Académique Documents

Professionnel Documents

Culture Documents

BUS13401n14099 10 09

Transféré par

jc199707Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BUS13401n14099 10 09

Transféré par

jc199707Droits d'auteur :

Formats disponibles

Taxi driver takings and expenses worksheet

This worksheet will help you keep proper GST records of your taxi earnings and expenses. You should fill in the worksheet at the end of each shift and you should keep all your receipts to support your expenses.

Day Month Year

Drivers name:

Shift details

Date Shift Operators name Distance travelled km

Period ending:

Gross earnings (including GST)

Cash (1) $ $ Credit (2) Total taxi takings (1 + 2) = (3) $ Rental to operator (4) $

Expenses (including GST)

Wash taxi (5) $ Other expenses* Description Amount (6) $ Total expenses (4 + 5 + 6) = (7) $ Net earnings (3 7) = (8) $

Page total Brought forward

NAT 14099-10.2009 [JS 14997]

TOTAL (YTD)

* This column can be used for a regular expense that is not reimbursed by your operator. For example, some drivers pay for the fuel they used during a shift, this amount can be recorded under Other expenses.

Activity statement payment card payment record:

Date Amount paid $ $ $ $ $ $ $ $ TOTAL

Taxi driver takings and expenses summary example

This worksheet will help you keep proper GST records of your taxi earnings and expenses. You should fill in the worksheet at the end of each shift and you should keep all your receipts to support your expenses.

Day Month Year

Drivers name:

Joe Driver

Shift details Gross earnings (including GST)

Distance travelled km Cash (1) $ $ Credit (2) Total taxi takings (1 + 2) = (3) $ Rental to operator (4) $ Wash taxi (5) $

Period ending:

Expenses (including GST)

Other expenses* Description Amount (6) $

3 0

0 4

2 0 0 9

Net earnings (3 7) = (8) $

Date

Shift

Operators name

Total expenses (4 + 5 + 6) = (7) $

25/04 26/04 27/04 28/04 29/04 30/04

Day Day Day Day Night Night

John Smith Alan Black Alan Black John Smith Alan Black Alan Black

212 263 274 284 333 342

124.40 186.00 178.80 210.70 205.00 297.30

76.50 67.10 84.50 74.00 139.50 81.40

200.90 253.10 263.30 284.70 344.50 378.70

100.45 126.55 131.65 142.35 172.25 189.35

3.00 5.00 5.00 5.00 Parking Street Map 2.20 34.80

100.45 129.55 136.65 142.35 179.45 229.15

100.45 123.55 126.65 142.35 165.05 149.55

Page total

1,708

1,202.20

523.00

1,725.20

862.60

18.00

37.00

917.60

807.60

GST calculation

GST collected less GST credits* equals Net GST payable Check calculation $156 Total takings divided by eleven (1,725.20 11) ($83) Total expenses divided by eleven (917.60 11) $73 Subtract GST paid from GST collected (156 83) $73 Net earnings divided by eleven (807.60 11)

* When we say GST credits, we are referring to the GST term input tax credits.

Vous aimerez peut-être aussi

- Receipt Entry Training DocumentDocument81 pagesReceipt Entry Training DocumentNguyễn TúPas encore d'évaluation

- Instant Brands 11Document38 pagesInstant Brands 11Ann DwyerPas encore d'évaluation

- The Gardens P & L April 2011Document1 pageThe Gardens P & L April 2011rls2orgPas encore d'évaluation

- Telegraphic Transfer GuideDocument12 pagesTelegraphic Transfer GuideBenedict Wong Cheng WaiPas encore d'évaluation

- Bank AccountsDocument8 pagesBank Accountsswetha pandianPas encore d'évaluation

- Merchant Account ChangeDocument1 pageMerchant Account Changeaglenn788934Pas encore d'évaluation

- ECS PDF Mandate CitibankDocument8 pagesECS PDF Mandate Citibankbrijesh_chokshi2012Pas encore d'évaluation

- Foundation Check: Considering The Whole AreaDocument4 pagesFoundation Check: Considering The Whole AreareyPas encore d'évaluation

- Legal Heir 1KDocument5 pagesLegal Heir 1Kpks2012Pas encore d'évaluation

- Direct Mode 3.1 Protocol Documentation GuideDocument18 pagesDirect Mode 3.1 Protocol Documentation GuideGayCanuckPas encore d'évaluation

- Commercial Banking DocumentsDocument3 pagesCommercial Banking DocumentsRandell BuyawePas encore d'évaluation

- 2011 W-2 EarningsDocument144 pages2011 W-2 EarningsaroenPas encore d'évaluation

- IB4B Statement Data Files GuideDocument28 pagesIB4B Statement Data Files GuiderpillzPas encore d'évaluation

- LoadEmUp Rate Card Latest-2019Document42 pagesLoadEmUp Rate Card Latest-2019Sergi RevoltPas encore d'évaluation

- Madj 10112022Document3 pagesMadj 10112022Vishal Ugale100% (1)

- SCP: Dystopia - Update Changelogs TitleDocument9 pagesSCP: Dystopia - Update Changelogs TitleCrying ChildPas encore d'évaluation

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaPas encore d'évaluation

- Check CC Balance Using Skype CallDocument1 pageCheck CC Balance Using Skype CallFrost SaintPas encore d'évaluation

- PNG Spring05Document16 pagesPNG Spring05David SarifPas encore d'évaluation

- How To Deposit and Withdraw MoneyDocument4 pagesHow To Deposit and Withdraw MoneyAar RageediPas encore d'évaluation

- Beware of Scam in Emails about Money TransferDocument4 pagesBeware of Scam in Emails about Money TransferMarcos Paulo Do NascimentoPas encore d'évaluation

- Full Name in English Bank Name Ifsccode Account NumberDocument7 pagesFull Name in English Bank Name Ifsccode Account NumberVarun MarwahaPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelPas encore d'évaluation

- HDFC Bank Insta Credit CardDocument1 pageHDFC Bank Insta Credit CardflirT2dirTPas encore d'évaluation

- SL ParticularsDocument18 pagesSL ParticularsRRajath ShettyPas encore d'évaluation

- Step 1:: Payment Process ProfilesDocument4 pagesStep 1:: Payment Process ProfilesckanadiaPas encore d'évaluation

- Merchant Information Sheet: - Regency Travel & ToursDocument2 pagesMerchant Information Sheet: - Regency Travel & ToursRafik AhmedPas encore d'évaluation

- Credit Cards D6Document11 pagesCredit Cards D6Isaac GonzalezPas encore d'évaluation

- Lifestyle: Merchant EstablishmentDocument1 pageLifestyle: Merchant EstablishmentSeshankSkPas encore d'évaluation

- Blitz-Logs 20230624132400Document48 pagesBlitz-Logs 20230624132400marekpetrekPas encore d'évaluation

- Electronic Deposit Instructions DIRECT DEPOSITDocument4 pagesElectronic Deposit Instructions DIRECT DEPOSITPedro PerezPas encore d'évaluation

- Strings 6272012Document130 pagesStrings 6272012Ivan RodriguezPas encore d'évaluation

- Bill Statement OIFCDocument24 pagesBill Statement OIFCrazibackerPas encore d'évaluation

- AT&T Network-Based IP VPN Remote Access Service (ANIRA) - 1Document106 pagesAT&T Network-Based IP VPN Remote Access Service (ANIRA) - 1Jim ThompsonPas encore d'évaluation

- Routing (ABA) : 061120084: Page 1 of 1Document1 pageRouting (ABA) : 061120084: Page 1 of 1Sayed Ariful AshrafPas encore d'évaluation

- Us American BinDocument21 pagesUs American BinPhan Văn BìnhPas encore d'évaluation

- Credit Card Assignment PDF WeeblyDocument2 pagesCredit Card Assignment PDF Weeblyapi-371069146Pas encore d'évaluation

- 123 Street: City: Zip 12345 Toll Free: (800) 123-XXXX (USA) Fax: (123) 345-XXXXDocument2 pages123 Street: City: Zip 12345 Toll Free: (800) 123-XXXX (USA) Fax: (123) 345-XXXXBrandyPas encore d'évaluation

- Self Certification of Social Security NumberDocument1 pageSelf Certification of Social Security NumberSheldon OrrPas encore d'évaluation

- Utah 2023 Unemployment BenefitsDocument49 pagesUtah 2023 Unemployment Benefitsdeemeejay11Pas encore d'évaluation

- SAMPLE Form 941 2018 Q3 660873668Document2 pagesSAMPLE Form 941 2018 Q3 660873668Waseem TariqPas encore d'évaluation

- Get Education Financed with SBI Student LoanDocument7 pagesGet Education Financed with SBI Student LoanPrerna AroraPas encore d'évaluation

- Prado: - Public Register of Authentic Travel and Identity Documents Online Check The Validity of Document NumbersDocument27 pagesPrado: - Public Register of Authentic Travel and Identity Documents Online Check The Validity of Document NumberswadagrosPas encore d'évaluation

- VCCDocument8 pagesVCCRaden AditiyaPas encore d'évaluation

- Anexa 5 Amex CenturionDocument1 pageAnexa 5 Amex CenturionRaluca AndreeaPas encore d'évaluation

- How To Read An ODBC Trace FileDocument13 pagesHow To Read An ODBC Trace FileganeshharidasPas encore d'évaluation

- Check21 data sources and file namesDocument11 pagesCheck21 data sources and file namesBankPas encore d'évaluation

- Applying For Unemployment BenefitsDocument31 pagesApplying For Unemployment BenefitsChris StonePas encore d'évaluation

- Serial Number Search CertificateDocument3 pagesSerial Number Search CertificateSandeep Tuladhar100% (1)

- User Init RegistrationDocument10 pagesUser Init RegistrationMashfiq SohrabPas encore d'évaluation

- Boa Bank StatementDocument7 pagesBoa Bank Statementtieashamassey100% (1)

- Colorado UiDocument13 pagesColorado Uijanemaserati9Pas encore d'évaluation

- 1 (1)Document15 pages1 (1)alicewilliams83nPas encore d'évaluation

- DME ACH Processing in SAP - ExcelDocument3 pagesDME ACH Processing in SAP - ExcelNaveen KumarPas encore d'évaluation

- Mt103 Swift CodesDocument3 pagesMt103 Swift CodesCh Waqas NawazPas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnRepeat BeatsPas encore d'évaluation

- Especificaciones de Banda MagneticaDocument2 pagesEspecificaciones de Banda MagneticachparrabPas encore d'évaluation

- CC Form (WPO)Document1 pageCC Form (WPO)Nancy SparlingPas encore d'évaluation

- Zipcar FishboneDocument24 pagesZipcar FishboneKrishna Srikumar0% (3)

- Waste Wizard SolutionDocument6 pagesWaste Wizard SolutionAnkit Gupta100% (5)

- Test Essays N Letters IELTS WritingDocument18 pagesTest Essays N Letters IELTS Writingjc199707Pas encore d'évaluation

- Work With Older People AssessmentDocument24 pagesWork With Older People Assessmentjc19970788% (8)

- Test Essays N Letters IELTS WritingDocument18 pagesTest Essays N Letters IELTS Writingjc199707Pas encore d'évaluation

- IELTS General Training Download SampleDocument18 pagesIELTS General Training Download Sampleavinash347980% (5)

- Aged Care AssignmentDocument12 pagesAged Care Assignmentjc19970750% (8)

- Test Essays N Letters IELTS WritingDocument18 pagesTest Essays N Letters IELTS Writingjc199707Pas encore d'évaluation

- Portfolio Management at ICICI Bank LtdDocument13 pagesPortfolio Management at ICICI Bank LtdkhayyumPas encore d'évaluation

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiPas encore d'évaluation

- JPM Fact Fiction and Momentum InvestingDocument19 pagesJPM Fact Fiction and Momentum InvestingmatteotamborlaniPas encore d'évaluation

- Mergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test BankDocument19 pagesMergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test Banksinapateprear4k100% (33)

- WriteableDocument9 pagesWriteableChinmay RaskarPas encore d'évaluation

- The Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going ForwardDocument10 pagesThe Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going Forwardgreenam 14Pas encore d'évaluation

- MBF12 CH3 Question BankDocument15 pagesMBF12 CH3 Question BankwertyuoiuPas encore d'évaluation

- St. Mary's Financial Accounting Comprehensive ExerciseDocument5 pagesSt. Mary's Financial Accounting Comprehensive ExerciseOrnet Studio100% (1)

- A Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFDocument7 pagesA Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFMegan Jane JohnsonPas encore d'évaluation

- Vdocuments - MX - Blackbook Project On Mutual Funds PDFDocument88 pagesVdocuments - MX - Blackbook Project On Mutual Funds PDFAbu Sufiyan ShaikhPas encore d'évaluation

- Capital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiDocument23 pagesCapital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiRafael G. MaciasPas encore d'évaluation

- Class 1 - Introduction The Foundation of Islamic EconomicsDocument22 pagesClass 1 - Introduction The Foundation of Islamic EconomicsBayu MurtiPas encore d'évaluation

- TaxSaleResearch OkDocument44 pagesTaxSaleResearch OkMarlon Ferraro100% (1)

- Application For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1Document3 pagesApplication For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1shobsundar1Pas encore d'évaluation

- Biz Cafe Operations Excel - Assignment - UIDDocument3 pagesBiz Cafe Operations Excel - Assignment - UIDJenna AgeebPas encore d'évaluation

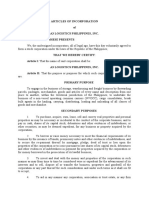

- Articles of IncorporationDocument4 pagesArticles of IncorporationRuel FernandezPas encore d'évaluation

- Macroeconomic Effects of Banking TaxesDocument35 pagesMacroeconomic Effects of Banking TaxesAlan Dennis Martínez SotoPas encore d'évaluation

- Ichimoku Trader - SignalsDocument6 pagesIchimoku Trader - Signalsviswaa.anupindiPas encore d'évaluation

- Audit of Cash & Cash Equivalents: Problem 1Document9 pagesAudit of Cash & Cash Equivalents: Problem 1John Lemuel RiveraPas encore d'évaluation

- Influence of Microfinance On Small Business Development in Namakkal District, TamilnaduDocument5 pagesInfluence of Microfinance On Small Business Development in Namakkal District, Tamilnaduarcherselevators100% (1)

- Kotler SummaryDocument27 pagesKotler Summaryshriya2413Pas encore d'évaluation

- Garima Axis Bank SDocument3 pagesGarima Axis Bank SSajan Sharma100% (1)

- Investment Management Analysis: Your Company NameDocument70 pagesInvestment Management Analysis: Your Company NameJojoMagnoPas encore d'évaluation

- Solved Copy The Mike Owjai Manufacturing Financial Statements From Problem 1Document1 pageSolved Copy The Mike Owjai Manufacturing Financial Statements From Problem 1DoreenPas encore d'évaluation

- Hathway Cable Internet Bill DetailsDocument1 pageHathway Cable Internet Bill Detailsshamala1250% (2)

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithPas encore d'évaluation

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDocument11 pagesForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreePas encore d'évaluation

- NIFTY Pharma Index captures 20 Indian pharma stocksDocument2 pagesNIFTY Pharma Index captures 20 Indian pharma stocksJackPas encore d'évaluation

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicalePas encore d'évaluation

- D-045 - Engagement Letter For Compilation of Financial Forcast or ProjectionDocument3 pagesD-045 - Engagement Letter For Compilation of Financial Forcast or ProjectionLuis Enrique Altamar Ramos100% (2)