Académique Documents

Professionnel Documents

Culture Documents

Buy Back

Transféré par

Manoj SharmaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Buy Back

Transféré par

Manoj SharmaDroits d'auteur :

Formats disponibles

The year 2012 started with shopping news of a different kind-share buybacks .

First, the market regulator, the Securities and Exchange Board of India (Sebi), changed the process and mandated that companies buying back own shares should declare the buyback ratio, as they do in rights issues, and fix a record date. Buyback ratio is a market valuation measure used to gauge what percentage of market value is being reduced by the share buyback activity.

Four per cent is the return given by the RIL stock between the announcement and start of buyback

Second, Sebi approved changes in rules to allow public sector units (PSUs) to buy back shares. As a result, shares of PSUs such as MMTC, Hindustan Copper, State Trading Corporation of India and Dredging Corporation of India rose 30-50 per cent in the first five trading sessions of January. However, on January 6, the Union cabinet deferred the decision due to differences among ministries. Third, on January 20, Reliance Industries, or RIL, approved buyback of up to 120 million shares at a price not exceeding Rs 870 per share. The stock has risen 4 per cent since despite the company reporting poor numbers for the third quarter. It was at Rs 830 at the commencement of the buyback on February 1. Why did shares of RIL and PSUs rise on buyback news? Varun Goel, head, equity portfolio management services, Karvy Private Wealth, says, "A buyback is done to send a signal to the market that the company believes the stock is trading below its intrinsic value." PERSPECTIVE: Behind RIL's share buyback move"Shares react positively to such announcements because buyback reduces the number of shares outstanding, which increases investors' claims on dividends and earnings of the company. As these claims increase, so do stock prices," says Samir Gilani, head, derivatives, and co-head, equities, MAPE Securities. However, Goel says, "A buyback may create a short-term spike that may not last. Most of the times, it is perceived as a vote of confidence in the company. However, in some cases, a company may buy back shares to delist." WHAT IS BUYBACK? Share buyback means purchase of outstanding shares by a company to reduce the number of shares trading in the market. Market experts say it usually shows the confidence of promoters in the future of the company. Pavan Kumar Vijay, managing director, Corporate Professionals Group, says, "There are a number of reasons companies go for buybacks. The intention is to reward investors, improve financial ratios (such as price to earnings, return on assets and return on equity), increase promoter holding, reduce public float and check the falling stock price, reduce volatility and build investor confidence." MODES OF BUYBACK Some common buyback routes companies take are tender offer and open market purchase. In

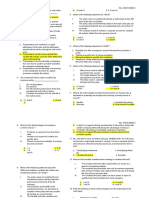

tender offer, the company makes an offer to buy a certain number of shares at a specific price directly from shareholders. Brijesh Parnami, chief executive officer, distribution, Destimoney Enterprises, says, "This route ensures all shareholders are treated equally, however small they are." In open market purchase, the company decides to acquire a certain number of shares. It fixes a price cap and can buy for any price up to that. "Most companies prefer the open market route. The biggest difference between the two is that the price in the tender route is fixed," says Parnami. WHAT'S IN IT FOR INVESTORS? A buyback usually improves the confidence of investors in the company and so its stock price rises. However, past data reveal the stock can move in either direction after the buyback announcement, though it helps stocks in most cases (See Stock Moves). For instance, out of 500 companies in the BSE 500 index, 14 bought back shares in 2011. These include Zee Enertainment Enterprises, CRISIL, Reliance Infrastructure, Rain Commodities, Onmobile Global, Monnet Ispat & Energy and Amtek Auto. Of these, share prices of eight rose between the announcement date and the day the buyback started. Onmobile Global, for instance, rose as much as 19.9 per cent during the period.

Four per cent is the return given by the RIL stock between the announcement and start of buyback

On the downside, share prices of Deccan Chronicle Holdings (DCHL), Jindal Poly Films, Amtek Auto and Praj Indusries, Balrampur Chini and FDC fell 32.2 per cent, 24.4 per cent, 16.6 per cent, 7.6 per cent, 6.1 per cent and 5.2 per cent, respectively. "The obvious reason for the fall is the mismatch between the buyback price announced by the company and investor expectations," says Pankaj Pandey, head of research, ICICIdirect.com. However, Vijay says, "The price trend depends on various factors such as the market situation, the mode of the offer, that is, tender or market purchase, the size of the offer, the difference between the offer price and the market price of the stock and the market's confidence in the management's intention to carry out the offer." On 27 May 2011, PVR announced an open market purchase of its shares on the Bombay Stock Exchange (BSE). From the date of announcement till the start of buyback on July 1, its stock rose 3.20 per cent from Rs 99.95 to Rs 103.15. CRISIL made a similar announcement on 18 October 2011. Between then and 26 December 2011, the day the buyback started, the stock rose 1.9 per cent to Rs 855. However, Indiabulls Real Estate started moving southwards after the buyback announcement. The company announced a buyback on 15 December 2011, after which the stock tumbled 3 per cent to Rs 48.25 till 7 January 2012. The benchmark BSE Realty index fell 6 per cent from 1,447 to 1,398 during the period.

Stock Moves: The shares of a company entering into a buyback can move in either directions after the announcement Click here to Enlarge "The movement of a stock after the buyback announcement depends on valuations. The result can differ from company to company," says Gajendra Nagpal, founder and chief executive, Unicon Investment Solutions. SHOULD YOU BUY? If you plan to invest in companies which are going to buy back their shares, market experts have a word of caution for you. Despite the commencement of buyback, market experts have mixed views on RIL. For instance, Goldman Sachs upgraded its target price from Rs 960 to Rs 970 on 7 February 2012. However, according to a research report of Mansukh Securities and Finance issued on 4 February 2012, the stock can touch a level of Rs 660 in the next 12 months. On February 6, 2012, RIL was trading at Rs 832.75. "You should not buy shares just because the company is working out a buyback plan. Investors must study the company they wish to invest in and take a decision based on its ability to generate profits. In some rare cases, buybacks are announced to trigger certain favourable movements (anticipation of an upward movement in stock price)," says Gilani of Mape Securities. Goel of Karvy Private Wealth says, "It is important to look at the size of the buyback offer, the buyback price and the duration of the offer. This is because if the buyback size is too small compared with the overall market capitalisation of the company, the impact on the stock could be very small

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Bill Glazer To The RescueDocument54 pagesBill Glazer To The RescueNagesh PrabhuPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Stock Market DictionayDocument24 pagesStock Market DictionayManoj SharmaPas encore d'évaluation

- Audit of HR DepartmentDocument52 pagesAudit of HR DepartmentMahabubur Rahman সম্রাট100% (6)

- Characteristics of OligopolyDocument7 pagesCharacteristics of OligopolyHemanth KumarPas encore d'évaluation

- 04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Document78 pages04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Rocío QuijadaPas encore d'évaluation

- Ebook Basic TradesmartfxDocument47 pagesEbook Basic TradesmartfxDanny P100% (1)

- Aditya Birla Fashion and Retail LTD - Initiating Coverage - ACMIIL IE - 121118Document24 pagesAditya Birla Fashion and Retail LTD - Initiating Coverage - ACMIIL IE - 121118Siva KumarPas encore d'évaluation

- Tutorial 2 Questions With SolutionDocument4 pagesTutorial 2 Questions With SolutionVictoria Wang100% (1)

- VUL Mock ExamDocument5 pagesVUL Mock ExamMillet Plaza Abrigo100% (2)

- High Moat BusinessesDocument1 pageHigh Moat BusinessesManoj SharmaPas encore d'évaluation

- E-Learning: A Project Report OnDocument82 pagesE-Learning: A Project Report OnManoj SharmaPas encore d'évaluation

- Major Project ReportDocument84 pagesMajor Project ReportManoj SharmaPas encore d'évaluation

- Linear Programming I PDFDocument14 pagesLinear Programming I PDFManoj SharmaPas encore d'évaluation

- Compulsory Pathway Offline RegistrationDocument1 pageCompulsory Pathway Offline RegistrationManoj SharmaPas encore d'évaluation

- General Knowledge TodayDocument2 pagesGeneral Knowledge TodayManoj SharmaPas encore d'évaluation

- The World's First Collaborative Marketing PlatformDocument3 pagesThe World's First Collaborative Marketing PlatformpranjaliPas encore d'évaluation

- Chapter 1 Kotler Keller 2016Document93 pagesChapter 1 Kotler Keller 2016luthfi190100% (1)

- Unit 1Document6 pagesUnit 1lifeis coolPas encore d'évaluation

- Assignment 2Document2 pagesAssignment 2Shekhar Singh0% (3)

- Chapter 4 (Entrepreneurial Marketing)Document19 pagesChapter 4 (Entrepreneurial Marketing)CathPas encore d'évaluation

- Strengths in The SWOT Analysis of UCB:: Brand Awareness EventsDocument2 pagesStrengths in The SWOT Analysis of UCB:: Brand Awareness EventsLizzy McquirePas encore d'évaluation

- 12th MATHS 2Document49 pages12th MATHS 2noobPas encore d'évaluation

- Advantages of Low Transportation CostsDocument4 pagesAdvantages of Low Transportation CostsSan Vito Cano SchorpiohPas encore d'évaluation

- BCG Matrix: Presentation by Pratik Shirsat - 19020841030 Shreyas T. - 19020841032 Siva Sravan V. - 19020841033Document7 pagesBCG Matrix: Presentation by Pratik Shirsat - 19020841030 Shreyas T. - 19020841032 Siva Sravan V. - 19020841033Shirsat Raju100% (2)

- Chapter Three: Channels of Distribution ManagementDocument20 pagesChapter Three: Channels of Distribution ManagementmuhdfirdausPas encore d'évaluation

- MbaDocument45 pagesMbaSreedhar KonduruPas encore d'évaluation

- Market Segmentation Targeting and PositioningDocument25 pagesMarket Segmentation Targeting and PositioningnujhdfrkPas encore d'évaluation

- Lesson 10 Recognizing The Importance of Marketing Mix I Part 2 The Development of Marketing Strategies NOTESDocument6 pagesLesson 10 Recognizing The Importance of Marketing Mix I Part 2 The Development of Marketing Strategies NOTESShunuan HuangPas encore d'évaluation

- Coeca1-22 Week 6 Lesson 2Document18 pagesCoeca1-22 Week 6 Lesson 2taraPas encore d'évaluation

- Consumer Behavior Theory - NotesDocument12 pagesConsumer Behavior Theory - NotesKarina Barretto Agnes33% (3)

- Case Study JabongDocument8 pagesCase Study JabongZayn ZahirPas encore d'évaluation

- Principles of MarketingDocument17 pagesPrinciples of MarketingZAINAB MALIKPas encore d'évaluation

- Exam December 2021 With AnswersDocument7 pagesExam December 2021 With AnswersChuyện của Hành TâyPas encore d'évaluation

- Repeated GamesDocument27 pagesRepeated GamesUday SrivastavaPas encore d'évaluation

- Break-Even Analysis: Margin of SafetyDocument2 pagesBreak-Even Analysis: Margin of SafetyNiño Rey LopezPas encore d'évaluation

- Single Trade Discount and Discount Series: Lesson 8Document19 pagesSingle Trade Discount and Discount Series: Lesson 8귀여워gwiyowoPas encore d'évaluation

- Chapter 3 - QDocument15 pagesChapter 3 - QNguyễn Thảo MyPas encore d'évaluation

- Kings Company Has Two Decentralized DivisionsDocument3 pagesKings Company Has Two Decentralized DivisionsMeghan Kaye LiwenPas encore d'évaluation