Académique Documents

Professionnel Documents

Culture Documents

CIR Vs BOAC

Transféré par

Marie ChieloTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CIR Vs BOAC

Transféré par

Marie ChieloDroits d'auteur :

Formats disponibles

CIR vs.

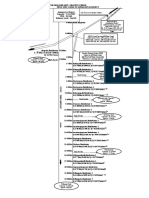

BRITISH OVERSEAS AIRWAYS CORPORATION Facts: Private respondent BOAC is a 100% British Government-owned corporation organized and existing under the laws of the UK. Engaged in the international airline business, it operates air transportation service and sells transportation tickets over the routes of the other airline members. During the periods covered by the disputed assessments, it is admitted that BOAC had no landing rights for traffic purposes in the Philippines. Moreover, it did not carry passengers and/or cargo to or from the Philippines, although during the period covered by the assessments, it maintained a general sales agent in the Philippines. In May 1968, petitioner CIR assessed BOAC for deficiency income taxes covering the years 1959 to 1963. This was protested by BOAC. Subsequent investigation resulted in the issuance of a new assessment, for the years 1959 to 1967 which BOAC paid under protest. In 1970, BOAC filed a claim for refund which claim was denied by the CIR. On 25 November 1971, BOAC requested that the assessment be countermanded and set aside. However, the CIR not only denied the BOAC request for refund in the First Case but also re-issued in the Second Case the deficiency income tax assessment. The Tax Court held that the proceeds of sales of BOAC passage tickets in the Philippines do not constitute BOAC income from Philippine sources "since no service of carriage of passengers or freight was performed by BOAC within the Philippines" and, therefore, said income is not subject to Philippine income tax. With the adverse decision of the tax court, hence, this Petition for Review on certiorari. Issue: Whether or not the revenue derived by BOAC from sales of tickets in the Philippines for air transportation, while having no landing rights here, constitute income of BOAC from Philippine sources. Ruling: Yes. The absence of flight operations to and from the Philippines is not determinative of the source of income or the site of income taxation. Admittedly, BOAC was an off-line international airline at the time pertinent to this case. The test of taxability is the "source"; and the source of an income is that activity ... which produced the income. Unquestionably, the passage documentations in these cases were sold in the Philippines and the revenue therefrom was derived from an activity regularly pursued within the Philippines. And even if the BOAC tickets sold covered the "transport of passengers and cargo to and from foreign cities", it cannot alter the fact that income from the sale of tickets was derived from the Philippines. The word "source" conveys one essential idea, that of origin and the origin of the income herein is the Philippines. It should be pointed out, however, that the assessments upheld herein apply only to the fiscal years covered by the questioned deficiency income tax assessments in these cases, or, from 1959 to 1967, 1968-69 to 1970-71. Pursuant to Presidential Decree No. 69, promulgated on 24 November, 1972, international carriers are now taxed. The 2- % tax on gross Philippine billings is an income tax. If it had been intended as an excise or percentage tax it would have been place under Title V of the Tax Code covering Taxes on Business.

Vous aimerez peut-être aussi

- Merlinda Cipriano Montañes v. Lourdes Tajolosa CiprianoDocument1 pageMerlinda Cipriano Montañes v. Lourdes Tajolosa CiprianoMarie Chielo100% (1)

- People of The Philippines v. Marlon Barsaga AbellaDocument1 pagePeople of The Philippines v. Marlon Barsaga AbellaMarie ChieloPas encore d'évaluation

- People of The Philippines v. Florencio Agacer, Et - Al.Document1 pagePeople of The Philippines v. Florencio Agacer, Et - Al.Marie ChieloPas encore d'évaluation

- People of The Philippines V Dela CernaDocument2 pagesPeople of The Philippines V Dela CernaMarie Chielo100% (1)

- People of The Philippines v. Florencio Agacer, Et - Al.Document1 pagePeople of The Philippines v. Florencio Agacer, Et - Al.Marie ChieloPas encore d'évaluation

- Cir vs. CA, Cta and YmcaDocument1 pageCir vs. CA, Cta and YmcaMarie ChieloPas encore d'évaluation

- People of The Philippines v. OrtizDocument2 pagesPeople of The Philippines v. OrtizMarie ChieloPas encore d'évaluation

- CIR v. SC Johnson and Son Inc.Document1 pageCIR v. SC Johnson and Son Inc.Marie Chielo100% (2)

- People of The Philippines V BringasDocument2 pagesPeople of The Philippines V BringasMarie ChieloPas encore d'évaluation

- Belle Corporation v. CIRDocument1 pageBelle Corporation v. CIRMarie Chielo100% (1)

- CIR vs. CA, CTA and Josefina P. PajonarDocument1 pageCIR vs. CA, CTA and Josefina P. PajonarMarie ChieloPas encore d'évaluation

- People of The Philippines V OcfemiaDocument2 pagesPeople of The Philippines V OcfemiaMarie ChieloPas encore d'évaluation

- Pepsi-Cola Distributors vs. GalangDocument2 pagesPepsi-Cola Distributors vs. GalangMarie ChieloPas encore d'évaluation

- Apolonio Taboada vs. Hon. Avelino Rosal DigestDocument1 pageApolonio Taboada vs. Hon. Avelino Rosal DigestMarie Chielo100% (1)

- 11 - SJS v. LimDocument1 page11 - SJS v. LimMarie ChieloPas encore d'évaluation

- Formula - Indemnification To TenantDocument2 pagesFormula - Indemnification To TenantMarie ChieloPas encore d'évaluation

- 05 - City of Gen San v. COADocument1 page05 - City of Gen San v. COAMarie Chielo67% (3)

- Taboada vs. RosalDocument1 pageTaboada vs. RosalMarie ChieloPas encore d'évaluation

- Pimentel vs. Executive SecretaryDocument1 pagePimentel vs. Executive SecretaryMarie ChieloPas encore d'évaluation

- Dansart Security Force vs. Jean BagoyDocument1 pageDansart Security Force vs. Jean BagoyMarie ChieloPas encore d'évaluation

- Uy vs. Centro Ceramica CorporationDocument2 pagesUy vs. Centro Ceramica CorporationMarie ChieloPas encore d'évaluation

- Sarocam v. Interorient MaritimeDocument2 pagesSarocam v. Interorient MaritimeMarie ChieloPas encore d'évaluation

- Cosmopolitan Funeral Homes vs. Maalat, 187 Scra 773Document1 pageCosmopolitan Funeral Homes vs. Maalat, 187 Scra 773Marie ChieloPas encore d'évaluation

- J.V. Angeles Construction Corporation vs. NLRCDocument1 pageJ.V. Angeles Construction Corporation vs. NLRCMarie Chielo100% (1)

- Grepalife Assurance Corporation vs. NLRC, 187 Scra 694Document1 pageGrepalife Assurance Corporation vs. NLRC, 187 Scra 694Marie ChieloPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- WHAT IS HYDROGRAPHY - NOAA Hydro Training 2009Document32 pagesWHAT IS HYDROGRAPHY - NOAA Hydro Training 2009Tony ThomasPas encore d'évaluation

- Automated Driving and Driver Assistance Systems A9c8 PDFDocument155 pagesAutomated Driving and Driver Assistance Systems A9c8 PDFred eagle wins100% (1)

- Structural Parts For Transportation Systems Made From AluminiumDocument18 pagesStructural Parts For Transportation Systems Made From AluminiumMarcWorldPas encore d'évaluation

- Annamayya Project Capacity: 2.234 TMC FRL: 203.600 Delivery Level: 204.600Document1 pageAnnamayya Project Capacity: 2.234 TMC FRL: 203.600 Delivery Level: 204.600Guru MogaralaPas encore d'évaluation

- Brochure Renault BVA DP2Document4 pagesBrochure Renault BVA DP2ossoski50% (2)

- Crane and Rigging - PDF - (382245420)Document23 pagesCrane and Rigging - PDF - (382245420)bilo1984Pas encore d'évaluation

- Hobart - Air Warfare DestroyerDocument13 pagesHobart - Air Warfare DestroyerhindujudaicPas encore d'évaluation

- Rural Revitalization - E-Mobility - Project - ReportDocument28 pagesRural Revitalization - E-Mobility - Project - ReportTarun KawPas encore d'évaluation

- IRCTC Brochure WebDocument24 pagesIRCTC Brochure WebArka Prabha PalPas encore d'évaluation

- InstructivoDocument5 pagesInstructivoPapeleria-ciber LoscompasPas encore d'évaluation

- InventoryDocument53 pagesInventoryVinoth KumarPas encore d'évaluation

- Fullrun Truck Tyre Catalogue PDFDocument17 pagesFullrun Truck Tyre Catalogue PDFjonathan ortizPas encore d'évaluation

- The Coming of The SpaniardsDocument73 pagesThe Coming of The SpaniardsAya BalangPas encore d'évaluation

- 2004 Ford F-150 SpecsDocument26 pages2004 Ford F-150 SpecsrodizianoPas encore d'évaluation

- Cooking Oil DisposalDocument1 pageCooking Oil DisposalKorawit Kongsan100% (1)

- VWvortex Forums DIY - Adjusting The Displayed Fuel Gauge Level With A VAG-COM ID3208286Document1 pageVWvortex Forums DIY - Adjusting The Displayed Fuel Gauge Level With A VAG-COM ID3208286JZPas encore d'évaluation

- Steam GeneratorDocument11 pagesSteam GeneratorElla Jane CabanagPas encore d'évaluation

- Fuel System Safety: Presented By: Tony HeatherDocument40 pagesFuel System Safety: Presented By: Tony HeatherABDELRHMAN ALIPas encore d'évaluation

- Mermaid CommanderDocument2 pagesMermaid CommanderFatin AfraPas encore d'évaluation

- Part 1 - Legislation and Administration Chapter Subject PG.: ETU - MHS Aviation BHD 1Document117 pagesPart 1 - Legislation and Administration Chapter Subject PG.: ETU - MHS Aviation BHD 1NurSyafiq MohamadPas encore d'évaluation

- AkzoNobel PresentationDocument47 pagesAkzoNobel PresentationSudhir BansalPas encore d'évaluation

- Nilam Bekti Sumardhani-BTH-NKRHCD-BTJ-FLIGHT - ORIGINATINGDocument4 pagesNilam Bekti Sumardhani-BTH-NKRHCD-BTJ-FLIGHT - ORIGINATINGahlan zulfakhriPas encore d'évaluation

- Toyota Motor Company Crisis Plan PDFDocument24 pagesToyota Motor Company Crisis Plan PDFKaoutar Fadel100% (1)

- Diagnostic Manual (EMS) : Cruise ControlDocument4 pagesDiagnostic Manual (EMS) : Cruise ControlZacklift Para Gruas Y CamionesPas encore d'évaluation

- Physiology and Neurobiliogy 2275 UCONN Test 3Document8 pagesPhysiology and Neurobiliogy 2275 UCONN Test 3sin117Pas encore d'évaluation

- 318 HO Vario Roof (WFF) 01-24-02Document55 pages318 HO Vario Roof (WFF) 01-24-02arkhom1100% (2)

- Essay ViolenceDocument3 pagesEssay Violencefz6z1n2p100% (2)

- CarManual SAIL Petrol 24sep13Document204 pagesCarManual SAIL Petrol 24sep13basantkumar83Pas encore d'évaluation

- Rigid PavementsDocument92 pagesRigid PavementsMadhur GuptaPas encore d'évaluation

- Test Ces Clasa A 7Document2 pagesTest Ces Clasa A 7andreifiuPas encore d'évaluation