Académique Documents

Professionnel Documents

Culture Documents

Mba Faa I Unit

Transféré par

Naresh GuduruDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mba Faa I Unit

Transféré par

Naresh GuduruDroits d'auteur :

Formats disponibles

UNIT - I INTRODUCTION TO ACCOUNTING CONCEPTS Synopsis: 1. Introduction 2. Objectives and Principles 3. Accounting Concepts and conventions 4.

Principles of accountancy according to GAAP . !ouble entry syste" #. Classification of accounts $. Accounting cycle

1. INTRODUCITON FINANCIAL ACCOUNTING %&e "ain object of any business is to "a'e profits. It is "ay be a business engaged in t&e purc&ase and sales of goods or it "ay be engaged in t&e production of goods or provision of services (&atever be it)s nature* t&e "ain object is to earn profits. A business"an enters into business in order to earn profits. in t&e business"an (is&es to find out &o( "uc& profit &e &as "ade during a given period* &e "ust be able to re"e"ber all t&e transactions t&at &ave ta'en place in &is business. +ut it is not possible for any business"an to re"e"ber all t&e transactions t&at &ave ta'es place in &is business. ,o &e &as to record t&e" in &is boo's of accounts. History of Acco ntin!: Accounting is as old as civili-ation itself. .ro" t&e ancient relics of +abylon* it can be (ill proved t&at accounting did e/ist as long as 2#00 +.C. 1o(ever* in "odern for" accounting based on t&e principles of !ouble 2ntry ,yste" ca"e into e/istence in 1$t& Century. Fra Luka Paciolo* a De computic et .ransiscan "on' and "at&e"atician publis&ed a boo'

scripturies in 1434 at 4enice in Italyl. %&is boo' (as translated into 2nglis& in 1 43. In t&is boo' &e covered a brief section on 5boo'6'eeping). Accounting in India is no( a fast developing discipline. %&e t(o pre"ier Accounting Institutes in India vi-.* c&artered Accountants of India and t&e Institute of Cost and 7or's Accountants of India are "a'ing continuous and substantial contributions. %&e international Accounts ,tandards Co""ittee 8IA,C9 (as establis&ed as on 23 t& :une. In India t&e 5Accounting ,tandards +oard 8A,+9 is for"ulating 5Accounting ,tandards) on t&e lines of standards fra"ed by International Accounting ,tandards Co""ittee. "oo#-#$$pin! is t&e art of recording all business transactions in t&e boo's of account "aintained by business"an for t&at purpose. ;eeping a separate boo' to recording all t&e business transaction by using principle of accounting is also called +oo'6'eeping. Acco ntin! is an art as (ell as sciences of identifying* analy-ing* recording* classifying and su""ari-ing of business transactions (&ic& are of a financial c&aracter and are e/pressed in ter"s of "oney. It also includes interpretation aspect of t&e recorded infor"ation. A%$ric&n Instit t$ of C$rtifi$' P ()ic Acco nt&nts *AICPA+: <%&e art of recording* classifying and su""ari-ing in a significant "anner and in ter"s of "oney transactions and events* (&ic& are in part at least* of a financial c&aracter and interpreting t&e results t&ereof.= %&us* accounting is an art of identifying* recording* su""ari-ing and interpreting business transactions of financial nature. 1ence accounting is t&e L&n! &!$ of " sin$ss. O",ECTI-ES OF "OO. .EEPING / ACCOUNTANC0 %o ascertain"ent of financial position of t&e business organi-ation. %o deter"ine t&e profit and loss of organi-ation %o 'no(ing t&e infor"ation about capital e"ployed in t&e business. %o 'no( t&e value of asset of t&e organi-ation %o Calculation of a"ounts due to and due by ot&ers. %o 'no( &o( "uc& ta/ to pay to t&e govern"ent

%o co"parison bet(een t&e current year and t&e previous year)s records. %o plan t&e organi-ation %o 'no( t&e financial infor"ation of t&e ot&er organi-ation %o preparation of financial state"ents

"ASIC ACCOUNTING CONCEPTS Accounting is a syste" evolved to ac&ieve a set of objectives. In order to ac&ieve t&e goals* (e need a set of rules or guidelines. %&ese guidelines are ter"ed &ere as <+A,IC ACCO>?%I?G CO?C2P%,=. %&e ter" concept "eans an idea or t&oug&t. +asic accounting concepts are t&e funda"ental ideas or basic assu"ptions underlying t&e t&eory and profit of .I?A?CIA@ ACCO>?%I?G. %&ese concepts &elp in bringing about unifor"ity in t&e practice of accounting. In accountancy follo(ing concepts are Auite popular. 1+ " sin$ss Entity Conc$pt %&is concept treats t&e o(ner as totally a different entity fro" t&e business. %o put in to nuts&ell BO(ner is different and +usiness is differentB. %&e capital (&ic& is broug&t inside t&e fir" by t&e o(ner* at t&e co""ence"ent of t&e fir" is 'no(n as capital. %&e a"ount of t&e capital* (&ic& (as initially invested s&ould be returned to t&e o(ner considered as due to t&e o(nerC (&o (as not&ing but t&e contributory of t&e capital. 1+ Goin! Conc$rn Conc$pt %&e concept deals (it& t&e Auality of long lasting status of t&e business enterprise irrespective of t&e o(nersD status* (&et&er &e is alive or not. %&is concept is 'no(n as concept of long6ter" assets. %&e fi/ed assets are boug&t in t&e intention to earn profits during t&e season of t&e business. %&e assets (&ic& are idle during t&e slac' season of t&e business retained for future usage* in spite of t&at t&ose assets are freAuently sold out by t&e fir" i""ediately after t&e utility leads to "ean t&at t&ose assets are not fi/ed assets but tradable assets. %&e fi/ed assets are retained by t&e fir" even after t&e usage is only due to t&e principle of long lastingness of t&e business enterprise. If t&e business disposes t&e assets i""ediately after t&e current usage by not considering t&e future utility of t&e assets in t&e fir" (&ic& (ill

not distinguis& in bet(een t&e long6ter" assets and s&ort6ter" assets 'no(n as tradable in categories 2+ 3on$y 3$&s r$%$nt Conc$pt %&is is t&e concept tunes t&e syste" of accounting as fruitful in recording t&e transactions and events of t&e enterprise only in ter"s of "oney. %&e "oney is used as (ell as e/pressed as a deno"inator of t&e business events and transactions. %&e transactions (&ic& are not in t&e e/pression of "onetary ter"s cannot be registered in t&e boo' of accounts as transactions. 4+ Cost Conc$pt It is t&e concept closely relevant (it& t&e going concern concept. >nder t&is concept* t&e transactions are recorded only in ter"s of cost rat&er t&an in "ar'et value. .i/ed assets are only entered in ter"s of t&e purc&ase price (&ic& is a original cost of t&e asset at t&e "o"ent of purc&ase. %&e depreciation is deducted fro" t&e original value (&ic& is t&e initial purc&ase price of t&e asset (ill &ig&lig&t t&e boo' value of t&e asset at t&e end of t&e accounting period. %&e "ar'eting value of t&e asset s&ould not be ta'en into consideration* 7&yE %&e "ain reason is t&at t&e "ar'et value of t&e asset is subject to fluctuations due to de"and and supply forces. %&e entry of "ar'et value of t&e asset (ill reAuire t&e freAuent update of infor"ation to t&e tune of c&anges in t&e "ar'et 5+ Acco ntin! P$rio' Conc$pt %&oug& t&e life period of t&e business is longer in span* (&ic& is classified into t&e operating periods (&ic& are s"aller in duration. %&e accounting period "ay be eit&er calendar year of :an6!ec or fiscal year of April6Far. %&e operating periods are not Concept of fusion in bet(een t&e e/penses and revenues O(ner and business organi-ations are t(o separate entities Accounting concept for long lastingness of t&e business enterprise eAuivalent a"ong t&e trading fir"s* (&ic& "eans t&at t&e operating period of one fir" .inancial Accounting "ay be s&orter t&an t&e ot&er one. %&e ulti"ate ai" of t&e concept is to nullify t&e deviations of t&e operating periods of various traders in t&e trading practice 6+ D &)ity or Do ()$ $ntry &cco ntin! conc$pt

It is t&e only concept (&ic& portrays t&e t(o sides of a single transaction. %&e la( of entire business revolves around only on "utual agree"ent så policy a"ong t&e players. 1o( "utual agree"ent is ta'ing place E %&e entire principle of business is "ainly conducted on "utual agree"ent a"ong t&e parties fro" one occasion to anot&er. %&e pay"ent of (ages are only "ade by t&e fir" out of t&e services of labourers. 7&at 'ind of "utual agree"ent in så t&e benefits is ta'ing placeE %&e services of t&e labourers are availed by t&e fir" t&roug& t&e pay"ent of (ages. @i'e6(ise* t&e labourers are regularly getting (ages for t&eir services in t&e fir". ACCOUNTING CON-ENTIONS Accounting is based on so"e custo"s or usages. ?aturally accountants &ere to adopt t&at usage or custo".%&ey are ter"ed as convert conventions in accounting. %&e follo(ing are so"e of t&e i"portant accounting conventions. 1. F )) Disc)os r$G According to t&is convention accounting reports s&ould disclose fully and fairly t&e infor"ation. %&ey purport to represent. %&ey s&ould be prepared &onestly and sufficiently disclose infor"ation (&ic& is if "aterial interest to proprietors* present and potential creditors and investors. %&e co"panies AC%* 13 # "a'es it co"pulsory to provide all t&e infor"ation in t&e prescribed for". 2.3&t$ri&)ityG >nder t&is convention t&e trader records i"portant factor about t&e co""ercial activities. In t&e for" of financial state"ents if any uni"portant infor"ation is to be given for t&e sa'e of clarity it (ill be given as footnotes. 3.Consist$ncyG It "eans t&at accounting "et&od adopted s&ould not be c&anged fro" year to year. It "eans t&at t&ere s&ould be consistent in t&e "et&ods or principles follo(ed. Or else t&e results of a year Cannot be conveniently co"pared (it& t&at of anot&er. 4. Cons$r7&tis%G %&is convention (arns t&e trader not to ta'e unreali-ed inco"e in to account. %&at is (&y t&e practice of valuing stoc' at cost or "ar'et price* (&ic& ever is lo(er is in vague. %&is is t&e policy of <playing safe=C it ta'es in to consideration all prospective losses but leaves all prospective profits.

DOU"LE ACCOUNTING S0STE3 !ouble entry syste" of +oo'6'eeping is si"ple and universal in its application. It &as t&e test of four &undred years continuous use. It "ay be clai"ed t&at it is t&e only syste" (ort&y of adoption by t&e practical business"an. %o understand t&e syste" of double entry syste" of boo'6 'eeping all t&at (e need to re"e"ber is t&e funda"ental ruleG Debit the account which receives the benefit. Credit the account which gives the benefit %ypes of account 19 Personal Account 29 Heal Account 39 ?o"inal Account RULES FOR DE"IT / CREDIT. 1+P$rson&) Acco ntG 6 %&is account deals (it& t&e individuals of t&e organi-ation t&ese includes accounts of natural persons in varied capacities li'es suppliers and buyers of goods* lenders and borro(ers of loans etc. Debit the receiver Credit the giver 29 R$&) Acco ntG 6 %&is account deals (it& t&e group of individuals of t&e organi-ation t&ese include co"binations of t&e properties or assets are 'no(n as real account. Debit what comes in Credit what goes out 39 No%in&) Acco ntG 6 ?o"inal accounts relate to suc& ite"s (&ic& e/ist in na"e only. %&ese ite"s pertain to e/penses and gains li'e interest* rent* co""ission* discount* salary etc* Debit all expenses and losses Credit all incomes and gains

"r&nc8$s9c)&ssific&tion of Acco ntin!: %&e i"portant branc&es of accounting areG 1. Fin&nci&) Acco ntin!: %&e purpose of Accounting is to ascertain t&e financial results i.e. profit or loass in t&e operations during a specific period. It is also ai"ed at 'no(ing t&e financial position* i.e.

assets* liabilities and eAuity position at t&e end of t&e period. It also provides ot&er relevant infor"ation to t&e "anage"ent as a basic for decision6"a'ing for planning and controlling t&e operations of t&e business. 1. Cost Acco ntin!: %&e purpose of t&is branc& of accounting is to ascertain t&e cost of a product I operation I project and t&e costs incurred for carrying out various activities. It also assist t&e "anage"ent in controlling t&e costs. %&e necessary data and infor"ation are gat&err4ed for" financial and ot&er sources. 2. 3&n&!$%$nt Acco ntin!: Its ai" to assist t&e "anage"ent in ta'ing correct policy decision and to evaluate t&e i"pact of its decisions and actions. %&e data reAuired for t&is purpose are dra(n accounting and cost6accounting. ACCOUNTING C0CLE: %&e accounting cycle is a series of steps perfor"ed during t&e accounting period to analyze* classify* record* summarize* and report useful financial infor"ation for t&e purpose of preparing financial state"ents. In boo''eeping* t&e accounting period is t&e period for (&ic& t&e boo's are balanced and t&e financial state"ents are prepared. Generally* t&e accounting period consists of 12 "ont&s. 1o(ever* t&e beginning of t&e accounting period differs according to t&e co"pany. .or e/a"ple* one co"pany "ay use t&e regular calendar year* :anuary to !ece"ber* as t&e accounting year* (&ile anot&er entity "ay follo( April to Farc& as t&e accounting period. St$ps in t8$ Acco ntin! Cyc)$ :ournali-e transactions in t&e journal. Post journal entries to t&e accounts in t&e ledger. Prepare a trial balance of t&e accounts and co"plete t&e (or's&eet 8includes adjusting entries9. Prepare .inancial ,tate"entsI.inal Accounts Journalize Transactions

Prepare Financial Statements/Final Accounts Prepare a Trial Balance

Ledger Accounts

1. !efine t&e concepts 5Accounting)* .inancial Accounting and Accounting ,yste"). 2. Give a brief account on t&e i"portant records of Accounting under !ouble 2ntry ,yste" and discuss briefly t&e scope of eac&E 3. 2/plain t&e accounting principles of GAAP and accounting cycle E 4.

Vous aimerez peut-être aussi

- Module 2 SolutionsDocument61 pagesModule 2 Solutionsrasmussen123456Pas encore d'évaluation

- SM Chapter 01Document36 pagesSM Chapter 01mfawzi010Pas encore d'évaluation

- PDF EvaDocument36 pagesPDF EvaShrey GoelPas encore d'évaluation

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanPas encore d'évaluation

- AccountingDocument13 pagesAccountingArjun SrinivasPas encore d'évaluation

- Case Study - Cooking The BooksDocument16 pagesCase Study - Cooking The Booksrahul_k811Pas encore d'évaluation

- Working Capital Management in HCL InfosystemDocument30 pagesWorking Capital Management in HCL InfosystemCyril ChettiarPas encore d'évaluation

- SCDL PGDBA Finance Sem 1 Management AccountingDocument19 pagesSCDL PGDBA Finance Sem 1 Management Accountingamitm17Pas encore d'évaluation

- Cogent Analytics M&A ManualDocument19 pagesCogent Analytics M&A Manualvan070100% (1)

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDocument55 pagesMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienPas encore d'évaluation

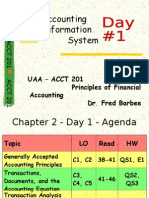

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDocument55 pagesAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeyenzelPas encore d'évaluation

- Financial Management Module 1Document24 pagesFinancial Management Module 1Anees SalihPas encore d'évaluation

- Chapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionDocument7 pagesChapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionAbraham Maharba BaezaPas encore d'évaluation

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Pas encore d'évaluation

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamPas encore d'évaluation

- Section 1: Introduction To Principles of AccountsDocument6 pagesSection 1: Introduction To Principles of AccountsArcherAcsPas encore d'évaluation

- How Is Payroll A HR FunctionsDocument8 pagesHow Is Payroll A HR FunctionsParamita SarkarPas encore d'évaluation

- Fin 635 Project FinalDocument54 pagesFin 635 Project FinalCarbon_AdilPas encore d'évaluation

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghPas encore d'évaluation

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010Pas encore d'évaluation

- Distinguish Between Capital Expenditure and Revenue ExpenditureDocument11 pagesDistinguish Between Capital Expenditure and Revenue ExpenditureGopika GopalakrishnanPas encore d'évaluation

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanPas encore d'évaluation

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7Pas encore d'évaluation

- ch02 AccountingDocument24 pagesch02 AccountingDebbie Cangco Dulatre-SupnetPas encore d'évaluation

- According To Terminology Committee of ACIPADocument3 pagesAccording To Terminology Committee of ACIPAKabit AgarwalPas encore d'évaluation

- Balance Sheet and Income StatementDocument11 pagesBalance Sheet and Income StatementAmelia Butan50% (2)

- Management Accounting PDFDocument55 pagesManagement Accounting PDFMaggi JohnPas encore d'évaluation

- FMM Acct For Business Ch1Document99 pagesFMM Acct For Business Ch1Rubi JangraPas encore d'évaluation

- Ratio ExplainDocument4 pagesRatio ExplainAnendya ChakmaPas encore d'évaluation

- Small Business AccountingDocument5 pagesSmall Business AccountingSDaroosterPas encore d'évaluation

- Chapter 7 Revenue Recognition: Learning ObjectivesDocument16 pagesChapter 7 Revenue Recognition: Learning Objectivessamuel_dwumfourPas encore d'évaluation

- Concepts in The Measurement of Income, The Price Level Problem, and Basic Concepts of Management ControlDocument14 pagesConcepts in The Measurement of Income, The Price Level Problem, and Basic Concepts of Management ControljunreymoralesPas encore d'évaluation

- A Study On Credit Management With Reference To Canara BankDocument93 pagesA Study On Credit Management With Reference To Canara BankDeepika KrishnaPas encore d'évaluation

- Financial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CDocument7 pagesFinancial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CQueenielyn TagraPas encore d'évaluation

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186Pas encore d'évaluation

- Financial Management Module 3Document14 pagesFinancial Management Module 3Anees SalihPas encore d'évaluation

- Mcs Merged Doc 2009.Document137 pagesMcs Merged Doc 2009.Nimish DeshmukhPas encore d'évaluation

- Myanmar Accounting Standard 7: Statement of Cash FlowsDocument18 pagesMyanmar Accounting Standard 7: Statement of Cash FlowsKyaw Htin WinPas encore d'évaluation

- Corporate Finance Assignment - 1Document14 pagesCorporate Finance Assignment - 1nsmkarthickPas encore d'évaluation

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega Filehaider_shah882267Pas encore d'évaluation

- Working Capital Management Unit - IVDocument54 pagesWorking Capital Management Unit - IVThanasekaran TharumanPas encore d'évaluation

- Recent Studies/Tax Credit Benefits ObtainedDocument7 pagesRecent Studies/Tax Credit Benefits ObtainedResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Pas encore d'évaluation

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiPas encore d'évaluation

- Business Accountant CertificationDocument0 pageBusiness Accountant CertificationVskills CertificationPas encore d'évaluation

- Guidance Manual FinalDocument27 pagesGuidance Manual FinalrosdobPas encore d'évaluation

- CPAR Conceptual FrameworkDocument5 pagesCPAR Conceptual Frameworkrommel_007Pas encore d'évaluation

- 7FE Project FrameworkDocument5 pages7FE Project FrameworkVenkatakrishnan Subramaniyan0% (1)

- Post Code 3500: Manageing DirectorDocument11 pagesPost Code 3500: Manageing DirectorMd Tarek RahmanPas encore d'évaluation

- Role of AccountantDocument5 pagesRole of AccountantRajinder SinghPas encore d'évaluation

- Evaluating Financial Performance: True-False QuestionsDocument9 pagesEvaluating Financial Performance: True-False Questionsbia070386100% (1)

- Module 3 Answers To End of Module QuestionsDocument40 pagesModule 3 Answers To End of Module QuestionsYanLi100% (3)

- The Conceptual Frame Work of AccountingDocument12 pagesThe Conceptual Frame Work of AccountingSneha KanadePas encore d'évaluation

- Evaluating Financial Performance: True-False QuestionsDocument10 pagesEvaluating Financial Performance: True-False QuestionsTayyabaSharifPas encore d'évaluation

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohPas encore d'évaluation

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Document24 pagesDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookD'EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookPas encore d'évaluation

- Befa Text BookDocument227 pagesBefa Text BookNaresh Guduru100% (1)

- Unit - II Professonal EticsDocument14 pagesUnit - II Professonal EticsNaresh GuduruPas encore d'évaluation

- 2023 Impact of Social Media On YouthDocument7 pages2023 Impact of Social Media On YouthNaresh Guduru100% (1)

- Work Life Balance in Road Transport CorporationDocument15 pagesWork Life Balance in Road Transport CorporationNaresh GuduruPas encore d'évaluation

- Lecture Notes OnDocument36 pagesLecture Notes OnNaresh GuduruPas encore d'évaluation

- You Correctly Answered 0 Questions For A Score of 0 Percent. Unanswered Questions Were Counted As Incorrect in The CalculationDocument4 pagesYou Correctly Answered 0 Questions For A Score of 0 Percent. Unanswered Questions Were Counted As Incorrect in The CalculationNaresh GuduruPas encore d'évaluation

- Management Science - Important QuestionsDocument6 pagesManagement Science - Important QuestionsNaresh GuduruPas encore d'évaluation

- IARDO Award For Distinguished Educator 2018Document1 pageIARDO Award For Distinguished Educator 2018Naresh GuduruPas encore d'évaluation

- Ob QuizDocument13 pagesOb QuizNaresh GuduruPas encore d'évaluation

- Business Economics Unit - 1Document19 pagesBusiness Economics Unit - 1Naresh GuduruPas encore d'évaluation

- OB Lesson Plan & Delivery ReportDocument4 pagesOB Lesson Plan & Delivery ReportNaresh GuduruPas encore d'évaluation

- I Mid Logistic and Supply Chain Management Multiple Choice QuestionsDocument10 pagesI Mid Logistic and Supply Chain Management Multiple Choice QuestionsNaresh Guduru100% (4)

- MBA Logistics ManagementDocument13 pagesMBA Logistics ManagementNaresh GuduruPas encore d'évaluation

- MBA Best PraticeDocument23 pagesMBA Best PraticeNaresh GuduruPas encore d'évaluation

- RV College of Engineering: The Very Spring and Root of Honesty and Virtue Lie in Good Education"-PlutarchDocument30 pagesRV College of Engineering: The Very Spring and Root of Honesty and Virtue Lie in Good Education"-PlutarchNaresh GuduruPas encore d'évaluation

- MEPMA, Telangana Job Mela: Click Here To Download EntrycardDocument1 pageMEPMA, Telangana Job Mela: Click Here To Download EntrycardNaresh GuduruPas encore d'évaluation

- SIFD Unit 1 PDFDocument52 pagesSIFD Unit 1 PDFNaresh GuduruPas encore d'évaluation

- Naresh BefaDocument69 pagesNaresh BefaNaresh Guduru91% (11)

- Befa Unit IIIDocument24 pagesBefa Unit IIINaresh Guduru75% (4)

- Naresh Befa Unit VDocument9 pagesNaresh Befa Unit VNaresh Guduru100% (2)

- Choice Based Credit System of Post Graduate Level Students in Higher Education NDocument9 pagesChoice Based Credit System of Post Graduate Level Students in Higher Education NNaresh GuduruPas encore d'évaluation

- GZU Past Exam Papers Purchasing and SupplyDocument1 pageGZU Past Exam Papers Purchasing and Supplyashley100% (2)

- Ias 8Document7 pagesIas 8Jan Joshua Paolo GarcePas encore d'évaluation

- Fletcher 2018Document13 pagesFletcher 2018Daniel Meza RivasPas encore d'évaluation

- Maria HernandezDocument6 pagesMaria Hernandezchtbox1039Pas encore d'évaluation

- Lean Concepts Transcend Manufacturing Through The Supply ChainDocument44 pagesLean Concepts Transcend Manufacturing Through The Supply ChainPatrice EloePas encore d'évaluation

- An Analysis of Consumer Satisfaction in Laguna On Online Selling Basis For A Marketing Strategy For LazadaDocument8 pagesAn Analysis of Consumer Satisfaction in Laguna On Online Selling Basis For A Marketing Strategy For LazadaMark ChuaPas encore d'évaluation

- Annual ReportDocument37 pagesAnnual ReportMukesh ManwaniPas encore d'évaluation

- Raymond: Established 1925Document17 pagesRaymond: Established 1925Varnika DevanPas encore d'évaluation

- Post Buy Back Offer (Company Update)Document2 pagesPost Buy Back Offer (Company Update)Shyam SunderPas encore d'évaluation

- International Business EnvironmentDocument6 pagesInternational Business Environmentsubbu2raj3372Pas encore d'évaluation

- Module 6 - Matching Strategy To A Company's SituationDocument75 pagesModule 6 - Matching Strategy To A Company's Situationhyrald67% (3)

- Sravan Digital Marketing ResumeDocument2 pagesSravan Digital Marketing ResumeRavi RanjanPas encore d'évaluation

- Arun Ice Cream Group - 11, Section - B Current SituationDocument2 pagesArun Ice Cream Group - 11, Section - B Current SituationShashwat MishraPas encore d'évaluation

- University of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Document6 pagesUniversity of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Zeshan NasirPas encore d'évaluation

- Marketing Notes (Finals)Document16 pagesMarketing Notes (Finals)J-ira LariosaPas encore d'évaluation

- Online Vs OfflineDocument3 pagesOnline Vs OfflineAnm AdnanPas encore d'évaluation

- Nidhi Mittal ReportDocument123 pagesNidhi Mittal Reportarjun_gupta0037Pas encore d'évaluation

- Interm - Financ.acc-Acc1232 - Updated On 27may 2019Document214 pagesInterm - Financ.acc-Acc1232 - Updated On 27may 2019Théotime HabinezaPas encore d'évaluation

- Costing Vs PricingDocument6 pagesCosting Vs PricingArif NasimPas encore d'évaluation

- Need For The StudyDocument7 pagesNeed For The StudyKalyan RagampudiPas encore d'évaluation

- Eco-10 em PDFDocument11 pagesEco-10 em PDFAnilLalvaniPas encore d'évaluation

- Paper 8Document647 pagesPaper 8Joydip Dasgupta100% (1)

- Multiple Choice Questions: The Consultative Selling Approach Is Based On The Sales PersonDocument5 pagesMultiple Choice Questions: The Consultative Selling Approach Is Based On The Sales Personjayant bansalPas encore d'évaluation

- RAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTDocument37 pagesRAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTrajawasthi7133Pas encore d'évaluation

- Entrepreneurship Development ManualDocument96 pagesEntrepreneurship Development ManualAdisu GaromaPas encore d'évaluation

- Management Accounting Chapter 4Document17 pagesManagement Accounting Chapter 4Sonia BhavnaniPas encore d'évaluation

- Cgse StatsDocument20 pagesCgse StatsChandu SagiliPas encore d'évaluation

- CRM - Future Group Big BazaarDocument25 pagesCRM - Future Group Big BazaarAadit ShahPas encore d'évaluation

- Institute of Management Studies, Davv University Indore: Mba (E-Commerce) 7 SemesterDocument30 pagesInstitute of Management Studies, Davv University Indore: Mba (E-Commerce) 7 SemesterPratiksha BairwaPas encore d'évaluation

- Strategic ManagementDocument17 pagesStrategic ManagementKECEBONG ALBINOPas encore d'évaluation