Académique Documents

Professionnel Documents

Culture Documents

SDF SDFDF 32 SDFDSF SDFDSF

Transféré par

Dineshan PTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SDF SDFDF 32 SDFDSF SDFDSF

Transféré par

Dineshan PDroits d'auteur :

Formats disponibles

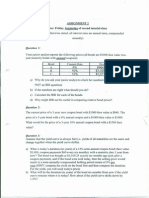

APS 1002 Financial Engineering May 25 2009 Name_______________________________________ Student number_______________________________ Exam 1 Instructions: Closed notes and book.

Non-programmable calculator permitted. Problem 1 (30 points, 10 points per part) Part 1: Suppose $1 dollar were invested in 1776 at 6.6% interest compounded yearly. Approximately how much would that investment be worth today? Choose one: (a) $500,000 (b) $1,750,000 (c) 1,000,000 (d) $2,000,000. Part 2: Consider two 5-year bonds (with face values of $100 for both): one has a 9% coupon and currently sells for 101.00, the other has a coupon of 7% and currently sells for 93.20. What is the price of a synthetic 5 year 0-coupon bond? Choose one: (a) $50.75 (b) $65.90 (c) $68.00 (d) $57.85. Part 3: What is the effective annual rate for 18% compounded quarterly? Choose one: (a) 19.56% (b) 19.77% (c) 18.99% (d) 19.25%? Problem 2 (40 points, 10 points for each part) Consider the four bonds having annual payments as shown in the table below. end of year payment Bond A year 1 year 2 year 3 100 100 Bond B 50 50 Bond C Bond D 0 0 01000 0

1001000 501000 01000 0

Suppose the yield to maturity of all the bonds is 15%. (a) Determine the price of bonds A and C. (b) Which bond is most sensitive to a change in yield? and why? (c) Suppose that you owe $2,000 at then end of 2 years. Concern about interest rate risk suggests that a portfolio consisting of the bonds and the obligation should be immunized. If V A ,V B , V c , V d are the total value of bonds of types A,B,C, and D to buy,respectively, write down the equations that represent the immunization. (Do not solve the equations, but explain what each equation does.) (d) In order to immunize the portfolio, you decide to use bond C and one other bond. Which other bond should you choose? Then, find the total amounts of each of the bonds to purchase for the immunization. Problem 3 (20 points) Suppose that a bank receives the following liability schedule year 1 year 2 year 3 i.e. the bank needs to pay 12,000 at the end of the first 12,000 18,000 20,000 year, 18,000 at the end of the second year, and 20,000 at the end of the third year.

The bank wishes to use the three bonds below to form a portfolio that will generate the required cash to meet the liabilities. All bonds have face value of a 100 and the coupons are annual (with one coupon per year). For example, one unit of Bond 2 costs 99 now and the holder will receive 3.5 after 1 year and then 3.5 plus the face value of 100 at the end of the second year. Bond Price Coupon 1 5 2 3 98 3 102 99 2

3.5 3.5

Maturity year 1

Formulate an optimization model that can be used to find the lowest cost bond portfolio consisting of bonds 1,2, and 3 above that will meet the liabilities. In your model you wish to allow carry over of money to future periods [i.e. you may generate more cash than needed to meet a liability] (the money should be carried over at 0% interest earned i.e. assume you earn no interest for extra cash carried over time). (Note: you must write out the detailed model showing all coefficients and variables in all constraints and objective function, explain all decision variables. DO NOT WRITE A GENERAL MODEL, Do not solve the model.) Problem 4 (10 points) You wish to invest in 3 securities S, B, and M. The expected returns for each security are S 10. 73%, B 7. 37%, M 6. 27%. The standard deviations of returns of the securities are S 16. 67%, B 10. 55%, M 3. 40%. The correlations of the returns between securities are given in the following table: ij S S B M 1 B 1 M -0.0545 1 0.2199 0.0366

Formulate an appropriate optimization model whose solution will give the optimal portfolio weightings for stocks, bonds, and money market (optimal in the sense of finding the minimum variance portfolio that achieves a desired level of return). The formulation must write out all of terms of the objective and the constraints with all coefficients taking on their appropriate numerical values! Define all decisions variables as well. DO NOT WRITE A GENERAL MODEL. And of course, you do not have to solve the model!!

Vous aimerez peut-être aussi

- Midterm 2012 APS1002Document3 pagesMidterm 2012 APS1002Mert Ertuğrul SayınPas encore d'évaluation

- FNCE-611 Wharton Waiver Exam Guide16Document21 pagesFNCE-611 Wharton Waiver Exam Guide16merag76668Pas encore d'évaluation

- Week 6Document7 pagesWeek 6Phil OdendronPas encore d'évaluation

- Bus 306 Exam 2 - Fall 2012 (A) - SolutionDocument15 pagesBus 306 Exam 2 - Fall 2012 (A) - SolutionCyn SyjucoPas encore d'évaluation

- 33 Comm 308 Final Exam (Summer 1 2018)Document16 pages33 Comm 308 Final Exam (Summer 1 2018)Carl-Henry FrancoisPas encore d'évaluation

- Spring03 Final SolutionDocument14 pagesSpring03 Final SolutionrgrtPas encore d'évaluation

- Assign 3 BEP Depreciation Sem 2-15-16Document3 pagesAssign 3 BEP Depreciation Sem 2-15-16Meor Aiman0% (1)

- MGF633 Assignment 4 - Fall 2010Document2 pagesMGF633 Assignment 4 - Fall 2010Mahmoud TaabodiPas encore d'évaluation

- Tutorial 1-3Document3 pagesTutorial 1-3xiyums chenPas encore d'évaluation

- Homework 01Document3 pagesHomework 01Tommy Chan Lui HoPas encore d'évaluation

- Mockexam Withsolutions20111004082649Document6 pagesMockexam Withsolutions20111004082649lehoangthuchienPas encore d'évaluation

- Answer FIN 401 Exam2 Fall15 V1Document7 pagesAnswer FIN 401 Exam2 Fall15 V1mahmudPas encore d'évaluation

- Bond Portfolio Management 25728 Autumn 2012 Assignment 1Document5 pagesBond Portfolio Management 25728 Autumn 2012 Assignment 1Dai DexterPas encore d'évaluation

- Bonds Test 1Document7 pagesBonds Test 1dfvybgunimPas encore d'évaluation

- D2fin ExamDocument17 pagesD2fin ExamjeffleeterPas encore d'évaluation

- Sample Bond ProblemsDocument2 pagesSample Bond ProblemsVanny Gimotea Baluyut100% (1)

- Problem 1.28: A) How High Do The Maintenance Margin Levels For Oil and Gold Have To Be Set So ThatDocument6 pagesProblem 1.28: A) How High Do The Maintenance Margin Levels For Oil and Gold Have To Be Set So Thataderajew shumetPas encore d'évaluation

- Chapter 4 Nominal and Effective Interest RateDocument42 pagesChapter 4 Nominal and Effective Interest RateRama Krishna100% (1)

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniPas encore d'évaluation

- Practice Midterm RSM330Document13 pagesPractice Midterm RSM330JhonGodtoPas encore d'évaluation

- 125.230 Mid-Term Test & Solutions - (1001)Document13 pages125.230 Mid-Term Test & Solutions - (1001)Tong Pan0% (1)

- Final Exam ADocument4 pagesFinal Exam Arheixzyl130Pas encore d'évaluation

- Ifaa 2Document2 pagesIfaa 2GUDATA ABARAPas encore d'évaluation

- Econ161A Winter2015 ExamFinalDocument16 pagesEcon161A Winter2015 ExamFinalKensan Flipmagic Jr.Pas encore d'évaluation

- 33 Comm 308 Final Exam (Summer 1 2018) SolutionsDocument13 pages33 Comm 308 Final Exam (Summer 1 2018) SolutionsCarl-Henry FrancoisPas encore d'évaluation

- Fixed Income Q1 March 2008Document2 pagesFixed Income Q1 March 2008jacch123Pas encore d'évaluation

- QUIZ2BDocument12 pagesQUIZ2BHa MinhPas encore d'évaluation

- Sapm Compre Partb QPDocument15 pagesSapm Compre Partb QPXavier CharlesPas encore d'évaluation

- 4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)Document8 pages4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)mohanraokp2279Pas encore d'évaluation

- Financial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988Document7 pagesFinancial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988EshanMishraPas encore d'évaluation

- FN2190 Ota Final Exam PaperDocument7 pagesFN2190 Ota Final Exam PaperNoor NoorPas encore d'évaluation

- Assignment 1Document31 pagesAssignment 1saad bin sadaqatPas encore d'évaluation

- 07 Comm 308 Final Exam (Fall 2010) SolutionsDocument16 pages07 Comm 308 Final Exam (Fall 2010) SolutionsAfafe ElPas encore d'évaluation

- FM - Hosp - Tutorial 5Document7 pagesFM - Hosp - Tutorial 5Sylvia AnnePas encore d'évaluation

- Quiz 1: Aybe MaybeDocument26 pagesQuiz 1: Aybe MaybeАлексей НикифоровPas encore d'évaluation

- Homework Assignment - Week 2 - AnswersDocument11 pagesHomework Assignment - Week 2 - AnswersVoThienTrucPas encore d'évaluation

- Finance 340 - Financial Management: Dr. Stanley D. Longhofer TTH 9:30-10:45Document6 pagesFinance 340 - Financial Management: Dr. Stanley D. Longhofer TTH 9:30-10:45Naneun NabilahPas encore d'évaluation

- ECON1202 2004 S2 PaperDocument8 pagesECON1202 2004 S2 Paper1234x3Pas encore d'évaluation

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlPas encore d'évaluation

- Fin SolutionsDocument5 pagesFin Solutionsmoshiur mubinPas encore d'évaluation

- Economics Final Exam SolutionsDocument4 pagesEconomics Final Exam SolutionsPower GirlsPas encore d'évaluation

- Intro To Portfolio Management 503ADocument2 pagesIntro To Portfolio Management 503AAjay PawarPas encore d'évaluation

- UC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasDocument3 pagesUC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasMaria Elena SalgadoPas encore d'évaluation

- Maths201unit 1Document3 pagesMaths201unit 1Siukeung PatrickPas encore d'évaluation

- Sample Final S12010Document7 pagesSample Final S12010Danielle CasamentoPas encore d'évaluation

- Practice ProblemsDocument9 pagesPractice Problemsvikas_gullu6593Pas encore d'évaluation

- AU FINC 501 MidTerm Winter 2013hhh SsDocument16 pagesAU FINC 501 MidTerm Winter 2013hhh SsSomera Abdul QadirPas encore d'évaluation

- Assignment 1-Answer KeyDocument3 pagesAssignment 1-Answer Keybexultan.batyrkhanovPas encore d'évaluation

- 2012 EE enDocument76 pages2012 EE enDiane MoutranPas encore d'évaluation

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanPas encore d'évaluation

- FM PT1 - Q&A AS2023 - May23Document12 pagesFM PT1 - Q&A AS2023 - May232017963155Pas encore d'évaluation

- Lesson 1: Fair Market Value of An AnnuityDocument7 pagesLesson 1: Fair Market Value of An AnnuityAlex Albarando SaraososPas encore d'évaluation

- Business Finance AssignmentDocument3 pagesBusiness Finance Assignmentk_Dashy8465Pas encore d'évaluation

- BA 502 (QMETH) Professor Hillier Sample Final ExamDocument8 pagesBA 502 (QMETH) Professor Hillier Sample Final ExamverarenPas encore d'évaluation

- Ôn Tập Cuối Kỳ - Trắc NghiệmDocument35 pagesÔn Tập Cuối Kỳ - Trắc Nghiệmthaoluhan456Pas encore d'évaluation

- Finance for Non-Financiers 1: Basic FinancesD'EverandFinance for Non-Financiers 1: Basic FinancesPas encore d'évaluation

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Financial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelD'EverandFinancial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelPas encore d'évaluation

- EntrepreneurshipDocument4 pagesEntrepreneurshipSukriti MandalPas encore d'évaluation

- The Correct Answers Are in Bold TextDocument3 pagesThe Correct Answers Are in Bold TextMichael WilsonPas encore d'évaluation

- Unit 7AccountingforMurabaha&AmpDocument27 pagesUnit 7AccountingforMurabaha&AmpSon Go Han0% (1)

- Gettes DayTradingDocument9 pagesGettes DayTradingsatish s100% (2)

- Intermediate 1Document11 pagesIntermediate 1Mary Anne ManaoisPas encore d'évaluation

- Angel PlatinumDocument14 pagesAngel Platinumvishal royPas encore d'évaluation

- Contract of InsuranceDocument3 pagesContract of InsuranceKirthana DarshayiniePas encore d'évaluation

- Campus Deli Case 4Document15 pagesCampus Deli Case 4Ash RamirezPas encore d'évaluation

- HUL SuccessDocument2 pagesHUL SuccessUjjval YadavPas encore d'évaluation

- AFAB Depreciation Run ExecutionDocument18 pagesAFAB Depreciation Run ExecutionraghuPas encore d'évaluation

- Minutes of Meeting Role PlayDocument7 pagesMinutes of Meeting Role PlayRajivPas encore d'évaluation

- Value Investing: Guide ToDocument19 pagesValue Investing: Guide ToDomo TagubaPas encore d'évaluation

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzPas encore d'évaluation

- Write-Up Sample (Financial Analysis)Document18 pagesWrite-Up Sample (Financial Analysis)chialunPas encore d'évaluation

- DocumentDocument2 pagesDocumenttharshini rajPas encore d'évaluation

- Derivatives Market Forwarded To ClassDocument51 pagesDerivatives Market Forwarded To ClassKaushik JainPas encore d'évaluation

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackPas encore d'évaluation

- 1772HK ProspetusENG LTN20180927025 PDFDocument602 pages1772HK ProspetusENG LTN20180927025 PDFGene LauPas encore d'évaluation

- Course OutlineDocument14 pagesCourse OutlineKris MercadoPas encore d'évaluation

- Allianz - Behavioral Finance in ActionDocument36 pagesAllianz - Behavioral Finance in Actionfreemind3682Pas encore d'évaluation

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDocument18 pagesPre-Feasibility Study Prime Minister's Small Business Loan Schemeadnansensitive5057100% (1)

- Chapter 8 Part 1 (B)Document88 pagesChapter 8 Part 1 (B)Nurul AsyilahPas encore d'évaluation

- Chinese English Translation of Accounting SubjectsDocument89 pagesChinese English Translation of Accounting SubjectsdanielPas encore d'évaluation

- Assignment 2 24 August 2017Document6 pagesAssignment 2 24 August 2017kanteshk7Pas encore d'évaluation

- Revised Tobin's Demand For MoneyDocument4 pagesRevised Tobin's Demand For MoneySnehasish MahataPas encore d'évaluation

- Diff Between Normal & Islamic Banking in MaldeevDocument2 pagesDiff Between Normal & Islamic Banking in MaldeevAfroza KhanPas encore d'évaluation

- Principle of ManagementDocument6 pagesPrinciple of ManagementWaqar AhmadPas encore d'évaluation

- Erp 2011Document83 pagesErp 2011Hadi P.Pas encore d'évaluation

- ACCT 221-Corporate Financial Reporting-Atifa Arif Dar-Waqar AliDocument7 pagesACCT 221-Corporate Financial Reporting-Atifa Arif Dar-Waqar AliAbdelmonim Awad OsmanPas encore d'évaluation

- BS 421 Assignments 2020Document2 pagesBS 421 Assignments 2020Daniel DakaPas encore d'évaluation