Académique Documents

Professionnel Documents

Culture Documents

Mergers and Acquisitions

Transféré par

Naeem MughalDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mergers and Acquisitions

Transféré par

Naeem MughalDroits d'auteur :

Formats disponibles

Mergers and acquisitions

If, at first

Sep 1st 2005 From The Economist print edition

Will the latest cycle of European mergers produce better results? COMPANIES have embar ed on !hat "oo s "i e the be#innin#s o$ a re%r&n o$ the mer#ers and ac'&isitions (M)A* !ave that de$ined the second b&bb"+ ha"$ o$ the 1,,0s- That period. readers mi#ht reca"". !as characterised b+ a co""ective sp"&r#e that sa! the creation o$ some o$ the most indebted companies in histor+. man+ o$ !hich "ater !ent ban r&pt or !ere themse"ves bro en &p- /i"d biddin# $or te"ecoms. internet and media assets. not to mention the madness that !as 0aim"er1s 230 bi""ion motorin# ta eover in 1,,4%,, o$ Chr+s"er or the Time%/arner5AO6 me#a%mer#er in 2000. he"ped to #ive mer#ers a thoro&#h"+ bad name- A consens&s emer#ed that M)A !as a #reat !a+ $or investment ban s to reap rich $ees. and a s&re !a+ $or ambitio&s mana#ers to betra+ investors b+ trashin# the va"&e o$ their sharesNo! M)A is bac - Its ret&rn is a #"oba" phenomenon. b&t it is perhaps most stri in# in E&rope. !here so $ar this +ear there has been a stream o$ dea"s !orth more than 2700 bi""ion in tota". aro&nd 308 hi#her than in the same period o$ 2003 (see artic"e*- The "atest e$$ort came this !ee !hen France1s Saint% 9obain. a b&i"din#%materia"s $irm. &nvei"ed the detai"s o$ its :;-7 bi""ion (27-5 bi""ion* hosti"e bid $or <P<. a <ritish riva"- In the $irst ha"$ o$ the +ear. cross%border activit+ !as &p three%$o"d over the same period "ast +ear- Even France Te"ecom. !hich !as "e$t a"most ban r&pt at the end o$ the "ast mer#er !ave. recent"+ bo&#ht Amena. a Spanish mobi"e operatorShareho"ders1 approva" o$ a"" these dea"s raises an interestin# '&estion $or companies ever+!here= are investors ri#ht to thin that these mer#ers are more "i e"+ to s&cceed than ear"ier ones> There are t!o ans!ers- The $irst is that past mer#ers ma+ have been ?&d#ed too harsh"+- The second is that the present rash o$ E&ropean dea"s does "oo more rationa". b&t@and the caveat is cr&cia"@on"+ so $ar- The pattern ma+ not ho"dM)A1s poor rep&tation stems not on"+ $rom the strin# o$ spectac&"ar $ai"&res in the 1,,0s. b&t a"so $rom st&dies that sho!ed va"&e destr&ction $or ac'&irin# shareho"ders in 408 o$ dea"s- <&t more recent st&dies b+ economists have introd&ced a note o$ ca&tion- Investors sho&"d "oo at the n&mber o$ dea"s that s&cceed or $ai" (t+pica""+ meas&red b+ the impact on the share price*. rather than (as +o& mi#ht thin * !ei#hin# them b+ siAe- For eBamp"e. no one do&bts that the 0aim"er%Chr+s"er mer#er destro+ed va"&eThe combined mar et va"&e o$ the t!o $irms is sti"" be"o! that o$ 0aim"er a"one be$ore the dea"- This sin#"e dea" acco&nted $or ha"$ o$ a"" 9erman M)A activit+ b+ va"&e in 1,,4 and 1,,,. and probab"+ dominated peop"e1s thin in# abo&t mer#ers to the same de#ree- Thro! in a $e! other s&ch monsters and it is no !onder that broad st&dies have tended to $ind that mer#ers are a bad idea- The tr&e pict&re is more comp"icated-

Of course, it's different this time

Severa" $actors s&##est that E&ropean companies. in common !ith their co&nterparts e"se!here. are not bein# rec "ess in the "atest ro&nd o$ dea"s- Important"+. some o$ the $eat&res o$ the b&bb"e +ears have disappeared or become "ess in$"&entia"- For eBamp"e. mana#ers are "ess "oaded &p !ith share options. !hich has red&ced their temptation to chase dea"s that de"iver a short%term pa+%o$$ at the cost o$ "on#% term va"&e creation- Companies a"so seem more intent this time on strate#ic. rather than $inancia""+ motivated dea"s@b&i"din# on core stren#ths and b&+in# into ne! #eo#raphic mar ets are common themes in the "atest ro&nd o$ dea"s. !hereas cost"+ diversi$ications are "itt"e in evidence- In addition. a bi##er proportion o$ dea"s are bein# paid $or in cash. a c&rrenc+ !hich mana#ers tend to harbo&r more pr&dent"+ than shares and !hich is a "ess $or#ivin# meas&rin# rodAnd $ina""+. as "abo&r%mar et and other re$orms (ho!ever modest* in E&rope have s"o!"+ eased the !a+ to!ards a #en&ine sin#"e mar et. $irms are &nderstandab"+ $oc&sin# on b&i"din# a stron#er pan%E&ropean competitive position- Sometimes the best !a+ to do this is thro&#h mer#ersCo!ever. there are a"so #ood reasons to be !ar+- The "atest dea"s ma+ seem more tar#eted and strate#ic. and there$ore better ?&sti$ied. than man+ in the 1,,0s- <&t most mer#er !aves be#in in this sensib"e !a+ be$ore spira""in# o&t o$ contro"- The recent #ro!th o$ hed#e $&nds and private%e'&it+ $irms means that there are man+ more potentia" bidders $or an+ tar#et compan+- Private e'&it+. in partic&"ar. is a potent competitor capab"e o$ p&shin# &p prices $or a compan+ "oo in# $or a strate#ic mer#er- And cash. toda+1s c&rrenc+ o$ choice. is a remar ab"+ cheap commodit+ than s to "o! interest rates and ab&ndant "i'&idit+In other !ords. the in#redients $or eBcess eBist- Pa+in# too m&ch $or a rep&tation%enhancin# ac'&isition or head"ine%#rabbin# ta eover remains an ever%present dan#er $or an+one at the top o$ a bi# compan+-

Mergers and acquisitions

Europe's nascent merger boom

Sep 1st 2005 D PAEIS From The Economist print edition

European mergers are booming, but economic nationalism remains an obstacle

/CEN is a cross%border ta eover in E&rope a #ood thin#> For the French #overnment. the ans!er seems to be c"ear- It is to be app"a&ded !hen the compan+ doin# the b&+in# hai"s $rom France. b&t treated !ith deep s&spicion !hen the tar#et is French- Spoo ed b+ r&mo&rs that 0anone. a $ood compan+ that o!ns m&ch%"oved French brands. mi#ht be ta en over b+ America1s PepsiCo. the #overnment has anno&nced its intention to come &p !ith a "ist o$ strate#ic French ind&stries that !i"" be protected $rom $orei#n ta eoverFO&r po"ic+ is not to oppose b+ princip"e ever+ ac'&isition o$ a French compan+.G sa+s FranHois 6oos. minister $or ind&str+- <&t i$ +o#h&rt is a strate#ic ind&str+. Mr 6oos1s promised "ist ma+ be '&ite "on#/hi"e French po"iticians contemp"ate an ind&stria" Ma#inot "ine. French b&sinessmen are snappin# &p companies e"se!here in E&rope- Accordin# to 0ea"o#ic. a research $irm. French $irms spent a"most 270 bi""ion on $orei#n ta eovers in E&rope a"one in the $irst seven months o$ this +ear (see tab"e*- Pernod Eicard. a drin s compan+. bo&#ht its <ritish riva" A""ied 0omec'I S&eA. a &ti"ities compan+. bo&#ht E"ectrabe" o$ <e"#i&mI France Te"ecom too over Spain1s Amena. a mobi"e%phone operator- J&st this !ee . another French $irm. Saint%9obain. a b&i"din#%materia"s compan+. had a :;-7 bi""ion (27-5 bi""ion* hosti"e bid $or <ritain1s <P< re?ectedF/e are in the ear"+ sta#es o$ a ne! mer#er c+c"e.G sa+s Je$$re+ Eosen o$ 6aAard. an investment ban 0ea" activit+ in a"" ma?or E&ropean mar ets is &p b+ abo&t 508- There is #reat potentia" $or va"&e%creatin# dea"s !ithin the EK. as $ra#mented nationa" economies mer#e into a rea" sin#"e mar et- <&t there are bi# obstac"es too- As France sho!s. man+ po"iticians c"in# to the idea o$ Fnationa" championsG and create obstac"es to cross%border mer#ersSti"". there are po!er$&" $orces p&shin# in the opposite direction- Stron# corporate pro$its are drivin# the c&rrent increase in mer#ers and ac'&isitions (M)A*- A$ter atonin# $or the past mer#er !ave1s eBcesses !ith cost c&ts and sa"es o$ &nre"ated b&sinesses. man+ bi# companies have hea"th+ ba"ance sheets- Credit is cheap. and shareho"ders are een on ta eovers once a#ain- France Te"ecom shares ?&mped a$ter the anno&ncement o$ its ac'&isition o$ Amena. as did those o$ Pernod Eicard and S&eA a$ter their respective ta eovers !ere made p&b"icCompan+ bosses are more cheer$&" too. accordin# to recent opinion s&rve+s- This ma+ re$"ect a be"ated &ptic in the EK1s economic per$ormance- The E&ropean Commission $orecasts the econom+ !i"" eBpand b+ aro&nd 0-38 and 0-78 in the third and $o&rth '&arters respective"+@the $astest #ro!th since the $irst ha"$ o$ 2003. tho&#h m&ch depends on oi" pricesAt present. E&ropean mer#ers represent abo&t one%third o$ #"oba" dea"s !hi"e American dea"s acco&nt $or ha"$- E&rope1s share is set to #ro!. b&t on"+ i$ po"iticians resist their instinct to medd"e !ith internationa" mer#ers. !hich represent more than ha"$ the tota"- <an in# and &ti"ities. $or instance. remain "ar#e"+ nationa" ind&stries in E&rope. beca&se the+ are considered Fstrate#icG- Cross%border ta eovers in these sectors are intense"+ po"itica"- The French and Ita"ian #overnments s'&abb"ed $or more than a +ear abo&t !hether to a""o! E"ectricitL de France (E0F* to b&+ Edison. an Ita"ian po!er compan+- Antonio FaAio. the #overnor o$ the <an o$ Ita"+. spent months this +ear emp"o+in# &n&s&a" methods (!ith the tacit approva" o$ the #overnment* to b"oc a Spanish and a 0&tch bid $or t!o o$ the co&ntr+1s mid%siAed ban s<&t E&ropean po"iticians1 inter$erence is not +et e#re#io&s eno&#h to disco&ra#e the <ritish and American private%e'&it+ $irms that are becomin# an increasin# presence in the e&ro Aone- Abo&t one%$i$th to one% third o$ c&rrent E&ropean mer#er activit+ is #enerated b+ private%e'&it+ $irms- These $irms mana#e $&nds that ta e contro""in# sta es in !hat the+ thin are &nderva"&ed and bad"+ mana#ed companies- On A&#&st 22nd Permira. a $irm based in 6ondon. and Moh"ber# Mravis Eoberts. a Ne! Nor $irm. too over S<S <roadcastin#. a pan%E&ropean broadcaster- Severa" private%e'&it+ companies are r&mo&red to be e+ein# bits o$ <oots. a <ritish chemistThe rise o$ private e'&it+ sho&"d be #ood ne!s $or corporate E&rope- S&ch $irms specia"ise in b&+in# and $iBin# companies that $e! !ant and provide "i'&idit+ to the mar et. sa+s 9ordon 0+a" o$ 9o"dman SachsThe+ can a"so sharpen &p b&siness per$ormance. b+ snappin# &p ne#"ected bits o$ con#"omerates and

r&nnin# them as independent b&sinesses- There is obvio&s scope $or this in E&rope. !here the de#ree o$ con#"omeration is sti"" $ar hi#her than in AmericaAn+ hi#h%pro$i"e move b+ an FAn#"o%SaBonG private%e'&it+ $irm in continenta" E&rope is s&re to be controversia"- <&t even so. &nder c&rrent E&ropean "a!. nationa" #overnments can do ver+ "itt"e to b"oc bids $or private companies- EK o$$icia"s have been '&ic to point o&t that. i$ France #en&ine"+ tries to protect a ran#e o$ Fstrate#icG ind&stries $rom ta eover. even b+ $irms $rom !ithin the E&ropean Knion. it !o&"d be in F$"a#rantG breach o$ EK "a! on the $ree movement o$ capita"- Those re#&"ations are indeed soon to #et a boost. !ith the passa#e o$ a ne! ta eover directive. !hich m&st be "a! in a"" EK states b+ Ma+ 2007This co&"d be the best +ear $or E&ropean M)A since the internet%b&bb"e +ears o$ the "ate 1,,0s- I$ there !ere another me#a dea" s&ch as "ast +ear1s O55 bi""ion (275 bi""ion* mer#er o$ Sano$i%S+nthL"abo and Aventis. t!o French pharmace&tica" $irms. mer#ers co&"d cross the 21 tri""ion thresho"d $or the $irst time since 2000- <&t i$ the dea" is a cross%border mer#er. and the tar#et is French. stand b+ $or $ire!or s-

Cop+ri#ht P 2005 The Economist Ne!spaper and The Economist 9ro&p- A"" ri#hts reserved-

Vous aimerez peut-être aussi

- Hedging Bets On A Eurozone Debt CrisisDocument63 pagesHedging Bets On A Eurozone Debt Crisisomkar_puri5277Pas encore d'évaluation

- Pestle Analysis of GreeceDocument18 pagesPestle Analysis of GreeceJohnny LeungPas encore d'évaluation

- Institute of Banking StudiesDocument10 pagesInstitute of Banking StudiesLeen BarghoutPas encore d'évaluation

- Riding The Waves SchumpeterDocument3 pagesRiding The Waves SchumpeterTabrez HassanPas encore d'évaluation

- Shihang H3econDocument33 pagesShihang H3econdavidbohPas encore d'évaluation

- Securities Regulation Code: Title and DefinitionsDocument56 pagesSecurities Regulation Code: Title and Definitionskara_agliboPas encore d'évaluation

- Insurance Company FailureDocument65 pagesInsurance Company FailureMundu_1102Pas encore d'évaluation

- Hotel Teatro PR Plan PT 2: December 1. 2013Document9 pagesHotel Teatro PR Plan PT 2: December 1. 2013Halea_MacPas encore d'évaluation

- Wallstreet 2 v2Document3 pagesWallstreet 2 v2Ru MartinPas encore d'évaluation

- Administrative Panel Decision: Case No. DPH 2011-0003Document6 pagesAdministrative Panel Decision: Case No. DPH 2011-0003Ashley CandicePas encore d'évaluation

- D.P.R.O., NelloreDocument17 pagesD.P.R.O., NelloreMasthan BabuPas encore d'évaluation

- Solutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsDocument7 pagesSolutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsBiloni KadakiaPas encore d'évaluation

- Case Study UCS1EDocument4 pagesCase Study UCS1EShashi Bhushan SonbhadraPas encore d'évaluation

- India Hydrocarbon Vision - 2025Document10 pagesIndia Hydrocarbon Vision - 2025RSPas encore d'évaluation

- Overview of RMDocument40 pagesOverview of RMmbapritiPas encore d'évaluation

- Memo To: Miss Kate Simpsons From: Nadra Aziz Subject: IT Department Job Interviews Date: 5 June 2013Document5 pagesMemo To: Miss Kate Simpsons From: Nadra Aziz Subject: IT Department Job Interviews Date: 5 June 2013Nadra Arrauda AzizPas encore d'évaluation

- Good Manufacturing Practice For The Feed Milling Industry: Australian Code ofDocument12 pagesGood Manufacturing Practice For The Feed Milling Industry: Australian Code ofmy_khan20027195Pas encore d'évaluation

- The Weekly Market Update For The Week of July 28th.Document2 pagesThe Weekly Market Update For The Week of July 28th.mike1473Pas encore d'évaluation

- Stolen From The Invited To TheDocument3 pagesStolen From The Invited To ThetristinalinhPas encore d'évaluation

- The Role of Communication in DEVELOPMENT: Lessons Learned From A Critique of The Dominant, Dependency, and Alternative ParadigmsDocument8 pagesThe Role of Communication in DEVELOPMENT: Lessons Learned From A Critique of The Dominant, Dependency, and Alternative ParadigmsnetijyataPas encore d'évaluation

- AntiFraud & Defence SystemDocument230 pagesAntiFraud & Defence SystemJessica LangPas encore d'évaluation

- Prof - Simplysimple UnderstandingQEandCapitalFlows23Dec2010055551Document12 pagesProf - Simplysimple UnderstandingQEandCapitalFlows23Dec2010055551Jaimin ShahPas encore d'évaluation

- Major Project Report: Post Graduate Diploma inDocument108 pagesMajor Project Report: Post Graduate Diploma inudayraj_vPas encore d'évaluation

- Yamaha-Marketing-ConsumerBehaviour-Final WithDocument101 pagesYamaha-Marketing-ConsumerBehaviour-Final WithSami ZamaPas encore d'évaluation

- ECON10004 Introductory Microeconomics Semester 1, 2113 Assignment 1Document6 pagesECON10004 Introductory Microeconomics Semester 1, 2113 Assignment 1Chandan HegdePas encore d'évaluation

- Star Weekend Magazine1Document3 pagesStar Weekend Magazine1himu6749721Pas encore d'évaluation

- Export FinanceDocument68 pagesExport FinanceǷřiţǝƧh ChąuhąnPas encore d'évaluation

- Industry Profile: Dairy Industry: in A GlobeDocument48 pagesIndustry Profile: Dairy Industry: in A GlobeKaran PatelPas encore d'évaluation

- Finance (MBA)Document106 pagesFinance (MBA)Deepika KrishnaPas encore d'évaluation

- Acceptability of Phone CardsDocument38 pagesAcceptability of Phone CardsamorakingPas encore d'évaluation

- Industry Analysis: Smm221 Managing International BusinessDocument18 pagesIndustry Analysis: Smm221 Managing International BusinessBharathiManiNoblePas encore d'évaluation

- Report On Pran RFL GroupDocument21 pagesReport On Pran RFL GroupNasrin Nahar Shanta100% (1)

- Chapter 2 - World Trade - An OverviewDocument36 pagesChapter 2 - World Trade - An Overviewvintosh_pPas encore d'évaluation

- Delegation of Powers (HRD)Document13 pagesDelegation of Powers (HRD)SanjayBagariaPas encore d'évaluation

- Current Market ConditionsDocument7 pagesCurrent Market ConditionsMShablom1Pas encore d'évaluation

- 5 Golden Rules For Writing Successful Press ReleasesDocument4 pages5 Golden Rules For Writing Successful Press ReleasestaniazloiPas encore d'évaluation

- Audit Research RGmanabatDocument12 pagesAudit Research RGmanabatjohnerolPas encore d'évaluation

- David Sm13e CN 13Document22 pagesDavid Sm13e CN 13Koki Mostafa100% (2)

- IT541 - Do Nhu Tai - Project 1.4Document4 pagesIT541 - Do Nhu Tai - Project 1.4Tran Nguyen Quynh TramPas encore d'évaluation

- Customer Satisfaction in Retail IndustryDocument59 pagesCustomer Satisfaction in Retail Industrypriya682Pas encore d'évaluation

- Managerial EconomicsDocument170 pagesManagerial EconomicsHaribhaskar GovindarajuluPas encore d'évaluation

- TestDocument47 pagesTestStefan PredaPas encore d'évaluation

- Tax Rev CasesDocument12 pagesTax Rev Casesmhilet_chiPas encore d'évaluation

- Lesson Plan #4: Grade: 5 Social Studies Strand: EconomicsDocument11 pagesLesson Plan #4: Grade: 5 Social Studies Strand: EconomicsDaniMLebelPas encore d'évaluation

- All ProductBusiness SampleDocument22 pagesAll ProductBusiness SampleHariharan VigneshPas encore d'évaluation

- Atestat EnglezaDocument16 pagesAtestat EnglezaCosmin CrisPas encore d'évaluation

- 4partnership Enterprise - ET Dt. 05-03-2012Document4 pages4partnership Enterprise - ET Dt. 05-03-2012Rajat KaushikPas encore d'évaluation

- Indirect Tax Reforms in India and A Way Ahead For GSTDocument18 pagesIndirect Tax Reforms in India and A Way Ahead For GSTAks SinhaPas encore d'évaluation

- Marine InsurenceDocument63 pagesMarine Insurencesink215Pas encore d'évaluation

- Consumer Behaviour: Business PurposeDocument30 pagesConsumer Behaviour: Business PurposeDeepika KalimuthuPas encore d'évaluation

- Chapter Seventeen Mutual Funds and Hedge FundsDocument17 pagesChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaPas encore d'évaluation

- 201 Final Winter 2013 V1aDocument11 pages201 Final Winter 2013 V1aKhalil Ben JemiaPas encore d'évaluation

- Projectonshampoo 101107134213 Phpapp01 DeepikaDocument30 pagesProjectonshampoo 101107134213 Phpapp01 DeepikaDeepika KalimuthuPas encore d'évaluation

- Assignment 1 OBDocument7 pagesAssignment 1 OBSwati RaghupatruniPas encore d'évaluation

- Assignment (FIN 201)Document22 pagesAssignment (FIN 201)amit-badhanPas encore d'évaluation

- First American Competitve Analysis - May 2008-CsDocument18 pagesFirst American Competitve Analysis - May 2008-CsPatrick AdamsPas encore d'évaluation

- Monopoly: Problem Set 4Document3 pagesMonopoly: Problem Set 4Shruti MehtaPas encore d'évaluation

- Tania Textile: A Concern of A Hussein GroupDocument7 pagesTania Textile: A Concern of A Hussein GroupShajiaAfrinPas encore d'évaluation

- The Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierD'EverandThe Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierPas encore d'évaluation

- The Pricing Roadmap: How to Design B2B SaaS Pricing Models That Your Customers Will LoveD'EverandThe Pricing Roadmap: How to Design B2B SaaS Pricing Models That Your Customers Will LoveÉvaluation : 5 sur 5 étoiles5/5 (1)

- Ritz 2016Document13 pagesRitz 2016Naeem MughalPas encore d'évaluation

- 9th - Computer Full Exercise Zahid NotesDocument25 pages9th - Computer Full Exercise Zahid NotesNaeem MughalPas encore d'évaluation

- Public Service Motivation and Performance The Role of Organizational IdentificationDocument10 pagesPublic Service Motivation and Performance The Role of Organizational IdentificationNaeem MughalPas encore d'évaluation

- Government of Pakistan Cabinet Secretariat Establishment DivisionDocument1 pageGovernment of Pakistan Cabinet Secretariat Establishment DivisionNaeem MughalPas encore d'évaluation

- Money, Banking and FinanceDocument2 pagesMoney, Banking and FinanceNaeem MughalPas encore d'évaluation

- Economics of Pakistan (Important Questions) : 'Respect Your Parents Till The Last Breath''Document2 pagesEconomics of Pakistan (Important Questions) : 'Respect Your Parents Till The Last Breath''Naeem MughalPas encore d'évaluation

- Result 10thDocument18 pagesResult 10thNaeem MughalPas encore d'évaluation

- Merger PDFDocument5 pagesMerger PDFNaeem MughalPas encore d'évaluation

- Accounting 03 (BRS Cash Book)Document2 pagesAccounting 03 (BRS Cash Book)Naeem MughalPas encore d'évaluation

- Syonyms 2nd YearDocument2 pagesSyonyms 2nd YearNaeem MughalPas encore d'évaluation

- The CRM Data WarehouseDocument31 pagesThe CRM Data Warehousesusanna88Pas encore d'évaluation

- Queston. Answer (9th)Document10 pagesQueston. Answer (9th)Naeem MughalPas encore d'évaluation

- Kinds of MarketsDocument4 pagesKinds of MarketsNaeem MughalPas encore d'évaluation

- Presentation On " ": Human Resource Practices OF BRAC BANKDocument14 pagesPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziPas encore d'évaluation

- What Is InflationDocument222 pagesWhat Is InflationAhim Raj JoshiPas encore d'évaluation

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDocument15 pagesThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoPas encore d'évaluation

- Soybean Scenario - LaturDocument18 pagesSoybean Scenario - LaturPrasad NalePas encore d'évaluation

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialPas encore d'évaluation

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDocument19 pagesChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzPas encore d'évaluation

- Benetton (A) CaseDocument15 pagesBenetton (A) CaseRaminder NagpalPas encore d'évaluation

- Ape TermaleDocument64 pagesApe TermaleTeodora NedelcuPas encore d'évaluation

- S03 - Chapter 5 Job Order Costing Without AnswersDocument2 pagesS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoPas encore d'évaluation

- International Financial Management 8th Edition Eun Test BankDocument38 pagesInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaPas encore d'évaluation

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDocument13 pagesFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghPas encore d'évaluation

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)

- The System of Government Budgeting Bangladesh: Motahar HussainDocument9 pagesThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadPas encore d'évaluation

- Legal Agreement LetterDocument1 pageLegal Agreement LetterJun RiveraPas encore d'évaluation

- Script For Performance Review MeetingDocument2 pagesScript For Performance Review MeetingJean Rose Aquino100% (1)

- Delivering The Goods: Victorian Freight PlanDocument56 pagesDelivering The Goods: Victorian Freight PlanVictor BowmanPas encore d'évaluation

- Skripsi - Perencanaan Lanskap Pasca Tambang BatubaraDocument105 pagesSkripsi - Perencanaan Lanskap Pasca Tambang Batubarahirananda sastriPas encore d'évaluation

- Production Planning & Control: The Management of OperationsDocument8 pagesProduction Planning & Control: The Management of OperationsMarco Antonio CuetoPas encore d'évaluation

- Dog and Cat Food Packaging in ColombiaDocument4 pagesDog and Cat Food Packaging in ColombiaCamilo CahuanaPas encore d'évaluation

- Intellectual Property RightsDocument2 pagesIntellectual Property RightsPuralika MohantyPas encore d'évaluation

- Quijano ST., San Juan, San Ildefonso, BulacanDocument2 pagesQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzPas encore d'évaluation

- Mechanizing Philippine Agriculture For Food SufficiencyDocument21 pagesMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanPas encore d'évaluation

- Annex 106179700020354Document2 pagesAnnex 106179700020354Santosh Yadav0% (1)

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocument39 pagesHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurPas encore d'évaluation

- QQy 5 N OKBej DP 2 U 8 MDocument4 pagesQQy 5 N OKBej DP 2 U 8 MAaditi yadavPas encore d'évaluation

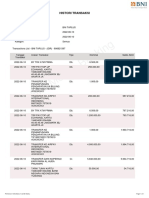

- BNI Mobile Banking: Histori TransaksiDocument1 pageBNI Mobile Banking: Histori TransaksiWebi SuprayogiPas encore d'évaluation

- GST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableDocument3 pagesGST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableAryanPas encore d'évaluation

- Kennedy 11 Day Pre GeneralDocument16 pagesKennedy 11 Day Pre GeneralRiverheadLOCALPas encore d'évaluation

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFDocument10 pages3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlPas encore d'évaluation