Académique Documents

Professionnel Documents

Culture Documents

Institute of Actuaries of India: Subject ST1 - Health and Care Insurance

Transféré par

Vignesh SrinivasanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Institute of Actuaries of India: Subject ST1 - Health and Care Insurance

Transféré par

Vignesh SrinivasanDroits d'auteur :

Formats disponibles

Institute of Actuaries of India

Subject ST1 Health and Care Insurance

For 2013 Examinations

Aim The aim of the Health and Care Specialist Technical subject is to instil in successful candidates the ability to apply, in simple situations, the principles of actuarial planning and control needed in health and care matters on sound financial lines. Links to other subjects Subject CT3 Probability and Mathematical Statistics: provides a basic grounding in statistics. Subject CT4 Models: covers some stochastic models used in health and care. Subject CT6 Statistical Methods: covers some of the mathematical methods relevant for this subject. Subject CA1 Actuarial Risk Management: covers the general underlying principles affecting all specialisms. Subject SA1 Health and Care Specialist Applications will use the principles developed in this subject to develop a deeper understanding of health and care insurance business and United Kingdom practice. Objectives On completion of this subject the candidate will be able to: (a) (b) Understand the principal terms in health and care. Describe and understand the main types of contract and their purpose for the customer: (c) critical illness insurance income protection insurance long term care insurance health cash plans major medical expenses private medical insurance group and individual covers

Describe the principles by which health and care insurance contracts are designed and the interests of the various stakeholders in the process. Understand the operating environments in which health and care insurance products and services are traded: distribution channels regulatory and fiscal regimes professional guidance economic influences

(d)

(e)

Explain the role of the State in the provision of alternative or complementary health and care protection: objectives of State healthcare provision

(f)

manner of State healthcare provision funding approaches

Understand and apply the techniques used in pricing health care insurance products in terms of: data availability assumptions used equation of value / formula approach cash flow techniques group risk assessments options and guarantees external influences

(g)

Understand the nature of the risks facing the insurer: data claim rates claim amounts investment performance expenses and inflation persistency mix of new business volume of new business guarantees and options competition actions of management counterparties regulatory and fiscal developments reputation internal audit failures/fraud physical risks aggregation and concentration of risk catastrophes non-disclosure and anti-selection

(h)

Understand how insurers use reinsurance to manage their risks and the reinsurance products involved: reasons for reinsurance types of reinsurance determination of the retention level

(i)

Describe how insurers manage their risks in other ways: experience monitoring service level agreements with outsourcers competence assessments for key staff checks on policy and claims data surveys on customer service satisfaction underwriting claims management

(j)

treating customers fairly controlling the distribution process

Describe the principal modelling techniques appropriate to health and care insurance: asset liability modelling objectives and basic features of a health insurance model uses (pricing, return and capital, profitability assessment) multi-state modelling in pricing, reserving and reporting comparison of formula and cash flow approach sensitivity analysis deterministic and stochastic models

(k)

Understand the assumptions that are crucial to pricing and valuation, including profit requirements. Understand the purposes of valuation and reserving, and the methodologies by which they are performed: role of statistical and individual case estimates purpose of calculation setting assumptions best estimate and market consistent reserves embedded values

(l)

(m)

Understand the principles and practices of supervisory reporting: principles of setting statutory or supervisory reserves difference in assumptions from those used in pricing use of sensitivity analysis interplay between the strength of reserves and the level of solvency capital requirements

(n)

(o)

Describe the principles of investment and how they apply to health and care insurance Describe the principles by which the experience from a health insurance operation is used to refocus business planning: reasons for monitoring experience data required analysis of mortality, morbidity, claim amounts and withdrawal rates analysis of expenses, new business and investment experience reasons for analysis of surplus and analysis of embedded value profit use of results to revise the models and assumptions used

END OF SYLLABUS

Vous aimerez peut-être aussi

- ST2 Life Insurance PDFDocument5 pagesST2 Life Insurance PDFVignesh SrinivasanPas encore d'évaluation

- Financial Statement Analysis: Business Strategy & Competitive AdvantageD'EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Institute of Actuaries of India: Subject ST4 - Pensions and Other Employee BenefitsDocument4 pagesInstitute of Actuaries of India: Subject ST4 - Pensions and Other Employee BenefitsVignesh SrinivasanPas encore d'évaluation

- ST7 General Insurance Reserving&Capital ModelingDocument5 pagesST7 General Insurance Reserving&Capital ModelingVignesh SrinivasanPas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18D'EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Pas encore d'évaluation

- Institute of Actuaries of India: Subject SA1 - Health and Care InsuranceDocument4 pagesInstitute of Actuaries of India: Subject SA1 - Health and Care InsuranceVignesh SrinivasanPas encore d'évaluation

- Mastering Opportunities and Risks in IT Projects: Identifying, anticipating and controlling opportunities and risks: A model for effective management in IT development and operationD'EverandMastering Opportunities and Risks in IT Projects: Identifying, anticipating and controlling opportunities and risks: A model for effective management in IT development and operationPas encore d'évaluation

- ST8 General Insurance Pricing PDFDocument4 pagesST8 General Insurance Pricing PDFVignesh SrinivasanPas encore d'évaluation

- SP2 Syllabus 2022Document6 pagesSP2 Syllabus 2022Munjal GoelPas encore d'évaluation

- Subject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsDocument11 pagesSubject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsMaina MuhoroPas encore d'évaluation

- CA1 Actuarial Risk Management PDFDocument9 pagesCA1 Actuarial Risk Management PDFVignesh Srinivasan50% (2)

- CCP - AhmDocument28 pagesCCP - AhmThe Potluck StoriesPas encore d'évaluation

- Sp2 Syllabus FinalDocument8 pagesSp2 Syllabus FinalMtaki deusPas encore d'évaluation

- CP1 - Syllabus - Final ProofDocument9 pagesCP1 - Syllabus - Final ProofMoon MoonPas encore d'évaluation

- Cia EconomicsDocument8 pagesCia EconomicsSivaramkrishnanPas encore d'évaluation

- Assignment # 1: Objective of Simulation Are As UnderDocument2 pagesAssignment # 1: Objective of Simulation Are As UnderAhmed HassanPas encore d'évaluation

- 30 Risk and InsuranceDocument4 pages30 Risk and InsuranceSiti Nur Ain RamliPas encore d'évaluation

- IAI SP2 Syllabus 2024Document6 pagesIAI SP2 Syllabus 2024Mtaki deusPas encore d'évaluation

- Cost Analysis and Pricing DecisionsDocument34 pagesCost Analysis and Pricing DecisionsSumy Thomas73% (11)

- Nebosh International Diploma NotesDocument9 pagesNebosh International Diploma Notesdroffilcz27100% (8)

- ILA - Life Product Management Exam: Fall 2019/spring 2020Document10 pagesILA - Life Product Management Exam: Fall 2019/spring 2020Joel Adrian SimbahanPas encore d'évaluation

- NEBOSH Idip (Unit A) Q&ADocument32 pagesNEBOSH Idip (Unit A) Q&ARejeesh Nathan100% (1)

- Mu0015 Compensation and BenefitsDocument9 pagesMu0015 Compensation and BenefitsSandeep Kanyal100% (1)

- Evaluation and Selection of Strategies Revision NotesDocument5 pagesEvaluation and Selection of Strategies Revision NotesDave Dearing100% (1)

- This Chapter Discussed The Major Aspects Needed To Consider, Researched and Analyzed by The Consultant in Preparing The Project Feasibility StudyDocument6 pagesThis Chapter Discussed The Major Aspects Needed To Consider, Researched and Analyzed by The Consultant in Preparing The Project Feasibility StudyNika Ella SabinoPas encore d'évaluation

- Subject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamsDocument11 pagesSubject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamszubboPas encore d'évaluation

- Test Bank For Handbook of Informatics For Nurses and Healthcare Professionals 6th Edition Toni L Hebda Kathleen Hunter Patricia CzarDocument17 pagesTest Bank For Handbook of Informatics For Nurses and Healthcare Professionals 6th Edition Toni L Hebda Kathleen Hunter Patricia Czarcourtneyriveraefjpadcmyx100% (29)

- 11 Chapter 3Document10 pages11 Chapter 3Mohammad khalid AmiriPas encore d'évaluation

- Market and Demand Analysis: Mba 4 SEM Mohit Sing Chauhan Honeyishwar DeepakDocument14 pagesMarket and Demand Analysis: Mba 4 SEM Mohit Sing Chauhan Honeyishwar DeepakMukesh Kumar SharmaPas encore d'évaluation

- We Love EconomicsDocument26 pagesWe Love EconomicsR Ahmad Anggi Hakim100% (1)

- Market and Demand Analysis - 1456648403380 - 1456649639726 - 1456667314154Document14 pagesMarket and Demand Analysis - 1456648403380 - 1456649639726 - 1456667314154Mukesh Kumar SharmaPas encore d'évaluation

- Production and Operation ManagementDocument11 pagesProduction and Operation ManagementNageshwar singhPas encore d'évaluation

- How Do Companies Craft Strategic Business Unit Level Strategies Based On Customer Needs?Document4 pagesHow Do Companies Craft Strategic Business Unit Level Strategies Based On Customer Needs?Nikky Bless LeonarPas encore d'évaluation

- A Computational Intelligence Approach For PredictiDocument13 pagesA Computational Intelligence Approach For PredictiUsha CDPas encore d'évaluation

- IBNR Reserves For Health Insurance ActuariesDocument85 pagesIBNR Reserves For Health Insurance ActuariesmoxbPas encore d'évaluation

- Igc 1.2 PDFDocument7 pagesIgc 1.2 PDFclementPas encore d'évaluation

- CA1 Exams 2010-2014Document221 pagesCA1 Exams 2010-2014Xavier Snowy100% (1)

- Assignment-1: Compliance RequirementsDocument26 pagesAssignment-1: Compliance RequirementsDivya JoshiPas encore d'évaluation

- Strategic PlanningDocument53 pagesStrategic PlanningAndy Molina100% (2)

- MI - 1 (45) So Pyay Aung Win MarketingDocument6 pagesMI - 1 (45) So Pyay Aung Win MarketingDr. SPas encore d'évaluation

- Lei Health Economics Rev2.0Document9 pagesLei Health Economics Rev2.0Rasha ElbannaPas encore d'évaluation

- PM Chapter 4 p1Document40 pagesPM Chapter 4 p1tedrostesfay74Pas encore d'évaluation

- What Are The Features of Service Marketing?Document9 pagesWhat Are The Features of Service Marketing?raaahul27Pas encore d'évaluation

- Health InsuranceDocument28 pagesHealth Insuranceप्रविण सराफPas encore d'évaluation

- Reimbursement Basics Mass Challenge 9-28-2010Document28 pagesReimbursement Basics Mass Challenge 9-28-2010masschallengePas encore d'évaluation

- CMAP ECON 532 Health Economics II - Lecture Notes 2020Document217 pagesCMAP ECON 532 Health Economics II - Lecture Notes 2020stephanieacheampong8Pas encore d'évaluation

- I. Aligning The Resources With The Strategic Plan (37%)Document17 pagesI. Aligning The Resources With The Strategic Plan (37%)Javed ChowdharyPas encore d'évaluation

- Claims Management (Non-Life) Study Course 820 - Peter Wedge & Deborah Handley CII, 2004Document261 pagesClaims Management (Non-Life) Study Course 820 - Peter Wedge & Deborah Handley CII, 2004Sally Youssef100% (1)

- Customer Satisfaction Insurance Products of ICICI PrudentialDocument71 pagesCustomer Satisfaction Insurance Products of ICICI Prudentialkarthik_shabby15Pas encore d'évaluation

- Forecasting and LimitationsDocument4 pagesForecasting and LimitationsSheikh Farhan WaheedPas encore d'évaluation

- NEBOSH IGC1 Quiestion& AnswersDocument22 pagesNEBOSH IGC1 Quiestion& AnswersKartheek Chandra Sykam92% (64)

- Suitable CriteriaDocument3 pagesSuitable CriteriaAhmed BelalPas encore d'évaluation

- Gap, ETOP Analyses, BSCDocument28 pagesGap, ETOP Analyses, BSCniaz11788Pas encore d'évaluation

- Notes b2b 139-150 & 215-231Document4 pagesNotes b2b 139-150 & 215-231Sattwik PattnaikPas encore d'évaluation

- Information On Strategic Evaluation.: What Is Strategic Evaluation? What Is Outcomes Theory?Document42 pagesInformation On Strategic Evaluation.: What Is Strategic Evaluation? What Is Outcomes Theory?akashabuttPas encore d'évaluation

- FINAL EXAM MGT 6260 STRATEGIC BUSINESS ANALYSIS 45of50 90 by PHINEEE PDFDocument7 pagesFINAL EXAM MGT 6260 STRATEGIC BUSINESS ANALYSIS 45of50 90 by PHINEEE PDFPhine TanayPas encore d'évaluation

- Six Sigma Approach To Health Carel Quality Management-Revised-1 by Jay Bandyopadhyay and Karen CoppensDocument13 pagesSix Sigma Approach To Health Carel Quality Management-Revised-1 by Jay Bandyopadhyay and Karen Coppensmisslopez89Pas encore d'évaluation

- 7072 AhtishamSiddiquqDocument3 pages7072 AhtishamSiddiquqAhmed HassanPas encore d'évaluation

- WWW Manblunder Com Search Label Bhagavad 20gita Updated MaxDocument37 pagesWWW Manblunder Com Search Label Bhagavad 20gita Updated MaxVignesh SrinivasanPas encore d'évaluation

- WWW Manblunder Com Search Label Bhagavad 20gita Updated MaxDocument28 pagesWWW Manblunder Com Search Label Bhagavad 20gita Updated MaxVignesh SrinivasanPas encore d'évaluation

- WWW Manblunder Com Search Label Bhagavad 20gita Updated MaxDocument12 pagesWWW Manblunder Com Search Label Bhagavad 20gita Updated MaxVignesh SrinivasanPas encore d'évaluation

- WWW Manblunder Com Search Label Bhagavad 20gita Updated MaxDocument29 pagesWWW Manblunder Com Search Label Bhagavad 20gita Updated MaxVignesh SrinivasanPas encore d'évaluation

- Manblunder: Your Partner in Self-RealizationDocument15 pagesManblunder: Your Partner in Self-RealizationVignesh SrinivasanPas encore d'évaluation

- 03 Firstmrjob Invertedindexconstruction 141206231216 Conversion Gate01 PDFDocument54 pages03 Firstmrjob Invertedindexconstruction 141206231216 Conversion Gate01 PDFVignesh SrinivasanPas encore d'évaluation

- Aditya Hridayam 0-5Document22 pagesAditya Hridayam 0-5Vignesh SrinivasanPas encore d'évaluation

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanPas encore d'évaluation

- Uttar Kala MR ItDocument65 pagesUttar Kala MR ItVignesh SrinivasanPas encore d'évaluation

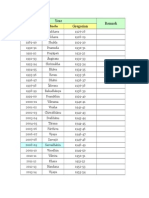

- Year Remark GregorianDocument3 pagesYear Remark GregorianVignesh SrinivasanPas encore d'évaluation

- Current Liabilities and Contingencies: PART II: Corporate Accounting Concepts and IssuesDocument68 pagesCurrent Liabilities and Contingencies: PART II: Corporate Accounting Concepts and IssuesKashif RaheemPas encore d'évaluation

- PFRS For SMEs - Summary NotesDocument5 pagesPFRS For SMEs - Summary NotesMaha Bianca Charisma CastroPas encore d'évaluation

- Landbank Vs CA and PascualDocument6 pagesLandbank Vs CA and PascualMerxeilles SantosPas encore d'évaluation

- Accounts & Adv Account BookDocument308 pagesAccounts & Adv Account Bookvishnuverma100% (1)

- Riyadh Cables Group Co Initiation Covergae Report PDFDocument22 pagesRiyadh Cables Group Co Initiation Covergae Report PDFikhan809Pas encore d'évaluation

- SBM Workbook Part 1Document844 pagesSBM Workbook Part 1Ima Adaka100% (1)

- Philippines - (Complainant: United States) : Taxes On Distilled SpiritsDocument20 pagesPhilippines - (Complainant: United States) : Taxes On Distilled SpiritsMa Gabriellen Quijada-TabuñagPas encore d'évaluation

- 08-05-16 Hogan Motion For Sanctions With Exhibits OCRDocument49 pages08-05-16 Hogan Motion For Sanctions With Exhibits OCRLaw&Crime100% (1)

- Rent A House (Autorecovered)Document15 pagesRent A House (Autorecovered)Lakkam sree deviPas encore d'évaluation

- Answer:: Stock ValuationDocument3 pagesAnswer:: Stock Valuationmuhammad hasanPas encore d'évaluation

- Intellectual Property Rights and RoyaltyDocument22 pagesIntellectual Property Rights and RoyaltyNikhil KasatPas encore d'évaluation

- AK0040 Accounting Theory: The Efficient Contracting Approach To Decision UsefulnessDocument17 pagesAK0040 Accounting Theory: The Efficient Contracting Approach To Decision UsefulnessFebPas encore d'évaluation

- Chapter 4Document24 pagesChapter 4FăÍż SăįYąðPas encore d'évaluation

- Final T Y B Com Syllabus 75-25 With New QP Semester V and VI 02-05-2014Document35 pagesFinal T Y B Com Syllabus 75-25 With New QP Semester V and VI 02-05-2014vinodgupta1146966100% (2)

- Amazon ResearchDocument39 pagesAmazon Researchmpjegan90Pas encore d'évaluation

- Download pdf Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta ebook full chapterDocument53 pagesDownload pdf Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta ebook full chapterjessie.ham964100% (1)

- Business Valuation ManagementDocument42 pagesBusiness Valuation ManagementRakesh SinghPas encore d'évaluation

- Business Valuation: Aruna Manharlal Shah Institute of Management and ResearchDocument55 pagesBusiness Valuation: Aruna Manharlal Shah Institute of Management and Researchriranna100% (1)

- Advance Financial Accounting Group Assig. by Gurmu EphremDocument5 pagesAdvance Financial Accounting Group Assig. by Gurmu Ephremsosina eseyew100% (1)

- Note On Angel InvestingDocument18 pagesNote On Angel InvestingSidakachuntuPas encore d'évaluation

- Land Bank v. YatcoDocument3 pagesLand Bank v. YatcoGRPas encore d'évaluation

- FMPM D 23 00098 PDFDocument7 pagesFMPM D 23 00098 PDFShahid HussainPas encore d'évaluation

- Chapter 01 - Auditing and Assurance ServicesDocument74 pagesChapter 01 - Auditing and Assurance ServicesBettina OsterfasticsPas encore d'évaluation

- Cash-Flow Reporting Between Potential Creative Accounting Techniques and Hedging Opportunities Case Study RomaniaDocument14 pagesCash-Flow Reporting Between Potential Creative Accounting Techniques and Hedging Opportunities Case Study RomaniaLaura GheorghitaPas encore d'évaluation

- CA Final New Syllabus Revised May 2018 - ICAI New SyllabusDocument20 pagesCA Final New Syllabus Revised May 2018 - ICAI New SyllabusRohan KulkarniPas encore d'évaluation

- Article SearchDocument75 pagesArticle SearchilyaskureshiPas encore d'évaluation

- Estimation and Costing PDFDocument20 pagesEstimation and Costing PDFNidhya Sudesh SinghPas encore d'évaluation

- Top 33 Investment Banking Interview Questions AnswersDocument7 pagesTop 33 Investment Banking Interview Questions AnswersRidwan KabirPas encore d'évaluation

- Mathias Fabich: Porr Bau GMBHDocument22 pagesMathias Fabich: Porr Bau GMBHFreedom Love NabalPas encore d'évaluation

- Principles of Accounts SyllabusDocument12 pagesPrinciples of Accounts SyllabusOyebamiji OlukayodePas encore d'évaluation

- The Layman's Guide GDPR Compliance for Small Medium BusinessD'EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessÉvaluation : 5 sur 5 étoiles5/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceD'EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceÉvaluation : 4 sur 5 étoiles4/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideD'Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Amazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobD'EverandAmazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersD'EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachD'EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachÉvaluation : 4 sur 5 étoiles4/5 (1)

- Internal Audit Checklists: Guide to Effective AuditingD'EverandInternal Audit Checklists: Guide to Effective AuditingPas encore d'évaluation

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowD'EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowPas encore d'évaluation

- Internal Controls: Guidance for Private, Government, and Nonprofit EntitiesD'EverandInternal Controls: Guidance for Private, Government, and Nonprofit EntitiesPas encore d'évaluation

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsD'EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsÉvaluation : 4 sur 5 étoiles4/5 (26)

- Strategic Consulting Frameworks: Consulting PreparationD'EverandStrategic Consulting Frameworks: Consulting PreparationPas encore d'évaluation

- Musings on Internal Quality Audits: Having a Greater ImpactD'EverandMusings on Internal Quality Audits: Having a Greater ImpactPas encore d'évaluation

- Business Process Mapping: Improving Customer SatisfactionD'EverandBusiness Process Mapping: Improving Customer SatisfactionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyD'EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyPas encore d'évaluation

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessD'EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessPas encore d'évaluation

- Internet Fraud Casebook: The World Wide Web of DeceitD'EverandInternet Fraud Casebook: The World Wide Web of DeceitPas encore d'évaluation

- Bribery and Corruption Casebook: The View from Under the TableD'EverandBribery and Corruption Casebook: The View from Under the TablePas encore d'évaluation