Académique Documents

Professionnel Documents

Culture Documents

Advanced Financial Accounting Sample Paper 1

Transféré par

Sherla Mae AlfonsoDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Advanced Financial Accounting Sample Paper 1

Transféré par

Sherla Mae AlfonsoDroits d'auteur :

Formats disponibles

Advanced Financial Accounting

Sample Paper 1

Questions & Suggested Solutions

INSTRUCTIONSTOCANDIDATES

PLEASEREADCAREFULLY

Candidates must indicate clearly whether they are answering the paper in accordance with the law

and practice of Northern Ireland or the Republic of Ireland.

In this examination paper the / symbol may be understood and used by candidates in Northern

Ireland to indicate the UK pound sterling and by candidates in the Republic of Ireland to indicate

the Euro.

AnswerALLTHREEquestionsinSectionAandTWOoftheTHREEquestionsinSectionB.If

morethanTWOquestionsisansweredinSectionB,thenonlythefirstTWOquestions,inthe

orderfiled,willbecorrected.

Candidatesshouldallocatetheirtimecarefully.

Allworkingsshouldbeshown.

Allfiguresshouldbelabelled,asappropriate,e.g.s,s,unitsetc.

Answersshouldbeillustratedwithexamples,whereappropriate.

Question1beginsonPage2overleaf.

NOTE:

Thispilotpaperandsolutionhavebeenpreparedinrecognitionthatpubliccompanies

arenowrequiredtoprepareaccountsimplementingthelanguageofInternational

AccountingStandards(I.A.S.s)butthatothercompaniesandnoncorporateentitiesare

notrequiredtodoso.

Examineeswouldbeatlibertytousethelanguageofeither(i)I.A.S.sor(ii)the

Companies(Amendment)Act1986andF.R.S.s/S.S.A.Psinansweringquestionsrelating

tononpubliccompanies

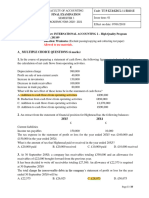

SECTIONA

AnswerALLTHREEQuestionsinthisSection

(ThetotalmarksforsectionAwillbe60,madeupofatheoryquestionof20marks,a

multiplechoicequestionof15marksandafurtherquestionof25marks)

QUESTION1

(i) The Turnbull Report attempts to define internal controls and in doing so describes three types of

controls:

(a) Operational controls

(b) Compliance controls

(c) Financial controls

Outline the purpose of each of the above internal controls and provide one example of each.

9 marks

(ii) The Board of Directors of your company has asked you, as Financial Accountant, to advise them on

the need for a robust internal control system and to describe five commonly found internal financial

controls, giving an example of each.

11marks

Total 20 marks

QUESTION 2

The following multiple choice question consists of TEN parts, each of which is followed by FOUR

possible answers. There is ONLY ONE right answer in each part.

Each part carries 1 marks.

Requirement

Indicate the right answer to each of the following TEN parts.

Total 15 Marks

N.B. Candidates should answer this question by ticking the appropriate boxes on the special green

answer sheet which is supplied with the examination paper.

[1]

Under the terms of IAS 2 the net realisable value of an inventory item is the:

(a)

estimated selling price in the ordinary course of business, less the estimated costs of

completion and estimated costs necessary to make the sale

(b)

estimated selling price in the ordinary course of business

(c)

actual selling price in the ordinary course of business less selling costs

(d)

estimated selling price in the ordinary course of business less the estimated costs of

completion

QUESTION 2 (contd)

[2]

An unqualified audit report is saying:

(a)

with certainty that the financial statements are 100% accurate

(b)

that in the opinion of the auditor the financial statements do not reflect a true and fair view

of the companys financial affairs

(c)

that in the opinion of the auditor the financial statements reflect a true and fair view of the

companys financial affairs

(d)

with certainty that the financial statements reflect a true and fair view of the companys

financial affairs

[3]

Under the terms of IAS 1 assets and liabilities and income and expenses may not be offset against

one another unless:

(a)

(b)

(c)

(d)

[4]

Overvaluing closing inventory in the Statement of Profit & Loss results in:

(a)

(b)

(c)

(d)

[5]

Current assets closing inventory / non-current liabilities

Current assets closing inventory / current liabilities

Current assets average inventory / current liabilities

Current assets average inventory / non-current liabilities

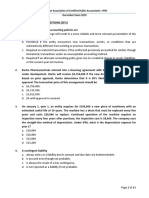

Under the terms of IAS 8, where the effect of a change in estimate is material to the financial

statements:

(a)

(b)

(c)

(d)

the understatement of Cost of Sales and overstatement of operating profit

the overstatement of Cost of Sales and understatement of operating profit

the understatement of Cost of Sales and understatement of operating profit

the overstatement of Cost of Sales and overstatement of operating profit

What is the ratio for Acid test?

(a)

(b)

(c)

(d)

[6]

the elements to be offset are immaterial in nature

the reason for doing so is detailed in the notes to the accounts

the external auditor approves

required or permitted by a standard

the nature and monetary effect of the change on the financial statements must be disclosed

the change in estimate should be applied retrospectively

the change in estimate should only be applied retrospectively where it is deemed necessary

to provide more reliable information

the nature and monetary affect of the change on the financial statements must be disclosed

only where it is deemed necessary to provide more reliable information

QUESTION 2 (contd)

[7]

Under the terms of IAS 37 contingent liabilities should:

(a)

(b)

(c)

(d)

[8]

only be disclosed by way of note to the financial statements if material in nature

be recognised in financial statements as it is probable that a cost will be incurred

only be recognised in the financial statements if material in nature

not be recognised in financial statements or disclosed by way of note

A fire which broke out at the shop premises of Sole Trader X resulted in damage being caused to

the accounting records. However the following information is available:

/

Bank balance

Cheque payments

Trade receivables

1 Jan 2010

31 Dec 2010

1 Jan 2010

31 Dec 2010

2,000

2,700 (overdrawn)

57,000

6,200

7,800

There are no cash sales. Calculate turnover for the year.

(a)

(b)

(c)

(d)

[9]

A government grant of /45,000 to help meet the cost of wages and salaries incurred during the

year to train staff was treated as deferred income in error. What journal entries are required to

correct this error?

(a)

(b)

(c)

(d)

[10]

/ 60,100

/ 59,300

/ 53,900

/ 63,300

debit deferred income, credit wages and salaries

debit wages and salaries, credit deferred income

debit bank, credit deferred income

debit bank, credit wages and salaries

If the balance sheets at 1 January 2006 and 31 December 2006 show a liability for tax of

/21,000 and /28,000 respectively and the charge for the year is 35% of operating profit. What

figure for tax will appear in the cash flow statement for the year ended 31 December 2009 if

operating profit is /110,000.

(a)

(b)

(c)

(d)

/38,500

/45,500

/28,000

/31,500

QUESTION3

Shoebox Ltd., is a shoe manufacturer with an authorised share capital of /2,400,000, comprised of

8,000,000 ordinary shares of 25 cent/pence each and /400,000 of 8% preference shares of /1 each.

The following trial balance was extracted as at 31st December 2009

/000

Ordinary share capital ......................................................................

8% preference share capital .............................................................

Retained profits at 1 January 2009 ..................................................

10% debenture stock ........................................................................

Land at cost ......................................................................................

Land accumulated depreciation .......................................................

Premises at cost ................................................................................

Premises accumulated depreciation .................................................

Plant and machinery at cost .............................................................

Plant and machinery accumulated depreciation ..............................

Motor vehicles at cost .....................................................................

Motor vehicles accumulated depreciation .......................................

Inventory at 31 December 2009 ......................................................

Goodwill ...........................................................................................

Investments (not for re-sale) ............................................................

Short term investments ....................................................................

Bank deposit account .......................................................................

Bank balance ....................................................................................

Trade receivables .............................................................................

Provision for doubtful debts at 31 December 2009 ........................

Trade payables .................................................................................

Corporation tax owing .....................................................................

Valued added tax owing ..................................................................

Accrued expenses.............................................................................

Deferred government grants at 1 January 2009 ..............................

Loan from director (repayable in 2015) ..........................................

Retained profit for the year ended 31 December 2009 ...................

....................................................................................................

/000

1,200

200

90

120

200

60

980

80

420

180

120

40

290

160

160

40

80

260

372

________

2,822

16

88

88

28

56

48

128

140

_______

2,822

ADDITIONAL INFORMATION

(1)

The above trial balance has been arrived at after charging depreciation for the year.

(2)

A final ordinary dividend of /0.025 per share has been approved by the shareholders. The

dividend should be provided for in the year end accounts.

(3)

Prepaid expenses valued at /24,000 were incorrectly included in operating costs.

(4)

Full year debenture interest to be provided for.

(5)

Government grants received of /40,000 have not been included in the trial balance. These

grants and the grants already provided for in the trial balance should be released to the profit and

loss account over a four year period starting with the current year.

QUESTION 3 (Contd)

Requirement

(a) Prepare, in a form suitable for publication, the statement of financial position for SHOEBOX

Ltd., for the year ended 31st December 2009 in as far as the information provided permits.

N. B. You are NOT required to prepare an Statement of Profit & Loss or notes to the accounts. You are

required to submit workings to show the make-up of the figures in the statement of financial

position.

18 Marks

(b)

You have been asked by a friend, who does not have a financial background, to explain the

statement of financial position as per (a) above. Prepare a note outlining your understanding of

what the statement of financial position tells you about Shoebox Limited.

5 Marks

Presentation 2 marks

Total 25 Marks

SECTIONB

AnswerTWOoftheTHREEquestionsinthisSection

QUESTION4

During a review of the draft accounts of CARTER Limited the financial accountant brought the following

issues to your attention:

i)

The company entered into a 5 year finance lease for a new machine on 1st January 2009.

The lease agreement requires 5 annual payments of / 30,000 to be made on 1st day of each

year. The present value of the minimum lease payments is / 125,096. The interest rate

implicit in the lease is 10%. The asset must be depreciated evenly over the life of the lease.

ii)

On the last day of the financial year a fire broke out in the warehouse and destroyed 50 units

of stock. On the same day 40 units of the same stock were sold for / 95 each. The

inventory valuation at year end was based on the stock count which was performed on the

second last day of the year and included 450 units of stock at a cost of / 105 each. Goods

sold were recorded in both sales and receivables.

iii)

/ 20,000 relating to the purchase of fixtures and fittings was incorrectly included in

administration costs at year end. Fixtures and fittings should be depreciated 10% per year

on cost.

iv)

Distribution expenses incorrectly include prepaid expenses of / 15,000.

QUESTION 4 (Contd)

Requirement

You are required to prepare the journal entries to show the financial accountant how each of the above

items should be dealt with in the final accounts for the year ended 31 December 2009. You should use

your understanding of the relevant IASs in dealing with each item.

Note: Journal narratives are required.

18 Marks

Presentation 2 marks

Total 20 Marks

QUESTION 5

IAS 37 provides definitions of a provision and a contingent liability and describes how each should be

treated in financial statements.

[a] Define both a provision and a contingent liability as set out in IAS 37 and describe under what

circumstances, if any, they should be recognised in the financial statements.

6 marks

[b] Review the following scenarios and confirm whether or not a provision should be recognised in the

financial statements as at 31 December 2009. Provide reasons for your answer.

(i)

On 12 December 2009 the board of Company A decided to close down a division making

a particular product. On 20 December 2009 a detailed closure plan was agreed by the

board and, on the same day, letters were sent to both customers and employees informing

them of the intended closure.

(ii)

Company B gives warranties at the time of sale to purchasers of its products. Under the

terms of the warranty the manufacturer undertakes to make good, by repair or

replacement, manufacturing defects that become apparent within three years from the

date of sale.

(iii)

Company C operates profitably from a factory that it has leased under an operating lease.

During December 2009 the entity relocates its operations to a new factory. The lease on

the old factory has four years remaining and it cannot be cancelled. The entity hopes to

re-let the premises to a tenant however no tenant has been found by year end.

(iv)

Under new legislation Company D is required to fit smoke alarms to its factories by 30

December 2011. The company has not yet fitted the smoke alarms.

8 marks

QUESTION 5 CONTINUED OVERLEAF

QUESTION 5 (Contd)

[c] The following information relates to BARNS Limited, a widget manufacturer, for the year

ended 31 December 2009:

/

Direct materials cost per unit

Direct labour cost per unit

Direct expenses per unit

Administration overheads per annum

Production overheads per annum

Selling overheads per annum

Interest payments per annum

2.00

3.00

2.50

600,000

900,000

200,000

100,000

There were no finished goods at the start of the year and no work in progress. There were 250,000

units in finished goods at the year end. The normal annual level of production is 750,000 widgets

however due to an industrial dispute only 450,000 widgets were produced in the year to 31

December 2009. The company uses a standard costing system to value its inventory.

These widgets have an expected selling price of /9 per unit if a further /1.20 is spent in

advertising costs.

Requirement

You are required to value the inventory at year end in accordance with IAS 2 Inventories.

4marks

Presentation 2 marks

Total 20 Marks

QUESTION6

The following trial balance has been extracted from the records of CORNWALL Limited at 31 December

2009.

/000

Revenue ............................................................................................

Purchases ..........................................................................................

Inventory at 1st January 2009 ...........................................................

Distribution costs .............................................................................

Administration expenses ..................................................................

Land at valuation 1 January 2009 ....................................................

Building at revalued amount............................................................

Building accumulated depreciation at 1 January 2009 ...................

Factory plant & equipment at cost...................................................

Factory plant & equip acc depreciation at 1 January 2009 .............

Warehouse plant & equipment at cost ............................................

Warehouse plant & equip acc depreciation at 1 January 2009 .......

Trade receivables and payables .......................................................

Cash at bank .....................................................................................

Ordinary shares of /1 each ...........................................................

Debenture interest ............................................................................

Dividends .........................................................................................

Share premium account ...................................................................

Retained earnings .............................................................................

Revaluation reserve ..........................................................................

Bank interest ....................................................................................

Long term bank loan ........................................................................

3% debentures ..................................................................................

Corporation tax ................................................................................

....................................................................................................

/000

30,780

17,180

2,890

3,040

2,240

21,840

16,000

4,430

26,640

5,140

2,400

8,520

800

1,040

4,660

28,000

120

300

6,000

9,320

6,700

60

2,000

4,000

40

________

102,070

_______

102,070

The following items are to be adjusted for in preparing financial statements for the year ended 31st

December 2009:

(1)

Depreciation is to be provided as follows:

................................. Buildings

................................. Plant & equipment

2% per year on revalued amount

20% reducing balance

Depreciation on buildings is to be charged fully to factory costs (cost of sales).

(2)

Closing inventory at 31 December 2009 is valued at cost of /3,250,000. Included in inventory

at 31 December 2009 are goods which had cost /500,000. Due to a downturn in demand, these

goods were sold at auction on 15th January 2010 for /300,000. Auctioneers fees were 3% of

sales proceeds.

(3)

The taxation charge of /40,000 included in the above trial balance is in respect of an under

provision in the previous year. The estimated tax charge for the current year is estimated to be

/940,000.

10

QUESTION 6(Contd)

(4) Included in trade receivables is a balance of /120,000 which is considered a bad debt and is to

be written off. The directors have decided to make an allowance for doubtful debts of 3% of

outstanding trade receivables.

Requirement

(a) Prepare, in a form suitable for publication, the companys Statement of Profit & Loss for the year

ended 31 December 2009

.

N. B. You are NOT required to prepare a statement of financial position or notes to the accounts. You

are required to submit workings to show the make-up of the figures in the statement of financial

position.

14 Marks

(b) You are required to calculate two ratios in respect of each of the following categories of ratios based

on the information provided above:

(i)

(ii)

Profitability

Liquidity

4 Marks

Presentation 2 marks

Total 20 Marks

11

AdvancedFinancialAccounting

SamplePaper1Solutions

NOTE:

Thispilotpaperandsolutionhavebeenpreparedinrecognitionthatpubliccompanies

arenowrequiredtoprepareaccountsimplementingthelanguageofInternational

AccountingStandards(I.A.S.s)butthatothercompaniesandnoncorporateentitiesare

notrequiredtodoso.

Examineeswouldbeatlibertytousethelanguageofeither(i)I.A.S.s,(ii)theCompanies

(Amendment)Act1986andF.R.S.s/S.S.A.Psinansweringquestionsrelatingtonon

publiccompanies.

12

Solutiontoquestion1

(a)

Internal control systems serve a critical role in the prevention and detection of fraud and error

withincompaniesofallsizes.IntheUKtheTurnbullReport(Report),whichwasfirstissuedin

1999,dealswiththeimportanceofinternalcontrolswithinpubliclimitedcompanies.Thisreport

hassincebeenupdatedandnowformspartoftheCombinedCodeofCorporateGovernancewhich

dealswithcorporategovernanceandethicalissueswithinpubliccompanies.

TheReportdefinesthreetypesofinternalcontrolsanditisworthnotingthattheReportdoesnot

confine internal controls to just financial accounting. The three types of internal controls are

discussedbelow:

Operationalcontrols

Operational controls are processes, tasks, policies, and actions that, combined together,

help an organisation to operate effectively and efficiently to safeguard the assets of the

companyfrominappropriateuseandloss.Operationalcontrolsalsohelptoensurethatall

the assets and liabilities of the company are identified, recorded, and managed

appropriately. Eg. Internal control system which records and monitors use of company

carsandsafeguardstheassetsfromunauthoriseduseortheft.

Compliancecontrols

Compliance controls are processes, tasks, policies and actions that, combined together,

helpanorganizationtoensurethatitisawareofandcomplieswithrelevantexternallaws

and regulations. These controls also help to ensure that the activities of the company

complywithinternalpolicies.Eg.Documentedprocessandcheckingproceduretoensure

thatacompanydisposesofhazardouswasteinaccordancewithlegalrequirements.

Financialcontrols

Financialcontrolsareprocesses,tasks,policiesandactionsthat,combinedtogether,help

toensurethequalityandintegrityofthefinancialinformationwhichisproducedbothfor

internalandexternalreporting.Eg.Monthlybankreconciliationspreparedbyoneperson

andapprovedbyanother.

(b)

To

:

BoardofDirectors

From :

A.Accountant

Date:10August2010

Subject:Internalcontrolsystem

Irefertoourrecentmeetingduringwhichtheneedforaninternalcontrolsystemwasdiscussed.

In this regard I have prepared this note to outline to you, as the Board of Directors, why it is

importantthatarobustinternalcontrolsystembedesignedandimplementedinordertoprotect

yourcompanyfromfraudand/orerror.

13

Aspreviouslydiscusseditisthecompanysdirectorswhoareresponsibleforthepreventionand

detectionoffraudanderror.Oneofthemeansbywhichdirectorsdischargethisresponsibilityisto

establishaninternalcontrolsystemwhichisimplementedandenforcedandreviewedregularlyto

ensureitseffectiveness.

As directors of many companies areremoved from the day to dayoperations and running of the

companytheyneedtoknowthattheriskoffraudorerrorismanagedandthisthereforeisoneof

theprimaryfunctionsofaninternalcontrolsystem.Accordinglyarobustinternalcontrolsystem

providescomforttothedirectorsthattheriskoffraudorerrorisminimisedandthattheassetsare

safeguardedandliabilitiesrecorded.

The Turnbull Report concentrates on the importance of internal control processes within public

limited companies and defines three types of internal controls; financial controls, compliance

controlsandoperationalcontrols.Ihavediscussedbelowfivecommonlyfoundinternalfinancial

controlsandprovidedanexampleofeach:

Physicalcontrols

These are measures designed to protect company assets from loss, misuse, theft or

damage.Eg.Employeesrequiredtouseswipecardstoaccesscompanypremises.Access

should be restricted to those areas individual employees need access to. This helps to

reducetheriskofcompanyassetsbeingstolen.

Approvalandauthorizationcontrols

Thesecontrolsrelatetospendingandenteringintoatransactiononbehalfofthecompany.

Eg. The person who approves purchase orders only approves orders submitted by

approvedpersonnel.Thishelpstoreducetheriskofunapprovedpurchaseordersbeing

processedandthecompanybeingboundbyunauthorizedpurchasetransactions.

Segregationofduties

Thiscontrolrelatestothedivisionofdutiessothattheworkcarriedoutbyoneindividual

isautomaticallycheckedbyanotherbeforebeingfinalised.Eg.Thepersonwhoprepares

monthly bank reconciliations is not responsible for reviewing and signing off the same

reconciliations.Thishelpstoreducetheriskoffundsbeingmisappropriatedandincreases

thechanceofanysuchtransactionsbeingidentified.

Personnelcontrols

These controls relate to the selection and training of employees to ensure that only

personnel who are suitably skilled undertake work for the company. Eg. Individuals

dispensing medical advice for a private hospital have the appropriate medical

qualifications. This helps to reduce the risk of incorrect advice being given to patients

whichcouldcauseharm.

Accountingcontrols

These controls relate to the integrity of the accounting system and help to ensure the

accuracyoftheinformationcontainedwithin.Eg.Accesstotheaccountingsystemrestricted

to authorised personnel each of whom only have access to the sections of the accounting

14

systemrelevanttotheirworkarea.Thishelpstoreducetheriskofinputerrors,deliberateor

otherwise.

15

Solutiontoquestion2

(1) A

(2) C

(3) D

(4) A

(5) B

(6) A

(7) D

(8) C(seeworkings)

(9) A

(10)D(seeworkings)

Workings:

(8) Bank:57,0002,0002,700=52,300

Debtors:52,300+7,8006,200=53,900(c)

(10)110,000x35%=38,500

21,000+38,50028,000=31,500(d)

16

Solutiontoquestion3

(a)

ShoeboxLtd.

Statementoffinancialpositionasat31December2009

/000/000

Noncurrentassets

Property,plant&equipment(W1)1,360

Goodwill160

Otherfinancialassets160

1,680

Currentassets

Inventories290

Tradereceivables(W6)356

Prepayments(W9)24

Cashandcashequivalents(W8)160

830

Totalassets2,510

Equityandliabilities

Capital1,400

Accumulatedprofits(W3)144

1,544

Noncurrentliabilities

Interestbearingborrowings120

Deferredincome(W5)66

Directorsloan128

314

Currentliabilities

Tradeandotherpayables(W7)380

Bankoverdraft260

Interestpayable(W4)12

652

2,510

17

Solutiontoquestion3(contd)

(b)

The balance sheet, as the statement of financial position is more commonly known, provides

informationonthefinancialpositionofShoeboxLimited(theCompany).Essentiallythebalance

sheetisalistoftheentitiesassetsandliabilitiesandprovidesinformationonhowtheCompanyis

financed.

Assets are resources owned by the Company from which future benefits accrue to the Company.

The Company owns long term assets which are more permanent in nature and include land,

premises, plant and machinery and motor vehicles. These assets are used by the company to

undertake its shoe manufacturing activities and generate profit, they are less liquid assets and

accordinglyarenoteasilyconvertedintocash.TheCompanyscurrentassetsincludemoreliquid

assets which are easier converted into cash. Inventories include the Companys stock of shoes

manufactured but not yet sold. It will also include materials to be used in the manufacturing

process. Trade receivables are amounts owing by debtors (customers) in respect of sales, most

likelyshoeretailers.

LiabilitiesareamountsowingbytheCompanyasaresultofpastevents.Liabilitiesincludecurrent

liabilitieswhichareshortterminnatureandincludeamountswhichmustbepaidwithinthenext

twelve months. Noncurrent liabilities include amounts owing over a longer term such as bank

debtandinthiscaseloansmadetotheCompanybyitsdirectors.

Equity is made up the funds the owners (shareholders) have invested in the business and in the

caseofShoeboxlimiteditincludesbothordinarysharesandpreferenceshares.Inthisparticular

situationtheCompanyisfinancedbybothdebtandsharecapitalhowevertheproportionofdebt

versusequityisquitelowandthereforethecompanyhasalowgearing.Ahighlygearedcompany

isonewhichhasahighproportionofdebtrelativetoequity.

Based on the statement of financial position prepared and the discussion above the Company

appearstobequitehealthy.TheCompanymadeaprofitin2009anddeclaredadividendwhichisa

distribution of profits to ordinary shareholders. Although the Company has a positive working

capital at year end (current assets (/830k) exceed current liabilities (/ 652k)) the current

ratioof1.27:1islessthantherecommendedratioof2:1.Itisalsoworthnotingthateventhough

currentassetsincludecashandcashequivalentsof/160kthisislessthanthebankoverdraftof

/260k.TheCompanyshouldconcentrateonreducingtheoverdraftduringthecomingyearor

considerconvertingpartofitintocheaperlongertermdebt.

18

Workings

(1)Property,plant&equipment

Cost

Accumulateddepreciation

NBV

Land

/000

Premises

/000

Plant &

machinery

/000

Motor

vehicles

/000

Total

/000

200

(60)

980

(80)

420

(180)

120

(40)

1,720

(360)

140

900

240

(2)Dividend

80

Sharecapital/1,200,000

Sharevalue25pence/centpershare

No.sharesissued4,800,000

Dividend4,800,000x/0.025/120,000

(3)Accumulatedprofits

/000

Retainedprofitforyearpertrialbalance140

Prepaidexpenses24

Dividend(W3)(120)

Interest(W4)(12)

Governmentgrantsreleased(W.5)22

54

RetainedProfitbroughtforward1Jan200990

Accumulatedprofits144

(4)Interest

Debenture10%/120,000

Interest/12,000

19

1,360

Solutiontoquestion3(contd)

(5)Grants

/000

Grantsasat1Jan200948

Grantsreceivedduringtheyear40

88

Grantsreleasedduringyear(88/4)22

Deferredgovernmentgrants66

(6)Tradereceivables

/000

Receivablespertrialbalance372

Lessprovisionfordoubtfuldebts(16)

356

(7)Tradeandotherpayables

/000

TradepayablesperTrialBalance88

Corporationtax88

VAT28

Accruedexpenses56

Dividendpayable(W2)120

380

(8)Cashandcashequivalents

/000

Shortterminvestments40

Bankdeposit80

Governmentgrantreceived40

160

(9)Prepayments

Prepaidexpensesof/24,000includedinoperatingcostsinerrortobein

currentassets.

20

Solutiontoquestion4

(i)

(ii)

(iii)

DRCR

DR Leasemachinery

CR Financelease

[Beingpurchaseofleasedmachinery]

DR StatementofProfit&Loss

CR Accumulateddepreciation

[Beingcalculationofannualdepreciationcharge]

DR Financelease

CR Bank

[Beingpaymentoffirstyearleasepayment]

DR StatementofProfit&Loss

CR Financelease

[Beingcalculationoffirstyearsleaseinterest]

25,019

30,000

9,510

125,096

25,019

30,000

9,510

DR Inventory(StatementofProfit&Loss)

5,250

Cr Inventory(balancesheet)

5,250

[Beingcorrectionofinventoryduetostockdestroyedinfire]

DR Inventory(StatementofProfit&Loss)

4,200

CR Inventory(balancesheet)

4,200

[Beingcorrectionofinventoryduetostocksoldbutnotyetrecorded]

DR Inventory(StatementofProfit&Loss)

3,600

CR Inventory(balancesheet)

3,600

[BeingwritedownofinventorytoNRVasperIAS2]

DR Fixtures&fittings

20,000

CR Administrationcosts

20,000

[Beingcorrectionofacquisitionoffixturesandfittingsincorrectlyrecordedas

administrationexpenses]

125,096

21

Solutiontoquestion4(contd)

(iv)

DR StatementofProfit&Loss

CR Accumulateddepreciation

[Beingcalculationofannualdepreciationcharge]

2,000

2,000

DR Prepayments

15,000

CR Distributionexpenses

15,000

[Beingcorrectionofprepaymentsincorrectlytreatedasdistributionexpenses]

DRCR

22

Solutiontoquestion5

[a]

IAS37definesaprovisionasaliabilityofuncertaintimingoramount.Aprovisioncanonlybe

recognised in the financial statements when all three of the following conditions have been

met:

i) Abusinesshasapresentobligationasaresultofapastevent(theobligatingevent).

ii) Itisprobablethatatransferofeconomicbenefitswillberequiredtosettletheobligation.

iii) Areliableestimatecanbemadeoftheamountoftheobligation.

IAS37definesacontingentliabilityas:

i) Apresentobligationthatarisesfrompasteventsbutitisnotrecognisedbecauseitisnot

probablethatatransferofeconomicbenefitswillberequiredtosettletheobligationorthe

amountoftheobligationcannotbemeasuredwithsufficientreliability.

ii) A possible obligation that arises from past events and whose existence will only be

confirmedbytheoccurrenceofoneormoreuncertainfutureeventsnotwhollywithinthe

entityscontrol.

Contingent liabilities should not be recognised in financial statements but they should be

disclosedbywayofanote.

[b]

(i) There isa present obligation (to close the division) as a result of a past obligating event

(decision to close division and communication of this decision to suppliers and

employees).Itismoreprobablethatatransferofeconomicbenefitswillariseastheentity

willincurclosurecosts.

Thereforeaprovisionshouldberecognisedintheaccounts.

(ii) Thereisapresentobligation(torepairorreplacedefectiveproducts)asaresultofapast

obligating event (sale of goods to customers which includes a three year warranty). A

transfer ofeconomic benefits will result as the company must meet the cost of repair or

replacement and this can be reliably measured based on sales information and costs

incurredinprioryears.

Thereforeaprovisionshouldberecognisedintheaccounts.

(iii) There isa present obligation(to paylease payments as they ariseandbecomedue)asa

resultofapastobligatingevent(signingofthelease).Untilsuchtimeastheentityfindsa

new tenant the entity must pay the unavoidable lease payments and this can be reliably

measured.

Thereforeaprovisionshouldberecognisedintheaccounts.

23

[c]

(iv) There is no present obligation as there is no past obligating event (the cost of fitting of

smokealarmsorforfinesunderthenewlegislation).

Thereforenoprovisionshouldberecognisedintheaccounts.

IAS2statesthatinventoriesshouldbemeasuredatthelowerofcostornetrealisablevalue.

Inventoryvaluation:

Cost

/perunit

Materials

2.00

Labour

3.00

Expenses

2.50

Production(900,000/750,000)

1.20

Costperunit

8.70

NRV

Sellingprice

9.00

Marketingcosts

(1.20)

NRVperunit

7.80

ThereforestockwillbevaluedatthelowerofcostofNRV,whichisNRV:

250,000unitsx/7.80perunit=/1,950,000

24

Solutiontoquestion6

[a]

[b]

CornwallLtd.

Statementofcomprehensiveincomefortheyearended31December2009

/000

SalesRevenue

30,780

Costofsales(W.7)

(21,649)

Grossprofit

9,131

Distributioncosts(W.3)

(3,312)

Administrativeexpenses(W.4)

(2,612)

3,207

Interest(W.8)

(180)

Profitbeforetax

3,027

Taxexpense(W.5)

(980)

Profitonordinaryactivitiesaftertax

2,047

Profitabilityratios

Grossprofit

(9,131/30,780)*100

29.7%

Netprofit

(3,027/30,780)*100

9.8%

Liquidityratios

Currentratio(W.9&W.10)

(11,989/5,600)

Acidtestratio(W.9&W.10)

(11,9893,041)/5,600 1.60:1

25

2.14:1

Workings

(1)Depreciation

/000/000/000

Buildings

Factory

Warehouse

Plant&

Plant&

equip

equip

Cost

16,000

26,640

2,400

Accdeprec

(4,430) (5,140)

(1,040)

11,570

21,500

1,360

Depreciation

2%revalued

320

20%redbal

4,300

272

(2)Closinginventory

/000

Auctionedgoodsatcost

500

Salesvalue

300

Less:auctioneerfees(3%)

(9)

NRV

291

AuctionedgoodstobevaluedatlowerofcostofNRVasperIAS2.

Closinginventory

3,250

Lessinventoryovervaluation(500291)

(209)

Adjustedclosinginventory

3,041

(3)Distributionexpenses

/000

PerT/B

3,040

Depreciation:Warehouseplant&equip.

272

3,312

(4)Administrativeexpenses

/000

PerT/B

2,240

Baddebt

120

Baddebtprovision(W6)

252

2,612

26

(5)Taxation

Pertrialbalance

Chargeforcurrentyear

Totaltaxationcharge

(6)Baddebtprovision

Debtors

Baddebt

Baddebtprovision(3%)

(7)Costofsales

Openinginventory

Add:purchases

Buildingsdepreciation

Factoryplant&equipmentdepreciation

Less:closinginventory

Costofgoodssold

(8)Interest

Debentureinterest

Bankinterest

Totalinterest

(9)Currentassets

Receivables

Less:baddebt(W.6)

Baddebtprovision(W.6)

Inventory(W.2)

Cashatbank

Totalcurrentassets

27

/000

40

940

980

/000

8,520

(120)

8,400

252

/000

2,890

17,180

320

4,300

(3,041)

21,649

/000

120

60

180

/000

8,520

(120)

(252)

3,041

800

11,989

(10)Currentliabilities

Payables

Tax

Totalcurrentliabilities

/000

4,660

940

5,600

28

Vous aimerez peut-être aussi

- Finance for IT Decision Makers: A practical handbookD'EverandFinance for IT Decision Makers: A practical handbookPas encore d'évaluation

- 001 1-1gbr 2002 Dec QDocument14 pages001 1-1gbr 2002 Dec QArun KarthikPas encore d'évaluation

- Advanced Financial Accounting: Sample Paper 2Document26 pagesAdvanced Financial Accounting: Sample Paper 2Rowbby GwynPas encore d'évaluation

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarPas encore d'évaluation

- POST TEST CHAPTER 1-3 - Enrichment Exercie For KB ManajemenDocument6 pagesPOST TEST CHAPTER 1-3 - Enrichment Exercie For KB ManajemenKiras SetyaPas encore d'évaluation

- Post Test KB Akuntansi UndoneDocument6 pagesPost Test KB Akuntansi UndoneKiras SetyaPas encore d'évaluation

- Financial Accounting II: 2 Year ExaminationDocument34 pagesFinancial Accounting II: 2 Year ExaminationRobin SicatPas encore d'évaluation

- Financial Accounting II: 2 Year ExaminationDocument32 pagesFinancial Accounting II: 2 Year ExaminationGeneGrace Zolina TasicPas encore d'évaluation

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Document14 pagesBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- Dec 2005 - Qns Mod ADocument14 pagesDec 2005 - Qns Mod AHubbak KhanPas encore d'évaluation

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Book-Keeping and Accounts/Series-3-2004 (Code2006)Document16 pagesBook-Keeping and Accounts/Series-3-2004 (Code2006)Hein Linn Kyaw100% (1)

- Revision 1-9 MCDocument5 pagesRevision 1-9 MCdilinhtinh04Pas encore d'évaluation

- Ifrs PQDocument26 pagesIfrs PQpakhok3Pas encore d'évaluation

- Exercise Invesment Financial AccountingDocument7 pagesExercise Invesment Financial Accountingukandi rukmanaPas encore d'évaluation

- Exercises/Assignments Answer The Following ProblemsDocument22 pagesExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanPas encore d'évaluation

- Accounting Quiz YP 51 BDocument4 pagesAccounting Quiz YP 51 Bnicasavio2725Pas encore d'évaluation

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaPas encore d'évaluation

- Jun 2003 - Qns Mod ADocument12 pagesJun 2003 - Qns Mod AHubbak KhanPas encore d'évaluation

- Acca ExercisesDocument10 pagesAcca ExercisesAmir AmirliPas encore d'évaluation

- Chapter 5 ReconciliationDocument7 pagesChapter 5 ReconciliationDevender SinghPas encore d'évaluation

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001Pas encore d'évaluation

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerPas encore d'évaluation

- Ffa Pilot PaperDocument21 pagesFfa Pilot PaperSyeda Saba BatoolPas encore d'évaluation

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209Pas encore d'évaluation

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyPas encore d'évaluation

- Edexcel Unit 2 Jun 2014 QPDocument14 pagesEdexcel Unit 2 Jun 2014 QPcyberdeadmanPas encore d'évaluation

- MCQ SampleDocument6 pagesMCQ Samplewilliam1988821Pas encore d'évaluation

- CPA IRELAND Accounting Framework April 07Document14 pagesCPA IRELAND Accounting Framework April 07Luke ShawPas encore d'évaluation

- 1 Fafn: Financial Accounting FundamentalsDocument12 pages1 Fafn: Financial Accounting FundamentalsAltaf HussainPas encore d'évaluation

- 1.pilot Paper 1Document21 pages1.pilot Paper 1Eugene MischenkoPas encore d'évaluation

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyPas encore d'évaluation

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlartePas encore d'évaluation

- 3gbr PilotpaperDocument10 pages3gbr Pilotpaperapi-19836745Pas encore d'évaluation

- Advanced Financial Accounting: Professional 2 Examination - April 2007Document12 pagesAdvanced Financial Accounting: Professional 2 Examination - April 2007Muhammad QamarPas encore d'évaluation

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasPas encore d'évaluation

- Company Accounts and IAS (Paper f3)Document7 pagesCompany Accounts and IAS (Paper f3)ASISHAHEENPas encore d'évaluation

- Lebanese Association of Certified Public Accountants - IFRS December Exam 2019Document11 pagesLebanese Association of Certified Public Accountants - IFRS December Exam 2019jad NasserPas encore d'évaluation

- FAF Revision 3 With AnswersDocument4 pagesFAF Revision 3 With AnswersSadeep MadhushanPas encore d'évaluation

- CT2-PX-0 - QP-x2-x3Document22 pagesCT2-PX-0 - QP-x2-x3AmitPas encore d'évaluation

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoPas encore d'évaluation

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestPas encore d'évaluation

- F3 Specimen Exam 2014 PDFDocument21 pagesF3 Specimen Exam 2014 PDFgrrrklPas encore d'évaluation

- Acco 1115Document9 pagesAcco 1115Sarah RanduPas encore d'évaluation

- FND - Pilot Question & AnswerDocument118 pagesFND - Pilot Question & AnswerSunday OluwolePas encore d'évaluation

- Documents - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFDocument96 pagesDocuments - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFSatyabrataNayak100% (1)

- DGSDFSBCSDHSFSDDocument8 pagesDGSDFSBCSDHSFSDbabylovelylovelyPas encore d'évaluation

- Advanced Financial Accounting Sample Paper 3Document27 pagesAdvanced Financial Accounting Sample Paper 3Vijay SinghPas encore d'évaluation

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16D'EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Pas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkD'EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkPas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryD'EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersD'EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersPas encore d'évaluation

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)D'EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Guide to Strategic Management Accounting for ManagerrsD'EverandGuide to Strategic Management Accounting for ManagerrsPas encore d'évaluation

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?D'EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Pas encore d'évaluation

- 2017 AEP Risks and Vulnerabilities of Virtual CurrencyDocument40 pages2017 AEP Risks and Vulnerabilities of Virtual CurrencyLisaPas encore d'évaluation

- New Product Development Process by Tamzidul AminDocument26 pagesNew Product Development Process by Tamzidul AminTamzidul Amin100% (1)

- Comparative Study of HDFC Bank SBI Bank MBA ProjectDocument9 pagesComparative Study of HDFC Bank SBI Bank MBA ProjectAsif shaikhPas encore d'évaluation

- MERS As Nominee For MFC - Mary Kist and Donald ClarkDocument2 pagesMERS As Nominee For MFC - Mary Kist and Donald ClarkLoanClosingAuditorsPas encore d'évaluation

- Minicase - Term Structure Interest RateDocument2 pagesMinicase - Term Structure Interest RateTho ThoPas encore d'évaluation

- Riya Food Product Project ReportDocument16 pagesRiya Food Product Project ReportSunny NarangPas encore d'évaluation

- Overview of Functions and Operations BSPDocument2 pagesOverview of Functions and Operations BSPKarla GalvezPas encore d'évaluation

- Money PadDocument17 pagesMoney PadPrajoth PaiPas encore d'évaluation

- Resa - The Review School of Accountancy Management ServicesDocument8 pagesResa - The Review School of Accountancy Management ServicesKindred Wolfe100% (1)

- Weekly Bond ListDocument83 pagesWeekly Bond ListMohan MirpuriPas encore d'évaluation

- Asian Development Bank Sustainability Report 2013: Investing in Asia and The Pacific's Future (Expanded Report Index)Document59 pagesAsian Development Bank Sustainability Report 2013: Investing in Asia and The Pacific's Future (Expanded Report Index)Asian Development BankPas encore d'évaluation

- Marshet Sisay Final Research PaperDocument81 pagesMarshet Sisay Final Research Paperdagnaye100% (1)

- Ramzan Ali PP ApoDocument1 pageRamzan Ali PP ApoAshok RauniarPas encore d'évaluation

- Case DigestsDocument4 pagesCase DigestsJustine Jay Casas LopePas encore d'évaluation

- PHD DissertationDocument14 pagesPHD DissertationShito Ryu100% (1)

- TermsDocument3 pagesTermsAmy GarrettPas encore d'évaluation

- Accounting AssmntDocument11 pagesAccounting AssmntasadPas encore d'évaluation

- Syla F552Document7 pagesSyla F552Aiman Maimunatullail RahimiPas encore d'évaluation

- Mortgage - S. 58 TPADocument3 pagesMortgage - S. 58 TPAAbhinav SrivastavPas encore d'évaluation

- Latest BillDocument3 pagesLatest Billrostyn160% (5)

- Black Book SoftDocument77 pagesBlack Book SoftSiddiqui AlmasPas encore d'évaluation

- BPI Employees Union Vs Bank of The Philippine IslandDocument6 pagesBPI Employees Union Vs Bank of The Philippine IslandAllen OlayvarPas encore d'évaluation

- Sukhchain Aggarwal: Financial Statement Analysis of ICICI BankDocument1 pageSukhchain Aggarwal: Financial Statement Analysis of ICICI Banksandy_jadhaoPas encore d'évaluation

- CBSE Class 12 Reconstitution of PartnershipDocument7 pagesCBSE Class 12 Reconstitution of Partnershipajay yadavPas encore d'évaluation

- D 415Document49 pagesD 415Alyssa LPas encore d'évaluation

- October 31, 2011 PostsDocument2 156 pagesOctober 31, 2011 PostsAlbert L. PeiaPas encore d'évaluation

- Card Sizes : Format Dimensions UsageDocument2 pagesCard Sizes : Format Dimensions UsageAnonymous hKt1bjMF2Pas encore d'évaluation

- International Trade Assignment 2Document22 pagesInternational Trade Assignment 2Gayatri PanjwaniPas encore d'évaluation

- IRCTC Sample Train TicketDocument3 pagesIRCTC Sample Train TicketPawan KumarPas encore d'évaluation

- Bank Audit Analysis Documentation - Check ListDocument6 pagesBank Audit Analysis Documentation - Check Listrao_gmailPas encore d'évaluation