Académique Documents

Professionnel Documents

Culture Documents

Chartbook PDF

Transféré par

didwaniasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chartbook PDF

Transféré par

didwaniasDroits d'auteur :

Formats disponibles

January 2013 riotinto.

com

Chartbook 2013

Driverless trucks, Pilbara

January 2013 riotinto.com

Contact details

Investor Relations, London Mark Shannon Office: +44 (0) 20 7781 1178 Mobile: +44 (0) 7917 576597 mark.shannon@riotinto.com David Ovington Office: +44 (0) 20 7781 2051 Mobile: +44 (0) 7920 010 978 david.ovington@riotinto.com Andrew Field Office: +44 (0) 20 7781 2054 Mobile: +44 (0) 7876 791341 andrew.j.field@riotinto.com Investor Relations, Australia Christopher Maitland Office: +61 (0) 3 9283 3063 Mobile: +61 (0) 459 800 131 chris.maitland@riotinto.com Investor Relations, North America Jason Combes Office: +1 (0) 801 204 2919 Mobile: +1 (0) 801 558 2645 jason.combes@riotinto.com

Financial calendar 2013

14 February 16 April 18 April 9 May 16 July 8 August 15 October Full year results for 2012 1Q13 Operations Review Rio Tinto plc AGM London Rio Tinto Ltd AGM Sydney 2Q13 Operations Review Half year results for 2013 3Q13 Operations Review

Rio Tinto overview 1 Cautionary statement 2 Safety performance 3 Rio Tintos strategy 4 A world leader in mining 5 Where we operate 6 >85% of assets in OECD 7 Revenue by destination and commodity 8 Innovation and technology 9 2012 first half highlights 10 Earnings reconciliation 11 Cash cost performance 12 Capex prioritised on highest quality projects 13 Approved capital expenditure by country and product 14 Balancing value adding investment with returns 15 Growth map, brownfield and greenfield 16 Major capital projects underway 17 Further quality growth options Market outlook 18 Title slide 19 Chinas share of market demand 20 Chinese steel production and iron ore imports 21 Chinese aluminium production and bauxite & alumina imports 22 Chinas coal production and net exports/imports 23 Thermal coal exports by country 24 China stimulus measures 25 China steel demand and intensity 26 China crude steel demand and production 27 Chinese provinces climbing the steel intensity curve 28 Chinas forecast power generation mix (coal dominance) 29 Indias thermal coal imports 30 Long term demand curves, saturation vs GDP 31 Rio Tinto continues to benefit from Chinas rapid growth rates January 2013

Product group information Iron ore 32 Title slide 33 Highlights 34 Unrivalled expansion programme 35 Pilbara production profile 36 Pilbara iron ore: mines, products, ports, product specs 37 Sales contract portfolio pricing mechanisms 38 Challenges of bringing on new iron ore supply 39 Industry supply falls short of forecasts 40 Superior performance delivering on time and budget 41 Integrated system development to support 353 Mt/a and beyond 42 Partner cooperation enabling solid progress Simandou 43 Phased development and ramp up of Simandou 44 IOC integrated mine to port production system Aluminium 45 Highlights 46 RTA strategic focus on transforming the business 47 Significant achievements since 2007 48 Energy profile: 97% carbon free 49 On path to deliver over $1 billion EBITDA 50 Capex focused on brownfield modernisation projects 51 Focused on Tier 1 projects Copper 52 Highlights 53 Copper supply will continue to be constrained 54 Our continued focus on production at low cost 55 Kennecott, Grasberg and Escondida 56 Turquoise Hill Resources: 51% ownership 57 Oyu Tolgoi

58 Attractive longer term growth profile (La Granja, Resolution) 59 Grasberg production profile Energy 60 Highlights 61 Rio Tinto Coal Mozambique 62 Benga: first production in H1 2012 63 Mozambique coal chain capacity growth path 64 Australian coal growth options 65 Australian infrastructure

end use 74 Diamonds market share, supply and demand Corporate information 75 Title slide 76 Earnings sensitivities 77 Principal corporate activity 2005-09 78 Principal corporate activity 2010-12 79 Major capital projects (1) 80 Major capital projects (2) 81 Major capital projects (3) 82 Major capital projects (4) 83 Major capital projects (5) 84 Major capital projects (6) 85 Market capitalisation of major listed mining companies 86 Geographical analysis of Rio Tinto shareholders 87 Rio Tinto executives 88 Rio Tinto Board 89 Rio Tinto Board (contd.)

Diamonds & Minerals 66 Highlights 67 Portfolio of industry leading businesses 68 RTIT positioned to capture market growth 69 TiO 2 process flow chart 70 Rio Tinto Fer et Titane process flow chart 71 Richards Bay Minerals process flow chart 72 TiO 2 strong pricing outlook 73 Borates demand, production,

January 2013

Chart Book |

Cautionary statement

This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (Rio Tinto) and consisting of the slides for a presentation concerning Rio Tinto. By reviewing/attending this presentation you agree to be bound by the following conditions. Forward-looking statements This presentation includes forward-looking statements. All statements other than statements of historical facts included in this presentation, including, without limitation, those regarding Rio Tintos financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio Tintos products, production forecasts and reserve and resource positions), are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Rio Tinto, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forwardlooking statements. Such forward-looking statements are based on numerous assumptions regarding Rio Tintos present and future business strategies and the environment in which Rio Tinto will operate in the future. Among the important factors that could cause Rio Tintos actual results, performance or achievements to differ materially from those in the forward-looking statements include, among others, levels of actual production during any period, levels of demand and market prices, the ability to produce and transport products profitably, the impact of foreign currency exchange rates on market prices and operating costs, operational problems, political uncertainty and economic conditions in relevant areas of the world, the actions of competitors, activities by governmental authorities such as changes in taxation or regulation and such other risk factors identified in Rio Tinto's most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (the "SEC") or Form 6-Ks furnished to the SEC. Forward-looking statements should, therefore, be construed in light of such risk factors and undue reliance should not be placed on forward-looking statements. These forward-looking statements speak only as of the date of this presentation. Nothing in this presentation should be interpreted to mean that future earnings per share of Rio Tinto plc or Rio Tinto Limited will necessarily match or exceed its historical published earnings per share.

2012, Rio Tinto, All rights reserved

Chart Book |

Continued improvements in safety

Injury frequency rates 2003 October 2012

Per 200,000 hours worked

2.0

All injury frequency rate

1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 03 04 05 06 07 08 09 10 11 Oct-12

Lost time injury frequency rate

2012, Rio Tinto, All rights reserved

Chart Book |

Delivering on our strategy

Robust business of long-life, costcompetitive, expandable assets that are resilient throughout the cycle Aim to maintain strong balance sheet and single A credit rating Consistent delivery against a clearlydefined growth programme Disciplined investment in highreturn growth projects Completion of major projects generating new revenues over next 12-18 months Further actions taken to shape the portfolio

2012, Rio Tinto, All rights reserved

Chart Book |

Rio Tinto a world leader in mining

Aluminium

#2 in bauxite #2 in aluminium #3 in alumina

Copper

#7 in copper #5 in molybdenum

Diamonds & Minerals

#1 in titanium dioxide #2 in borates #3 in zircon #5 in diamonds

Energy

#5 in uranium #8 in export coking coal #10 in export thermal coal

Iron Ore

#2 in seaborne iron ore

2011 market share data

2012, Rio Tinto, All rights reserved

Chart Book |

Where we operate

North America

Europe Asia Africa

Key

Mines and mining projects Smelters, refineries, power facilities and processing plants remote from mine

Aluminium Copper Diamonds Energy Iron ore Minerals

South America Australasia

2012, Rio Tinto, All rights reserved

Chart Book |

>85% of assets in OECD

2011 total assets (excluding non-controlling interests) by region

Canada 25% Europe 5% US 7% Mongolia Other Asia1 2% Africa

1

5%

Other Asia mainly relates to assets in India and Oman. Total assets are calculated from information extracted from the consolidation schedules of the Company for the year ended 31 December 2011, with adjustments for non-controlling interests, cash, current and deferred tax receivables and derivatives.

1% Indonesia

3%

South America

6%

Australia/NZ 46%

2011 total assets = $95 billion

2012, Rio Tinto, All rights reserved

Chart Book |

Strength in diversity

Revenue by destination

(%)

Revenue by commodity

(%)

8 1% 13 31 1% 5%

12%

43% 9% 16 17% 16 16 11% Iron ore Uranium Copper Minerals Aluminium Diamonds Coal Other

China North America

Japan Europe

Other Asia Other

Gross sales revenue in H1 2012 = $28 billion

*Other commodities mainly relate to engineered products and Pacific Aluminium

2012, Rio Tinto, All rights reserved

Chart Book |

Embedding leadership in next generation step change technologies

Our Mine of the Future provides an integrated approach to unlocking value

Find Develop Mine Recover

Find future tier one ore bodies VK1 in initial flight trials Complex testing programme under way

Develop future block cave mines safer, faster, better Tunnel boring system trials to commence at Northparkes during H2 2012

Optimise resource productivity Expansion of driverless truck fleet to 150 Operations Centre Smart drilling and blasting Autonomous trains (AutoHaul)

Recover more from mineral deposits IronX iron ore recovery pilot plant to be scaled up NuWave copper sorting pilot plant being commissioned at KUC

Innovation networks created through long term strategic alliances Protection of Intellectual Property is key to sustaining competitive advantage

2012, Rio Tinto, All rights reserved

Chart Book |

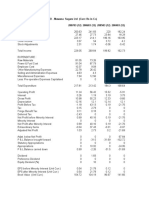

2012 first half highlights

Solid financial results driven by record operational performance of iron ore division Underlying earnings of $5.2 billion Net earnings of $5.9 billion Underlying EBITDA of $10.1 billion Cash flows of $7.8 billion

$ billions Underlying EBITDA Underlying earnings Net earnings Cash flows from operations Capital expenditure Interim dividend (US cents per share) H1 2011 14.3 7.8 7.6 12.9 5.1 54.0 H1 2012 10.1 5.2 5.9 7.8 7.6 72.5 Movement -29% -34% -22% -39% +49% +34%

2012, Rio Tinto, All rights reserved

Chart Book |

10

Strong underlying earnings in a lower price environment

Underlying earnings 2011 first half vs 2012 first half

$ millions

8,000

6,000

4,000

2,000

0 7,781 H1 11 underlying earnings (1,936) Price 200 Exchange Rates 366 Volume increase (584) Volume decrease (174) (388) Energy and Other cash inflation costs (111) Explor'n, eval'n & other 5,154 5,885 H1 12 H1 12 underlying Net earnings earnings

2012, Rio Tinto, All rights reserved

Chart Book |

11

External cost pressures have reduced but remain significant

Earnings cash cost impact

$ millions

Cost increases Operational Readiness Grade and stripping One-offs Cost decreases

Operational readiness costs largely relate to preparation for Pilbara volume ramp-up Reduced impact from weather has been offset by other one-offs including Alma and Cu grades Prioritising productivity improvements

Alma

One-offs and volume related Structural cost increases Mining Inflation

Weather

Further savings expected from support and service cost reduction programme

Other -200 -100 0 100 200

2012, Rio Tinto, All rights reserved

Chart Book |

12

Capital expenditure is being prioritised on the highest quality projects

Approved capital expenditure

US$ billions

18 16 14 12 10 8 6 4 2 0

2008 2009 2010 2011 2012F 2013F 2014F 2015F 2016F

$16 billion capital expenditure approved for 2012 Rio Tintos proportionate share of capital is $13.6 billion Disciplined and rigorous capital approval process Investment focused on projects that will deliver superior returns Phased approach to major capital projects Three significant projects in three commodities to come on line within the next 18 months Flexibility around further major project approvals

Sustaining Pilbara - sustaining mines Other Approved

Pilbara - historical Pilbara - growth

2012, Rio Tinto, All rights reserved

Chart Book |

13

Approved capital expenditure diversified across geographies and products

2012 Capital expenditure by country 2012 Capital expenditure by product

5% 12% 7%

5%

11% 7% 43%

15%

61%

16%

Australia United States Other Excludes equity accounted units

Canada Mongolia

18% Iron ore Aluminium Diamonds & Minerals Excludes equity accounted units

Copper Energy Other

2012, Rio Tinto, All rights reserved

Chart Book |

14

Balancing value adding investment with returns to shareholders

Disciplined and balanced approach to capital allocation

Cash from operations

Balance sheet strength and single A credit rating prudent in a volatile environment

Cash returns to shareholders

Disciplined investment in highest value projects

Prudent balance sheet management

Progressive dividend provides sustainable long term returns to shareholders Investment programme focused on highest quality projects

$10 billion of non-sustaining investments in 2012

Single A credit Rating Average borrowing maturity of 9 years

Progressive dividend increased by 34% $7 billion buy-back completed

2012, Rio Tinto, All rights reserved

Chart Book

15

Our growth programme is across regions, products and brownfield/greenfield

Kitimat 420ktpa Al Oyu Tolgoi 425ktpa Cu; 460kozpa Au Utah Copper 10 year life extension

Resolution 600ktpa Cu

Simandou 95mtpa iron ore Coal Mozambique Up to 25mtpa coking coal Yarwun 2 +2mtpa alumina

La Granja 500ktpa Cu

Escondida 1.3mtpa Cu

Brownfield Greenfield

Pilbara growth +133mtpa iron ore

Chart Book |

16

Major capital projects underway

Project timeline(1)

% Complete(2) $ Capex approved(3)

$0.9bn $2.1bn $1.7bn $9.8bn $1.1bn $5.9bn $1.0bn $0.5bn $0.9bn(6) $6.2bn $0.5bn(7) $1.4bn(6) $0.7bn $0.5bn(7) $1.1bn $3.3bn $2.0bn $2.2bn

$ Capex remaining 2012-2015(3)(4)

$0.3bn $1.3bn $1.6bn $6.8bn $0.6bn $5.4bn $1.0bn $0.3bn(7) $0.8bn $1.0bn $0.3bn(7) $1.3bn(6) $0.7bn $0.2bn $0.3bn $2.4bn $0.8bn $0.9bn

Production

+5.3Mt/a 15Mt/a(5) +4Mt/a +53Mt/a 15Mt/a(5) +70Mt/a N/a 30mlb Ph1, 60mlb Ph2 (capacity)

IOCC Ph 1 & 2 Hope Downs 4 Yandicoogina Pilbara 283 Marandoo Pilbara 353 Simandou MAP Grasberg Oyu Tolgoi Ph 1 Eagle Escondida OGP1 KUC ISAL AP 60 Kitimat Kestrel Argyle U/G

+100kt/d ore +17kt/a Ni, 13kt/a Cu 152kt/d mill, access to higher grade ore Extend LOM to 2029 +40kt/a +60kt/a +140kt/a +1.4Mt/a 20mc/a capacity

2012

2013

2014

2015

(1) Represents timing of project completion and initial production (2) As of 30 June 2012 (3) 100% unless otherwise stated (4) As of 1 January 2012. (5) Sustaining production at Pilbara total capacity (6) RT share of capex (7) Budgets and schedule are under review

2012, Rio Tinto, All rights reserved

Chart Book |

17

Further quality growth options from a rich portfolio of tier one and earlier stage projects

Iron Ore IOCC Phase 3 Pilbara major debottlenecking Oyu Tolgoi Phase 2 Resolution La Granja Weipa South of Embley AP60 Phase 2 Cameroon brownfield and greenfield Benga phase 2 and Zambeze Hail Creek expansion Hunter Valley options Valeria Mt Pleasant Winchester South Rssing heap leach ERA Ranger 3 Deeps Simandou Orissa Escondida options KUC North Rim Skarn Northparkes expansion

Copper

Aluminium

Energy

Diamonds & Minerals

Bunder (diamonds) Diavik A21 (diamonds) Jadar (borates, lithium)

Ilmenite mine expansions TiO2 smelter expansions

2012, Rio Tinto, All rights reserved

Chart Book

18

Market outlook

Chart Book |

19

Chinas share of market demand

(% of total world demand)

61 60 50 43 40 30 20 12 10 0 1990 Copper Source: CRU, Brook Hunt, WBMS, Rio Tinto 2000 Aluminium Traded iron ore 2011 6 5 4 13 39

14

2012, Rio Tinto, All rights reserved

Chart Book |

20

Chinese steel production and iron ore imports

Crude steel production/iron ore imports/ domestic iron ore production

(million tonnes) 800 700 600 500 400 300 200 100 0 95 97 99 01 03 05 07 09 11 Steel production Implied domestic iron ore production (import equivalent) Iron ore imports Domestic iron ore % market share 80% 70% 60% 50% 40% 30% 20% 10% 0%

Domestic iron ore market share

Source: World Steel Association /GTIS/RTIO Analysis *H1 annualised Implied Domestic Iron Ore Production (import equivalent): Pig Iron Consumption implied Fe unit demand less imports, plus stock changes and transformed to equivalised to imported ore characteristics (moisture and Fe content).

2012, Rio Tinto, All rights reserved

Chart Book |

21

Chinese aluminium production and bauxite & alumina imports

(million tonnes)

20 18 16 14 12 10 8 6 4 2 0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

Alumina imports Source: CRU, GTA Bauxite imports expressed in terms of alumina content

Bauxite imports

Aluminium production

2012, Rio Tinto, All rights reserved

Chart Book |

22

Chinas coal production and net exports/imports

Chinese coal production and net exports/imports

(million tonnes)

Production (line) 100 50 0 -50 -100 -150 -200 2002 2003 2004 2005 2006 2007 Coking coal 2008 2009 2010 2011 Imports left axis Exports left axis 4000 3500 3000 2500 2000 1500 1000 500 0

Thermal coal Source: SX Coal, McCloskey

Production

2012, Rio Tinto, All rights reserved

Chart Book |

23

Thermal coal exports

(million tonnes)

350 300 250 200 150 100 50 0 1992 2000 Indonesia Source: GTIS, McCloskey 2007 Australia 2008 South Africa 2009 China 2010 2011 United States

2012, Rio Tinto, All rights reserved

Chart Book |

24

China stimulus supports Q4 demand, but near term risks remain

Eurozone debt crises and fragile US recovery create ongoing near-term uncertainty Central government launched a series of pro-growth policies since April 2012 Expect this to lead to renewed demand from fourth quarter of 2012

China stimulus measures announced since April 2012

NDRC (Federal) April 2012 May 2012 June 2012 State July 2012 July 2012 Jiangsu province Zhejiang province Hunan province City of Nanjing 30-point plan to increase consumption City of Ningbo to implement 24 stimulus measures, including a fund to support new business, tax cuts for qualified companies City of Changsha 5 year investment plan, valued at $130 billion. Involves 195 development projects including airport, subway, energy production 280 new projects approved 135 new projects approved 70 projects approved Focused on industrial innovation and clean energy Baosteel and Wuhan alone granted permission to build RMB 134 billion of new steel capacity 69 projects relate to green energy and new energy production

July 2012

2012, Rio Tinto, All rights reserved

Chart Book |

25

Chinese steel growth still has a long way to run

Total steel demand over 20-yr period

(tonnes per capita)

Steel intensity and GDP 1900-2011

(kg/capital crude steel production)

1,400

US 1960-80 1,200 Germany 1970-90 1,000 800 600 400 China 1990-2010 200 China 2010-30 0 5 10 15 20 India 0 0

Korea

Japan China (actual) 19502011 China (forecast) 20122040

Japan 1980-2000

South Korea 1990-2010

Germany USA

10,000

20,000

30,000

40,000

GDP per capita (PPP basis, $2005) Note: Stylistic representation Source: Correlates of War, Maddison, Global Insight, Rio Tinto

Source: Correlates of War, Maddison, Global Insight, Rio Tinto Note: Steel stock refers to the level of cumulative steel consumed within an economy over a 20-year period

2012, Rio Tinto, All rights reserved

Chart Book |

26

We continue to forecast Chinese crude steel production of ~1 billion tonnes p.a. towards 2030

Chinese crude steel demand forecasts

Million tonnes

1000 900 800 700 600 500 400 300 200 100 0 2000 x 2010 2020 2030 2040 2050

Industrial - Export (RT est) Construction (RT est) Wood Mackenzie est. Industrial - Domestic (RT est) CRU est. AME est.

Chinese crude steel production

Million tonnes

-1 -1

1600 1400 1200

1000 800 600 400

18

200 0 2005 2015 2025 2035

Decade average compound annual growth rate (%)

Source: Rio Tinto analysis

Source: Rio Tinto analysis, CRU (2011), AME, Wood Mackenzie

2012, Rio Tinto, All rights reserved

Chart Book |

27

Many large Chinese provinces are just beginning to climb the steel intensity curve

Chinese regional steel intensity (urban population)

Steel use per capita 2011 (kg)

2000 1800 1600 1400 Combined > 330m 1200 1000 800 600 400 200 0 2,000 3,000 4,000 5,000 6,000 7,000 8,000 GDP per capita 2011 (US$) 9,000 Shandong 54m 10,000 11,000 12,000 Sichuan 35m Jiangsu 58m Guangdong 76m Beijing 20m Shanghai 23m

Bubble size reflects 2011 population of each of the 31 Chinese provinces Source: McKinsey Global Institute, China Statistical Yearbook 2011, Rio Tinto estimates

2012, Rio Tinto, All rights reserved

Chart Book |

28

Despite the emergence of substitutes, Chinas power will continue to be predominantly generated by coal

Chinas forecast power generation mix

(TWh)

11 000 10 000 9 000 8 000 7 000 6 000 5 000 4 000 3 000 2 000 1 000 2009

Coal percentage of power generation mix

10,023

2009-2030 CAGR

Other alternatives Wind Hydro Nuclear Gas Coal 13.0% 14.8% 3.4% 11.7% 10.9% 4.0%

7,537

3,735

2020 69%

2030 68%

79%

Source: IEA World Energy Outlook 2011

2012, Rio Tinto, All rights reserved

Chart Book |

29

Indias thermal coal imports will likely more than double over the next 5 years to meet power demand

India coal-fired electricity generation capacity and thermal coal imports

India coal-fired electricity capacity

(gigawatts) 250 200 150 100 50 2010 2017 100 34 26 49 61 88 96 150 111 144 95

India thermal coal imports

(Mt) 300

Forecast

246

2x

193 250 195 161

200

Indian Government plans to double coal-fired electricity generation capacity by 2017 Nine ultra mega power stations with a capacity of 4000 megawatts each are planned for construction Smaller coal-fired power stations will be commissioned in the lead up to 2012 to support robust economic growth

Source: Wood Mackenzie, Dec 2011

50

0 2007 2009 2011 2013 2015 2017

2012, Rio Tinto, All rights reserved

Chart Book |

30

Demand growth strength in later stages of economic development

Inflection point not yet reached for many of our products Percentage of saturation level*

Titanium dioxide

Nickel Crude steel Copper Aluminium

Titanium Dioxide

Diamonds Borates

2,000 Timeframe

10,000 2010 2020

18,000 2030

26,000 2040

34,000 2050

42,000

50,000

58,000 World GDP/capita 2000 US$ PPP

*Saturation level point at which consumption per capita does not increase with income levels Source: Rio Tinto

2012, Rio Tinto, All rights reserved

Slide 30

Chart Book |

31

Rio Tinto continues to benefit from Chinas rapid growth rates

Rio Tinto sales to China

($bn)

25 28% 20 19% 24% $16..7bn 15 15% 10 8% 5 $0.9bn 0 03 04 05 Iron ore 06 Copper 07 Aluminium 08 Other 09 10 11 H1 12 $1.5bn 0% $3.1bn $4.1bn 10% $6.0bn 16% $10.8bn $10.7bn $8.5bn 10% 5% 15% 18% 31% $20.1bn 25% 20% 31% 30%

% of total global sales

2012, Rio Tinto, All rights reserved

Chart Book

32

Product group information

Chart Book |

33

Iron ore: record Pilbara production and sales alongside major project development

Iron ore underlying results

US$ billions

10 9 8 7 6 5 4 3 2 1 0 H1 08 H1 09 H1 10 H1 11 H1 12

Record production and sales from Pilbara iron ore operations Lower prices partly offset by higher volumes 5 Mt annual capacity increase through low capex debottlenecking Poised for major expansion Scaling up deployment of innovative technologies to improve productivity

Underlying EBITDA

Underlying earnings

2012, Rio Tinto, All rights reserved

Chart Book |

34

Unrivalled global iron ore expansion programme

Capital expenditure on time and on local currency budget Further 5mt at end of Q1 2012: increased Pilbara capacity to 230Mt/a 283 Mt/a expansion fully approved 353 Mt/a expansion port and rail infrastructure fully approved Pilbara mineralisation to last > 50 years even on elevated production volumes Capital intensity from 220 Mt/a to 353 Mt/a expected around mid US$150/t on a 100% basis, with our share of capital intensity expected around mid US$130/t

Car dumpers (x2) CD1 car dumper replacement (20 Mt/a) Existing Cape Lambert Port 1.8 km 2.5 km

Tug harbour

1st 53 Mt/a 2nd 50 Mt/a 1.8 km

Each berth 400 m

Cape Lambert expansion

2012, Rio Tinto, All rights reserved

Chart Book |

35

Unrivalled global iron ore expansion programme

Expected Pilbara production (100 per cent)

Million tonnes

400 350 300 250 200 150 100 50 0 2011 2012F 2013F 2014F 2015F 2016F 283 Mt/a first ore in Q4 2013 353 Mt/a first ore in H1 2015

Pilbara expansion remains on time and local currency budget Dredging now complete Phase one piling for 283Mt/a capacity 85% complete Potential expansions beyond 353 Mt/a through major debottlenecking Progressive investment at Simandou a further step towards development and ramp up

2012, Rio Tinto, All rights reserved

Chart Book |

36

Our world-class Pilbara iron ore product

Pilbara iron ore: mines, products, ports and product specifications

Banded Iron Formation derived Iron Deposits

Channel Iron Deposits

Ore group Mines Ore-types

Paraburdoo (inc. Channar Eastern Range) B

Brockman 2 B

Brockman 4 B

Mt Tom Price B & MM

Marandoo MM

Nammuldi MM

West Angelas MM

Hope Downs 1 MM

Yandicoogina PIS

Mesa Mesa A J PIS

Products

L&F

Pilbara Blend (PB)

L&F

HIY F RV

L&F

Ports

Dampier

Cape Lambert

Ore-types B = Brockman Iron Formation MM = Marra Mamba Iron Formation PIS = Yandicoogina pisolite PIS = Robe Valley pisolite

Product characteristics Pilbara Blend Lump Pilbara Blend Fines Robe Valley Lump Robe Valley Fines Yandicoogina Fines

Fe (dry basis) 62.5% 61.5% 57.0% 57.0% 58.5%

Moisture 4.0% 8.5% 6.0% 7.0% 9.0%

2012, Rio Tinto, All rights reserved

Slide 36

Chart Book |

37

Continued evolution of our sales contract portfolio

Rio Tinto iron ore sales contract portfolio

(Proportion of pricing mechanisms)

FY 2010 Spot

About 60% of global products to China and about 35% to Japan, Korea and Taiwan Our contract portfolio focuses on: Diversification of markets and customer segments Matching products to segments that value them the most Ensuring full offtake

Quarter Lag

Current

Monthly

Quarter Lag

Approximately 40% of sales priced by reference to average index for previous quarter with 1 month lag

Quarter Actual

*Includes HI, HD, RR + IOC contract tonnes

2012, Rio Tinto, All rights reserved

Chart Book |

38

Challenges of bringing on new iron ore supply

Announced and completed iron ore production capacity (global) (Million tonnes)

1000 800 600 400 200 0 Announced for 2008-10 Certain 1000 800 600 400 200 0 Announced for 2011-13 Completed by Q1 2012 Probable Completed by Q4 2010 Possible Rio Tinto Other

Announcements from others do not necessarily translate to supply capacity Competition for labour with oil/ gas Reduced sources of project financing Protracted approvals processes Shortage of specialist mining skills Difficulty working in remote locations High cost Chinese domestic supply required to meet demand in the short to medium term

Source: UNCTAD, Rio Tinto

2012, Rio Tinto, All rights reserved

Chart Book |

39

Iron ore: supply continues to fall short of forecasts

Major iron ore production*

(million tonnes)

1000

Rio Tinto Pilbara iron ore

(million tonnes)

400

800

-158 Mt

300 -31 Mt

600

200

400 2007 2008 2009 2010 2011 2012 2013 Actual

100 2007 2009 2011 2013 2015 Actual

2007-8 forecast

2011-12 forecast

Jun-08 forecast Source: Deutsche Bank, Rio Tinto

Nov-11 forecast

*Data set comprises Rio Tinto Pilbara, BHP Billiton and Vale Source: Deutsche Bank, Rio Tinto

2012, Rio Tinto, All rights reserved

Chart Book |

40

We have demonstrated superior performance in delivering Pilbara projects on time and on budget

Western Australian construction projects performance Cost (% of local currency budget)

250% 60

RTIO projects

200%

Non RTIO projects

50 40 30

Over budget behind schedule

150%

20 10

100%

0 -10

50%

-20 Under budget -30 ahead of schedule -40

0% Source: Pit Crew Management Consulting Services, Rio Tinto

2012, Rio Tinto, All rights reserved

Months over budget

Chart Book |

41

Integrated system development to support 353 Mt/a and beyond

2012, Rio Tinto, All rights reserved

Chart Book |

42

Strong co-operation with our partners is enabling solid progress to be made at Simandou

Mine

Govt. Guinea 35% IFC 3.25% Rio Tinto/ Chalco 61.75%

Largest integrated mining project in Africa Secured tenure and full support of Government of Guinea and Chalco Establishing a robust infrastructure investment framework with Government of Guinea JV with Chalco finalised, triggering the earn-in payment of US$1.35 bn

46.5% Rio Tinto/ Chalco

Simfer SA

Rail and Port Services Agreement

Tariff

Infrastructure SPV

51% Govt. Guinea

2.5% IFC

Infrastructure

Indicative ownership shares as of December 2031. Assumes the Government of Guinea exercise their 10% at cost option and 10% option at market value.

2012, Rio Tinto, All rights reserved

Chart Book |

43

Phased development and ramp up of Simandou

Further progressive commitment of US$0.5 billion (100% basis $1.0 billion) Rail line works and marine structures to enable 2015 ore exports Complete definitive engineering 4 logistic supply centres and 22 camps along the railway line

Summary of Simandou spend to date ($bn) Spend prior to Chalco earn-in Government settlement Chalco earn-in June 12 announcement (RT share) Total Rio Tinto commitment Government infrastructure share Net Rio Tinto commitment $1.9 $0.7 $(1.3) $0.5 $1.8 $(0.5) $1.3

2012, Rio Tinto, All rights reserved

Chart Book |

44

IOC integrated mine to port production system

Mine

Expandable high quality resource base with significant exploration potential Concentrator capacity of 22 Mt/a (23.3 Mt/a post CEP2 expansion), pellet plant capacity 12.5 Mt/a Ore upgraded often in excess of 65% Fe concentrate Majority of concentrate converted to pellets (pellet plant capacity 12.5 Mt/a) Product transported to port via ~400 km QNS&L railway Rail capacity +80Mt/a, current fleet capacity of 35 Mt/a Year round, expandable deep water port Vessel capacity currently 255kt Port capacity currently 28Mt/a, expansion potential to ~200Mt/a

Plant

Rail

Port

2012, Rio Tinto, All rights reserved

Chart Book |

45

Aluminium: continued focus on productivity and business improvement

Aluminium underlying results

US$ billions

2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 H1 08 H1 09 H1 10 H1 11 H1 12

2011 Onwards Excludes Pacific Aluminium, Lynemouth, Sebree, Gardanne refinery, and European specialty alumina

Challenging market conditions and operating environment 15% lower LME price half on half Continued high input costs Alma lock-out now resolved Accelerating cost reduction efforts Limiting growth projects in line with market conditions Increased bauxite production driven by strong demand Expansion of Yarwun alumina refinery complete, full capacity in Q3 2013

Underlying EBITDA

Underlying earnings

2012, Rio Tinto, All rights reserved

Chart Book |

46

Rio Tinto Alcan: strategic focus on transforming the aluminium business

Disciplined portfolio management Deliver cost and productivity improvements Focus on high return production creep and modernisation projects Focused strategy will reshape the aluminium business Best bauxite and energy positions in the aluminium industry Lowest carbon footprint Modern, large-scale, long-life assets First and second quartile positions on the industry cost curve Leading AP Technology position

Yarwun refinery, Australia

Kitimat smelter, Canada

2012, Rio Tinto, All rights reserved

Chart Book |

47

Significant achievements since 2007 with a clear pathway forward

Portfolio management 13 assets identified for divestment or closure Lynemouth smelter closed on 29 March 2012 Continued portfolio discipline

Phase 2

Business improvement

Over $1 billion EBITDA improvement via cost and production efficiencies, capacity creep, optimisation of product mix

40% EBITDA margin

Investment

Focused capital investment on high-return brownfield projects and modernisation

Phase 1

Integration and synergies

$1.1 billion of synergies achieved into 2009

Strategic decisions during global financial crisis

Sold Ningxia, Brockville, Ghana Bauxite Company Closed Beauharnois and Anglesey

2012, Rio Tinto, All rights reserved

Chart Book |

48

Energy profile: 97% carbon free

Positioned for almost 85% clean hydropower, lowest cost quartile power for smelting

Current power sources

Enhanced cost position with almost 65% selfgenerated power versus 34% industry average

Current power sources

Post-divestments and closures

Post-divestments and closures

Note: Post divestment and closures charts excludes Pacific Aluminium and other assets separated from Rio Tinto Alcans perimeter

2012, Rio Tinto, All rights reserved

Chart Book |

49

$250 million annual run rate on path to deliver over $1 billion EBITDA from our operations

Business improvement initiatives

Per cent of total EBITDA improvement

Annual EBITDA improvement

US$ millions

Acceleration of cost reduction and continued creep in 20122015 steepens improvement curve Cost reduction comprises 50 % of EBITDA improvement: further reductions in SG&A additional procurement efficiencies Revenue contributions are driven by volume creep, bauxite export and VAP margins

Note: All data reflects the period 2011-2015 inclusive

2011, Rio Tinto, All rights reserved

Chart Book |

50

Capital expenditure focused on brownfield modernisation projects

2012 Capital expenditure

$ Billions $0.1 $0.8 $0.3

$0.2

Yarwun expansion to 3.4mt will reach full capacity in Q3 2013 with 90% of the capacity delivered by year end 2012 Kitimat modernisation will move production to first decile of industry cost curve ISAL to increase production by 20%, improve cost curve position and add new value added product cast house

$0.8

$0.4

AP60 is R&D platform for AP Technology commercialisation

Sustaining ISAL

Kitimat Yarwun 2

AP60 Shipshaw

(1) Excludes equity accounted units.

2011, Rio Tinto, All rights reserved

Chart Book |

51

Focused investment in Tier 1 projects

Approved

Project timeline(1)

Current status

Total capex (100%)

Capacity Capex remaining expansion (2) (100%)

ISAL

Under construction Under construction

$0.5bn

$0.2bn

40+ ktpa

AP 60 Phase 1

$1.1bn

$0.3bn

60 ktpa Increase from 282 ktpa to 420+ ktpa 2 mtpa

Kitimat

Under construction

$3.3bn

$2.4bn

Yarwun 2

Complete

$2.3bn

South of Embley

Feasibility study

<$2bn

100%

22.5 mtpa

2012

12 2013

24

2014 36

2015 48

As at 1 July 2012

Represents timing of project completion and initial production

2012, Rio Tinto, All rights reserved

Chart Book |

52

Copper: supply constraints continue

Copper underlying results

US$ billions

3

Lower volumes due to temporary grade decline Copper production expected to increase from second half 2012 Brownfield investment to extend life of KUC mine, increase Escondida production Acquired majority stake in Turquoise Hill (formerly Ivanhoe)

0 H1 08 H1 09 H1 10 H1 11 H1 12

Underlying EBITDA

Underlying earnings

2012, Rio Tinto, All rights reserved

Chart Book |

53

Copper supply will continue to be constrained

Disruption rates will continue

(% of planned production) 8 7 6 5 4 3 2 1 0 2004 2005 2006 2007 2008 2009 2010 2011

Sovereign risk

Copper supply location (%) 9% 41% 47%

36%

62%

54%

44% 2020 Lower risk

2000 Higher risk

2010 Medium risk

Increasing depths

Indicative depth of discoveries

Declining grades

Average head grade treated (% Copper)

Sources: Brook Hunt A Wood Mackenzie company

2012, Rio Tinto, All rights reserved

Chart Book |

54

Our continued focus on production at low cost

Production profile

2011- 2015 Production forecast

Kt Cu/ Koz Au 1,350 1,200 1,050 900 750 600 450 300 150 0 2010 A 2011 2012 2013 2014 Moly (Mlbs) 2015 10 0 Rio Tinto Xstrata Freeport Codelco BHP Billiton 30 50 40 95 30 66 20 37 Mlbs Mo 70 60

Continued focus at low cost

C1 costs 2010 (c/lb)*

100

Copper (Kt)

Gold (Koz)

Source: Rio Tinto *Brook Hunts quoted C1 cash costs (C1 costs = cash costs net of by products)

2012, Rio Tinto, All rights reserved

Chart Book |

55

Kennecott, Grasberg and Escondida

Kennecott Moly Autoclave Process progressing Seven year LOM extension, south wall push back Tunnel boring and sorting technologies tested Grasberg Pre-production construction of Block Cave Deep Mill Level Zone underground mines From 2021 entitled to 40% of all production Escondida Organic Growth 1 Project (OGP 1) Oxide Leach Area Project (OLAP) Ore access, bioleach and de-bottlenecking projects Los Colorados concentrator relocation

Escondida, Chile

Grasberg, Indonesia

2012, Rio Tinto, All rights reserved

Chart Book |

56

Turquoise Hill Resources: majority, 51% ownership

Equity financing US$1.8 Billion Rights offering completed 19 July 2012, yielding $1.8 billion in gross proceeds No shares purchased under Rio Tinto standby commitment Ensuring Oyu Tolgoi development remains on track In addition to US $1.8 billion interim financing facility, $1.8 billion drawn as at the end of July 2012 $3 $4 billion Proceeds to repay bridge loan and interim finance facility Target agreement by end of 2012 Rio Tinto nominated 11 of 13 board members Majority of board remains independent Rio Tinto Senior Leadership team, including CEO and CFO Own 74.2 million Series D Warrants exercisable for three years at US$10.37 per share Quantity and price of Warrants adjusted for the rights issue and per the MOA

Bridge loan US$1.5 Billion

Project financing

Board and management changes

Warrants

2012, Rio Tinto, All rights reserved

Chart Book |

57

Oyu Tolgoi: a world class asset

A top five copper producer and major gold producer1 Average annual production of 425kt of copper and 460koz of gold

Phase 1

Large Open pit mine 100,000 tonne per day concentrator Preliminary development of UG mine Long life

3.1bt resource and 1.4bt reserve Potential for > 50 year mine life Highly prospective region with further exploration potential

Phase 2

Complete development of UG mine Low cost Mill expansion to 160,000 tonnes per day Power station

Significant by-product credits from gold Expected to have first quartile net unit cash costs

Note: 1 Ranked using 2013 Brook Hunt mine production data and Oyu Tolgois full capacity production. Source: Brook Hunt a Wood Mackenzie Company, Rio Tinto, Oyu Tolgoi LLC

2012, Rio Tinto, All rights reserved

Chart Book |

58

Attractive longer term growth profile

La Granja (100%) #7 Worlds seventh largest undeveloped copper resource La Granja staged development plan

Conceptual development plan

Copper (Ktpa) 600 500 400 300 200 100 0 0 Year Mill Source: Rio Tinto Leach Ore processed 9 Processing capacity (Mtpa) 160 140 120 100 80 60 40 20 0

Resolution (55%) #3 Worlds third largest undeveloped copper resource

Potential 500ktpa Cu for 40+ years Investment decision

expected ~2014 for phase 1 development Starter mine conceptually planned to commence 2016 First cathode product from heap leach 2017

High quality resource

1.47% copper with significant molybdenum Potential 600ktpa Cu with initial production ~2021 Prefeasibility and negotiations for land exchange are ongoing

2012, Rio Tinto, All rights reserved

Chart Book |

59

Grasberg metal strip

Cu (m lbs) 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021* 1,035 1,066 1,066 1,057 1,044 1,008 1,008 1,024 1,027 699 Au (000 oz) 1,283 1,471 1,461 1,493 1,529 1,589 1,589 1,589 1,593 872 Ag (000 oz) 4,010 4,268 4,277 4,156 3,768 3,359 3,359 3,396 3,405 2,196

Rio Tinto is entitled to 40% of all production in excess of the metal strip 2012 production not expected to reach amount set out in metal sharing agreement Due to planned mine sequencing in lower grade areas Accordingly, our share of production is expected to be zero throughout 2012

*Revisions were made to the 2021 metal strip following the industrial dispute in 2011.

2012, Rio Tinto, All rights reserved

Chart Book

60

Energy: challenging market and cost environment

Energy underlying results

US$ billions

1.5

Earnings impacted by lower prices and Australian cost inflation Significant unseasonal wet weather in Australia continued into July Closure of Blair Athol by end of 2012 First shipment of coking coal from Benga in June $227 million net gain on sale of Extract and Kalahari interests

0.5

0 H1 08 H1 09 H1 10 H1 11 H1 12

Underlying EBITDA

Underlying earnings

H1 2010 includes $0.4 billion (pre-tax) and $0.2 billion (post-tax) profit on disposal from Maules Creek and Vickery. H1 2012 earnings and EBITDA includes $0.2 billion and $0.3 billion respectively for the profit on the sale of Extract and Kalahari interests.

Chart Book |

61

Rio Tinto Coal Mozambique: a tier one resource

Tier one resource with expansion options; Moatize Basin is a 50yr+ opportunity Strategic potential to grow beyond 40mtpa coal Benga Mine officially opened May 2012; first shipment of coking coal June 2012. Rio Tinto Coal Mozambique has been integrated into Rio Tinto Developing cohesion and alignment of resource development/assessment plans CEO and senior management team in place Rio Tinto standards for Health, Safety, Environment and Community

2012, Rio Tinto, All rights reserved

Chart Book |

62

Benga: first production in H1 2012

Benga: 65% Rio Tinto, 35% Tata Steel Stage 1 production 2Mt of in-pit coal currently uncovered Plant commissioned early 2012 2012 is constrained by lack of coal chain capacity (target 800kt sales). Stage 1 potential (when coal chain capacity in place): 5.3Mtpa Run of Mine (ROM) 1.5Mtpa hard coking coal product 0.9Mtpa thermal coal product Power supply from the national grid Stage 2 production Growth potential up to 20Mtpa ROM (total mine hard coking coal to 6Mtpa and 4Mtpa thermal coal) Potential for 2015 commissioning first additional module dependent on coal chain capacity Zambeze: 100% Rio Tinto Potential production profile First production 2016 dependent on coal chain capacity Potential growth to 40mtpa (ROM) Mining concession application submitted to Mozambique Government 20,000t bulk sample collected to further coal quality test work programme Environmental and social impact assessment underway

2012, Rio Tinto, All rights reserved

Chart Book |

63

Mozambique coal chain capacity growth path

Barging options First Coal

June 2012 1-2 Mtpa RTCM capacity Sena Line to Port of Beira RTCM rail operations Capacity for 3Mtpa, growing to 10Mtpa+ River barging on Zambeze River, and transloaded to OGV off shore

Greenfield Rail & Port

2018+ Potential to 100+Mtpa (RTCM share to be negotiated) New infrastructure built on new alignment

Expand existing rail and port export corridors

2015+ Up to 40Mtpa across various corridors (RTCM share to be negotiated)

2012, Rio Tinto, All rights reserved

Chart Book |

64

Significant growth options across the Australian portfolio

2012 production increase through NSW brownfield expansions ongoing Clermont Mine business improvement programme Hail Creek expanded to 8Mtpa nameplate rate Kestrel Mine Extension Extends life to 2032, low cost, coking coal production to start 2013 incremental production (+1Mt) Capital cost increased to $2bn: 50% FX, 20% inflation, 30% delay/scope creep Investment decision to be made on Mount Pleasant an 8.5Mtpa operation

Bengalla, New South Wales

2012, Rio Tinto, All rights reserved

Chart Book |

65

Australian infrastructure

QLD

QLD Sufficient port/rail until greenfield expansions come online 2017 Northern Missing Link completed December 2011 Port capacity options post 2017 NSW Port allocation at NCIG and PWCS to meet growth needs New rail access undertaking approved Additional rail haulage being negotiated

NSW

Legend

Operating sites Undeveloped projects Growth options

2012, Rio Tinto, All rights reserved

Chart Book |

66

Diamonds and Minerals: strong fundamentals drive price, earnings growth

Diamonds and Minerals1 results

US$ millions

600 500 400 300 200 100 0 H1 2010 H2 2010 H1 2011 H2 2011 H1 2012 EBITDA Earnings

Strong earnings growth in titanium dioxide will continue as supply tightens and long term priced contracts unwind Sustained price growth for borates expected Doubled stake in RBM to drive further earnings growth Strong long term fundamentals for diamonds seeking to extract more value through different ownership structure

1. Includes RTIT, RTM, RTD, DSL, Talc (until disposal in mid 2011).

2012, Rio Tinto, All rights reserved

Portfolio of industry leading businesses

Chart Book | 67

Titanium dioxide

Minerals

Diamonds

Salt

#1 producer of TiO2

feedstocks

#2 producer of

refined borates

#3 rough diamond

producer globally

#1 exporter of solar

salt

#2 producer of zircon Mines in South

Africa, Canada, Madagascar with significant expansion potential

Tier one mine in

California with expansion optionality

Leader in the

production of coloured diamonds

JV between Rio

Tinto (68%), Marubeni (22%), Sojitz (10%)

Jadar lithium-borate

project in Serbia

Mines in Australia,

Canada, Zimbabwe

3 mines in Western

Australia

Portfolio optimised

through proprietary production technology and expertise

2012, Rio Tinto, All rights reserved

Potash Exploration

JV in Saskatchewan

Project in India Strategic review

underway

Slide 67

Chart Book | 68

RTIT is well positioned to capture market growth

TiO2 demand development Million tonnes, pigment (LHS), crude steel (RHS)

Future wealth and demographic profiles translate to an unprecedented surge in demand for TiO2 in pigment Little investment in new mine and smelting capacity in past two decades

Continuing to replace long-term price

contracts, increasing exposure to current market prices

Studies to expand mining and refining

Committed supply and demand growth kmt TiO2 feedstock

10,000 9,000 8,000 7,000 6,000 5,000 2005 2007 2009 2011 2013 2015 2017 2019

capacity by up to 50% launched in May 2012 and aims to capture more than 20% of demand growth out to 2020

Expected TIO4 supply contribution

Strong resource position to capture further

demand upside

Industry leader in reliability, furnace life,

energy efficiency and scale

Online supply

Committed projects

Demand

Source: Rio Tinto, World Steel Association

2012, Rio Tinto, All rights reserved

Slide 68

Building blocks for the growing middle class

Ilmenite mining (33 60% TiO2 feedstocks)

Chart Book | 69

Upgrading (80 - 95% TiO2 feedstocks)

Fluxes and welding rods (5% of production) Industrial uses

TiO2 pigments (90% of production) Paints and coatings (58%) Plastics (22%) Paper (9%) Other, eg inks, fabrics, cosmetics (11%)

Titanium metals (5% of production) Industrial (51%) Aerospace (29%) Military (11%) Automotive/medical/sporting goods (9%)

Sources: Rio Tinto, TZ Minerals International

2012, Rio Tinto, All rights reserved

Slide 69

Proprietary processes and products (RTFT)

Chart Book | 70

QMM Ilmenite (mineral sands)

RTFT Ilmenite (hard rock)

Sorelflux = crushed and screened lump ilmenite ore used by steelmakers to combat blast furnace hearth erosion

Sorelslag (80% TiO2) sulphate pigment process RTCS slag (90% TiO2) chloride pigment process

Smelter 9 furnaces

Liquid iron

TiO2 feedstocks (capacity = ~1.2 mtpa)

Sorelmetal: highpurity iron-carbon alloy used to produce castings with high impact resistance (capacity = 300 ktpa)

UGS plant UGS (95% TiO2) UGS plant chloride pigment process and titanium metal

Steel plant Sorelsteel billets for high quality wire and seamless tubes (capacity = 500 ktpa)

Metal powder plant Iron powders (capacity = 40 ktpa) and steel powders (capacity = 110 ktpa) used by the automotive industry

2012, Rio Tinto, All rights reserved

Slide 70

Chart Book | 71

Proprietary processes and products (RBM)

Dredge and Floating Concentrator Plant Heavy mineral concentrate Mineral separation plant Rutile and zircon Ilmenite

Dryer

Smelter 4 furnaces

Liquid iron

Electrostatic separation

Titanium dioxide slag (85% TiO2) chloride pigment process (capacity = ~1 mtpa)

Pig iron used to produce castings with high impact resistance (capacity = 500 ktpa)

Rutile used primarily in pigment manufacture (capacity = 100 ktpa)

Zircon used in ceramics and refractories (capacity = 300 ktpa)

2012, Rio Tinto, All rights reserved

Slide 71

Chart Book | 72

TiO2 pricing outlook remains strong

Price progression estimates from TZMI and brokers US$ nominal Previous multi-year pricing mechanisms have guaranteed volumes, but limited exposure to market pricing These are being replaced with new long-term contracts with shorter-term pricing (quarterly or per shipment) Some customers prefer to secure longer term volumes by reopening existing contracts early Price negotiations held to date have reflected tight market conditions Short term pricing exposure limits downside risk of under-selling Price discovery mechanisms include auctions (zircon) and negotiations (TiO2)

RTIT revenue by product line (US$bn, 100% basis)

2.5 2 1.5 1 0.5

Source: TZMI and broker reports

TiO2 contract volumes 2011 2015 (kt)

2500 2000 1500 1000 500 0 2011 2012 2013 2014 2015 Longer-term pricing

Source: Rio Tinto

2012, Rio Tinto, All rights reserved

0 2007 2008 2009 2010 2011

Shorter-term pricing

Co-product revenue TiO2 revenue Slide 72

Driving productivity and performance in borates

Borate demand drivers Cumulative kmt boric oxide B2O3 equivalent

1000 800 600 400 200 0 2007 2009 Urbanisation 2011 2013 Energy Efficiency 2015 2017 Agriculture 11%

CAGR

Chart Book | 73

Demand growth driven by energy efficiency,

food supply, consumer trends

5.9% 6.4%

Tier 1 orebody at Boron, California, with

consistent product quality and supply reliability

Options for incremental capacity expansion

through strategic production planning at low capital intensity

Production B203 kmt

Jadar lithium borate project can deliver two

high value product streams from one mine

2011 borate demand by end use

Source: Rio Tinto

2012, RioTinto, Tinto, All rights reserved 2012 Rio All Rights Reserved

Slide 73

Significant presence in the diamonds industry

Global share of production by value (2011)

9% 28% 16%

Alrosa

Chart Book |

74

Production of 11.7 million carats and revenue of

US$726 million in 2011

Third largest rough diamond producer globally

by volume, behind Alrosa and De Beers

7% 3% 2% 2%

Supplies all major markets with a leadership

position in emerging markets

10% 24%

Expected significant growth in production over

the next five years

CAGR (2010-20) 6.1%

Source: Rio Tinto

Supply demand balance (US$bn)

30 25 20 15 10 5 0 2010 2012 2014 2016 2018 2020 Rough Demand value (US$b) Rough Supply value (US$b)

Source: Rio Tinto

2012, Rio Tinto, All rights reserved

The worlds largest producer of coloured

diamonds

Supplier of more than 90% of the worlds rare

pink diamonds

CAGR (2010-20) 0.8%

Chart Book

75

Corporate information

76

Modelling earnings

2012 first half average price / rate Impact on full year underlying earnings ($m)

Earnings sensitivity

10% Change

Copper Aluminium Gold Iron ore Coal* A$ C$

*For both thermal and coking coal

367c/lb $2,081/t $1,652/oz

+/-37c/lb +/-$208/t +/-$165/oz +/-10% +/-10%

234 399 32 1,073 186 981 256

103 Usc 99 Usc

+/-US10.3c +/-US9.9c

2012, Rio Tinto, All rights reserved

Chart Book |

77

Principal corporate activity 2005 to 2009

2005

Buy-back of Rio Tinto Limited shares (off-market) Buy-back of Rio Tinto Plc shares

2006

$774m $103m $2,370m $303m $1,624m $37,481m $750m $1,695m $495m $850m $814m $764m $741m $14.8bn $388m $349m

Buy-back of Rio Tinto Plc shares (up to 31st December 2006) Purchase of 9.95% shareholding in Ivanhoe Mines

2007

Buy-back of Rio Tinto Plc shares Acquisition of Alcan

2008

Sale of 70.3% interest in Greens Creek Sale of 40% interest in Cortez gold mine Sale of Kintyre uranium project

2009

Sale of potash projects in Argentina (Potasio Rio Colorado) and Canada Sale of Corumb mine in Brazil Sale of Jacobs Ranch coal mine in US Cloud Peak IPO and related debt offering Net equity raised via rights issues to shareholders Increase in stake in Ivanhoe Mines to 19.7% Sale of Alcan Composites

2012, Rio Tinto, All rights reserved

Chart Book |

78

Principal corporate activity 2010 to 2012

2010

2011

Sale of majority of Alcan Packaging to Amcor Sale of Coal & Allied undeveloped properties (Maules Creek and Vickery) Rio Tinto share Sale of Alcan Packaging Food Americas to Bemis Inc Increase in stake in Ivanhoe Mines to 40.1% Sale of remaining 48% stake in Cloud Peak Energy Increase in stake in Ivanhoe Mines to 42.1% and participation in rights offering Increase in stake in Ivanhoe Mines to 46.5% Acquisition of Riversdale Mining Ltd (net of cash acquired) Sale of talc business to Imerys enterprise value Increase in stake in Ivanhoe Mines from 46.5% to 49% Increase in holding in Coal and Allied from 75.7% to 80% Acquisition of Hathor Buy-back of Rio Tinto plc shares (up to 31 December 2011) Purchase of remaining shares in Hathor Increase in stake in Ivanhoe Mines from 49% to 51% Buy-back of Rio Tinto plc shares (up to 26 March 2012) Increase in stake in Richards Bay Minerals from 37% to 74%

$1,948m $306m $1,200m $1,591m $573m $751m $502m $3,690m $340m $607m $266m $536m $5.5bn $76m $308m $1.5bn $1.7bn

2012

Note: only selected transactions are shown.

2012, Rio Tinto, All rights reserved

Chart Book |

79

Ongoing major capital projects (1 of 6)

All numbers on 100% basis (US$) Iron ore Two phased expansion of Iron Ore Company of Canada (IOC) (Rio Tinto 58.7%) from 18 to 22 Mt/a and then to 23.3Mt/a Iron ore Expansion of the Pilbara mines, ports and railways from 230Mt/a to 283Mt/a. Rio Tintos share of capex is $8.4 bn. Iron ore Expansion of the Pilbara port and rail capacity to 353Mt/a. Rio Tintos share of capex is $3.5 bn. Approved capital cost $0.8m Status Phase one is currently being commissioned as planned. Phase two is progressing with first production expected in late 2012. The phase one expansion to 283Mt/a is due to come onstream by the end of 2013. Dredging at Cape Lambert is complete and pilings are 85 per cent complete. The phase two expansion to 353Mt/a is expected to come onstream in the first half of 2015. This includes the port and rail elements which are now fully approved and an investment in autonomous trains. The key component of the project still requiring approval is further mine production capacity. Approved in August 2010, first production is expected in 2013. The new mine is anticipated to have a capacity of 15 Mt/a and a capital cost of $1.6 billion (Rio Tinto share $0.8 billion). Rio Tinto is funding the $0.5 billion for the rail spur, rolling stock and power infrastructure.

$9.8bn

$5.9bn

Iron ore Development of Hope Downs 4 mine in the Pilbara (Rio Tinto 50%) to sustain production at 230 Mt/a

$2.1bn

2012, Rio Tinto, All rights reserved

Chart Book |

80

Ongoing major capital projects (2 of 6)

All numbers on 100% basis (US$) Iron ore Phase two of the Marandoo mine expansion in the Pilbara to sustain production at 230 Mt/a Iron ore Investment to extend the life of the Yandicoogina mine in the Pilbara to 2021 and expand its nameplate capacity from 52 Mt/a to 56 Mt/a. Iron ore Investment in detailed design studies, early works and longlead items at the Simandou iron ore project in Guinea, West Africa. Approved capital cost $1.1bn Status Approved in February 2011, the mine will extend Marandoo at 15 Mt/a by 16 years to 2030. Approved in June 2012, the investment includes a wet processing plant to maintain product specification levels and provide a platform for future potential expansion. Approved in June 2012, the investment (Rio Tinto share $501 million) is primarily for rail and port infrastructure with first commercial production planned for mid-2015. Timing of the ramp up is dependent on receiving necessary approvals from the Government of Guinea and on the Government of Guinea progressing and finalising its financing strategy.

$1.7bn

$1.0bn

2012, Rio Tinto, All rights reserved

Chart Book |

81

Ongoing major capital projects (3 of 6)

All numbers on 100% basis (US$) Aluminium Construction of a new 225MW turbine at the Shipshaw power station in Quebec, Canada Aluminium Modernisation of ISAL smelter in Iceland Approved capital cost $0.3bn Status Approved in October 2008, the project remains on track to be completed in December 2012. An additional $40m was approved in 2011 due to currency impacts and scope changes. Approved in September 2010, the project is expected to increase production from 190kt to 230kt by the third quarter of 2014. The new casting facility produced its first billet in the second quarter of 2012 Approved in December 2010, first hot metal is expected in February 2013. A further amount of $2.7bn was approved in December 2011. This was in addition to the cumulative spend of $550m. It will increase capacity from 280ktpa to 420ktpa. Expected to come onstream in first half of 2014.

$0.5bn

Aluminium 60kt per annum AP60 plant in Quebec, Canada Aluminium Modernisation and expansion of Kitimat smelter in British Columbia

$1.1 bn $3.3bn

2012, Rio Tinto, All rights reserved

Chart Book |

82

Ongoing major capital projects (4 of 6)

All numbers on 100% basis (US$) Molybdenum Investment in the Moly Autoclave Process (MAP) in Utah, United States to enable lower-grade molybdenum concentrate to be processed more efficiently than conventional roasters and allow improved recoveries Nickel Construction of the Eagle nickel and copper mine in Michigan, United States. Copper Construction of phase one of Oyu Tolgoi copper/ gold mine in Mongolia. In 2012, Rio Tinto increased its stake in Ivanhoe to 51%. Ivanhoe owns 66 % of OT. Approved capital cost $0.5bn Status The facility is due to come onstream by the second quarter of 2013 followed by a 12 month period to reach full capacity

$0.5bn

Approved in June 2010, first production is expected in early 2014. The mine will produce an average of 16kt and 13kt per year of nickel and copper metal respectively over seven years. The Oyu Tolgoi project was 90 per cent complete at 30 June 2012. First commercial production is expected in the first half of 2013. Turquoise Hill is due to release its second quarter results on 14 August 2012.

$5.9bn

2012, Rio Tinto, All rights reserved

Chart Book |

83

Ongoing major capital projects (5 of 6)

All numbers on 100% basis (US$) Copper Development of Organic Growth Project 1 and the Oxide Leach Area Project at Escondida (RT share 30%), Chile. Approved capital cost $1.4bn (RT share) Status Approved in February 2012, OGP1 primarily relates to replacing the Los Colorados concentrator with a new 152kt per day plant, allowing access to high grade ore. Construction of the new plant is expected to be complete within three years. OLAP maintains oxide leaching capacity. Investment to continue the pre-production construction of the Grasberg Block Cave, the Deep Mill Level Zone underground mines, and the associated common infrastructure. Rio Tintos final share of capital expenditure will in part be influenced by its share of production over the 2012 to 2016 period. The project was approved in June 2012. Ore from the south wall push back will be processed through existing mill facilities. The investment will enable production at an average of 180kt of copper, 185koz of gold and 13.8kt of molybdenum a year from 2019 through 2029.

Copper Grasberg project funding for 2012 to 2016

$0.9bn (RT share)

Copper - Investment over next seven years to extend mine life at Kennecott Utah Copper, United States from 2018 to 2029.

$0.7bn

2012, Rio Tinto, All rights reserved

Chart Book |

84

Ongoing major capital projects (6 of 6)

All numbers on 100% basis (US$) Thermal coal 20 year extension and expansion from 4.3 Mt/a to 5.7 Mt/a at Kestrel (Rio Tinto 80%), Queensland, Australia Diamonds Argyle Diamond mine underground project, extending the mine life to at least 2019. (Originally approved in 2005, the project was slowed in 2009 and restarted in September 2010.) Approved capital cost $2.0bn Status The investment will extend the life of the mine to 2031 and is expected to come onstream in the second quarter of 2013. Capital cost increased from $1.1bn: 50% of the increase relates to exchange rates, 20% from higher inflation and 30% due to delays and scope changes. An additional $0.6bn was approved in November 2011, primarily reflecting the impact of a record 2010/11 wet season and adverse exchange movements. Production is expected to commence in the first half of 2013 with full production in 2014.

$2.2bn

2012, Rio Tinto, All rights reserved

Chart Book |

85

Market capitalisation of major listed mining companies

At 15 August 2012

(US$bn)

BHP Billiton Vale Rio Tinto Shenhua Anglo American Xstrata Potash Corp Barrick Gold Glencore Freeport Norilsk Goldcorp Southern Copper Co Mosaic Grupo Mexico Newmont Mining Teck Cominco Newcrest Antofagasta Fresnillo 0 159.5 105 90.5 71.1 44.3 39.6 37.7 34.8 34.1 31.5 30.9 27.6 26 23.4 22.6 22.6 17.4 16.6 16.4 16.1 50 100 150

2012, Rio Tinto, All rights reserved

Chart Book |

86

Geographical analysis of Rio Tinto shareholders

At 13 August 2012

(%)

16

37 9

19

19 UK North America Australia Europe Asia

2012, Rio Tinto, All rights reserved

Chart Book |

87

Rio Tinto executives

Chairman

Chairman Jan du Plessis

Group executive / directors

CEO Sam Walsh

CFO Guy Elliott

ExCo

Aluminium Montreal Copper London Diamonds & Minerals London Alan Davies Energy Brisbane Iron Ore Perth Technology People & & Innovation Organisation Salt Lake London Preston Chiaro Hugo Bague Legal & External Affairs London Debra Valentine Business Support & Operations London Bret Clayton

Jacynthe Ct

Andrew Harding

Harry KenyonSlaney

Paul Shannon(1)

(1) Acting head of Iron Ore, as of 17 January 2013

2012, Rio Tinto, All rights reserved

Chart Book |

88

Rio Tinto Boards diverse, operational experience

Role Chairman Executive Director Executive Director Non-executive Directors Name Jan du Plessis Sam Walsh Guy Elliott Robert Brown Vivienne Cox Michael Fitzpatrick Ann Godbehere Sector experience Finance former chairman of BAT plc CEO since 2013, CEO Rio Tinto Iron Ore since 2004, CEO Aluminium 2001-2004, Rio Tinto since 1991 Rio Tinto since 1980, CFO since 2002 Aerospace Chairman of Groupe Aeroplan Inc. Joined Boards on 1 April 2010 Oil and Gas Head of Gas Power, Renewables and Trading, BP plc Finance Founder and former director of Hastings Fund Management Finance former CFO of Swiss Re. Joined Boards on 9 February 2010. Chairman of the Audit committee

2012, Rio Tinto, All rights reserved

Chart Book |

89

Rio Tinto Boards diverse, operational experience (contd)

Role Non-executive Directors Name Richard Goodmanson Lord Kerr Sector experience Chemicals ex COO of DuPont Govt/Foreign Affairs Head of UK Diplomatic Service, Ambassador in USA/EU. Deputy Chairman of Royal Dutch Shell plc Mining and metals former CFO of BHP Billiton and formerly group president Carbon Steel Materials. Prior to this he spent 20 years with Alcoa Inc. Currently chief executive officer of Transurban Group. Aluminium / Government former non-executive director of Alcan, former CEO of Bombardier and Cabinet Secretary to Government of Canada Finance former CEO of Barclays. Chairman of the Remuneration Committee. Current non-executive directorships at AstraZeneca plc and BlackRock Inc. He remains a senior advisor to Barclays.

Chris Lynch

Paul Tellier

John Varley

2012, Rio Tinto, All rights reserved

Vous aimerez peut-être aussi

- Rio Tinto Chartbook 2012Document49 pagesRio Tinto Chartbook 2012chasstyPas encore d'évaluation

- Mike Jolley - President Director PT Rio Tinto IndonesiaDocument24 pagesMike Jolley - President Director PT Rio Tinto IndonesiaAhmad AshariPas encore d'évaluation

- RT Fact BookDocument133 pagesRT Fact BookAlireza RastegarPas encore d'évaluation

- Driving Performance and Executing On Strategy: Simon Moore Director, Investor RelationsDocument23 pagesDriving Performance and Executing On Strategy: Simon Moore Director, Investor RelationsChristopher TownsendPas encore d'évaluation

- New Horizon 2015: JGC Corporation JGC Corporation Medium-Term Management PlanDocument15 pagesNew Horizon 2015: JGC Corporation JGC Corporation Medium-Term Management PlanJustinPas encore d'évaluation

- 5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsDocument2 pages5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsRavi ChandPas encore d'évaluation

- Titan Industries Limited: 5 August 2009Document51 pagesTitan Industries Limited: 5 August 2009dilippalaiPas encore d'évaluation

- RIL Annual Report 2013Document228 pagesRIL Annual Report 2013Amar ItagiPas encore d'évaluation

- Boaml 2012 Final WebsiteDocument17 pagesBoaml 2012 Final WebsitecholentPas encore d'évaluation

- Analysis of Business Strategy of Rio TintoDocument33 pagesAnalysis of Business Strategy of Rio TintoSandeep Pandharkar67% (3)

- Dialog2011 MainDocument73 pagesDialog2011 MainSopsky SalatPas encore d'évaluation

- BTG Pactual CEO ConferenceDocument34 pagesBTG Pactual CEO ConferenceFibriaRIPas encore d'évaluation

- Challenges To Indian GrowthDocument40 pagesChallenges To Indian GrowthVarsha BhutraPas encore d'évaluation

- Mongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsD'EverandMongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsPas encore d'évaluation

- L&T Press Release: Performance For The Quarter Ended March 31, 2012Document6 pagesL&T Press Release: Performance For The Quarter Ended March 31, 2012blazegloryPas encore d'évaluation

- Harsco Investor PresentationDocument18 pagesHarsco Investor PresentationVincent C. CiepielPas encore d'évaluation

- Contents of The Business Report - Volume 1: 1 Anglo Platinum Business Report 2003 1 Anglo Platinum Business Report 2003Document153 pagesContents of The Business Report - Volume 1: 1 Anglo Platinum Business Report 2003 1 Anglo Platinum Business Report 2003harpal_161Pas encore d'évaluation

- BHP Billiton Results For The Half Year Ended 31 December 2013Document40 pagesBHP Billiton Results For The Half Year Ended 31 December 2013digifi100% (1)

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjPas encore d'évaluation

- Titan Industries Limited 1224679601179891 8Document47 pagesTitan Industries Limited 1224679601179891 8Aditya MehtaniPas encore d'évaluation

- Rio Tinto Alcan: Financial Community Site VisitDocument22 pagesRio Tinto Alcan: Financial Community Site Visitmythos1976Pas encore d'évaluation

- Graphite India Ltd2 110512 RSTDocument13 pagesGraphite India Ltd2 110512 RSTVarun JainPas encore d'évaluation

- Investor Meet - Nov 2011Document28 pagesInvestor Meet - Nov 2011Santosh ShetPas encore d'évaluation

- TI India - PPT - Oct 12Document60 pagesTI India - PPT - Oct 12vishmittPas encore d'évaluation

- CF Industries Investor Day 11 Jun 2013Document111 pagesCF Industries Investor Day 11 Jun 2013Alan ChungPas encore d'évaluation

- Titan Industries LTD Report - Mahadev SharmaDocument27 pagesTitan Industries LTD Report - Mahadev SharmaDev SharmaPas encore d'évaluation

- Corporate Presentation November 2006: Integrated Supply Chain SolutionsDocument38 pagesCorporate Presentation November 2006: Integrated Supply Chain SolutionsRaghavendra Rao KancharlaPas encore d'évaluation

- 2012 Annual ReportDocument66 pages2012 Annual ReportJesus SanchezPas encore d'évaluation

- Morgan Stanley - Latin America Mid-Cap Corporate Access DaysDocument36 pagesMorgan Stanley - Latin America Mid-Cap Corporate Access DaysMillsRIPas encore d'évaluation

- Overview of The Nigerian Oil and Gas IndustryDocument39 pagesOverview of The Nigerian Oil and Gas Industryneocentricgenius100% (4)

- Consmin Quarterly Report Q1 2012Document31 pagesConsmin Quarterly Report Q1 2012BeeHoofPas encore d'évaluation

- FAM Project Report of ACC CementDocument16 pagesFAM Project Report of ACC CementRajiv PaniPas encore d'évaluation

- 130207setsumeikai eDocument68 pages130207setsumeikai eShaiju ERecycling VarghesePas encore d'évaluation

- Media Release - RIL 1Q FY 19-20Document33 pagesMedia Release - RIL 1Q FY 19-20FlameOfTruthPas encore d'évaluation

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaDocument126 pagesStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaPas encore d'évaluation

- PTT 2010 AnalystMeetingDocument43 pagesPTT 2010 AnalystMeetingspmzPas encore d'évaluation

- PR913g Rio Tinto Announces Record First Half EarningsDocument52 pagesPR913g Rio Tinto Announces Record First Half EarningskhotarisPas encore d'évaluation

- Economy of OmanDocument8 pagesEconomy of OmanAman DecoraterPas encore d'évaluation

- Rolls-Royce Group PLCDocument148 pagesRolls-Royce Group PLCArvinLedesmaChiong100% (3)

- Rio TintoDocument20 pagesRio TintoSandeep PandharkarPas encore d'évaluation

- 4 May Opening BellDocument8 pages4 May Opening BelldineshganPas encore d'évaluation

- Justin Paul: Business EnvironmentDocument20 pagesJustin Paul: Business Environmentbalamurali sankaranarayananPas encore d'évaluation

- STO Annual Report 2010 EngDocument43 pagesSTO Annual Report 2010 EngAzmee Al MuntaqimPas encore d'évaluation

- Tata Steel Annual Report 12-13Document228 pagesTata Steel Annual Report 12-13jsmnjasminesPas encore d'évaluation

- F.D.I. in India: Suneel GuptaDocument37 pagesF.D.I. in India: Suneel GuptaYash PatelPas encore d'évaluation

- Rio Tinto Iron OreDocument68 pagesRio Tinto Iron Orehatschi1Pas encore d'évaluation

- Global Oil & Gas Drilling ServicesDocument44 pagesGlobal Oil & Gas Drilling ServicesHasumati VankarPas encore d'évaluation

- Sun Microsystems Q107 Quarterly Results Release: Investor RelationsDocument39 pagesSun Microsystems Q107 Quarterly Results Release: Investor RelationsjohnachanPas encore d'évaluation

- Thejo Engineering LTD (TEL) : IPO SnapshotDocument3 pagesThejo Engineering LTD (TEL) : IPO SnapshotshobhaPas encore d'évaluation

- Campus PPT - jspl2Document53 pagesCampus PPT - jspl2deepesh3191Pas encore d'évaluation

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportD'EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportPas encore d'évaluation

- Vedanta GrowthDocument38 pagesVedanta Growthsudeep khandelwalPas encore d'évaluation

- Trafigura Beheer BV Annual Report 2013 1Document53 pagesTrafigura Beheer BV Annual Report 2013 1Lautaro AntonelliPas encore d'évaluation

- R R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDocument27 pagesR R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDipen TusharPas encore d'évaluation

- Ril Ar 2011-12 - 07052012Document220 pagesRil Ar 2011-12 - 07052012Indrajit DattaPas encore d'évaluation

- Ford PresentationDocument47 pagesFord Presentationshagi25Pas encore d'évaluation

- RilDocument220 pagesRiljainsasaPas encore d'évaluation

- Silverwood Partners - NAB 2012 - Strategic Industry AnalysisDocument57 pagesSilverwood Partners - NAB 2012 - Strategic Industry AnalysisBrian ZapfPas encore d'évaluation

- Drilling Deeper PetrobrasDocument41 pagesDrilling Deeper PetrobrasCarolina MonteiroPas encore d'évaluation

- Trade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentD'EverandTrade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentRoger HoseinPas encore d'évaluation

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDocument8 pagesInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasPas encore d'évaluation

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasPas encore d'évaluation

- 0hsie F PDFDocument416 pages0hsie F PDFchemkumar16Pas encore d'évaluation

- Industry Report Card April 2018Document16 pagesIndustry Report Card April 2018didwaniasPas encore d'évaluation

- APL Apollo Antique Stock Broking Coverage Aprl 17Document17 pagesAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasPas encore d'évaluation

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDocument10 pagesRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasPas encore d'évaluation

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDocument2 pagesMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasPas encore d'évaluation

- BandhanBank 15 3 18 PL PDFDocument13 pagesBandhanBank 15 3 18 PL PDFdidwaniasPas encore d'évaluation