Académique Documents

Professionnel Documents

Culture Documents

Department of Labor: 00 042

Transféré par

USA_DepartmentOfLaborDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Department of Labor: 00 042

Transféré par

USA_DepartmentOfLaborDroits d'auteur :

Formats disponibles

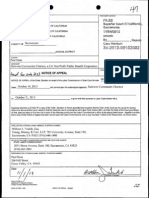

U.S.

Department of Labor Administrative Review Board

200 Constitution Avenue, N.W.

Washington, D.C. 20210

In the Matter of:

UNITED KLEENIST ORGANIZATION ARB CASE NO. 00-042

CORP. and YOUNG PARK,

ALJ CASE NO. 1999-SCA-18

Petitioners.

DATE: January 25, 2002

Re: Dispute concerning payment of prevailing

wages, fringe benefits and overtime pay, and de-

barment for labor standards violations with respect

to DOT Contract No. DTFA09-95-C-25005.

BEFORE: THE ADMINISTRATIVE REVIEW BOARD1/

Appearances:

For the Petitioner:

Scott A. Lathrop, Esq., Groton, Massachusetts

For the Wage and Hour Administrator:

Carol Arnold, Esq., Paul L. Frieden, Esq., Steven J. Mandel, Esq., U.S. Department of Labor,

Washington, D.C.

FINAL DECISION AND ORDER

This case involves allegations that a federal service contractor, United Kleenist Organization

Corp. (Kleenist), and its President, Young Park (Park) violated the minimum wage, fringe benefit

and recordkeeping provisions of the McNamara-O’Hara Service Contract Act of 1965, as amended,

42 U.S.C.A. §351 et seq. (West 1994)(SCA) and its implementing regulations, as well as the

overtime pay requirements of the Contract Work Hours and Safety Standards Act, as amended, 40

U.S.C.A. §§327-33 (West 2000)(CWHSSA). In a Decision and Order (D&O) issued January 10,

2000, a Labor Department Administrative Law Judge (ALJ) determined that Kleenist and Park

(collectively, “Petitioners”) had violated these laws. The ALJ ordered that Kleenist and Park be

debarred and listed as ineligible for future government contracts for a period of three years and that

they pay $21,631.50 in back wages to the Department of Labor, to be distributed to the underpaid

workers. Petitioners have filed this appeal. We affirm.

1/

This appeal has been assigned to a panel of two Board members, as authorized by Secretary's Order

2-96. 61 Fed. Reg. 19,978 §5 (May 3, 1996).

USDOL/OALJ REPORTER PAGE 1

BACKGROUND

Kleenist provides janitorial services to its customers primarily in Massachusetts. Petitioner

Young Park is the president of Kleenist and, for all relevant time periods, was responsible for the

employment and management practices of the company. On January 4, 1995, Kleenist entered into

a contract for the performance of janitorial services at a Federal Aviation Administration (“FAA”)

facility located in Olathe, Kansas. The contract was subject to both the SCA and CWHSSA. The

applicable wage determination, which was incorporated into the contract, mandated that janitorial

employees be paid wages no less than $7.17 per hour plus $.90 per hour in fringe benefits. Under

the wage determination, fringe benefits also were to include holiday pay for ten federal holidays and

a two-week vacation after one year of employment. Tr. 200-201.

Randy Kim worked for Kleenist as a janitor at the FAA facility. Because Park lived in

Massachusetts, he delegated to Kim the responsibility for recording the work hours of his co-workers

at the FAA facility and forwarding that information to Kleenist’s bookkeeper, Kay Park, who was

located in Gower, Missouri.2/ Petitioners characterize the information that Kim forwarded to Kay

Park as “payroll summaries.”

In June 1996, the Wage and Hour Division began an investigation into Kleenist’s

performance on the FAA contract. According to investigator Michelle Wilson, Kleenist was less

than cooperative. Wilson testified that, in order to obtain Kleenist’s payroll information, she drove

from her office in Kansas City, Kansas, to Gower, Missouri, about a hour and a half away. When

Wilson arrived, Kay Park gave her the payroll summaries prepared by Kim and told her that they

were Kleenist’s payroll records. Wilson was unable to obtain the time cards because Kay Park said

they were unavailable. Tr. 206.

When Wilson returned to her office, she discovered that the payroll summaries were

incomplete. In some cases, the records reflected the hours the employees worked but not the gross

amounts they earned, and in other cases it was just the opposite. Wilson determined that she needed

the time cards to “get a full picture,” so she contacted Kay Park and made an appointment to pick

them up. Tr. 207-209.

The day before Wilson was to pick up the time cards, she telephoned Kay Park to confirm

that the cards would be available. Kay Park assured her that the cards were ready to be picked up.

However, when Wilson arrived at Kleenist’s office, she was greeted by Young Park. He told her that

the cards were not available and turned her away without explanation. Later that same day, Young

Park called Wilson and informed her that the time cards were ready to be picked up. However, when

Wilson declined to drive back to Gower, Park delivered the time cards to her two days later. Tr. 209-

210, 245. Once again, Wilson found that the payroll information was incomplete so she drove back

to Gower and picked up additional material from Kay Park. However, when she examined the

material, she discovered that it did not include all of the time cards. Tr. 211-212.

According to Wilson, Kleenist’s records were “highly” substandard. Specifically, she

testified:

2/

Young Park and Kay Park are not related. Tr. 71.

USDOL/OALJ REPORTER PAGE 2

Several of the employees had been paid on some type of a salary that

didn’t cover all hours worked to the regular rate, meaning that money

that they paid, if I would divide the hours that they worked into gross

amounts that they were paid, it did not equal the regular rate of $7.17

an hour that was required. The employer had not paid in separately

stated health and welfare benefits. The employer had not paid

vacation pay. And only in one instance could I find that the employer

had ever paid holiday pay . . . There were deductions made clearly on

the payrolls, and absolutely no documentation as to why . . . . Full

names were not kept. Total remuneration was not kept accurately.

You couldn’t tell, in many instances, what the rates of pay were.3/

Tr. 213, 215.

Nevertheless, Wilson completed her computations using the information available and

concluded that Kleenist owed back wages. She then met with Park, explained why his company

owed back wages, and requested that he pay them. Park denied violating any laws and refused to

pay anything. Tr. 216.

On May 20, 1999, the Administrator filed a complaint against Petitioners alleging that they

had failed to pay the wages and benefits required by the SCA, had failed to pay overtime wages as

required by CWHSSA, and had failed to keep adequate records as required by the Department’s

regulations. In the complaint, the Administrator sought an order debarring Petitioners for three years

and directing them to pay $25,631.50 in back wages and benefits. Petitioners denied the allegations

against them.

The ALJ reviewed this matter consistent with the burden-shifting methodology set forth in

Anderson v. Mt. Clemens Pottery Co., 328 U.S. 680 (1946). Under this standard,

[The employee] bears the burden of proving that he performed work

for which he was not compensated. The remedial nature of this

statute and the great public policy which it embodies, however,

militate against making that burden an impossible hurdle for the

employee. Due regard must be given to the fact that it is the

employer who has the duty . . . to keep proper records of wages, hours

and other conditions and practices of employment and who is in

position to know and produce the most probative facts concerning the

nature and amount of work performed. Employees seldom keep such

records themselves; even if they do, the records may be and

frequently are untrustworthy . . . . When the employer has kept

3/

Department regulations require every contractor performing work subject to the SCA to keep payroll

records for three years from the completion of the work and to make those records available to authorized

representatives of the Wage and Hour Division. Among other things, those records must include the number

of daily and weekly hours worked by each employee and any deductions, rebates, or refunds from the total

daily or weekly compensation of each employee. See 29 C.F.R. §4.6 (g)(1)(2000).

USDOL/OALJ REPORTER PAGE 3

proper and accurate records the employee may easily discharge his

burden by securing the production of those records. But where the

employer’s records are inaccurate or inadequate and the employee

cannot offer convincing substitutes a more difficult problem arises

. . . . In such a situation, we hold that an employee has carried out his

burden if he proves that he has in fact performed work for which he

was improperly compensated and if he produces sufficient evidence

to show the amount and extent of that work as a matter of just and

reasonable inference. The burden then shifts to the employer to come

forward with evidence of the precise amount of work performed or

with evidence to negative the reasonableness of the inference to be

drawn from the employee’s evidence. If the employer fails to

produce such evidence, the court may then award damages to the

employee, even though the result be only approximate.

328 U.S. at 687-688.4/

In this case, several employees testified about the hours for which they were not compensated

and the fringe benefits that they did not receive. Because the payroll records were not complete, the

Wage and Hour investigator testified as to how she reconstructed the payroll records based on

interviews with the employees and the information provided by Kleenist. The burden then shifted

to Petitioners to either come forward with evidence of the precise amount of work performed or with

evidence to negate the reasonableness of the inference to be drawn from the Administrator’s

evidence. Petitioners attempted to rebut that evidence with their own analysis of the payroll

information, but the ALJ found this evidence unpersuasive, reasoning as follows:

During cross-examination of Mr. Young Park, and the wage records

he created for the hearing, it became clear that the after-the-fact

compilation of hours and wages were entirely inconsistent.

Paychecks issued to employees often did not match Mr. Park’s figures

of the wages owed. Additionally, if there was an inconsistency with

the earlier records provided by Mr. Park to Ms. Wilson, Mr. Park

would simply allege “time card fraud.” Also, Mr. Park relied upon an

assertion that it was policy to withhold the first two weeks of pay

from an employee’s check, yet the amounts withheld rarely, if ever,

equaled the appropriate amount the employee should have been paid

for the two week period in question.

D&O at 11.

4/

Although Anderson involved back wage awards under the Fair Labor Standards Act, the logic and

reasoning underlying the Anderson standard is equally applicable to awards under the SCA and CWHSSA.

See generally American Waste Removal Company v. Donovan, 748 F.2d 1406 (10th 1984) Because this is

an enforcement action brought by the Wage and Hour Administrator, the initial burden of proving that wages

have been underpaid falls to the Administrator. See, e.g., Thomas &Sons Building Contractors, Inc., Order

Denying Reconsideration, ARB No. 00-050, ALJ No. 96-DBA-37 (ARB Dec. 6, 2001).

USDOL/OALJ REPORTER PAGE 4

The ALJ found that Kleenist had violated the SCA, CWHSSA, and the Department’s

regulations. However, he determined that $4,000 of the requested back pay award was

unrecoverable in this action.5/ Accordingly, the ALJ reduced the assessment and ordered Petitioners

to pay $21,631.50. As for debarment, the ALJ noted that persons violating the SCA are ineligible

for an award of government contracts for a period of three years unless the penalty is relieved due

to unusual circumstances. Finding no such unusual circumstances in this case, the ALJ ordered that

Petitioners be debarred. This appeal followed.

JURISDICTION

The Board has jurisdiction over this appeal pursuant to the SCA, CWHSSA, and 29 C.F.R.

§8.1 (2000).

STANDARD OF REVIEW

The Board’s review of an ALJ’s decision is in the nature of an appellate proceeding. 29

C.F.R. §8.1(d). Pursuant to 29 C.F.R. §8.9 (b), the Board shall modify and set aside an ALJ’s

findings of fact only when it determines that those findings are not supported by a “preponderance

of the evidence.” Conclusions of law are reviewed de novo.

DISCUSSION

I. Reliance on the Payroll Records

In determining that Petitioners violated the applicable statutes, the ALJ relied upon the

payroll summaries that were prepared by Kim and presented to Wilson as Kleenist’s payroll records.

Because the time cards were also part of the evidence in this case, and because Wilson testified that

the payroll summaries were “highly” substandard, Petitioners argue that it was prejudicial error for

the ALJ to rely on the payroll summaries rather than the time cards. Petition for Review (Petition)

at 4. We disagree.

Wilson explained the respective roles that time cards and payroll records play in an

investigation, observing that Wage and Hour’s investigators rely on the employer’s representation

that the payroll records are accurate and use time cards only as a means to spot check or to fill gaps

in the payroll records. Tr. 207-208, 219, 257, 261. Petitioners do not allege that Wilson failed to

adhere to this practice, nor do they challenge the reasonableness of the practice itself. Rather, they

direct our attention to the following excerpt from the cross-examination of Wilson:

Petitioners’ attorney: Okay. Now will you agree with me that even

though it may not be your standard practice,

but that in a case where you have highly

suspect payroll records, the ultimate analysis,

5/

The Administrator had assessed Petitioners $4,000 for unpaid salary owed to Randy Kim. However,

the ALJ declined to address this issue because it involved “salary owed outside the time of the investigation.”

D&O at 12. This aspect of the ALJ’s decision was not appealed by the Administrator.

USDOL/OALJ REPORTER PAGE 5

whether you’re prepared to do it or not, is the

best analysis as to hours worked and wages

paid would be looking at the time cards.

Ms. Wilson: Absolutely.

Tr. 267 (emphasis added). Based on this testimony, Petitioners urge us to conclude that the ALJ

erred in relying on the payroll summaries. Petition at 4. There are several problems with this

argument.

First, Petitioners have never disputed that Wilson followed standard DOL practice, nor have

they argued that the standard practice itself is inconsistent with law or regulation. Absent a direct

challenge to the validity of the Administrator’s practice, Wilson’s speculation as to what might be

appropriate under some other practice is totally irrelevant.

Second, Wilson’s testimony on the use of time cards is, at best, ambiguous. In answer to the

above hypothetical, Wilson agreed that it would be better to use the time cards in cases where there

are highly “suspect” payroll records. This question was posed as a followup to Wilson’s testimony

that she found the Petitioners’ payroll records “highly substandard.” However, contrary to

Petitioners’ implicit assumption, the words “suspect” and “substandard” are not synonymous.

Substandard means “deviating from or falling short of a standard or norm.” Suspect means

“regarded or deserving to be regarded with suspicion.” Webster’s Ninth New Collegiate Dictionary

(1984). There is nothing in the record of this case to suggest that Wilson found the payroll records

suspicious. In fact, Wilson testified that she had no reason to doubt the validity of either the payroll

summaries or the time cards. Tr. 258.

Finally, Petitioners’ argument is premised on the assumption that, with regard to the number

of hours worked, the time cards are either more accurate than the payroll summaries or that they

contain significantly different information. These assumptions are not only inconsistent with the

testimony but also with one of the theories on which Petitioners themselves argued their case. In

their opening statement, Petitioners claimed that Kim “doctored” the time cards. Tr. 16. We fail to

see how the time cards that the Petitioners characterize as “doctored” are any more reliable than the

payroll summaries that Kim prepared. Moreover, the testimony does not reflect that the time cards

and payroll records contained significantly different information. Wilson testified that she spot

checked the payroll records against the time cards and found that they were “pretty much the same.”

Tr. 258, 272.

II. Fringe Benefits

A. Meaning of the Applicable Regulation

The SCA regulations at 29 C.F.R. §4.170(a) require contractors and subcontractors to furnish

fringe benefits separate from, and in addition to, monetary wages. Petitioners, however, argue that

this requirement is inapplicable to them unless the requirement is prescribed in the contract itself.

Specifically, Petitioners state:

USDOL/OALJ REPORTER PAGE 6

Section §4.170(a) of 29 C.F.R. provides that the fringe benefits “shall

be furnished, separate from and in addition to the specified monetary

wages, [by the contractor or subcontractor to the employees engaged

in performance of the contract] as specified in the determination of

the Secretary or his authorized representative and prescribed in the

contract documents.” The contract documents provided to [Kleenist]

did not prescribe that its fringe benefits had to be furnished “separate

from” the specified monetary wages. Therefore, it cannot be said that

[Kleenist] was required to do such.

Petition at 8 (emphasis in original).

This argument is clearly based on a misreading of the regulation. The phrase “as specified

in the determination of the Secretary or his authorized representative and prescribed in the contract

documents” does not modify the words “separate from.” It simply requires that the amount of fringe

benefits shall be as specified in the determination of the Secretary or his authorized representative

and prescribed in the contract documents. It does not mean that the contract itself has to specify that

the fringe benefits must be paid separately. This interpretation is supported by the grammatical

structure of the sentence itself. The phrase “separate from and in addition to the specified monetary

wages” is set off by commas and, as a result, stands independent of the language that follows. See

U.S. v. Ron Pair Enterprises, Inc., 489 U.S. 235, 241 (1989).

B. Fringe Benefit Payments Allegedly Included in the Hourly Wage

In the proceedings below, Petitioners asserted that the money they were required to pay for

fringe benefits was included in the hourly wage paid to their employees, thus explaining why

employees were paid $10 an hour instead of $7.17, the minimum hourly rate required under the

applicable wage determination.6/ The ALJ rejected this argument as specious, in part, because he

found it “unlikely that [Petitioners] would pay vacation and holiday pay in advance since an

employee might not work long enough to earn vacation or might not work on the particular holiday

for which they were being paid.” D&O at 9.

Petitioners take issue with the ALJ ’s reasoning and argue as follows:

It is undisputed that in 1995, during the first year of [Kleenist’s] very

first contract, it paid all its employees at the rate of $10.00 per hour.

Park testified that this hourly rate of $10.00 per hour was intended to

cover the employees’ base rate of $7.17 per hour and their fringe

benefits. Regarding holiday pay, Kim, who was called as a DOL

witness, testified that [Kleenist] began separately paying holiday pay

sometime before July, 1995. Therefore [Kleenist] did not pay holiday

6/

If the $10.00 hourly rate did not include fringe benefits, then it raises a question as to why Petitioners

would pay their employees above the required $7.17 hourly rate. A possible answer was provided by Wilson

who testified that one of Kleenist’s employees told her that the market rate for janitorial work in the area was

$10.00 an hour and that employees would not work for less. Tr. 287.

USDOL/OALJ REPORTER PAGE 7

pay in advance; holiday pay was not part of the fringe benefits that

was added to the base rate. With regard to vacation pay, as it

occurred, only Kim worked long enough for [Kleenist] to earn any

vacation, and he was paid on a salary basis. . . . Hence, it was not a

“specious” argument for the Respondents to contend that the health

and welfare benefits were included within the $10.00 per hour paid

to [Kleenist] employees.

Petition at 7 (citations omitted).

We agree with the Petitioners that the ALJ’s analysis on this point is somewhat confused,

conflating the holiday and vacation fringe benefit with the hourly fringe benefit rate that typically

is used to purchase health insurance. However, the ALJ’s ultimate conclusion – i.e., that proper

fringe benefits were not paid to the employees – plainly is correct.

Petitioners concede that an “employer cannot offset an amount of monetary wages paid in

excess of the [required] wages . . . in order to satisfy his fringe benefit obligations.” Petition at 8.

Instead, they assert that Kleenist “specifically paid in excess of the $7.17 per hour minimum rate for

the purpose of meeting its obligations under the contract documents, and it only seeks now credit for

the payments made to meet such fringe benefit obligations.” Id.

The Administrator responds as follows:

While it is true that 29 C.F.R. 4.170 permits payment of fringe

benefits in cash, “[u]nless the employees were informed that fringe

benefits were included in their pay and understood this fact, the

existence of wages above minimum cannot be considered the

provision of required fringe benefits.” Crist Trucking Inc., SCA-

1275 (Nov. 23, 1983). Moreover, an employer “must keep

appropriate records separately showing amounts paid for wages and

amounts paid for fringe benefits.” 29 C.F.R. 4.170(a). Previous

decisions on administrative review under the SCA have consistently

held that when an employer has not made any provision for fringe

benefits, “overpaid” wages cannot be credited against an employer’s

fringe benefit obligation. [citations omitted]. As noted above, the

testimony here indicates that [Kleenist’s] employees were not

informed that fringe benefits were included in their pay.

Adm. Opp. to Pet. for Rev. at 10-11. Petitioners have not filed a reply brief taking issue with either

the Administrator’s citation of the relevant authorities or the Administrator’s application of the law

to the facts of this case. Quite simply, to the extent that Petitioners now claim that they intentionally

paid a higher-than-minimum wage rate to its workers in order to satisfy the fringe benefit

requirements, there is nothing in the record suggesting that it maintained records documenting such

a policy. In the absence of rebuttal, we can only conclude that Petitioners have conceded the point.

USDOL/OALJ REPORTER PAGE 8

With specific regard to the requirement that employees on the contract be paid for ten paid

holidays, the ALJ noted Kim’s testimony that only when one employee complained that she was not

paid for a holiday was she provided with additional compensation – a payment which was

corroborated by the payroll records. This evidence strongly supports the ALJ’s view that Petitioners’

claim to have included the fringe benefit payments as part of the hourly wage was false, because if

Petitioners believed that they already were compensating their workers for holiday pay, it is unlikely

that they would have made a second holiday payment to a worker merely upon demand.7/

III. Overtime Computations

The ALJ found that “[t]here is simply no evidence upon which to support a finding that

[Petitioners] paid employees wages equal to time and a half their normal hourly rate” for hours

worked in excess of a forty hour week. D&O at 10. Petitioners take issue with the ALJ’s finding

and state:

Under the Contract Work Hours and Safety [Standards] Act (40

U.S.C. § 328 et seq.) overtime premiums must be provided to

employees covered under that Act. Under 29 C.F.R. § 4.166

employees “may be paid on a daily, weekly, or other time basis, by

piece or task rates, so long as the measure of work and compensation

used, when translated or reduced by computation to an hourly basis

each workweek, will provide a rate per hour that will fulfill the

statutory requirement.” Based on the foregoing and [Petitioners’]

Exhibit 1, all [Kleenist] employees received all moneys owing them.8/

Petition at 9-10 (emphasis in original).9/

The language quoted above constitutes the totality of Petitioners’ argument on this point. All

Petitioners have done is recite the language of the statute, reference their reconstructed payroll

records, and conclude that they owe no money to their employees. Such statements, unaccompanied

by a legal argument, clearly are insufficient to show that the ALJ’s decision regarding the overtime

7/

Petitioners also suggest that they did not have to pay for vacations because none of their employees

had worked long enough to take one. Although Park testified that he did not recall anyone other than Kim

who had worked for him longer than a year, this line of questioning was never developed into an argument.

Tr. 298. We decline to address this argument absent a showing that it could not have been raised below.

8/

Petitioners’ Exhibit 1 is the reconstructed payroll record that Petitioners prepared for the hearing.

9/

Petitioners also complain that the ALJ erred in relying on Kim’s payroll summaries to conclude that

it failed to pay overtime compensation to its employees. Presumably, Petitioners are again arguing that the

ALJ should have relied on the time cards instead of the payroll summaries. For the reasons stated earlier in

this decision, Petitioners’ argument regarding reliance on the payroll summaries is without merit.

USDOL/OALJ REPORTER PAGE 9

computation is erroneous as a matter of law or unsupported by a preponderance of the evidence.10/

Based on our review of the record, Petitioners failed to carry their burden of rebutting the

Administrator’s prima facie case of wage and fringe benefit underpayments and overtime violations.

Therefore, the Administrator’s evidence and testimony constitute ample evidence to support the

ALJ’s finding with regard to the wages and benefits owed to the employees in question. The only

issue remaining is whether Petitioners are entitled to be relieved from debarment under the SCA.

IV. Debarment

The Administrator seeks to debar Kleenist and Park for violations of the SCA. Under Section

5(a), of the SCA, any person or firm found by the Secretary of Labor to have violated the Act shall

be ineligible to receive Federal contracts for a period of three years from the date of listing by the

Comptroller General “[u]nless the Secretary otherwise recommends because of unusual

circumstances.” 41 U.S.C.A. §354(a). Debarment is assumed once violations of the Act have been

found, unless the violator is able to show the existence of “unusual circumstances” that warrant relief

from the SCA’s debarment sanction. 29 C.F.R. §4.188(a) and (b); Hugo Reforestation, Inc., ARB

No. 99-003, ALJ No. 97-SCA-20 (ARB Apr. 30, 2001).

As has been noted on many occasions, “Section 5(a) is a particularly unforgiving provision

of a demanding statute. A contractor seeking an ‘unusual circumstances’ exemption from debarment

must, therefore, run a narrow gauntlet.” Sharipoff dba BSA Co., No. 88-SCA-32, slip op. at 6 (Sec’y

Sept. 20, 1991). Accord Colorado Security Agency, No. 85-SCA-53, slip op. at 2-3 (Sec’y July 5,

1991); Able Building Maintenance & Serv. Co., No. 85-SCA-4 (Dep. Sec.’y Feb. 27, 1991); A to Z

Maintenance Corp. v. Dole, 710 F.Supp. 853, 855-856 (D.D.C. 1989). “The legislative history of

the SCA makes clear that debarment of a contractor who violated the SCA should be the norm, not

the exception, and only the most compelling of justifications should relieve a violating contractor

from that sanction.” Vigilantes v. Administrator of Wage and Hour Div., 968 F.2d 1412, 1418 (1st

Cir. 1992).

The SCA does not define “unusual circumstances.” However, DOL regulations establish a

three-part test which sets forth the criteria for determining when relief from debarment is

appropriate. See 29 C.F.R. §1.188(b). Under Part I of this test, the contractor must establish that

the conduct giving rise to the SCA violations was neither willful, deliberate, nor of an aggravated

nature, and that the violations were not the result of culpable conduct. Moreover, the contractor must

demonstrate the absence of a history of similar violations, an absence of repeat violations of the SCA

and, to the extent that the contractor has violated the SCA in the past, that such violation was not

serious in nature. Under Part II, the contractor must demonstrate a good compliance history,

cooperation in the investigation, repayment of the moneys due, and sufficient assurances of future

compliance. Under Part III, there are a number of other factors that must be considered including,

inter alia, whether the contractor has previously been investigated for violations of the SCA, whether

10/

In connection with its argument on overtime compensation, Petitioners note that Kim was paid a flat

rate of $2,000 a month and that, based on their calculations, this wage included all pay and benefits to which

he was entitled. Petition at n. 3. This argument not only ignores Kim’s testimony that he was never paid for

overtime but also ignores the fact that the ALJ found his testimony credible. Tr. 129, D&O at 10.

USDOL/OALJ REPORTER PAGE 10

the contractor has committed recordkeeping violations which impeded the Department’s

investigation, and whether the determination of liability under the Act was dependent upon the

resolution of bona fide legal issues of doubtful certainty. A contractor must meet all three parts of

the test in order to be relieved from debarment. See Hugo Reforestation, supra.

As a basis for relief from debarment, Petitioners state:

If there were any violations of Service Contract Act, they were at

most record keeping violations . . . . If there were any record keeping

violations, they were not willful, deliberate or of an aggravated nature

or the result of culpable conduct. [Kleenist] otherwise has a good

compliance history. Once [Kleenist] was informed of the way that

the Department of Labor wanted it to keep its records and make its

methods of payments [sic], it has complied. Furthermore Park is

Korean and English is not his native tongue. This was the first time

he operated a payroll, and the contracting officer never told him that

he had to separately state the fringe benefits.

Petition at 11.

This argument is unpersuasive for several reasons. First, the plea that Petitioners should not

be debarred because the Petitioners view their recordkeeping violations as de minimis or excusable

erroneously assumes that they would not suffer the same sanction based on the other charges against

them. This is not solely a case of recordkeeping violations, it also involves a substantial failure to

pay the wages and benefits required by the SCA. Second, although English may not be Park’s native

tongue, this fact does not, in and of itself, establish that he lacks a proficiency in the English

language or that any such lack of proficiency materially impeded his ability to comply with the SCA.

Accord, Hugo Reforestation, Inc., supra. Finally, the regulations make clear that “unusual

circumstances” do not include

those circumstances which commonly exist in cases where violations

are found, such as negligent or willful disregard of the contract

requirements and of the Act and regulations, including a contractor’s

plea of ignorance of the Act’s requirements where the obligation to

comply with the Act is plain from the contract, failure to keep

necessary records and the like.

29 C.F.R. §4.188(b)(1).

Far from presenting unusual circumstances, this case typifies a garden variety failure to

comply with the Act and applicable regulations. As such, we see no basis for concluding that

Petitioners meet the criteria for relief from debarment.

USDOL/OALJ REPORTER PAGE 11

CONCLUSION

The Petition for Review is DENIED, and the ALJ’s decision and order is AFFIRMED.

SO ORDERED.

PAUL GREENBERG

Chief Administrative Appeals Judge

OLIVER M. TRANSUE

Administrative Appeals Judge

USDOL/OALJ REPORTER PAGE 12

Vous aimerez peut-être aussi

- Final Exam (Cases Compilation)Document17 pagesFinal Exam (Cases Compilation)Arvhie SantosPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument12 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- Sameer Overseas Placement Agency v. Joy Cabiles PDFDocument5 pagesSameer Overseas Placement Agency v. Joy Cabiles PDFGain DeePas encore d'évaluation

- Counts v. SC Electric Gas Co, 4th Cir. (2003)Document7 pagesCounts v. SC Electric Gas Co, 4th Cir. (2003)Scribd Government DocsPas encore d'évaluation

- James Wilson v. Department of Health and Human Services, 34 F.3d 1077, 10th Cir. (1994)Document5 pagesJames Wilson v. Department of Health and Human Services, 34 F.3d 1077, 10th Cir. (1994)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument7 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- National Labor Relations Board, Petitioner/Cross-Respondent, v. Ferguson Electric Company, Inc., Respondent/Cross-PetitionerDocument13 pagesNational Labor Relations Board, Petitioner/Cross-Respondent, v. Ferguson Electric Company, Inc., Respondent/Cross-PetitionerScribd Government DocsPas encore d'évaluation

- Gagnon v. Resource Technology, 10th Cir. (2001)Document11 pagesGagnon v. Resource Technology, 10th Cir. (2001)Scribd Government DocsPas encore d'évaluation

- Raymond J. Donovan, Secretary of Labor, United States Department of Labor v. Bel-Loc Diner, Inc William Doxanas, Individually and As An Officer of The Corporation, 780 F.2d 1113, 4th Cir. (1985)Document7 pagesRaymond J. Donovan, Secretary of Labor, United States Department of Labor v. Bel-Loc Diner, Inc William Doxanas, Individually and As An Officer of The Corporation, 780 F.2d 1113, 4th Cir. (1985)Scribd Government DocsPas encore d'évaluation

- Nos. 18804-18809, 432 F.2d 232, 3rd Cir. (1970)Document14 pagesNos. 18804-18809, 432 F.2d 232, 3rd Cir. (1970)Scribd Government DocsPas encore d'évaluation

- James H. Mills v. United States, 890 F.2d 1133, 11th Cir. (1989)Document5 pagesJames H. Mills v. United States, 890 F.2d 1133, 11th Cir. (1989)Scribd Government DocsPas encore d'évaluation

- W. Willard Wirtz, Secretary of Labor, United States Department of Labor v. Fred McClure, 333 F.2d 45, 10th Cir. (1964)Document3 pagesW. Willard Wirtz, Secretary of Labor, United States Department of Labor v. Fred McClure, 333 F.2d 45, 10th Cir. (1964)Scribd Government DocsPas encore d'évaluation

- Labor RevDocument5 pagesLabor RevCarla Virtucio100% (1)

- Raymond J. Donovan, Secretary of Labor, United States Department of Labor v. Simmons Petroleum Corporation, 725 F.2d 83, 10th Cir. (1983)Document5 pagesRaymond J. Donovan, Secretary of Labor, United States Department of Labor v. Simmons Petroleum Corporation, 725 F.2d 83, 10th Cir. (1983)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Fourth CircuitDocument11 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsPas encore d'évaluation

- Amcor, Incorporated, A Florida Corporation v. William E. Brock, Secretary of Labor, 780 F.2d 897, 11th Cir. (1986)Document6 pagesAmcor, Incorporated, A Florida Corporation v. William E. Brock, Secretary of Labor, 780 F.2d 897, 11th Cir. (1986)Scribd Government DocsPas encore d'évaluation

- Workers' Comp Conflicting HistoryDocument14 pagesWorkers' Comp Conflicting HistorySeneida BiendarraPas encore d'évaluation

- National Labor Relations Board v. F. M. Reeves and Sons, Inc., 273 F.2d 710, 10th Cir. (1959)Document7 pagesNational Labor Relations Board v. F. M. Reeves and Sons, Inc., 273 F.2d 710, 10th Cir. (1959)Scribd Government DocsPas encore d'évaluation

- Stat Con 2nd Set of CasesDocument92 pagesStat Con 2nd Set of CasesCarl DemalataPas encore d'évaluation

- Clements v. Serco, Inc., 530 F.3d 1224, 10th Cir. (2008)Document18 pagesClements v. Serco, Inc., 530 F.3d 1224, 10th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- Labor Case DigestsDocument12 pagesLabor Case DigestsOtep Belciña LumabasPas encore d'évaluation

- American Wire vs. CA PDFDocument14 pagesAmerican Wire vs. CA PDFDani McstPas encore d'évaluation

- Clientlogic Vs Castro (Labor)Document6 pagesClientlogic Vs Castro (Labor)Mary Lorie BereberPas encore d'évaluation

- Termination - 11. Time To ReplyDocument6 pagesTermination - 11. Time To Replylove sabPas encore d'évaluation

- CBA Digest Cases 1 5Document5 pagesCBA Digest Cases 1 5VioletPas encore d'évaluation

- Clientlogic Vs CastroDocument4 pagesClientlogic Vs CastroDhin CaragPas encore d'évaluation

- Harrison Combs v. Mrs. Bob King, Individually and D/B/A King Trucking, 764 F.2d 818, 11th Cir. (1985)Document15 pagesHarrison Combs v. Mrs. Bob King, Individually and D/B/A King Trucking, 764 F.2d 818, 11th Cir. (1985)Scribd Government DocsPas encore d'évaluation

- Beery v. University of Okla, 10th Cir. (2000)Document9 pagesBeery v. University of Okla, 10th Cir. (2000)Scribd Government DocsPas encore d'évaluation

- G.R. No. 186070 April 11, 2011 Clientlogic Philppines, Inc. (Now Known As Sitel), Joseph Velasquez, Irene Roa, and RODNEY SPIRES, Petitioners, BENEDICT CASTRO, RespondentDocument4 pagesG.R. No. 186070 April 11, 2011 Clientlogic Philppines, Inc. (Now Known As Sitel), Joseph Velasquez, Irene Roa, and RODNEY SPIRES, Petitioners, BENEDICT CASTRO, RespondentMarra RicaldePas encore d'évaluation

- Stat Con 2nd Set of CasesDocument80 pagesStat Con 2nd Set of CasesRuss TuazonPas encore d'évaluation

- Labor Law 1 Digested CasesDocument24 pagesLabor Law 1 Digested CasestatskoplingPas encore d'évaluation

- Procedural Due Process Cases Til End of LabstandardsDocument169 pagesProcedural Due Process Cases Til End of LabstandardsJerome MoradaPas encore d'évaluation

- 03 - KING OF KINGS TRANSPORT INC., CLAIRE DELA FUENTE and MELISSA LIM VS SANTIAGO O. MAMACDocument13 pages03 - KING OF KINGS TRANSPORT INC., CLAIRE DELA FUENTE and MELISSA LIM VS SANTIAGO O. MAMACthelawanditscomplexitiesPas encore d'évaluation

- Labor Law Case DigestDocument15 pagesLabor Law Case DigestRobert MandigmaPas encore d'évaluation

- TAX-EJR Crafts v. IACDocument2 pagesTAX-EJR Crafts v. IACGrezyl AmoresPas encore d'évaluation

- National Labor Relations Board v. Central Oklahoma Milk Producers Association, 285 F.2d 495, 10th Cir. (1960)Document4 pagesNational Labor Relations Board v. Central Oklahoma Milk Producers Association, 285 F.2d 495, 10th Cir. (1960)Scribd Government DocsPas encore d'évaluation

- Miller v. AT&T Corporation, 4th Cir. (2001)Document32 pagesMiller v. AT&T Corporation, 4th Cir. (2001)Scribd Government DocsPas encore d'évaluation

- Digests 2.0 PDFDocument5 pagesDigests 2.0 PDFPatrick D GuetaPas encore d'évaluation

- Araneta V DinglasanDocument21 pagesAraneta V DinglasanAngel Agustine O. Japitan IIPas encore d'évaluation

- Leslie W. Carter v. Central States, Southeast and Southwest Areas Pension Plan, 656 F.2d 575, 10th Cir. (1981)Document7 pagesLeslie W. Carter v. Central States, Southeast and Southwest Areas Pension Plan, 656 F.2d 575, 10th Cir. (1981)Scribd Government DocsPas encore d'évaluation

- 33 - Meteoro V Creative CreaturesDocument9 pages33 - Meteoro V Creative CreaturesBernadettePas encore d'évaluation

- King of Kings vs. MamacDocument14 pagesKing of Kings vs. MamacBalboa JapePas encore d'évaluation

- Sameer Vs Cabiles DigestDocument4 pagesSameer Vs Cabiles DigestHuzzain Pangcoga100% (1)

- Labor LawDocument16 pagesLabor Lawnicole coPas encore d'évaluation

- Newport News Shipbuilding and Dry Dock Company v. Jasper J. Hall, Jr. and Director, Office of Workers' Compensation Programs, United States Department of Labor, 674 F.2d 248, 4th Cir. (1982)Document7 pagesNewport News Shipbuilding and Dry Dock Company v. Jasper J. Hall, Jr. and Director, Office of Workers' Compensation Programs, United States Department of Labor, 674 F.2d 248, 4th Cir. (1982)Scribd Government DocsPas encore d'évaluation

- MERALCO vs. Quisumbing, G.R. No. 127598, January 27, 1999 FactsDocument16 pagesMERALCO vs. Quisumbing, G.R. No. 127598, January 27, 1999 FactsLorraine DianoPas encore d'évaluation

- SMC vs. Ca 2002Document6 pagesSMC vs. Ca 2002Marcelino CasilPas encore d'évaluation

- Sameer Overseas Placement Agency Case DigestDocument5 pagesSameer Overseas Placement Agency Case DigestgabbieseguiranPas encore d'évaluation

- Maine State Building v. US Dept of Labor, 359 F.3d 14, 1st Cir. (2004)Document6 pagesMaine State Building v. US Dept of Labor, 359 F.3d 14, 1st Cir. (2004)Scribd Government DocsPas encore d'évaluation

- Haas v. Gateway Community ChartersDocument179 pagesHaas v. Gateway Community ChartersThe UnionPas encore d'évaluation

- 024 Sameer Overseas Placement Agency v. CabilesDocument5 pages024 Sameer Overseas Placement Agency v. CabilesEarl100% (1)

- South East International Rattan, Inc. vs. ComingDocument17 pagesSouth East International Rattan, Inc. vs. ComingEMELYPas encore d'évaluation

- Albert Labor CasesDocument7 pagesAlbert Labor CasesEmily LeahPas encore d'évaluation

- LaborRev Handwritten CasesDocument16 pagesLaborRev Handwritten Casesejusdem generis100% (1)

- Cases For Oct 17 2022Document14 pagesCases For Oct 17 2022JEREMIAHPas encore d'évaluation

- Tangga-An vs. Philippine Transmarine Carriers, Inc., Et Al., G.R. No. 180636 March 13, 2013Document2 pagesTangga-An vs. Philippine Transmarine Carriers, Inc., Et Al., G.R. No. 180636 March 13, 2013WrenPas encore d'évaluation

- First, Proof Must Be Shown That Such Facilities Are CustomarilyDocument9 pagesFirst, Proof Must Be Shown That Such Facilities Are CustomarilyNikko Franchello SantosPas encore d'évaluation

- Labor Case Digest 23-28 REVISEDDocument10 pagesLabor Case Digest 23-28 REVISEDgretchen vasquezPas encore d'évaluation

- United States Court of Appeals, Second Circuit.: No. 586, Docket 33917Document5 pagesUnited States Court of Appeals, Second Circuit.: No. 586, Docket 33917Scribd Government DocsPas encore d'évaluation

- 14 Meteoro v. Creative CreaturesDocument8 pages14 Meteoro v. Creative CreaturesPatricia BautistaPas encore d'évaluation

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Dst-Aces-Cps-V20040617Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040617USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Dst-Aces-Cps-V20040123Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040123USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: ForkliftstickerDocument1 pageDepartment of Labor: ForkliftstickerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop2stickerDocument1 pageDepartment of Labor: Stop2stickerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop2sticker6Document1 pageDepartment of Labor: Stop2sticker6USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop1stickerDocument1 pageDepartment of Labor: Stop1stickerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Forkliftsticker6Document1 pageDepartment of Labor: Forkliftsticker6USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop1sticker6Document1 pageDepartment of Labor: Stop1sticker6USA_DepartmentOfLaborPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: KonstaDocument1 pageDepartment of Labor: KonstaUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: BookmarkDocument2 pagesDepartment of Labor: BookmarkUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: LindseyDocument1 pageDepartment of Labor: LindseyUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 2Document1 pageDepartment of Labor: JYMP 8x11 2USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: YouthConstructDocument1 pageDepartment of Labor: YouthConstructUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 3Document1 pageDepartment of Labor: JYMP 8x11 3USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 2Document1 pageDepartment of Labor: JYMP 11x17 2USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 1Document1 pageDepartment of Labor: JYMP 8x11 1USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 1Document1 pageDepartment of Labor: JYMP 11x17 1USA_DepartmentOfLaborPas encore d'évaluation

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedÉvaluation : 5 sur 5 étoiles5/5 (80)

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisD'EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (23)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (88)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Summary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisD'EverandSummary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisÉvaluation : 5 sur 5 étoiles5/5 (15)

- Summary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisD'EverandSummary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisÉvaluation : 5 sur 5 étoiles5/5 (4)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooD'EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooÉvaluation : 5 sur 5 étoiles5/5 (323)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterD'EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Financial Intelligence: How to To Be Smart with Your Money and Your LifeD'EverandFinancial Intelligence: How to To Be Smart with Your Money and Your LifeÉvaluation : 4.5 sur 5 étoiles4.5/5 (540)

- Sleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceD'EverandSleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (105)

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!D'EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Évaluation : 5 sur 5 étoiles5/5 (388)

- Summary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiD'EverandSummary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiÉvaluation : 4.5 sur 5 étoiles4.5/5 (23)

- Where the Money Is: Value Investing in the Digital AgeD'EverandWhere the Money Is: Value Investing in the Digital AgeÉvaluation : 4.5 sur 5 étoiles4.5/5 (41)

- Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyD'EverandRich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyÉvaluation : 4 sur 5 étoiles4/5 (8)

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomD'EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomÉvaluation : 5 sur 5 étoiles5/5 (7)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerD'EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerÉvaluation : 4 sur 5 étoiles4/5 (52)

- Passive Income Ideas for Beginners: 13 Passive Income Strategies Analyzed, Including Amazon FBA, Dropshipping, Affiliate Marketing, Rental Property Investing and MoreD'EverandPassive Income Ideas for Beginners: 13 Passive Income Strategies Analyzed, Including Amazon FBA, Dropshipping, Affiliate Marketing, Rental Property Investing and MoreÉvaluation : 4.5 sur 5 étoiles4.5/5 (165)

- Summary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisD'EverandSummary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisÉvaluation : 5 sur 5 étoiles5/5 (10)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotD'EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotPas encore d'évaluation

- Fluke: Chance, Chaos, and Why Everything We Do MattersD'EverandFluke: Chance, Chaos, and Why Everything We Do MattersÉvaluation : 4.5 sur 5 étoiles4.5/5 (19)

- A Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessD'EverandA Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessÉvaluation : 5 sur 5 étoiles5/5 (158)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (58)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationD'EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationÉvaluation : 4 sur 5 étoiles4/5 (11)