Académique Documents

Professionnel Documents

Culture Documents

Multi Chance Reverse Convertible On RIO TINTO PLC, GAZPROM and

Transféré par

api-25890856Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Multi Chance Reverse Convertible On RIO TINTO PLC, GAZPROM and

Transféré par

api-25890856Droits d'auteur :

Formats disponibles

Multi Chance Reverse Convertible on RIO TINTO PLC, GAZPROM and LUKOIL

Multi Chance 2 out of 3; Coupon 10% p.a.; 6 Months; USD; Barrier at 66%

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 12.08.2009 Client pays USD 1000 (Denomination)

Rating: Fitch A

Underlying RIO TINTO PLC-SPON GAZPROM OAO- LUKOIL OAO-SPON

ADR SPON ADR ADR On 12.02.2010 Client receiv es 5% in fine (10% p.a.) Coupon plus:

Bbg Ticker RTP UN Equity OGZD LI Equity LKOD LI Equity

Strike Level (100%) USD 171.10 USD 21.50 USD 50.80 Scenario 1: if there has never been two or more Underlyings trading below the Barrier Level

Barrier Level (66%) USD 112.93 USD 14.19 USD 33.53 in the same time

Conversion Ratio 5.84 46.51 19.69 The Investor will receive a Cash Settlement in the Settlement Currency equal to:

Payment Date 12.08.2009 Denomination

Valuation Date 05.02.2010

Maturity 12.02.2010 Scenario 2: if two or more Underlyings traded at least once at or below the Barrier Level in

EU Saving Tax Option Premium Component 4.43% (8.87% p.a.) the same time

Interest Component 0.57% (1.13% p.a.) the Investor will receive a predefined round number (i.e. Conversion Ratio) of the

Details Physical Settlement American Barrier Underlying with the Worst Performance per Denomination.

ISIN CH0103367592

Valoren 103367592

SIX Symbol not listed

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________________

Rio Tinto plc is an international mining company. The Company has interests in mining for aluminum, borax, coal, copper, gold, iron ore, lead, silver, tin, uranium, zinc, titanium

dioxide feedstock, diamonds, talc and zircon. Rio Tinto's various mining operations are located in Australia, New Zealand, South Africa, the United States, South America, Europe, and

Gazprom extracts, transports, stores, and sells natural gas. The Company is the successor to the State-owned gas company. Gazprom owns and operates Russia's Unified Gas Supply

System. The Company has a monopoly in supplying gas in the Russian Federation, and exports natural gas to Western Europe.

LUKOIL explores for, produces, refines, transports, and markets oil and gas, mainly from Western Siberia. The Company also manufactures petrochemicals, fuels, and other petroleum

products. LUKOIL operates refineries, and gasoline filling stations in Russia and the United States. The Company transports oil through pipelines, and petroleum products with its fleet of

ships.

Opportunities_________________________________________________________________ Risks______________________________________________________________________________

1. A guaranteed Coupon of 5% in fine (10% p.a.) 1. Maximum return of 5% in fine (10% p.a.)

2. Protection against 34% drop in tw o out of three Underlyings' price 2. Exposure to v olatility changes

3. Low er v olatility than direct equity exposure

4. Secondary market as liquid as a share

5. Optimization of EU Tax components

Best case scenario____________________________________________________________ Worst case scenario_______________________________________________________________

I f there has nev er been tw o or more Underlyings trading below the Barrier I f tw o or more Underlyings traded at least once at or below the Barrier Lev el in

Lev el in the same time the same time

Redemption: Denomination + Coupon of 5% in fine (10% p.a.) Redemption: Worst performing Underlying + Coupon of 5% in fine (10% p.a.)

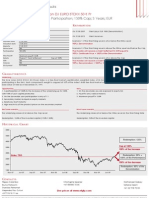

Historical Chart

350%

importer depuis la deuxieme feuille

RIO TINTO

GAZPROM

300% LUKOIL

Redemption: Denomination

250% + Coupon of 5% in fine

200%

150%

100%

34% Protection

50% Redemption: Underlying (with a negative

performance) + Coupon of 5% in fine

0%

Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frat eschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial instruments

mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket

Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial situatio n; the info rmatio n co ntained in this

do cument do es no t substitute such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct do cumentatio n can be o btained directly at EFG Financial

P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees.

EFG Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity o f the financial pro ducts. © EFG

Financial P ro ducts A G A ll rights reserved.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- How Trade, The WTO and The Financial Crisis Reinforce EachDocument10 pagesHow Trade, The WTO and The Financial Crisis Reinforce Eachapi-25890856Pas encore d'évaluation

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25890856Pas encore d'évaluation

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Pas encore d'évaluation

- NullDocument1 pageNullapi-25890856Pas encore d'évaluation

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856Pas encore d'évaluation

- NullDocument4 pagesNullapi-25890856Pas encore d'évaluation

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Pas encore d'évaluation

- NullDocument1 pageNullapi-25890856Pas encore d'évaluation

- BCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJDocument3 pagesBCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJapi-25890856100% (2)

- Single Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%Document1 pageSingle Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%api-25890856100% (2)

- Single Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.Document1 pageSingle Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.api-25890856100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- EUR16.93 Zoom Invoice for Auriga Global InvestorsDocument3 pagesEUR16.93 Zoom Invoice for Auriga Global InvestorsDavid AurigaPas encore d'évaluation

- Internal Control Manual SummaryDocument14 pagesInternal Control Manual SummaryMarina OleynichenkoPas encore d'évaluation

- Acc802 Tut Topc 7 QuestionsDocument3 pagesAcc802 Tut Topc 7 Questionssanjeet kumarPas encore d'évaluation

- Rau's FEBRUARY Magazine - 2023 Final PDFDocument132 pagesRau's FEBRUARY Magazine - 2023 Final PDFshaik abdullaPas encore d'évaluation

- BFI Topic 1 2 3Document17 pagesBFI Topic 1 2 3Arnold LuayonPas encore d'évaluation

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiPas encore d'évaluation

- Unit-3 (BALANCE OF PAYMENTS)Document15 pagesUnit-3 (BALANCE OF PAYMENTS)Shivam SharmaPas encore d'évaluation

- Greenpanel Annual Report Highlights Broad-basing StrategyDocument134 pagesGreenpanel Annual Report Highlights Broad-basing Strategykdinesh05Pas encore d'évaluation

- Portugal Citizenship ProgramsDocument6 pagesPortugal Citizenship ProgramsKenan Goja100% (1)

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalPas encore d'évaluation

- Final Presentation On Accounting FraudDocument15 pagesFinal Presentation On Accounting FraudDisha JugatPas encore d'évaluation

- Integrated Accounting SystemsDocument15 pagesIntegrated Accounting SystemsSanjeev JayaratnaPas encore d'évaluation

- Formulation of Portfolio StrategyDocument9 pagesFormulation of Portfolio StrategyKhyati KhokharaPas encore d'évaluation

- Home Depot ROE decomposition 1986-1999Document11 pagesHome Depot ROE decomposition 1986-1999agnarPas encore d'évaluation

- Breakfast For Leadership That Listens PACDocument2 pagesBreakfast For Leadership That Listens PACSunlight FoundationPas encore d'évaluation

- Investing in The Philippine Stock Market - Fv3Document64 pagesInvesting in The Philippine Stock Market - Fv3Rocky CadizPas encore d'évaluation

- Investment Calculator & Planner - Overview: InstructionsDocument22 pagesInvestment Calculator & Planner - Overview: Instructionsmc limPas encore d'évaluation

- Employment Vs Independent Contractor AnalysisDocument4 pagesEmployment Vs Independent Contractor AnalysisLarry HaberPas encore d'évaluation

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryPas encore d'évaluation

- Entrep TemplateDocument18 pagesEntrep TemplateVinjason Cabugason100% (1)

- Sample Paper 1 MCQ AccDocument2 pagesSample Paper 1 MCQ AccDRPas encore d'évaluation

- Top 40 Property Management CompaniesDocument9 pagesTop 40 Property Management Companiessudeeksha dhandhaniaPas encore d'évaluation

- Tranzact Insurance 7-06Document1 pageTranzact Insurance 7-06julissaPas encore d'évaluation

- Engineering Economics and Financial Accounting NotesDocument6 pagesEngineering Economics and Financial Accounting NotessivasankarmbaPas encore d'évaluation

- Accounting 1 Introduction Defines ObjectivesDocument8 pagesAccounting 1 Introduction Defines ObjectivesJamodvipulPas encore d'évaluation

- IPO Performance Report - Q4 2021 FINALDocument11 pagesIPO Performance Report - Q4 2021 FINALSassi BaltiPas encore d'évaluation

- Sabeetha Final ProjectDocument52 pagesSabeetha Final ProjectPriyesh KumarPas encore d'évaluation

- Micro and Small Enterprises in India PDFDocument23 pagesMicro and Small Enterprises in India PDFSuryamaniPas encore d'évaluation

- Introduction To Financial Statements AuditDocument8 pagesIntroduction To Financial Statements AuditDemafilasan, Khyro Paul G.Pas encore d'évaluation

- National Bank of Romania Versus European Central Bank: Popescu IonuțDocument9 pagesNational Bank of Romania Versus European Central Bank: Popescu IonuțAdina Cosmina PopescuPas encore d'évaluation