Académique Documents

Professionnel Documents

Culture Documents

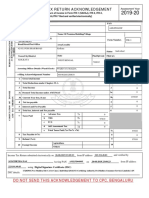

Fmr2014 Sin

Transféré par

Randora LkDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fmr2014 Sin

Transféré par

Randora LkDroits d'auteur :

Formats disponibles

o.o. o . ro:.ro< O.o r.

O

zcI!

oc: o.ocro

o:..cr cc o c. rocOc.: o.r.

zcI+ c:.O,O-o zI

zoo+ or + cu c.:. ._. r_.u.rc. (O.r.) cu: cOe:, c.:. ._. re..c.c

O.c:.O zo+ (!, : e O.u:O_O our_O) : ocOc, o.c.r :. c.:. ._. :::Oc c_-j

O.c:.O-zo+ (, s : O.u:O_O our_O) .c ._ o..:.:.. u ur: rcu _e.

3 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

cO:

cro

cO

.rc

zoo+ or + cu c.:. ._. r_.u.rc. (O.r.) cu:

zoo+ or + cu c.:. ._. r_.u.rc. (O.r.) cu: cOe: c: r_ c: O.c:. 7

our_:.Oc - zo+ 8

o.o. o. rco.c.c O.or.O zcI! 9

.r._u c.:. ._. re..c.c 11

cO,c, .oOr c. o.o. o. rrrOc c- O.or.O zcI! 29

o.o. o. _c:r:

..e_.Duc 31

c:ec o.c. 37

c.:ec c. 46

.<....o cocccO 49

cc o.c:c 52

ooc cr O.o O.Oc.cc: c r.occ..:c 63

.oOrc 87

o .ccc cO<r. 99

c..c .oOrc 105

zcI! cO,c ,crcO:r c,rco cc. c:O O c..r 112

O.

cO

.rc

O.O ... r._u .cO c.:. ._. c..O (.e.u. c:.:cr e_) 13

z O.O .... c:ecu c_.: c. eO: o.c5 ..c r5 14

+ O.O ocOc .c..c 33

! O.O o:e5u:.: :. ::. o.c. : c. 36

O.O c.:. o.c5 r.cc..uec r.c:c 37

e O.O o.c5 - r.cc..uc 38

O.O cr: r_ o.c .: - r.cc..uc 39

s O.O u.c.u - c.- o.c5 r.cc..u 40

O.O 5O5 .: u.c.u - e...ucu 40

o O.O e..Oc c. O.:u o.ucu : uO _c.cc r5 41

O.O c..u u: eO_ .5 ouO _-. eu _ :c - :u cOe: o.ucuc rcu _

c..O_ O5u.r.

41

z O.O e.. eO_ c.. - ouc.: 42

+ O.O :..e...-., .c - : e..Oc c. O.:u _c.cc re5 ..: r.cc..uc 43

! O.O c.:. o.c5 D_:. .e_..c 45

O.O c.:. c5 r.cc..uc 46

e O.O -..u c5 47

O.O u.c ouc.:c : c:ec dr5c: .: e.Ou ec._ ouc.:rec :. (`) 48

s O.O c.:. o.ec.:uc- o.ec.:uc rcu _ c..u o. ouO 48

O.O c:ec ._ cO.: cr..c 49

zo O.O e.c .c .u5 - . _r. Oc.u -5rc 49

z O.O e.c .c .u. - c.....c -_c: 50

zz O.O e.c .c .u5 - c.....c -5rc 51

z+ O.O Oc.ec :uO. O c:5-c rO. o:u rcu _ e. ._.cu cr.:. .5 52

z! O.O e. ._.cu cr.:. 56

z O.O zo+ Oc.ec :uO.c O c:5-c rO. o:u rcu _ e. .c ._.cu cr.:.

.5 (._. uc.cu ..)

58

48 FISCAL MANAGEMENT R

The overall policy strategy of the Government,

enunciated in the Mahinda Chinthana - Vision for

the Future, the Development Policy Framework of

the Government, aims at attaining a rapid economic

transformation to a modern, environmentally-friendly

and well-connected rural-urban economy consolidating

Sri Lanka as a competitive emerging economy that can

create employment opportunities and greater social

advancement. To achieve this, the importance of making

a constant renement in policy strategies to tackle

immediate term problems to address downside risks and

to sustain medium-term prospects of high investment

and growth momentum with economic stability has

been recognised.

In line with this, the scal strategy of the Government

has been designed to reduce the budget decit and

public debt on a sustainable basis to maintain them well

within the level required to support public spending

without crowding out private sector expansion.

Accordingly, priority has been assigned in the scal

management to further consolidate the decit reduction

path achieved in the recent past by reducing the decit

from a high level of 9.9 percent of GDP in 2009 to 6.9

percent in 2011 and to around 6.2 percent in 2012. A

further improvement is expected in the scal operations

with the reduction of the budget decit and anticipated

economic expansion over the medium term.

Fiscal Strategy in the

Medium Term

The Government will continue to protect public

investment in the medium term to expand the

infrastructure facilities necessary to stimulate the

economy. The reduction in scal decit is to be achieved

in a framework of maintaining public investment at

around 6 percent of GDP. These adjustments are aimed

at the revenue account to phase out its underlying

decit. Consequently, revenue decit has been reduced

from 3.7 percent of GDP in 2009 to 1.1 percent in 2011

and it is expected to reduce further to 0.8 percent in

2012. The medium term adjustments are expected to

generate a surplus in the revenue account in support of

further reduction in the overall budget decit below 5

percent of GDP.

Given the several major challenges that the country

had to face over the last few years, both externally and

internally, the reaching of the scal targets outlined

in previous Fiscal Management Report in terms of the

Fiscal Management (Responsibility) Act (FMRA) No.

3 of 2003 has taken a longer than expected time. The

ongoing tax reforms, tax administration reforms, and

improvements in the public expenditure management

are expected to provide a greater scal consolidation in

the medium term.

The medium term scal policy framework envisages

phasing out the budget decit gradually to encourage

private sector participation in economic activities

towards stable high economic growth with stability of

around 8 percent. Hence, the strategy envisages to:

Achieve a surplus in the revenue account over the

medium term by improving revenue buoyancy and

Reduce the budget decit to below 5 percent

of GDP by 2015 without compromising public

investment.

Reduce the outstanding Government debt to

around 65 percent of GDP by 2015 and lower it

further thereafter.

Ensure the welfare expenditure to protect

vulnerable sectors in society.

In achieving the medium term adjustments, the

transformation is expected to come from the revenue

account through the creation of a revenue surplus

in the medium term. Accordingly, a combination of

growth-friendly, revenue enhancing and expenditure

rationalization measures is being implemented to

strengthen the scal consolidation process. In line with

this, comprehensive tax reforms have been introduced

in the 2011 Budget to simplify and broadbase the

countrys tax system and to make it more investment-

friendly. The scal policy strategy also encompasses the

development of infrastructure in the country to create

an enabling environment to facilitate the private sector

investment while promoting inclusive growth and food

security.

This strategy has to be implemented in the context of

an uncertain world economic and nancial outlook.

The continued uncertainties and risks in the Euro

Zone, macroeconomic imbalances in many countries,

risks from aggressive scal tightening in advanced

economies, political unrest in the Middle Eastern

countries and the slow progress in the US economy

impose unfavourable impact on the Sri Lankan economy

in sustaining its adjustments. The medium term macro

scal framework is given in Table 1.

Medium Term Fiscal Strategy

Overview

2014

... .,. :_..:.~ ..c. .|-

ze O.O e. ._.cu c:_.u (Oc.u c.c.OrcOu ouO) 62

z O.O cr.:. c_r_ ce:: cec.:uc o.O ucc: e. ._.cu c...c 63

zs O.O ccc c: -r .c e..c - ._. eu.Ou O.: O.O.ccu 64

z O.O ._. eu.Ou c.:. O.: O.O.ccu : _.cc:Oc 65

+o O.O c:c : ._. O.O.ccu : _.cc:Oc 66

+ O.O _r. _-_ .._ec ._. :::Oc 67

+z O.O _r. -u: e:_ u:.: ..eo ._. :::Oc 71

++ O.O :.:r :_ 5c.u : :_.cO:u .._ec ._. :::Oc 72

+! O.O . _r. Oc.c o.r.ec ._. :::Oc 73

+ O.O ._ru .Ou ...e5 ._. :::Oc 74

+e O.O .Ou e:.Oec._ :. .Ou eO. (. _r.) ...e5 ._. :::Oc 75

+ O.O . _r. ..u...u .._ec ._. :::Oc 76

+s O.O _r. -reo ._. :::Oc 77

+ O.O .::u -reo ._. :::Oc 78

!o O.O :.:r : re5 -reo ._. :::Oc 79

! O.O eO. ucr:rcue. c.cr.c oc.e_ ._. :::Oc 80

!z O.O . _r. cr.. ..eo ._. :::Oc 80

!+ O.O c. 5c: o.ec ._. :::Oc 81

!! O.O e-. o.cO oc: O..c.cO_ ._. :::Oc 82

! O.O _r. e:. o.c:uec ._. :::Oc 83

!e O.O ec.e:.c ...5O_ ._. :::Oc 83

! O.O c:c : O.O.ccu : O.c.r O.c:. c: r. 84

!s O.O c:c : O.: O.O.ccue.u _ occ.c_.c.. o.c. 86

! O.O _ e.c u.c.:ec o..r c:c 89

o O.O eO. o.ec e:.c..: c.rcu 95

O.O D.cr o.ec r.cc..uc 96

z O.O .e.u. Oc.uec o..r O..c:c 97

+ O.O . _r.eo .:cO, ._r : o.:.c ..uc 100

! O.O e.c eO_. 103

O.O e_.rec cOO_O_ .e.u Oc.u ouc.:cu 106

e O.O ..uc : eO. cr:c 107

O.O e:.c..: cOO_ c.:. .c 108

s O.O ocOc :.c 109

o,cccO:

cO

.rc.

c,cO:u ocOc :.c 11

z c,cO:u .: - o..ce5 Oc.uc 31

+ c,cO:u o.ucu .: cu5 O - o.ce5 Oc.uc 31

! c,cO:u - o.ce5 c:c 37

c,cO:u u.c.u -c.- o.ce5 r.cc..uc 39

e c,cO:u e. ._.u cr.:.Ocu Oc.u :O_rcOu ouO 57

c,cO:u e. ._.u cr.:. o. ouO 57

s c,cO:u e. ._.cu cec.:uc - Oc.u :O_rcOu ouO 63

c,cO:u e. ._.cu cec.:uc - o. ouO 63

o c,cO:u cr.:.Oc c_ r_ cec.:uc eu.O e. ._.cu - o. ouO 64

c,cO:u cr.:.Oc c_ r_ cec.:uc eu.O e. ._.cu - Oc.u c.c.OrcOu ouO 64

z c,cO:u c:c : ._. eu.Ou O..: O.O.cu : _.cc:Oc 65

+ c,cO:u c:c : ._. O.O.cu : _.cc:Oc 65

5 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

cco cOc:

cO

.rc

e.. O:u o.c5 - O.:c 15

z e.. O:u O.: eru..u ...u 17

+ e.. O:u o.c:ur : :rc. Oc.uc 18

! e.. O:u - cc._u c:rc.cu : c.:c eru 20

e.. O:u c.:. o.ec r.cc .._ r_.u.rc.c 23

e e.. O:u c:ec c5c.u rOc:O_ c.: c.:cu .uo. c zo+ Oc.ec

:uO. eu _ rc...c.

24

e.. O:u c..u c:c::.c rc...c. 34

! c,cO:u -r .c e..cu : O.c.r eOu o5 65

c,cO:u _ :c.uc zoo-zo+ 70

e c,cO:u _r. _-_ .._ec _.cc:Oc 70

c,cO:u -u: e:_ u:.: ..eo _.c.c:Oc 71

s c,cO:u e-u. e-.ce:_ c_ zooz-zo+ 71

c,cO:u :_ 5-u.:. -..O 72

zo c,cO:u o.c5 eu._-u :_c : :_ oe_c 72

z c,cO:u . _r. Oc.c o.r.c u e.e:cOu _- -:.g5 c...c 73

zz c,cO:u .Ou .. D_ucu 74

z+ c,cO:u .Ou e:.Oec._ :. .Ou eO. (. _r.) ...e5 ._. :::Oc 75

z! c,cO:u . _r. ..u...u .._ec ._. :::Oc 76

z c,cO:u c.:. -r :uc: zoo-zo+ 77

ze c,cO:u _ e.c u.c.uec Oc.uc 87

z c,cO:u _ e.c u.c.uec c:c 88

zs c,cO:u rc..u: o.ec c:c 88

z c,cO:u rc..u: o.ec c:c 92

+o c,cO:u u.c.uc o.ec c:c 92

+ c,cO:u eO. o.ec c:c 94

+z c,cO:u drc.O 98

++ c,cO:u c_ ouc.: ._ .:cu :. ec._r o.ec .c Oc.uc 100

+! c,cO:u .:cO, ._r :. o.:.c ..uec eOu o5 101

+ c,cO:u eO_ e..c : u.c ouc.:c eOu o5 101

+e c,cO:u ocucu c:c 102

+ c,cO:u o.ucu c:c 102

+s c,cO:u eOr ec.. e. drc. : drc. eO_ec._ ouO c:c 104

+ c,cO:u r_.cc u.c.:c 105

!o c,cO:u e-.ce:_ c_..u 110

! c,cO:u oe.r.u e._ccO .ecr.O u.c ouc.: eOu o. 110

!z c,cO:u c._r c...u cO.: (..) 1 1 1

!+ c,cO:u _uu ou:c -r cr.. .c ._ ouc.:c (c..r) D_uc 1 1 1

,o<O

cO

.rc

,o<o I ocOc :.c eO. : : oO..:. O.r5 O..c:c cOe: .:. c.....cc u

_-. u c:c.u

115

,o<o II zo+.o.+o uO eu.ccO -r ocrc 129

,o<o III .cO o.c.r c.rc 134

,o<o IV zo! o.c5 o:e5u: :. c.r O c_ cr_cu 143

7 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

zcc+ .r + o: o.o. o. ro:.ro< (O.ro) c:r cOcr cr r cr O.or.

O.:rc O.:rc Oc. :ro.rc :rr.Oc

!, : e

O.u:

c.:. ._. re..c.c

O.c:.O c:

r.

c.:. ._. c:c::c c_-j .::u

uO:c.Oc :_ uo. : c:ec

c.:. ._. re..c.ec c.:c o.c.

j:. 5.:cr o: rc .u. j:.

Ou c.:. ._. re..c.c cr..c

c:u cu: erO5c:

eOu OcO rcOu uec

.::u:.OO : c.c_e5u:OO

c: r_ c:c.

, s :

O.u:

ocOc, o.c.r :.

c.:. ._. :::Oc

c_-j O.c:.O

c: r.

c.:. ._. rc.r:Oc c.:. ._.

re..c.cO .ecr.O o.c. j:.

oO.. ocOc, o.c.r : c.:. ._.

:::O O.c:.O

c:u cu: erO5c:

eOu OcO rcOu uec

.::u:.OO : c.c_e5u:OO

c: r_ c:c.

o, : z

O.u:

Oc . c.:. ._.

:::Oc c_-j

O.c:.O c:

r.

Oec c_. .. ::cO o._ O

c:ec c.:. ._. rc.r:Oc c_-j

uO:. e:.c:c .::u:.OO u

.u.O _o. : c:ec c.:.

._. re..c.cO .ecr.O c.:.

._. rc.r.:Oc c_-jO o.c.r

r.O :rc.Or _-. . j:.

Ou, Oc . c.:. ._. :::O

O.c:.O

o._ Oc.ec :u . oO.u

uO e:. c:u cu:

5.: oe.u .. e r r.

c..O ecc cu r._ cce

eeru cO c_e.u uO

c.., .::u:.OO ur: r_

c:c. c. ur: re5 u O

: err r._cr :_ e.c

c.c_e5u:OO c: r_

c:c.

+, ! :

O.u:

oO.u ocOc

:::Oc c_-j

O.c:.O c:

r. (O.c.r

O.c:.O)

cO:u. OcO o._ O c:ec c.:.

._. rc.r.:Oc c_-j uO:.

e:.c:c .::u:.OO u .u.O

_o. : c:ec c.:. ._.

re..c.cO .ecr.O rc.r.:Oc

c_-jO o.c.r r.O

:rc.Or _-. . j:. Ou, oO.u

ocOc :::Oc c_-j O.c:.O

(O.c.r O.c:.O)

._ Oc.c oO.u o .. c:r

r.O. c..O ecc .::u:.OO

ur: rc c. ur: re5 u

O : err r._cr :_

e.c c.c_e5u:OO c: r_

c:c.

e,,s :

O.u:

ccO .:Oc.

ocOc :::Oc

c_-j O.c:.O

c: r.

ce. c.:. ._. :::Oc c_-j

uO:. e:.c:c .::u:.OO u.

u.O _o. j:. Ou ccO

.:Oc. ocOc :::Oc c_-j

O.c:.O

c.c_e5u:OO .u:Ocu

e:.c. c: rc .u. j:.

.: .:Oc.cr cO:o.O

uc. re5 cr..ecu :

:ur o:_: ce. c.:. ._.

:::Oc c_-j e:.c:c

o:_: .:Oc. ccO :::Oc

c_-j O.c:.Or .::u:.O

eO: c: r_ c:c. uO

c.c_e5u:O d re5 u

O : err r._cr :_

e.c c.c_e5u:OO c: r_

c:c.

* fuu jdr;dj uqo,a wud;Hjrhd iska bm;a l< hq;=h

** fuu jdr;dj uqo,a wud;HdxYfha f,aljrhd iska bm;a l< hq;=h

88 FISCAL MANAGEMENT R

The overall policy strategy of the Government,

enunciated in the Mahinda Chinthana - Vision for

the Future, the Development Policy Framework of

the Government, aims at attaining a rapid economic

transformation to a modern, environmentally-friendly

and well-connected rural-urban economy consolidating

Sri Lanka as a competitive emerging economy that can

create employment opportunities and greater social

advancement. To achieve this, the importance of making

a constant renement in policy strategies to tackle

immediate term problems to address downside risks and

to sustain medium-term prospects of high investment

and growth momentum with economic stability has

been recognised.

In line with this, the scal strategy of the Government

has been designed to reduce the budget decit and

public debt on a sustainable basis to maintain them well

within the level required to support public spending

without crowding out private sector expansion.

Accordingly, priority has been assigned in the scal

management to further consolidate the decit reduction

path achieved in the recent past by reducing the decit

from a high level of 9.9 percent of GDP in 2009 to 6.9

percent in 2011 and to around 6.2 percent in 2012. A

further improvement is expected in the scal operations

with the reduction of the budget decit and anticipated

economic expansion over the medium term.

Fiscal Strategy in the

Medium Term

The Government will continue to protect public

investment in the medium term to expand the

infrastructure facilities necessary to stimulate the

economy. The reduction in scal decit is to be achieved

in a framework of maintaining public investment at

around 6 percent of GDP. These adjustments are aimed

at the revenue account to phase out its underlying

decit. Consequently, revenue decit has been reduced

from 3.7 percent of GDP in 2009 to 1.1 percent in 2011

and it is expected to reduce further to 0.8 percent in

2012. The medium term adjustments are expected to

generate a surplus in the revenue account in support of

further reduction in the overall budget decit below 5

percent of GDP.

Given the several major challenges that the country

had to face over the last few years, both externally and

internally, the reaching of the scal targets outlined

in previous Fiscal Management Report in terms of the

Fiscal Management (Responsibility) Act (FMRA) No.

3 of 2003 has taken a longer than expected time. The

ongoing tax reforms, tax administration reforms, and

improvements in the public expenditure management

are expected to provide a greater scal consolidation in

the medium term.

The medium term scal policy framework envisages

phasing out the budget decit gradually to encourage

private sector participation in economic activities

towards stable high economic growth with stability of

around 8 percent. Hence, the strategy envisages to:

Achieve a surplus in the revenue account over the

medium term by improving revenue buoyancy and

Reduce the budget decit to below 5 percent

of GDP by 2015 without compromising public

investment.

Reduce the outstanding Government debt to

around 65 percent of GDP by 2015 and lower it

further thereafter.

Ensure the welfare expenditure to protect

vulnerable sectors in society.

In achieving the medium term adjustments, the

transformation is expected to come from the revenue

account through the creation of a revenue surplus

in the medium term. Accordingly, a combination of

growth-friendly, revenue enhancing and expenditure

rationalization measures is being implemented to

strengthen the scal consolidation process. In line with

this, comprehensive tax reforms have been introduced

in the 2011 Budget to simplify and broadbase the

countrys tax system and to make it more investment-

friendly. The scal policy strategy also encompasses the

development of infrastructure in the country to create

an enabling environment to facilitate the private sector

investment while promoting inclusive growth and food

security.

This strategy has to be implemented in the context of

an uncertain world economic and nancial outlook.

The continued uncertainties and risks in the Euro

Zone, macroeconomic imbalances in many countries,

risks from aggressive scal tightening in advanced

economies, political unrest in the Middle Eastern

countries and the slow progress in the US economy

impose unfavourable impact on the Sri Lankan economy

in sustaining its adjustments. The medium term macro

scal framework is given in Table 1.

Medium Term Fiscal Strategy

Overview

2014

... .,. :_..:.~ ..c. .|-

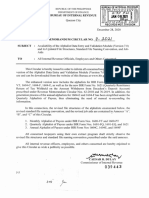

:rr.Oc zcI+

Oc.: cO,c rrrOc c-q O.or.O- ._ :. r.5c.u o..:...ec zoz O.c.r O.c:.O, c. Oec

c.:. ._. :. o.c.r :::Oc c_-j rc. c: rccu zo+ .c . oOu Ou O .::u:.OO

ur: rc, u ou:cO cc c.c_e5u:O eO: c: rcu _.

Oco o, o.o. o. rrrOc c- O.or.O zcI+ Oc . c.:. . _. :: : Oc c _ -j rc. c: rccu

zo+ : u . oOu Ou O .::u:.O eO: c: rc u c c.c _ e5u : O eO: c: rcu _.

coo o.o. o. ro:.ro< O.or.O zcI! c :ro.rc

o.o. o. rco.c.c O.or.O - ._ :. r.5c.u o..:...c c: rcu e.. O.c:.eo, .:

c.:. ._. c:c::c rc.OO uoe5 O.: e_ _ru _-u c_ c.:. ._. rc...c.cu rOcu

c:ec c..u re..c.cr c.-:.Ocu o:_:eo. c:u cu: erO5c: eOuOc rcOu uec e.c

c.c_e5u:OO c: r_ c:c.

cO,c, .oOrc cc o.o. o. rrrO c-q O.or.O zcI! - ._ :. r.5c.u o..:...c u

c: rcu e.. O.c:.eo c:ec o..c., c. : c:ec .c .u5 cu.ec o:e5u: o:_:

Ou o:c, c:ec c.:. ._. re..c.cO .ecr.O c:ec ._. rc.r.:Oc o.c.O cu5 Ou rc.

o:_:eo. c:u cu: erO5c: eOu Oc rcOu uec e.c c.c_e5u:OO c: r_ c:c.

9 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

o.o. o. rco.c.c O.or.O zcI!

zcc+ .r + o: o.o. o. ro:.ro< (O.ro) c:cr !, > cc t

O.:r cOcr .o, o o.r.Ooc. c: :rr ro: .

zoo+ or + cu c.:. ._. r_.u.rc. (O.r.) cue: !, : e O.u: ouO c:u cu: erO5c:

c.c_e5u:eo eOuOc rcOu uec ._ o..:.Occ. u c:ec c.:. ._. re..c.c O.c:.O

.::u:.OO : c.c_e5u:OO c: r_ c: Ou o:c c ouO e.. O.c:.O c: rcu _e.

ocOc j:. cu5 O c_ re..c.cr c.-:.Ocu : c.:. ._. re..c.c :. .: c.:. ._. c:c::c

rc.:.r re5 O.: c :r cc c:c _ru _-u c..u c.:. ._. rc...c. e.. O.c:.O ..u

c:_ rcu _-c.

11 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

rEmigyk 1: whjeh ys`.h

%

0

2

4

6

8

10

12

9.9

8.0

6.9

6.4

5.8

2009 2010 2011 2012 2013

weia;fka;=

. _r. o.c.rc c.c Oc :ur r._c :_ ccO

. r ...u. eo.cru Oc.uc O o:c e.c :.

e.c ocec.. ...ec OO e.. Oc.uc o:rc

.u.O ..Oc .cO o.c.r c:c::.c cccr

cO:. cr. c. zo+ Oc.ec o.c.r Oc.uc

.... ..O.r cO:c ..uc ccO e r

c.. ..O.r cO:O. .u.O o-.O :ro. :_u

..c:.Oc :: :_ o.c.r Oc.ucr eccr.

O.: .r:.: o o:.

c:ec c:c:: c..O Ou . _r.O o.c.eo u.

cu o..Dccc - .:u cu:u r.`` :_

reOu .r._u c_ Oc.u oc.. :. ...cO

c..u oecr.: _rr _..rc .u. j:. :.c

o. c .: c.:. ._. re..c.c uc...c rc

o:. O.r5 :: c.:. ._. r_.u.rc.cr ::O

ocOc :.c :. c:ec .c r..ur_O or. j:.

Ou u:.c c..O o. zoo+ or + c. c.:. ._.

r_.u.rc. (O.r5) cu: ..u c.:. ._. rOc:

j:. oO.. .. ecuo. _-. ec.

.ucu c.:. o.ec.:u .e.u ecu ccO e r c..

cO:O. .u.O oecr.. erec. e.c : e.c

O.ecu cO:u .r._u oc._ _-. .uu. o:c

ec._r o.ec: .c Oc.uc o.O o: oO..Ou

c_ er.O ec._r o.ec.:u O r. ...

r._u c.:. ._. c:c:: c..eO: :O: cr c..u

oc..r. ..uc :u ... o.cr cO:O. .ucu

c_ ..c:.Oc O.: .r:.: r. j:. ._

c:c::c :co.O .: -rOO O.: c_ u:r

_-.. j:. oO.. O.:.Oc.c e.. ..Oe5 ocOc

:.cr ..u r rc eu _-c. e5 e::eOu ec._

ouc.:rc oOu o: o:c cc c:ec ocOc .:

e.u. .: o.c.rcO. Ou cuc oO. rcu o:c

c..cr ocOc :.c .r:.: rc .u.O ::rc e_

-_c.u o:.

.r._u ocOc _rr _..rc .ue5 c:ec uc

:c5O_O e::eOcu cO:u o.c5 ..e.: :.c

c:ec eO. cc. cr.: rccu : c..u

c5 o.cr.. rccu o.c5 o:r:cr -OO c:rc

.u.O oecr.. erec. cOu o:r:cr ..u

Ou c:ec :c5 c.:. o.ec.:u O_u er.Or

._.uc r. j:. ec..: :rOu o: o:c c

e::eOu .c .ue5 oO..:.Oc oOu o:.

. o.O_ c:rc. :uO.ecu e..ecu.

r_.cc O.ecu :c.r. - O.:cr : c_ -

cu.r :: o.ec.:ucO ::: c_ - r.cr

:uO. ecu : - cc._uc Oc. r.

..u cc :O: .r:.: rccu c.:. ._. o.ec

rcu _ c:rc. :_u e.. rc.O_cO oO..

:ec..c _-.ecu :e.

- cc._uc .r:.: o uO - c:rc. :c:.

o.c.r rOc: Oc.uc Ou eo.cO ..uO -

o.c. OOu u.. - r.cr ..c: Ou O

Oc:..uec .e.u ecu ccO + r c.. ..Oe5

cO:u o.c. :_ cu o:c oecr.:c. e.c

o.ec ..c:.Oc cr.: r. j:. .,:r :uO.

eu _ ._ :. c.:. ._. c:rc.O_O cO

- cu. r.ecu c.. :::OcO c:o.: ..

.r._uO o.c. .e.u. ecu ccO - e c..

rO. OOu o:c oecr.:c. o.c. :OcO:

Orc .u. ocOc O.: e:.ju rc.:.r r.

c: r.O c.....c e.e:c5 rOc: j:.

c...O: O._:.Ocr _-.. erec: O.: eo.

eO. o.c erec: O.: u.cOr o: o.c.rcr

-OO . _r. o.c.rec: O.:.:.r O.ecu o o:

cOc:uc :_ eO. o.ecu - ocre5 cO:u

o,r.: o.o. o. rco.c.c

c:ec ...r._u c.:. ._. re..c.ec: oc..

Ouec ocOc :.c : .c o r. :_u ... :.

.r._u o.c.r Oc.u rc.O_c :. cr. o.c.

.e.u. c:.:cr e_O zoo Oc.ec ccO . r

O ocOc :.c zoz Oc.ec ccO e.! rO.: zo+

Oc.ec oOu OcO: ccO .s c.. rO. o

rc .ucu .,: r._uO _-..: c.:. ._. o.ec

O c.o. :O cO: .r:.: r. e.. re..c.c

..u oO..c.c rcc. zo! - zoe . r._u c.:.

._. OO:u :_ ocOc :.c .e.u. : c:.:cr

O.ecu ccO rO O. o ..O.rO e.u c.O

-_.ec.ec.:: eo. e.. re..c.c ..u o.ce5

Oo.r e.u. Oc:u c. .... ..O.r cO:O.

12 8 FISCAL MANAGEMENT R

The overall policy strategy of the Government,

enunciated in the Mahinda Chinthana - Vision for

the Future, the Development Policy Framework of

the Government, aims at attaining a rapid economic

transformation to a modern, environmentally-friendly

and well-connected rural-urban economy consolidating

Sri Lanka as a competitive emerging economy that can

create employment opportunities and greater social

advancement. To achieve this, the importance of making

a constant renement in policy strategies to tackle

immediate term problems to address downside risks and

to sustain medium-term prospects of high investment

and growth momentum with economic stability has

been recognised.

In line with this, the scal strategy of the Government

has been designed to reduce the budget decit and

public debt on a sustainable basis to maintain them well

within the level required to support public spending

without crowding out private sector expansion.

Accordingly, priority has been assigned in the scal

management to further consolidate the decit reduction

path achieved in the recent past by reducing the decit

from a high level of 9.9 percent of GDP in 2009 to 6.9

percent in 2011 and to around 6.2 percent in 2012. A

further improvement is expected in the scal operations

with the reduction of the budget decit and anticipated

economic expansion over the medium term.

Fiscal Strategy in the

Medium Term

The Government will continue to protect public

investment in the medium term to expand the

infrastructure facilities necessary to stimulate the

economy. The reduction in scal decit is to be achieved

in a framework of maintaining public investment at

around 6 percent of GDP. These adjustments are aimed

at the revenue account to phase out its underlying

decit. Consequently, revenue decit has been reduced

from 3.7 percent of GDP in 2009 to 1.1 percent in 2011

and it is expected to reduce further to 0.8 percent in

2012. The medium term adjustments are expected to

generate a surplus in the revenue account in support of

further reduction in the overall budget decit below 5

percent of GDP.

Given the several major challenges that the country

had to face over the last few years, both externally and

internally, the reaching of the scal targets outlined

in previous Fiscal Management Report in terms of the

Fiscal Management (Responsibility) Act (FMRA) No.

3 of 2003 has taken a longer than expected time. The

ongoing tax reforms, tax administration reforms, and

improvements in the public expenditure management

are expected to provide a greater scal consolidation in

the medium term.

The medium term scal policy framework envisages

phasing out the budget decit gradually to encourage

private sector participation in economic activities

towards stable high economic growth with stability of

around 8 percent. Hence, the strategy envisages to:

Achieve a surplus in the revenue account over the

medium term by improving revenue buoyancy and

Reduce the budget decit to below 5 percent

of GDP by 2015 without compromising public

investment.

Reduce the outstanding Government debt to

around 65 percent of GDP by 2015 and lower it

further thereafter.

Ensure the welfare expenditure to protect

vulnerable sectors in society.

In achieving the medium term adjustments, the

transformation is expected to come from the revenue

account through the creation of a revenue surplus

in the medium term. Accordingly, a combination of

growth-friendly, revenue enhancing and expenditure

rationalization measures is being implemented to

strengthen the scal consolidation process. In line with

this, comprehensive tax reforms have been introduced

in the 2011 Budget to simplify and broadbase the

countrys tax system and to make it more investment-

friendly. The scal policy strategy also encompasses the

development of infrastructure in the country to create

an enabling environment to facilitate the private sector

investment while promoting inclusive growth and food

security.

This strategy has to be implemented in the context of

an uncertain world economic and nancial outlook.

The continued uncertainties and risks in the Euro

Zone, macroeconomic imbalances in many countries,

risks from aggressive scal tightening in advanced

economies, political unrest in the Middle Eastern

countries and the slow progress in the US economy

impose unfavourable impact on the Sri Lankan economy

in sustaining its adjustments. The medium term macro

scal framework is given in Table 1.

Medium Term Fiscal Strategy

Overview

2014

... .,. :_..:.~ ..c. .|-

ocec..O_O .:.. j:. c-_ :.:cr cu

o:. uO o.c.rec: u. cu o. j:. c:r5

cc. e.u. ocucu e.u. e.c u.c.uc

.uo. Ou oeur: ocec.. j:.

rc...c. :uO. eu o:.

e..ecu. .ecr. O.ecu o o.cr.r c.

: oO:u OOu j:. O c. oo. :_u

Oc:u ce.: o:o o: oo. o-.O Ou

o:c oecr.:c. Oeu.c.c oO.. Oc.o.

e.u. eO. ucr:c, _r. :. ..uc oOu

O.:.Oc.cr :_ -..u c5 e5 o_

OO:uO_ ...:.r c.Oc Oc. r.O

oO..O _- o:. c.:. O..c.cO_ ._. ..Occ.Oc

Oc. r. j:. cOc c_-. Ou c c_

._c5 r. o-.O rcu o: o:c cc o.c5

..e.: :.c r..ur_O orc .u.O cr. Ou

o:.

zoo Oc.ec .e.u. ecu ccO +. r O o.c5

..e5 :.c zo+ Oc.c Ou O ccO o. r rO.

orc .: :r O o:c ...r._uO cc :OcO:

.r:.: ..O.rO orc .u.O oecr.:c. o.c5

..e.: o-. Oc.o. c.:. o.ec.:u .e.u.

ecu ccO e r c.. ..O.r cr.: rc .ucu

c:ec .c _-. .ue5 oO..:.Oc orc .u.O

e::Ou o:.

e.. .r._u c.:. ._. OO:u :_ ocOc

:.c r..ur_O orc .u.O : oecr.: ccO

- s r c.. :_ o.c.r Oc.uc e::eOu .c

ouc.:c r..ur_O orc .u. j:. c:ec .c

r_.u.rc. c.c..c.c r rc o:. Oc. zoe

Ou O .e.u. ec: c:.:cr O.ecu c:ec .c

c...c ccO e rO. orc .u.O _rr rc

o:.

oecr.: _rr _..rc .ue5 rc.O_c

ou.c::. O_u :. oOu5 :.: -u e:.cOOr

eu.eo. c.:. ._. r_.u.rc.c e-.e:. O e.c

:. :.:.u:c O.ecu rc. o.c.r cccr

...ec r.O o :-. cO e::Oc. e.c

O.ecu .:O ouecr.: r._.r ccc.cu

ocOc rOc: erec: o:rcu o::rc -_c,.

.,:r :_ e.. o:. :.:.u:cO _r. -g

O c.:. ._. r_.u.rc.c e..ecu. rc.

r.cccr -OO c:o :e. c. o.c.rcu ::

cOO_O c c.:. ._. rOc: c.. :::OcO

e.uc.O .:: c..cr .O o :-. e.u.

. cOO_O .:. .O o o: .O ..r.co.

: uO .O :. ocec..cu o-.O .:eOcu

cO:u O.:.Oc.cr :_ cO.O 5 eoe5

uO uc...._ 5 c: re5 oO..:.Ocr

cu u. :-. cO e::Oc. :.:.u:c o.c.rc

:_ o.c.r Oc.uc .u..c o., cec. r_.cc

:_ cO:u eeO:O .c oc-c, cr: :uc

o.c.rec: c.. :::OcO c:o. .ecr. O.ecu

.u..cO o., cr: :ucc u c....:.r

_:_rc. rc...c. r..ur_O O: rcu _-u

o: r._c :. u o:c :r -_c,., Oc.:

cOO_ u :. c.:. ._. c:c:: c_ e_

r. j:. :uO. eu c:rc.

rc...c. O_u o:c :r -_c,., :.:.u:c

-u:e:_ c_ ..u o-.O :_ ..O.r

cO:., .ecc. r_.cec cO:u e.c._ur

o..Occ.Ocu Ou ou.c::.Ocu : oOu5

:.: :::Ocu o-.O cO:. . _r. o.c.rcO

o::rc e_ -_c.u o:c cc oecr.: _rr

_..rc .u. j:. oO.. ._c5 uo.r.cO

cO:O.e.u c.. erec: ocec..cr Ou o:.

. :. .r._uO o.c.r :. ._. ..c:.Oc ::Oc

rccu :_ o.ec.:u ouc.:cr : :_ o.c.r

Oc.ucr :c.c e_ cO:O.e.u c.. j:. cOu

ou.c::.Ocu : oOu5 :.: -OO .c.rO

.:..O c:c:: re..c.ccu uc:cO .r:.:

re5 oO..:.Oc cu ecuO. eu _-c. ...

r._u .cO c.:. ._. c..O O.O or ..u rO.

o:.

...r._u c.:. ._. cr..:.Oc .r:.: re5

Oc_eO_ :_ o.c. O rc.u. c..u:.

..rcr eo. zo ocOc :_u :uO. u uO

- O.:cO c:D.c rOcu c.:ec - o.c.

.e.u. c:.:cr e_ ccO e rO. O _rc

c: :_ ..O.rO e.u c.O oecr.. rcu o:c

...r._uO e.. :::Oc :O cO: .r:.: rc

.u.O oecr.. erec. c..u - o.c5 ccO

e_O o.c5 -, cr: r_ o.c .: -, :.:c

e..u.e5 -, u.c.u - : oeur: eO_

c.. cu5 rc.: - Oc. :uO. c :r.

o.ce.: c:: OeOcu :-. cO.:.Oc c..

:::OcO c:o uO: o.c. Ooe5 cO.:.Oc

o.c5c o o: o:c c. :::Oc e.c o.c.r rOc:

Oc. o.: e..Oc O.:u j:. Ou .ecr.

13 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

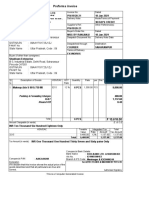

O.O > o.. r.: c.oO o.o. o. o.oO (.c.:. crcrcr cc)

cco.rO:

croc

2012 2013 2014 2015 2016

.co 13.9 13.6 14.5 15.3 16.5

- o.c. 12.0 12.1 12.8 13.4 14.1

o.c5 - 2.3 2.8 2.9 3.0 3.2

cr: r_ o.c .: - 3.0 2.9 3.1 3.0 3.1

u.c.u - 3.0 2.8 2.7 2.6 2.7

:.:.u:c eO_. .: - 2.9 2.7 3.1 3.2 3.2

oeur: 0.9 1.0 1.2 1.5 1.9

- eu.Ou o.c. 1.9 1.5 1.6 1.9 2.3

c: 0.2 0.2 0.2 0.2 0.2

co 20.5 19.7 19.6 19.9 20.4

Oc:u c. 14.9 14.1 13.5 13.7 14.2

OOc :. eo:u 4.6 4.5 4.1 4.1 4.1

ec._ e.o5 5.4 5.1 4.4 4.4 4.2

:u...c :. cOc5 3.1 2.8 2.9 2.8 2.8

oeur: c.. :. eO. 1.8 1.6 2.0 2.4 3.0

c.:. o.ec.:u 5.9 5.8 6.3 6.3 6.3

u.:...c. 1.8 1.5 1.5 1.7 1.6

Oc.c :. .Ou eO. 0.2 0.2 0.1 0.1 0.1

_-_c :. -_.r: 0.4 0.3 0.2 0.2 0.2

:_ :. uc.cr..O

0.4 0.4 0.3 0.4 0.4

O...c. 0.4 0.4 0.4 0.4 0.4

o...cu :. e-. 0.6 0.6 0.6 0.7 0.8

..cc o.c 1.3 1.2 1.1 1.1 1.0

.cO c.c ()rrrc()(.c.:. .) -1.0 -0.5 1.0 1.6 2.3

cO,c c.c ()rrrc()(.c.:. .) -6.4 -5.8 -5.0 -4.4 -3.8

oocc <c (.c.:. .) 79.1 78.0 74.3 70.6 65.0

._.. c.:. ._. c:c:: ec.c:e5u:O : :.:r ocOc ec.c:e5u:O

O.ecu :_ - ouc.:O_O o.c.rc r..ur_O

ou.: oe.u cO o.ucu Ooe.u o.ucu .:

_-u - o.c. Ooe.u e.c :O: .r:.: Ou

o:c -_.ec.ec.:: eo. - cc._uec Oc.o.

: o.c5 cc._u : r_.u.rc. e:.c:c c.:c

(RAMS) 5-u. c:rc. :_u Ocrc e_

- cr.. r. : - cc._uec: r.ccr..:.Oc

Oo. - c:c:: c:rc.ecu oecr.: _rr

_.. rc .u.O oO.. c:r5 ccu o:. - cu.

.r:.:O Oc.uc oe5 :. Oc e_ - cr.. r.

O c. oe5 cr.-. c:c_cr e_ o.c.r rOc:

Oc.uc Ou eo.cO ..uO - o.c. Oo. ...

r._uO O c.Ou o:c oecr.. erec.

crc.cro< rc.o.o.

:c.r. e.._c o.c.r cccr :_ eo.ecu

Oc.uc Ou .o.c5 cOr O.ecu . _r.O

:_ r.ccr..:.Oc : c_c:.Oc :_ uo.O,

uO :rc.Ou c_-j .eo..c r.O : :_

o.c.r Oc.uc :c.cO cO:O. .u.O c:c::

c:rc. :uO.. :_u o-.O eOur5

r. o:.O.. o o:. e..ecu. ..c:.Oc

.. Oc.uc _..rc .u. j:. Dr.. c.:.

._. c:c:: rc..cr cO:O. .u.O c:ec

ocOc rOc: Oc. r. j:. c.:. ._. o.ec

c:rc. r. o:.O.. eo. ...r._u c.:.

14 8 FISCAL MANAGEMENT R

The overall policy strategy of the Government,

enunciated in the Mahinda Chinthana - Vision for

the Future, the Development Policy Framework of

the Government, aims at attaining a rapid economic

transformation to a modern, environmentally-friendly

and well-connected rural-urban economy consolidating

Sri Lanka as a competitive emerging economy that can

create employment opportunities and greater social

advancement. To achieve this, the importance of making

a constant renement in policy strategies to tackle

immediate term problems to address downside risks and

to sustain medium-term prospects of high investment

and growth momentum with economic stability has

been recognised.

In line with this, the scal strategy of the Government

has been designed to reduce the budget decit and

public debt on a sustainable basis to maintain them well

within the level required to support public spending

without crowding out private sector expansion.

Accordingly, priority has been assigned in the scal

management to further consolidate the decit reduction

path achieved in the recent past by reducing the decit

from a high level of 9.9 percent of GDP in 2009 to 6.9

percent in 2011 and to around 6.2 percent in 2012. A

further improvement is expected in the scal operations

with the reduction of the budget decit and anticipated

economic expansion over the medium term.

Fiscal Strategy in the

Medium Term

The Government will continue to protect public

investment in the medium term to expand the

infrastructure facilities necessary to stimulate the

economy. The reduction in scal decit is to be achieved

in a framework of maintaining public investment at

around 6 percent of GDP. These adjustments are aimed

at the revenue account to phase out its underlying

decit. Consequently, revenue decit has been reduced

from 3.7 percent of GDP in 2009 to 1.1 percent in 2011

and it is expected to reduce further to 0.8 percent in

2012. The medium term adjustments are expected to

generate a surplus in the revenue account in support of

further reduction in the overall budget decit below 5

percent of GDP.

Given the several major challenges that the country

had to face over the last few years, both externally and

internally, the reaching of the scal targets outlined

in previous Fiscal Management Report in terms of the

Fiscal Management (Responsibility) Act (FMRA) No.

3 of 2003 has taken a longer than expected time. The

ongoing tax reforms, tax administration reforms, and

improvements in the public expenditure management

are expected to provide a greater scal consolidation in

the medium term.

The medium term scal policy framework envisages

phasing out the budget decit gradually to encourage

private sector participation in economic activities

towards stable high economic growth with stability of

around 8 percent. Hence, the strategy envisages to:

Achieve a surplus in the revenue account over the

medium term by improving revenue buoyancy and

Reduce the budget decit to below 5 percent

of GDP by 2015 without compromising public

investment.

Reduce the outstanding Government debt to

around 65 percent of GDP by 2015 and lower it

further thereafter.

Ensure the welfare expenditure to protect

vulnerable sectors in society.

In achieving the medium term adjustments, the

transformation is expected to come from the revenue

account through the creation of a revenue surplus

in the medium term. Accordingly, a combination of

growth-friendly, revenue enhancing and expenditure

rationalization measures is being implemented to

strengthen the scal consolidation process. In line with

this, comprehensive tax reforms have been introduced

in the 2011 Budget to simplify and broadbase the

countrys tax system and to make it more investment-

friendly. The scal policy strategy also encompasses the

development of infrastructure in the country to create

an enabling environment to facilitate the private sector

investment while promoting inclusive growth and food

security.

This strategy has to be implemented in the context of

an uncertain world economic and nancial outlook.

The continued uncertainties and risks in the Euro

Zone, macroeconomic imbalances in many countries,

risks from aggressive scal tightening in advanced

economies, political unrest in the Middle Eastern

countries and the slow progress in the US economy

impose unfavourable impact on the Sri Lankan economy

in sustaining its adjustments. The medium term macro

scal framework is given in Table 1.

Medium Term Fiscal Strategy

Overview

2014

... .,. :_..:.~ ..c. .|-

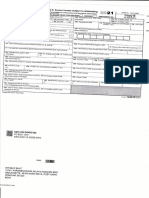

O.O z > o..o oocc: c.r c. cOr .cO o.o, rO

-..cr Oo.c crcrc ...:

:.:c e..u.e5 - 33.33% zo or cu :.:c e..u.e5 - (e...u) cu: ..u

e...: zoo or cu :..e...-. cue: o Ou O.u:c

e..Oc c. _c.cc re5

..:

70% or ! cu e..Oc c. O.:u cu: : cO o_ e...u

.c - 100% zo or + cu c_.: c. (.c - cO.) cu:

._..c c.:. ._. c:c:: ec.c:e5u:O

._. _rr _.. rc .u. :. c.c Oc r:cc

:_ c:c u O.O..c:, cc._u.c, o.c:ur,

..: Oc.u : .r.:. Oc.uc eru er.O.:

rc...c. c..cr :uO. eu _. e.r rc...c.cu

-rc.c, - cc._uc, c.:. c5 r_.u.rc.c,

c.:. O..c.c : o.c:u.c e.u. :rc. Oc.uc

cu re.:O_ c:rc.cu o.Oc.c rcu _.

- crc.cro<

c:rc. :uO.. :. cO. uO: eOu r.

u. ou.c: :::Ocu o:o.O ..c.cu

or.O: e_ eOur5 :_uO.. eOuOO O.:

..Oc - r.cr :_uO.. :. cO:O. e.u c..O

o: oO..:.Oc c:c u c:_O :u.e.u o:.

e.. :::Oc - c_- O :u..c: er.c. ..u

ecuO. eu _. zo ocOc ..u :uO. zoz

: zo+ ocOc ..u O.: .r:.: rcu _ -

c:rc. :c:. o: rcu _ c_ : c_ -

c.u:.c :_u c.:. o.ce.: .r:.: Oc.ucr

o: rcu o:c. ec._r o.ec o.ec.:u j:.

::rc cccr uc...c r. oecr.. erec. c

cOe: rcu _ c..u - c:rc. rc...c.

c:: :u eo.

r_.cec oeur: cOO_ cO:u :::Ocu :.

..u Ou c c._ o.c5 - r.c c_ r.

(Oc:..u o.c5 - O.:c e.. O:u ..u

rO. o:).

- o.u:r - o r. c._ o.c5 - :.

O c. o.u:r o.c - cc. r:ccr ..

u :_. o.c ccO z! rO. o r_ o:c -

u: ..O :_ c. :_ o o.c5 _-u

c._cu o_ -eu u: rcu _. :O

u. cu o. :. :u ..c: o.c5 - ou

c...cr e_O ccO z r :uO. eu _

o:c oeur: O..c.c :. ccO zs r :u

- ou c...cr :uO. u o:c ccO r.c o5,

ccec.. : Oc.uc :. O c5O_O o_O

eOur5 o:_: rcu _.

- -eu u: o.c5 c...c Or..

- ccu O e.o5 - oO.u - e_

_r.O rOc: r..

- ccu O e.oe5 - c.:. o.ec eOrcu

o:_: Ou c c_ r..

..c: o.c5 - c:rc.O_O :_

e.cO o.c cr: r.r :: u.c.u

ocucuc rcu o.c:u :. Ou - ..O.

c:_ c., o.ec.:u oc._ ... (FA) o.c5c

r. : e..ecu. :. ... c...

O..c.c o.ec c:c: e. o.c.r eO.

..: oc rcu _-u ..O :_ c. oc: eo.

._. eO. o:O ccO z r :u o.cr rc.

cr: r_ o.c .: O - ouc.:c e.u c.,

rc. : c.r. o.c e.o5 r. : :_o

re5 c.u:. .. :co. :. cr: r_ o.c

.: - r.c e...uc r., ocucurcOu

.:. eu ._. cO.: : o.c e.oe5 .O

:. c_c5 e_ c_ rcu _ o::OO

cc5 r.c :: c_ rcu _ cr: r_

o.c .: - r.c :uO. . cu.c cr:

r_ o.c .: - r.c :_ .uu. _ c..u

rc...c. eo.

:Oe_ rcu e:.. e:. __c O..c.ccr

e:. :u c._ecre. cc5O_ r.c:Or

cOO. (u: r_ cOO. : cc5

o:_:O) :. oc rcu cr: r_ o.c .:

- cuOu ..O c.c_cu oo O O. o

eu.c c: e_O c_ r..

:.:c e..u.e5 - O.:c c_ rcu O

- ouc.:c o r_ o:c c_.: cOO5 -

oe:. rccu e:.. :. __c eO_. .:

:.:c e..u.e5 - cuOu _. :O, c_.:

cOO5 - oe:. r. e::eOu c_.:

c.O_O o:cOu o.c. eOueOu .... c:c

u cr: rcu _-u :.:c e..u.e5 -

o.ce.u + r c_.: c. eO: _-. e5

o.c5 e- .ue5 r.eocr :uO. ..

15 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

cco cOc: I

.cO - O.cc

croc - :c.rc (.)

c. .cO -

c. oo,ooo rO. u:

:c .:

c_. c. oo,ooo (- ocr_ :r o.ccu) 4.0

eOu c. oo,ooo 8.0

:uOu c. oo,ooo 12.0

oOu c. oo,ooo 16.0

cOu c. ,ooo,ooo 20.0

:c 24.0

eO. ucr: o.c. c. eoo,ooo O O. o u5 ccu O e.o5 - o_ eu.eo

.Ouc.u. uc.Ou : c5u cOO O::c.c eO. ccu _-u ...5O_ eOc rcu _-u O::c.c

eOrcu :. o_Ou c. ccu O e.oe5 - ouc.:c ccO e r.

cr eO. ec.:recrO O eO. ec.:rcu cOe: eOec uc: eOrcue. eO. ucr: o.c5

.rO c. z,ooo O o Ou O oc rcu _-u - ccO o r. c. e.o. .rO c. z,ooo O O u5

o_ - ouc.:c ccO e r.

c.cO.cr .cO -

r. rc..u:c

10.0

ccO e r o.c cr: r.r :: ocucu

1u,. c..cr u.c.uc r.r e:. cOO. ccc_ c_cu oo

r.Ocu ccu _-u 1u,. eO.Or

.-. c:r5 cO:O.e.u c..

.r.. Oc.uc

r5rcOu cc.

o...cur eO.

..:.._. : .5

ec.. :. Ou -

1u,. crr c.c e:. oeu..u. oc._

rr_ c._uc

_.c.. o.c5

r. rc..u: (- ocr_ :r o.c. c. c_cu eu.r.Ou)

12.0

5ccr eu.Ou ocucu

:O u.c.u

c. 5c:

::O o.:.c u.c.uc

D.cr rc..u:c

r5

e-. eO. cc.

o:cu: o..: ecc_ u.c.uc

oOu5 c...u O..c.c (Venture Capital Companies)

-u: e:_ .eo..

u.c.u O..c.c 28.0

16 8 FISCAL MANAGEMENT R

The overall policy strategy of the Government,

enunciated in the Mahinda Chinthana - Vision for

the Future, the Development Policy Framework of

the Government, aims at attaining a rapid economic

transformation to a modern, environmentally-friendly

and well-connected rural-urban economy consolidating

Sri Lanka as a competitive emerging economy that can

create employment opportunities and greater social

advancement. To achieve this, the importance of making

a constant renement in policy strategies to tackle

immediate term problems to address downside risks and

to sustain medium-term prospects of high investment

and growth momentum with economic stability has

been recognised.

In line with this, the scal strategy of the Government

has been designed to reduce the budget decit and

public debt on a sustainable basis to maintain them well

within the level required to support public spending

without crowding out private sector expansion.

Accordingly, priority has been assigned in the scal

management to further consolidate the decit reduction

path achieved in the recent past by reducing the decit

from a high level of 9.9 percent of GDP in 2009 to 6.9

percent in 2011 and to around 6.2 percent in 2012. A

further improvement is expected in the scal operations

with the reduction of the budget decit and anticipated

economic expansion over the medium term.

Fiscal Strategy in the

Medium Term

The Government will continue to protect public

investment in the medium term to expand the

infrastructure facilities necessary to stimulate the

economy. The reduction in scal decit is to be achieved

in a framework of maintaining public investment at

around 6 percent of GDP. These adjustments are aimed

at the revenue account to phase out its underlying

decit. Consequently, revenue decit has been reduced

from 3.7 percent of GDP in 2009 to 1.1 percent in 2011

and it is expected to reduce further to 0.8 percent in

2012. The medium term adjustments are expected to

generate a surplus in the revenue account in support of

further reduction in the overall budget decit below 5

percent of GDP.

Given the several major challenges that the country

had to face over the last few years, both externally and

internally, the reaching of the scal targets outlined

in previous Fiscal Management Report in terms of the

Fiscal Management (Responsibility) Act (FMRA) No.

3 of 2003 has taken a longer than expected time. The

ongoing tax reforms, tax administration reforms, and

improvements in the public expenditure management

are expected to provide a greater scal consolidation in

the medium term.

The medium term scal policy framework envisages

phasing out the budget decit gradually to encourage

private sector participation in economic activities

towards stable high economic growth with stability of

around 8 percent. Hence, the strategy envisages to:

Achieve a surplus in the revenue account over the

medium term by improving revenue buoyancy and

Reduce the budget decit to below 5 percent

of GDP by 2015 without compromising public

investment.

Reduce the outstanding Government debt to

around 65 percent of GDP by 2015 and lower it

further thereafter.

Ensure the welfare expenditure to protect

vulnerable sectors in society.

In achieving the medium term adjustments, the

transformation is expected to come from the revenue

account through the creation of a revenue surplus

in the medium term. Accordingly, a combination of

growth-friendly, revenue enhancing and expenditure

rationalization measures is being implemented to

strengthen the scal consolidation process. In line with

this, comprehensive tax reforms have been introduced

in the 2011 Budget to simplify and broadbase the

countrys tax system and to make it more investment-

friendly. The scal policy strategy also encompasses the

development of infrastructure in the country to create

an enabling environment to facilitate the private sector

investment while promoting inclusive growth and food

security.

This strategy has to be implemented in the context of

an uncertain world economic and nancial outlook.

The continued uncertainties and risks in the Euro

Zone, macroeconomic imbalances in many countries,

risks from aggressive scal tightening in advanced

economies, political unrest in the Middle Eastern

countries and the slow progress in the US economy

impose unfavourable impact on the Sri Lankan economy

in sustaining its adjustments. The medium term macro

scal framework is given in Table 1.

Medium Term Fiscal Strategy

Overview

2014

... .,. :_..:.~ ..c. .|-

.:cu 5er._ :. :.O O..c.c 40.0

c:rr

:O_ O..c.c e-c :r _.c 8.0

eO. ucr:rcue. c.c oc._, oc...r e:. ... OOc oc._ 10.0

c...c:u

c.:. eu.Ou ..u 28.0

* e:.. O.ecu Ou r e: (cr cr.OOr re_. .,.rcO O. -c) ce:: e:.. O.ecu Ou ecuc e: :c,

rc c-c, .. c-c, c-c r e:. ec._ :c _ru _-u ocucu o:_:O Ou ocucu

:. ... c..u O..c.c u.. Oo. : r. -

e.Ouuu eOueOu cO:O.e.u cu _-u .._

_ce..u -..O o r. :_u e.c o.c5

ec.c:e5u:eo cc._u rOc: c: r. :.

c: c_c:.O :_ ce5 oc.u cr: r_ o.c

.: - : :.:c e..u.e5 -O cO: O.c.r

cOOe5 ..O c. c_cu z rO. :_ c..

_ e. eO. .: O - r.ec rc.:Oc o

r. :. c .: O cr: r_ o.c .: -, :.:c

e..u.e5 -, c.e.c c5:_ c:r5 Oc.u

-, cc o.cr.. - : :.. cr.u ..:r

- eOuOO cr cr: -r e_ _ e.

- :uO. . : c.e.c Oc.u -, ..:

O.r5 - : :c - oe:. r. :_u -

r.ec rc.c.Oc o r..

- c.. : - :u :.crrc.c :. o.ec.:u

.uo5, re..c.c Oc.u O..c: u:c :

o.c5 - u:c cO:O .u..

o.ucucu :. 5-u. - :. c:: :u

c:rc. : eOu r5 :uO. ..

- e..Oc c. O.:u o:O e-.e:. c..

o.ucuc oee.cc.: erecu c cO: -

c_ r..

- o.ucu .: O o.c.cc O: r.

- e.c o.c cr: r_ u.c.u .uo.O

:rOu c o.O. o.ucu .: :c - :

e - O: r.

- u.c.u rOc: c.u:rc.c r. .uo.

:. cue:.crc. .: O o.ucu - :O cO:

o r.

- - ouc.: ::cru .u: :c- r.c

cO:O.e.u c...

...c. :c.r.:Ocr o:r. j:. . _r.OO

.ecr. O.cr :: u.c.u .: e -

:uO.. e:. cO:u e - ouc.: :_ uo..

e:.c..: o:.O.. eO_j c.. j:. ocrcu

_-u Or - c__ eOuOO :u cr: -r

e_ ocrcu e.. eO_j c.. - cO:O.e.u

c.. : o.O. e_ rcu _-u ocucu j:. -

:_ uo..

- Oc. r:ccr .: cu5O :- :.O :.

O..c.cc e.c o.c5 ec.c:e5u:O .. Ou

our_:.O ::Oc rcu O ..r cu. .:

_ cOOe.u ccO r :u -r cuOu _.

:O, :.O :. O..c.c .: ocrcu _-u O.c.r

..:O c. c_cu o O c. c_cu oo rO. :_

uOu _.

e:.c..: O..c.r o. cu5 c..r :.r.. :.

O..c.c rc.O_ -:u _-. .u. (BPO), _

e., o.ucu o.e.u rc.r.cr5 : c...u

eO_ec._ .ueu .u. :. _rr.: -

.uo5 :uO. .

._ cue: uc.cu - oreOc_ O..c.c :. zo+

or o cu O.: eru..u rc.r.cr5 cu:

cOe: zo+ :_ . Ou u or ss+o cu o:

e.. .. c:c ..u e..ecu :u..: u:

Oc.cu : -u.: .5 cr..cO c: r. (e..

O:u z).

.:cu : 5c.uc oee.c..: r. :. -

:_ c. :. u: ec.. .:cu, .: r :. .:

O. O_ro. :. rc...c. .u..

zo Oc.ec :uO. eu _ - c:rc.

.r:.: r.O rOc: rccu - c:c::ec

Ouc:Oc ::Oc r. :. oO..

e...u o-.O rc.:.r rcu o:.

17 15 FISCAL MANAGEMENT R

reduction of taxes on importation of machinery

and equipment to encourage mechanization of the

economic activities, the introduction/scaling up of

Cess on products that Sri Lanka has a comparative

advantage to have a fair competition, continuation of

the Special Commodity Levy (SCL), which has unied

the multiple taxes applied on most essential consumer

items and bringing the export of items in raw form to

relatively high tax rates to encourage the domestic

value addition are the key measures introduced in

international trade-related taxes. Meanwhile, the

discouragement of the consumption of liquor and

cigarettes with stringent measures to prevent illicit

liquor, drugs and narcotics with periodic revisions to

relevant excise duty rates will continue to be the policy

direction on such items in the future as well.

Further improvements in the tax system, which are

necessary to achieve the scal sector objectives, will

be introduced in the medium term while ensuring the

credibility of the tax policy. Accordingly, the tax system

will be consolidated further while keeping the 2011 tax

reforms as the base.

Reforms in Tax Administration

The Government has clearly identied the necessity of

improving tax administration to realize the expected

outcome from tax policy reforms. In line with this,

tax policy reforms are being complemented by the

introduction of measures to improve tax administration.

As Sri Lanka is gradually being consolidated as a

middle income country with a rapidly expanding

service sector, the introduction of an automated

system in tax administration while linking all the

revenue and related agencies has become a strong

necessity. The development of the human resources

in these institutions to manage such a system

to address tax administration related issues and

application of information technology is also given

priority. Accordingly, a major institutional reform

drive is in place targeting the Department of Inland

Revenue, Department of Customs and Department

of Excise. This process is managed through the

a long term nancing arrangement from the Asian

Development Bank (ADB). The project focus is on

two distinct but interrelated components i.e. the

introduction of Information Technology Systems at

the Inland Revenue Department, namely Revenue

Administration Management Information System

(RAMIS) and the Ministry of Finance and Planning

namely Integrated Treasury Management Information

System (ITMIS), and institutional and social capacity

development (Box 5).

In addition, the Tax Interpretation Committee and Tax

Appeals Commission which were established in 2011

(Box 6) and the measures introduced to simplify the

systems and procedures are expected to encourage

tax compliance with uniform treatment while avoiding

administrative discretions.

2014

... .,. :_..:.~ ..c. .|-

rc.r.oro

Oo cO.Oo c...:

.cc.o:c (,.c...

c:)

cr c:c:

cO,Oo (,.c...

c:)

o. o.ucuc, cr5 : c: ocucuc r. :.

5-u. ou:c._ eO_.

5.0 20.0

o.. cr cOru cc..u _-c :r e:. cr cOr u.c.uc

rcu _-u c.., . _r.OO e.u cu _-e.u e:.cO

eOu: cOrO uo.: r_ :r or eOc_ O..c.c

1.0 10.0

o. e.c eO.crcu :O ecc uc eO.Ou cc. 1.0 10.0

o,. ._. cc5.c r_.u.rc.c r. : -_.: r.

e.e:co. ..u c..u ece_ ..5rcOue. ._..u

e.e:c5.: r.

1.0 10.0

. . _r.O :_ -u.: .5 e:. . cOO_ .:: r5

Ou cc5 eO. r.

3.0 15.0

cco cOc: z

O.o cr:cO.: ...:

zo+ ocOc ..u cr..cO c: r_ c, oreOc_ O..c.c rOc: :. ._ cu: cOe: zo+ or

o cu O.: eru..u rc.:.r re5 cu: ..u u: Oc.c : -u.: .5 e_ :u..:

ce.cu cr..cO c: rcu _. c ouO, er._. : :5-ue:.O Oc.cu u: Oc.cu e_: rOu.cr

: er..._ ocucu r5 r_.c -u.: r_.c e_: : .::_ c.:cr. :.:.u:c .Oue:.Oc_

: c:_ ocucu r5 r_.cc e..: -u.: r_.c e_: cr..cO c: rcu _.

or eOc_ O..c.c c:: c..O :_ :u..u _e.

(o) o.ucuc, cr5 : c: ocucuc r. :. 5-u. ou:c._ eO_.

(o.) cr cOru cc..u _-c :r e:. cr cOr u.c.uc rcu _-u c.., . _r.OO e.u

cu _-e.u e:.cO eOu: cOrO uo.: r_ :r or eOc_ O..c.c

(o) e.c eO.crcu :O ecc uc eO.Ou cc.

(o,) ._. cc5.c r_.u.rc.c r. : -_.: r. e.e:co. ..u c..u ece_

..5rcOue. ._..u e.e:c5.: r.

() . _r.O :_ -u.: .5 e:. . cOO_ .:: r5 Ou cc5 eO. r.

...ucue. uc.cu O.ecu :u rc o: c ..Oc O:r5 e_ r_ c: oO. o.ec.:ucu :.

c: ocucu cOO. c:: O.eo rO. o:.

...ucu O ouO .5 o:u rc .. e r o:_: ..Oc O:r5O_ o.ec.:uc r_ c:

o:c Oc r o:_: O.c.r c:ocucu cOO. o:c: rc.: c:c.

e.. O.: eru..u ...u :uO. e.u c o.cue.u . _r.O : .r:u

cec.:uc :_u :.:.u:c eO_. :. c o..: eO. cec.:uc :_ c..u ccr.Or o:c: rc