Académique Documents

Professionnel Documents

Culture Documents

Telecom Italia - Plan de Negocios PDF

Transféré par

MinutoUno.comDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Telecom Italia - Plan de Negocios PDF

Transféré par

MinutoUno.comDroits d'auteur :

Formats disponibles

TELECOM ITALIA GROUP

9M 2013 Results & 2014-2016 Plan Outline

Milan, November 7th, 2013

Telecom Italia Group

9M 2013 Results & 2014-2016 Plan Outline

PIERGIORGIO PELUSO

Safe Harbour

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

These presentations contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this presentation and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company and the Group. Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those projected or implied in the forward looking statements as a result of various factors. Consequently, Telecom Italia S.p.A. makes no representation, whether expressed or implied, as to the conformity of the actual results with those projected in the forward looking statements. Forward-looking information is based on certain key assumptions which we believe to be reasonable as of the date hereof, but forward looking information by its nature involves risks and uncertainties, which are outside our control, and could significantly affect expected results. Analysts are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Telecom Italia S.p.A. undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this presentation, including, without limitation, changes in Telecom Italia S.p.A. business or acquisition strategy or planned capital expenditures or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company's Annual Report on Form 20-F as well as periodic filings made on Form 6-K, which are on file with the United States Securities and Exchange Commission. The accounting policies and consolidation principles adopted in the preparation of the Condensed Consolidated Financial Statements as of, and for the nine months ended, 30 September 2013 have been applied on a basis consistent with those adopted in the Annual Consolidated Financial Statements at 31 December 2012, to which reference can be made, except for the new standards and interpretations adopted by the Group, which, other than for the prospective adoption of IFRS 13 (Fair Value measurement), didnt impact on the Condensed Consolidated Financial Statements as of, and for the nine months ended, 30 September 2013. Some data for the first quarter 2012, used in comparisons, included into this presentation have been restated as a result of the early adoption, starting from the first half 2012, of the revised version of IAS 19 (Employee Benefits) and the reclassification of Matrix (company that was disposed of on October 31, 2012) from the Business Unit DomesticCore Domestic to the Business Unit Other Activities.

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Agenda

9M13 Net Debt Evolution and FY13 Net Debt Target Confirmed Extraordinary Transactions New Group Debt Guidance Backup

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

9M13 Net Debt Evolution

Euro mln, Reported Data

28,274

(2,777) +74 +1,230

+540

+888

28,229

EBITDA CAPEX WC & Others Operating FCF

(7,933) +3,453 +1,703 (2,777)

(45)

2012YE Adjusted Operating FCF Disposals/ Cash Financial Expenses/ Financial Investment Financial Accruals Dividends Cash Taxes/Other Impacts 9M13 Adjusted

2011YE 30,414 vs. 12 (4,141) +1,364 (32) +106

(929) +1,314 (84) +1,027 (487) +903 (15)

9M12 29,485

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

FY13 Net Debt Target Confirmed

Euro mln

Balance to FY13 Adjusted Net Debt Target

28,274

(45)

28,229

NCF Generation

<27bn

Of which 0.5 bln refers to first half (4Q12 suppliers payment deferral and Brazil spectrum payment) includes Less cash taxes Working capital optimization Higher FCF from Latam

2012YE

9M 13

(2,140)

FY 13

2011YE 30,414 (929)

9M12

29,485 (1,211)

FY12 28,274

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Agenda

9M13 Net Debt Evolution and FY13 Net Debt Target confirmed Extraordinary Transactions New Group Debt Guidance Backup

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Announced Extraordinary Transactions: around 4 bln of financial strengthening

Financial Contribution

Telecom Argentina Disposal Mandatory Convertible Bond

Ongoing

>1 bln

Expected by 2014

Further assets available for value creation (towers in Italy and Brazil, TI Media Broadcasting)

>2 bln*

Total Extraordinary Transactions materially increase financial flexibility:

Around 4 bln

* Cash proceeds. The overall treatment of the transactions will be subject to IFRS rules

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Mandatory Convertible Bond

Telecom Italia launched an issuance of: more than 1 bln Euro subordinated, unsecured mandatorily convertible securities

Issuer: Telecom Italia Finance S.A. Guarantor: Telecom Italia S.p.A. Ranking: Senior only to share capital Maximum size: 1.3 bln Eur Underlying Shares: Ordinary and Saving Telecom Italia S.p.A. Shares (with a preference to maximise the issuance of Ordinary Share Bonds, consistent with market demand) Maturity date: November 2016 Issue price: at par Expected annual coupon: 5.75% - 6.5% Minimum Conversion Price at maturity: initially equal to the Share Reference Price (WVAP to be disclosed tomorrow COB) Maximum Conversion Price at maturity: equal to 120% to 125% of the Minimum Conversion Price.

The issuance will:

reflect TI expectation of future share price performance assure rapid execution & minimize exposure to market risk further strengthen TI liquidity and capital base, as well as allowing greater diversification of financial sources The market context is very supportive and there is currently a strong investor appetite for Telecom sector MCB paper

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Other assets available for value creation worth, in aggregate, more than 2 bln

Tower lease (Italy and Brazil)

Multiplex sale

TI forerunner in passive infrastructure sharing - initiated 10 years ago in order to reduce costs The goal is now to enhance and extract value from tower asset base, also reducing focus on non core passive elements of the network

Main non captive network operator in the Italian market

Potential synergies (efficiencies, broadening of our portfolio, better allocation of bandwidth capacity)

1st phase integration between TIMB and Rete A, retaining control of the combined entity 2nd phase sale of a stake of the company (up to 100%) to a third party investor

Perimeter:

Perimeter:

Italy: more than 10k owned towers Brazil: more than 7k owned towers (average market price 344k R$ per tower - based on recent transactions (Vivo, Oi and Nextel tower sales)

TI Media Broadcasting: assignee of 3 MUX - 65.4 Mbps capacity DTT platform (812 sites, 95% of Italys population) Gruppo Espresso - Rete A: assignee of 2 MUX - 47 Mbps capacity DTT platform (427sites, 90.9% of Italys population)

No active network component

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Agenda

9M13 Net Debt Evolution and FY13 Net Debt Target confirmed Extraordinary Transactions New Group Debt Guidance Backup

PIERGIORGIO PELUSO

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

New Group Debt Guidance

Net Debt Evolution

Euro mln

<27bln

NET DEBT

>1 bln Equity strengthening

FY13

FY14

FY15

FY16

NET DEBT/ EBITDA*

~ 2.9x New perimeter (w/o Argentina)

~2.1x **

* Adj Net Debt; Reported EBITDA

** including equity strengthening

PIERGIORGIO PELUSO

10

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Robust Liquidity Margin and Well-Distributed Debt Maturities

Liquidity Margin

Euro bln Euro mln

Debt Maturities

13,822 34,710 (1)

1,500

11,740

3,911 13.45 6.70 3,348 4,722 6.75 1,891

1,481 410 Undrawn Portion of Facility/Committed Group Liquidity Position 1,500 1,809 1,413 2,035 1,313

2,082 25,202

3,891 3,125

2,250 875 2,897 994

2,990 921

8,008

Within 2013

FY 2014

Bonds

FY 2015

FY 2016

FY 2017

FY 2018

Beyond 2018 Total M/L Term Debt

Drawn bank facility

Loans (of which long-term rent, financial and operating lease payable 1,305)

(1) 34.710 mln is the nominal amount of outstanding medium-long term debt . By adding IAS adjustments ( 856 mln) and current liabilities ( 500 mln), the gross debt figure of 36.066 mln is reached N.B. Debt maturities are net of 1.830 mln (face value) of repurchased ( 1.206 in the 2013) own bonds (of which 1.615 mln related to bonds due within 2015)

PIERGIORGIO PELUSO

11

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Agenda

9M13 Net Debt Evolution and FY13 Net Debt Target confirmed Extraordinary Transactions New Group Debt Guidance Backup

PIERGIORGIO PELUSO

12

TELECOM ITALIA GROUP 9M 2013 Results & 2014-2016 Plan Outline

Well Diversified and Hedged Debt

Total Gross Debt net of Adjustment: Euro 36,066 mln

Euro mln

Maturities and Risk Management

4.0% Bank Facility 1,446 15.7% Bank & EIB 5,652 3.7% Op. Leases and long rent 1,319 5.4% Other 1,979 71.2% Bonds 25,670

Average debt maturity: 7.03 years (bond only 7.89 years) Fixed rate portion on gross debt approximately 67.3%

Around 42% of outstanding bonds (nominal amount) is denominated in USD, GBP and YEN and is fully hedged

Gross debt Financial assets

of which C & CE and marketable securities C & CE Marketable securities

36,066 (7,837)

(6,747) (5,456) (1,291)

Italian Government Securities Other

(1,028) (263)

Cost of debt: 5.4%

Net Financial Position

28,229

N.B.The figures are net of the adjustment due to the fair value measurement of derivatives and related financial liabilities/assets, as follows: - the impact on Gross Financial Debt is equal to 1,835 /mln (of which 500 /mln on bonds) - the impact on Financial Assets is equal to 877 /mln Therefore, the Net Financial Indebtedness is adjusted by 958 /mln

PIERGIORGIO PELUSO

13

Vous aimerez peut-être aussi

- Detalle Del Acuerdo UE-MercosurDocument17 pagesDetalle Del Acuerdo UE-MercosurCronista.com100% (1)

- MATE Emoji Proposal by EmojinationDocument41 pagesMATE Emoji Proposal by EmojinationMinutoUno.comPas encore d'évaluation

- Informe Marcas Más ValoradasDocument77 pagesInforme Marcas Más ValoradasMinutoUno.comPas encore d'évaluation

- Carta Universidad de Austin, TexasDocument1 pageCarta Universidad de Austin, TexasTélamPas encore d'évaluation

- Contrato para El Show Del Indio SolariDocument7 pagesContrato para El Show Del Indio SolariMinutoUno.comPas encore d'évaluation

- Causa de Fiscalía de New York - FIFA 2015Document164 pagesCausa de Fiscalía de New York - FIFA 2015Tribu GlobalPas encore d'évaluation

- Municipalidad de Olavarría Como Fiadora de La ColmenaDocument3 pagesMunicipalidad de Olavarría Como Fiadora de La ColmenaMinutoUno.comPas encore d'évaluation

- FIFADocument30 pagesFIFAMinutoUno.comPas encore d'évaluation

- The World's 50 Best Restaurants 2017 ListDocument6 pagesThe World's 50 Best Restaurants 2017 ListMinutoUno.comPas encore d'évaluation

- Informe Revisión FMIDocument145 pagesInforme Revisión FMIMinutoUno.com100% (2)

- Fondos Buitre: Rechazan Embargar Activos Del Banco CentralDocument43 pagesFondos Buitre: Rechazan Embargar Activos Del Banco CentralMinutoUno.comPas encore d'évaluation

- Comunicado de Daniel PollackDocument2 pagesComunicado de Daniel PollackMinutoUno.comPas encore d'évaluation

- Fallo de Griesa (Citibank)Document16 pagesFallo de Griesa (Citibank)El DestapePas encore d'évaluation

- Fallo de La Corte de Apelaciones de NYDocument19 pagesFallo de La Corte de Apelaciones de NYMinutoUno.comPas encore d'évaluation

- La ONU Destacó La Caída de La Mortalidad Infantil en ArgentinaONU PDFDocument249 pagesLa ONU Destacó La Caída de La Mortalidad Infantil en ArgentinaONU PDFMinutoUno.com100% (1)

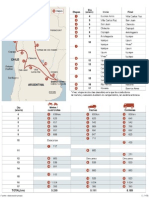

- Recorrido Dakar 2015Document1 pageRecorrido Dakar 2015MinutoUno.comPas encore d'évaluation

- Brisbane G20 Leaders Summit CommuniqueDocument5 pagesBrisbane G20 Leaders Summit CommuniqueabossonePas encore d'évaluation

- Fallo de Griesa (Citibank)Document16 pagesFallo de Griesa (Citibank)El DestapePas encore d'évaluation

- La Carta de Cristina A Obama en InglésDocument5 pagesLa Carta de Cristina A Obama en InglésMinutoUno.comPas encore d'évaluation

- Tim CookDocument2 pagesTim CookMinutoUno.comPas encore d'évaluation

- Clausura Lawn Tennis Clubb PDFDocument1 pageClausura Lawn Tennis Clubb PDFMinutoUno.comPas encore d'évaluation

- IMF - Sovereign Debt RestructuringDocument48 pagesIMF - Sovereign Debt RestructuringAlphaX NewsPas encore d'évaluation

- Cláusula Pari PassuDocument1 pageCláusula Pari PassuMinutoUno.comPas encore d'évaluation

- Presentacion Griesa. InglesDocument19 pagesPresentacion Griesa. InglesMinutoUno.comPas encore d'évaluation

- Clausura Lawn Tennis Club PDFDocument1 pageClausura Lawn Tennis Club PDFMinutoUno.comPas encore d'évaluation

- Bagley Final PDFDocument4 pagesBagley Final PDFMinutoUno.com100% (1)

- Fixture Mundial de Clubes PDFDocument1 pageFixture Mundial de Clubes PDFMinutoUno.comPas encore d'évaluation

- Orden Juez Griesa PDFDocument5 pagesOrden Juez Griesa PDFMinutoUno.comPas encore d'évaluation

- Nuevos Estándares para Reestructuraciones de DeudaDocument16 pagesNuevos Estándares para Reestructuraciones de DeudaMinutoUno.comPas encore d'évaluation

- Comunicado Del ICMADocument2 pagesComunicado Del ICMAMinutoUno.comPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- SoapDocument23 pagesSoapPrakash Giri67% (3)

- 1 - Basic Chemistry Vocabulary ListDocument12 pages1 - Basic Chemistry Vocabulary ListJoshep Petrus CopperPas encore d'évaluation

- Henry Schein Orthodontics - Catalog - Warranty Ordering IndexDocument8 pagesHenry Schein Orthodontics - Catalog - Warranty Ordering IndexOrtho OrganizersPas encore d'évaluation

- LumpSum Project GuidelinesDocument48 pagesLumpSum Project GuidelinesAiswarya RajeevPas encore d'évaluation

- Automating The Precision Trading SystemDocument134 pagesAutomating The Precision Trading SystemAggelos Kotsokolos100% (1)

- NSEC 2013 Solution 1.1 PDFDocument14 pagesNSEC 2013 Solution 1.1 PDFArpit GargPas encore d'évaluation

- October Free Chapter - CASINO ROYALE by Ian FlemingDocument49 pagesOctober Free Chapter - CASINO ROYALE by Ian FlemingRandomHouseAUPas encore d'évaluation

- What Are Inorganic CompoundsDocument1 pageWhat Are Inorganic CompoundsSherryl V MorenoPas encore d'évaluation

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LinePas encore d'évaluation

- Rule 59Document2 pagesRule 59AMPas encore d'évaluation

- NotesAcademy - Year 3&4 ChemistryDocument119 pagesNotesAcademy - Year 3&4 Chemistrydarkadain100% (1)

- Synthesis of AspirinDocument3 pagesSynthesis of AspirinShoomyla RashidPas encore d'évaluation

- 1.2 Energetics and Enthalpy Changes RescuedDocument18 pages1.2 Energetics and Enthalpy Changes RescuedIsamElAminPas encore d'évaluation

- CompleteDocument17 pagesCompleteTelPas encore d'évaluation

- Tentative Auction ScheduleDocument3 pagesTentative Auction ScheduleLaLa BanksPas encore d'évaluation

- Financial Management 2 I. Risk and ReturnDocument2 pagesFinancial Management 2 I. Risk and ReturnCarla Jean CuyosPas encore d'évaluation

- STPM Trials 2009 Chemistry Answer Scheme TerengganuDocument17 pagesSTPM Trials 2009 Chemistry Answer Scheme Terengganusherry_christyPas encore d'évaluation

- HCI Chem H2 Paper 1 Question PaperDocument17 pagesHCI Chem H2 Paper 1 Question PaperonnoezPas encore d'évaluation

- Carbon and Its CompoundsDocument7 pagesCarbon and Its CompoundsMoomin Ahmad DarPas encore d'évaluation

- Factors that Determine Paper StrengthDocument23 pagesFactors that Determine Paper StrengthNur Ariesman Salleh100% (2)

- EnzymesDocument17 pagesEnzymesakshaymoga0% (1)

- 7081 01chemistryDocument36 pages7081 01chemistryRigen AlamPas encore d'évaluation

- DRV Bank&VSD Messages V1.1Document249 pagesDRV Bank&VSD Messages V1.1Trang Phùng MinhPas encore d'évaluation

- BR Long-Term Approach To Equity InvestingDocument2 pagesBR Long-Term Approach To Equity InvestingJordan MorleyPas encore d'évaluation

- Bacterial Phospholipase A: Structure and Function of An Integral Membrane PhospholipaseDocument11 pagesBacterial Phospholipase A: Structure and Function of An Integral Membrane PhospholipaseDiana SahoneroPas encore d'évaluation

- 2012 Local Olympiad ExamDocument8 pages2012 Local Olympiad ExamihappyscribdPas encore d'évaluation

- CH 6 Chemical BondingDocument14 pagesCH 6 Chemical Bondingapi-240972605Pas encore d'évaluation

- Condur SC 01Document2 pagesCondur SC 01visvisvisvisPas encore d'évaluation

- Piperina 1Document10 pagesPiperina 1LisZvtsPas encore d'évaluation