Académique Documents

Professionnel Documents

Culture Documents

Salas v. Sta. Mesa Market Corporation

Transféré par

temporiariCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Salas v. Sta. Mesa Market Corporation

Transféré par

temporiariDroits d'auteur :

Formats disponibles

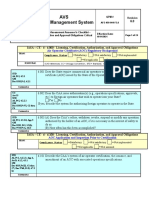

SALAS v. STA.

MESA MARKET CORPORATION [SMMC] AND HEIRS OF DOMINGO 2007 / Corona / Public documents Primitivo Domingo and Ernesto Salas had a letter-agreement (15 Oct 1984). Domingo handed the management of his estate (including SMMC) to Salas. Salas, as estate manager, was tasked to ensure SMMC's viability and profitability by redeveloping the Sta. Mesa market and restructuring the finances. Domingo bound himself to transfer 30% of SMMC's stock to Salas as part of his compensation. If Salas fails to achieve the minimum monthly market revenue of P350k, he has to return the shares of stock. Domingo (in his capacity as SMMC chairman) and Salas (in his personal capacity and as chairman of Inter-Alia Management Corporation) formalized their agreement under a property and financial management contract (28 Dec 1984). SMMC, under Salas, leased the Sta. Mesa market to Malaca Realty. However, it became apparent that Malaca was financially incapable of improving the market--Malaca was actually unable to pay the monthly rent! SMMC terminated the lease contract. The SMMC board became dissatisfied with Salas, so SMMC ended the management contract with Salas and Inter-Alia. Salas filed an action for specific performance and damages against SMMC and Domingo. Salas: SMMC's monthly market revenue surpassed P350k, yet Domingo refused to comply with his obligation. Domingo: Salas is not entitled to the shares. SMMC suffered additional losses and incurred new liabilities [P1.9M~] over the 21 months under Salas' management. RTC ruled in favor of Salas. Copies of SMMC's audited financial statements [audited FS] showing an improvement in the corporation's monthly average gross income was considered by the court. SMMC's monthly gross income was increased, and the P350k target was surpassed. Domingo was ordered to deliver the shares to Salas. CA held that RTC erred in admitting the copies of audited FS, so it reversed the RTC's ruling. Salas failed to prove the authenticity of the audited financial statements. o SMMC's external auditor was not presented to testify on the documents' genuineness and due execution. o Salas only presented a memorandum prepared by a member of his management team attesting to the increase in revenue. The audited FS were self-serving AND hearsay. Salas' argument Amado Domingo (SMMC VP and heir of Domingo) testified that the audited FS presented were copies of those submitted to BIR and SEC for purposes of tax payments, compliance with reportorial requirements. Hence, A. Domingo admitted genuineness and due execution, which made authentication unnecessary. ISSUE & HOLDING WON the copies of audited FS are public or private documents. Private documents, because they were mere copies and NOT certified true copies WON the copies of audited FS should be admitted in evidence. NO, due to lack of proper authentication Rule 132, Section 19. Classes of documents.--For the purpose of their presentation in evidence, documents are either public or private. Public documents are: The written official acts, or records of the official acts of the sovereign authority, official bodies and tribunals, and public officers, whether of the Philippines, or of a foreign country; Documents acknowledged before a notary public except last wills and testaments; and Public records, kept in the Philippines, of private documents required by law to be entered therein. All other writings are private.

Financial statements show the fiscal condition of a particular entity within a specified period. The financial statements prepared by external auditors who are CPAs are audited. Financial statements, whether audited or not, as a general rule, are private documents. They become public documents once they are filed with a government office pursuant to law. Whether a document is public or private is relevant in determining its admissibility as evidence. Public documents are admissible in evidence even without further proof of their due execution and genuineness. Private documents are inadmissible in evidence unless they are properly authenticated. Rule 132, Section 20. Proof of private documents.--Before any private document offered as authentic is received in evidence, its due execution and authenticity must be proved either: By anyone who saw the document executed or written; or By evidence of the genuineness of the signature or handwriting of the maker. Any other private document need only be identified as that which it is claimed to be. Rule 132, Section 27. Public record of a public document.--An authorized public record of a private document may be proved by the original record, or by a copy thereof, attested by the legal custodian of the record, with an appropriate certificate that such officer has the custody. Neither party claimed that the copies presented were certified true copies of audited FS obtained or secured from BIR or SEC, which would have been public documents. There was no authentication. What usually happens: A witness positively testifies that a document presented as evidence is genuine and has been duly executed, or that the document is neither spurious nor counterfeit nor executed by mistake or under duress. In this case: Salas merely presented a memorandum. o While there is no fixed criterion as to what constitutes competent evidence to establish authenticity, the best proof available must be presented. o The best proof would have been the testimony of a representative of SMMC's external auditor who prepared the audited FS. PETITION DENIED. CA DECISION AND RESOLUTION AFFIRMED.

Vous aimerez peut-être aussi

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- People vs. Napat-ADocument2 pagesPeople vs. Napat-AKaren Patricio LusticaPas encore d'évaluation

- People of The Philippines vs. Eduardo Hernandez, Merlito Hernandez, and Maximo HernandezDocument2 pagesPeople of The Philippines vs. Eduardo Hernandez, Merlito Hernandez, and Maximo HernandezTootsie GuzmaPas encore d'évaluation

- People Vs RendoqueDocument3 pagesPeople Vs RendoqueLindsay MillsPas encore d'évaluation

- SC upholds conviction of accused who pleaded guilty to kidnapping and murderDocument3 pagesSC upholds conviction of accused who pleaded guilty to kidnapping and murderTelle MariePas encore d'évaluation

- Heirs of Lacsa v. CADocument1 pageHeirs of Lacsa v. CAcmv mendozaPas encore d'évaluation

- Philippines land dispute case from 1903Document2 pagesPhilippines land dispute case from 1903Veah Caabay100% (2)

- Marital Disqualification Rule Does Not Apply to Rape of DaughterDocument1 pageMarital Disqualification Rule Does Not Apply to Rape of DaughterBingoheartPas encore d'évaluation

- Evidence CasesDocument23 pagesEvidence CasesRaymundoPas encore d'évaluation

- People vs. Fabre EvidDocument2 pagesPeople vs. Fabre Evidjulandmic9100% (1)

- How Due Process Was Not Violated in Jose R. Catacutan v. People of the PhilippinesDocument2 pagesHow Due Process Was Not Violated in Jose R. Catacutan v. People of the PhilippinesMichelle DecedaPas encore d'évaluation

- 35 People v. Tia FongDocument2 pages35 People v. Tia FongdPas encore d'évaluation

- Unchuan vs. LozadaDocument3 pagesUnchuan vs. LozadaMarlene TongsonPas encore d'évaluation

- People Vs Henry SalveronDocument2 pagesPeople Vs Henry SalveronAya Baclao100% (1)

- E1 - 1 People v. FabreDocument2 pagesE1 - 1 People v. FabreAaron AristonPas encore d'évaluation

- Heirs of Demetria Lacsa vs. Court of Appeals 197 SCRA 234, May 20, 1991Document1 pageHeirs of Demetria Lacsa vs. Court of Appeals 197 SCRA 234, May 20, 1991HaroldDeLeon100% (1)

- A Child of Tender Years May Be Asked Leading Questions Under Section 10 (C), Rule 132 of The Rules of CourtDocument3 pagesA Child of Tender Years May Be Asked Leading Questions Under Section 10 (C), Rule 132 of The Rules of CourtJ CallejaPas encore d'évaluation

- People Vs LorenzoDocument2 pagesPeople Vs LorenzoNath AntonioPas encore d'évaluation

- Lazaro v. Agustin DIGESTDocument4 pagesLazaro v. Agustin DIGESTkathrynmaydevezaPas encore d'évaluation

- Heirs of Spouses Arcilla vs. TeodoroDocument1 pageHeirs of Spouses Arcilla vs. TeodoroMark CoPas encore d'évaluation

- 10 Banco Filipino vs. Monetary Board People vs. InvencionDocument3 pages10 Banco Filipino vs. Monetary Board People vs. InvencionJuris Renier MendozaPas encore d'évaluation

- Tabao V.peopleDocument2 pagesTabao V.peopleTeff Quibod100% (1)

- Digest Datalift Movers, Inc. Vs Belgravia RealtyDocument2 pagesDigest Datalift Movers, Inc. Vs Belgravia Realtyleizle funa100% (1)

- People Vs DiopitaDocument1 pagePeople Vs DiopitaRonnie RimandoPas encore d'évaluation

- 005 Edsa Shangri-La Hotel v. BF Corp.Document2 pages005 Edsa Shangri-La Hotel v. BF Corp.keith10575% (4)

- Admissibility of Accident Investigator OpinionDocument2 pagesAdmissibility of Accident Investigator Opinionapril75Pas encore d'évaluation

- People v. CerillaDocument1 pagePeople v. Cerillashookt panboiPas encore d'évaluation

- Rule 132 Section 34 - Offer of Evidence Conviction UpheldDocument2 pagesRule 132 Section 34 - Offer of Evidence Conviction UpheldDan LocsinPas encore d'évaluation

- Marcos Vs Heirs of NavarroDocument2 pagesMarcos Vs Heirs of NavarroRal Tibs100% (2)

- Gonzales v. CFI: Properties Reserved Under Article 891Document2 pagesGonzales v. CFI: Properties Reserved Under Article 891sdfoisaiofasPas encore d'évaluation

- People Vs Alido People Vs YatarDocument29 pagesPeople Vs Alido People Vs Yatarmonica may ramos100% (1)

- PP vs. Victor P. Padit, G.R. No. 202978 DigestDocument1 pagePP vs. Victor P. Padit, G.R. No. 202978 DigestValerie Kaye BinayasPas encore d'évaluation

- People v. OngayanDocument1 pagePeople v. Ongayanzetters03Pas encore d'évaluation

- de La Paz vs. IacDocument2 pagesde La Paz vs. Iacsunem blackPas encore d'évaluation

- Judicial Admissions Doctrine Limited by CircumstancesDocument2 pagesJudicial Admissions Doctrine Limited by CircumstancesRenz Aimeriza AlonzoPas encore d'évaluation

- Heirs of Prodon vs. Heirs of AlvarezDocument2 pagesHeirs of Prodon vs. Heirs of AlvarezShane Fernandez JardinicoPas encore d'évaluation

- Dela Rama Vs PapaDocument2 pagesDela Rama Vs PapaEloisa SalitreroPas encore d'évaluation

- Canque Vs CADocument3 pagesCanque Vs CANap GonzalesPas encore d'évaluation

- Child Witness Competency Regardless of AgeDocument2 pagesChild Witness Competency Regardless of AgeChristine Joy PrestozaPas encore d'évaluation

- All Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjDocument16 pagesAll Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjJan Erik Manigque100% (1)

- 02 People v. RaquelDocument2 pages02 People v. RaquelAliyah Rojo100% (1)

- Evidence Digests2Document8 pagesEvidence Digests2Alyssa Clarizze MalaluanPas encore d'évaluation

- People vs. TandoyDocument1 pagePeople vs. TandoyMarcial Gerald Suarez III100% (2)

- 340 People vs. Sambahon (Sanchez)Document3 pages340 People vs. Sambahon (Sanchez)Danielle AbuelPas encore d'évaluation

- People Vs VillaricoDocument3 pagesPeople Vs VillaricoKevin KhoPas encore d'évaluation

- CTA jurisdiction over tax disputes between government agenciesDocument21 pagesCTA jurisdiction over tax disputes between government agenciesAnna Dela VegaPas encore d'évaluation

- Criminal Law ExaminationDocument3 pagesCriminal Law ExaminationJay R MVPas encore d'évaluation

- People Vs SatorreDocument4 pagesPeople Vs SatorreKat Miranda100% (1)

- 08 Cerezo v. TuazonDocument2 pages08 Cerezo v. TuazonRachelle GoPas encore d'évaluation

- Commercial Law Exercise QuestionsDocument38 pagesCommercial Law Exercise QuestionsRachelPas encore d'évaluation

- People v. CepedaDocument1 pagePeople v. CepedaBianca Margaret TolentinoPas encore d'évaluation

- CABALLERO Vs PCGDocument1 pageCABALLERO Vs PCGLouie RaotraotPas encore d'évaluation

- G.R. No. L-31408 April 22, 1991Document1 pageG.R. No. L-31408 April 22, 1991Kikoy IlaganPas encore d'évaluation

- IBC-13 executive dismissal disputeDocument2 pagesIBC-13 executive dismissal disputeMamito KampitanPas encore d'évaluation

- People v. AlegadoDocument2 pagesPeople v. AlegadoRaymond SanchezPas encore d'évaluation

- Polido v. CADocument2 pagesPolido v. CAAbigayle RecioPas encore d'évaluation

- Lezama v. RodriguezDocument2 pagesLezama v. RodriguezJustin Moreto100% (1)

- US v. Torres and Padilla: Evidence of compromise inadmissibleDocument55 pagesUS v. Torres and Padilla: Evidence of compromise inadmissibleEduardPas encore d'évaluation

- Case Digest - Yap VS InopiquezDocument2 pagesCase Digest - Yap VS InopiquezGladys Cañete33% (3)

- Salas v. Sta. Mesa Market Corporation ruling on admissibility of audited financial statementsDocument2 pagesSalas v. Sta. Mesa Market Corporation ruling on admissibility of audited financial statementsDominique PobePas encore d'évaluation

- Article - Another Look at Trust CorporationsDocument4 pagesArticle - Another Look at Trust CorporationstemporiariPas encore d'évaluation

- L/Epublic: QcourtDocument36 pagesL/Epublic: QcourtRoizki Edward MarquezPas encore d'évaluation

- IP Rights (Recipes, Kitchen Techniques, Food Packaging)Document2 pagesIP Rights (Recipes, Kitchen Techniques, Food Packaging)temporiariPas encore d'évaluation

- Rivera v. MoranDocument1 pageRivera v. MorantemporiariPas encore d'évaluation

- ARTICLE - Death, Real Estate, and Estate TaxesDocument10 pagesARTICLE - Death, Real Estate, and Estate TaxestemporiariPas encore d'évaluation

- Luzon Stevedoring Corporation Tax Exemption CaseDocument1 pageLuzon Stevedoring Corporation Tax Exemption CasetemporiariPas encore d'évaluation

- BIR - Registration of Book of AccountsDocument1 pageBIR - Registration of Book of AccountstemporiariPas encore d'évaluation

- In Re Shoop, November 29, 1920Document6 pagesIn Re Shoop, November 29, 1920temporiariPas encore d'évaluation

- BIR - Affidavit of Cessation of Business OperationDocument1 pageBIR - Affidavit of Cessation of Business OperationtemporiariPas encore d'évaluation

- A.M. No. 02-11-10-SCDocument8 pagesA.M. No. 02-11-10-SCtemporiariPas encore d'évaluation

- Amin Rasheed Shipping Corp. v. Kuwait InsuranceDocument24 pagesAmin Rasheed Shipping Corp. v. Kuwait Insurancetemporiari100% (2)

- Administrator's Fees and Commission RulesDocument3 pagesAdministrator's Fees and Commission RulestemporiariPas encore d'évaluation

- Eo 200Document1 pageEo 200temporiariPas encore d'évaluation

- Ocejo, Perez and Co. v. International BankDocument6 pagesOcejo, Perez and Co. v. International BanktemporiariPas encore d'évaluation

- Heritage Hotel Manila v. NUWHRAIN-HHMSC (2011)Document6 pagesHeritage Hotel Manila v. NUWHRAIN-HHMSC (2011)temporiariPas encore d'évaluation

- 1987 ConstitutionDocument34 pages1987 ConstitutiontemporiariPas encore d'évaluation

- Amadora v. CADocument2 pagesAmadora v. CAtemporiariPas encore d'évaluation

- SpecPro SyllabusDocument11 pagesSpecPro Syllabustemporiari0% (1)

- Kairys, DanGat, VitugDocument1 pageKairys, DanGat, VitugtemporiariPas encore d'évaluation

- Locgov - Provisions - 12 Nov 2013 of A. Villafuerte (D2015)Document6 pagesLocgov - Provisions - 12 Nov 2013 of A. Villafuerte (D2015)temporiariPas encore d'évaluation

- People v. OcampoDocument1 pagePeople v. OcampotemporiariPas encore d'évaluation

- Other Provisions Under Estate TaxDocument4 pagesOther Provisions Under Estate TaxtemporiariPas encore d'évaluation

- Ortañez v. CADocument2 pagesOrtañez v. CAtemporiariPas encore d'évaluation

- Nestle Phils. v. FY SonsDocument2 pagesNestle Phils. v. FY SonstemporiariPas encore d'évaluation

- Razon v. IACDocument3 pagesRazon v. IACtemporiariPas encore d'évaluation

- Frias v. San Diego-SisonDocument1 pageFrias v. San Diego-SisontemporiariPas encore d'évaluation

- Marturillas v. PeopleDocument3 pagesMarturillas v. PeopletemporiariPas encore d'évaluation

- Home Insurance Corporation v. CADocument2 pagesHome Insurance Corporation v. CAtemporiari100% (1)

- La Bugal-B'laan Tribal Assn. v. DENRDocument5 pagesLa Bugal-B'laan Tribal Assn. v. DENRtemporiariPas encore d'évaluation

- StarBus - UTC Online 4.0Document1 pageStarBus - UTC Online 4.0Jitendra BhandariPas encore d'évaluation

- Echegaray Vs Secretary of JusticeDocument12 pagesEchegaray Vs Secretary of JusticeCherry BepitelPas encore d'évaluation

- Ranger SportsDocument2 pagesRanger SportsSai Swaroop MandalPas encore d'évaluation

- International Aviation Safety Assessment Assessor’s ChecklistDocument23 pagesInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaPas encore d'évaluation

- Balibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchDocument13 pagesBalibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchRelmie TaasanPas encore d'évaluation

- SENSE AND SENSIBILITY ANALYSIS - OdtDocument6 pagesSENSE AND SENSIBILITY ANALYSIS - OdtannisaPas encore d'évaluation

- Abhivyakti Yearbook 2019 20Document316 pagesAbhivyakti Yearbook 2019 20desaisarkarrajvardhanPas encore d'évaluation

- Financial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterDocument202 pagesFinancial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterVISHNUKUMAR S VPas encore d'évaluation

- PNP Ethical Doctrine Core ValuesDocument10 pagesPNP Ethical Doctrine Core Valuesunknown botPas encore d'évaluation

- Applications Forms 2 EL BDocument2 pagesApplications Forms 2 EL Bilerioluwa akin-adeleyePas encore d'évaluation

- Significance of Wearing of Complete UniformDocument13 pagesSignificance of Wearing of Complete Uniformcherry mae rosaliaPas encore d'évaluation

- RA 7160 Local Government CodeDocument195 pagesRA 7160 Local Government CodeStewart Paul Tolosa Torre100% (1)

- VW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesDocument2 pagesVW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesMister MCPas encore d'évaluation

- Pathalgadi Movement and Adivasi RightsDocument5 pagesPathalgadi Movement and Adivasi RightsDiXit JainPas encore d'évaluation

- Unit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Document2 pagesUnit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Rafael VillegasPas encore d'évaluation

- Myths, Heroes and Progress in Mrs. Rania's Speaking ClassDocument26 pagesMyths, Heroes and Progress in Mrs. Rania's Speaking ClassRania ChokorPas encore d'évaluation

- CIA Triangle Review QuestionsDocument11 pagesCIA Triangle Review QuestionsLisa Keaton100% (1)

- PoliceLife April-2011 Issuu PDFDocument32 pagesPoliceLife April-2011 Issuu PDFshane parrPas encore d'évaluation

- Determining The Number of IP NetworksDocument6 pagesDetermining The Number of IP Networksonlycisco.tkPas encore d'évaluation

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordPas encore d'évaluation

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDocument2 pagesDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCOPas encore d'évaluation

- Commencement of A StatuteDocument110 pagesCommencement of A StatutePrasun Tiwari80% (10)

- 1 2 PNP Professional Code of Conduct and Ethical StandardsDocument47 pages1 2 PNP Professional Code of Conduct and Ethical Standardsunknown botPas encore d'évaluation

- NdpsDocument22 pagesNdpsRaviKumar VeluriPas encore d'évaluation

- Cornell Notes Financial AidDocument3 pagesCornell Notes Financial AidMireille TatroPas encore d'évaluation

- Premachandra and Dodangoda v. Jayawickrema andDocument11 pagesPremachandra and Dodangoda v. Jayawickrema andPragash MaheswaranPas encore d'évaluation

- Building Code PDFDocument11 pagesBuilding Code PDFUmrotus SyadiyahPas encore d'évaluation

- Takeovers: Reading: Takeovers, Mergers and BuyoutsDocument4 pagesTakeovers: Reading: Takeovers, Mergers and BuyoutsFreakin 23Pas encore d'évaluation

- Bangladesh Merchant Shipping Act 2020Document249 pagesBangladesh Merchant Shipping Act 2020Sundar SundaramPas encore d'évaluation

- Jeff Gasaway Investigation Report From Plano ISD April 2010Document21 pagesJeff Gasaway Investigation Report From Plano ISD April 2010The Dallas Morning NewsPas encore d'évaluation