQRW ': OoeryuftDocument1 pageMqatr - SQRW ': OoeryuftyashpalahujaPas encore d'évaluation

- Detail Form1 MainsDocument12 pagesDetail Form1 MainsyashpalahujaPas encore d'évaluation

- Dept OrderDocument1 pageDept OrderyashpalahujaPas encore d'évaluation

- Jktlfkku Yksd Lsok VK KSX) Vtesj: Jktlfkku JKT, Oa V/Khulfk Lsok, A La QDR Izfr KSXH Ijh (KK) 2012Document8 pagesJktlfkku Yksd Lsok VK KSX) Vtesj: Jktlfkku JKT, Oa V/Khulfk Lsok, A La QDR Izfr KSXH Ijh (KK) 2012Voice NgoPas encore d'évaluation

- 1 - Lecturer Girls Schools, 2 - Lecturer Boys Schools: Year Division/GradeDocument1 page1 - Lecturer Girls Schools, 2 - Lecturer Boys Schools: Year Division/GradeyashpalahujaPas encore d'évaluation

- Ceo NiyuktiDocument1 pageCeo NiyuktiyashpalahujaPas encore d'évaluation

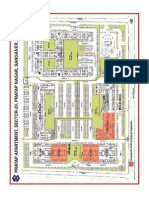

- Final Map Mig B S 10 Hig S 10 Pratap Apartment Sector 29 22-6-2013 To 26-6-2013aaDocument8 pagesFinal Map Mig B S 10 Hig S 10 Pratap Apartment Sector 29 22-6-2013 To 26-6-2013aayashpalahujaPas encore d'évaluation

- DK Kzy JFTLV KJ LGDKJH Lfefr Ka) Jktlfkku T Iqj: Vfr&Vko' DDocument5 pagesDK Kzy JFTLV KJ LGDKJH Lfefr Ka) Jktlfkku T Iqj: Vfr&Vko' DyashpalahujaPas encore d'évaluation

- Tour Programme Jrcs Oct.13Document2 pagesTour Programme Jrcs Oct.13yashpalahujaPas encore d'évaluation

- Zbikaner PsDocument8 pagesZbikaner PsyashpalahujaPas encore d'évaluation

- Merit List Ras 2010Document48 pagesMerit List Ras 2010ultravoilet4uPas encore d'évaluation

- Answer Key-2013 RAS Pre (B-Sereis)Document2 pagesAnswer Key-2013 RAS Pre (B-Sereis)yashpalahujaPas encore d'évaluation

- 20x10with Internal Partition WallDocument1 page20x10with Internal Partition WallyashpalahujaPas encore d'évaluation

- Detail Teacher GR II Elementary2013Document2 pagesDetail Teacher GR II Elementary2013yashpalahujaPas encore d'évaluation

- HindiDocument12 pagesHindiAnil KumarPas encore d'évaluation

- Syllabus Actt JrAcctt 051211Document6 pagesSyllabus Actt JrAcctt 051211yashpalahujaPas encore d'évaluation

- Detail Advt.13-14 J LO & Jr. Acctt.-Tra Joint and PTI II & III Grade-Rev-1Document3 pagesDetail Advt.13-14 J LO & Jr. Acctt.-Tra Joint and PTI II & III Grade-Rev-1yashpalahujaPas encore d'évaluation

- Syllabus Iigr Hindi 280711Document2 pagesSyllabus Iigr Hindi 280711yashpalahujaPas encore d'évaluation

- My BillDocument3 pagesMy BillyashpalahujaPas encore d'évaluation

- Rajasthan TeacherDocument13 pagesRajasthan Teachertanpreet_makkadPas encore d'évaluation

- 20x10with Internal Partition WallDocument1 page20x10with Internal Partition WallyashpalahujaPas encore d'évaluation

- RPSC 2nd Grade Science Subject KeyDocument4 pagesRPSC 2nd Grade Science Subject KeyyashpalahujaPas encore d'évaluation

- Plots: S.NO: Time Linked Installment PlanDocument2 pagesPlots: S.NO: Time Linked Installment PlanyashpalahujaPas encore d'évaluation

- RTI Online CertificateDocument1 pageRTI Online CertificateyashpalahujaPas encore d'évaluation

- EnrollmentForm YashpalahujaDocument2 pagesEnrollmentForm YashpalahujayashpalahujaPas encore d'évaluation

- Nstse Registration FormDocument1 pageNstse Registration FormyashpalahujaPas encore d'évaluation

- RAS (Pre) Hindi VersionDocument4 pagesRAS (Pre) Hindi Versionbaba321Pas encore d'évaluation

- EnrollmentForm YashpalahujaDocument2 pagesEnrollmentForm YashpalahujayashpalahujaPas encore d'évaluation

- Republic of The Philippin15Document2 pagesRepublic of The Philippin15LUCKY DAMASENPas encore d'évaluation

- Ashish JaiswalDocument5 pagesAshish JaiswalMritunjai SinghPas encore d'évaluation

- Cuaycong V CuaycongDocument36 pagesCuaycong V CuaycongJepz FlojoPas encore d'évaluation

- 12 - Cabral v. Heirs of Florencio Adolfo, G.R. No. 191615Document12 pages12 - Cabral v. Heirs of Florencio Adolfo, G.R. No. 191615MaggiePas encore d'évaluation

- NO 1 0 Indiva NON: RupeesDocument5 pagesNO 1 0 Indiva NON: RupeesVickyPas encore d'évaluation

- Babe EeeDocument6 pagesBabe EeeKyle HernandezPas encore d'évaluation

- Ancheta vs. Guersey-Dalaygon Case DigestDocument1 pageAncheta vs. Guersey-Dalaygon Case DigestA M I R A100% (1)

- TPA Assignment.. Shashwat Srivastava.. 1020171828 PDFDocument22 pagesTPA Assignment.. Shashwat Srivastava.. 1020171828 PDFKushagra SrivastavaPas encore d'évaluation

- CI Installment Classroom SheetDocument4 pagesCI Installment Classroom SheetSidhant KumarPas encore d'évaluation

- A Stranger in Philadelphia MississippiDocument4 pagesA Stranger in Philadelphia Mississippipolygamists2010Pas encore d'évaluation

- Tanedo vs. CADocument2 pagesTanedo vs. CAClaudine GolangcoPas encore d'évaluation

- Rabadilla Vs CADocument2 pagesRabadilla Vs CAMariePas encore d'évaluation

- Landlord Tenant RulesDocument4 pagesLandlord Tenant Rulesapi-309055809Pas encore d'évaluation

- Una Limosna Último Trémolo Barrios J.Amaya PDFDocument10 pagesUna Limosna Último Trémolo Barrios J.Amaya PDFjuan luis caroPas encore d'évaluation

- Howto Avira Fusebundle Generator enDocument9 pagesHowto Avira Fusebundle Generator enmariandincaPas encore d'évaluation

- Revied SuccessionDocument8 pagesRevied SuccessionMuhoma TinotendaPas encore d'évaluation

- Deed of Sale of Shares of StockDocument2 pagesDeed of Sale of Shares of StockJoy AnnPas encore d'évaluation

- AFN PDF Copy Agreement Among HeirsDocument3 pagesAFN PDF Copy Agreement Among HeirsDolores ValientePas encore d'évaluation

- avisAUG Ang (2003-01)Document2 pagesavisAUG Ang (2003-01)ngslidesPas encore d'évaluation

- Waiver of RightsDocument14 pagesWaiver of RightsAstralDropPas encore d'évaluation

- Mortgage 2 AbilarDocument2 pagesMortgage 2 AbilarMark LojeroPas encore d'évaluation

- Assignment of Business DebtsDocument2 pagesAssignment of Business DebtsRitikaPas encore d'évaluation

- Residences by Armani CasaDocument2 pagesResidences by Armani CasaHakanPas encore d'évaluation

- Tri 1610 Udl3612 Topic 1 STD VerDocument11 pagesTri 1610 Udl3612 Topic 1 STD VerLyana SulaimanPas encore d'évaluation