Académique Documents

Professionnel Documents

Culture Documents

Macro Assignment

Transféré par

Charlie Magne G. SantiaguelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Macro Assignment

Transféré par

Charlie Magne G. SantiaguelDroits d'auteur :

Formats disponibles

Questions: 1. What is the function of a countrys central bank? Is there really a need for it? 2.

Can the central bank regulate the amount of money circulated within the countrys economy? If yes, how? Answers: 1. A countrys central bank is the one that governs the operation of all banks in the country. They decide the interest rates, deposit rates and also the guidelines based on which banks must operate. Its functions are: Issue of notes As government bank As banker of banks Creation and control of credits Develops banking system Mobilizes capital and manages debt Controls foreign exchange There is a need for it to have the assurance that the countrys economy is table and the citizens interests are protected by against any unwanted activities by the bank. 2. Central banks use several different methods to increase (or decrease) the amount of money in the banking system. These actions are referred to as monetary policy. While the Federal Reserve Board (the Fed) could print paper currency at its discretion in an effort to increase the amount of money in the economy, this is not the measure used. Here are three methods the Fed uses in order to inject (or withdraw) money from the economy: The Fed can influence the money supply by modifying reserve requirements, which is the amount of funds banks must hold against deposits in bank accounts. By lowering the reserve requirements, banks are able loan more money, which increases the overall supply of money in the economy. Conversely, by raising the banks' reserve requirements, the Fed is able to decrease the size of the money supply.

The Fed can also alter the money supply by changing short-term interest rates. By lowering (or raising) the discount rate that banks pay on short-term loans from the Federal Reserve Bank, the Fed is able to effectively increase (or decrease) the liquidity of money. Lower rates increase the money supply and boost economic activity; however,

decreases in interest rates fuel inflation, so the Fed must be careful not to lower interest rates too much for too long. Finally, the Fed can affect the money supply by conducting open market operations, which affects the federal funds rate. In open operations, the Fed buys and sells government securities in the open market. If the Fed wants to increase the money supply, it buys government bonds. This supplies the securities dealers who sell the bonds with cash, increasing the overall money supply. Conversely, if the Fed wants to decrease the money supply, it sells bonds from its account, thus taking in cash and removing money from the economic system.

Vous aimerez peut-être aussi

- Batas Pambansa Blg. 22-Check and Bouncing LawDocument2 pagesBatas Pambansa Blg. 22-Check and Bouncing LawRocky MarcianoPas encore d'évaluation

- JP GAAP Vs IFRSDocument181 pagesJP GAAP Vs IFRSCharlie Magne G. SantiaguelPas encore d'évaluation

- Hospital ListDocument2 pagesHospital ListCharlie Magne G. SantiaguelPas encore d'évaluation

- BS in Accountancy in The PhilippinesDocument7 pagesBS in Accountancy in The PhilippinesCharlie Magne G. SantiaguelPas encore d'évaluation

- GR 165569Document10 pagesGR 165569Charlie Magne G. SantiaguelPas encore d'évaluation

- Famous Chicken AdoboDocument2 pagesFamous Chicken AdoboCharlie Magne G. SantiaguelPas encore d'évaluation

- List of Hospitals in Cavite ProvinceDocument5 pagesList of Hospitals in Cavite ProvinceCharlie Magne G. Santiaguel100% (1)

- Building Your SkillsDocument46 pagesBuilding Your SkillsCharlie Magne G. SantiaguelPas encore d'évaluation

- CHAPTER 7 - Competition and Policies Toward Monopolies and Oligopolies Privatization and DeregulationDocument30 pagesCHAPTER 7 - Competition and Policies Toward Monopolies and Oligopolies Privatization and DeregulationCharlie Magne G. Santiaguel90% (10)

- Applications of Microeconomics TheoryDocument37 pagesApplications of Microeconomics TheoryCharlie Magne G. SantiaguelPas encore d'évaluation

- Building Your SkillsDocument47 pagesBuilding Your SkillsCharlie Magne G. SantiaguelPas encore d'évaluation

- Applications of Microeconomics TheoryDocument37 pagesApplications of Microeconomics TheoryCharlie Magne G. Santiaguel100% (1)

- Pandora Hearts - Melody PDFDocument2 pagesPandora Hearts - Melody PDFMax UrrejolaPas encore d'évaluation

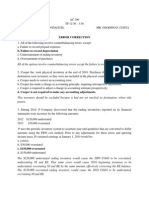

- Error CorrectionDocument8 pagesError CorrectionCharlie Magne G. SantiaguelPas encore d'évaluation

- National Internal Revenue Code of 1997Document160 pagesNational Internal Revenue Code of 1997Charlie Magne G. SantiaguelPas encore d'évaluation

- Professional Practice of AccountancyDocument32 pagesProfessional Practice of AccountancyCharlie Magne G. SantiaguelPas encore d'évaluation

- Jose Cangco vs. Manila Railroad CompanyDocument4 pagesJose Cangco vs. Manila Railroad CompanyCharlie Magne G. SantiaguelPas encore d'évaluation

- Philippine RegionsDocument2 pagesPhilippine RegionsCharlie Magne G. Santiaguel80% (20)

- Nirc PDFDocument160 pagesNirc PDFCharlie Magne G. Santiaguel100% (3)

- Environmental AccountingDocument7 pagesEnvironmental AccountingCharlie Magne G. SantiaguelPas encore d'évaluation

- AC 204 PROJECT - LiabilitiesDocument5 pagesAC 204 PROJECT - LiabilitiesCharlie Magne G. SantiaguelPas encore d'évaluation

- Macro AssignmentDocument2 pagesMacro AssignmentCharlie Magne G. SantiaguelPas encore d'évaluation

- Nirc 1997Document160 pagesNirc 1997Charlie Magne G. SantiaguelPas encore d'évaluation

- Nirc PDFDocument160 pagesNirc PDFCharlie Magne G. Santiaguel100% (3)

- Sheet MusicDocument3 pagesSheet MusicCharlie Magne G. SantiaguelPas encore d'évaluation

- I Hate You LyricsDocument1 pageI Hate You LyricsCharlie Magne G. SantiaguelPas encore d'évaluation

- Title PageDocument1 pageTitle PageCharlie Magne G. SantiaguelPas encore d'évaluation

- Management Chapter 1Document13 pagesManagement Chapter 1Charlie Magne G. SantiaguelPas encore d'évaluation

- Tik Tok LyricsDocument1 pageTik Tok LyricsCharlie Magne G. SantiaguelPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Money, Banking, and Monetary Policy Cheat Sheet: by ViaDocument2 pagesMoney, Banking, and Monetary Policy Cheat Sheet: by ViaAli Aqeel IbrahimPas encore d'évaluation

- 04 Trenovski Tashevska 2015 1 PDFDocument21 pages04 Trenovski Tashevska 2015 1 PDFArmin ČehićPas encore d'évaluation

- Macroeconomics 15Th Canadian Edition by Campbell R Mcconnell Full ChapterDocument41 pagesMacroeconomics 15Th Canadian Edition by Campbell R Mcconnell Full Chapteropal.wells168100% (19)

- 18feb14 Global Macro Outlook 14 15Document16 pages18feb14 Global Macro Outlook 14 15Calin PerpeleaPas encore d'évaluation

- A Project On M.P of RbiDocument37 pagesA Project On M.P of RbiUmesh Soni100% (1)

- Roles and Functions of The Reserve Bank of Australia: Monetary PolicyDocument1 pageRoles and Functions of The Reserve Bank of Australia: Monetary PolicyNima MoaddeliPas encore d'évaluation

- Introduction To Securities and Investment Ed30 PDFDocument278 pagesIntroduction To Securities and Investment Ed30 PDFjeff76% (21)

- India Market Report-2013Document15 pagesIndia Market Report-2013Chelladurai KrishnasamyPas encore d'évaluation

- Monetary Policy and Central Banking PDFDocument2 pagesMonetary Policy and Central Banking PDFTrisia Corinne JaringPas encore d'évaluation

- Practice 4 Assessment - TeamDocument12 pagesPractice 4 Assessment - TeamTrang Anh Thi TrầnPas encore d'évaluation

- CHAPTER 8 InflationDocument8 pagesCHAPTER 8 InflationDheeraj KumarPas encore d'évaluation

- Macro Tut 5Document7 pagesMacro Tut 5TACN-2M-19ACN Luu Khanh LinhPas encore d'évaluation

- History of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDocument6 pagesHistory of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDivine Grace JasaPas encore d'évaluation

- Role of Rbi & SebiDocument6 pagesRole of Rbi & Sebiabhiarora07Pas encore d'évaluation

- Introduction To MacroeconomicsDocument45 pagesIntroduction To MacroeconomicsAnkita MalikPas encore d'évaluation

- Mruna SirDocument32 pagesMruna Sirprabh17Pas encore d'évaluation

- Ged 104 Midterm ReviewerDocument11 pagesGed 104 Midterm ReviewerRijohnna Moreen RamosPas encore d'évaluation

- FULL Download Ebook PDF International Finance 4th Edition by Keith Pilbeam PDF EbookDocument41 pagesFULL Download Ebook PDF International Finance 4th Edition by Keith Pilbeam PDF Ebooksally.marcum863100% (31)

- What Caused The Great DepressionDocument16 pagesWhat Caused The Great DepressionBerenice MondilloPas encore d'évaluation

- Case Study On Inflation in IndiaDocument13 pagesCase Study On Inflation in IndiaAkash KamalPas encore d'évaluation

- Research Thesis On Inflation by ShoaibDocument14 pagesResearch Thesis On Inflation by Shoaibgrimshobi75% (16)

- Akalpler & Duhok (2018)Document20 pagesAkalpler & Duhok (2018)IZMAN GlobalPas encore d'évaluation

- Security Investment Slide Notes W4-W8Document213 pagesSecurity Investment Slide Notes W4-W8priyaPas encore d'évaluation

- International Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualDocument11 pagesInternational Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Solution ManualJenniferNelsonfnoz100% (38)

- 2022 Level I Key Facts and Formulas SheetDocument13 pages2022 Level I Key Facts and Formulas Sheetayesha ansari100% (2)

- EC424 Monetary Economics (Michaelmas Term) Additional QuestionsDocument5 pagesEC424 Monetary Economics (Michaelmas Term) Additional QuestionsSteamPunkPas encore d'évaluation

- Monetary Policy and Commercial Banks Performance in EthiopiaDocument70 pagesMonetary Policy and Commercial Banks Performance in Ethiopiabereket nigussie0% (1)

- Banko Sentral NG PilipinasDocument8 pagesBanko Sentral NG PilipinasJoshua OrobiaPas encore d'évaluation

- 6 Fiscal PolicyDocument792 pages6 Fiscal Policywerner71100% (1)

- A Glossary of Macroeconomic TermsDocument13 pagesA Glossary of Macroeconomic TermsRana WaqasPas encore d'évaluation