Académique Documents

Professionnel Documents

Culture Documents

Modaraba Statistics

Transféré par

FarRukh IjazTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Modaraba Statistics

Transféré par

FarRukh IjazDroits d'auteur :

Formats disponibles

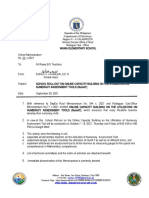

S,No

Name of Companies

1 Allied Rental Modaraba

2011

2010

Profit/Loss Total Assets

Equity

Profit /Loss Total Assets

Equity

288,293,514 2,110,795,298 1,302,945,936 277,973,164 1,510,871,535 1,149,652,422

2 BF Modaraba

17,491,422

132,439,159

3 BRR Guardian Modaraba

41,702,786

2,966,799,465

4 Crescent Standard Modaraba

5,025,679

5 First Al-Noor Modaraba

127,504,307

3,402,708

104,659,270

102,220,777

732,683,816 (161,233,731) 3,643,074,397

632,893,804

148,239,234

117,551,066

5,024,212

159,131,597

115,030,261

29,892,423

349,432,737

326,139,744

11,034,804

330,869,281

306,873,492

6 First Constellation Modaraba

2,405,351

73,977,637

69,591,101

2,445,264

74,439,593

67,185,750

7 First Elite Capital Modaraba

8,811,772

168,140,039

124,041,952

7,320,231

155,023,312

117,679,778

180,251

613,656,964

562,817,628

(714,030)

586,947,330

547,820,968

8,680,310

375,228,584

335,186,127

(11,849,077)

432,867,007

325,202,187

10 First Habib Bank Modaraba

71,566,614

809,611,550

677,067,738

44,975,845

764,029,782

647,616,784

11 First Habib Modaraba

277,921,978 4,075,214,557 3,059,624,447 267,420,541 3,775,202,662 2,892,195,489

12 First IBL Modaraba

(8,782,498)

283,304,768

233,173,648

2,082,051

379,882,684

247,982,787

13 First Imrooz Modaraba

27,573,010

316,387,849

116,950,752

28,569,858

224,989,438

112,177,742

2,167,572,691

337,139,427

26,234,350 1,761,257,802

331,539,819

8 First Equity Modaraba

9

First Fidelity Leasing

Modaraba

14 First National Bank Modaraba 30,599,608

15 First Pak Modaraba

13,432,493

81,926,896

75,983,182

6,896,655

71,685,225

66,312,689

16 First Paramount Modaraba

27,795,840

245,435,606

144,005,903

16,713,197

227,558,780

126,764,062

17 First Prudential Modaraba

33,269,590

572,123,833

512,996,453

33,292,699

569,102,375

505,487,404

18 First Punjab Modaraba

(70,182,027) 2,628,353,867

296,445,612

7,031,191

2,665,098,306

370,029,639

First Treet Manufacturing

19

Modaraba

123,228,000 1,428,642,000

878,189,000

48,516,000

948,012,000

476,801,000

20 First Tri-Star Modaraba

(1,529,000)

8,005,895

261,045,759

190,277,845

21 First UDL Modaraba

72,959,966

659,927,929

494,661,966

50,768,932

640,295,587

475,164,850

22 KASB Modaraba

40,138,552

1,113,872,460

307,639,655

17,095,690

953,667,713

274,752,640

23 Modaraba Al-Mali

(20,155,120)

213,052,459

178,890,055

(12,913,089)

248,857,837

199,045,175

24 Standard Chartered Modaraba

86,606,872

4,161,109,055

938,069,605

79,879,660 3,605,065,050

928,614,734

25 Trust Modaraba

21,019,459

377,213,880

283,389,001

23,396,924

371,133,905

279,581,825

26 Unicap Modaraba

(357,257)

3,151,921

(173,733)

(456,675)

3,517,143

183,524

SUB TOTAL 'A'

1,127,589,588 26,075,610,438 12,232,514,388 780,913,269 24,468,285,370 11,489,087,447

http://www.nbfi-modaraba.com.pk/statistics.aspx

Pakistan: Investing in Modaraba Companies

By Shabbir Kazmi On September 22, 2013

Most probably Pakistan is the first among the Muslim countries that converted the concept of

Modaraba agreement into an entity. The first ever specific purpose Modaraba was created in mid

eighties, as an attempt to Islamize financial system in Pakistan. The number proliferated to

around 52 but has now reduced to less than half.

Over the years Modarabas have emerged as major non-banking financial institutions (NBFIs)

well as dependable source of medium term financing. They also offer opportunity to investors to

earn Riba-free income. With the opening up of Islamic banks and designated Islamic banking

branches by conventional banks in Pakistan, operations of Modaraba companies have remained

subdued because these have not been able to mobilize low cost funds.

Some of the sponsors made attempt to go beyond leasing (Ijarah) by entering into asset rental,

equities trading and establishing manufacturing facilities etc. However, it is often felt that the

real potential of the sector has not been exploited as yet. May be the time has come to review the

business model and strategies of the players but above all soliciting low cost funds.

The concept of Modaraba entity is almost replica of closed-end mutual fund. The Modaraba

Management Company (MMC) is equivalent to an Asset Management Company (AMC). The

MMCs, like AMCs were expected to float different types of Modarabas but most remained

confined to the first one and if a few had floated more than one, these were merged subsequently.

According to the details compiled based on financial results (year ending June 30, 2012) the

major highlights are: 1) though, there are 24 listed Modarabas bulk of the sector aggregate equity

is contributed by half a dozen companies, 2) largest quantum of profit earned also pertains to

these companies and 3) bulk of investment is in lease finance pertaining to two Modarabas.

Three observations demand specific mention: 1) bulk of the total equity is invested in lease

finance; 2) operating expenses eat up substantial portion of revenue and 3) borrowing is very

high, which also results in higher financial charges.

The way forward could be: 1) preferably arrangement of credit lines from outside Pakistan to

bring down financial cost, 2) inviting foreign investors to become stakeholders in MMCs, 3)

secondary offer of Modaraba Certificates and 4) reduction in number of MMCs (through mergers

and acquisitions) to bring down operating expenses.

Pakistan having a population of 200 million people looks forwards to boosting GDP size as well

as growth rate. The country needs fresh capital for the creation of new infrastructure and

productive facilities. The prevailing situation offers an opportunity worth exploring to foreign

investors, who are keen in earning Riba-free income.

http://www.alhudacibe.com/mc-pak.php

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Broadway Pizza (Operations Management)Document14 pagesBroadway Pizza (Operations Management)FarRukh IjazPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Military Aircraft SpecsDocument9 pagesMilitary Aircraft Specszstratto100% (2)

- Del Rosario v. ShellDocument2 pagesDel Rosario v. ShellJoshua ReyesPas encore d'évaluation

- Review Test 4 - Units 7-8, Real English B1, ECCEDocument2 pagesReview Test 4 - Units 7-8, Real English B1, ECCEΜαρία ΒενέτουPas encore d'évaluation

- A Small Promo For The Webpage)Document1 pageA Small Promo For The Webpage)FarRukh IjazPas encore d'évaluation

- 16 Points, Times New Roman, Centralized, Single Line Spacing, Spacing Before and After 50Document3 pages16 Points, Times New Roman, Centralized, Single Line Spacing, Spacing Before and After 50FarRukh IjazPas encore d'évaluation

- BSFIMDocument12 pagesBSFIMFarRukh IjazPas encore d'évaluation

- CorinnamunteanDocument2 pagesCorinnamunteanapi-211075103Pas encore d'évaluation

- Egyptian Gods and GoddessesDocument5 pagesEgyptian Gods and GoddessesJessie May BonillaPas encore d'évaluation

- Aquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlDocument2 pagesAquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlTuan DaoPas encore d'évaluation

- Dreaded Homework Crossword ClueDocument9 pagesDreaded Homework Crossword Clueafnahsypzmbuhq100% (1)

- Bishal BharatiDocument13 pagesBishal Bharatibishal bharatiPas encore d'évaluation

- Zmaja Od Bosne BB, UN Common House, 71000 Sarajevo, Bosnia and Herzegovina Tel: +387 33 293 400 Fax: +387 33 293 726 E-Mail: Missionsarajevo@iom - Int - InternetDocument5 pagesZmaja Od Bosne BB, UN Common House, 71000 Sarajevo, Bosnia and Herzegovina Tel: +387 33 293 400 Fax: +387 33 293 726 E-Mail: Missionsarajevo@iom - Int - InternetavatarpetrovicPas encore d'évaluation

- Lea3 Final ExamDocument4 pagesLea3 Final ExamTfig Fo EcaepPas encore d'évaluation

- Conditions of The Ahmediya Mohammediya Tijaniya PathDocument12 pagesConditions of The Ahmediya Mohammediya Tijaniya PathsamghanusPas encore d'évaluation

- Variable Ticket PricingDocument3 pagesVariable Ticket Pricingn8mckittrick16Pas encore d'évaluation

- William SantiagoDocument5 pagesWilliam SantiagoSubhadip Das SarmaPas encore d'évaluation

- Quote For 1.83x3m Ball Mill - FTM JerryDocument13 pagesQuote For 1.83x3m Ball Mill - FTM JerryChristian HuamanPas encore d'évaluation

- Tales From The SSRDocument48 pagesTales From The SSRBrad GlasmanPas encore d'évaluation

- The MinoansDocument4 pagesThe MinoansAfif HidayatullohPas encore d'évaluation

- University of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramDocument10 pagesUniversity of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramRoldan TalaugonPas encore d'évaluation

- Republic of The Philippines Department of Education Region Iv - A Calabarzon Schools Division Office of Rizal Rodriguez Sub - OfficeDocument6 pagesRepublic of The Philippines Department of Education Region Iv - A Calabarzon Schools Division Office of Rizal Rodriguez Sub - OfficeJonathan CalaguiPas encore d'évaluation

- Aud Prob Compilation 1Document31 pagesAud Prob Compilation 1Chammy TeyPas encore d'évaluation

- Summarydoc Module 2 LJGWDocument14 pagesSummarydoc Module 2 LJGWKashish ChhabraPas encore d'évaluation

- Functions and Roles of RbiDocument3 pagesFunctions and Roles of RbiMOHITPas encore d'évaluation

- Lecture 1Document15 pagesLecture 1Skyy I'mPas encore d'évaluation

- Earth Blox BrochureDocument8 pagesEarth Blox BrochureLionel Andres Corzo MoncrieffPas encore d'évaluation

- JioMart Invoice 16776503530129742ADocument1 pageJioMart Invoice 16776503530129742ARatikant SutarPas encore d'évaluation

- Weird Tales PresentationDocument11 pagesWeird Tales PresentationBogdan StanciuPas encore d'évaluation

- Factors That Shape A Child's Self-ConceptDocument17 pagesFactors That Shape A Child's Self-ConceptJaylou BernaldezPas encore d'évaluation

- Written Report ON Ethical Issues IN Media CoverageDocument3 pagesWritten Report ON Ethical Issues IN Media CoverageEMMAPas encore d'évaluation

- Bakst - Music and Soviet RealismDocument9 pagesBakst - Music and Soviet RealismMaurício FunciaPas encore d'évaluation

- CPAR FLashcardDocument3 pagesCPAR FLashcardJax LetcherPas encore d'évaluation

- Oracle IRecruitment Setup V 1.1Document14 pagesOracle IRecruitment Setup V 1.1Irfan AhmadPas encore d'évaluation