Académique Documents

Professionnel Documents

Culture Documents

Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFD

Transféré par

api-25890856Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFD

Transféré par

api-25890856Droits d'auteur :

Formats disponibles

Single Barrier Reverse Convertible on PORSCHE AUTOMOBIL HLDG-PFD

Coupon 10.75% p.a.; 1 Year; EUR; Barrier at 53.50%

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 27.08.2009 Client pays EUR 1000 (Denomination)

Rating: Fitch A

Underlying PORSCHE AUTOMOBIL HLDG-PFD On 25.11.2009 Client receiv es a Coupon of 10.75% in fine

Bbg Ticker PAH3 GY Equity

Payment Date 27.08.09 PLUS

Valuation Date 23.11.09

Maturity 25.11.09 Scenario 1: if the Final Fixing Lev el is above the Barrier Level

Strike Level EUR 50.47 (100%)

The Investor will receive a Cash Settlement equal to the Denomination

Barrier Level EUR 27 (53.50%)

EU Saving Tax Option Premium Component 9.42% (9.42% p.a.)

Interest Component 1.34% (1.34% p.a.)

Details Physical Settlement European Barrier

Scenario 2: if the Final Fixing Lev el is at or below the Barrier Level

Conversion Ratio 19.81

ISIN CH0104432718 The Investor will receive a predefined round number (i.e. Conversion

Valoren 10443271 Ratio) of the Underlying per Denomination.

SIX Symbol not listed

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________

Porsche Automobil Holding SE designs, manufactures, and markets luxury sports cars such as the Porsche 911 Carrera, Targa and Turbo, and the Boxster

models. The Company designs and builds engines, transmissions, and driver security collision systems for all its cars, and engines and vehicles on contract

for other manufacturers. Porsche sells and leases its cars worldwide.

Opportunities______________________________________________________________ Risks__________________________________________________________________________

1. A guaranteed Coupon of 10.75% in fine 1. Maximum yield is limited to 10.75% in fine

2. Protection against 46.5% drop in Underlying's price 2. Exposure to v olatility changes

3. Barrier is only observ ed on the Final Fixing Date

4. Low er v olatility than direct equity exposure

5. Secondary market as liquid as a share

Best case scenario_________________________________________________________ Worst case scenario___________________________________________________________

The Underlying is abov e the Barrier on the Final Fixing Date The Underlying closes at or below the Barrier Lev el on the Final Fixing Date

Redemption: Denomination + Coupon of 10.75% in fine Redemption: Underlying + Coupon of 10.75% in fine

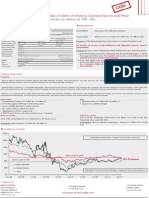

Historical Chart

160 importer depuis la deuxieme feuille

140

Redemption: 100% and a Coupon of 10.75% in fine

120

100

80

60 Strike: EUR 50.47 (100% of Spot Reference)

40 46.50% Protection

Barrier: EUR 27 (53.50% of Strike Level)

20

Redemption: 19.81 shares and a Coupon of 10.75% in fine

0

Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial

instruments mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by

the Swiss Financial M arket Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial

situatio n; the info rmatio n co ntained in this do cument do es no t substitute such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct

do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject t

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers

co sts and fees. EFG Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity

o f the financial pro ducts. © EFG Financial P ro ducts A G A ll rights reserved.

Vous aimerez peut-être aussi

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Pas encore d'évaluation

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Pas encore d'évaluation

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Pas encore d'évaluation

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Pas encore d'évaluation

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Pas encore d'évaluation

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Pas encore d'évaluation

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552Pas encore d'évaluation

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Pas encore d'évaluation

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Pas encore d'évaluation

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Pas encore d'évaluation

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQDocument1 pageCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Pas encore d'évaluation

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Pas encore d'évaluation

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Pas encore d'évaluation

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDocument1 page12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552Pas encore d'évaluation

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Pas encore d'évaluation

- 260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onDocument1 page260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onapi-25889552Pas encore d'évaluation

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Pas encore d'évaluation

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Pas encore d'évaluation

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Pas encore d'évaluation

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDocument1 pageCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Pas encore d'évaluation

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Pas encore d'évaluation

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Pas encore d'évaluation

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552Pas encore d'évaluation

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Pas encore d'évaluation

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Pas encore d'évaluation

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Pas encore d'évaluation

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552Pas encore d'évaluation

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Pas encore d'évaluation

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocument1 pageCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552Pas encore d'évaluation

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Pas encore d'évaluation

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552Pas encore d'évaluation

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Pas encore d'évaluation

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552Pas encore d'évaluation

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552Pas encore d'évaluation

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocument1 pageCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552Pas encore d'évaluation

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocument1 pageCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552Pas encore d'évaluation

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552Pas encore d'évaluation

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocument1 page6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552Pas encore d'évaluation

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552Pas encore d'évaluation

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552Pas encore d'évaluation

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Pas encore d'évaluation

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Pas encore d'évaluation

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552Pas encore d'évaluation

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552Pas encore d'évaluation

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Pas encore d'évaluation

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocument1 pageCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552Pas encore d'évaluation

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552Pas encore d'évaluation

- 94% Strike - 99% Stop Loss - 5.5 Months - CHF: Bullish Mini-Future On EUR-CHF X-RATEDocument1 page94% Strike - 99% Stop Loss - 5.5 Months - CHF: Bullish Mini-Future On EUR-CHF X-RATEapi-25889552Pas encore d'évaluation

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Pas encore d'évaluation

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552Pas encore d'évaluation

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCDocument1 pageCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552Pas encore d'évaluation

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDocument1 pageCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Pas encore d'évaluation

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552Pas encore d'évaluation

- Single Barrier Reverse Convertible On GERDAU SADocument1 pageSingle Barrier Reverse Convertible On GERDAU SAapi-25889552Pas encore d'évaluation

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Pas encore d'évaluation

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25890856Pas encore d'évaluation

- How Trade, The WTO and The Financial Crisis Reinforce EachDocument10 pagesHow Trade, The WTO and The Financial Crisis Reinforce Eachapi-25890856Pas encore d'évaluation

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Pas encore d'évaluation

- NullDocument1 pageNullapi-25890856Pas encore d'évaluation

- NullDocument1 pageNullapi-25890856Pas encore d'évaluation

- Single Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%Document1 pageSingle Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%api-25890856100% (2)

- NullDocument4 pagesNullapi-25890856Pas encore d'évaluation

- BCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJDocument3 pagesBCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJapi-25890856100% (2)

- Single Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.Document1 pageSingle Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.api-25890856100% (2)

- Multi Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andDocument1 pageMulti Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andapi-25890856100% (2)

- Onkar SeedsDocument1 pageOnkar SeedsTejaspreet SinghPas encore d'évaluation

- 5-Vendors Are The King MakerDocument2 pages5-Vendors Are The King Makersukumaran3210% (1)

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDocument2 pagesManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshPas encore d'évaluation

- Townhall SustDocument21 pagesTownhall Sustpritom173Pas encore d'évaluation

- Offtake Agreement For Maize: WHEREAS The Seller Has Offered To Supply The Buyer and The Buyer Has Agreed To PurchaseDocument3 pagesOfftake Agreement For Maize: WHEREAS The Seller Has Offered To Supply The Buyer and The Buyer Has Agreed To PurchaseChiccoe Joseph100% (1)

- Case StudyDocument17 pagesCase Studysubakarthi0% (1)

- FIN542 Ind. AssignmentDocument10 pagesFIN542 Ind. AssignmentCici KakaPas encore d'évaluation

- Developing Global ProfessionalsDocument28 pagesDeveloping Global ProfessionalsNguyễn Thị Kiều GiangPas encore d'évaluation

- Poverty and Human Development Report 2011Document184 pagesPoverty and Human Development Report 2011Repoa TanzaniaPas encore d'évaluation

- Cases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)Document22 pagesCases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)RizkyArsSetiawan0% (1)

- 6S LeanDocument1 page6S Leanmickee rosePas encore d'évaluation

- RedSeer - Job Description - Associate ConsultantDocument3 pagesRedSeer - Job Description - Associate ConsultantAnshuman MohantyPas encore d'évaluation

- Pfif PDFDocument1 pagePfif PDFcrystal01heartPas encore d'évaluation

- 2021 DFGE Klimastrategie Eng Web PDFDocument2 pages2021 DFGE Klimastrategie Eng Web PDFDFGE – Institute for Energy, Ecology and EconomyPas encore d'évaluation

- Global CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodDocument2 pagesGlobal CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodLanceGatewoodPas encore d'évaluation

- Inventory MCQDocument6 pagesInventory MCQsan0z100% (2)

- Sbi NeftformatDocument5 pagesSbi NeftformatPPCPL Chandrapur0% (1)

- Supply Chain Management in Brief: Medhi CahyonoDocument7 pagesSupply Chain Management in Brief: Medhi CahyonoSetio TanoePas encore d'évaluation

- Global RetailingDocument41 pagesGlobal RetailingPink100% (1)

- Dealing With Competition: Competitive ForcesDocument9 pagesDealing With Competition: Competitive Forcesasif tajPas encore d'évaluation

- Activity - Cultural Differences and HRMDocument3 pagesActivity - Cultural Differences and HRMSaraKovačićPas encore d'évaluation

- Mutual Fund SynopsisDocument8 pagesMutual Fund SynopsisAamit Bhardwaj50% (2)

- 1992 ColwellDocument20 pages1992 ColwellBhagirath BariaPas encore d'évaluation

- Topic Selection: by Tek Bahadur MadaiDocument24 pagesTopic Selection: by Tek Bahadur Madairesh dhamiPas encore d'évaluation

- Working Capital Management at BEMLDocument20 pagesWorking Capital Management at BEMLadharav malikPas encore d'évaluation

- Means of Avoiding or Minimizing The Burdens of TaxationDocument6 pagesMeans of Avoiding or Minimizing The Burdens of TaxationRoschelle MiguelPas encore d'évaluation

- MAS-04 Relevant CostingDocument10 pagesMAS-04 Relevant CostingPaupauPas encore d'évaluation

- Wedge Worksheet: Strategy Sector (Cost Challenges 1 2 3 4 5 6 7 8 TotalsDocument1 pageWedge Worksheet: Strategy Sector (Cost Challenges 1 2 3 4 5 6 7 8 Totals许凉发Pas encore d'évaluation

- Re-Engineering Agricultural Education For Sustainable Development in NigeriaDocument5 pagesRe-Engineering Agricultural Education For Sustainable Development in NigeriaPremier PublishersPas encore d'évaluation

- Code of Business Ethics and ConductDocument7 pagesCode of Business Ethics and ConductShane NaidooPas encore d'évaluation