Académique Documents

Professionnel Documents

Culture Documents

The U.S.A Economic Crisis

Transféré par

Andrei StoianTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The U.S.A Economic Crisis

Transféré par

Andrei StoianDroits d'auteur :

Formats disponibles

THE U.S. economy is currently experiencing its worst crisis since the Great Depression.

The crisis started in the home mortgage market, especially the market for so called !su"prime# mortgages, and is now spreading "eyond su"prime to prime mortgages, commercial real estate, corporate $unk "onds, and other forms of de"t. Total losses of U.S. "anks could reach as high as one third of the total "ank capital. The crisis has led to a sharp reduction in "ank lending, which in turn is causing a se%ere recession in the U.S. economy.

This article analy&es the underlying causes of the current crisis, estimates how "ad the crisis is likely to "e, and discusses the go%ernment economic policies pursued so far '"y "oth the (ed and )ongress* to deal with the crisis. The final section makes recommendations for more radical go%ernment policies that the left should ad%ocate and support in response to this crisis.

+. The decline of the rate of profit To understand the fundamental causes of the current crisis, we ha%e to look "ack o%er the entire post Second ,orld ,ar period. The most important cause of the su"par performance of the U.S. economy in recent decades is a %ery significant decline in the rate of profit for the economy as a whole. (rom +-./ to the mid +-0/s, the rate of profit in the U.S. economy declined almost ./ percent, from around 11 to around +1 percent 'see (igure +*. This significant decline in the rate of profit appears to ha%e "een part of a general worldwide trend during this period, affecting all capitalist nations. 2ccording to 3arxist theory, this %ery significant decline in the rate of profit was the main cause of the !twin e%ils# of higher unemployment and higher inflation, and hence also of lower real wages, experienced in recent decades. 2s in past periods of depression, the decline in the rate of profit reduced "usiness in%estment, which in turn resulted in slower growth and higher rates of unemployment. 2n important factor in the postwar period was that many go%ernments in the +-0/s attempted to reduce unemployment "y adopting expansionary fiscal and monetary policies 'more go%ernment spending, lower taxes, and lower interest rates*. Howe%er, these policies generally resulted in higher rates of inflation, as capitalist firms responded to the go%ernment stimulation of demand "y rapidly raising prices in order to restore the rate of profit, rather than "y increasing output and employment.

4n the +-5/s, financial capitalists re%olted against these higher rates of inflation, and generally forced go%ernments to adopt restricti%e policies,

especially tight monetary policy 'i.e., higher interest rates*. The result was less inflation and a return to higher unemployment. These facts demonstrate that go%ernment policies ha%e affected the particular com"ination of unemployment and inflation at particular times, "ut ne%ertheless the fundamental cause of "oth of these !twin e%ils# has "een the decline in the rate of profit.

1. Strategies to restore the rate of profit )apitalists ha%e responded to this decline "y attempting to restore the rate of profit in a %ariety of ways. 4n the U.S. economy, the last three decades ha%e "een characteri&ed a"o%e all else "y attempts "y capitalists to "ring the rate of profit "ack up to its earlier, higher le%els. 4 ha%e already mentioned the strategy of inflation, i.e., of increasing prices at a faster rate, which reduced real wages, or at least a%oided increases in real wages, so that all the "enefits of increasing producti%ity in recent decades ha%e gone to higher profits. 3ore recently, more and more companies in the U.S. are actually reducing money wages for the first time since the Great Depression. 3any workers ha%e "een faced with the choice of either accepting lower wages or losing their $o"s.

2nother widespread strategy has "een to cut "ack on health insurance and retirement pension "enefits. ,orkers are ha%ing to pay higher and higher premiums for health insurance, and many workers who thought that they would ha%e a comforta"le retirement are in for a rude awakening6 ha%ing to work until an older age and lea%ing fewer $o"s for younger workers. 2 recent article in the 7ew 8ork Times 3aga&ine was entitled !The end of pensions.#

2nother %ery common strategy to increase the rate of profit has "een to make workers work harder and faster on the $o"9 in other words, enforcing a !speedup.# Such a speedup in the intensity of la"or increases the %alue produced "y workers and therefore increases profit and the rate of profit. The higher unemployment of this period contri"uted to this speedup, forcing workers to compete with each other for the limited $o"s a%aila"le "y working harder. :ne common "usiness strategy has "een !downsi&ing,# i.e., lay off +/;1/ percent of a firm<s employees and then re=uire the remaining workers to do the work of the laid off workers. This method also generally increases the intensity of la"or e%en "efore the workers are laid off, as all workers work harder so that they will not "e among those whose $o"s are cut.

2 more recent strategy has "een to use "ankruptcy as a way to cut wages and "enefits drastically. )ompanies declare )hapter ++ "ankruptcy, which allows them to continue to operate, to renegotiate their de"ts, and, most importantly, to declare their union contracts null and %oid. This strategy was pioneered "y the steel industry in the +--/s, and spread to the airline industry in recent years. Half of the airline companies in the U.S. are currently in )hapter ++ "ankruptcy, and they are making %ery steep cuts in wages and "enefits '1. percent or more*.

The most recent example of this drastic strategy occurred at Delphi 2uto >arts, the largest auto parts manufacturer in the U.S., which was owned "y General 3otors until +---. Delphi declared )hapter ++ "ankruptcy in :cto"er 1//? and announced that it is cutting wages "y approximately two thirds 'from roughly @A/ per hour to roughly @+/ per hour* and reducing "enefits correspondingly. The Delphi chief executi%e 'who used to work in the steel industry* has pu"licly urged the automo"ile companies to follow the same strategy. This strategy could spread to the unioni&ed companies in the rest of the manufacturing sector of the economy in the years ahead.

2nother increasingly important strategy used "y capitalists to reduce wage costs has "een to mo%e their production operations to low wage areas around the world. This has "een the main dri%ing force "ehind the so called !glo"ali&ation# of recent decades6 a worldwide search for lower wages in order to increase the rate of profit. This is the essence of glo"ali&ation. This strategy also puts more downward pressure on wages in the U.S., "ecause of the much greater threat of outsourcing $o"s to other countries. 72(T2 and )2(T2 are of course %ery important parts of this o%erall glo"ali&ation strategy to reduce wages and increase the rate of profit.

The strategies used "y capitalist enterprises to increase their rates of profit in recent decades ha%e in general caused great suffering for many workersB higher unemployment and higher inflation, lower li%ing standards, and increased insecurity and stress and exhaustion on the $o". 3arx<s !general law of capitalist accumulation#Bthat the accumulation of wealth "y capitalists is accompanied "y the accumulation of misery for workersBhas "een all too o"%ious in recent decades in the U.S. economy 'and of course in most of the rest of the world*. 3ost 2merican workers today work harder and longer for less pay and lower "enefits than they did se%eral decades ago. 2n

era in which "lue collar workers in the U.S. could "e considered part of the middle class appears to ha%e ended.

4t also appears that this all out campaign "y capitalists to increase the rate of profit in all these ways has "een fairly successful in achie%ing its o"$ecti%e. 4t has taken a long time, "ut the rate of profit is now approaching the peaks achie%ed in the +-?/s, as we can see from (igure + 'charts a%aila"le only in hardcopy %ersion of this article*. The last se%eral years, especially since the recession of 1//+, ha%e seen a %ery strong reco%ery of profits, as real wages ha%e not increased at all, and producti%ity has increased rapidly 'C;. percent a year*. 2nd these estimates include only profits from domestic U.S. production, not the profits of U.S. companies from their production a"road. They also do not include the multimillion dollar salaries of top corporate executi%es. :n the other hand, these estimates do include a large and increasing percentage of profits from the financial sector 'approximately one third of total profit in recent years has "een financial profit*, much of which will pro"a"ly turn out to "e fictitious 'i.e., anticipated future earnings that are !"ooked# in the current year, "ut will pro"a"ly ne%er actually materiali&e "ecause of the crisis*. 2ll in all, 4 conclude that there has "een a %ery su"stantial and pro"a"ly almost complete reco%ery of the rate of profit in the United States.

2s we ha%e seen a"o%e, this reco%ery of the rate of profit of U.S. companies has "een accomplished at the expense of U.S. workers. 4t has also "een accomplished without a ma$or depression in the U.S. economy. 4 think this would ha%e surprised 3arx, who argued that $ust cutting wages "y itself would, in general, not "e enough "y itself to fully restore the rate of profit, and that such a restoration would usually re=uire, in addition, a deep depression characteri&ed "y widespread "ankruptcies that would result in a significant de%aluation of capital. That has not yet happened in the U.S. economy, and yet the rate of profit appears to "e more or less fully restored. Dut 4 don<t think 3arx en%isioned reducing wages "y as much as the -/ percent made possi"le "y !glo"ali&ation# and the dou"ling of the industrial reser%e army.

A. Search for new "orrowersBlow income workers Surprisingly and disappointingly, the reco%ery of the rate of profit has not resulted in a su"stantial increase of "usiness in%estment, and thus has not led to the kind of increase in employment that would normally "e expected.

(igure 1 shows that non residential in%estment as a percentage of GD> has remained at low le%els in spite of the reco%ery of the rate of profit. 4nstead, owners and executi%es ha%e chosen to spend their higher profits in other ways "esides in%esting in expanding their "usinesses6 '+* They ha%e paid out higher di%idends to stockowners 'i.e., to themsel%es*9 '1* they ha%e !"ought "ack# shares of their own companies, which has increased the prices of their stock and their executi%e compensation9 and 'A* they ha%e loaned the money out 'e.g., for mortgages*, there"y contri"uting to the financial speculati%e "u""le in recent years. )onse=uently, workers ha%e not e%en "enefited through the !trickle down# effect of more in%estment leading to more $o"s. 4nstead, capitalists ha%e spent their increased profits on luxury consumption 'e.g., airplanes, expensi%e automo"iles, multiple %acation homes, etc.* and in%ested their profits in low wage areas of the world, rather than in the United States '!glo"ali&ation,# as discussed a"o%e*.

2n important further conse=uence of the higher profits and the continued weakness of "usiness in%estment was that financial capitalists had lots of money to lend, "ut non financial corporations did not ha%e much need to "orrow. Therefore, financial capitalists went searching for new "orrowers. 3eanwhile, workers were strapped with stagnant wages and were all too eager to "orrow money to "uy a house or a new car, and sometimes e%en "asic necessities. So financial corporations increasingly focused on workers as their "orrower customers o%er the last decade or so, especially for home mortgages. The percentage of "ank lending to households increased from A/ percent in +-0/ to ./ percent in 1//?. The total %alue of home mortgages tripled "etween +--5 and 1//?. 2nd the ratio of household de"t to disposa"le income increased from ?/ percent in +-0/ to +// percent in 1/// to +C/ percent in 1//0 'see (igure A*. This was an extraordinary increase of household de"t, unprecedented in U.S. history.

Howe%er, financial capitalists soon ran out of !credit worthy# workers who =ualified for !prime# mortgages. Dut they still had lots of money to lend out, so they decided to expand into su"prime mortgages for less credit worthy workers who had less income. These su"prime mortgages re=uired little or no down payments and little or no documentation of the "orrower<s income 'for this reason, these mortgages were sometimes called !liar loans#*. Su"prime mortgages as a percentage of total mortgages increased from 0 percent in 1/// to 1/ percent in 1//?. The most extreme of these new types of mortgages were called 747E2 loans, with 747E2 standing for !7o 4ncome, 7o Eo", 7o 2ssets,# and yet "orrowers still !=ualified# for mortgages 'se%eral companies actually ad%ertised with green turtles*.

8ou might think that this new strategy of financial capitalistsBto lend to low income workersBwould "e %ery risky and not %ery profita"le. There would seem to "e a high pro"a"ility that these low income workers would sooner or later default on their loans and the financial capitalists would lose money. Howe%er, further details of this strategy were supposed to take care of this pro"lem.

To "egin with, "orrowers were gi%en low mortgage rates that they could pro"a"ly afford for the first two to three years 'these initial low rates were called !teaser rates#*. 2nd the strategy was that "y the time the teaser rates expired and the rates were to "e ad$usted upward, the %alue of their homes would ha%e increased enough so that a new mortgage could "e taken out and the old mortgage paid off. Howe%er, this strategy worked only as long as housing prices were increasing. ,hen housing prices stopped increasing in 1//?, this strategy no longer worked. :ld mortgages could no longer "e refinanced, so the "orrowers were stuck with higher reset mortgage rates that they could not afford, and the default rates started to increase.

C. Structure of home mortgage market The structure of the U.S. home mortgage market in recent decades also contri"uted to the expansion of mortgages to low income workers. )ommercial "anks used to make mortgages and own them for their entire thirty year term, and thus had a strong financial incenti%e to try to make sure that the "orrowers were credit worthy and likely to "e a"le to keep up with their mortgage payments. Dut "eginning in the +-5/s, commercial "anks no longer held onto these mortgages !in their own portfolio,# "ut instead sold the mortgages to in%estment "anks, which in turn pooled together hundreds and e%en thousands of mortgages as !mortgaged "ased securities# 'securiti&ation*. The in%estment "anks then sold these mortgage "ased securities to hedge funds, pension funds, foreign in%estors, etc.

:ne important result of the securiti&ation of mortgages was that the !originators# of mortgagesBcommercial "anks and mortgage companiesBno longer had a financial incenti%e to make sure that the home "uyers were creditworthy and were likely to "e a"le to keep up with their monthly mortgage payments. 4ndeed, these originators ha%e per%erse financial incenti%es to lower credit standards and to ignore possi"le pro"lems with

creditworthiness, "oth "ecause they will soon sell the mortgage to other in%estors, and also "ecause they earn their income from !origination fees,# not from the e%entual monthly mortgage payments. So the more mortgages originated, the more fees, and the more income for the originators, no matter what the creditworthiness of the "orrowers might "e 'or not "e*. 4n%estment "anks ha%e a similar per%erse incenti%e in their role as "rokers or middlemen in the securiti&ation process. 4n%estment "anks primarily "uy mortgages from the originators and sell them to the final in%estors, and make most of their money from !processing fees# 'or !"roker fees#*. So again, the more mortgage "ased securities sold, the more fees and income for in%estment "anks, whether or not the "orrowers can make their payments down the road.

The reader might ask6 didn<t someone care a"out and pay attention to the creditworthiness of the "orrowersF Surely, the final in%estors or owners of the mortgage "ased securities should ha%e cared. Howe%er, these mortgage "ased securities are extremely complicated and consist of hundreds or thousands of mortgages. 4t is a %ery time consuming and tedious task to carefully examine the creditworthiness of such large num"ers of "orrowers. Therefore, the final in%estors depended to a large extent on the "ond rating agencies '3oody<s, Standard and >oor<s, (itch<s* to e%aluate the risks in the mortgage "ased securities and to assign ratings to them, similar to their rating of corporate "onds. The highest rating for the lowest risk securities is 222, and the ratings go down from there as the risk of the securities goes up.

Howe%er, there was a per%erse incenti%e at work with the rating agencies as well. Gating agencies are pri%ate, profit making "usinesses that compete with one another for the rating "usiness of the in%estment "anks. Gating mortgage "ased securities "ecame a %ery lucrati%e "usiness in recent decades, along with the growing securiti&ation of mortgages. Therefore, there was a %ery strong incenti%e for the rating agencies to gi%e the highest 222 rating to e%en risky mortgage "ased securities, so they would continue to get the "usiness of these in%estment "anks in the future. 4t has recently come out that in some cases in%estment "anks re=uested that specific employees of the rating agencies "e remo%ed from rating their mortgage "ased securities "ecause of the !excessi%e diligence# of these employees, and these re=uests were generally granted.

4n sum, the securiti&ation of mortgages was a process that was filled with

per%erse incenti%es to ignore the credit risks of the "orrowers, and to make as much money as possi"le on %olume and processing fees.

.. The current crisis The housing "u""le started to "urst in 1//?, and the decline accelerated in 1//0 and 1//5. Housing prices stopped increasing in 1//?, started to decrease in 1//0, and ha%e fallen a"out 1. percent from the peak so far. The decline in prices meant that homeowners could no longer refinance when their mortgage rates were reset, which caused delin=uencies and defaults of mortgages to increase sharply, especially among su"prime "orrowers. (rom the first =uarter of 1//? to the third =uarter of 1//5, the percentage of mortgages in foreclosure tripled, from + percent to A percent, and the percentage of mortgages in foreclosure or at least thirty days delin=uent more than dou"led, from C.. percent to +/ percent. These foreclosure and delin=uency rates are the highest since the Great Depression9 the pre%ious peak for the delin=uency rate was ?.5 percent in +-5C and 1//1. 2nd the worst is yet to come. The 2merican dream of owning your own home is turning into an 2merican nightmare for millions of families.

Early estimates of the total num"er of foreclosures that will result from this crisis in the years to come ranged from A million 'Goldman Sachs, 4nternational 3onetary (und* to 5 million '7uriel Gou"ini, a 7ew 8ork Uni%ersity economics professor whose forecasts carry some weight "ecause he was one of the first to predict se%eral years ago the "ursting of the housing "u""le and the current recession*. So far 'as of Eanuary 1//-*, there ha%e already "een almost A million mortgage foreclosures. 2nother + million mortgages are ninety days delin=uent 'foreclosure notices usually go out after ninety days*, and another 1 million were thirty days delin=uent. Therefore, a total of a"out ? million mortgages either ha%e already "een foreclosed, are in foreclosure, or are close to foreclosure. Six million mortgages are a"out +1 percent of all the mortgages in the United States. The situation could get a lot worse in the months ahead, due to the worsening recession and lost $o"s and income, unless the go%ernment adopts stronger policies to reduce foreclosures.

Defaults and foreclosures on mortgages mean losses for lenders. Estimates of losses on mortgages keep increasing, and many are now predicting losses of @+ trillion or more.

4n addition to losses on mortgages, there will also "e losses on other types of loans, due to the weakness of the economy, in the months ahead6 consumer loans 'credit cards, etc.*, commercial real estate, corporate $unk "onds, and other types of loans 'e.g. credit default swaps*. Estimates of losses on these other types of loans range up to another trillion dollars. Therefore, total losses for the financial sector as a whole could "e as high as @1 trillion.

4t is further estimated that "anks will suffer a"out half of the total losses of the financial sector. The rest of the losses will "e "orne "y non "ank financial institutions 'hedge funds, pension funds, etc.*. Therefore, di%iding the total losses for the financial sector as a whole in the pre%ious paragraph "y two, the losses for the "anking sector could "e as high as @+ trillion. Since the total "ank capital in the U.S. is approximately @+.. trillion, losses of this magnitude would wipe out two thirds of the total capital in U.S. "anksHI This would o"%iously "e a se%ere "low, not $ust to the "anks, "ut also to the U.S. economy as a whole.

The "low to the rest of the economy would happen "ecause the rest of the economy is dependent on "anks for loansB"usinesses for in%estment loans, and households for mortgages and consumer loans. Dank losses result in a reduction in "ank capital, which in turn re=uires a reduction in "ank lending 'a credit crunch*, in order to maintain accepta"le loan to capital ratios. 2ssuming a loan to capital ratio of +/6+ 'this conser%ati%e assumption was made in a recent study "y Goldman Sachs*, e%ery @+// "illion loss and reduction of "ank capital would normally result in a @+ trillion reduction in "ank lending and corresponding reductions in "usiness in%estment and consumer spending. 2ccording to this rule of thum", e%en the low estimate of "ank losses of @+ trillion would result in a reduction of "ank lending of @+/ trillionH This would "e a se%ere "low to the economy and would cause a se%ere recession.

Dank losses may "e offset to some extent "y !recapitali&ation,# i.e., "y new capital "eing in%ested in "anks from other sources. 4f "ank capital can "e at least partially restored, then the reduction in "ank lending does not ha%e to "e so significant and traumatic. So far, "anks ha%e lost a"out @.// "illion and ha%e raised a"out @C// "illion in new capital, most of it coming from !so%ereign wealth funds# financed "y the go%ernments of 2sian and 3iddle Eastern countries. So ironically, U.S. "anks may "e !sa%ed# 'in part* "y

increasing foreign ownership. U.S. "ankers are now figurati%ely on their knees "efore these foreign in%estors offering discounted prices and pleading for help. 4t is also an important indication of the decline of U.S. economic hegemony as a result of this crisis. Howe%er, it is "ecoming more difficult for "anks to raise new capital from foreign in%estors, "ecause their prior in%estments ha%e already suffered significant losses.

4n addition to the credit crunch, consumer spending will "e further depressed in the months ahead due to the following factors6 decreasing household wealth9 the end of mortgage e=uity withdrawals 'which were %ery significant in the recent "oom*9 and declining $o"s and incomes. 2ll in all, it is shaping up to "e a %ery se%ere recession.

?. Go%ernment policies The federal go%ernment has acted fairly %igorously in attempts to pre%ent a more serious crisis, and has "een modestly successful in the short run, "ut it remains to "e seen how successful it will "e in the long run.

?.+ (ederal Geser%e. The (ederal Geser%e initially adopted %ery expansionary policies 'lower short term interest rates and increased loans to commercial "anks* in the hopes that "anks would increase their lending to "usinesses and households. Howe%er, these traditional policies ha%e not "een effecti%e, "ecause "anks ha%e "een unwilling to increase their lending, "oth "ecause they do not trust the creditworthiness of the "orrowers and also "ecause the loss of capital that they ha%e suffered 'and will continue to suffer* re=uires that they reduce their lending in order to maintain accepta"le loan to capital ratios.

Decause of this failure of traditional policies, the (ed "egan to impro%ise with new unprecedented policies. 4t "roadened the eligi"le collateral for its loans9 pre%iously only Treasury "onds were eligi"le, "ut now all sorts of more risky securities are eligi"le, including mortgage "ased securities. 3ost importantly, the (ed extended loans to in%estment "anks for the first time in its history. 4n%estment "anks are not regulated "y the (ed, so it has always "een thought that the (ed had no responsi"ility to act as !lender of last resort# to in%estment "anks when they are in trou"le. Howe%er, when the in%estment "ank Dear Stearns was on the %erge of "ankruptcy in late 3arch, the (ed

decided that it had to act as lender of last resort to Dear Stearns and E>3organ )hase, which took o%er Dear Stearns. Since Dear Stearns was hea%ily inde"ted to so many different financial institutions, its "ankruptcy would ha%e caused %ery widespread losses and could ha%e resulted in a complete meltdown of the U.S. financial systemBno"ody lending money to any"ody for anythingBand a disaster for the economy. That was (ed chief Den Dernanke<s nightmare, and why the (ed inter%ened so =uickly and decisi%ely as lender of last resort to these in%estment "anks. The (ed $ustified its going "eyond its traditional "oundaries "y saying that !the financial system of the U.S. was at risk.# The (ed<s statement and its action are clear e%idence of how fragile and unsta"le the U.S. financial system is at the present time.

Then, in Septem"er 1//5, when the "ankruptcy of Jehman Drothers 'at the time the fourth largest in%estment "ank in the U.S.* triggered a worsening of the crisis, the (ed took an e%en more extraordinary and unprecedented step to "ail out an insurance company, 24G, the largest insurance company in the world. 24G had dominated the market for credit default swaps, which are a form of insurance against the default of "onds, including high risk, mortgage "ased securities, as well as a form of speculation that "onds and other securities will default. Dut 24G was in such financial trou"le that the (ed feared the company would not "e a"le to pay off on all the insurance policies that it had sold. 2nd failure "y 24G to pay off would mean losses for "anks 'and others* that had "ought this insurance, adding more losses to the already staggering losses suffered "y "anks. So once again, the (ed decided that it had to "ail out 24G in order to !sa%e the financial system.#

So far, the (ed<s unprecedented policies ha%e "een mildly successful, "ut "y no means a complete success. 2t least an all out financial collapse has "een a%erted 'for now*. 2nd in%estor confidence seems to ha%e "een restored somewhat "y the demonstrated commitment on the part of the (ed to do e%erything possi"le to a%oid a financial disaster. Howe%er, commercial "anks and in%estment "anks ha%e still not increased their lending. 2nd the (ed<s policies do not sol%e and cannot sol%e the fundamental pro"lems of too much household de"t, declining housing prices and rising foreclosure rates.

?.1 )ongress. 4n (e"ruary 1//5, )ongress =uickly passed an !economic stimulus# "ill of @+?5 "illion that included tax re"ates for households and tax cuts for "usinesses. These tax cuts had some positi%e effect on the economy

last summer, "ut their effect was small and temporary. 2t "est, the tax re"ates pro%ided a one time "oost to consumer spending, since these re"ates could "e spent only once.

The incoming :"ama administration and Democrats in )ongress are working on a second, much larger stimulus package of a"out @5./ "illion, which will consist of two thirds increased spending 'with emphasis on aid to states, education, unemployment "enefits, and pu"lic works infrastructure pro$ects and one third tax cuts 'mainly on payroll taxes*. This second stimulus package will "e somewhat more effecti%e than the first, mainly "ecause it is so much "igger, and also "ecause more of the total money is for increased spending rather than lower taxes. So this stimulus will make the recession somewhat less se%ere than it otherwise would ha%e "een, "ut 4 don<t think it will generate a reco%ery of the economy in the last half of 1//-, as most economists think. 4 think the downward forces in the economy are so strong right nowBcut"acks here leading to further cut"acks there, in a mutually reinforcing downward spiralBthat the economy will continue to decline at least through 1//- and pro"a"ly most of 1/+/.

The positi%e effects of this second stimulus will "e short li%ed, like the first one. 4f the economy is still contracting in 1/+/, there will pro"a"ly "e a need for a third stimulus plan. Dut will that "e possi"leF 2nd in the long run, there are possi"le negati%e effects of this wildly expansionary fiscal policy. ,hen the reco%ery finally comes, it will "e slower than usual, "ecause interest rates will ha%e to "e higher and taxes will ha%e to "e higher in order to pay for today<s stimulus spending and tax cuts. >lus, expansionary fiscal policy does not sol%e the fundamental pro"lem in the economyBthe hea%y de"t "urdens of households and "usinesses that threaten "ankruptcies and restrain spending. 2 significant portion of this de"t must "e written off if this fundamental pro"lem is to "e sol%ed.

4n Euly 1//5, )ongress passed an anti foreclosure measure, which allows for the refinancing of existing mortgages, which are in default with new mortgages that would ha%e a %alue of approximately 5. percent of the current market %alue of the houses, and would "e guaranteed "y the (ederal Housing 2dministration. Howe%er, the lenders must initiate this refinancing, and so far %ery few lenders ha%e "een willing to initiate these new mortgages with write downs of the principle owed.

4n early Septem"er 1//5, (annie 3ae and (reddie 3ac, the two giant home mortgage companies that own or guarantee almost half of the total mortgages in the U.S., were in danger of "ankruptcy due to the continued deterioration of the home mortgage industry. The Treasury responded "y taking o%er (annie and (reddie in a conser%atorship and guaranteeing to pay all their de"ts in full. This "ailout will pro"a"ly cost taxpayers hundreds of "illions of dollars. ,illiam >oole 'ex president of the St. Jouis (ed* has estimated that the total cost to taxpayers could "e in the neigh"orhood of @A// "illion.

The $ustification for this "ailout of (annie and (reddie was similar to that of Dear StearnsBthat they were in danger of going "ankrupt, and if that happened, then the U.S. home mortgage industry and the home construction industry pro"a"ly would ha%e collapsed almost completely, which would ha%e dealt a serious "low to the U.S. economy as a whole.

Then in late Septem"er, as the crisis worsened, Treasury Secretary >aulson re=uested and )ongress appro%ed 'in the threatening en%ironment of a rapidly falling stock market* @0// "illion to purchase high risk, mortgage "ased securities '!toxic waste#* from U.S. "anks. @0// "illion is a lot of money9 it is @1,A// for e%ery man, woman, and child in the United States. Soon after the law was passed, >aulson changed his mind, and decided to use the @0// "illion to !in$ect capital# into "anks 'rather than purchase their toxic securities*, in the hopes that this would "e a "etter way to encourage "anks to increase their lending. So far, the first half of the @0// "illion has "een spent, as a giant "ailout of the "anks and their "ondholders, "ut "anks ha%e still not "een willing to increase their lending. >rospects are similar for the second half of this "ank "ailout money.

The $ustification for this "ailout, like the pre%ious ones, is that, if the go%ernment did not "ail out the "anks and their "ondholders, then the whole financial system in the U.S. would collapse 'in the memora"le words of the worst president in U.S. history6 !this sucker would go down#*. E%en the dreaded !d word# is heard more and more, like a gun to our heads. 4t is a kind of economic !Sophie<s )hoice#Beither "ail out the "ondholders with taxpayers< money or suffer a deep recession or depression.

Ha%ing to choose "etween these options represents a stinging indictment of

our current financial system. The situation suggests that the capitalist financial system, left on its own, is inherently unsta"le, and can only !a%oid# crises "y "eing "ailed out "y the go%ernment, at the taxpayers< expense. There is a dou"le indictment here6 the capitalist financial system is inherently unsta"le and the necessary "ailouts are economically un$ust.

0. 7ationali&e finance Thus we can see that there is a cruel dilemma in capitalist economies for go%ernments and the pu"lic and also for the left. ,hen a financial crisis threatens, or "egins, there seem to "e only two options6 "ail out the financial capitalists in some way or suffer a more se%ere financial crisis, which in turn will cause an e%en more se%ere crisis in the economy as a whole, which will cause widespread misery and hardships.

The only way to a%oid this cruel dilemma is to make the economy less dependent on financial capitalists. 2nd the only way to accomplish this greater independence from financial capitalists is for the go%ernment itself to "ecome the main pro%ider of credit in the economy, especially for home mortgages, and perhaps also for consumer loans, and may"e e%en e%entually for "usiness loans. 4n other words, finance should "e nationali&ed and operated "y the go%ernment in the interest of pu"lic policy o"$ecti%es.

,hat this means in the U.S. today is, first of all, the =uasi nationali&ation of (annie 3ae and (reddie 3ac that has already occurred should "e made permanent, and these go%ernment mortgage agencies should "e used to achie%e the pu"lic policy goal of decent afforda"le housing for all, rather than profit maximi&ation. Secondly, ma$or "anks '!systematically significant# "anks that are !too "ig to fail#* that are in danger of "ankruptcy should "e nationali&ed and operated in order to achie%e similar pu"lic policy o"$ecti%es. These nationali&ations should also in%ol%e a significant writedown of the existing de"t of (annie and (reddie and the nationali&ed "anks 'as is usually done in "ankruptcy proceedings*, in order to make these financial institutions sol%ent again without costing taxpayers anything.

,e ha%e to do something like this. :therwise, we will continue to face the same cruel dilemma of either "ailing out financial capitalists or suffering a worse economic crisis o%er and o%er again in the future, as will our children

and their children. ,ithin the institutional framework of financial capitalism, these are the only two options. 4n order to create other options 'more worker friendly options*, we ha%e to change drastically the institutional framework of financial capitalism9 we ha%e to con%ert capitalist finance into nationali&ed go%ernment finance.

The nationali&ation of "anks would not sol%e the current economic crisis completely, "ut it would help sta"ili&e the "anking system and could lead to increased lending to creditworthy "usinesses and consumers. 2 full solution to the current crisis re=uires a"o%e all else a significant writedown of the huge mountains of de"t "uilt up in recent decadesBhome mortgage de"t, consumer de"t, "usiness de"t, "ank de"t, etc.

The nationali&ation of "anks is not socialism, "ut it could "e an important step on the road to socialism. The use of go%ernment "anks to pursue important pu"lic policy o"$ecti%es, rather than profit maximi&ation, would "e a model for the rest of the economy. 3ore and more people would reali&e that an entire economy run according to democratically decided policy o"$ecti%es would "e "etter for the %ast ma$ority of 2mericans than our current economy, which is run according to profit maximi&ation, produces great ine=uality, and is highly unsta"le and prone to crises, like the present crisis, that cause great suffering and hardship. Surely we can create an economic system "etter than this.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- TDStds 65607 Woc en Uk 20200514082718 LR PDFDocument1 pageTDStds 65607 Woc en Uk 20200514082718 LR PDFAndrei StoianPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- jgt424t - TRW Automotive Aftermarket PartsDocument1 pagejgt424t - TRW Automotive Aftermarket PartsAndrei StoianPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Introduction To EconomicsDocument16 pagesIntroduction To EconomicsAndrei StoianPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Tutorial 1 Essential Skills City EngineDocument14 pagesTutorial 1 Essential Skills City EngineFoxjarJaffPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- C1BxaOC0 IS PDFDocument92 pagesC1BxaOC0 IS PDFSrinivas ReddyPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Politics of The USADocument4 pagesThe Politics of The USAAndrei StoianPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Third Periodical Test in TLE VI (Home Eco)Document3 pagesThird Periodical Test in TLE VI (Home Eco)irecPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Bicycle Parts Manufacturing Unit CarrierDocument17 pagesBicycle Parts Manufacturing Unit CarrierAftabunarPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Gen EwsDocument2 pagesGen EwsPramod ReddyPas encore d'évaluation

- Finance Module 8 Capital Budgeting - InvestmentDocument8 pagesFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Ashok Jain FinalDocument8 pagesAshok Jain FinalSonu KumarPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Amit Singh - Ssjcet20024 - Financial Accounting AssignmentDocument16 pagesAmit Singh - Ssjcet20024 - Financial Accounting AssignmentSushma YadavPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Elasticity of Demand and Supply: Mcgraw-Hill/IrwinDocument21 pagesElasticity of Demand and Supply: Mcgraw-Hill/IrwinZenedel De JesusPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Laws Relating To Finance and Support Services of TESDA, CHED, Dep-EdDocument51 pagesLaws Relating To Finance and Support Services of TESDA, CHED, Dep-EdEron Roi Centina-gacutan100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Articles of Association of Single Member CompanyDocument7 pagesArticles of Association of Single Member CompanyM.SohailPas encore d'évaluation

- Corporate+Presentation August 2015 Enercom FINALDocument27 pagesCorporate+Presentation August 2015 Enercom FINALpco123Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- New Contractor's License Application FormDocument25 pagesNew Contractor's License Application FormAlexander Madayag80% (30)

- Does Competition Destroy Ethical Behavior?: Ndrei HleiferDocument5 pagesDoes Competition Destroy Ethical Behavior?: Ndrei HleiferKlinik Jurnal KJ FH UBPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- ProjectsDocument2 pagesProjectsshane89Pas encore d'évaluation

- SAP Financial ClosingDocument33 pagesSAP Financial ClosingIrfan Basha100% (2)

- IND As 116 Leases BDO in IndiaDocument4 pagesIND As 116 Leases BDO in Indiaprachi soniPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Internship Report On "General Banking & Foreign Exchange Activities of BASIC Bank Limited: A Study On Dilkusha Corporate BrunchDocument88 pagesInternship Report On "General Banking & Foreign Exchange Activities of BASIC Bank Limited: A Study On Dilkusha Corporate BrunchRayhan Zahid HasanPas encore d'évaluation

- L1 Question and Answer June 2016Document19 pagesL1 Question and Answer June 2016Metick Micaiah100% (2)

- UttarakhandDocument383 pagesUttarakhandhiteshnayyar123Pas encore d'évaluation

- CIR v. DLSUDocument2 pagesCIR v. DLSUJoseph DimalantaPas encore d'évaluation

- Maf 603 (Dividend Policy)Document5 pagesMaf 603 (Dividend Policy)culaini sayongPas encore d'évaluation

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomPas encore d'évaluation

- Analysing Service-Level Solvency of Local Governments From Accounting Perspective: A Study of Local Governments in The Province of Yogyakarta Special Territory, IndonesiaDocument15 pagesAnalysing Service-Level Solvency of Local Governments From Accounting Perspective: A Study of Local Governments in The Province of Yogyakarta Special Territory, IndonesiaAlicia JasminePas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Companies and PartnershipsDocument24 pagesCompanies and Partnershipsh1kiddPas encore d'évaluation

- "Equity Research On Cement Sector": Master of Business AdministrationDocument62 pages"Equity Research On Cement Sector": Master of Business AdministrationVishwas ChaturvediPas encore d'évaluation

- #124 East Main Ave. Laguna Technopark Biñan, Laguna, Philippines LagunaDocument1 page#124 East Main Ave. Laguna Technopark Biñan, Laguna, Philippines LagunaJoshua DescallarPas encore d'évaluation

- Accounting For Merchandising OperationsDocument53 pagesAccounting For Merchandising OperationsTanvirPas encore d'évaluation

- Consolidation of WiproDocument82 pagesConsolidation of WiproMUKESH MANWANIPas encore d'évaluation

- Customers - The Focus of Service ManagementDocument31 pagesCustomers - The Focus of Service ManagementMuthusamy SenthilkumaarPas encore d'évaluation

- China Banking Corporation, - Court of Appeals, Commissioner of Internal Revenue and Court of Tax AppealsDocument9 pagesChina Banking Corporation, - Court of Appeals, Commissioner of Internal Revenue and Court of Tax AppealsJose Antonio BarrosoPas encore d'évaluation

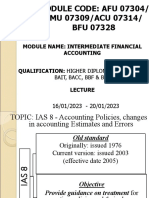

- IAS 8 PPT FinalDocument19 pagesIAS 8 PPT Finaljaneth pallangyoPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)